Page 1 :

CHAPTER, , 10, , INSURANCE CLAIMS FOR, LOSS OF STOCK AND, LOSS OF PROFIT, LEARNING OUTCOMES, After studying this chapter, you will be able to–, , , , , , , Understand the significance of Claim for loss of stock and loss, of profit., Comprehend with the terms Loss of profit; Standing Charges, and Increased cost of working., Compute the amount of claim for loss of stock and loss of, profit, , © The Institute of Chartered Accountants of India

Page 2 :

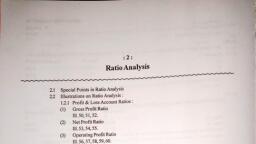

10.2, , Significance of, insurance policy, , ACCOUNTING, , Loss due to fire,, flood, theft,, earthquake etc, , Claim for loss of, stock and Loss of, profit, , Important terms, , Amount of claim for loss of, stock in case of, , Total Loss (Goods fully destroyed), , Actual loss (provided the goods are fully, insured), , Insurance for, Loss of Profit, , limited to, , © The Institute of Chartered Accountants of India, , Partial Loss (Goods partially, destroyed), Actual loss (subject to goods being, fully insured and whether average, clause is applicable or not), , loss of gross, profit, , (i)Reduction in, turnover, and, (ii) Increase in, the cost of, working

Page 3 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.3, , IMPORTANT TERMS, , Claim for Loss of The Loss of Profit Policy normally covers the following items:, Profit, (1) Loss of net profit, and, (2), , Any increased cost of working, , Gross Profit, , Net profit +Insured Standing charges, OR, Insured Standing charges – [Net Trading Loss (If any) X Insured, Standing charges/All standing charges of business], , Net Profit, , The net trading profit (exclusive of all capital receipts and, accretion and all outlay properly chargeable to capital), resulting from the business of the Insured at the premises after, due provision has been made for all standing and other, charges including depreciation., , Insurable, Standing, Charges, , Interest on Debentures, Mortgage Loans and Bank Overdrafts,, Rent, Rates and Taxes (other than taxes which form part of net, profit) Salaries of Permanent Staff and Wages to Skilled, Employees, Boarding and Lodging of resident Directors and/or, Manager, Directors’ Fees, Unspecified Standing Charges., , Rate of, Profit, , Gross The rate of Gross Profit earned on turnover during the financial, year immediately before the date of damage plus / minus, adjustment for current year changes in price level., , Annual, Turnover, , The turnover during the twelve months immediately preceding, to the date of damage., , Standard, Turnover, , The turnover of the period in corresponding previous year from, the year in which damage occurred, that corresponds with the, Indemnity Period., , Indemnity, Period, , The period beginning with the occurrence of the damage and, ending not later than twelve months. Thus, it is a period during, which business is disturbed due to fire and it is not greater, than 12 months., , Adjusted Annual Annual Turnover adjusted with (+/-) Trend, Turnover, Actual Turnover, , Turnover during dislocation / indemnity period, , © The Institute of Chartered Accountants of India

Page 4 :

10.4, , Adjusted, Standard, Turnover, , ACCOUNTING, , Standard Turnover (+/-) Trend (if any) which would be sales in, the indemnity period had there been no fire., , Fire, Fighting Expenses incurred to avoid the damages to the business due to, Expenses, fire. For Example: Fire Brigade Expenses / Water Tankers’, Charges, Trend, , It is an indication of Sales pattern of an organization over a, specific time period. It will help in estimation of future, expected sales., , 1. INTRODUCTION, Business enterprises get insured against the loss of stock on the happening of, certain events such as fire, flood, theft, earthquake etc. Insurance being a contract, of indemnity, the claim for loss is restricted to the actual loss of assets. Sometimes, an enterprise also gets itself insured against consequential loss of profit due to, decreased turnover, increased expenses etc., If loss consequential to the loss of stock is also insured, the policy is known as loss, of profit or consequential loss policy., Insurance claim can be studied under two parts as under:, , Claim for loss of stock, , , , Claim for loss of profit, , 2. MEANING OF FIRE, For purposes of insurance, fire means:, 1., , Fire (whether resulting from explosion or otherwise) not occasioned or, happening through:, (a), , Its own spontaneous fomentation or heating or its undergoing any, process involving the application of heat;, , (b), , Earthquake, subterraneous fire, riot, civil commotion, war, invasion act, of foreign enemy, hostilities (whether war be declared or not), civil war,, rebellion, revolution, insurrection, military or usurped power., , © The Institute of Chartered Accountants of India

Page 5 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.5, , 2., , Lightning., , 3., , Explosion, not occasioned or happening through any of the perils specified, in 1 (a) above., (i), , of boilers used for domestic purposes only;, , (ii), , of any other boilers or economizers on the premises;, , (iii), , in a building not being any part of any gas works or gas for domestic, purposes or used for lighting or heating the building., , The policy of insurance can be made to cover any of the excepted perils by, agreement and payment of extra premium, if any. Damage may also be covered if, caused by storm or tempest, flood, escape of water, impact and breakdown of, machinery, etc., again by agreement with the insurer., Usually, fire policies covering stock or other assets do not cover explosion of boilers, used for domestic purposes or other boilers or economizers in the premises but, policies in respect of profit cover such explosions., , 3. CLAIM FOR LOSS OF STOCK, Fire insurance being a contract of indemnity, a claim can be lodged only for the, actual amount of the loss, not exceeding the insured value. In dealing with, problems requiring determination of the claim the following point must be noted:, (a), , Total Loss: If the goods are totally destroyed, the amount of claim is equal, to the actual loss, provided the goods are fully insured. However, in case of, under insurance (i.e. insurable value of stock insured is more than the sum, insured),the amount of claim is restricted to the policy amount., , Example:, Stock on the date of fire, , ` 3,00,000, , Stock fully destroyed by fire (no salvage), Amount of policy in case (1) ` 4,00,000 and in case (2) ` 2,50,000., Here, in case (1), claim can be lodged for actual amount of loss i.e. ` 3,00,000,, as it is not exceeding the policy value. But in case (2), i.e. claim amount cannot, exceed policy amount and it will be for ` 2,50,000., (b), , Partial Loss: If the goods are partially destroyed, the amount of claim is equal, to the actual loss provided the goods are fully insured. However, in case of, , © The Institute of Chartered Accountants of India

Page 6 :

10.6, , ACCOUNTING, , under insurance, the amount of claim will depend upon the nature of, insurance policy as follows:, (i), , Without Average clause: Claim is equal to the lower of actual loss or, the sum insured., , Example:, Stock on the date of fire, , ` 3,00,000, , Goods saved from fire (i.e. salvage), , ` 1,20,000, , Compute the amount of claim if amount of policy (without average, clause) is, Case (1), , ` 1,00,000, , Case (2), , ` 2,00,000, , Solution, Stock on the date of fire, , ` 3,00,000, , Less: Salvage, , (` 1,20,000), , Loss of Stock, , ` 1,80,000, , Amount of claim is as under:, Case (1), ` 1,00,000 (restricted to amount of policy, although loss is, of ` 1,80,000 only), Case (2), (ii), , ` 1,80,000 (restricted to amount of loss), , With Average Clause: Amount of claim for loss of stock is, proportionately reduced, considering the ratio of policy amount (i.e., insured amount) to the value of stock as on the date of fire (i.e. insurable, amount) as shown below:, , Amount of claim = Loss of stock × sum insured / Insurable amount (Total Cost), One should note that the average clause applies only where the insured value is, less than the total cost and not when goods are fully insured., , Example (Logic of Average Clause), Stock on the date of fire, , ` 60,000, , Amount of policy for loss of stock, , ` 15,000, , Salvage Value (residual value), , ` 50,000, , © The Institute of Chartered Accountants of India

Page 7 :

10.7, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, Loss of stock, , ` 10,000, , Find out claim which should be paid by an insurance company., Solution, Usually, students think that loss of `10,000 is lower than amount of policy of, `15,000. So full loss is recoverable by insurance claim. But in reality, as only 25% of, the stock was insured (`15,000/`60,000X100) and remaining 75% is uninsured., Hence, claim should be restricted to 25% of the loss of ` 10,000 i.e. ` 2,500 only., SUMMARY CHART, Amount of claim in case of Under Insurance, , Total Loss, Restricted to the, policy amount, , Partial Loss, , Without Average clause, , With Average, Clause, , Actual loss Or, Sum insured, whichever is lower, , Loss of stock x sum, insured / Insurable, amount (Total Cost), , 3.1 Relevant points, (i), , Where the stock records are maintained and such records are not destroyed, by fire, the value of the stock as at the date of the fire can be easily arrived, at., , (ii), , Where either the stock records are not available or where they are, destroyed by the fire, the value of stock at the date of the fire has to be, estimated. The usual method of arriving at this value is to build up a Trading, Account as from the date of last accounting year. After allowing for the usual, gross profit, the figure of closing stock on the date of the fire can be, ascertained as the balancing item., , © The Institute of Chartered Accountants of India

Page 8 :

10.8, , ACCOUNTING, , (iii), , Where books of account are destroyed, the task of building up the Trading, Account becomes difficult. In that case information is obtained from the, customers and suppliers have to be circularised to ascertain the amount of, sales and purchases., , (iv), , After the insurance company makes payment for total loss, it has the same, rights which the insured had over the damaged stock. These are subrogated 1, to the insurance company. In practice, in determining the amount of the, claim, credit is given for damaged and salvaged stock., , (v), , Frequently salvaged stock can be made saleable after it is reconditioned. In, that case, the cost of such stock must be credited to the Trading Account and, debited to a salvaged stock account. The expenses on reconditioning must, be debited and the sales credited to this account, the final balance being, transferred to the Profit & Loss Account., Loss of Stock, Amount of loss of stock is calculated as under:, Value of stock on the date of fire, , XXXX, , Less: Value of Salvaged stock, , XXXX, , Amount of loss of stock, , XXXX, , Value of salvaged stock, Add:, , Particulars, , Expenses on re-conditioning, , Less: Sales, , Profit/ (loss), , Amount, , xxx, xxx, xxx, , xxx, , Illustration 1, From the following information, ascertain the value of stock as on 31 st March, 20X2:, , `, Stock as on 01-04-20X1, Purchases, , Manufacturing Expenses, , 28,500, , 1,52,500, , 30,000, , Subrogation is the right of an insurer to legally pursue a third party that caused an insurance, loss to the insured, i.e., the right to sue the third party for the loss suffered by the insured., 1, , © The Institute of Chartered Accountants of India

Page 9 :

10.9, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, Selling Expenses, , 12,100, , Administration Expenses, Financial Expenses, , 6,000, 4,300, , Sales, , 2,49,000, , At the time of valuing stock as on 31st March, 20X1, a sum of ` 3,500 was written off, on a particular item, which was originally purchased for ` 10,000 and was sold during, the year for ` 9,000. Barring the transaction relating to this item, the gross profit, earned during the year was 20% on sales., Solution, Statement showing valuation of stock as on 31.3.20X2, `, Stock as on 01.04.20X1, Less: Book value of abnormal stock, (` 10,000 – ` 3,500), , 28,500, , 6,500, , Add: Purchases, Manufacturing expenses, Less: Cost of Sales:, , Sales, Less: Sale of abnormal stock, , Less: Gross profit @ 20%, Value of Stock as on 31st March, 20X2, , `, , 22,000, , 1,52,500, 30,000, 2,04,500, 2,49,000, (9,000), 2,40,000, , (48,000), , (1,92,000), 12,500, , Alternative Method (Trading Account Approach), Computation of Gross Profit for the Year, Total Sales, , Less: Abnormal Sales, , Regular Sales, A. Gross Profit on Regular Sales @ 20%, , B. Gross Profit on Abnormal Sales [9,000 – 6,500*], Total Gross Profit (A+B), , * Written down cost (Original Cost 10,000 less write off for 3,500), © The Institute of Chartered Accountants of India, , `, 2,49,000, , (9,000), , 2,40,000, , 48,000, , 2,500, , 50,500

Page 10 :

10.10, , ACCOUNTING, , Computation of Closing Stock as on 31st March, 20X2, Opening Stock, , Add: Purchases, , Add: Manufacturing Expenses, Add: Gross Profit (as computed above), Less: Total Sales, , Value of Stock as on 31st March, 20X2, , 28,500, , 1,52,500, , 30,000, 50,500, , 2,61,500, (2,49,000), 12,500, , Illustration 2, Mr. A prepares accounts on 30th September each year, but on 31st December, 20X1, fire destroyed the greater part of his stock. Following information was collected from, his book:, , `, Stock as on 1.10.20X1, , 29,700, , Wages from 1.10.20X1 to 31.12.20X1, , 33,000, , Purchases from 1.10.20X1 to 31.12.20X1, Sales from 1.10.20X1 to 31.12.20X1, , 75,000, 1,40,000, , The rate of gross profit is 33.33% on cost. Stock to the value of ` 3,000 was salvaged., Insurance policy was for ` 25,000 and claim was subject to average clause., Additional information:, (i), , Stock at the beginning was calculated at 10% less than cost., , (ii), , A plant was installed by firm’s own worker. He was paid ` 500, which was, included in wages., , (iii), , Purchases include the purchase of the plant for ` 5,000, , You are required to calculate the claim for the loss of stock., Solution, Computation of claim for loss of stock:, `, Stock on the date of fire i.e. 31.12.20X1(Refer working note), Less: Salvaged stock, Loss of stock, , © The Institute of Chartered Accountants of India, , 30,500, , (3,000), 27,500

Page 11 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.11, , Amount of claim:, =, , Insured value, ×loss of stock, Total cost of stock on the date of fire, , = 27500 X 25000/30500 = ` 22,541, Working Note:, Memorandum trading account can be prepared for the period from 1.10.20X1 to, 31.12.20X1 to compute the value of stock on 31.12.20X1., Memorandum Trading Account, for period from 1.10.20X1 to 31.12.20X1, `, To Opening stock, (` 29,700 x 100/90), To Purchases, Less: Cost of plant, , 75,000, (5,000), , To Wages, , 33,000, , Less: Wages paid for plant, To Gross profit, (33.33% on cost or 25% on, sales), , (500), , `, 33,000 By Sales, By Closing stock, (bal. fig.), , `, 1,40,000, 30,500, , 70,000, 32,500, 35,000, , 1,70,500, , 1,70,500, , Illustration 3, On 20th October, 20X1, the godown and business premises of Aman Ltd. were affected, by fire. From the salvaged accounting records, the following information is available:, , `, Stock of goods @ 10% lower than cost as on 31 st March, 20X1, , 2,16,000, , Purchases less returns (1.4.20X1 to 20.10.20X1), , 2,80,000, , Sales less returns (1.4.20X1 to 20.10.20X1), , 6,20,000, , © The Institute of Chartered Accountants of India

Page 12 :

10.12, , ACCOUNTING, , Additional information:, (1), , Sales upto 20th October, 20X1 includes ` 80,000 for which goods had not been, dispatched., , (2), , Purchases upto 20th October, 20X1 did not include ` 40,000 for which purchase, invoices had not been received from suppliers, though goods have been, received in Godown., , (3), , Past records show the gross profit rate of 25%., , (4), , The value of goods salvaged from fire ` 31,000., , (5), , Aman Ltd. has insured their stock for ` 1,00,000., , Compute the amount of claim to be lodged to the insurance company., Solution, Memorandum Trading A/c, (1.4.20X1 to 20.10.20X1), Particulars, , (` ) Particulars, , To Opening stock (at cost,, 2,16,000 / 0.90), , 2,40,000, , To Purchases, (` 2,80,000 + ` 40,000), , 3,20,000, , To Gross profit, (` 5,40,000 x 25%*), , By Sales, (` 6,20,000 – ` 80,000), By Closing stock, (bal. fig.), , 1,35,000, 6,95,000, , * It is assumed that gross profit is provided as a percentage of sales, , (` ), 5,40,000, 1,55,000, , 6,95,000, , `, Stock on the date of fire (i.e. on 20.10.20X1), , 1,55,000, , Stock destroyed by fire, , 1,24,000, , Less: Stock salvaged, , Insurance claim = Loss of Stock X Insured Value / Total Cost of Stock, = `1,24,000 X 1,00,000 / 1,55,000 = `80,000, © The Institute of Chartered Accountants of India, , (31,000)

Page 13 :

10.13, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, Illustration 4, , On 12th June, 20X2 fire occurred in the premises of N.R. Patel, a paper merchant. Most, of the stocks were destroyed, cost of stock salvaged being ` 11,200. In addition, some, stock was salvaged in a damaged condition and its value in that condition was agreed, at ` 10,500. From the books of account, the following particulars were available., 1., , His stock at the close of account on December 31, 20X1 was valued at ` 83,500., , 2., , His purchases from 1-1-20X2 to 12-6-20X2 amounted to ` 1,12,000 and his, sales during that period amounted to ` 1,54,000., , On the basis of his accounts for the past three years it appears that he earns on an, average a gross profit of 30% of sales., Patel has insured his stock for ` 60,000. Compute the amount of the claim., Solution, Computation of claim for loss of stock, , `, Opening Stock on 1-1-20X2, Add: Purchases during the period, Less: Cost of Goods Sold: Sales during the period, Gross Profit thereon, , Value of Closing Stock before fire, Less: Stock Salvaged, , Agreed value of damage Stock, , Loss of Stock, , Claim = Loss of Stock X Insured Value / Total Cost, of Stock = 66,000 X 60,000 / 87,700 =` 45,154, , `, 83,500, 1,12,000, , 1,54,000, , (46,200), 11,200, 10,500, , 1,95,500, , (1,07,800), 87,700, , (21,700), 66,000, , Illustration 5, On 1st April, 20X2 the stock of Shri Ramesh was destroyed by fire but sufficient, records were saved from which following particulars were ascertained:, , `, Stock at cost-1st January, 20X1, Stock at cost-31st December, 20X1, , Purchases-year ended 31st December,20X1, © The Institute of Chartered Accountants of India, , 73,500, 79,600, , 3,98,000

Page 14 :

10.14, , ACCOUNTING, , Sales-year ended 31st December, 20X1, Purchases-1-1-201X2 to 31-3-20X2, , 4,87,000, 1,62,000, , Sales-1-1-20X2 to 31-3-20X2, , 2,31,200, , In valuing the stock for the Balance Sheet at 31st December, 20X1 ` 2,300 had been, written off on certain stock which was a poor selling line having the cost ` 6,900. A, portion of these goods were sold in March, 20X2 at loss of ` 250 on original cost of, ` 3450. The remainder of this stock was now estimated to be worth its original cost., Subject to the above exception, gross profit had remained at a uniform rate, throughout the year., The value of stock salvaged was ` 5,800. The policy was for ` 50,000 and was subject, to the average clause. Work out the amount of the claim of loss by fire., Solution, Shri Ramesh, Trading Account for 20X1, (to determine the rate of gross profit), `, To, , Opening Stock, , To, , Gross Profit (b.f.), , To, , Purchases, , 73,500, , 3,98,000, , 97,400, , `, By Sales A/c, , 4,87,000, , By Closing Stock :, , As valued, Add:, Amount, written, off, to, restore stock to, original cost, , 79,600, , 2,300, , 5,68,900, The (normal) rate of gross profit to sales is =, , `, , 81,900, , 5,68,900, , 97,400, × 100 = 20%, 4,87,000, , Memorandum Trading Account upto March 31, 20X2, , To Opening, Stock, , Normal, , Abnormal, , items, , items, , `, , `, , 75,000, , 6,900*, , Total, , Normal, , `, 81,900 By Sales, By Loss, , © The Institute of Chartered Accountants of India, , Abnormal, , Total, , items, , items, , `, , `, , `, , 2,28,000, , 3,200, , 2,31,200, , —, , 250, , 250

Page 15 :

10.15, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , To Purchases, To, , 1,62,000, , —, , 1,62,000 By Closing, , 54,600, , 3,450**, , 58,050, , 2,82,600, , 6,900, , 2,89,500, , Stock (bal. fig.), , Gross, , Profit (20% on, ` 2,28,000), , 45,600, , —, , 45,600, , 2,82,600, , 6,900, , 2,89,500, , * at cost, book value is ` 4,600, ** Book value will also be restored for remaining unsold abnormal stock since the, remainder of this stock was now estimated to be worth its original cost., , Calculation of Insurance Claim, `, Value of Stock on March 31, 20X2, , 58,050, , Less: Salvage, , (5,800), , Loss of stock, , 52,250, , Claim subject to average clause:, = Amount of Policy × Actual Loss of Stock, Value of Stock, , = `, , 50,000, × 52,250 = ` 45,004, 58,050, , Illustration 6, On 19th May, 20X2, the premises of Shri Garib Das were destroyed by fire, but, sufficient records were saved, wherefrom the following particulars were ascertained:, `, Stock at cost on 1.1.20X1, Stock at cost on 31.12.20X1, , Purchases less returns during 20X1, Sales less return during 20X1, , Purchases less returns during 1.1.20X2 to 19.5.20X2, Sales less returns during 1.1.20X2 to 19.5.20X2, , 36,750, 39,800, , 1,99,000, 2,43,500, , 81,000, , 1,15,600, , In valuing the stock for the balance Sheet as at 31st December, 20X1, ` 1,150 had, been written off on certain stock which was a poor selling line having the cost ` 3,450., A portion of these goods were sold in March, 20X2 at a loss of ` 125 on original cost, © The Institute of Chartered Accountants of India

Page 16 :

10.16, , ACCOUNTING, , of ` 1,725. The remainder of this stock was now estimated to be worth the original, cost. Subject to the above exceptions, gross profit has remained at a uniform rate, throughout. The stock salvaged was ` 2,900., Show the amount of the claim of stock destroyed by fire. Memorandum Trading, Account to be prepared for the period from 1-1-20X2 to 19-5-20X2 for normal and, abnormal items., Solution, Shri Garib Das, Trading Account for the year ended on 31st December, 20X1, , `, To Opening Stock, , `, , 36,750, , `, , By Sales A/c, , To Purchases, 1,99,000, To Gross Profit (b.f.), 48,700, , 2,43,500, , By Closing Stock :, As valued, , Add: Amount written, off to restore stock to, original cost, , 2,84,450, , 39,800, , 1,150, , 40,950, , 2,84,450, , The normal rate of gross profit to sales is = 48,700 × 100 = 20%, 2,43,500, , Memorandum Trading Account up to 19, May, 20X2, Normal Abnormal, , To Opening Stock, To Purchases, , To Gross Profit, (20% on, , ` 1,14,000), , items, , items, , `, , `, , 37,500, , 3,450*, , 81,000, , 22,800, , 1,41,300, , —, , —, , Total, , Normal Abnormal, , `, 40,950 By Sales, 81,000 By Loss, , By Closing, , 22,800, , 3,450 1,44,750, , Stock, , (bal. fig.), , Total, , items, , items, , `, , `, , `, , 1,14,000, , 1,600, , 1,15,600, , 27,300, , 1,725**, , —, , 1,41,300, , 125, , 3,450, , 125, , 29,025, , 1,44,750, , * at cost, book value is ` 2,300., ** Book value will also be restored for remaining unsold abnormal stock since the remainder of this, stock was now estimated to be worth its original cost., , © The Institute of Chartered Accountants of India

Page 17 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.17, , Calculation of Insurance Claim, `, Value of Stock on 19th May, 20X2, , 29,025, , Less: Salvage, , (2,900), , Loss of stock, , 26,125, , Therefore, insurance claim will be for ` 26,125 only., Illustration 7, On 30th March, 20X2 fire occurred in the premises of M/s Suraj Brothers. The concern, had taken an insurance policy of ` 60,000 which was subject to the average clause., From the books of accounts, the following particulars are available relating to the, period 1st January 20X2 to 30th March 20X2., (1), , Stock as per Balance Sheet at 31st December, 20X1, ` 95,600., , (2), , Purchases (including purchase of machinery costing ` 30,000) ` 1,70,000, , (3), , Wages (including wages ` 3,000 for installation of machinery) ` 50,000., , (4), , Sales (including goods sold on approval basis amounting to ` 49,500), ` 2,75,000. No approval has been received in respect of 2/3rd of the goods sold, , on approval., (5), , The average rate of gross profit is 20% of sales., , (6), , The value of the salvaged goods was ` 12,300., , You are required to compute the amount of the claim to be lodged to the insurance, company., Solution, Computation of claim for loss of stock, `, Stock on the date of fire i.e. on 30th March, 20X2 (W.N.1), Less: Value of salvaged stock, Loss of stock, , © The Institute of Chartered Accountants of India, , 62,600, , (12,300), 50,300

Page 18 :

10.18, , Amount of claim =, , ACCOUNTING, , Insured value, , Total cost of stock on the date of fire, 60,000, , 62,600 × 50,300 , , , , =, , x Loss of stock, , 48,211, (approx.), , A claim of ` 48,211 (approx.) should be lodged by M/s Suraj Brothers to the, insurance company., Working Notes:, 1., , Calculation of closing stock as on 30th March, 20X2, Memorandum Trading Account for, (from 1st January, 20X2 to 30th March, 20X2), Particulars, To Opening stock, To Purchases, , (1,70,000-30,000), , Amount Particulars, (`), 95,600 By Sales (W.N.3), , By Goods with customers, 1,40,000, (for approval) (W.N.2), , To Wages, , 47,000 By Closing stock (Bal. fig.), , To Gross profit, (20% on sales), , 48,400, , (50,000 – 3,000), , 3,31,000, , Amount, (`), 2,42,000, 26,400*, 62,600, , 3,31,000, , * For financial statement purposes, this would form part of closing stock (since, there is no sale). However, this has been shown separately for computation of, claim for loss of stock since the goods were physically not with the concern and,, hence, there was no loss of such stock as a result of fire., 2., , Calculation of goods with customers, Since no approval for sale has been received for the goods of ` 33,000 (i.e., 2/3 of ` 49,500) hence, these should be valued at cost i.e. ` 33,000 – 20% of, ` 33,000 = ` 26,400., , 3., , Calculation of actual sales, Total sales – Sale of goods on approval (2/3rd)= ` 2,75,000 – ` 33,000 =, ` 2,42,000., , © The Institute of Chartered Accountants of India

Page 19 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.19, , 4. CLAIM FOR LOSS OF PROFIT, When a fire occurs, apart from the direct loss on account of stock or other assets, destroyed, there is also a consequential loss because, for some time, the business, is disorganized or has to be discontinued, and during that period, the standing, expenses of the business like rent, salaries etc. continue. Moreover, there is loss of, profits which the business would have earned during the period. This loss can be, insured against by a "Loss of Profit" or "Consequential Loss" policy; there must be a, separate policy in respect of the consequential loss but claim will be admitted in, respect of the policy only when the claim on account of fire is also admitted under, other policies., The Loss of Profit Policy normally covers the following items:, (1), , Loss of net profit, , (2), , Any increased cost of working., Loss of Profit Policy, Loss of net profit, , Business is interrupted due to damage, of premises, , Any increased cost of working, e.g., renting of temporary premises, , In every business, there is some standard by which its activity or progress can be, accurately judged: it may be sales affected or the quantity of goods (or services), produced. To measure the loss suffered by a firm due to fire, it is necessary to set, up some standard expressed in such units to represents the volume of work. There, should be a direct relation between the amount of standard and the amount of, profit raised. A comparison between the amount of the standard before and after, the fire will give a reliable indication of the loss of profit. The most satisfactory unit, of measuring the prosperity (and therefore profits) is usually turnover:, A claim for loss of profits can be established only if :, (i), , the insured’s premises, or the property therein, are destroyed or, damaged by the peril defined in the policy; and, , (ii), , the insured’s business carried on the premises is interrupted or, interfered with as a result of such damage., , © The Institute of Chartered Accountants of India

Page 20 :

10.20, , ACCOUNTING, , Further, a claim for loss of profits cannot arise if the claim for loss of property as a, result of the fire is not admitted. It is also possible that the business of the insured, may suffer because of fire in the neighbourhood, not causing damage to the, property of the insured, say by closing the street for some time. Such eventualities, may be covered by agreement with the insurer on payment of extra premium. If fire, does not affect the volume of business, there can be no claim for loss of profits., Also, it does not mean that if there is a large property claim, there will be necessarily, a large claim for loss of profit or vice versa., , 4.1. Terms Defined, The following terms should be noted:, Gross Profit is the sum produced by adding to the Net Profit the amount of the, Insured Standing Charges, or, if there be no Net profit, the amount of the Insured, Standing Charges less such a proportion of any net trading loss as the amount of, the Insured Standing Charges bears to all the standing charges of the business., Net Profit is the net trading profit (exclusive of all capital receipts and accretion, and all outlay properly chargeable to capital) resulting from the business of the, Insured at the premises after due provision has been made for all standing and, other charges including depreciation., Insurable Standing Charges: Interest on Debentures, Mortgage Loans and Bank, Overdrafts, Rent, Rates and Taxes (other than taxes which form part of net profit), Salaries of Permanent Staff and Wages to Skilled Employees, Boarding and Lodging, of resident Directors and/or Manager, Directors’ Fees, Unspecified Standing, Charges [not exceeding 5% (five per cent) of the amount recoverable in respect of, Specified Standing Charges]., , 4.2. Conditions included in a Loss of Profit Insurance Policy, Insurance policies covering loss of profit contain the following considerations, usually:, Rate of Gross Profit: The rate of Gross Profit earned on turnover during the, financial year immediately before the date of damage plus / minus adjustment for, current year changes in price level., , GP Rate applicable for the year = GP Rate of last Financial Year +/- Adjustment, for changes in purchase and sale prices in the, year of fire., , © The Institute of Chartered Accountants of India

Page 21 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.21, , Annual Turnover: The turnover during the twelve months immediately before the, damage., Standard Turnover: The turnover during that period in the twelve months, immediately before the date of damage which corresponds with the Indemnity, Period., It is to this corresponding turnover of previous year, further adjustment shall be, made as may be necessary to provide for the trend of the business and for, variations in or special circumstances affecting the business either before or after, the damage or which would have affected the business had the damage not, occurred, also known as Adjusted Standard Turnover. Accordingly, this shall, represent, as nearly as may be reasonably practicable the results which (but for the, damage) would have been obtained during the relative period after damage., Indemnity Period: The period beginning with the occurrence of the damage and, ending not later than twelve months thereafter during which, the results of the, business shall be affected in consequence of the damage. Thus, it is a period during, which business is disturbed due to fire and is not greater than 12 months., Memo 1: If during the indemnity period goods shall be sold or services shall be, rendered elsewhere than at the premises for the benefit of the business either by, the insured or by others on the Insured’s behalf, the money paid or payable in, respect of such sales or service shall be brought into account in arriving at the, turnover during the indemnity period., Memo 2: If some of the standing charges of the business are not being insured by, this policy then in computing the amount recoverable hereunder as increase in cost, of workings only that proportion of the additional expenditure shall be taken into, consideration which the sum of the Net Profit and the insured Standing Charges, bear to the sum of the Net Profit and all standing charges., Amount Recoverable as increase in cost of workings =, Increased Cost of Working X, , (GP on Adjusted Annual Turnover), , (GP on Adjusted Annual Turnover) + Uninsured Standing Charges, Alternative Formula: Amount recoverable as increase in cost of workings =, Additional expenditure x [(Net Profit + Insured Standing Charges)/ (Net Profit + All, Standing Charges)], Memo 3: This insurance does not cover loss occasioned by or happening through, or in consequence of destruction of or damage to a dynamo motor, transformer,, © The Institute of Chartered Accountants of India

Page 22 :

10.22, , ACCOUNTING, , rectifier or any part of an electrical installation resulting from electric currents,, however, arising., The student should note the following:, (i), , The word ‘turnover’ used above may be replaced by any other term denoting, the basis for arriving at the loss of profit e.g., output., , (ii), , Insured standing charges may include additional items, by agreement with, the insurer., , (iii), , Net profit means profit before income tax based on profit., , (iv), , Depending upon the nature of business, the indemnity period may extend, beyond 12 months (it may be as long as 6 years). Indemnity period shall not, be confused with the period of insurance which cannot be more than one, year., , The insurance for Loss of Profit is limited to loss of gross profit due to:, (i), , reduction in turnover, and, , (ii), , increase in the cost of working., , The amount payable as indemnity is the sum of (a) and (b) below:, (a), , In respect of reduction in turnover : The sum produced by applying the rate, of gross profit to the amount by which the turnover during the indemnity, period shall, in consequence of the damage, falls short of the standard, turnover, i.e., gross profit on short sales., , (b), , In respect of increase in cost of working: The additional expenditure, [subject to the provisions of Memo (2) given above] necessarily and, reasonably incurred for the sole purpose of avoiding or diminishing the, reduction in turnover which, but for that expenditure, would have taken place, during the indemnity period in consequence of the damage. The amount, allowable under this provision cannot exceed the sum produced by applying, the rate of gross profit to the amount of reduction avoided by the additional, expenditure, i.e., gross profit on (additional) sales generated by increased, cost of workings., , Thus, to summarize, in case of Loss of Profit, the claim shall comprise of:, 1), , Gross Profit on Short Sales (i.e. loss of profit) and, , © The Institute of Chartered Accountants of India

Page 23 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, 2), , 10.23, , Claim with respect to Increased cost of Working which shall be the least of, the following:, a), , Actual amount incurred i.e. increased cost of working, , b), , Increased Cost of Working X, , (GP on Adjusted Annual Turnover), , (GP on Adjusted Annual Turnover) + Uninsured Standing Charges, c), , GP on the additional sales generated because of increased cost of, working, , The amount payable arrived at as above is reduced by any sum saved during, the indemnity period in respect of such amount of the insured standing, charges as may be ceased or reduced in consequence of the damage, (because those were anyways avoided or not required to be incurred), Average Clause: Insurance policies provide that if the sum insured in respect of loss, of profit is less than the sum produced by applying the rate of gross profit to the, annual turnover (as adjusted by the trend of the business or variation in special, circumstances affecting the business either before or after the damage or which, would have affected the business had the damage not occurred), the amount, payable by the insurer shall be proportionately reduced. This is nothing but, application of the average clause., The turnover of a business rarely remains constant and where there has been an, upward or downward trend since the date of the last accounts and upto the date, of the fire, the "standard turnover" should be appropriately adjusted, as per, definition given above., Similarly, where the earning capacity of the business has changed, the rate of gross, profit may not represent a correct indication of the lots and mutually agreed rate, may be used for the computation., Students should carefully go through the working of the following illustration to, understand the process of the computation of the claim made on a "Loss of Profit", policy., Illustration 8, From the following information, compute the amount of claim under loss of profit, policy:, (i), , Indemnity period 13 months, , © The Institute of Chartered Accountants of India

Page 24 :

10.24, , ACCOUNTING, , (ii), , Sum insured ` 2,00,000, , (iii), , Turnover, last financial year ended Dec. 31, 20X1 ` 12,00,000., , (iv), , Gross Profit, i.e., Net profit plus insured standing charges, ` 2,40,000 giving a, gross profit rate of 20%., , (v), , Net profit plus all standing charges, ` 2,90,000 i.e., 50,000 of the standing, charges are not insured., , (vi), , Fire occurs on 31st March, 20X2, and affects business for 6 months., , (vii) Turnover for 12 months ended 31st March, 20X2, ` 11,70,000., (viii) Turnover: 1-4-20X1 to 30-9-20X1, , 5,00,000, , 1-4-20X2 to 30-9-20X2, , 3,00,000, , Reduction in turnover, , 2,00,000, , (ix), , Sales amounting ` 1,60,000 generated in period 1.4.20X2 to 30.9.20X2 by, incurring additional expenses of ` 30,000., , (x), , Saving in insured standing charges in the indemnity period ` 10,000., , Solution, The claim in respect of profit will be calculated as follows:, (a), , Short Sales:, Turnover 1-4-20X1 to 30-9-20X1, Less: Turnover 1-4-20X2 to 30-9-20X2, Reduction in turnover, Down-trend:, , `, 5,00,000, (3,00,000), 2,00,000, `, , Quarterly sales in 20X1 ` 12,00,000 × 3 , 12, , , , 3,00,000, , ` 12,00,000 , × 9, Sales of first quarter in 20X2: ` 11,70,000 - , 12, , , , 2,70,000, , (Jan-Mar 20X2), , © The Institute of Chartered Accountants of India, , 30,000

Page 25 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.25, , Adjusted Annual Turnover:, , `, , Sales for the period 1-4-20X1 to 31-12-20X1, (11,70,000 - 2,70,000), , 9,00,000, , Add: Sales from 1-1-20X2 to 31-3-20X2, , 2,70,000, 11,70,000, , (b), , Gross Claim: Gross Profit @ 20% on short sales (` 2,00,000), , 40,000, , Add: Claim for increase in cost of working (see below), , 24,718, 64,718, , Less: Saving in insured standing charges, , (10,000), 54,718, , Claim for increased cost of working is subject to two tests, (i), , Increased cost of working×, , = ` 30,000 ×, (ii), , G.P. on Adjusted Annual Turnover, G.P. as above + Uninsured Standing Charges, , ` 11,70,000 ×, , 20, 100, , 20, ` 11,70,000 ×, + ` 50,000, 100, , = ` 24,718., , Gross Profit on sales generated by increased cost of workings, = 1,60,000 ×, , 20, = ` 32,000, 100, , Lower of the two, i.e., ` 24,718 is allowable, (c), , Application of average clause:, , `, , Gross Profit on adjusted annual turnover, 20% on ` 11,70,000 2,34,000, Sum insured, , Hence claim limited to 54, 718 ×, , ` 2, 00, 000, ` 2, 34, 000, , 2,00,000, 46,768, , Illustration 9, A fire occurred on 1st February, 20X2, in the premises of Pioneer Ltd., a retail store, and business was partially disorganized upto 30th June, 20X2. The company was, insured under a loss of profits for ` 1,25,000 with a six months period indemnity., , © The Institute of Chartered Accountants of India

Page 26 :

10.26, , ACCOUNTING, , From the following information, compute the amount of claim under the loss of profit, policy assuming entire sales during interrupted period was due to additional, expenses., Actual turnover from 1st February to 30th June, 20X2, , `, , 80,000, , Turnover from 1st February to 30th June, 20X1, , 2,00,000, , Turnover from 1st February, 20X1 to 31st January, 20X2, , 4,50,000, , Net Profit for last financial year, , 70,000, , Insured standing charges for last financial year, , 56,000, , Total standing charges for last financial year, , 64,000, , Turnover for the last financial year, , 4,20,000, , The company incurred additional expenses amounting to ` 6,700 which reduced the, loss in turnover. There was also a saving during the indemnity period of ` 2,450 in, the insured standing charges as a result of the fire., There had been a considerable increase in trade since the date of the last annual, accounts and it has been agreed that an adjustment of 15% be made in respect of, the upward trend in turnover., Solution, Computation of the amount of claim for the loss of profit, Reduction in turnover, , `, , Standard Turnover from 1st Feb. 20X1 to 30th June, 20X1, , 2,00,000, , Adjusted Standard Turnover, , 2,30,000, , Short Sales, , 1,50,000, , Add: 15% expected increase, , Less: Actual Turnover from 1st Feb., 20X2 to 30th June, 20X2, Gross Profit on reduction in turnover @ 30% on ` 1,50,000, (see working note 1), , Add: Claim for Additional Expenses being Lower of, , (i), , Actual = ` 6,700, , (ii), , Additional Exp. x, , G.P. on Adjusted Annual Turnover, G.P. as above + Uninsured Standing Charges, , © The Institute of Chartered Accountants of India, , 30,000, , (80,000), , 45,000

Page 27 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 6,700 ×, , (iii), , 10.27, , 1,55,250, = 6,372, 1,63,250, , G.P. on sales generated by additional expenses, — 80,000 x 30% = 24,000, , Therefore, lower of above is, Less: Saving in Insured Standing Charges, , Amount of claim before Application of Average Clause, Application of Average Clause:, , 6,372, , 51,372, , (2,450), 48,922, , Amount of Policy, × Amount of Claim, G.P. on Annual Turnover, , = 1,25,000 ×48,922, , 39,390, , 1,55,250, , Amount of claim under the policy = ` 39,390, , Working Notes:, (i), , Rate of Gross Profit for last Financial Year:, , Gross Profit:, Net Profit, , Add: Insured Standing Charges, Turnover for the last financial year, Rate of Gross Profit =, (ii), , `, , 1,26,000, ×100 = 30%, 4,20,000, , Annual Turnover (adjusted):, , Turnover from 1st Feb., 20X1 to 31st January, 20X2, , Add: 15% expected increase, , 70,000, , 56,000, , 1,26,000, 4,20,000, , 4,50,000, , 67,500, , 5,17,500, , Gross Profit on ` 5,17,500 @ 30%, , 1,55,250, , Gross Profit plus non-insured standing charges, , 1,63,250, , Standing charges not Insured (64,000 – 56,000), , © The Institute of Chartered Accountants of India, , 8,000

Page 28 :

10.28, , ACCOUNTING, , Illustration 10, The premises of XY Limited were partially destroyed by fire on 1st March, 20X2 and, as a result, the business was practically disorganized upto 31st August, 20X2. The, company is insured under a loss of profits policy for ` 1,65,000 having an indemnity, period of 6 months., From the following information, prepare a claim under the policy:, (i), , Actual turnover during the period of dislocation, (1-3-20X2 to 31-8-20X2), , (ii), , `, 80,000, , Turnover for the corresponding period (dislocation), in the 12 months immediately before the fire, (1-3-20X1 to 31-8-20X1), , (iii), , 2,40,000, , Turnover for the 12 months immediately preceding, the fire (1-3-20X1 to 28-2-20X2), , 6,00,000, , (iv), , Net profit for the last financial year, , 90,000, , (v), , Insured standing charges for the last financial year, , 60,000, , (vi), , Uninsured standing charges, , (vii) Turnover for the last financial year, , 5,000, 5,00,000, , Due to substantial increase in trade, before and up to the time of the fire, it was, agreed that an adjustment of 10% should be made in respect of the upward trend in, turnover. The company incurred additional expenses amounting to ` 9,300, immediately after the fire and but for this expenditure, the turnover during the period, of dislocation would have been only ` 55,000. There was also a saving during the, indemnity period of ` 2,700 in insured standing charges as a result of the fire., Solution, Computation of loss of profit Insurance claim, , `, (1) Rate of gross profit:, , Net profit for the last financial year, Add: Insured standing charges, , © The Institute of Chartered Accountants of India, , 90,000, 60,000, , 1,50,000

Page 29 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.29, , Turnover for the last financial year, , ` 1,50,000, , 5,00,000, , , , × 100 = 30%, Rate of gross profit = , ` 5,00,000, , (2) Short sales:, , Standard Turnover, , 2,40,000, , Add: 10% increasing trend, , 24,000, , Less: Turnover during the dislocation period (which is at par, with the indemnity period of 6 months), , 2,64,000, (80,000), 1,84,000, , (3) Annual (Adjusted) Turnover:, , Annual Turnover (1-3-20X1 to 28-2-20X2), , 6,00,000, , Add: 10% increasing trend, , 60,000, , 6,60,000, Note: Assumed that trend adjustment is required on total amount of annual, turnover. However, part of the annual turnover represents trend adjusted, figure. Alternatively, the students may ignore trend and take simply annual, turnover. The claim would be ` 55,000 which is more than the claim computed, in Para (5). So, the Insurance Company would insist on trend adjusted on, annual turnover., (4), , Additional Expenses: Least of the below shall be allowed, (i), , Actual Expenses, , (ii), , Gross profit on sales generated by additional expenses, 30/100× (` 80,000 – ` 55,000), , (iii), , Gross Profit on Annual (Adjusted) Turnover, , Gross Profit shown in the numerator + Uninsured standing charges, , `, 9,300, 7,500, , ×Additional Expenses, , 30% on ` 6,60,000, ×` 9,300, 30% on ` 6,60,000 + ` 5,000, ` 1,98,000, ×` 9,300 =, ` 2,03,000, , Least of the above three figures, i.e. ` 7,500 allowable., © The Institute of Chartered Accountants of India, , 9,071

Page 30 :

10.30, , (5), , ACCOUNTING, , Claim:, , `, , Loss of profit on short sales (30% on ` 1,84,000), , 55,200, , Add: Allowable additional expenses, , 7,500, 62,700, , Less: Savings in insured standing charges, , (2,700), 60,000, , Application of average clause, , ` 1,65,000 , , ` 60,000 × ` 1,98,000 , , , , 50,000, , Illustration 11, Sony Ltd.’s. Trading and profit and loss account for the year ended 31 st December,, 20X1 were as follows:, Trading and Profit and Loss Account for the year ended 31.12.20X1, , `, To, , Opening stock, , 20,000 By, , To, , Purchases, , 6,50,000 By, , To, , Manufacturing expenses, , 1,70,000, , To, , Gross profit, , 2,50,000, , `, Sales, Closing stock, , 10,90,000, To, , Administrative expenses, , 80,000 By, , To, , Selling expenses, , 20,000, , To, , Finance charges, , 1,00,000, , To, , Net profit, , 10,00,000, 90,000, , 10,90,000, Gross profit, , 2,50,000, , 50,000, 2,50,000, , 2,50,000, , The company had taken out a fire policy for ` 3,00,000 and a loss of profits policy for, ` 1,00,000 having an indemnity period of 6 months. A fire occurred on 1.4.20X2 at, the premises and the entire stock were gutted with nil salvage value. The net quarter, sales i.e. 1.4.20X2 to 30.6.20X2 was severely affected. The following are the other, information:, © The Institute of Chartered Accountants of India

Page 31 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.31, , Sales during the period, , 1.1.X2 to 31.3.X2, , 2,50,000, , Sales during the period, , 1.4.X2 to 30.6.X2, , 87,500, , Purchases during the period, Manufacturing expenses, , 1.1.X2 to 31.3.X2, 1.1.X2 to 31.3.X2, , Standing charges insured, , Actual expense incurred after fire, , 3,00,000, 70,000, 50,000, 60,000, , The general trend of the industry shows an increase of sales by 15% and decrease in, GP by 5% due to increased cost., Ascertain the claim for stock and loss of profit., Solution, Calculation of loss of stock:, Sony Ltd., Trading A/c, for the period 1.1.20X2 to 31.3.20X2, , `, To Opening stock, To Purchases, , To Manufacturing expenses, To Gross profit, ` 2,50,000) (W.N.3), , (20% ∗, , 90,000, , By Sales, , 70,000, , (balancing figure), , 3,00,000, of, , `, , 50,000, 5,10,000, , By Closing stock, , 2,50,000, 2,60,000, , 5,10,000, , `, Stock destroyed by fire, , 2,60,000, , Amount of fire policy, , 3,00,000, , As the value of stock destroyed by fire is less than the policy value, the entire claim, will be admitted., , G.P. of 20X1, Less: Decrease in trend, ∗, , 25%, 5%, , © The Institute of Chartered Accountants of India, , 20%

Page 32 :

10.32, , ACCOUNTING, , Calculation of loss of profit, Computation of short sales:, , `, Average sales for the period 1.4.20X1 to 30.6.20X1, (W.N.1) (` 7,82,610/3), Add: Increasing trend of sales (15%), , Less: Sales during the period 1.4.20X2 to 30.6.20X2, Short sales, , 2,60,870, 39,130 (Approx.), , 3,00,000, 87,500, 2,12,500, , Computation of G.P. Ratio:, Gross profit ratio, , =, , Net profit + Insured standing charges, x 100, Sales, , = ` 50,000 + ` 50,000 x 100 =, ` 10,00,000, , Less: Decreasing trend in G. P., , 10%, 5%, 5%, , Loss of profit = 5% of ` 2,12,500 = ` 10,625, Amount allowable in respect of additional expenses (least of the following):(i), , Actual expenditure, , (ii), , G.P. on sales generated by, additional expenses 5% of ` 87,500, , ` 60,000, ` 4,375, , (assumed that entire sales during disturbed period is due to additional, expenses), (iii), , Additional Exp., ` 60,000 ×, , ×, , G.P. on Adjusted Annual Turnover, G.P. as above + Uninsured Standing Charges, , 57,500, = ` 18,400 (approx.), 57,500 + 1,30,000, , least i.e. ` 4,375 is admissible., , © The Institute of Chartered Accountants of India

Page 33 :

10.33, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, G.P. on annual turnover:, Adjusted annual turnover:, , `, Average turnover for the period 1.4.20X1 to 31.12.20X1 (W.N.1), Turnover for the period 1.1.20X2 to 31.3.20X2, , 7,82,610, 2,50,000, , Annual Turnover (1.4.20X1 to 31.3.20X2), , 10,32,610, , Adjusted Annual Turnover, , 11,50,000, , Add: Increase in trend (15% of ` 7,82,610) (W.N.2), , 1,17,390, , Gross profit on adjusted annual turnover (5% of ` 11,50,000), , 57,500, , As the gross profit on annual turnover (` 57,500) is less than policy value, (` 1,00,000), average clause is not applicable., , Insurance claim to be submitted:, `, Loss of stock, , 2,60,000, , Additional expenses, , 4,375, 2,75,000, , Loss of profit, , 10,625, , Note: According to the given information standing charges include administrative, expenses (` 80,000) and finance charges (` 1,00,000). Insured standing charges, being ` 50,000, uninsured standing charges would be ` 1,30,000 (` 1,80,000 –, ` 50,000)., Working Note:, , `, 1., , Break up of sales for the year 20X1:, Sales of the first quarter of 20X1, , (` 2,50,000 x 100/115), Sales for the remaining three quarters of 20X1, ` (10,00,000-2,17,390), , 2,17,390* (approx.), 7,82,610, , * Sales for the first quarter of 20X1 is computed on the basis of sales of the first, quarter of 20X2., , © The Institute of Chartered Accountants of India

Page 34 :

10.34, , ACCOUNTING, , 2., , The increase in trend of sales has been applied to the sales of 20X1 only, as, the sales figure of the first quarter of 20X2 was already trend adjusted., , 3., , Rate of gross profit in 20X1, = Gross profit/ Sales x 100 = 2,50,000/ 10,00,000 x 100 = 25%, In 20X2, gross profit had declined by 5% due to increased cost, hence, the, rate of gross profit for loss of stock is taken at 20%., , SUMMARY, 1., , Claim for Loss of Stock, •, , Loss of Stock:, Amount of loss of stock is calculated as under:, Value of stock on the date of fire, Less: Value of Salvaged stock, Amount of loss of stock, , •, , XXXX, (XXXX), XXXX, , Claim for loss of stock can be studied under two heads:, a., , Total Loss:, Amount of claim = Actual loss (If goods are fully insured but the, amount of claim is restricted to sum insured or policy amount)., , b., , Partial Loss:, (i), , Without Average clause:Claim =Lower of actual Loss or Sum Insured, , (ii), , With Average Clause:Claim = Loss of stock x sum insured / Insurable amount, (Total Cost), , •, , Other Points:, (i), , Where stock records are maintained and not destroyed by fire, the, value of the stock as at the date of the fire can be easily arrived at., , © The Institute of Chartered Accountants of India

Page 35 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.35, , (ii), , Where stock records are not available or destroyed by the fire, the, value of stock at the date of the fire has to be estimated., , (iii), , Where books of account are destroyed, the Trading Account has, to be prepared., , (iv), , Insurance company makes payment for total loss (subject to sum, insured and whether average clause applicable or not)., , (v), , Salvaged stock can be made saleable after it is reconditioned. In, that case, the cost of such stock must be credited to the Trading, Account and debited to a salvaged stock account. The expenses, on reconditioning must be debited and the sales credited to this, account, the final balance being transferred to the Profit & Loss, Account., , 2., , Claim for Loss of Profit, , •, , The Loss of Profit Policy normally covers the following items:, (1), , Loss of net profit, , (2), , Standing charges., , (3), , Any increased cost of working, , , , Gross Profit:, Net profit +Insured Standing charges OR, Insured Standing charges – [Net Trading Loss (If any) × Insured, Standing charges/All standing charges of business], , , , Net Profit: The net trading profit (exclusive of all capital receipts and, accretion and all outlay properly (chargeable to capital) resulting from, the business of the Insured at the premises after due provision has been, made for all standing and other charges including depreciation., , , , Insurable Standing Charges: Interest on Debentures, Mortgage Loans, and Bank Overdrafts, Rent, Rates and Taxes (other than taxes which, form part of net profit), Salaries of Permanent Staff and Wages to Skilled, Employees, Boarding and Lodging of resident Directors and/or, Manager, Directors’ Fees, Unspecified Standing Charges [not exceeding, 5% (five per cent) of the amount recoverable in respect of Specified, Standing Charges]., , © The Institute of Chartered Accountants of India

Page 36 :

10.36, , , , ACCOUNTING, , Rate of Gross Profit: The rate of Gross Profit earned on turnover, during the financial year immediately before the date of damage plus /, minus adjustment for current year changes in price level., Thus GP Rate applicable for the year = GP Rate of last FY +/- Adjustment, for changes in purchase and sale prices in the year of fire, , , , Annual Turnover:, The turnover during the twelve months immediately before the, damage., , , , Standard Turnover:, The turnover of the period in corresponding previous year from the year, in which damage occurred, that corresponds with the Indemnity Period., , , , Indemnity Period:, The period beginning with the occurrence of the damage and ending, not later than twelve months. Thus, it is a period during which business, is disturbed due to fire and is not greater than 12 months., , •, , Claim in case of Loss of Profit shall comprise of :, (i), , Gross Profit on Short Sales (i.e. loss of profit) and, , (ii), , Claim with respect to Increased cost of Working which shall be the least, of the following:, (a), , Actual amount incurred i.e. increased cost of working, , (b), , Increased Cost of Working X (GP on Adjusted Annual Turnover), (GP on Adjusted Annual Turnover) + Uninsured Standing Charges, , (c), , GP on the additional sales generated because of increased cost of, working, , The amount payable arrived at as above is reduced by any sum saved during the, indemnity period in respect of standing charges., Further, Average Clause may apply if the sum insured in respect of loss of profit is, less than the sum produced by applying the rate of gross profit to the adjusted, annual turnover., Thus, Amount of Indemnity Payable: Gross Profit Lost + Claim for increased cost, of working Capital – Saving in Insured standing Charges. [Subject to Average Clause], , © The Institute of Chartered Accountants of India

Page 37 :

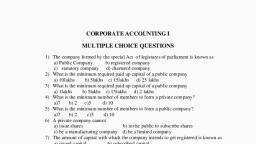

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.37, , TEST YOUR KNOWLEDGE, MCQs, 1., , 2., , 3., , 4., , 5., , 6., , Goods costing ` 1,00,000 were insured for ` 50,000. Out of these goods, ¾, are destroyed by fire. The amount of claim with average clause will be, (a), , ` 37,500., , (b), , ` 50,000., , (c), , ` 75,000., , Fire insurance claim will be limited to the, (a), , actual loss suffered even though the insured value of the goods may be, higher., , (b), , proportion of the loss as the insured value bears to the total cost., , (c), , both (a) and (b))., , The Loss of Profit Policy normally covers the following items:, (a), , Loss of net profit and Standing charges., , (b), , Any increased cost of working e.g., renting of temporary premises., , (c), , Both (a) and (b)., , A plant worth ` 40,000 has been insured for ` 30,000, the loss on account of, fire is ` 25,000. The insurance company will bear the loss to the extent of, (a), , ` 18,750., , (b), , ` 25,000., , (c), , ` 30,000., , If the policy is without average clause, a claim for loss of profit will be, (a), , Sum insured., , (b), , Higher of actual loss and sum insured., , (c), , Lower of actual loss and sum insured, , Standard turnover is, (a), , Turnover during the last 12 months immediately before damage., , © The Institute of Chartered Accountants of India

Page 38 :

10.38, , 7., , 8., , 9., , ACCOUNTING, , (b), , Turnover during that period in 12 months immediately before damage, which corresponds with indemnity period., , (c), , Turnover during the last accounting period immediately before, damage., , Gross profit can be calculated as, (a), , Net profit + Insured standing charges., , (b), , Net profit - Insured standing charges., , (c), , Net profit + standing charges., , The cost of salvaged stock must be, (a), , Credited to trading account., , (b), , Debited to salvaged stock account., , (c), , Both (a) and (b)., , Amount of indemnity payable is, (a), , Gross Profit lost – Claim for increased cost of working Capital – Saving, in Insured standing Charges., , (b), , Gross Profit lost– Claim for increased cost of working Capital + Saving, in Insured standing Charges., , (c) Gross Profit Lost +Claim for increased cost of working Capital – Saving in, Insured standing Charges., 10., , Short Sales for the purposes of Loss of Profit Policy shall be:, (a), , Adjusted Annual Turnover – Annual Turnover, , (b), , Adjusted Annual Turnover – Adjusted Standard Turnover, , (c), , Adjusted Standard Turnover – Actual Turnover, , Theoretical Questions, 1., , Explain the significance of ‘Average Clause’ in a fire insurance policy., , 2., , Define the following terms:, (i), , Indemnity Period;, , (ii), , Standard Turnover, , © The Institute of Chartered Accountants of India

Page 39 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.39, , Practical Questions, Question 1, On 15th December, 20X1, a fire occurred in the premises of M/s. OM Exports. Most, of the stocks were destroyed. Cost of stock salvaged being ` 1,40,000. From the, books of account, the following particulars were available:, (i), , Stock at the close of account on 31st March, 20X1 was valued at ` 9,40,000., , (ii), , Purchases from 01-04-20X1 to 15-12-20X1 amounted to ` 13,20,000 and the, sales during that period amounted to ` 20,25,000., , On the basis of his accounts for the past three years, it appears that average gross, profit ratio is 20% on sales., Compute the amount of the claim, if the stock were insured for ` 4,00,000., Question 2, On 29th August, 20X2, the godown of a trader caught fire and a large part of the, stock of goods was destroyed. However, goods costing ` 1,08,000 could be, salvaged incurring fire fighting expenses amounting to ` 4,700., The trader provides you the following additional information:, `, Cost of stock on 1st April, 20X1, , Cost of stock on 31st March, 20X2, , Purchases during the year ended 31st March, 20X2, Purchases from 1st April, 20X2 to the date of fire, , Cost of goods distributed as samples for advertising from, 1st April, 20X2 to the date of fire, Cost of goods withdrawn by trader for personal use from, 1st April, 20X2 to the date of fire, Sales for the year ended 31st March, 20X2, , Sales from 1st April, 20X2 to the date of fire, , 7,10,500, 7,90,100, , 56,79,600, 33,10,700, , 41,000, 2,000, , 80,00,000, 45,36,000, , The insurance company also admitted firefighting expenses. The trader had taken, the fire insurance policy for ` 9,00,000 with an average clause., Calculate the amount of the claim that will be admitted by the insurance company., © The Institute of Chartered Accountants of India

Page 40 :

10.40, , ACCOUNTING, , Question 3, A fire occurred in the premises of M/s. Fireproof Co. on 31st August, 20X1. From the, following particulars relating to the period from 1st April, 20X1 to 31st August, 20X1,, you are requested to ascertain the amount of claim to be filed with the insurance, company for the loss of stock. The concern had taken an insurance policy for, ` 60,000 which is subject to an average clause., `, (i), , Stock as per Balance Sheet at 31-03-20X1, , (iv), (v), , Sales, Sale value of goods drawn by partners, , (ii), (iii), , (vi), , Purchases, Wages (including wages for the installation of a machine, ` 3,000), , Cost of goods sent to consignee on 16th August, 20X1, lying, unsold with them, , (vii) Cost of goods distributed as free samples, , 99,000, , 1,70,000, 50,000, 2,42,000, 15,000, 16,500, , 1,500, , While valuing the stock at 31st March, 20X1, ` 1,000 were written off in respect of a, slow moving item. The cost of which was ` 5,000. A portion of these goods were, sold at a loss of ` 500 on the original cost of ` 2,500. The remainder of the stock is, now estimated to be worth the original cost. The value of goods salvaged was, estimated at ` 20,000. The average rate of gross profit was 20% throughout., Question 4, A fire occurred in the premises of M/s. Kailash & Co. on 30th September 20X1. From, the following particulars relating to the period from 1st April 20X1 to 30th, September 20X1, you are required to ascertain the amount of claim to be filed with, the Insurance Company for the loss of Stock. The company has taken an Insurance, policy for ` 75,000 which is subject to average clause. The value of goods salvaged, was estimated at ` 27,000. The average rate of Gross Profit was 20% throughout, the period., (i), , (ii), , (iii), , Particulars, , Opening Stock, , Purchase made, , Wages paid (including wages for the installation of a, machine ` 5,000), , © The Institute of Chartered Accountants of India, , Amount in `, 1,20,000, 2,40,000, , 75,000

Page 41 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, (iv), , Sales, , (vi), , Cost of goods sent to Consignee on 20, 20X1, lying unsold with them, , (v), , (vii), , Goods taken by the Proprietor (Sale Value), , 10.41, , 3,10,000, th, , 25,000, , September, , 18,000, , Free Samples distributed-Cost, , 2,500, , Question 5, On 2.6.20X2, there occurred a fire in the warehouse of Mr. Jack and his total stock, was destroyed by fire. However, following information could be obtained from the, records saved:, `, Stock at cost on 1.4.20X1, , 5,40,000, , Stock at 90% of cost on 31.3.20X2, , 6,48,000, , Purchases for the year ended 31.3.20X2, , 25,80,000, , Sales for the year ended 31.3.20X2, , 36,00,000, , Purchases from 1.4.20X2 to 2.6.20X2, Sales from 1.4.20X2 to 2.6.20X2, , 9,00,000, 19,20,000, , Sales up to 2.6.20X2 includes `3,00,000 (invoice price) being the goods not, dispatched to the customers. Purchases up to 2.6.20X2 includes a machinery, acquired for `60,000. However, it does not include goods worth ` 1,20,000 received, from suppliers, as invoice not received up to the date of fire. These goods have, remained in the godown at the time of fire. The insurance policy is for ` 4,80,000, and it is subject to average clause., You are required to ascertain the amount of claim for loss of stock applying average, clause., Question 6, A trader intends to take a loss of profit policy with indemnity period of 6 months,, however, he could not decide the policy amount. From the following details, you, are required to suggest the policy amount to him., , © The Institute of Chartered Accountants of India

Page 42 :

10.42, , ACCOUNTING, , Turnover in last financial year, , ` 4,50,000, , Standing Charges in last financial year, , ` 90,000, , 1., , Net profit earned in last year was 10% of turnover and the same trend, expected in subsequent year;, , 2., , Increase in turnover expected 25%;, , 3., , To achieve additional sales, trader has to incur additional expenditure of, ` 31,250., , Question 7, On account of a fire on 15th June, 20X2 in the business house of a company, the, working remained disturbed upto 15th December 20X2 as a result of which it was, not possible to affect any sales. The company had taken out an insurance policy, with an average clause against consequential losses for ` 1,40,000 and a period of, 7 months has been agreed upon as indemnity period. An increase of 25% was, marked in the current year’s sales as compared to the last year. The company, incurred an additional expenditure of ` 12,000 to make sales possible and made a, saving of ` 2,000 in the insured standing charges. Compute the amount of claim, admissible for the loss of profit., `, Actual sales from 15 June, 20X2 to 15 Dec, 20X2, Sales from 15th June 20X1 to 15th Dec 20X1, , 70,000, 2,40,000, , Total standing charges for the last financial year, , 1,20,000, , Turnover for one year : 16 June 20X1 to 15 June 20X2, , 5,60,000, , th, , th, , Net profit for last financial year, Insured standing charges for the last financial year, Turnover for the last financial year, th, , 80,000, 70,000, , 6,00,000, , th, , ANSWERS/ SOLUTIONS, MCQs, 1., , (a), , 2., , (c), , 3., , (c), , 4., , (a), , 7., , (a), , 8., , (c), , 9., , (c), , 10., , (c), , © The Institute of Chartered Accountants of India, , 5., , (c), , 6., , (b)

Page 43 :

INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, , 10.43, , Theoretical Questions, 1., , In order to discourage under-insurance, fire insurance policies often include, an average clause. The effect of these clause is that if the insured value of the, subject matter concerned is less than the total cost then the average clause, will apply, that is, the loss will be limited to that proportion of the loss as the, insured value bears to the total cost., The actual claim amount would therefore be determined by the following, formula:, Claim=, , Insured value, ×Loss suffered, Total cost, , The average clause applies only when the insured value is less than the total, value of the insured subject matter., 2., , (i), , Indemnity period is the period beginning with the occurrence of the, damage and ending not later than twelve months., , (ii), , Standard Turnover is the turnover during that period in the twelve, months immediately before the date of damage which corresponds, with the Indemnity Period., , Practical Questions, Answer 1, Memorandum Trading Account, For the period 01.04.20X1 to 15.12.20X1, Particulars, To Opening stock, To Purchases, , To Gross Profit @20%, , `, , Particulars, , `, , 9,40,000 By Sales, 13,20,000 By Closing Stock, , 20,25,000, 6,40,000, , 26,65,000, , 26,65,000, , 4,05,000, , (Bal. figure), , Statement of Claim, , `, Estimated value of Stock as at date of fire, , 6,40,000, , Estimated Value of Stock lost by fire, , 5,00,000, , Less: Value of Salvaged Stock, , © The Institute of Chartered Accountants of India, , 1,40,000

Page 44 :

10.44, , ACCOUNTING, , As the value of stock is more than insured value, amount of claim would be subject, to average clause., Amount of Claim=, , Amount of Policy, × Actual Loss of Stock, Value of Stock, , Amount of Claim = 4,00,000 ×5,00,000 = ` 3,12,500, 6, 40,000, , Answer 2, Memorandum Trading Account for the period, 1st April, 20X2 to 29th August 20X2, , `, To Opening Stock, To Purchases, , Less: Advertisement, Drawings, , To Gross Profit [30%, of Sales - Refer, Working Note], , 33,10,700, , `, , 7,90,100 By Sales, , By Closing stock (Bal., fig.), , (41,000), , 45,36,000, , 8,82,600, , (2,000) 32,67,700, , 13,60,800, 54,18,600, , 54,18,600, , Statement of Insurance Claim, , `, Value of stock destroyed by fire, Less: Salvaged Stock, , Add: Fire Fighting Expenses, Insurance Claim, , 8,82,600, , (1,08,000), 4,700, , 7,79,300, , Note: Since policy amount is more than claim amount, average clause will not, apply. Therefore, claim amount of ` 7,79,300 will be admitted by the Insurance, Company., , © The Institute of Chartered Accountants of India

Page 45 :

10.45, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, Working Note:, , Trading Account for the year ended 31st March, 20X2, , `, To Opening Stock, , `, , 7,10,500 By Sales, , To Purchases, , 80,00,000, , 56,79,600 By Closing stock, , To Gross Profit (b.f.), , 7,90,100, , 24,00,000, 87,90,100, , 87,90,100, , Rate of Gross Profit in 20X1-X2, Gross Profit, 24,00,000, × 100 =, × 100 = 30%, Sales, 80,00,000, , Answer 3, Memorandum Trading Account for the period 1st April, 20X1 to 31st August,, 20X1, Normal Abnormal, Items, Items, , `, To Opening, stock, , 95,000, , Total, , `, , `, , 5,000 1,00,000* By Sales, , To Purchases, (Refer W.N.), , 1,56,500, , -, , 1,56,500 By Goods, sent to, consignee, , To Wages, (50,000 – 3,000), , 47,000, , -, , 47,000 By Loss, , To Gross profit, @ 20%, , 48,000, , -, , 48,000 By Closing, stock, (Bal.fig.), , 3,46,500, , 5,000, , 3,51,500, , Normal Abnormal, Items, Items, , Total, , `, , `, , `, , 2,40,000, , 2,000, , 2,42,000, , 16,500, , -, , 16,500**, , -, , 500, , 500, , 90,000, , 2,500, , 92,500, , 3,46,500, , 5,000, , 3,51,500, , * 99,000 + 1,000, ** For financial statement purposes, this would form part of closing stock (since there is no sale)., However, this has been shown separately for computation of claim for loss of stock since the goods, were physically not with the concern and, hence, there was no loss of such stock., , © The Institute of Chartered Accountants of India

Page 46 :

10.46, , ACCOUNTING, Statement of Claim for Loss of Stock, , `, Book value of stock as on 31.08.20X1, , 92,500, , Less: Stock salvaged, , (20,000), , Loss of stock, , 72,500, , Amount of claim to be lodged with insurance company, = Loss of stock x, = ` 72,500 x, , Policy value, Value of stock on the date of fire, , 60,000, = ` 47,027, 92,500, , Working Note:, Calculation of Adjusted Purchases, , `, Purchases, , 1,70,000, , Less: Drawings [15,000 – (20% x 15,000)], , (12,000), , Free samples, , (1,500), , Adjusted purchases, , 1,56,500, , Answer 4, Memorandum Trading Account for the period 1st April, 20X1 to 30th Sept. 20X1, , `, To Opening Stock, To Purchases, , Less: Advertisement, Cost of goods taken by, proprietor, To Wages, , (75,000 – 5,000), , 2,40,000, , `, , 1,20,000 By Sales, , By Consignment, stock, , By Closing Stock, (Bal. fig.), , (2,500), , (20,000) 2,17,500, 70,000, , © The Institute of Chartered Accountants of India, , 3,10,000, , 18,000*, , 1,41,500

Page 47 :

10.47, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, To Gross Profit, [20% of Sales), , 62,000, 4,69,500, , 4,69,500, , * For financial statement purposes, this would form part of closing stock (since there is no sale)., However, this has been shown separately for computation of claim for loss of stock since the goods, were physically not with the concern and, hence, there was no loss of such stock., , Statement of Insurance Claim, , `, Value of stock destroyed by fire, , 1,41,500, , Less: Salvaged Stock, , (27,000), , Insurance Claim, , 1,14,500, , Note: Since policy amount is less than claim amount, average clause will apply., Therefore, claim amount will be computed by applying the formula, Claim=, , Insured value, Total cost, , ×Loss suffered, , Claim amount = ` 60,689 (1,14,500 x 75,000/ 1,41,500), Answer 5, , In the books of Mr Jack, , Trading Account for the year ended 31st March 20X2, , `, To Opening stock, To Purchases, To Gross Profit, , `, , 5,40,000 By Sales, , 25,80,000 By Closing Stock (at cost), 648000/90%, 12,00,000, 43,20,000, , 36,00,000, , 7,20,000, , 43,20,000, , Thus, the GP ratio = 12,00,000 / 36,00,000 = 33.33%, , Memorandum Trading Account, , for the period 1st April 20X2 to 2nd June 20X2, , `, To Opening stock, , 7,20,000 By Sales, , © The Institute of Chartered Accountants of India, , `, 19,20,000

Page 48 :

10.48, To Purchases, , ACCOUNTING, , 9,00,000, , Less: good sold but not, despatched, (3,00,000), , Less: Machinery (60,000), , Add: Good received but, not invoiced, 1,20,000, To Gross Profit (33.33%), , 16,20,000, , By Closing Stock, (balancing figure), 9,60,000, 5,40,000, , 6,00,000, _________, 22,20,000, , 22,20,000, , Insurance Cover = ` 4,80,000 and amount of loss of stock = `6,00,000. Thus, the, insurance claim admissible shall be maximum up to ` 4,80,000., Answer 6, (a) Calculation of Gross Profit, , Gross Profit = Net Profit + Standing Charges / Turnover x 100, Gross Profit = (`45,000 + `90,000 / `4,50,000) x 100 = 30%, (b), , Calculation of policy amount to cover loss of profit, Particulars, , Turnover in the last financial year, Add: 25% increase in turnover, Total, , Gross profit on increase turnover (` 5,62,500 x 30%), Add: Additional standing charges, Policy Amount, , Amount (`), 4,50,000, 1,12,500, 5,62,500, , 1,68,750, 31,250, 2,00,000, , Therefore, the trader should go in for a loss of profit policy of ` 2,00,000., Answer 7, (1), , Calculation of short sales:, `, Sales for the period 15.6.20X1 to 15.12.20X1, , 2,40,000, , Estimated sales in current year, , 3,00,000, , Short sales, , 2,30,000, , Add: 25% increase in sales, , Less: Actual sales from 15.6.20X2 to 15.12.20X2, , © The Institute of Chartered Accountants of India, , _ 60,000, (70,000)

Page 49 :

10.49, , INSURANCE CLAIMS FOR LOSS OF STOCK AND LOSS…, (2), , Calculation of gross profit:, Gross profit =, , Net profit + Insured standing charges, ×100, Turnover, , = ` 80,000 + ` 70,000 × 100, ` 6,00,000, , = ` 1,50,000 × 100, ` 6,00,000, , = 25%, (3), , Calculation of loss of profit:, ` 2,30,000 x 25% =` 57,500, , (4), , Calculation of claim for increased cost of working:, Least of the following:, (i), , Actual expense= ` 12,000, , (ii), , Expenditure x, ` 12,000 x, , Gross profit on adjusted turnover, Gross profit as above + Uninsured standing charges, , (25 /100) x ` 7,00,000, = ` 9,333 approx., [(25 /100) x ` 7,00,000] + ` 50,000, , Where,, Adjusted turnover, , Turnover from 16.06.20X1 to 15.06.20X2, Add: 25% increase, (iii), , `, 5,60,000, 1,40,000, 7,00,000, , Gross profit on sales generated due to additional expenditure =, 25% x ` 70,000 = ` 17,500., ` 9,333 being the least, shall be the increased cost of working., , (5), , Calculation of total loss of profit, `, Loss of profit, Add: Increased cost of working, , © The Institute of Chartered Accountants of India, , 57,500, 9,333

Page 50 :

10.50, , ACCOUNTING, , Less: Saving in insured standing charges, (6), , 66,833, (2,000), 64,833, , Calculation of insurable amount:, Adjusted turnover x G.P. rate, = ` 7,00,000 x 25% = ` 1,75,000, , (7), , Total claim for consequential loss of profit – Due to Average Clause, =, , Insured amount, ×Total loss of profit, Insurable amount, , =, , ` 1, 40,000, x ` 64,833 = ` 51,866.40, ` 1,75,000, , © The Institute of Chartered Accountants of India