Page 1 :

CHAPTER, , 11, , HIRE PURCHASE AND, INSTALMENT SALE, TRANSACTIONS, LEARNING OUTCOMES, After studying this chapter, you will be able to–, , , , , , , , , Understand the salient features and nature of Hire purchase, transactions., Journalize the Hire purchase entries both in the books of hire, purchaser and the hire vendor., Learn various methods of accounting for hire purchase, transactions., Ascertain various missing values, required while accounting, the hire purchase transactions, on the basis of given, information., Calculate and record the value of repossessed goods and also, to calculate the profit on re-sale of such goods., Understand the instalment payment system and also how it, is different from hire purchase transactions., , © The Institute of Chartered Accountants of India

Page 2 :

11.2, , ACCOUNTING, , Distinction between sales under, Hire purchase and Instalment, payment system, , Accounting for sales under, Instalment payment system, , Definition of Important terms, used in Hire Purchase transa, , Repossession and Recording, the value of repossessed, goods, , ctions, , Accounting for hire purchase, transactions in books of Hire, Purchaser and Hire Vendor, , Ascertainment of Cash price, and Interest, , Methods of Accounting for hire purchase transactions, , In Hire Vendor's books, , In Hire Purchaser's books, , Cash price, method, , Interest, suspense, method, , Sales method, , © The Institute of Chartered Accountants of India, , Interest, suspense, method

Page 3 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.3, , 1. INTRODUCTION, With an increasing demand for better life, the consumption of goods has been on, the expanding scale. But this has not been backed up by adequate purchasing power,, transforming it into effectual demand, i.e., actual sale at set or settled prices. This has, created the market for what is called hire purchase., When a person wants to acquire an asset, but is not sure how to make payment, within a stipulated period of time he may pay in instalments if the vendor agrees., This enables the purchaser to use the asset while paying for it in instalments over an, agreed period of time. This type of a business deal is known as hire purchase, transaction. Here, the customer pays the entire amount either in monthly or quarterly, or yearly instalments, while the asset remains the property of the seller until the buyer, squares up his entire liability. For the seller, the agreed instalments include his, interest on the assets given on credit to the purchaser. Therefore, when the total, amount (being paid in instalments over a period of time) is certainly higher than the, cash down price of the asset because of interest charges. Obviously, both the parties, benefit in the bargain. By virtue of this, the purchaser has the right of immediate use, of the asset without making immediate full payment for the asset, by this, he gets, both credit and product from the same seller. From seller’s view point, he derives, the benefits by way of increase in sales and also he recovers his own cost of credit., , 2. NATURE OF HIRE PURCHASE AGREEMENT, Under the Hire Purchase System, the Hire Purchaser gets possession of the goods at, the outset and can use it, while paying for it in instalments over a specified period of, time as per the agreement. However, the ownership of the goods remains with the, Hire Vendor until the hire purchaser has paid all the instalments. Each instalment, paid by the hire purchaser is treated as hire charges for using the asset. In case he, fails to pay any of the instalments (even the last one) the hire vendor has the right to, take back his goods without compensating the buyer, i.e., the hire vendor is not, going to pay back a part or whole of the amount received through instalments till, the date of default from the buyer., , 3. SPECIAL FEATURES, AGREEMENT, 1., , OF, , HIRE, , PURCHASE, , Possession: The hire vendor transfers only possession of the goods to the, hire purchaser immediately after the contract for hire purchase is made., , © The Institute of Chartered Accountants of India

Page 4 :

11.4, , ACCOUNTING, , 2., , Instalments: The goods are delivered by the hire vendor on the condition, that a hire purchaser should pay the amount in periodical instalments., , 3., , Down Payment: The hire purchaser generally makes a down payment, i.e., an, amount on signing the agreement., , 4., , Constituents of Hire purchase instalments: Each instalment consists of two, elements- finance charge (interest on unpaid amount) and capital payment., , 5., , Ownership: The property in goods is to pass to the hire purchaser on the, payment of the last instalment and exercising the option conferred upon him, under the agreement., , 6., , Repossession: In case of default in respect of payment of even the last, instalment, the hire vendor has the right to take the goods back without, making any compensation., , 4. TERMS USED IN HIRE PURCHASE AGREEMENTS, 1., , Hire Vendor: Hire vendor is a person who delivers the goods along with its, possession to the hire purchaser under a hire purchase agreement., , 2., , Hire Purchaser: Hire purchaser is a person who obtains the goods and rights, to use the same from hire vendor under a hire purchase agreement., , 3., , Cash Price: Cash price is the amount to be paid by the buyer on outright, purchase in cash., , 4., , Down Payment: Down payment is the initial payment made to the hire, vendor by the hire purchaser at the time of entering into a hire purchase, agreement., , 5., , Hire Purchase Instalment: Hire purchase instalment is the amount which the, hire purchaser has to pay after a regular interval up to certain period as, specified in the agreement to obtain the ownership of the asset purchased, (on payment of the last instalment) under a hire purchase agreement. It, comprises of principal amount and the interest on the unpaid amount., , 6., , Hire purchase price: It means the total sum payable by the hire purchaser to, obtain the ownership of the asset purchased under hire purchase agreement., It comprises of cash price and interest on outstanding balances., , © The Institute of Chartered Accountants of India

Page 5 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.5, , 5. ASCERTAINMENT OF CASH PRICE, We know that the basis for accounting in the books of the hire purchaser is the, total cash price. Sometimes, the total cash price may not be given. For the purpose, of ascertaining the total cash price, we can use any of the following methods, according to the need., Calculation of total cash price, Without using annuity table, , With the help of annuity table, , 5.1. Calculation of Cash Price without using Annuity Table, In this method, the interest included in the last instalment is to be calculated first, with the help of the appropriate formula (explained below)., For example, in a hire purchase transaction, apart from down payment, four other, instalments are payable. The interest will be calculated first on the 4th instalment,, then on the 3rd instalment, then on the 2nd instalment and lastly on the 1st, instalment. Interest on down payment will be nil., In this connection, it should be noted that the amount of interest will go on, increasing from the 4th instalment to the 3rd instalment, from the 3rd instalment, to the 2nd instalment and from the 2nd instalment to the 1st instalment., We know that interest is to be calculated on the outstanding balance of cash price., In this case, we will have to calculate the interest with the help of the total amount, due on hire purchase price since the cash price is not known. For the purpose of, calculating the interest, the following steps should be followed:, Step 1 :, , Calculate the ratio between interest and the amount due with the help, of the following formula:, , Ratio of interest andamount due =, Step 2:, , Rateof interest, 100 + Rateof interest, , Calculate the interest included in the last instalment by applying the, following formula:, Interest = Total amount due at the time of instalment x Ratio of interest, and amount due (as calculated in step 1), , © The Institute of Chartered Accountants of India

Page 6 :

11.6, , ACCOUNTING, , Step 3:, , Subtract the interest (as calculated in step 2) from this instalment to get, the amount of outstanding cash price at the time of last instalment., , Step 4:, , Add the cash price calculated in Step 3 to the amount of instalment due, at the end of the third year., , Step 5:, , Calculate the interest on the entire sum (cash price included in the 4th, instalment + amount of 3rd instalment). Deduct this interest from the, total amount due at the end of 3rd year to get the outstanding cash price, at the time of 3rd instalment., , Step 6:, , Add the cash price calculated in step 5 to the amount of instalment due, at the end of 2nd year., , Step 7:, , Calculate the interest on the entire sum so obtained in Step 6. Deduct, this interest from the total amount due at the end of 2nd year to get the, outstanding cash price at the time of 2nd instalment., , Step 8:, , Add the cash price calculated in Step 7 to the amount of instalment due, at the end of 1st year., , Step 9:, , Calculate the interest on the entire sum so obtained in Step 8. Deduct, this interest from the total amount due at the end of 1st year to get the, outstanding cash price at the time of 1st instalment., , Step 10: Add the cash price calculated in Step 9 to the amount of down payment,, if any. The sum so obtained will be the cash price., Illustration 1, Asha purchased a truck on hire purchase system. As per terms she is required to pay, ` 70,000 down, ` 53,000 at the end of first year, ` 49,000 at the end of second year, and ` 55,000 at the end of third year. Interest is charged @ 10% p.a., You are required to calculate the cash price of the truck and the interest paid with, each instalment., Solution, (1), , Ratio of interest and amount due =, , Rate of interest, 10, = = 1, 11, 100 + Rate of interest 110, , © The Institute of Chartered Accountants of India

Page 7 :

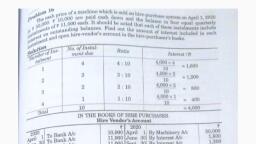

11.7, , HIRE PURCHASE AND INSTALLMENT SALE …, (2), , Calculation of Interest and Cash Price, No. of, instalm, ents, , Amount due at, the time of, instalment, , Interest, , [1], , [2], , [3], , 3, , 2, , rd, , nd, , 1st, , 55,000, , *99,000, , **1,43,000, , Cash, price, , 1/11 of ` 55,000 =` 5,000, , 1/11 of ` 99,000 = ` 9,000, , 1/11of ` 1,43,000 = ` 13,000, , [4], , 50,000, 90,000, , 1,30,000, , Total cash price = ` 1,30,000+ 70,000 (down payment) =` 2,00,000., *` 50,000 + 2nd instalment of ` 49,000 = ` 99,000., , ** ` 90,000 + 1st instalment of ` 53,000 = ` 1,43,000., Illustration 2, A acquired on 1st January, 20X1 a machine under a Hire-Purchase agreement which, provides for 5 half-yearly instalments of ` 6,000 each, the first instalment being due, on 1st July, 20X1. Assuming that the applicable rate of interest is 10 per cent per, annum, calculate the cash value of the machine. All working should form part of the, answer., Solution, Statement showing cash value of the machine acquired on hire-purchase basis, , 5th Instalment, Less: Interest, , Add: 4th Instalment, Less: Interest, Add: 3rd instalment, , Instalment, Amount, , Interest @ 5% half, yearly (10% p.a.), = 5/105 = 1/21, (in each instalment), , Principal, Amount, (in each, instalment), , `, , `, , `, , 6,000, , 286, , 5,714, , 558, , 5,442, , (286), , 5,714, 6,000, , 11,714, , (558), , 11,156, , 6,000, , © The Institute of Chartered Accountants of India, , (6,000 – 558)

Page 8 :

11.8, , Less: Interest, Add: 2nd instalment, Less: Interest, Add: 1st instalment, Less: Interest, , ACCOUNTING, , 17,156, (817), , 817, , 5,183, (6,000 – 817), , 1,063, , 4,937, , 16,339, , 6,000, , 22,339, , (1,063), 21,276, , 6,000, , 27,276, (1,299), 25,977, , 1,299, 4,023, , (6,000 – 1,063), , 4,701, (6,000 –1,299), 25,977, , The cash purchase price of machinery is ` 25,977., , 5.2 Calculation of Cash Price with the help of Annuity Table, Cash price = Down payment + Present value of instalments, Present value of instalments is calculated as follows:, (a), , If present value of an annuity of ` 1 for a given period, at given rate of interest,, is given Present value of instalments = Annual instalments x Present value of, an annuity of ` 1 for a given period at given rate of interest, = Annual instalment x, , (b), , (1 + r )n − 1, n, r (1 + r ), , If annuity to recover ` 1 during a given period at given rate of interest is given, = Annual instalment x, , r (1 + r ), , n, , (1 + r )n − 1, , Illustration 3, On 1st April, 20X1 a manufacturing company buys on Hire-purchase system a, machinery for ` 90,000, payable by three equal annual instalments combining, principal and interest, the rate of interest was 5% per annum. Calculate the amount, of cash price and interest. Assume that the present value of an annuity of one rupee, for three years at 5% interest is ` 2.723., , © The Institute of Chartered Accountants of India

Page 9 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.9, , Solution, Calculation of Cash Price – The present value of an annuity of Re. 1 paid for 3, year @ 5% = ` 2.723. Hence, the present value of ` 30,000 for 3 years = 2.723 x, 30,000 = ` 81,690., Thus, Cash Price will be computed as ` 81,690., Cash price may also be calculated using the annuity formula discussed above:, Cash price = Annual instalment x, , (1 + r )n − 1, n, r (1 + r ), , = 30,000 x [(1 + 0.05)3 – 1]/ 0.05 (1 + 0.05)3, = ` 81697., Note- The difference in cash price of ` 7 is on account of approximation., , 6. ASCERTAINMENT OF INTEREST, We know that the hire purchase price consists of two elements: (i) cash price; and, (ii) interest. Cash price is an expenditure incurred for the acquisition of an asset, towards payment of capital (principal) amount and (ii) interest is a expense in the, nature of revenue for delay in making the full payment. Ascertainment of any of, these two gives the answer for the other, e.g., if we ascertain the total amount of, interest, it becomes very simple to ascertain the cash price just by deducting the, amount of interest from the hire purchase price., Interest is charged on the amount outstanding. Therefore, if the hire purchaser, makes a down payment on signing the contract, it will not include any amount of, interest. It should be noted that though the instalments of a hire purchase, agreement may be equal, the interest element in each instalment is not the same., At the time of calculating interest, students may face the following two situations:, (a), , When the cash price, rate of interest and the amount of instalments are given;, and, , (b), , When the cash price and the amount of instalments are given, but the rate of, interest is not given., , Now, let us consider the above two situations., , © The Institute of Chartered Accountants of India

Page 10 :

11.10, , ACCOUNTING, , 6.1 When the cash price, rate of interest and the amount of, instalments are given, In this situation, the total amount of interest is to be ascertained first. It is the, difference between the hire purchase price (down payment + total instalments) and, the cash price. To calculate the amount of interest involved in each instalment the, following steps are followed:, Step 1 :, , Deduct down payment from the cash price. Calculate the interest at the, given rate on the remaining balance. This represents the amount of, interest included in the first instalment., , Step 2 :, , Deduct the interest of Step 1 from the amount of first instalment. The, resultant figure is the cash price included in the first instalment., , Step 3 :, , Deduct the cash price of the 1st instalment (Step 2) from the balance due, after down payment. It represents the amount outstanding after the 1st, instalment is paid., , Step 4 :, , Calculate the interest at the given rate on the balance outstanding after, the 1st instalment. Deduct this interest from the amount of the, 2nd instalment to get the cash price included in the 2nd instalment., , Step 5:, , Deduct the cash price of the 2nd instalment (Step 4) from the balance, due after the 1st instalment. It represents the amount outstanding after, the 2nd instalment is paid., , Repeat the above steps till the last instalment is paid., Illustration 4, Om Ltd. purchased a machine on hire purchase basis from Kumar Machinery Co. Ltd., on the following terms:, (a), , Cash price ` 80,000, , (b), , Down payment at the time of signing the agreement on 1.1.20X1 ` 21,622., , (c), , 5 annual instalments of ` 15,400, the first to commence at the end of twelve, months from the date of down payment., , (d), , Rate of interest is 10% p.a., , You are required to calculate the total interest and interest included in cash, instalment., , © The Institute of Chartered Accountants of India

Page 11 :

HIRE PURCHASE AND INSTALLMENT SALE …, Solution, , Calculation of interest, Total, (`), , Cash Price, Less: Down Payment, Balance due, payment, , after, , Interest / Cash, 1st instalment, , down, , 58,378, -, , Less: Cash price of 1st instalment, Balance due after 1st instalment, , (9,562), 48,816, , Less: Cash price of 2nd instalment, Balance, due, after, 2nd, instalment, Interest/Cash, price, of, 3rd, instalment, , (10,518), , Less: Cash price of 3rd instalment, Balance due after 3rd instalment, , (11,570), 26,728, , Less: Cash price of 4th instalment, , (12,728), , Interest/Cash, instalment, , Price, , 80,000, (21,622), , of, , Interest/cash, instalment, , price, , price, , of, , of, , 2nd, , 4th, , Balance due after 4 instalment, Interest/Cash, price, of, 5th, instalment, th, , Less: Cash price of 5th instalment, Total, , 11.11, , -, , Interest in, each, instalment (1), Nil, , Cash price in, each, instalment (2), ` 21,622, , ` 58,378, x10/100 =, ` 5,838, , ` 15,400 –, ` 5,838 =, ` 9,562, , ` 48,816 x, 10/100 =, ` 4,882, , ` 15,400 ` 4,882=, ` 10,518, , ` 38,298 x, 10/100 =, ` 3,830, , ` 15,400 ` 3,830=, ` 11,570, , ` 26,728, x10/100 =, ` 2,672, , ` 15,400 ` 2,672 =, ` 12,728, , `14,000, x10/100 =, ` 1,400, , ` 15400–, ` 1,400 =, 14,000, , ` 18,622, , ` 80,000, , 38,298, -, , -, , 14,000, -, , (14,000), Nil, , © The Institute of Chartered Accountants of India

Page 12 :

11.12, , ACCOUNTING, , Total interest can also be calculated as follow:, (Down payment + instalments) – Cash Price = ` [21,622 +(15400 x 5)] – ` 80,000 =, ` 18,622, , 6.2 When the cash price and the amount of instalments are given, but, the rate of interest is not given, When the rate of interest is not given, but the cash price and the amount of, instalments are given, we have to find interest rate implicit in the transaction by, bifurcating the instalments between reduction in liability and finance charges, (interest)., Internal rate of return (IRR) is the discount rate that equates the present value of, the expected net cash outflows (amount of down-payment and instalments) with, the cash price. When the net cash flows are not uniform over the life of the, investment, the determination of the discount rate can involve trial and error and, interpolation between interest rates., In case of hire purchase, Internal Rate of Return Method (IRR) • method considers, the time value of money, the cash price, and all cash outflows (amount of downpayment and instalments) relating to the purchase of the asset on hire purchase, basis. IRR method does not use the desired rate of return but estimates the, discount rate that makes the present value of subsequent net cash outflows equal, to the cash price., Illustration 5, Happy Valley Florists Ltd. acquired a delivery van on hire purchase on 01.04.20X1, from Ganesh Enterprises. The terms were as follows:, Particulars, Hire Purchase Price, , Amount (`), 180,000, , Down Payment, , 30,000, , 1st instalment payable after 1 year, , 50,000, , 2, , instalment after 2 years, , 50,000, , 3 instalment after 3 years, , 30,000, , 4th instalment after 4 years, , 20,000, , nd, rd, , For detailed understanding of IRR, students are advised to refer Financial Management Study, Material., , •, , © The Institute of Chartered Accountants of India

Page 13 :

11.13, , HIRE PURCHASE AND INSTALLMENT SALE …, , Cash price of van ` 150,000 You are required to calculate Total Interest and Interest, included in each instalment., Solution, Calculation of total Interest and Interest included in each installment, Hire Purchase Price (HPP), , = Down Payment + instalments, = 30,000 + 50,000 + 50,000 + 30,000 + 20,000 = 1,80,000, , Total Interest, , = 1,80,000 – 1,50,000 = 30,000, , Computation of IRR (considering two guessed rates of 6% and 12%), Year, , Cash Flow, , DF @6%, , 1, 2, , 50,000, 50,000, , 0.94, 0.89, , 0, , 3, 4, , 30,000, , 30,000, 20,000, , PV, , DF @12%, , 47,000, 44,500, , 0.89, 0.80, , 1.00, , 30,000, , 0.84, , 25,200, , 0.79, NPV, , 15,800, 1,62,500, , PV, , 1.00, , 30,000, , 0.71, , 21,300, , 0.64, NPV, , 44,500, 40,000, 12,800, 1,48,600, , Interest rate implicit on lease is computed below by interpolation:, Interest rate implicit on lease = 6% +, , 1,62, 500 - 1, 50,000, × ( 12 - 6 ) = 11.39%, 1,62, 500 - 1, 48,600, , Thus, repayment schedule and interest would be as under:, Instalment, no., , Principal, at, beginning, , Cash down, , 1,50,000, , 1, 2, 3, 4, , Interest, included in, each, instalment, , 1,20,000, , 13,668, , 18,118, , 2,064, , 83,668, 43,198, , 9,530, 4,920, , 30,182*, , Gross, amount, , Instalment, , Principle, at end, , 1,50,000, , 30,000, , 1,20,000, , 93,198, 48,118, , 50,000, 30,000, , 43,198, 18,118, , 1,33,668, , * difference is on account of approximations, , © The Institute of Chartered Accountants of India, , 20,182, , 50,000, , 20,000, , 83,668, , 182*

Page 14 :

11.14, , ACCOUNTING, , 7. ACCOUNTING, TRANSACTION, , FOR, , HIRE, , PURCHASE, , 7.1 In the Books of Hire Purchaser, There are following two methods of recording the hire purchase transactions in the, books of the hire-purchaser:, 1., , Cash price method, , 2., , Interest suspense method, , It is necessary to disclose assets taken on hire purchase basis by classifying it, as “Asset on Hire Purchase”. Accordingly, amount due to the hire vendor, should also be shown in his books as a liability — “Hire Purchase Creditors”, with additional such classifications of amount of hire purchase instalment due, and amount of hire purchase instalment not yet due., , Methods, Cash Price Method, , Full cash price of, asset is debited to, Asset Account and, credited to Hire, Vendor Account, , Interest Suspense Method, , At the time of transfer of possession of, asset, total interest unaccrued is, transferred to interest suspense account., , At later years, as and when interest, becomes due, interest account is debited, and interest suspense account is credited., , Cash price method, Under this method, the full cash price of the asset is debited to the Asset Account, and credited to the Hire Vendor Account, therefore, it is also called Full Cash Price, © The Institute of Chartered Accountants of India

Page 15 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.15, , Method. At the time of payment of instalment, Interest Account is debited and Hire, Vendor Account is credited (with the interest on outstanding balance). When, instalment is paid, the Hire Vendor Account is debited and Bank Account is, credited. At the time of preparation of Final Accounts, interest is transferred to, Profit and Loss Account and asset is shown in the Balance Sheet at cost less, depreciation. The balance due to hire vendor is shown in the Balance Sheet as a, liability., Accounting, To have proper accounting record, one should know: (1) Date of purchase of the, asset; (2) Cash price of the asset; (3) Hire purchase price of the asset; (4) The amount, of down payment; (5) Number and amount of each instalment; (6) Rate of interest;, (7) Method and rate of depreciation; (8) Date of payment of every instalment; and, (9) Date of closing the books of account., Journal Entries in books of Hire Purchaser, 1., , At the time of entering into the agreement, Asset Account, , Dr. [Full cash price], , To Hire Vendor Account, 2., , When down payment is made, Hire Vendor Account, , Dr. [Down payment], , To Cash/Bank Account, 3., , When an instalment becomes due, Interest Account, , To Hire Vendor Account, , 4., , Dr. [Interest on outstanding, balance], , When an instalment is paid, Hire Vendor Account, , Dr. [Amount of instalment], , To Bank Account, 5., , When depreciation is charged on the asset, Depreciation Account, To Asset Account, , © The Institute of Chartered Accountants of India, , Dr. [Calculated on cash price]

Page 16 :

11.16, , 6., , ACCOUNTING, , For closing interest and depreciation, account, Profit and Loss Account, , Dr., , To Interest Account, To Depreciation Account, , Disclosure in the balance sheet, Assets, Fixed Assets:, Asset (at cash price), Less: Depreciation, , xxxxxxx.xx, xxxx.xx, xxxxxxx.xx, , Liabilities, Hire Purchase Creditors:, Balance in hire vendor's A/c, , xxxxx.xx, , Interest accrued not yet due, , xxxxx.xx, , Illustration 6, On January 1, 20X1 HP M/s acquired a Pick-up Van on hire purchase from FM M/s., The terms of the contract were as follows:, (a), , The cash price of the van was ` 1,00,000., , (b), , ` 40,000 were to be paid on signing of the contract., , (c), , The balance was to be paid in annual instalments of ` 20,000 plus interest., , (d), , Interest chargeable on the outstanding balance was 6% p.a., , (e), , Depreciation at 10% p.a. is to be written-off using the straight-line method., , You are required to:, (a), , Give Journal Entries and show the relevant accounts in the books of HP, M/s from January 1, 20X1 to December 31, 20X3; and, , (b), , Show the relevant items in the Balance Sheet of the purchaser as on December, 31, 20X1 to 20X3., , © The Institute of Chartered Accountants of India

Page 17 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.17, , Solution, In the books of HP M/s, Journal Entries, Date, 20X1, Jan. 1, , “, , Dec. 31, , “, , “, , “, , 20X2, , Dec. 31, , Particulars, , Dr., , Cr., , `, , `, , Dr., , 1,00,000, , Dr., , 40,000, , Dr., , 3,600, , FM M/s A/c (` 20,000+` 3,600), , Dr., , 23,600, , Depreciation A/c, , Dr., , 10,000, , Profit & Loss A/c, , Dr., , 13,600, , Pick-up Van A/c, To FM M/s A/c, (Being the purchase of a pick-up van on, hire purchase from FM M/s), , FM M/s A/c, To Bank A/c, (Being the amount paid on signing the, H.P. contract), Interest A/c, To FM M/s A/c, (Being the interest payable @ 6% on, ` 60,000, To Bank A/c, (Being the payment of 1st instalment, along with interest), To Pick-up Van A/c, (Being the depreciation charged @ 10%, p.a. on ` 1,00,000), To Depreciation A/c, To Interest A/c, , (Being the depreciation and interest, transferred to Profit and Loss Account), Interest A/c, , To FM M/s A/c, (Being the interest payable @ 6% on, ` 40,000), , © The Institute of Chartered Accountants of India, , 1,00,000, , 40,000, , 3,600, , 23,600, , 10,000, , 10,000, , 3,600, , Dr., , 2,400, , 2,400

Page 18 :

11.18, , ACCOUNTING, , FM M/s A/c (` 20,000 + ` 2,400), To Bank A/c, , Dr., , 22,400, , Depreciation A/c, , Dr., , 10,000, , Profit & Loss A/c, To Depreciation A/c, , Dr., , 12,400, , (Being the payment of 2, along with interest), , nd, , instalment, , To Pick-up Van A/c, (Being the depreciation charged @ 10%, p.a.), , 20X3, Dec. 31, , To Interest A/c, (Being the depreciation and interest, charged to Profit and Loss Account), Interest A/c, To FM M/s A/c, , 22,400, , 10,000, , 10,000, , 2,400, , Dr., , 1,200, , Dr., , 21,200, , 1,200, , (Being the interest payable @ 6% on, ` 20,000), FM M/s A/c (` 20,000 + ` 1,200), To Bank A/c, , 21,200, , (Being the payment of final instalment, along with interest), Depreciation A/c, , Dr., , 10,000, , To Pick-up Van A/c, , 10,000, , (Being the depreciation charged @ 10%, p.a. on ` 1,00,000), Profit & Loss A/c, To Depreciation A/c, To Interest A/c, (Being the interest and depreciation, charged to Profit and Loss Account), , © The Institute of Chartered Accountants of India, , Dr., , 11,200, 10,000, 1,200

Page 19 :

11.19, , HIRE PURCHASE AND INSTALLMENT SALE …, Ledgers in the books of HP M/s, Pick-up Van Account, Date, 1.1.20X1, , Particulars, To, , ` Date, , FM M/s A/c, , Particulars, , 1,00,000 31.12.20X1 By Depreciation A/c, 31.12.20X1 By Balance c/d, 1,00,000, , 1.1.20X2, , To, , Balance b/d, , To, , 90,000 31.12.20X2 By Depreciation A/c, , Balance b/d, , 10,000, 90,000, 1,00,000, , 31.12.20X2 By Balance c/d, 1.1.20X3, , `, , 10,000, 80,000, , 90,000, , 90,000, , 80,000 31.12.20X3 By Depreciation A/c, , 10,000, , 31.12.20X3 By Balance c/d, 80,000, , 70,000, 80,000, , FM M/s Account, Date, 1.1.20X1, , Particulars, , Date, , `, , To Bank A/c, , 40,000 1.1.20X1, , By, , 31.12.20X1 To Bank A/c, , 23,600 31.12.20X1 By, , 31.12.20X1 To Balance c/d, , 40,000, , Particulars, , `, , Pick-up Van A/c, , 1,00,000, , Interest c/d, , 1,03,600, , 3,600, 1,03,600, , 31.12.20X2 To Bank A/c, , 22,400 1.1.20X2, , By, , Balance b/d, , 40,000, , 31.12.20X2 To Balance c/d, , 20,000 31.12.20X2 By, , Interest A/c, , 2,400, , 42,400, 31.12.20X3 To Bank A/c, , 42,400, , 21,200 1.1.20X3, , By, , Balance b/d, , 20,000, , 31.12.20X3 By, , Interest A/c, , 1,200, , 21,200, , 21,200, , Depreciation Account, Date, , Particulars, , `, , Date, , Particulars, , `, , 31.12.20X1 To Pick-up Van A/c, , 10,000 31.12.20X1 By Profit & Loss A/c, , 10,000, , 31.12.20X2 To Pick-up Van A/c, , 10,000 31.12.20X2 By Profit & Loss A/c, , 10,000, , 31.12.20X3 To Pick-up Van A/c, , 10,000 31.12.20X3 By Profit & Loss A/c, , 10,000, , © The Institute of Chartered Accountants of India

Page 20 :

11.20, , ACCOUNTING, Interest Account, , Date, , Particulars, , `, , Date, , Particulars, , `, , 31.12.20X1 To FM M/s A/c, , 3,600 31.12.20X1, , By Profit & Loss A/c, , 3,600, , 31.12.20X2 To FM M/s A/c, , 2,400 31.12.20X2, , By Profit & Loss A/c, , 2,400, , 31.12.20X3 To FM M/s A/c, , 1,200 31.12.20X3, , By Profit & Loss A/c, , 1,200, , Balance Sheet of HP M/s as at 31st December, 20X1, Liabilities, , `, , FM M/s, , 40,000, , Assets, , `, , Pick-up Van, , 90,000, , Balance Sheet of HP M/s as at 31st December, 20X2, Liabilities, , `, , FM M/s, , 20,000, , Assets, , `, , Pick-up Van, , 80,000, , Balance Sheet of HP M/s as at 31st December, 20X3, Liabilities, , `, , Assets, , `, , Pick-up Van, , 70,000, , Interest suspense method, Under this method, at the time of transfer of possession of asset, the total interest, unaccrued is transferred to interest suspense account. At later years, as and when, interest becomes due, interest account is debited and interest suspense account is, credited., Journal Entries in the books of Hire Purchaser, 1., , When the asset is acquired on hire purchase, Asset Account, , To Hire Vendor Account, , 2., , For total interest payment, H.P. Interest Suspense Account, To Hire Vendor Account, , 3., , Dr. [Full cash price], , Dr. [Total interest], , When down payment is made, Hire Vendor Account, , © The Institute of Chartered Accountants of India, , Dr. [Down payment]

Page 21 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.21, , To Bank Account, 4., , For Interest of the relevant period, , 5., , When an instalment is paid, , Dr. [Interest of the relevant, period], , Interest Account, To H.P. Interest Suspense Account, Hire Vendor Account, , Dr., , To Bank Account, , 6., , When depreciation is charged on the asset, Depreciation Account, , Dr. [Calculated on cash price], , To Asset Account, , 7., , For closing interest and depreciation account, Profit and Loss Account, , Dr., , To Interest Account, , To Depreciation Account, Illustration 7, Continuing with the information given in illustration 6, assume that the hire, purchaser adopted the interest suspense method for recording his hire purchase, transactions. On this basis, prepare H.P. Interest Suspense Account, Interest Account, and FM M/s Accounts and Balance Sheets in the books of hire purchaser., Solution, H.P. Interest Suspense Account, Date, , Particulars, , 1.1.20X1, , To FM M/s A/c, (W.N.), , `, 7,200, , Date Particulars, 31.12.20X1 By Interest A/c, , 3,600, , 31.12.20X1 By Balance c/d, , 3,600, , 7,200, 1.1.20X2, , To Balance b/d, , 3,600, , 7,200, 31.12.20X2 By Interest A/c, 31.12.20X2 By Balance c/d, , 3,600, 1.1.20X3, , To Balance b/d, , 1,200, , © The Institute of Chartered Accountants of India, , `, , 2,400, 1,200, 3,600, , 31.12.20X3 By Interest A/c, , 1,200

Page 22 :

11.22, , ACCOUNTING, Interest Account, , Date, , Particulars, , 31.12.20X1 To H.P. Interest, Suspense A/c, 31.12.20X2 To H.P. Interest, Suspense a/c, 31.12.20X3 To H.P. Interest, Suspense A/c, , ` Date, , Particulars, , `, , 3,600 31.12.20X1 By Profit & Loss, A/c, 2,400 31.12.20X2 By Profit & Loss, A/c, 1,200 31.12.20X3 By Profit & Loss, A/c, , 3,600, 2,400, 1,200, , FM M/s Account, Date, , 1.1.20X1, , Particulars, , To Bank A/c, , 31.12.20X1 To Bank A/c, 31.12.20X1 To Balance c/d, 31.12.20X2 To Bank A/c, , 31.12.20X2 To Balance c/d, 31.12.20X3 To Bank A/c, , ` Date, , Particulars, , `, , 40,000 1.1.20X1 By Pick-up Van, A/c, , 23,600 1.1.20X1 By H.P. Interest, 43,600, Suspense A/c, , 1,07,200, , 22,400 1.1.20X2 By Balance b/d, , 1,00,000, 7,200, 1,07,200, , 43,600, , 21,200, 43,600, , 43,600, , 21,200 1.1.20X3 By Balance b/d, , 21,200, , Balance Sheet of HP M/s as at 31st December, 20X1, Liabilities, , FM M/s, Less: H.P., Suspense, , ` Assets, , Interest, , 43,600, Pick-up Van, (3,600) 40,000 Less: Depreciation, , `, 1,00,000, (10,000), , 90,000, , Balance Sheet of HP M/s as at 31st December, 20X2, Liabilities, , FM M/s, Less: H.P. Interest, Suspense, , 21,200, (1,200), , ` Assets, , Pick-up Van, Less:, 20,000 Depreciation, , © The Institute of Chartered Accountants of India, , `, 90,000, (10,000), , 80,000

Page 23 :

11.23, , HIRE PURCHASE AND INSTALLMENT SALE …, , Balance Sheet of HP M/s as at 31st December, 20X3, Liabilities, , `, , Assets, , `, , Pick-up Van, , Less: Depreciation, , 80,000, , (10,000), , 70,000, , Working Note:, Total Interest = ` 3,600 + ` 2,400 + ` 1,200 = ` 7,200., , 7.2 In the books of the Hire Vendor, There are two methods of recording hire purchase transactions in the books of the, hire vendor. The selection of the method is based on the type and value of goods, sold, volume of transactions, the length of the period of purchase, etc. These two, methods are as follows:, Methods of recording hire purchase transactions, , Sales Method, , (hire purchase sale is treated as, a credit sale)., , Interest Suspense Method (hire, purchaser is debited with full cash, price and interest included in the, selling price), , Sales Method, A business that sells relatively large items on hire purchase may adopt this method., Under this method, hire purchase sale is treated as a credit sale. The only exception, is that the vendor agrees to accept payments in instalments and for that he charges, interest. Generally, a special Sales Day Book is maintained for recording all sales, under hire purchase agreement. The amount due from the hire purchaser at the, end of the year is shown in the Balance sheet on the assets side as Hire Purchase, Debtors., Journal Entries in the books of Hire Vendor, 1., , When goods are sold and delivered, under hire purchase, Hire Purchaser Account, To H.P. Sales Account, , © The Institute of Chartered Accountants of India, , Dr. [Full cash price]

Page 24 :

11.24, , 2., , ACCOUNTING, , When the down payment is received, Bank Account, , Dr. [Down payment], , To Hire Purchaser Account, 3., , When an instalment becomes due, Hire Purchaser Account, , Dr. [Amount of instalment], , To Interest Account, 4., , When the amount of instalment is, received, Bank Account, , Dr. [Amount of instalment], , To Hire Purchaser Account, 5., , For closing interest Account, Interest Account, , Dr., , To Profit and Loss Account, 6., , For closing Hire Purchase Sales Account, H.P. Sales Account, , Dr., , To Trading Account, It is worth noting that, (i), , The entire profit on sale under hire purchase agreement is credited to the, Profit and Loss account of the year in which the sale has taken place; and, , (ii), , Interest pertaining to each accounting period is credited to the Profit and, Loss Account of the respective year., , Interest Suspense Method, This method is almost similar to the sales method, except the accounting for, interest. Under this method, the hire purchaser is debited with full cash price and, interest (total) included in the hire selling price. Credit is given to the H.P. Sales, Account and Interest Suspense Account. When the instalment is received, the Bank, Account is debited and the Hire Purchaser Account is credited. At the same time an, appropriate amount of interest (i.e., interest for the relevant accounting period) is, © The Institute of Chartered Accountants of India

Page 25 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.25, , removed from the Interest Suspense Account and credited to the Interest Account., At the time of preparation of Final Accounts, interest is transferred to the credit of, the Profit and Loss Account. The balance of the Interest Suspense Account is shown, in the Balance Sheet as a deduction from Hire Purchase Debtors., Journal Entries in the books of Hire Vendor, 1., , When goods are sold and delivered, under hire purchase, Hire Purchaser Account, , Dr. [Full cash price + total interest], , To H.P. Sales Account, , 2., , To Interest Suspense Account, , To Hire Purchaser Account, , For interest of, accounting period, , the, , 5., , Dr. [Amount of down payment/, instalment], , relevant, , Interest Suspense Account, 4., , [Total Interest], , When down payment/instalment is, received, Bank Account, , 3., , [Full cash price], , To Interest Account, , Dr. [Amount of interest], , For closing interest Account, Interest Account, , To Profit and Loss Account, , Dr., , For closing Hire Purchase Sales, Account, H.P. Sales Account, , To Trading Account, , Dr., , The disclosure in balance sheet of the respective parties will be:, Balance Sheet of Hire Purchaser, , Balance Sheet of Vendor, , Fixed assets:, , Current assets:, , Less: Depreciation, , Less: Balance in Interest suspense A/c, , Assets, , Asset on Hire purchase, , © The Institute of Chartered Accountants of India, , Assets, , Hire purchase debtors

Page 26 :

11.26, , ACCOUNTING, , Liabilities, , Liabilities, , Amount payable to Vendor, , Less: Balance in Interest Suspense A/c, , 8. REPOSSESSION, In a hire purchase agreement, the hire purchaser has to pay up to the last instalment, to obtain the ownership of goods. If the hire purchaser fails to pay any one or more, of the instalments, the hire vendor has the right to take the asset back in its actual, form without any refund of the earlier payments to the hire purchaser. The amounts, received from the hire purchaser through down payment and instalments are, treated as the hire charges by the hire vendor. This act of recovery of possession, of the asset is termed as repossession., Repossessed assets are resold to any other customer after repairing or, reconditioning (if necessary). Accounting figures relating to repossessed assets are, segregated from the normal hire purchase entries. Repossessions are then, accounted for in a separate “Goods Repossessed Account”., So far as the repossession of assets are concerned, the hire vendor can take back, the whole of the asset or a part thereof depending on the agreement between the, parties. The former is called “Complete Repossession” and the latter is called, “Partial Repossession”., Repossession, Complete Repossession, , (Hire vendor repossesses all the, goods.), , Partial Repossession, , (Hire vendor repossesses part of the, goods and balance of goods remains, with the purchaser. ), , 8.1 Complete Repossession, The hire vendor closes Hire Purchaser’s Account by transferring balance of Hire, Purchaser Account to Goods Repossessed Account., The hire purchaser closes the Hire Vendor’s Account by transferring the balance of, Hire Vendor Account to Hire Purchase Asset and then finding the profit and loss, on repossession in Asset Account., © The Institute of Chartered Accountants of India

Page 27 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.27, , After repossession, the vendor may incur expenses on repossessed stock and may, sell the same in due course of time., Particulars, , Books of hire purchaser, , Books of hire vendor, , Purchase/Sales, , Asset A/c, , …Dr. Hire Purchaser A/c, , Instalment, , Hire Vendor A/c, To Cash A/c, , …Dr. Cash A/c, …Dr., To Hire Purchaser A/c, , Hire Vendor A/c, To Asset A/c, , …Dr. Goods Repossessed A/c …Dr., To Hire Purchaser, , Interest, Repossession, , To Hire Vendor A/c, , Interest A/c, To Hire Vendor, , To Sales A/c, , …Dr. Hire Purchaser A/c, To Interest A/c, , …Dr., , …Dr., , 8.2 Partial Repossession, In case of a partial repossession, only a part of the asset is taken back by the hire, vendor and other part is left with the hire purchaser. The Journal Entries are as usual, up to the date of default (excepting entry for payment) in the books of both the, parties. As a portion of the asset is still left with the hire purchaser, neither party, closes the account of the other in their respective books., Assets are repossessed at a mutually agreed value (based on agreed rate of, depreciation which is an enhanced rate). The hire vendor debits the Goods, Repossessed Account and credit the Hire Purchaser Account with the value as, agreed upon on the repossession. Similarly, the hire purchaser debits the Hire, Vendor Account and credits the Assets Account with the same amount. If the, repossessed value is less than the book value of the asset which is repossessed, the, difference is charged to the Profit and Loss Account of the hire purchaser as ‘loss, on surrender’., For the remaining portion of the asset lying with the hire purchaser, the (Hire, Purchaser) applies the usual rate of depreciation and shows the Asset Account at, its usual written-down value., , © The Institute of Chartered Accountants of India

Page 28 :

11.28, , ACCOUNTING, , MISCELLANEOUS ILLUSTRATIONS, Illustration 8, X Ltd. purchased 3 scooters from Super Motors costing ` 75,000 each on hire purchase, system. Payment was to be made: ` 45,000 down and the remainder in 3 equal, instalments together with interest @ 9%. X Ltd. writes off depreciation @ 20% on the, diminishing balance. It paid the instalment at the end of the 1st year but could not, pay the next. Super Motor agreed to leave one scooter with the purchaser, adjusting, the value of the other two scooters against the amount due. The scooters were valued, on the basis of 30% depreciation annually on written down value basis. Also, X Ltd., settled the seller’s dues., You are required to give necessary journal entries and Scooters Account and Super, Motors Account in the books of X Ltd for the first two years., Solution, In the Books of X Ltd., Journal Entries, Dr. (` ), , Cr. (` ), , I Year, , Scooters purchased:, Scooters A/c, , To Vendor A/c, (Being purchase of 3 scooters on hire purchase at, ` 75,000 each), On down payment:, Vendor A/c, , To Bank, , Dr., , 2,25,000, , Dr., , 45,000, , Dr., , 16,200, , (Being down payment made), I Year end, , Interest A/c (` 1,80,000 @ 9%), To Vendor A/c, , (Being Interest due on outstanding balance), , © The Institute of Chartered Accountants of India, , 2,25,000, , 45,000, , 16,200

Page 29 :

HIRE PURCHASE AND INSTALLMENT SALE …, Vendor A/c, , To Bank A/c (60,000 + 16,200), , 11.29, , Dr., , 76,200, , Dr., , 45,000, , Dr., , 61,200, , (Being First Instalment paid along with Interest), Depreciation A/c, , To Scooters A/c, , (Being depreciation provided@ 20%), Profit & Loss A/c, , To Depreciation, , To interest A/c, (Being Interest and Depreciation charged to profit, and loss account), II Year end, , Dr., , 36,000, , Interest A/c, , Dr., , 10,800, , (1,20,000 @ 9%), , To Vendor A/c, , Super Motors A/c (1,50,000 – 45,000 – 31,500), Profit & Loss A/c (b.f.), , To Scooters A/c [(2,25,000 – 45,000 – 36,000), x 2/3], , 45,000, , 36,000, , 10,800, , (Being interest due on balance outstanding), For Loss on Repossession:, , 45,000, , 16,200, , Depreciation A/c, , To Scooters A/c, (Being Depreciation provided @ 20%)), , 76,200, , Dr., , Dr., , 73,500, 22,500, , 96,000, , (Being re-possession of scooters), Vendor A/c, , To Bank, , (Being vendor’s account settled), , © The Institute of Chartered Accountants of India, , Dr., , 57,300, , 57,300

Page 30 :

11.30, , ACCOUNTING, Scooters Account, , Year, 1, , ` Year, To Super Motors, A/c, , 2,25,000, , `, , 1 end, , By Depreciation A/c, , ”, , By Balance c/d, , 2,25,000, 2, , To Balance b/d, , 1,80,000, , 45,000, 1,80,000, 2,25,000, , 2 end, , By Depreciation, , By Super Motors, (value of 2 scooters, after depreciation for, 2 years @ 30%), By P & L A/c, (balancing figure), , By Balance c/d (one, scooter less dep. for, 2 years) @ 20%, 1,80,000, , 36,000, , 73,500, , 22,500, , 48,000, 1,80,000, , Super Motors Account, Year, 1, , `, , Year, , `, , To Bank A/c, , 45,000 1, , By Scooters A/c, , To Bank A/c, , 76,200, , By Interest @ 9% on, ` 1,80,000, , To Balance c/d, , 16,200, , 1,20,000, 2,41,200, , 2, , 2,25,000, , 2,41,200, , To Scooters A/c, , 73,500 2, , By Balance b/d, , 1,20,000, , To Bank A/c, , 57,300, , By Interest A/c, , 10,800, , 1,30,800, , © The Institute of Chartered Accountants of India, , 1,30,800

Page 31 :

11.31, , HIRE PURCHASE AND INSTALLMENT SALE …, Illustration 9, , A firm acquired two tractors under hire purchase agreements from HP Co., details of, which were as follows:, Date of Purchase, Cash price, , Tractor A, 1st April, 20X1(` ), , 14,000, , Tractor B, 1st Oct., 20X1(`), , 19,000, , Both agreements provided for payment to be made in twenty-four monthly instalments, (of ` 600 each for Tractor A and ` 800 each for Tractor B), commencing on the last day, of the month following purchase, all instalments being paid on due dates., On 30th June, 20X2, Tractor B was completely destroyed by fire. In full settlement, on, 10th July, 20X2 an insurance company paid ` 15,000 under a comprehensive policy., Any balance on the hire purchase company’s account in respect of these transactions, was to be written off., The firm prepared accounts annually to 31st December and provided depreciation on, tractors on a straight-line basis at a rate of 20 per cent per annum rounded off to, nearest ten rupees, apportioned as from the date of purchase and up to the date of, disposal., You are required to record these transactions in the following accounts, carrying, down the balances on 31st December, 20X1 and 31st December, 20X2:, (a), , Tractors on hire purchase., , (b), , Provision for depreciation of tractors., , (c), , Disposal of tractors., , Solution, Hire Purchase accounts in the buyer’s books, Tractors on Hire Purchase Account, , (a), 20X1, , `, , April, 1, , To, , Oct. 1, , ”, , HP Co. - Cash, price, Tractor A, , 14,000, , Tractor B, , 19,000, , HP Co. - Cash, price, , 20X1, Dec. 31, , 33,000, , © The Institute of Chartered Accountants of India, , `, By, , Balance c/d, Tractor A, Tractor B, , 14,000, 19,000, , 33,000, , 33,000

Page 32 :

11.32, , 20X2, , Jan. 1, , To, , Balance b/d, , Tractor B, , Jan. 1, , (b), , To, , `, , June 30, , 14,000, 19,000, , 33,000, , Dec. 31, , 33,000, , Balance b/d, , By, , Disposal of, Tractor A/c Transfer, , By, , 19,000, , Balance c/d, , 14,000, 33,000, , 14,000, , Provision for Depreciation of Tractors Account, , 20X1, Dec. 31, , 20X2, , `, , Tractor A, , 20X3, , ACCOUNTING, , `, To Balance c/d, , * 14,000 x 20% x 9/12 = 2,100, , 3,050, , 20X1, Dec.31, , `, By P & L A/c:, Tractor A, Tractor B, , 3,050, , 2,100*, , 950**, , 3,050, 3,050, , ** 19,000 x 20% x 3/12 = 950, 20X2, , ` 20X2, , June30 To Disposal of Tractor, account—Transfer, (950 + 1,900), , 2,850 Jan. 1, , Dec., 31, , 4,900, , To Balance c/d, , 7,750, , 20X2, on, June30 To Tractors, hire purchase, —Tractor B, , By, , Balance b/d, , Jun. 30 By, , P & L A/c, , Dec. 31 By, , P & L A/c, , 20X3, , Jan. 1, , (c), , `, 3,050, , (Dep. for Tractor B), (19,000 x 20% x 6/12), , 1,900, , (Dep. for Tractor A), (14,000 x 20%), , 2,800, , By Balance b/d, , 4,900, , 7,750, `, , Disposal of Tractor Account, , ` 20X2, 19,000 June 30, , © The Institute of Chartered Accountants of India, , `, By Provision for Depn. of, Tractors A/c, , 2,850

Page 33 :

11.33, , HIRE PURCHASE AND INSTALLMENT SALE …, July 10, , Dec. 31, , By Cash: Insurance, , By P & L A/c: Loss (b.f.), , 19,000, , 15,000, , 1,150, , 19,000, , Illustration 10, A machinery is sold on hire purchase. The terms of payment is four annual instalments, of ` 6,000 at the end of each year commencing from the date of agreement. Interest is, charged @ 20% and is included in the annual payment of ` 6,000., Show Machinery Account and Hire Vendor Account in the books of the purchaser who, defaulted in the payment of the third yearly payment whereupon the vendor repossessed the machinery. The purchaser provides depreciation on the machinery, @ 10% per annum on WDV basis. All workings should form part of your answers., Solution, Machinery Account, , `, I Yr., , To Hire Vendor, A/c (W.N.), , 15,533 I Yr., , `, By Depreciation A/c, By Balance c/d, , 13,980, , 15,533, II Yr. To Balance b/d, , 15,533, , 13,980 II Yr. By Depreciation A/c*, By Balance c/d, , 13,980, III Yr. To Balance b/d, , 1,553, , 1,398, , 12,582, 13,980, , 12,582 III Yr. By Depreciation A/c*, By Hire Vendor, , By Profit & Loss A/c, (Loss, on, (bal.fig.), , 12,582, , Surrender), , 1,258, , 11,000, , 324, , 12,582, , *Depreciation has been directly credited to the Machinery Account; it could have, been accumulated in provision for depreciation account., , © The Institute of Chartered Accountants of India

Page 34 :

11.34, , ACCOUNTING, Hire Vendor Account, , `, I Yr., , II Yr., , `, , To Bank A/c, To Balance c/d, , 6,000, 12,639, , I Yr., , To Bank A/c, To Balance c/d, , 6,000, 9,167, , II Yr., , 11,000, , III Yr., , 18,639, , 15,167, , III Yr. To Machinery A/c, (transfer), , 11,000, , By Machinery A/c, By Interest A/c, , 15,533, 3,106, , By Balance b/d, By Interest A/c, , 12,639, 2,528, , 18,639, , 15,167, , By Balance b/d, , 9,167, , By Interest A/c, , 1,833, , 11,000, , Note: Alternatively, total interest could have been debited to Interest Suspense A/c, and credited to Hire Vendor A/c with consequential changes., Working Notes:, Instalment Amount, , 4th Instalment, Interest, , 6,000 x, , 20, 120, , Add: 3rd Instalment, Interest, , 11,000 x, , 20, 120, , Add: 2nd Instalment, Interest, , 6,000, 1,000, , Interest, , Principal, , `, , `, , 1,000, , 5,000, , 1,833, , 4,167, , 2,528, , 3,472, , 5,000, 6,000, , 11,000, , 1,833, 9,167, 6,000, , 15,167 x, , 20, 120, , Add: Ist Instalment, , © The Institute of Chartered Accountants of India, , 15,167, , 2,528, , 12,639, , 6,000, , 18,639

Page 35 :

11.35, , HIRE PURCHASE AND INSTALLMENT SALE …, Interest, , 18,639 x, , 20, 120, , 3,106, , 3,106, , 2,894, , 15,533, , 8,467, , 15,533, , Illustration 11, X Transport Ltd. purchased from Delhi Motors 3 Tempos costing ` 50,000 each on the, hire purchase system on 1-1-20X1. Payment was to be made ` 30,000 down and the, remainder in 3 equal annual instalments payable on 31-12-20X1, 31-12-20X2 and, 31-12-20X3 together with interest @ 9%. X Transport Ltd. write off depreciation at, the rate of 20% on the diminishing balance. It paid the instalment due at the end of, the first year i.e. 31-12-20X1 but could not pay the next on 31-12-20X2. Delhi Motors, agreed to leave one Tempo with the purchaser on 1-1-20X3 adjusting the value of, the other 2 Tempos against the amount due on 31-12-20X2 (date of repossession)., The Tempos were valued based on 30% depreciation annually. Show the necessary, accounts in the books of X Transport Ltd. for the years 20X1, 20X2 and 20X3., Solution, X Transport Ltd., Tempo Account, 20X1, , Jan. 1, , `, , To, Delhi, Motors, , 1,50,000, , 20X1, , Dec. 31, , `, , By, , Depreciation A/c: 20% on, 1,50,000, , By, , Balance c/d, , 1,20,000, , 1,50,000, 20X2, Jan 1., , 30,000, 1,50,000, , 20X2, To Balance, b/d, , 1,20,000, , Dec.31., , By, , Depreciation A/c, , 24,000, , By, , Delhi Motors A/c (Value, of 2 tempos taken away), , 49,000, , [(96,000 x 2/3) – 49,000], , 15,000, , of one, (W.N.1), , 32,000, , By, By, , 1,20,000, , © The Institute of Chartered Accountants of India, , Profit and Loss A/c, Balance c/d (Value, tempo, , left), , 1,20,000

Page 36 :

11.36, , ACCOUNTING, , 20X3, Jan. 1, , 20X3, To Balance, b/d, , 32,000, , Dec. 31, , 32,000, , By, , Depreciation A/c, , By, , Balance c/d, , 6,400, 25,600, 32,000, , Delhi Motors Account, 20X1, , `, , 20X1, , `, , Jan. 1, , To, , Bank, (Down, Payment), , 30,000, , Jan. 1, , By, , Tempos A/c, , Dec. 31, , To, , Bank, , 50,800, , Dec. 31, , By, , Interest (9% on, ` 1,20,000), , To, , Balance c/d, , 80,000, 1,60,800, , 20X2, , 10,800, , 1,60,800, 20X2, , Jan. 1, , To, , Tempo, , 49,000, , Jan. 1, , By, , Balance b/d, , Dec. 31, , To, , Balance c/d, , 38,200, , Dec. 31, , By, , Interest (9%, on ` 80,000), , 87,200, 20X3, Dec. 31, , 1,50,000, , To, , Bank, , 80,000, 7,200, 87,200, , `, , 20X3, , 41,638, , Jan. 1, , By, , Balance b/d, , Dec. 31, , By, , Interest (9% on, ` 38,200), , `, , 41,638, , 38,200, 3,438, 41,638, , Working Notes:, (1), , Value of a Tempo left with the buyer:, , `, Cost, , Depreciation @ 20% p.a. under WDV method for, , 2 years [i.e. ` 10,000 + ` 8,000], Value of the Tempo left with the buyer at the end of 2nd year, , © The Institute of Chartered Accountants of India, , 50,000, (18,000), 32,000

Page 37 :

HIRE PURCHASE AND INSTALLMENT SALE …, (2), , 11.37, , Value of Tempos taken away by the seller:, No. of tempos Two, , `, Cost ` 50,000 × 2 =, , 1,00,000, , Depreciation @ 30%, Under WDV method for 2 years [i.e. ` 30,000 + ` 21,000 ], Value of tempos taken away at the end of 2nd year, , (51,000), 49,000, , 9. INSTALMENT PAYMENT SYSTEM, In instalment payment system, the ownership of the goods is passed immediately, to the buyer on the signing the agreement. The accounting entries under, instalment payment system are similar to those passed under the hire-purchase, system. The scheme of entries is as under:, Books of buyer:, •, , Buyer debits asset account with full cash price, credits vendor’s account with, full instalment price and debits interest suspense account with the difference, between full cash price and full instalment price. Interest is debited to interest, suspense account (not interest account) because it includes interest, unaccrued in respect of number of years of the contract., , •, , Every year interest account is debited and interest suspense account is, credited with the interest of current year. Interest account., , •, , At the end of the year, is closed by transferring to profit and loss account., , •, , Vendor is paid the instalment due to him and, , •, , Entry for the depreciation is passed in the usual way., , •, , The balance of vendor account should be shown in the balance sheet after, deducting amount in interest suspense account., , Books of Seller:, •, , The seller debits the purchaser with the full amount (instalment price) payable, by him and credits sales account by the full cash price and credits interest, suspense account by the difference between the total instalment price and, total cash price., , © The Institute of Chartered Accountants of India

Page 38 :

11.38, , ACCOUNTING, , •, , Seller, like the buyer, also transfers the amount of interest due from the, interest suspense account interest account every year., , •, , Interest account is closed by transferring to profit and loss account., , •, , On receiving the instalment the vendor debits cash/bank account and credits, purchaser’s account., , •, , The purchaser’s account should be shown in the balance sheet after, deducting amount in interest suspense account., , 10. DIFFERENCE OF HIRE PURCHASE AGREEMENT, AND INSTALMENT PAYMENT AGREEMENT, A hire purchase agreement is a contract of bailment coupled with an option to the, hire purchaser to acquire the goods delivered to him under such an agreement. By, the delivery of goods to the hire purchaser, the hire vendor merely pass with their, possession, but not the ownership. The property or title to the goods is transferred, to the hire-purchaser, on his paying the last instalment of the hire price or, complying with some other conditions stipulated in the contract. At any time before, that the hire-purchaser has the option to return the goods and, if he does so, he, has only to pay the instalments of price that by then have fallen due. The right or, option to purchase is the essence of hire-purchase agreement. In the event of a, default by the buyer (hire purchaser) in the payment of any of the instalments of, hire price, the vendor can take back the goods into his possession. This is legally, permissible since the property in the goods is still with the vendor., On the other hand, it may have been agreed between the buyer and the seller that, the price of the goods would be payable by instalments and the property would, immediately pass to the buyer; in the event of a default of instalments, it would not, be possible for the vendor to recover back the goods. He, however, would have the, right to bring an action against the purchaser for the recovery of the part of the, price that has not been paid to him., Analysis of the hire purchase price: The hire purchase price is always greater than, the cash price, since it includes interest payable over and above the price of the, goods to compensate the seller for the sacrifice he has made by agreeing to receive, the price by instalments and the risk that he thereby undertakes. It is thus made up, of following elements:, (a), , cash price;, , © The Institute of Chartered Accountants of India

Page 39 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.39, , (b), , interest on unpaid instalments; and, , (c), , a charge to cover the risk involved in the buyer defaulting to pay one or more, of instalments of price or that of his returning the goods in a damaged, condition., , Interest is the charge for the facility to pay the price for the goods by instalments, after they have been delivered. The rate of interest is generally higher than that, payable in respect of an advance or a loan since it also includes a charge to cover, the risk that the hirer may fail to pay any of the instalments and, in such an event,, the goods may have to be taken back into possession in whatever condition they, are at the time. A separate charge on this account is not made as that would not, be in keeping with the fundamental character of the hire-purchase sale., Statement showing differences between Hire Purchase and Instalment System, Basis, Distinction, , of Hire Purchase, , 1. Governing Act, , Instalment System, , It is governed by Hire It is governed by the Sale of, Purchase Act, 1972., Goods Act, 1930., , of It is an agreement of hiring. It is an agreement of sale., 2. Nature, Contract, 3. Passing of Title The title to goods passes on The title to goods passes, (ownership), last payment., immediately as in the case, of usual sale., seller, defaults,, 4. Right to Return The hirer may return goods Unless, goods, without further payment goods are not returnable., except, for, accrued, instalments., , 5. Seller’s right to The seller may take The seller can sue for price, repossess, possession of the goods if if the buyer is in default. He, hirer is in default., cannot take possession of, the goods., 6. Right of Disposal, , Hirer cannot hire out sell,, pledge or assign entitling, transferee, to, retain, possession as against the, hire vendor., , © The Institute of Chartered Accountants of India, , The buyer may dispose off, the goods and give good, title to the bona fide, purchaser.

Page 40 :

11.40, , ACCOUNTING, , 7. Responsibility for The hirer is not responsible, Risk of Loss., for risk of loss of goods if he, has, taken, reasonable, precaution because the, ownership has not yet, transferred., 8. Name of Parties The parties involved are, involved, called Hire purchaser and, Hire vendor., Component other than, 9. Component, other than cash Cash Price included in, price., instalment is called Hire, charges., , The buyer is responsible for, risk of loss of goods, because of the ownership, has transferred., The parties involved are, called buyer and seller., Component other than, Cash Price included in, Instalment is called Interest., , SUMMARY, •, , Under Hire Purchase System, hire purchaser will pay cost of purchased asset, in instalments. The ownership of the goods will be transferred by the Hire, Vendor only after payment of outstanding balance., , •, , Under instalment system, ownership of the goods is transferred by owner, on the date of delivery of goods., , •, , Accounting for hire purchase transactions, , , , , Hire purchaser’s books, , , Cash price Method, , , , Interest suspense method, , Hire vendor’s books, , , Sales Method, , , , Interest suspense method, , , , Repossession: In the event of default by the Hire purchaser, The, Hire vendor has the right to take back the possession called as, repossession. Later the Hire vendor may resell the repossessed, goods after making any repair or reconditioning if required., , © The Institute of Chartered Accountants of India

Page 41 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.41, , TEST YOUR KNOWLEDGE, MCQs, 1., , 2., , 3., , 4., , 5., , 6., , The amount paid at the time of entering the hire-purchase transaction for the, goods purchased is known as, (a), , Cash price, , (b), , Down payment, , (c), , First instalment, , Total interest on hire purchased goods is the difference between, (a), , Hire purchase price and cash price, , (b), , Hire purchase price and down payment, , (c), , Cash price and first instalment, , Depreciation on hire purchased asset is claimed by, (a), , Hire vendor, , (b), , Hire purchaser, , (c), , Either the hire vendor or the hire purchaser as per the agreement, between them, , Under instalment payment system, ownership of goods, (a), , is transferred at the time of payment of last instalment, , (b), , is not transferred, , (c), , is transferred at the time of signing the contract., , The hire purchaser records the asset at its, (a), , Hire purchase price, , (b), , Amount paid to the vendor till date, , (c), , Cash price, , The ownership of goods purchased under hire purchase is transferred only when, (a), , Down payment is paid, , (b), , Outstanding balance is paid in full., , (c), , Cash price and first instalment is paid, , © The Institute of Chartered Accountants of India

Page 42 :

11.42, 7., , 8., , 9., , ACCOUNTING, , Hire purchase price is, (a), , Cash price, , (b), , Interest on unpaid instalments., , (c), , Both (a) and (b)., , Which method of recording Hire purchase transactions is not used in Hire, vendor’s books?, (a), , Sales method, , (b), , Interest suspense method., , (c), , Cash price method., , The balance of the Interest Suspense Account is shown in the Balance Sheet, of vendor as, (a), , Addition to Hire Purchase Debtors., , (b), , Deduction from balance of Hire Purchase Debtors., , (c), , Deduction from balance of Hire Purchase Creditors., , Theoretical Questions, 1., , What is meant by Hire purchase transactions? What are the specific features, of hire purchase transactions?, , 2., , What are the differences between Hire Purchase and Instalment System?, , 3., , Describe in brief the methods of recording Hire purchase transactions in the, books of Hire vendor., , 4., , Describe in brief the methods of recording Hire purchase transactions in the, books of Hire purchaser., , 5., , What is meant by repossession. What is the treatment in the books of Hire, Purchaser?, , Practical Questions, Question 1, M/s. Kodam Enterprises purchased a generator on hire purchase from M/s. Sanctum, Ltd. on 1st April, 20X1. The hire purchase price was `48,000. Down payment was, ` 12,000 and the balance is payable in 3 annual instalments of ` 12,000 each, , © The Institute of Chartered Accountants of India

Page 43 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.43, , payable at the end of each financial year. Interest is payable @ 8% p.a. and is, included in the annual payment of ` 12,000., Depreciation at 10% p.a. is to be written off using the straight-line method., You are required to:, (i), , calculate the cash price of the generator and the interest paid on each, instalment., , (ii), , pass relevant journal entries in the books of M/s. Kodam Enterprises from, 1st April, 20X1 to 31st March, 20X2 following the interest suspense method., , Question 2, Lucky bought 2 tractors from Happy on 1-10-20X1 on the following terms:, `, Down payment, , 5,00,000, , 1st instalment at the end of first year, , 2,65,000, , 2nd instalment at the end of 2nd year, , 2,45,000, , 3rd instalment at the end of 3rd year, , 2,75,000, , Interest is charged at 10% p.a., Lucky provides depreciation @ 20% on the diminishing balances., On 30-9-20X4 Lucky failed to pay the 3rd instalment upon which Happy repossessed, 1 tractor. Happy agreed to leave one tractor with Lucky and adjusted the value of, the tractor against the amount due. The tractor taken over was valued on the basis, of 30% depreciation annually on written down basis. The balance amount, remaining in the vendor's account after the above adjustment was paid by Lucky, after 3 months with interest @ 18% p.a., You are required to:, (1), , Calculate the cash price of the tractors and the interest paid with each, instalment., , (2), , Prepare Tractor Account and Happy Account in the books of Lucky assuming, that books are closed on September 30 every year. Figures may be rounded, off to the nearest rupee., , © The Institute of Chartered Accountants of India

Page 44 :

11.44, , ACCOUNTING, , Question 3, On 1st April, 20X1, Mr. Nilesh acquired a Tractor on Hire purchase from Raj Ltd. The, terms of contract were as follows:, (i), , The Cash price of the Tractor was ` 11,50,000., , (ii), , ` 2,50,000 were to be paid as down payment on the date of purchase., , (iii), , The Balance was to be paid in annual instalments of ` 3,00,000 plus interest, at the end of the year., , (iv), , Interest chargeable on the outstanding balance was 8% p.a., , (v), , Depreciation @ 10% p.a. is to be charged using straight line method., , Mr. Nilesh adopted the Interest Suspense method for recording his Hire purchase, transactions. You are required to: prepare the Tractor account and Interest, Suspense account in the books of Mr. Nilesh for the period of hire purchase., , ANSWERS/SOLUTIONS, MCQs, 1., 7., , (b), (c), , 2., 8., , (a), (c), , 3., 9., , (b), (b), , 4., , (c), , 5., , (c), , 6., , (b), , Theoretical Questions, 1., , Under the Hire Purchase System, the Hire Purchaser gets possession of the, goods at the outset and can use it, while paying for it in instalments over a, specified period of time as per the agreement. However, the ownership of the, goods remains with the Hire Vendor until the hire purchaser has paid all the, instalments. For specific features of such transactions, refer Para 3 of the, Chapter., , 2., , Hire Purchase is an agreement of hiring the asset whereas Instalment sale is, an agreement of sale. The title to goods passes on last payment in the hire, purchase transaction but the title to goods passes immediately in the case of, instalment sale. The hirer may return goods without further payment except, for accrued instalments in hire purchase transaction but in case of instalment, sale, goods are not returnable unless seller defaults. For details, refer Para 10, of the Chapter., , © The Institute of Chartered Accountants of India

Page 45 :

11.45, , HIRE PURCHASE AND INSTALLMENT SALE …, 3., , There are two methods of recording hire purchase transactions in the books, of the hire vendor. The method for recording transactions is selected, according to the type and value of goods sold, volume of transactions, the, length of the period of purchase, etc. These methods are: Sales Method and, Interest Suspense Method. For details of these methods, refer Para 7.2 of the, chapter., , 4., , There are two methods of recording hire purchase transactions in the books, of the hire purchaser. The method for recording transactions is selected, according to accounting policy. These methods are: Cash Price Method and, Interest Suspense Method. For details of these methods, refer Para 7.1 of the, chapter., , 5., , Repossession is the Right of the Seller to take back the goods sold from the, Hire purchaser in case of any default by the Hire purchaser and can sell the, goods after reconditioning to any other person. For details, refer para 8 of, the chapter., , Practical Questions, Answer 1, (i), , Calculation of Interest and Cash Price, Ratio of interest and amount due = 8 / (100 + rate of interest) i.e. 8/108, To ascertain cash price, interest will be calculated from last instalment to first, instalment as follows:, No. of, instalments, , Amount due at the, time of instalment, , Interest, , Cumulative, Cash price, , [1], , [2], , [3], , (2-3) = [4], , 3rd, , 12,000, , 8/108 of ` 12,000, =` 889, , 11,111, , 2nd, , 23,111 [W.N.1], , 8/108 of ` 23,111, = ` 1,712, , 21,399, , 1st, , 33,399 [W.N.2], , 8/108 of ` 33,399, = ` 2,474, , 30,925, , 5,075, Total cash price = ` 30,925 + ` 12,000 (down payment) =` 42,925, © The Institute of Chartered Accountants of India

Page 46 :

11.46, , ACCOUNTING, , Working Notes:, 1., , ` 11,111+ 2nd instalment of ` 12,000= ` 23,111, , 2., , ` 21,399+ 1st instalment of ` 12,000= ` 33,399, , (ii), , Journal Entries in the books of M/s Kodam Enterprises, 1.4.20X1, 1., , `, Generator Account, , Dr. [Full cash price], , `, , 42,925, , To Sanctum Ltd., Account, , 42,925, , (Asset acquired on hire, purchase), 2., , H.P. Interest, Account, To, , Sanctum, Account, , (For, total, payment, due), 3., , Suspense Dr. [Total interest], , 5,075, , Ltd., , 5,075, , interest, , Sanctum Ltd. Account, , Dr., , 12,000, , To Bank Account, , 12,000, , (When down payment is, made), 31.3.20X2, 4., , Interest Account, , Dr., , 2,474, , To H.P. Interest, Suspense Account, , 2,474, , (For Interest of the year), 5., , Sanctum Ltd. Account, , Dr., , To Bank Account, (Being instalment paid), , © The Institute of Chartered Accountants of India, , 12,000, 12,000

Page 47 :

11.47, , HIRE PURCHASE AND INSTALLMENT SALE …, , 6., , Depreciation Account, , Dr. [Calculated on 4,292.50, cash price i.e. 10%, of ` 42,925], , To Generator Account, , 4,292.50, , (Being, depreciation, charged on the asset @, 10%), 7., , Profit and Loss Account, , Dr., , 6,766.50, , To Interest Account, , 4,292.50, , To Depreciation, Account, , 2,474.00, , (For closing interest and, depreciation account), Answer 2, (i), , Calculation of Interest and Cash Price, No. of, instalments, , Outstanding Amount due at Outstanding Interest Outstanding, balance at, the time of, balance at the, balance at, the end after, instalment, end before the, the, the payment, payment of, beginning, of instalment, instalment, , [1], , [2], , [3], , [4]= 2 +3, , [5]= 4 x, 10/110, , 3rd, , -, , 2,75,000, , 2,75,000, , 25,000, , 2,50,000, , 4,50,000, , 2,65,000, , 7,15,000, , 65,000, , 6,50,000, , 2, , nd, , 1, , st, , 2,50,000, , 2,45,000, , 4,95,000, , 45,000, , [6]= 4-5, , 4,50,000, , Total cash price = ` 6,50,000+ 5,00,000 (down payment) =` 11,50,000., (ii), , In the books of Lucky, Tractors Account, Date, , Particulars, , 1.10.20X1 To Happy a/c, , `, , Date, , Particulars, , 11,50,000 30.9.20X2 By Depreciation A/c, 11,50,000, , © The Institute of Chartered Accountants of India, , Balance c/d, , `, 2,30,000, 9,20,000, , 11,50,000

Page 48 :

11.48, , ACCOUNTING, , 1.10.20X2 To Balance b/d, , 1.10.20X3 To Balance b/d, , 9,20,000 30.9.20X3 By Depreciation A/c, , 1,84,000, , 9,20,000, , 9,20,000, , Balance c/d, , 7,36,000 30.9.20X4 By Depreciation A/c, , By Happy a/c (Value of 1, Tractor taken over after, depreciation for 3 years, @30%, p.a.), {5,75,000(1,72,500+1,20,750+84,525)}, By Loss transferred to Profit, and Loss a/c on surrender, (Bal. fig.) or (2,94,4001,97,225), By Balance c/d, ½ (7,36,000-1,47,200, = 5,88,800), , 7,36,000, , 7,36,000, 1,47,200, , 1,97,225, , 97,175, , 2,94,400, 7,36,000, , Happy Account, Date, , Particulars, , 1.10.X1 To Bank (down payment), To Bank (1 Instalment), st, , 30.9.X2 To Balance c/d, , `, , Date, , Particulars, , 5,00,000 1.10.X1 By Tractors a/c, 2,65,000 30.9.X2 By Interest a/c, 4,50,000, 12,15,000, , 30.9.X3 To Bank (2, , nd, , Instalment), , To Balance c/d, , 30.9.X4 To Tractor a/c, , To Balance c/d (b.f.), , 31.12.X4 To Bank (Amount settled, after 3 months), , `, 11,50,000, , 65,000, , 12,15,000, , 2,45,000 1.10.X2 By Balance b/d, , 4,50,000, , 4,95,000, , 4,95,000, , 1,97,225 1.10.X3 By Balance b/d, , 2,50,000, , 2,75,000, , 2,75,000, , 2,50,000 30.9.X3 By Interest a/c, , 77,775 30.9.X4 By Interest a/c, , 81,275 1.10.X4 By Balance b/d, , 31.12.X4 By Interest a/c, (@ 18% on bal.), , (77,775x3/12x18/, 100), , 81,275, , © The Institute of Chartered Accountants of India, , 45,000, , 25,000, 77,775, 3,500, , 81,275

Page 49 :

HIRE PURCHASE AND INSTALLMENT SALE …, , 11.49, , Answer 3, Tractor Account, Date, , 1.4.X1, , 1.4.X2, , 1.4.X3, , Particulars, , ` Date, , To Raj, , 11,50,000 31.3.X2, , To Balance b/d, , 11,50,000, 10,35,000 31.3.X3, , To balance b/d, , 10,35,000, 9,20,000 31.3.X4, , _______, , ________, , _______, 9,20,000, , Particulars, By Dep., , By Balance c/d, , `, 1,15,000, , 10,35,000, , By Dep., , 11,50,000, 1,15,000, , By Dep., , 10,35,000, 1,15,000, , By Balance c/d, , By Balance c/d, , 9,20,000, , 8,05,000, 9,20,000, , H.P. Interest Suspense Account, Date, , Particulars, , 1.4.X1, , To Raj Ltd. A/c, , 1.4.X2, , 1.4.X3, , To Balance b/d, , To Balance b/d, , `, , Date, , 1,44,000, , 31.3.X2, , 1,44,000, , 72,000, 72,000, 24,000, , 31.3.X2, 31.3.X3, 31.3.X3, 31.3.X4, , Particulars, By Interest A/c, By Balance c/d, , By Interest A/c, By Balance c/d, , By Interest A/c, , Total Interest = ` 72,000 + ` 48,000 + ` 24,000 = ` 1,44,000, , © The Institute of Chartered Accountants of India, , `, 72,000, 72,000, , 1,44,000, , 48,000, 24,000, 72,000, 24,000