Page 1 :

, , CHAPTER, , 8, , REDEMPTION OF, DEBENTURES, LEARNING OUTCOMES, After studying this chapter, you will be able to–, , , , , , , , Understand about the redemption of debentures;, Understand the requirement of creation of a Debenture, Redemption Reserve and creation of Debenture Redemption, Fund (i.e. making investments for purpose of redemption of, debentures);, Understand various methods of redemption of debentures;, Understand the accounting treatment of redemption of, debentures;, Solve problems based on redemption of debentures., , © The Institute of Chartered Accountants of India

Page 2 :

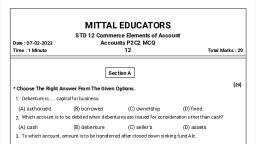

8.2, , ACCOUNTING, , Secured Debentures, , Security, , Unsecured Debentures, Covertible Debentures, , Convertibility, , Types of Debentures, , Permanence, , Negotiability, , Non-convertible, Debentures, Redeemable Debentures, Irredeembale Debentures, Registered Debentures, Bearer Debentures, First Mortgage, Debentures, , Priority, , Second Mortgage, Debentures, , Methods of Redemption of, Debentures, By payment in, Lumpsum, , By, payment in, instalments, , By purchase in, open market, , © The Institute of Chartered Accountants of India, , By, conversion, into shares

Page 3 :

8.3, , REDEMPTION OF DEBENTURES, , Provisions under the Companies Act, 2013, for Issue of Debentures, , Section 71 (1), , A company may, issue debentures, with an option to, convert such, debentures into, shares, either, wholly or partly, at the time of, redemption., , Section 71 (2), , No company can, issue any, debentures, which carry any, voting rights., , Provided that the issue, of debentures with an, option to convert such, debentures into shares,, wholly or partly, should, be approved by a, special resolution, passed at a duly, convened general, meeting., , Section 71 (4), Where debentures, are issued by a, company, then the, company should, create a debenture, redemption reserve, account out of the, profits of the, company available, for payment of, dividend and the, amount credited to, such account, should not be, utilised by the, company for any, purpose other than, the redemption of, debentures., , 1. INTRODUCTION, A debenture is an instrument issued by a company under its seal, acknowledging a, debt and containing provisions as regards repayment of the principal and interest., Under Section 71 (1) of the Companies Act, 2013, a company may issue debentures, with an option to convert such debentures into shares, either wholly or partly at, the time of redemption., © The Institute of Chartered Accountants of India

Page 4 :

8.4, , ACCOUNTING, , Provided that the issue of debentures with an option to convert such debentures, into shares, wholly or partly, should be approved by a special resolution passed at, a duly convened general meeting., Section 71 (2) further provides that no company can issue any debentures which, carry any voting rights., Section 71 (4) provides that where debentures are issued by a company, the, company should create a debenture redemption reserve account out of the profits, of the company available for payment of dividend and the amount credited to such, account should not be utilized by the company for any purpose other than the, redemption of debentures., Basic provisions, If a charge has been created on any asset or the entire assets of the company,, , , the nature of the charge, , , , the asset(s) charged, , are described therein., •, , Since the charge is not valid unless registered with the Registrar, his, certificate registering the charge is printed on the bond., , •, , It is also customary to create a trusteeship in favour of one or more persons, in the case of mortgage debentures. The trustees of debenture holders have, all powers of a mortgage of a property and can act in whatever manner they, think necessary to safeguard the interest of debenture holders., , As per Rule 18(2) of the Companies (Share Capital and Debentures) Rules, 2014, the, company shall appoint debenture trustees as required under sub-section (5) of, section 71 of the Companies Act 2013, after complying with certain conditions, mentioned in that rule., Note: Issue of debentures has already been discussed in detail at Foundation level., Students are advised to refer the Foundation Study Material - Chapter 10 for, understanding of the requirements relating to issue of debentures., , © The Institute of Chartered Accountants of India

Page 5 :

REDEMPTION OF DEBENTURES, , 8.5, , 2. REDEMPTION OF DEBENTURES, Debentures are usually redeemable i.e. either redeemed in cash or convertible after, a time period., Redeemable debentures may be redeemed:, , , after a fixed number of years; or, , , , any time after a certain number of years has elapsed since their issue; or, , , , on giving a specified notice; or, , , , by annual drawing., , A company may also purchase its debentures, as and when convenient, in the open, market. When the debentures are quoted at a discount on the Stock Exchange, it, may be profitable for the company to purchase and cancel them., As per Rule 18 (1) of the Companies (Share Capital and Debentures) Rules, 2014, a, company shall not issue secured debentures, unless it complies with the following, conditions, namely:, a., , An issue of secured debentures may be made, provided the date of its, redemption shall not exceed ten years from the date of issue:, Provided that the following classes of companies may issue secured, debentures for a period exceeding ten years but not exceeding thirty years,, (i), , Companies engaged in setting up of infrastructure projects;, , (ii), , Infrastructure Finance Companies' as defined in clause (viia) of subdirection (1) of direction 2 of Non-Banking Financial (Non-deposit, Accepting or Holding) Companies Prudential Norms (Reserve Bank), Directions, 2007;, , (iii), , Infrastructure Debt Fund Non-Banking Financial Companies' as defined, in clause (b) of direction 3 of Infrastructure Debt Fund Non-Banking, Financial Companies (Reserve Bank) Directions, 2011;, , (iv), , Companies permitted by a Ministry or Department of the Central, Government or by Reserve Bank of India or by the National Housing, Bank or by any other statutory authority to issue debentures for a, period exceeding ten years., , © The Institute of Chartered Accountants of India

Page 6 :

8.6, , ACCOUNTING, , b., , such an issue of debentures shall be secured by the creation of a charge on, the properties or assets of the company or its subsidiaries or its holding, company or its associates companies, having a value which is sufficient for, the repayment of the amount due on debentures and interest thereon., , c., , the company shall appoint a debenture trustee before the issue of prospectus, or letter of offer for subscription of its debentures and not later than sixty, days after the allotment of the debentures, execute a debenture trust deed, to protect the interest of the debenture holders; and, , d., , the security for the debentures by way of a charge or mortgage shall be, created in favour of the debenture trustee on(i), , any specific movable property of the company or its holding company, or subsidiaries or associate companies or otherwise., , (ii), , any specific immovable property wherever situate, or any interest, therein:, , Provided that in case of a non-banking financial company, the charge or, mortgage under sub-clause (i) may be created on any movable property., Provided further that in case of any issue of debentures by a Government company, which is fully secured by the guarantee given by the Central Government or one or, more State Government or by both, the requirement for creation of charge under, this sub-rule shall not apply., Provided also that in case of any loan taken by a subsidiary company from any bank, or financial institution the charge or mortgage under this sub-rule may also be, created on the properties or assets of the holding company., , 3. DEBENTURE REDEMPTION RESERVE, A company issuing debentures may be required to create a debenture redemption, reserve account out of the profits available for distribution of dividend and, amounts credited to such account cannot be utilised by the company for any other, purpose except for redemption of debentures. Such an arrangement would ensure, that the company will have sufficient liquid funds for the redemption of debentures, at the time they fall due for payment., An appropriate amount is transferred from profits every year to Debenture, Redemption Reserve and its investment is termed as Debenture Redemption, Reserve Investment (or Debenture Redemption Fund). In the last year or at the time, © The Institute of Chartered Accountants of India

Page 7 :

REDEMPTION OF DEBENTURES, , 8.7, , of redemption of debentures, Debenture Redemption Reserve Investments are, encashed and the amount so obtained is used for the redemption of debentures., , 3.1 REQUIREMENT TO CREATE DEBENTURE REDEMPTION RESERVE, Section 71 of the Companies Act 2013 covers the requirement of creating a, debenture redemption reserve account. Section 71 states as follows:, (1), , Where a company issues debentures under this section, it should create a, debenture redemption reserve account out of its profits which are available, for distribution of dividend every year until such debentures are redeemed., , (2), , The amounts credited to the debenture redemption reserve should not be, utilised by the company for any purpose except for the purpose aforesaid., , (3), , The company should pay interest and redeem the debentures in accordance, with the terms and conditions of their issue., , (4), , Where a company fails to redeem the debentures on the date of maturity or, fails to pay the interest on debentures when they fall due, the Tribunal may,, on the application of any or all the holders of debentures or debenture, trustee and, after hearing the parties concerned, direct, by order, the, company to redeem the debentures forthwith by the payment of principal, and interest due thereon., , 3.2 BALANCE IN DEBENTURE REDEMPTION RESERVE (DRR), When the company decides to establish the Debenture Redemption Reserve, Account, the amount indicated by the Debenture Redemption Reserves tables is, credited to the Debenture Redemption Reserve account and debited to profit and, loss account. That shows the intention of the company to set aside sum of money, to build up a fund for redeeming debentures. Immediately, the company should, also purchase outside investments. The entry for the purpose naturally will be to, debit Debenture Redemption Reserve Investments and credit Bank., If the debentures are purchased within the interest period, the price would be, inclusive of interest provided these are purchased “Cum-interest”; but if purchased, “Ex-interest”, the interest to the date of purchase would be payable to the seller, additionally. In order to adjust the effect thereof the amount of interest accrued till, the date of purchase, if paid, is debited to the Interest Account against which the, interest for the whole period will be credited. As a result, the balance in the account, would be left equal to the interest for the period for which the debentures were, held by the company., © The Institute of Chartered Accountants of India

Page 8 :

8.8, , ACCOUNTING, , 3.3 ADEQUACY OF DEBENTURE REDEMPTION RESERVE (DRR), As per Rule 18 (7) of the Companies (Share Capital and Debentures) Amendment, Rules, 2019, the company shall comply with the requirements with regard to, Debenture Redemption Reserve (DRR) and investment or deposit of sum in respect, of debentures maturing during the year ending on the 31st day of March of next, year (refer para 3.4 below), in accordance with the conditions given below—, a., , the Debenture Redemption Reserve shall be created out of the profits of the, company available for payment of dividend;, , b., , the limits with respect to adequacy of DRR and investment or deposits, as the, case may be, shall be as under:, S., No, 1, , 2, , 3, , 4, , Debentures issued by, , Adequacy, of, Debenture, Redemption Reserve (DRR), , All India Financial Institutions (AIFIs) No DRR is required, regulated by Reserve Bank of India and, Banking Companies for both public, as well as privately placed debentures, , Other Financial Institutions (FIs) DRR will be as applicable to, within the meaning of clause (72) of NBFCs registered with RBI (as, section 2 of the Companies Act, 2013, per (3) below), , For listed companies (other than AIFIs and Banking Companies as, specified in Sr. No. 1 above):, a., , All listed NBFCs (registered with No DRR is required, RBI under section 45-IA of the, RBI Act,) and listed HFCs, (Housing Finance Companies, registered with National Housing, Bank) for both public as well as, privately placed debentures, , b., , Other listed companies for No DRR is required, both public as well as privately, placed debentures, , For unlisted companies (other than AIFIs and Banking Companies as, specified in Sr. No. 1 above, a., , All unlisted NBFCs (registered No DRR is required, , © The Institute of Chartered Accountants of India

Page 9 :

REDEMPTION OF DEBENTURES, , 8.9, , with RBI under section 45-IA of, the RBI (Amendment) Act, 1997), and unlisted HFCs (Housing, Finance Companies registered, with National Housing Bank) for, privately placed debentures, b., , Other unlisted companies, , DRR shall be 10% of the value, of the outstanding debentures, issued, , 3.4 INVESTMENT OF DEBENTURE REDEMPTION RESERVE (DRR), AMOUNT, Further, as per Rule 18 (7) of the Companies (Share Capital and Debentures), Amendment Rules, 2019, following companies, (a), , All listed NBFCs, , (b), , All listed HFCs, , (c), , All other listed companies (other than AIFIs, Banking Companies and Other, FIs); and, , (d), , All unlisted companies which are not NBFCs and HFCs, , shall on or before the 30th day of April in each year, in respect of debentures issued,, deposit or invest, as the case may be, a sum which should not be less than 15% of, the amount of its debentures maturing during the year ending on the 31st day of, March of next year, in any one or more of the following methods, namely:, (a), , in deposits with any scheduled bank, free from charge or lien;, , (b), , in unencumbered securities of the Central Government or of any State, Government;, , (c), , in unencumbered securities mentioned in clauses (a) to (d) and (ee) of Section, 20 of the Indian Trusts Act, 1882;, , (d), , in unencumbered bonds issued by any other company which is notified under, clause (f) of Section 20 of the Indian Trusts Act, 1882., , The amount deposited or invested, as the case may be, above should not be utilised, for any purpose other than for the redemption of debentures maturing during the, year referred to above., , © The Institute of Chartered Accountants of India

Page 10 :

8.10, , ACCOUNTING, , Provided that the amount remaining deposited or invested, as the case may be,, shall not at any time fall below 15% of the amount of debentures maturing during, the 31st day of March of that year., In case of partly convertible debentures, DRR shall be created in respect of nonconvertible portion of debenture issue in accordance with this sub-rule., The amount credited to DRR shall not be utilised by the company except for the, purpose of redemption of debentures., Note: It should be noted that appropriation to DRR can be made any time before, redemption and Investments in specified securities as mentioned above can be, done before 30th April for the debentures maturing that year, however, for the sake, of simplicity and ease, it is advisable to make the appropriation and investment, immediately after the debentures are allotted assuming that the company has, sufficient amount of profits (issued if allotment date is not given in the question)., Also, in some cases, the date of allotment could be missing, in such cases the, appropriation and investments should be done on the first day of that year for, which ledgers accounts are to be drafted., , 3.5 JOURNAL ENTRIES, The necessary journal entries passed in the books of a company are given below:, 1., , After allotment of debentures, (a), , For setting aside the fixed amount of profit for redemption, Profit and Loss A/c, , Dr., , To Debenture Redemption Reserve A/c, (b), , For investing the amount set aside for redemption, Debenture Redemption Reserve Investment A/c, , Dr., , To Bank A/c, (c), , For receipt of interest on Debenture Redemption Reserve Investments, Bank A/c, , Dr., , To Interest on Debenture Redemption Reserve Investment A/c, (d), , For transfer of interest on Debenture Redemption Reserve Investments, (DRRI), , © The Institute of Chartered Accountants of India

Page 11 :

REDEMPTION OF DEBENTURES, , 8.11, , Interest on Debenture Redemption Reserve Investment A/c, , Dr., , To Profit and loss A/c*, * Considering the fact that interest is received each year through cash/bank, account and it is not re-invested. In the illustrations given in the chapter, the, same has been considered and hence interest on DRR investment is not credited, to DRR A/c but taken to P&L A/c., 2., , At the time of redemption of debentures, (a), , For encashment of Debenture Redemption Reserve Investments, Bank A/c, , Dr., , To Debenture Redemption Reserve Investment A/c, (b), , For amount due to debentureholders on redemption, Debentures A/c, , Dr., , To Debentureholders A/c, (c), , For payment to debentureholders, Debentureholders A/c, , Dr., , To Bank A/c, (d), , After redemption of debentures, DRR should be transferred, to general reserve, DRR A/c, , Dr., , To General Reserve, Note: In case, the company purchases its own debentures in the market, additional set, of accounting entries would be passed (refer para 4.3 of this chapter for the guidance)., , 4, , METHODS OF REDEMPTION OF DEBENTURES, , Redemption of debentures must be done according to the terms of issue of, debentures and any deviation therefrom will be treated as a default by the, company., Redemption by paying off the debt on account of debentures issued can be done, in any one of the three methods viz:, , © The Institute of Chartered Accountants of India

Page 12 :

8.12, , ACCOUNTING, , 4.1 BY PAYMENT IN LUMPSUM, Under payment in lumpsum method, at maturity or at the expiry of a specified, period of debenture the payment of entire debenture is made in one lot or even, before the expiry of the specified period., , 4.2 BY PAYMENT IN INSTALMENTS, Under payment in instalments method, the payment of specified portion of, debenture is made in instalments at specified intervals., , 4.3 PURCHASE OF DEBENTURES IN OPEN MARKET, Debentures sometimes are purchased in open market. In such a case Own, Debenture Account is debited and bank is credited., Suppose a company has issued 8% debentures for ` 10,00,000, interest being, payable on 31st March and 30th September every year. The company purchases, ` 50,000 debentures at ` 96 on 1st August 20X1. This means that the company will, have to pay ` 48,000 as principal plus ` 1,333 as interest for 4 months., Entry, , `, , Own Debentures (50,000 x 96/ 100), , Dr., , 48,000, , Interest Account (50,000 x 8% x 4/12), , Dr., , 1,333, , `, , To Bank, , 49,333, , It should be noted that even though ` 50,000 debentures have been purchased for, ` 48,000 there is no profit. On purchase of the debentures , profit does not arise;, only on sale and in this case on cancellation of debentures, profit could arise., These debentures may be cancelled on same date. The journal entries to be passed, will be the following:, , `, 8% Debentures A/c, , To Own Debentures A/c, , To Profit on cancellation of debentures, , (Cancellation of ` 50,000 Debentures), , Dr., , 50,000, , `, 48,000, 2,000, , Note: Students should refer to Illustration 1 for complete and detailed, understanding of this concept., , © The Institute of Chartered Accountants of India

Page 13 :

REDEMPTION OF DEBENTURES, , 8.13, , Illustration 1, On January 1, Rama Ltd. (listed company), had 500 Debentures of ` 100 each, outstanding in its books carrying interest at 6% per annum. In accordance with the, regulatory requirements, the directors of the company acquired debentures from the, open market for immediate cancellation as follows:, March 1, , ` 5,000 at face value ` 98.00 (cum interest), , Aug. 1, , ` 10,000 at face value ` 100.25 (cum interest), , Dec. 15, , ` 2,500 at face value ` 98.50 (ex-interest), , Debenture interest is payable half-yearly, on 30th June and 31st Dec., Show ledger accounts of Debentures and Debenture interest for the full year by, splitting into first and second half years, ignoring income-tax., Solution, 6% Debentures Account, 1st Half Year, , `, Mar. 1, , `, , To Bank-Debentures, , `, Jan. 1 By Balance b/d 50,000, , Purchased [(5,000 4,850, x 98/ 100) – 50], To Profit & Loss on, cancellation of, debenture, A/c, (5,000 – 4,850), June 30 To Balance c/d, , 150, , 5,000, 45,000, 50,000, , 50,000, , Debenture Interest Account, , `, Mar. 1, , To Bank-Interest for 2, months, , © The Institute of Chartered Accountants of India, , `, June, 30, , By Profit & Loss A/c, , 1,400

Page 14 :

8.14, , June, 30, , ACCOUNTING, , on, `, 5,000, Debentures @ 6%, , To Debenture-holders, (Interest) A/c (45,000, x 6% x 6/12), , 50, 1,350, , 1,400, , 1,400, , 2nd Half Year, 6% Debentures Account, , `, Aug., 1, , To Bank-Debenture, Purchased [(10,000 x, 100.25/ 100) – 50], , To P & L A/c on, Cancellation, debentures, , Dec., 15, , 9,975, , of, , (10,000 – 9,975), , To Bank-Deb., , (2,500 x 98.50/ 100), , `, July, 1, , By Balance b/d, , 45,000, , 25, , 2,462.50, , Purchased, , To Profit & Loss, , on Cancellation, of Debentures, , Dec., 31, , (2,500 – 2,462.50), , To Balance c/d, , 37.50, , 32,500, 45,000, , 45,000, , Debenture Interest Account, , `, Aug. 1, , To, , Bank - Interest for, one, month, on, , © The Institute of Chartered Accountants of India, , `, Dec., , By P & L, Account, , 1,093.75

Page 15 :

REDEMPTION OF DEBENTURES, , Dec. 15, , To, , Dec. 31, , To, , ` 10,000 @ 6%, , 50.00, 68.75, , Bank (2,500 x 6% x, 5.5/ 12), , Debenture holders, (32,500 x 6% x 6/12), , 8.15, , 975.00, 1,093.75, , 1,093.75, , Notes:, (i), , Profit or loss on redemption of debenture arises only on sale or cancellation., Adjustments related to own purchases that have been made in the, debentures account directly since the cancellation also happened on the, same day. If debentures are straightway cancelled on purchase, the profit or, loss on redemption of debentures will be ascertained by comparing (i) the, nominal value of debentures cancelled, and (ii) the price paid less interest to, the date of purchase (if the transaction is cum-interest)., , (ii), , Alternatively, Own Debentures Account can be debited on own purchase and, the same can be knocked off against Debentures Account on cancellation i.e., Own Debentures Account will be credited and Debenture Account debited on, cancellation. The difference between the nominal value of the debentures, cancelled and the amount standing to the debit on Own Debentures Account, will be profit or loss on redemption of debentures., , (iii), , In case the transaction is ex-interest, the interest to the date of transaction, will be paid in addition to the settled price and hence profit on redemption, will be nominal value minus the settled price., , (iv), , As per Rule 18 (7) of the Companies (Share Capital and Debentures), Amendment Rules, 2019, in respect of debentures issued, the company would, be required to deposit or invest (referred to as Debenture Redemption, Reserve Investment or DRRI), as the case may be, on or before the 30th day, of April in each year, a sum which should not be less than 15% of the amount, of its debentures maturing during the year ending on the 31st day of March, of next year. In the given question, DRRI account is not required and hence, no such adjustment has been given., , Illustration 2, The following balances appeared in the books of a company (unlisted company other, than AIFI, Banking company, NBFC and HFC) as on December 31, 20X1: 6% Mortgage, © The Institute of Chartered Accountants of India

Page 16 :

8.16, , ACCOUNTING, , 10,000 debentures of ` 100 each; Debenture Redemption Reserve (for redemption of, debentures) `50,000; Investments in deposits with a scheduled bank, free from any, charge or lien ` 1,50,000 at interest 4% p.a. receivable on 31st December every year., Bank balance with the company is ` 9,00,000., The Interest on debentures had been paid up to December 31, 20X1., On February 28, 20X2, the investments were realised at par and the debentures were, paid off at 101, together with accrued interest., Write up the concerned ledger accounts (excluding bank transactions). Ignore taxation., Solution, 6% Mortgage Debentures Account, 20X2, Feb., 28, , To, , Debentureholders A/c, , ` 20X2, , 10,00,000 Jan., 1, , `, By, , Balance b/d, , 10,00,000, , Premium on Redemption of Debentures Account, 20X2, Feb., 28, , ` 20X2, To, , Debentureholders A/c, , 10,000 Feb., 28, , `, By, , Profit and, loss A/c, , 10,000, , Debentures Redemption Reserve Investment Account, 20X2, Jan. 1, , ` 20X2, To, , Balance b/d, , 1,50,000 Feb., 28, , `, By, , Bank, , 1,50,000, , Debenture Interest Account, 20X2, Feb., 28, , ` 20X2, To Bank (10,000 x, 100 x 6% x 2/12), , 10,000 Feb. 28 By, , `, Profit & Loss, A/c, , 10,000, , Bank A/c, 20X2, Jan 01 To Balance b/d, , ` 20X2, 9,00,000 Feb. 28 By Debenture-, , © The Institute of Chartered Accountants of India, , `, 10,10,000

Page 17 :

8.17, , REDEMPTION OF DEBENTURES, , Feb 28, , To Interest on, Debentures, Redemption, Investments, (1,50,000 x 4% x, 2/12), , To Debentures, Redemption, , Reserve, investment A/c, , 1,000, , 1,50,000, , holders, (10,000 x 101), , By Deb., A/c, , Interest, , By Balance c/d, , 10,51,000, , 10,000, 31,000, 10,51,000, , Debenture Redemption Reserve Account, 20X2, , ` 20X2, , Feb, 28, , To, , General, Reservenote, , 1,00,000, , `, , Jan.1, , By Balance b/d, , 50,000, , Jan.1, , By Profit & Loss (b/f), , 50,000, , 1,00,000, , 1,00,000, , Note, Amount to be transferred to DRR before the redemption = ` 1,00,000 [i.e. 10% of, (10,000 X 100)]., Illustration 3, Sencom Limited (listed company) issued ` 1,50,000 5% Debentures on 30th September, 20X0 on which interest is payable half yearly on 31st March and 30th September. The, company has power to purchase debentures in the open market for cancellation, thereof. The following purchases were made during the year ended 31st December,, 20X2 and the cancellation were made on the same date. On 31 December 20X0,, investments made for the purpose of redemption were ` 22,500., 1st March 20X2 - ` 25,000 nominal value purchased for ` 24,725 ex-interest., © The Institute of Chartered Accountants of India

Page 18 :

8.18, , ACCOUNTING, , 1st September 20X2 - ` 20,000 nominal value purchased for ` 20,125 cum-interest., You are required to draw up the following accounts up to the date of cancellation:, (i), , Debentures Account; and, , (ii), , Own Debenture (Investment) Account., , Ignore taxation., Solution, , 20X2, , Mar 1, Mar 1, Sep 1, Sep 1, , Sencom Limited, Debenture Account, , ` 20X2, , To Own Debentures, To Profit on cancellation, (25,000-24,725), To Own Debentures, (Note 3), To Profit on cancellation, (20,000-19,708), , Dec 31 Balance c/d, , `, , 24,725 Jan 1 By Balance b/d, 275, , 1,50,000, , 19,708, 292, 1,05,000, 1,50,000, , 1,50,000, , Own Debenture (Investment) Account, Nominal Interest, Cost, , `, , `, , Nominal Interest, Cost, , Cost, , `, , `, , 20X2, , `, , 20X2, , Mar 1, , To Bank, , 25,000, , 521, , 24,725 Mar 1, , By Debentures, A/c, , 25,000, , -, , 24,725, , Sep 1, , To Bank, , 20,000, , 417, , 19,708 Sep 1, , By Debentures, A/c, , 20,000, , -, , 19,708, , (W.N. 1), , (W.N. 2, & 3), , Dec. 31 By P&L A/c, 45,000, , 938, , 44,433, , Working notes:, 1., , `, , Cost, , 25,000 x 5% x 5/12 = 521, , © The Institute of Chartered Accountants of India, , 938, 45,000, , 938, , 44,433

Page 19 :

REDEMPTION OF DEBENTURES, 2., , 20,000 x 5% x 5/12 = 417, , 3., , 20,125 – 417 = 19,708, , 8.19, , Illustration 4, The following balances appeared in the books of Paradise Ltd (unlisted company, other than AIFI, Banking company, NBFC and HFC) as on 1-4-20X1:, (i), , 12 % Debentures ` 7,50,000, , (ii), , Balance of DRR ` 25,000, , (iii), , DRR Investment 1,12,500 represented by 10% ` 1,125 Secured Bonds of the, Government of India of ` 100 each., , Annual contribution to the DRR was made on 31st March every year. On 31-3-20X2,, balance at bank was ` 7,50,000 before receipt of interest. The investment were, realised at par for redemption of debentures at a premium of 10% on the above date., You are required to prepare the following accounts for the year ended 31st March, 20X2:, (1), , Debentures Account, , (2), , DRR Account, , (3), , DRR Investment Account, , (4), , Bank Account, , (5), , Debenture Holders Account., , Solution, 1., , 12% Debentures Account, Date, 31st March,, 20X2, , Particulars, To Debenture, holders A/c, , 2., , `, 7,50,000, 7,50,000, , Date, 1st April,, 20X1, , Particulars, , By Balance b/d, , `, 7,50,000, 7,50,000, , DRR Account, , Date, , Particulars, , ` Date, 1st April,, 20X1, st, 31 March, To General reserve A/c 75,000 1st April,, 20X2, 20X1, (Refer Note 1), 75,000, , © The Institute of Chartered Accountants of India, , Particulars, By Balance b/d, By Profit and loss A/c, (Refer Note 1), , `, 25,000, 50,000, 75,000

Page 20 :

8.20, 3., , ACCOUNTING, , 10% Secured Bonds of Govt. (DRR Investment) A/c, `, 1 April,, 20X1, st, , To Balance b/d, , `, , 1,12,500, , 31 March,, 20X2, st, , By Bank A/c, , 1,12,500, , 4., , 1,12,500, 1,12,500, , Bank A/c, `, 31, March,, 20X2, st, , To Balance b/d, To, , Interest on, Investment, , DRR, , 7,50,000, 11,250, , `, 31, March,, 20X2, st, , By Debenture, holders A/c, , 8,25,000, , (1,12,500 X 10%), To DRR Investment A/c, , 1,12,500, , By Balance c/d, , 8,73,750, , 5., , 48,750, 8,73,750, , Debenture holders A/c, `, 31st, To Bank A/c, March,, 20X2, , `, , 8,25,000 31st, By 12% Debentures, March, By, Premium, on, 20X2, redemption, of, debentures, , 7,50,000, , 8,25,000, , 8,25,000, , (7,50,000 X 10%), , 75,000, , Note 1 –, Calculation of DRR before redemption = 10% of ` 7,50,000 = 75,000, Available balance = ` 25,000, DRR required = 75,000 – 25,000 = ` 50,000., Illustration 5, The Balance Sheet of BEE Co. Ltd. (unlisted company other than AIFI, Banking, company, NBFC and HFC) as at 31st March, 20X1 is as under:, , © The Institute of Chartered Accountants of India

Page 21 :

8.21, , REDEMPTION OF DEBENTURES, Particulars, I., , Equity and liabilities, (1), , (2), (3), , II., , Note No, , Shareholder's Funds, (a), , (b), , Share Capital, , Reserves and Surplus, , Current Liabilities, (a), , Trade payables, , Assets, (1), , Non-current assets, , (2), , Current assets, , (a), , Property, Plant and Equipment, , (a), (b), , Inventories, Trade receivables, , (c), , Cash and bank balances, , 1, , 2,00,000, , 3, , 1,20,000, , 2, , Non-current liabilities, (a) Long term borrowings, , 1,20,000, , 1,15,000, , Total, , 5,55,000, , 4, , Total, , `, , 5, , 1,15,000, 1,35,000, 75,000, 2,30,000, , 5,55,000, , Notes to Accounts, 1., , 2., 3., 4., 5., , Share Capital, Authorised share capital, 30,000 shares of ` 10 each fully paid, Issued and subscribed share capital, 20,000 shares of ` 10 each fully paid, Reserve and Surplus, Profit & Loss Account, Long term borrowings, 12% Debentures, Property, Plant and Equipment, Freehold property, Cash and bank balances, Cash at bank, Cash in hand, , © The Institute of Chartered Accountants of India, , `, , 3,00,000, 2,00,000, 1,20,000, 1,20,000, 1,15,000, 2,00,000, 30,000, , 2,30,000

Page 22 :

8.22, , ACCOUNTING, , At the Annual General Meeting, it was resolved:, (a), , To give existing shareholders the option to purchase one ` 10 share at ` 15 for, every four shares (held prior to the bonus distribution). This option was taken up, by all the shareholders., , (b), , To issue one bonus share for every five shares held., , (c), , To repay the debentures at a premium of 3%., , Give the necessary journal entries and the company’s Balance Sheet after these, transactions are completed., Solution, Journal of BEE Co. Ltd., , Bank A/c, , To Equity Shareholders A/c, , (Application money received on 5,000 shares @, ` 15 per share to be issued as rights shares in the, ratio of 1:4), Equity Shareholders A/c, , To Equity Share Capital A/c, , Dr., , Cr., , `, , `, , Dr., , 75,000, , Dr., , 75,000, , To Securities Premium A/c, , (Share application money on 5,000 shares @ ` 10 per, share transferred to Share Capital Account, and ` 5, per share to Securities Premium Account vide, Board’s Resolution dated…), Securities Premium A/c, Profit & Loss A/c, , To Bonus to Shareholders A/c, , (Amount transferred for issue of bonus shares to, existing shareholders in the ratio of 1:5 vide General, Body’s resolution dated...), Bonus to Shareholders A/c, , © The Institute of Chartered Accountants of India, , 75,000, , 50,000, 25,000, , Dr., Dr., , Dr., , 25,000, 25,000, , 50,000, , 50,000

Page 23 :

8.23, , REDEMPTION OF DEBENTURES, To Equity Share Capital A/c, , (Issue of bonus shares in the ratio of 1 for 5 vide, Board’s resolution dated....), , 50,000, , Profit and Loss A/c, , Dr., , 12,000, , Debenture Redemption Reserve Investment A/c, , Dr., , 18,000, , 12% Debentures A/c, , Dr., , 1,20,000, , To Debenture Redemption Reserve, (for DRR created 10% x 1,20,000), , To Bank A/c, (for DRR Investment created 15% x 1,20,000), Premium Payable on Redemption A/c @ 3%, To Debenture holders A/c, , (Amount payable to debentures holders), Profit and loss A/c, , Dr., , 3,600, , Dr., , 3,600, , Debenture Redemption Reserve A/c, , Dr., , 12,000, , Bank A/c, , Dr., , 18,000, , Dr., , 1,23,600, , To Premium Payable on Redemption A/c, , (Premium payable on redemption of debentures, charged to Profit & Loss A/c), To General Reserve, (for DRR transferred to general reserve), To Debenture Redemption Reserve Investment, , (for DRR Investment realised), Debenture holders A/c, To Bank A/c, , (Amount paid to debenture holders on redemption), , 12,000, , 18,000, , 1,23,600, , 3,600, , 12,000, , 18,000, , 1,23,600, , Balance Sheet of BEE Co. Ltd. as at...... (after completion of transactions), Particulars, I., , Note No, , `, , Equity and liabilities, (1), , Shareholder's Funds, (a), , Share Capital, , © The Institute of Chartered Accountants of India, , 1, , 3,00,000

Page 24 :

8.24, , (2), , II., , ACCOUNTING, , (b), , Reserves and Surplus, , (a), , Trade payables, , 2, , Current Liabilities, , Assets, (1), , Non-current assets, , (2), , Current assets, , (a), , Property, Plant and Equipment, , (a), , Inventories, , (c), , Cash and bank balances, , (b), , 91,400, 1,15,000, , Total, , 5,06,400, , 3, , 1,15,000, 1,35,000, , Trade receivables, , Total, , 4, , 75,000, , 1,81,400, 5,06,400, , Notes to Accounts, , `, 1., , Share Capital, , 2., , Reserve and Surplus, , 30,000 shares of ` 10 each fully paid (5,000 shares, of ` 10 each, fully paid issued as bonus shares out, of securities premium and P&L Account), , 3,00,000, , Profit & Loss Account, Less: Premium on redemption of debenture, , 1,20,000, (3,600), , Less: Utilisation for issue of bonus shares, Less: DRR created, , (25,000), (12,000), , General Reserve, 3., , Property, Plant and Equipment, , 4., , Cash and bank balances, , 79,400, 12,000, , Freehold property, , Cash at bank (2,00,000 + 75,000 – 1,23,60018000+18000), Cash in hand, , © The Institute of Chartered Accountants of India, , 91,400, 1,15,000, , 1,51,400, 30,000, , 1,81,400

Page 25 :

8.25, , REDEMPTION OF DEBENTURES, , Illustration 6, The Balance Sheet of Convertible Limited (unlisted company other than AIFI, Banking, company, NBFC and HFC), as at 31st March, 20X1, stood as follows:, Particulars, I., , Equity and liabilities, (1), , (2), (3), , II., , Note No, , Shareholder's Funds, (a) Share Capital, , 1, , Non-current liabilities, (a) Long term borrowings, , 2, , 1,10,00,000, , 3, , 1,65,00,000, , (b), , Reserves and Surplus, , Current Liabilities, (a) Other current liabilities, , Assets, (1), , (2), , `, , (b), Non-current investment, Current assets, (a), (b), , Cash and cash equivalents, Other current assets, , 1,25,00,000, , Total, , Non-current assets, (a) Property, Plant and Equipment, , 50,00,000, , 4,50,00,000, , 4, , 1,60,00,000, 15,00,000, , 75,00,000, 2,00,00,000, , Total, , 4,50,00,000, , Notes to Accounts, `, 1., , Share Capital, , 2., , Reserve and Surplus, , 5,00,000 shares of ` 10 each fully paid, General Reserve, , 90,00,000, , Debenture redemption reserve, , 10,00,000, , Profit & Loss Account, 3., , 50,00,000, , Long term borrowings, , 13.5% convertible Debentures, , © The Institute of Chartered Accountants of India, , 10,00,000, , 1,10,00,000, 1,00,00,000

Page 26 :

8.26, , ACCOUNTING, , (1,00,000 debentures of ` 100 each), Other loans, 4., , 65,00,000, , 1,65,00,000, , Non-current investments, , Debenture redemption reserve, , 15,00,000, , The debentures are due for redemption on 1st April, 20X1. The terms of issue of, debentures provided that they were redeemable at a premium of 5% and also conferred, option to the debenture holders to convert 20% of their holdings into equity shares at, a predetermined price of ` 15.75 per share and the payment in cash., Assuming that:, (i), , except for 100 debenture holders holding totally 25,000 debentures, the rest of, them exercised the option for maximum conversion., , (ii), , the investments were realised at par on sale; and, , (iii), , all the transactions are put through, without any lag, on 1st April, 20X1., , Redraft the balance sheet of the company as on 1st April, 20X1 after giving effect to, the redemption. Show your calculations in respect of the number of equity shares to, be allotted and the necessary cash payment., Solution, Convertible Limited, Balance Sheet as at April 1, 20X1, Particulars, , Note, No, , Figures as at the, end of current, reporting period, , `, I., , Equity and Liabilities, (1), , (2), , Shareholder's Funds, (a), , (b), , Share Capital, , Reserves and Surplus, , Non-Current Liabilities, (a), , Long-term, borrowingsUnsecured Loans, , © The Institute of Chartered Accountants of India, , 1, 2, , 60,00,000, , 1,10,75,000, 65,00,000

Page 27 :

8.27, , REDEMPTION OF DEBENTURES, (3), , II., , Current Liabilities, (a), , Other liabilities, , 1,25,00,000, , Total, , 3,60,75,000, , (a), , Property, Plant & Equipment, , 1,60,00,000, , (a), , Cash and bank, (Refer WN (iii)), , Assets, (1), , Non-current assets, , (2), , Current assets, , (b), , balances, , 75,000, , Other current assets, , 2,00,00,000, Total, , 3,60,75,000, , Notes to Accounts, , `, 1., , Share Capital, , 2., , Reserves and Surplus, , 6,00,000 Equity Shares (5,00,000 + 1,00,000), of ` 10 each (Refer WN (i)), General Reserve, Profit & Loss, , Add: Debenture Redemption Reserve transfer, Less: Premium on redemption of debentures, (1,00,000 debentures x ` 5 per debenture), Securities Premium, (1,00,000 shares x ` 5.75) (Refer WN (i)), , 60,00,000, , 90,00,000, 10,00,000, 10,00,000, 110,00,000, , (5,00,000), , 1,05,00,000, , 5,75,000, 1,10,75,000, , Working Notes:, (i), , Calculation of number of shares to be allotted:, Total number of debentures, , © The Institute of Chartered Accountants of India, , 1,00,000

Page 28 :

8.28, , ACCOUNTING, , Less: Number of debentures for which debenture holders, did not opt for conversion, 20% of 75,000, , Redemption value of 15,000 debentures (15,000 x 105), Number of Equity Shares to be allotted:, =, , (ii), , 15,75,000, 15.75, , Total number of debentures, Less: number of debentures to be converted into equity shares, Redemption value of 85,000 debentures (85,000 × ` 105), , (iii) Cash and Bank Balance:, , Balance before redemption, Add: Proceeds of investments sold, Less: Cash paid to debenture holders, , SUMMARY, , 75,000, 15,000, , ` 15,75,000, , = 1,00,000 shares of ` 10 each., , Calculation of cash to be paid:, , Balance, , (25,000), , `, , 1,00,000, (15,000), 85,000, , ` 89,25,000, 75,00,000, 15,00,000, , 90,00,000, (89,25,000), 75,000, , , , Debentures may create a charge against some or all the assets of the, company., , , , Charge may be fixed or floating, depends upon the condition of issue., , , , Debentures may be redeemed after a fixed number of years or after a certain, period has elapsed., , , , For redemption of debentures, certain companies are required to create, Debenture Redemption Reserve., , , , Methods of redemption: lumpsum payment; payment in instalments and, purchase of debentures in open market., , © The Institute of Chartered Accountants of India

Page 29 :

REDEMPTION OF DEBENTURES, , 8.29, , TEST YOUR KNOWLEDGE, MCQ, 1., , 2., , 3., , 4., , 5., , Which of the following statements is true?, (a), , A debenture holder is an owner of the company., , (b), , A debenture holder can get his money back only on the liquidation of the, company., , (c), , A debenture issued at a discount can be redeemed at a premium., , Which of the following statements is false?, (a), , Debentures can be redeemed by payment in lump sum at the end of a, specified period., , (b), , Debentures cannot be redeemed during the life time of the company., , (c), , Debentures can be redeemed by payments in annual instalments., , For debentures issued by unlisted companies (other than AIFIs, Banking, companies, NBFCs and HFCs), Debentures Redemption reserve will be, considered adequate if it is:, (a), , 25% of the value of debentures issued through public issue., , (b), , 10% of the value of debentures issued through public issue., , (c), , 5% of the value of debentures issued through public issue., , At the time of cancellation of own debentures, the account credited will be, (a), , Debentures account., , (b), , Own debentures account., , (c), , Bank account., , A company has issued 6% debentures for ` 10,00,000, interest being payable on, 31st March and 30th September. The company purchases ` 10,000 debentures, at ` 96 (ex-interest) on 1st August 20X1. These debentures were cancelled on, same date. The amount of Profit/loss on cancellation of debentures will be, (a), , Profit of ` 600., , (b), , Profit of ` 400., , (c), , Loss of ` 400, , © The Institute of Chartered Accountants of India

Page 30 :

8.30, , ACCOUNTING, , Theoretical Questions, Question 1, What is meant by redemption of debentures? Explain., Question 2, Write short note on Debenture Redemption Reserve., , Practical Questions, Question 1, A company had issued 20,000, 13% debentures of ` 100 each on 1st April, 20X1. The, debentures are due for redemption on 1st July, 20X2. The terms of issue of debentures, provided that they were redeemable at a premium of 5% and also conferred option to, the debenture holders to convert 20% of their holding into equity shares (Nominal value, ` 10) at a price of ` 15 per share. Debenture holders holding 2,500 debentures did not, exercise the option. Calculate the number of equity shares to be allotted to the, debenture holders exercising the option to the maximum., Question 2, Libra Limited (a listed company) recently made a public issue in respect of which the, following information is available:, (a), , No. of partly convertible debentures issued- 2,00,000; face value and issue price` 100 per debenture., , (b), , Convertible portion per debenture- 60%, date of conversion- on expiry of 6, months from the date of closing of issue., , (c), , Date of closure of subscription lists- 1.5.20X1, date of allotment- 1.6.20X1, rate of, interest on debenture- 15% payable from the date of allotment, value of equity, share for the purpose of conversion- ` 60 (Face Value ` 10)., , (d), , Underwriting Commission- 2%., , (e), , No. of debentures applied for- 1,50,000., , (f), , Interest payable on debentures half-yearly on 30th September and 31st, March., , Write relevant journal entries for all transactions arising out of the above during, the year ended 31st March, 20X2 (including cash and bank entries)., , © The Institute of Chartered Accountants of India

Page 31 :

8.31, , REDEMPTION OF DEBENTURES, Question 3, , On 1st April, 20X1, in MK Ltd.’s (unlisted company other than AIFI, Banking company,, NBFC and HFC) ledger, 9% debentures appeared with an opening balance of, ` 50,00,000 divided into 50,000 fully paid debentures of ` 100 each issued at par., Interest on debentures was paid half-yearly on 30th of September and 31st March, every year., On 31.5.20X1, the company purchased 8,000 debentures of its own @ ` 98, (ex-interest) per debenture. On same day, it cancelled the debentures acquired., You are required to prepare necessary ledger accounts (excluding Bank A/c)., Question 4, YZ Ltd (an unlisted company other than AIFI, Banking company, NBFC and HFC), had 16,000, 12% debentures of ` 100 each outstanding as on 1st April, 20X1,, redeemable on 31st March, 20X2., On 1 April 20X1, the following balances appeared in the books of accountsInvestment in 2,000 9% secured Govt. bonds of ` 100 each. DRR is ` 1,00,000., Interest on investments is received yearly at the end of financial year., 2,000 own debentures were purchased on 31st March 20X2 at an average price of, ` 99 and cancelled on the same date., On 30 March 20X2, the investments were realised at par and the debentures were, redeemed on 31st March, 20X2. You are required to write up the following accounts, for the year ended 31st March 20X2:, (1), , 12% Debentures Account, , (2), , Debenture Redemption Reserve Account, , (3), , Debenture Redemption Investments Account., , ANSWERS/ HINTS, MCQ, 1., , (c), , 2., , (b), , 3., , (b), , © The Institute of Chartered Accountants of India, , 4., , (b), , 5., , (b)

Page 32 :

8.32, , ACCOUNTING, , Theoretical Questions, Answer 1, Debentures are usually redeemable i.e. either redeemed in cash or convertible after, a time period., Redeemable debentures may be redeemed:, , , after a fixed number of years; or, , , , any time after a certain number of years has elapsed since their issue; or, , , , on giving a specified notice; or, , , , by annual drawing., , For details, refer para 2 of the chapter., Answer 2, A company issuing debentures may be required to create a debenture redemption, reserve account out of the profits available for distribution of dividend and, amounts credited to such account cannot be utilised by the company except for, redemption of debentures. Such an arrangement would ensure that the company, will have sufficient liquid funds for the redemption of debentures at the time they, fall due for payment. For details, refer para 3.1., , Practical Questions, Answer 1, Calculation of number of equity shares to be allotted, Total number of debentures, , Less: Debenture holders not opted for conversion, Debenture holders opted for conversion, Option for conversion, , Number of debentures to be converted (20% of, 17,500), Redemption value of 3,500 debentures at a premium, of 5% [3,500 x (100+5)], Equity shares of ` 10 each issued on conversion, [` 3,67,500/ ` 15], © The Institute of Chartered Accountants of India, , Number of debentures, 20,000, , (2,500), 17,500, , 20%, , 3,500, ` 3,67,500, , 24,500 shares

Page 33 :

8.33, , REDEMPTION OF DEBENTURES, Answer 2, Journal Entries in the books of Libra Ltd., Journal Entries, Date, , Particulars, , Amount Dr. Amount Cr., `, , 1.5.20X1, , Bank A/c, , `, , Dr. 1,50,00,000, , To Debenture Application A/c, , 1,50,00,000, , (Application money received on, 1,50,000 debentures @ ` 100 each), 1.6.20X1, , Debenture Application A/c, , Dr. 1,50,00,000, , Underwriters A/c, , Dr., , 50,00,000, , To 15% Debentures A/c, , 2,00,00,000, , (Allotment of 1,50,000 debentures to, applicants and 50,000 debentures to, underwriters), Underwriting Commission, , Dr., , 4,00,000, , To Underwriters A/c, , 4,00,000, , (Commission payable to underwriters, @ 2% on ` 2,00,00,000), Bank A/c, , Dr., , 46,00,000, , To Underwriters A/c, , 46,00,000, , (Amount received from underwriters in, settlement of account), 01.06.20X1 Debenture Redemption Investment Dr., A/c, To Bank A/c, , (200,000 X 100 x 15% X 40%), (Being, Investments, redemption purpose), , made, , © The Institute of Chartered Accountants of India, , for, , 12,00,000, 12,00,000

Page 34 :

8.34, , 30.9.20X1, , ACCOUNTING, , Debenture Interest A/c, , Dr., , To Bank A/c, , 10,00,000, , 10,00,000, , (Interest paid on debentures for 4, months @ 15% on ` 2,00,00,000), 31.10.20X1 15% Debentures A/c, , To Equity Share Capital A/c, , Dr. 1,20,00,000, , To Securities Premium A/c, , 1,00,00,000, , (Conversion of 60% of debentures into, shares of ` 60 each with a face value of, ` 10), 31.3.20X2, , Debenture Interest A/c, , Dr., , To Bank A/c, , 20,00,000, , 7,50,000, , 7,50,000, , (Interest paid on debentures for the, half year), (Refer working note below), Working Note:, Calculation of Debenture Interest for the half year ended 31st March, 20X2, On ` 80,00,000 for 6 months @ 15%, , = `6,00,000, , On ` 1,20,00,000 for 1 months @ 15%, , = ` 1,50,000, `7,50,000, , Answer 3, (i), , Debentures Account, , MK Ltd.’s Ledger, , `, 31.5.X1, , 31.5.X1, 31.3.X2, , To, Own, Debentures, (8,000 X `98), , To Profit on, cancellation, To balance c/d, , 7,84,000 1.4.X1, , `, By balance b/d, , 50,00,000, , 16,000, 42,00,000, , 50,00,000, , © The Institute of Chartered Accountants of India, , 50,00,000

Page 35 :

REDEMPTION OF DEBENTURES, (ii), , 8.35, , Interest on Debentures Account, , `, 31.5.X1, , To Bank (Interest for, 2 months on 8,000, debentures), (Refer, Note), , 30.9.X1, , 12,000 31.3.X2 By Profit, and Loss, A/c (b.f.), , 3,90,000, , To Bank (Interest for, 6, months, on 1,89,000, 42,000, debentures), (Refer, Note), , 31.3.X2, , Working, , `, , Working, , To Bank (Interest for, 6, months, on 1,89,000, 42,000, debentures), 3,90,000, , 3,90,000, , (iii) Debentures Redemption Reserve A/c, Date, , Particulars, , 31, May, , By, General, Reserve, , 31, March, 20X2, , By Balance c/d, , 20X1, , (8,000 x 100 x, 10%), , Amount Date, 80,000 1, April, 20x1, , Particulars, , Amount, , To Profit & Loss, A/c, , 5,00,000, , (50,000 X 100 X, 10%), , 4,20,000, 5,00,000, , © The Institute of Chartered Accountants of India, , 5,00,000

Page 36 :

8.36, (iv), , ACCOUNTING, , Debentures Redemption Reserve Investments A/c, , Date, , Particulars, , Amount Date, , 1 April, 20x1, , To Bank A/c, , 7,50,000 30, May, 20X1, , 7,50,000, , Particulars, , Amount, , By Bank A/c, , 1,20,000, , (8,000 x 100 x, 15%), , 31, To Balance b/d, March, 20X2, , 6,30,000, 7,50,000, , Working Note:, , `, 31.5. X1, , 31.5.X1, , 30.9. X1, , Acquired 8,000 Debentures @ 98 per debenture, (ex-interest), Purchase price of debenture (8,000 × ` 98), , Interest for 2 months [` 8,00,000 × 9% × 2/12], Interest on other debentures, ` 42,00,000 × 9% × ½, , =, , 7,84,000, , =, , 1,89,000, , =, , 12,000, , Answer 4, 12% Debentures Account, Date, , Particulars, , 31st, To Own, March, Debentures A/c, 20X2, 31st, To Profit on, March, cancellation, 20X2, , 31st, To Bank A/c, March,, 20X2, , ` Date, 1,98,000 1st April,, 20X1, , Particulars, By Balance, b/d, , `, 16,00,000, , 2,000, , 14,00,000, , 16,00,000, , © The Institute of Chartered Accountants of India, , 16,00,000

Page 37 :

REDEMPTION OF DEBENTURES, , 8.37, , Debenture Redemption Reserve Account, Date, , Particulars, , `, , Date, , Particulars, , 1st April, By Balance b/d, 20X1, 31st March, To General, 20X2, Reserve A/c, , 1st April, By Profit and loss, A/c [(16,00,000 X, 1,60,000 20X1, 10%) – 1,00,000], 1,60,000, , `, 1,00,000, , 60,000, 1,60,000, , Debenture Redemption Investments A/c, Date, , Particulars, , Amount Date, , Particulars, , Amount, , 1st, April, 20X1, , To Balance b/d, , 2,00,000 30th, March, , By Bank A/c, , 30,000, , 1st, April, 20X1, , To Bank A/c, , 20X2, , (Refer Working, Note 1), , 30th, March, 40,000 20X2, , (2,000 x 100 x 15%), (Refer Working, Note 2), By Bank A/c, , (Refer Working, Note 3), , 2,40,000, , 2,10,000, 2,40,000, , Working Note 1:, Additional investment in Debenture Redemption Investment A/c on 1 April, 20X1, The company would be required to invest an amount equivalent to 15% of the value, of the debentures in specified investments which would be equivalent to:, = Total No of debentures X Face value per debenture X 15%, = 16,000 X 100 X 15%, = ` 2,40,000/The company has already invested in specified investments i.e. 9% Govt bonds for, an amount of ` 2,00,000 as per the information given in the question., , © The Institute of Chartered Accountants of India

Page 38 :

8.38, , ACCOUNTING, , The balance amount of ` 40,000 (i.e. ` 2,40,000 less ` 2,00,000) would be invested, by the company on 1 April 20X1., Working Note 2:, Redemption of Debenture Redemption Investments on 30 March 20X2, amounting to ` 30,000, Since the company purchased 2,000 own debentures on 31 March 20X2, the, company would also realize the investments of 15% corresponding to these, debentures for which computation is as follows:, = No of own debentures to be bought X Face value per debenture X 15%, = 2,000 X 100 X 15%, = ` 30,000/Working Note 3:, Redemption of Debenture Redemption Investments on 30 March 20X2, amounting to ` 2,10,000, The remaining debentures i.e. total debentures less own debentures would be, redeemed on 31 March 20X2 and hence the company would also realize the, balance investments of 15% corresponding to these debentures for which, computation is as follows:, = (Total no of debentures - No of own debentures) X Face value per debenture X 15%, = (16,000 - 2,000) X 100 X 15%, = ` 2,10,000/-, , © The Institute of Chartered Accountants of India