Page 1 :

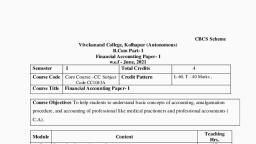

, , CHAPTER, , 1.1, , 1, , INTRODUCTION TO, ACCOUNTING, STANDARDS, LEARNING OUTCOMES, After studying this chapter, you will be able to–, , , Understand the concept of Accounting Standards;, , , , Grasp the objectives and benefits and limitations of Accounting, Standards;, , , , Learn the standards setting process;, , , , Familiarize with the status of Accounting Standards in India;, , , , Recognize the International Accounting Standard Authorities;, , , , Appreciate the emergence of International Financial Reporting, Standards as global standards;, , , , Differentiate between convergence vs. adoption;, , , , Know the process of convergence of IFRS in India;, , , , Understand the concept of Ind AS;, , , , Understand the objectives and concepts of carve outs/ins., , © The Institute of Chartered Accountants of India

Page 2 :

1.2, , ACCOUNTING, , Introduction,, objectives and, benefits of, Accounting, Standards, , Accounting, Standards setting, process, , List of Accounting, Standards, , Convergence to IFRS, in India, , International, Financial Reporting, Standards (IFRS), , Need for, convergence to, Global Standards, , Concept of Ind AS, , Carve Outs and Carve, Ins, , Roadmap for Ind AS, implementation, , 1. INTRODUCTION, Generally Accepted Accounting Principles, Generally accepted accounting principles (GAAP) refer to a common set of, accepted accounting principles, standards, and procedures that business reporting, entity must follow when it prepares and presents its financial statements., GAAP is a combination of authoritative standards (set by policy boards) and the, commonly accepted ways of recording and reporting accounting information. At, international level, such authoritative standards are known as International, Financial Reporting Standards (IFRS) at many places and in India we have, authoritative standards named as Accounting Standards (ASs) and Indian, Accounting Standard (Ind AS)., © The Institute of Chartered Accountants of India

Page 3 :

1.3, , INTRODUCTION TO ACCOUNTING STANDARDS, , Accounting Standards (ASs) are written policy documents issued by the, Government with the support of other regulatory bodies e.g., Ministry of Corporate, Affairs (MCA) issuing Accounting Standards for corporates in consultation with, National Financial Reporting Authority (NFRA) covering the following aspects of, accounting transaction or events in the financial statements:, •, , recognition;, , •, , measurement;, , •, , presentation; and, , •, , disclosure., , The ostensible purpose of the standard setting bodies is to promote the, dissemination of timely and useful financial information to investors and certain, other stakeholders, having an interest in the company's economic performance., Accounting Standards reduce the accounting alternatives in the preparation of, financial statements within the bounds of rationality, thereby, ensuring, comparability of financial statements of different enterprises., , Accounting Standards deal with the following aspects:, (i), , recognition of events and transactions in the financial statements;, , (ii), , measurement of these transactions and events;, , (iii), , presentation of these transactions and events in the financial statements in a, manner that is meaningful and understandable to the reader; and, , (iv), , the disclosures relating to these transactions and events to enable the public, at large and the stakeholders and the potential investors in particular, to get, an insight into what these financial statements are trying to reflect and, thereby facilitating them to take prudent and informed business decisions., , Accounting Standards deal with aspects of, accounting events, , Recognition of, events and, transactions, , Measurement of, transactions and, events, , Presentation of, transactions and, events, , © The Institute of Chartered Accountants of India, , Disclosure, requirements

Page 4 :

1.4, , ACCOUNTING, , The following are the benefits of Accounting Standards:, (i), Standardisation of alternative accounting treatments: Accounting, Standards reduce or eliminate, to a reasonable extent, any confusing variations in, the accounting treatment and presentation of economic events while preparing, financial statements., The standard policies are intended to reflect a consensus on accounting policies to, be used in different identified areas, e.g. inventory valuation, capitalisation of costs,, depreciation and amortisation, etc., Since it is not possible to prescribe a single set of policies for any specific, accounting area that would be appropriate for all enterprises, it is not enough to, comply with the standards and state that they have been followed., In other words, one must also disclose the accounting policies used in preparation, of financial statements. (Refer AS 1, Disclosure of Accounting Policies given in, Accounting Pronouncements)., For example, an enterprise should disclose which of the permitted cost formula (FIFO,, Weighted Average, etc.) has actually been used for ascertaining inventory costs., (ii) Requirements for additional disclosures: There are certain areas where, information is not statutorily required to be disclosed. However, accounting, standards may call for appropriate disclosures of accounting policies followed and, other required information in the financial statements which would be helpful for, readers to understand the accounting treatment done for various items in those, financial statements., (iii) Comparability of financial statements: In addition to improving, credibility of accounting data, standardisation of accounting procedures, improves comparability of financial statements, both intra-enterprise and, inter-enterprise. Such comparisons are very effective and most widely used tools, for assessment of enterprise’s financial health and performance by users of financial, statements for taking economic decisions, e.g., whether or not to invest, whether, or not to lend and so on., The intra-enterprise comparison involves comparison of financial statements, of same enterprise over a number of years. The intra-enterprise comparison is, possible if the enterprise uses same accounting policies every year in drawing up, its financial statements., , © The Institute of Chartered Accountants of India

Page 5 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.5, , The inter-enterprise comparison involves comparison of financial statements, of different enterprises for same accounting period. This is possible only when, comparable enterprises use similar accounting policies in preparation of respective, financial statements (or in case the policies are slightly different, the same are, disclosed in the financial statements). The disclosure of accounting policies allows, a user to make appropriate adjustments while comparing the financial statements, of comparable enterprises., Standardisation, of alternative, accounting, treatments, , Benefits of, Accounting, Standards, Comparability, of financial, statements, , Requirements, for additional, disclosures, , Since Accounting Standards are principle based, application of Accounting, Standards becomes judgemental in case of complex business transactions., Accounting Standards have to be read in line with the legal requirements, i.e., in, case of any conflict, Statute would prevail over Accounting Standards., Another advantage of standardisation is reduction of scope for creative accounting., The creative accounting refers to twisting of accounting policies to produce financial, statements favourable to a particular interest group. For example, it is possible to, overstate profits and assets by capitalising revenue expenditure or to understate them, by writing off a capital expenditure against revenue of current accounting period. Such, practices can be curbed only by framing policies for capitalisation, particularly for the, borderline cases where it is possible to have divergent views. The accounting standards, provide adequate guidance in this regard., , © The Institute of Chartered Accountants of India

Page 6 :

1.6, , ACCOUNTING, , 2. STANDARDS SETTING PROCESS, The Institute of Chartered Accountants of India (ICAI), being a premier accounting, body in the country, took upon itself the leadership role by constituting the, Accounting Standards Board (ASB) in 1977. The ICAI has taken significant initiatives, for the issuance of Accounting Standards to ensure that the standard-setting, process is fully consultative and transparent. The ASB considered the International, Accounting Standards (IASs)/International Financial Reporting Standards (IFRSs), while framing Accounting Standards (ASs) in India and tried to integrate them, in, the light of the applicable laws, customs, usages and business environment in the, country. The composition of ASB includes representatives of industries,, associations of industries (namely, ASSOCHAM, CII, FICCI), regulators,, academicians, government departments, etc. Although ASB is a body constituted, by the Council of the ICAI, it (ASB) is independent in the formulation of accounting, standards. NFRA recommend these standards to the MCA. MCA has to spell out the, accounting standards applicable for companies in India., The standard-setting procedure of ASB can be briefly outlined as follows:, ♦, , Identification of broad areas by ASB for formulation of AS., , ♦, , Constitution of study groups by ASB to consider specific projects and to, prepare preliminary drafts of the proposed accounting standards. The draft, normally includes objective and scope of the standard, definitions of the, terms used in the standard, recognition and measurement principles, wherever applicable and presentation and disclosure requirements., , ♦, , Consideration of the preliminary draft prepared by the study group of ASB, and revision, if any, of the draft on the basis of deliberations., , ♦, , Circulation of draft of accounting standard (after revision by ASB) to the Council, members of the ICAI and specified outside bodies such as MCA, Securities and, Exchange Board of India (SEBI), Comptroller and Auditor General of India, (C&AG), Central Board of Direct Taxes (CBDT), Standing Conference of Public, Enterprises (SCOPE), etc. for comments., , ♦, , Meeting with the representatives of the specified outside bodies to ascertain, their views on the draft of the proposed accounting standard., , ♦, , Finalisation of the exposure draft of the proposed accounting standard and, its issuance inviting public comments., , ♦, , Consideration of comments received on the exposure draft and finalisation, , © The Institute of Chartered Accountants of India

Page 7 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.7, , of the draft accounting standard by the ASB for submission to the Council of, the ICAI for its consideration and approval for issuance., ♦, , Consideration of the final draft of the proposed standard by the Council of, the ICAI and if found necessary, modification of the draft in consultation with, the ASB is done., , ♦, , The accounting standard on the relevant subject (for non-corporate entities), is then issued by the ICAI. For corporate entities the accounting standards are, issued by the Ministry of Corporate Affairs in consultation with the NFRA., Standard – Setting Process, Identification of area, Constitution of study group, Preparation of draft and its circulation, Ascertainment of views of different bodies on, draft, Finalisation of exposure draft (E.D.), Comments received on exposure draft (E.D.), Modification of the draft, Issue of AS, , Earlier, ASB used to issue Accounting Standard Interpretations (ASIs) which address, questions that arise in course of application of standard. These were, therefore,, issued after issuance of the relevant standard. Authority of the ASIs was same as, that of the AS to which it relates., However, after notification of Accounting Standards by the Central Government for, the companies, where the consensus portion of ASI was merged as ‘Explanation’ to, , © The Institute of Chartered Accountants of India

Page 8 :

1.8, , ACCOUNTING, , the relevant paragraph of the Accounting Standard, the Council of ICAI also, decided to merge the consensus portion of ASI as ‘Explanation’ to the relevant, paragraph of the AS issued by them. This initiative was taken by the Council of the, ICAI to harmonise both the set of standards, i.e., ASs issued by the ICAI for noncorporates and ASs notified by the MCA for corporates., It may be noted that as per Section 133 of the Companies Act, 2013, the Central, Government may prescribe the standards of accounting or any addendum thereto,, as recommended by the ICAI, constituted under section 3 of the Chartered, Accountants Act, 1949, in consultation with and after examination of the, recommendations made by NFRA., , 3. HOW MANY ACCOUNTING STANDARDS?, The Institute of Chartered Accountants of India has, so far, issued 29 Accounting, Standards. However, AS 6 on ‘Depreciation Accounting’ has been withdrawn on, revision of AS 10 ‘Property, Plant and Equipment ∗’ and AS 8 on ‘Accounting for, Research and Development’ has been withdrawn consequent to the issuance of AS, 26 on ‘Intangible Assets’., Thus effectively, there are 27 Accounting Standards at present. The ‘Accounting, Standards’ issued by the Accounting Standards Board establish standards which, have to be complied by the business entities so that the financial statements are, prepared in accordance with GAAP., In recent times there are various improvements/developments in the global, accounting standards which have taken place. In India, Ind AS have become, mandatory for certain class of companies as per the MCA roadmap. AS being the, guidelines to prepare financial statements, have to keep pace with these changes, in global accounting scenarios. Number of fundamental changes have been made, in these AS so as to be globally aligned as far as possible., MCA vide notification date 30th March 2016 announced Companies (Accounting, Standards) Amendment Rules, 2016. Various ASs i.e. AS 2, AS 4, AS 10, AS 13, AS, 14, AS 21, AS 29 were revised vide this notification to make them in line with, corresponding Ind AS to the extent possible., , ∗, , Earlier AS 10 was on ‘Accounting for Fixed Assets’., , © The Institute of Chartered Accountants of India

Page 9 :

1.9, , INTRODUCTION TO ACCOUNTING STANDARDS, , The following is the list of Accounting Standards with their respective date of, applicability:, AS, No., , AS Title, , Date of, applicability, , 1, , Disclosure of Accounting Policies, , 01/04/1993, , 2, , Valuation of Inventories (Revised), , 01/04/1999, , 3, , Cash Flow Statement, , 01/04/2001, , 4, , Contingencies and Events Occurring after the Balance, Sheet Date (Revised), , 01/04/1998, , 5, , Net Profit or Loss for the Period, Prior Period Items and, Changes in Accounting Policies, , 01/04/1996, , 7, , Construction Contracts, , 01/04/2002, , 9, , Revenue Recognition, , 01/04/1993, , 10, , Property, Plant and Equipment (Revised), , 01/04/2016, , 11, , The Effects of Changes in Foreign Exchange Rates, (Revised), , 01/04/2004, , 12, , Accounting for Government Grants, , 01/04/1994, , 13, , Accounting for Investments (Revised), , 01/04/1995, , 14, , Accounting for Amalgamations (Revised), , 01/04/1995, , 15, , Employee Benefits, , 01/04/2006, , 16, , Borrowing Costs, , 01/04/2000, , 17, , Segment Reporting, , 01/04/2001, , 18, , Related Party Disclosures, , 01/04/2001, , 19, , Leases, , 01/04/2001, , 20, , Earnings Per Share, , 01/04/2001, , 21, , Consolidated Financial Statements (Revised), , 01/04/2001, , 22, , Accounting for Taxes on Income, , 01/04/2006, , 23, , Accounting for Investments in, Consolidated Financial Statements, , © The Institute of Chartered Accountants of India, , Associates, , in, , 01/04/2002

Page 10 :

1.10, , ACCOUNTING, , 24, , Discontinuing Operations, , 01/04/2004, , 25, , Interim Financial Reporting, , 01/04/2002, , 26, , Intangible Assets, , 01/04/2003, , 27, , Financial Reporting of Interests in Joint Ventures, , 01/04/2002, , 28, , Impairment of Assets, , 01/04/2008, , 29, , Provisions, Contingent Liabilities and Contingent Assets, (Revised), , 01/04/2004, , NOTE: AS 1; AS 2 (Revised); AS 3; AS 10 (Revised); AS 11(Revised); AS 12;, AS 13 (Revised); AS 16 are covered in the syllabus of this paper at, Intermediate Level., , 4., , STATUS OF ACCOUNTING STANDARDS, , It has already been mentioned that the ASs are developed by the ASB of the ICAI., The Institute not being a legislative body can enforce compliance with its standards, only by its members. Also, the standards cannot override laws and local regulations., The ASs are nevertheless made mandatory from the dates specified in respective, standards and are generally applicable to all enterprises, subject to certain, exceptions. The implication of mandatory status of an AS depends on whether the, statute governing the enterprise concerned requires compliance with the ASs. The, Companies Act had earlier notified 28 ASs and mandated the corporate entities to, comply with the provisions stated therein. However, in 2016 the MCA withdrew AS, 6. Hence there are now only 27 notified ASs as per the Companies (Accounting, Standards) Rules, 2006 (as amended in 2016)., , 5., , NEED, FOR, CONVERGENCE, GLOBAL STANDARDS, , TOWARDS, , The last decade has witnessed a sea change in the global economic scenario. The, emergence of trans-national corporations in search of money, not only for, fuelling growth, but to sustain on-going activities has necessitated raising of, capital from all parts of the world, cutting across frontiers., , © The Institute of Chartered Accountants of India

Page 11 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.11, , Each country has its own set of rules and regulations for accounting and financial, reporting. Therefore, when an enterprise decides to raise capital from the markets, , other than the country in which it is located, the rules and regulations of that, other country will apply and this in turn will require that the enterprise is in a, position to understand the differences between the rules governing financial, reporting in the foreign country as compared to its own country of origin., Therefore, translation and reinstatements are of utmost importance in a world, , that is rapidly globalising in all ways. Further, the ASs and principles need to be, , robust so that the larger society develops degree of confidence in the financial, statements, which are put forward by organisations., , International analysts and investors would like to compare financial statements, based on similar ASs, and this has led to the growing need for an internationally, , accepted set of ASs for cross-border filings. The harmonization of financial, reporting around the world will help to raise confidence of investors, generally,, in the information they are using to make their decisions and assess their risks., , Also, a strong need was felt by legislation to bring about uniformity,, rationalisation,, , comparability,, , transparency, , and, , adaptability, , in, , financial, , statements. Having a multiplicity of types of ASs around the world is against the, public interest. If accounting for the same events and information produces, , different reported numbers, depending on the system of standards that are being, , used, then it is self-evident that accounting will be increasingly discredited in the, , eyes of those using the numbers. It creates confusion, encourages error and may, , facilitate fraud. The cure for these ills is to have a single set of global standards,, of the highest quality, set in the interest of public. Global Standards facilitate cross, , border flow of money, global listing in different stock markets and comparability, of financial statements., , The convergence of financial reporting and ASs is a valuable process that, contributes to the free flow of global investment and achieves substantial benefits, , for all capital market stakeholders. It improves the ability of investors to compare, investments on a global basis and, thus, lower their risk of errors of judgment. It, , facilitates accounting and reporting for companies with global operations and, eliminates some costly requirements like reinstatement of financial statements. It, © The Institute of Chartered Accountants of India

Page 12 :

1.12, , ACCOUNTING, , has the potential to create a new standard of accountability and greater, , transparency provides value to all market participants including regulators. It, reduces operational challenges for accounting firms and focuses their values and, expertise around an increasingly unified set of standards. It creates an, , unprecedented opportunity for standard setters and other stakeholders to, improve the reporting model. For the companies with joint listings in both, , domestic and foreign country, the convergence is very much significant., , 6. INTERNATIONAL, BOARD (IASB), , ACCOUNTING, , STANDARD, , With a view of achieving the objective of setting global standards, the London, based group namely the International Accounting Standards Committee (IASC),, responsible for developing International Accounting Standards (IAS), was, established in June, 1973. It is presently known as International Accounting, Standards Board (IASB), The IASC comprises the professional accountancy bodies, of over 75 countries (including the ICAI). Primarily, the IASC was established, in the, public interest, to formulate and publish, IASs to be followed in the preparation, and presentation of financial statements. IASs were issued to promote acceptance, and observance of IASs worldwide. The members of IASC undertook a responsibility, to support the standards developed by IASC and to propagate those standards in, their respective countries., Between 1973 and 2001, the IASC released IASs. Between 1997 and 1999, the IASC, restructured their organisation, which resulted in formation of IASB. These changes, came into effect on 1st April, 2001. Subsequently, IASB issued statements about, current and future standards. IASB publishes its Standards in a series of, pronouncements called International Financial Reporting Standards (IFRS)., However, IASB has not rejected the standards issued by the IASC. Those, pronouncements continue to be designated as “International Accounting, Standards” (IAS)., The standards issued by IASC till 31.03.2001 are known as IASs and the standards, issued by IASB since 01.04.2001 are known as IFRSs., , © The Institute of Chartered Accountants of India

Page 13 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.13, , 7. INTERNATIONAL, FINANCIAL REPORTING, STANDARDS (IFRS) AS GLOBAL STANDARDS, IFRS issued, by IASB, , IAS issued by, IASC and, adopted by, IASB, , IFRS, , Interpretations, on IAS/IFRS, issued by IFRS, Interpretation, Commitee, , Interpretation, on IAS issued, by SIC, , The term International Financial Reporting Standards (IFRS) comprises IFRS issued, by IASB; IAS issued by IASC; Interpretations issued by the Standard Interpretations, Committee (SIC) and the IFRS Interpretations Committee of the IASB., IFRSs are considered as a "principles-based" set of standards. In fact, they establish, broad rules rather than dictating specific treatments. Every major nation is moving, toward adopting them to some extent. Large number of authorities permits public, companies to use IFRS for stock-exchange listing purposes, and in addition, banks,, insurance companies and stock exchanges may use them for their statutorily, required reports. So, over the next few years, number of companies will adopt the, international standards. This requirement will affect thousands of enterprises,, including their subsidiaries, equity investors and joint venture partners. The, increased use of IFRS is not limited to public-companies listing requirements or, statutory reporting. Many lenders and regulatory and government bodies are, looking to IFRS to fulfil local financial reporting obligations related to financing or, licensing., © The Institute of Chartered Accountants of India

Page 14 :

1.14, , ACCOUNTING, , 8. BECOMING IFRS COMPLIANT, Any country can become IFRS compliant either by adoption process or by, convergence process. Adoption would mean that the country sets a specific, timetable when specific entities would be required to use IFRS as issued by the, IASB. Convergence means that the country will develop high quality, compatible, accounting standards and there would be alignment of the standards of different, standard setters with a certain rate of compromise, by adopting the requirements of, the standards either fully or partially. Ind AS are almost similar to IFRS but with few, carve outs so as to make them suitable for Indian Environment., Convergence with IFRS will result in following benefits:, , , , , , Improves investor confidence across the world with transparency and, comparability, Improves inter-unit/ inter-firm/inter-industry comparison, Group consolidation will be easy with same standard by all companies in group, irrespective of their global location., Acceptability of financial statements by stock exchanges across the globe, which, will facilitate listing of Indian companies to international stock exchanges., , Cross border, flow of money, Listing of, companies at, global stock, exchange, , Helps investors, in decision, making, , Becoming IFRS, compliant, Comparability, of financial, statements, , Low risk of, error, Greater, transparency, , © The Institute of Chartered Accountants of India

Page 15 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.15, , 9. WHAT ARE CARVE OUTS/INS IN IND AS?, The Government of India in consultation with the ICAI decided to converge and not, to adopt IFRS issued by the IASB. The decision of convergence rather than adoption, , was taken after the detailed analysis of IFRS requirements and extensive discussion, with various stakeholders., , Accordingly, while formulating Ind AS, efforts have been made to keep these, , Standards, as far as possible, in line with the corresponding IAS/IFRS and, , departures have been made where considered absolutely essential. These changes, , have been made considering various factors, such as, , , , Various terminology related changes have been made to make it consistent, with the terminology used in law, e.g., ‘statement of profit and loss’ in place, of ‘statement of comprehensive income’ and ‘balance sheet’ in place of, ‘statement of financial position’., , , , Removal of options in accounting principles and practices in Ind AS vis-a-vis, , IFRS, have been made to maintain consistency and comparability of the, , financial statements to be prepared by following Ind AS. However, these, changes will not result into carve outs., , , , Certain changes have been made considering the economic environment of, , the country, which is different as compared to the economic environment, presumed to be in existence by IFRS. These differences are due to differences, , in economic conditions prevailing in India. These differences which are in, , deviation to the accounting principles and practices stated in IFRS, are, commonly known as ‘Carve-outs’., , Additional guidance given in Ind AS over and above what is given in IFRS, is termed, as ‘Carve in’., , © The Institute of Chartered Accountants of India

Page 16 :

1.16, , ACCOUNTING, , Formulation of Ind AS, , Departures, , Resulting into Carve-outs, , not resulting into carve-outs, , Deviation from the, accounting principles stated, in IFRS, , Removal of options in accounting, principles and practices in Ind AS visa-vis IFRS, , 10. CONVERGENCE TO IFRS IN INDIA, In the scenario of globalisation, India cannot isolate itself from the accounting, developments taking place worldwide. In India, so far as the ICAI, NFRA and various, regulators such as SEBI and Reserve Bank of India (RBI) are concerned, the aim is, to comply with the IFRS to the extent possible with the objective to formulate sound, financial reporting standards for the purpose of preparing globally accepted, financial statements. The ICAI, being a member of the International Federation of, Accountants (IFAC), considered the IFRS and tried to integrate them, to the extent, possible, in the light of the laws, customs, practices and business environment, prevailing in India., Due to the recent stream of overseas acquisitions by Indian companies, there is, need for adoption of high quality standards to convince foreign enterprises about, the financial standing as also the disclosure and governance standards of Indian, acquirers., In India, the ICAI has worked towards convergence of global accounting standards, by considering the application of IFRS in Indian corporate environment., Recognising the growing need of full convergence of Ind AS with IFRS, ICAI, constituted a Task Force to examine various issues involved., Full convergence involves adoption of IFRS in the same form as that issued by the, IASB., , © The Institute of Chartered Accountants of India

Page 17 :

1.17, , INTRODUCTION TO ACCOUNTING STANDARDS, , For convergence of Ind AS with IFRS, the ASB in consultation with the MCA, decided, that there will be two separate sets of accounting standards viz. (i) Ind AS, converged with the IFRS – standards which are being converged by eliminating the, differences of the Ind AS vis-à-vis IFRS and (ii) Existing notified AS., , ICAI, , convergence, to IFRS;, , not adoption, , Application, of IFRS in, India, considering, legal and, other, conditions, prevailing, in India, , Deviation from, corresponding, IFRS, if required, , Decision to, have two, set of, Accounting, standards, , Indian Accounting Standards (Ind AS), , Existing Accounting Standards (ASs), , 11. WHAT, ARE, INDIAN, STANDARDS (IND AS)?, , ACCOUNTING, , Ind AS are IFRS converged standards issued by the Central Government of India, under the supervision and control of ASB of ICAI and in consultation with NFRA., NFRA recommends these standards to the MCA. MCA has to spell out the, accounting standards applicable for companies in India., Ind AS are named and numbered in the same way as the corresponding IAS., However, for Ind AS corresponding to IFRS, one need to add 100 to the IFRS, number e g. for IFRS 1 corresponding Ind AS number is 101., , Indian Accounting Standards, Globalization and, Libreralization, , Transparency of, financial, statements, , © The Institute of Chartered Accountants of India, , Comparability of, financial, statements, , Enhanced, Disclosure, requirements

Page 18 :

1.18, , ACCOUNTING, , 12. HISTORY, OF, IFRS-CONVERGED, ACCOUNTING STANDARDS (IND AS), , INDIAN, , First Step towards IFRS, The ICAI being the accounting standards-setting body in India, way back in 2006,, initiated the process of moving towards the IFRS issued by the IASB with a view to, enhance acceptability and transparency of the financial information communicated, by the Indian corporates through their financial statements. This move towards IFRS, was subsequently accepted by the Government of India., , Government of India - Commitment to IFRS Converged Ind AS, As per the original roadmap for implementation of IFRS-converged Ind AS issued, by the Government of India, initially Ind AS were expected to be implemented from, the year 2011. However, keeping in view the fact that certain issues including tax, issues were still to be addressed, the Ministry of Corporate Affairs decided to, postpone the date of implementation of Ind AS. In 2014, the then Hon'ble Union, Finance Minister of India, Late Shri Arun Jaitely, in his Budget Speech in July 2014, stated that – “There is an urgent need to converge the current Indian accounting, standards with the International Financial Reporting Standards (IFRS). I propose for, adoption of the new Indian Accounting Standards (Ind AS) by the Indian companies, from the financial year 2015-16 voluntarily and from the financial year 2016-17 on, a mandatory basis. Based on the international consensus, the regulators will, separately notify the date of implementation of Ind AS for the Banks, Insurance, companies etc. Standards for the computation of tax would be notified separately”., Pursuant to the above announcement, various steps were taken to facilitate the, implementation of IFRS-converged Indian Accounting Standards (Ind AS). Moving, in this direction, the Ministry of Corporate Affairs (MCA) has issued the Companies, (Indian Accounting Standards) Rules, 2015 vide Notification dated February 16,, 2015 including the revised roadmap of implementation of Ind AS for companies, other than Banking companies, Insurance Companies and NBFCs. As per the, Notification, Ind AS converged with IFRS shall be implemented on voluntary basis, from 1st April, 2015 and mandatorily from 1st April, 2016. Further, the MCA on, March 30, 2016, had also notified the Roadmap for implementation of Ind AS for, Scheduled Commercial Banks, Insurance companies and NBFCs from 1st April, 2018, onwards and also amendments to Ind AS in line with the amendments made in, IFRS/IAS vide Companies (Indian Accounting Standards) Amendment Rules, 2016., © The Institute of Chartered Accountants of India

Page 19 :

1.19, , INTRODUCTION TO ACCOUNTING STANDARDS, , However, IRDAI vide press release dated June 28, 2017 had deferred the, implementation of Ind AS for the Insurance Sector in India for a period of two years,, whereby the effective date was deferred to FY 2020-21. Thereafter, vide circular, dated January 21, 2020, IRDAI has deferred Implementation of Ind AS in the, Insurance Sector till further notice. Additionally, the insurance companies are no, longer required to submit proforma Ind AS financial statements to IRDAI on, quarterly basis as was required earlier. The Reserve Bank of India vide its circular, dated April 05, 2018 had deferred the implementation of Ind AS for Schedule, Commercial Banks (SCBs), excluding Regional Rural Banks (RRBs) by one year i.e.,, to be made effective from 1st April, 2019 onwards. However, vide circular dated, 22nd March, 2019, the implementation of Ind AS for Scheduled Commercial Banks, (SCBs) has been further deferred until further notice by the Reserve Bank of India., One of the most significant steps in moving towards to Ind AS taken by the ICAI, was to provide a stable platform to the Indian entities for smoother and for effective, implementation of Ind AS it has been decided to converge early by notifying Ind, AS corresponding to IFRS 9, Financial Instruments (effective from January 01, 2018), issued by the IASB. The ICAI continues with its march towards continuous, convergence with IFRS Standards at all times and closely monitors the amendments, in IFRS Standards with timely incorporation of those changes in Ind ASs The IASB, issued IFRS 15 Revenue from Contracts with Customers with effect from January 01,, 2018 and IFRS 16 Leases with effect from January 01, 2019. Consequently to keep, in pace with the global standards, ICAI formulated Ind AS 115 Revenue from, Contracts with Customers which was notified by MCA in March, 2018 effective for, F.Y. 2018-19 onwards and Ind AS 116 Leases, which was notified by MCA in March,, 2019 for F.Y. 2019-20 onwards., , 13. LIST OF IND AS, The following is the list of Ind AS vis-a-vis IFRS and AS:, Ind AS, , IAS/ IFRS Title of Ind AS/IFRS, , 101, , IFRS 1, , First Time Adoption of, Indian, Accounting, Standards, , 102, , IFRS 2, , Share Based Payment, , © The Institute of Chartered Accountants of India, , AS/GN, -, , GN, , AS/GN Title, -, , Guidance Note, Accounting, , on, for

Page 20 :

1.20, , ACCOUNTING, , Ind AS, , IAS/ IFRS Title of Ind AS/IFRS, , 103, , IFRS 3, , Business Combinations, , 104, , IFRS 4, , Insurance Contracts, , 105, , IFRS 5, , Non-current, Assets, Held for Sale and, Discontinued, Operations, , AS 24, , Discontinuing, Operations, , 106, , IFRS 6, , Exploration for and, Evaluation of Mineral, Resources, , GN 15, , Guidance Note on, Accounting for Oil and, Gas, Producing, Activities, , 107, , IFRS 7, , Financial Instruments:, Disclosures, , -, , 108, , IFRS 8, , Operating Segments, , AS 17, , 109, , IFRS 9, , Financial Instruments, , -, , 110, , IFRS 10, , Consolidated Financial, Statements, , AS 21, , Consolidated Financial, Statements, , 111, , IFRS 11, , Joint Arrangements, , AS 27, , Financial Reporting of, Interests, in, Joint, Ventures, , 112, , IFRS 12, , Disclosure of Interests, in Other Entities, , -, , -, , 113, , IFRS 13, , Fair, Measurement, , -, , -, , 114, , IFRS 14, , Regulatory, Accounts, , Deferral, , GN, , Accounting for Rate, Regulated Activities, , 115, , IFRS 15, , Revenue, contracts, customers, , from, with, , AS 7, AS 9, , Construction Contract, Revenue Recognition, , 116, , IFRS 16, , Leases, , AS 19, , Leases, , Value, , © The Institute of Chartered Accountants of India, , AS/GN, , AS 14, -, , AS/GN Title, , Employee Share-based, Payments, Accounting, Amalgamations, , for, , -, , Segment Reporting, -

Page 21 :

INTRODUCTION TO ACCOUNTING STANDARDS, , Ind AS, , IAS/ IFRS Title of Ind AS/IFRS, , 117, is under, formulat, ion, , IFRS 17, Insurance Contracts, (It, will, replace, IFRS 4), , 1, , IAS 1, , Presentation, of, Financial Statements, , AS 1, , Disclosure, of, Accounting Policies, , 2, , IAS 2, , Inventories, , AS 2, , Valuation, Inventories, , 7, , IAS 7, , Statement, Flows, , Cash, , AS 3, , Cash Flow Statements, , 8, , IAS 8, , Accounting, Policies,, Changes in Accounting, Estimates and Errors, , AS 5, , Net Profit or Loss for, the Period, Prior period, Items and Changes in, Accounting Policies, , 10, , IAS 10, , Events, after, Reporting Period, , AS 4, , Contingencies, and, Events Occurring After, the Balance Sheet date, , 12, , IAS 12, , Income Taxes, , AS 22, , Accounting for Taxes, on Income, , 16, , IAS 16, , Property, Plant, Equipment, , AS 10, , Property, Plant, Equipment, , 19, , IAS 19, , Employee Benefits, , AS 15, , Employee Benefits, , 20, , IAS 20, , Accounting, for, Government, Grants, and, Disclosure, of, Government Assistance, , AS 12, , Accounting, for, Government Grants, , 21, , IAS 21, , The Effects of Changes, in Foreign Exchange, Rates, , AS 11, , The Effects of Changes, in Foreign Exchange, Rates, , 23, , IAS 23, , Borrowing Costs, , AS 16, , Borrowing Costs, , 24, , IAS 24, , Related, Disclosures, , AS 18, , Related, Disclosures, , of, , the, , and, , Party, , © The Institute of Chartered Accountants of India, , AS/GN, , 1.21, , AS/GN Title, , of, , and, , Party

Page 22 :

1.22, , ACCOUNTING, , Ind AS, , IAS/ IFRS Title of Ind AS/IFRS, IAS 27, , Separate, Statements, , 28, , IAS 28, , Investment, in, Associates and Joint, Ventures, , AS 23, , 29, , IAS 29, , Financial Reporting in, Hyperinflationary, Economies, , -, , -, , 32, , IAS 32, , Financial Instruments:, Presentation, , -, , -, , 33, , IAS 33, , Earnings per Share, , AS 20, , Earnings per Share, , 34, , IAS 34, , Interim, Reporting, , AS 25, , Interim, Reporting, , 36, , IAS 36, , Impairment of Assets, , AS 28, , Impairment of Assets, , 37, , IAS 37, , Provisions, Contingent, Liabilities, and, Contingent Assets, , AS 29, , Provisions, Contingent, Liabilities, and, Contingent Assets, , 38, , IAS 38, , Intangible Assets, , AS 26, , Intangible Assets, , 40, , IAS 40, , Investment Property, , AS 13, , Accounting, Investments, , 41, , IAS 41, , Agriculture, , 27, , Financial, , Financial, , AS/GN, -, , -, , AS/GN Title, -, , Accounting, for, Investment, in, Associates, in, Consolidated Financial, Statements, , Financial, , for, , -, , 14. ROADMAP FOR IMPLEMENTATION OF INDIAN, ACCOUNTING STANDARDS (IND AS): A, SNAPSHOT, For Companies other than Banks, NBFCs and Insurance Companies, Phase I: 1st April 2015 or thereafter (with Comparatives): Voluntary Basis for any, company (other than Banks, NBFCs and Insurance companies) and its holding,, subsidiary, Joint venture (JV) or Associate Company., © The Institute of Chartered Accountants of India

Page 23 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.23, , 1st April 2016: Mandatory Basis, (a), , Companies listed/in process of listing on Stock Exchanges in India or Outside, India having net worth of INR 500 crore or more;, , (b), , Unlisted Companies having net worth of INR 500 crore or more;, , (c), , Parent, Subsidiary, Associate and JV of above., , Phase II: 1st April 2017: Mandatory Basis, (a) All companies which are listed/or in process of listing on Stock Exchanges in, India or outside India not covered in Phase I (other than companies listed on SME, Exchanges);, (b) Unlisted companies having net worth of INR 250 crore or more but less than, INR 500 crore;, (c) Parent, Subsidiary, Associate and JV of above., , Special Points to Consider:•, , Companies listed on SME exchange are not required to apply Ind AS. Such, companies shall continue to apply existing ASs unless they choose otherwise., , •, , Once Ind AS are applicable, an entity shall be required to follow the Ind AS, for all the subsequent financial statements i.e. there is no looking back once, the Ind AS are adopted by companies., , •, , Companies not covered by the above roadmap shall continue to apply, Accounting Standards notified in Companies (Accounting Standards) Rules,, 2006., , For Scheduled Commercial Banks (Excluding RRBs), Insurers/Insurance, Companies and Non-Banking Financial Companies (NBFCs), Non-Banking Financial Companies (NBFCs), Phase I:, , From 1st April, 2018 (with comparatives), •, , NBFCs (whether listed or unlisted) having net worth INR 500, crores or more, , •, , Holding, Subsidiary, JV and Associate companies of above, NBFC other than those already covered under corporate, roadmap shall also apply from said date, , © The Institute of Chartered Accountants of India

Page 24 :

1.24, , Phase II:, , ACCOUNTING, , From 1st April, 2019 (with comparatives), •, , NBFCs whose equity and/or debt securities are listed or are in, the process of listing on any stock exchange in India or outside, India and having net worth less than INR 500 crores, , •, , NBFCs that are unlisted having net worth INR 250 crores or, more but less than INR 500 crores, , •, , Holding, Subsidiary, JV and Associate companies of above, companies other than those already covered under corporate, roadmap shall also apply Ind AS from the said date., , , , Applicable to both Consolidated and Individual Financial Statements, , , , NBFC having net worth below INR 250 crores and not covered under the, above provisions shall continue to apply ASs specified in Annexure to, Companies (Accounting Standards) Rules, 2006., , , , Adoption of Ind AS is allowed only when required as per the roadmap., , , , Voluntary adoption of Ind AS is not allowed., , Scheduled Commercial banks (excluding RRBs), , , Scheduled Commercial Banks (SCBs) excluding Regional Rural Banks, (RRBs) were initially required to implement Ind AS from 1 April 2018., However, RBI (Reserve Bank of India) vide a press release dated 5 April, 2018, deferred the implementation of Ind AS by one year i.e. to be, effective from 1 April 2019 instead of 1 April 2018., , , , Further, the RBI through a notification dated 22 March 2019, deferred, the Ind AS implementation till further notice. This was because the, amendments recommended by the RBI are still under consideration of, the Government of India, therefore, RBI took a decision to defer the, applicability of Ind AS till further notice., , , , Urban Cooperative banks (UCBs) and Regional Rural banks (RRBs) are not, required to apply Ind AS., , Insurers/Insurance companies, , , MCA had outlined the road map for implementation of Ind AS by, insurers/insurance companies from 1 April 2018., , © The Institute of Chartered Accountants of India

Page 25 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.25, , , , IRDAI (Insurance Regulatory and Development Authority of India), deferred the implementation of Ind AS in the insurance sector in India, for a period of two years whereby the effective date was deferred to 1, April 2020. However, insurance companies were required to submit, proforma Ind AS financial statements to IRDAI on a quarterly basis, effective 31 December 2016 (vide circular dated 28 June 2017)., , , , Further, IRDAI in its meeting held on 20 December 2019 decided to, implement Ind AS 109, Financial Instruments and Ind AS 117, simultaneously, along with other applicable Ind AS. In India, Ind AS 117, (converged with IFRS 17) is still at an exposure draft stage and will be, updated based on the amendments made to IFRS 17. Once Ind AS 117 is, notified in India by MCA, IRDAI would be in a position to notify the, regulation on preparation of Ind AS compliant financial statements and, modify other regulations that may be impacted due to the, implementation of Ind AS 117., , , , Therefore, the effective date of implementation of Ind AS for insurance, companies is not yet finalized and it would be finalized after the, finalisation of IFRS 17 by IASB., , , , IRDAI, vide circular dated 21 January 2020, has deferred implementation, of Ind AS in the insurance sector till further notice. The circular dated 28, June 2017 was also withdrawn by IRDAI along with the requirement of, proforma Ind AS financial statements being submitted on a quarterly, basis as directed in that circular., , SUMMARY, The accounting standards aim at improving the quality of financial reporting by, promoting comparability, consistency and transparency, in the interests of users, of financial statements. The ICAI has, so far, issued 29 ASs. However, AS 6 on, ‘Depreciation Accounting’ was withdrawn on revision of AS 10 ‘Property, Plant, and Equipment and AS 8 on ‘Accounting for Research and Development’ has been, withdrawn consequent to the issuance of AS 26 on ‘Intangible Assets’. Thus, there, are 27 ASs at present., In the scenario of globalisation, India cannot isolate itself from the developments, taking place worldwide. In India, so far as the ICAI and the Government authorities, and various regulators such as SEBI and RBI are concerned, the aim has always, © The Institute of Chartered Accountants of India

Page 26 :

1.26, , ACCOUNTING, , been to comply with the IFRS to the extent possible with the objective of, formulating sound financial reporting standards., Ind AS are IFRS converged standards issued by the Central Government of India, under the supervision and control of ASB of ICAI and in consultation with NFRA., As per the MCA Notification dated 16 th February 2015, Ind AS converged with, IFRS shall be implemented on voluntary basis from 1st April, 2015 and, mandatorily from 1st April, 2016., Separate roadmaps have been prescribed for implementation of Ind AS in Banking, companies, Insurance companies and NBFCs., , TEST YOUR KNOWELDGE, MCQs, 1., , 2., , 3., , 4., , Accounting Standards for non-corporate entities in India are issued by, (a), , Central Govt., , (b), , State Govt., , (c), , Institute of Chartered Accountants of India., , Accounting Standards, (a), , Harmonise accounting policies and eliminate the non-comparability of, financial statements., , (b), , Improve the reliability of financial statements., , (c), , Both (a) and (b)., , It is essential to standardize the accounting principles and policies in order, to ensure, (a), , Transparency., , (b), , Consistency., , (c), , Both (a) and (b)., , Which committee is responsible for approval of accounting standards and, their modification for the purpose of applicability to companies?, (a), , NFRA., , © The Institute of Chartered Accountants of India

Page 27 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 5., , 6., , 7., , 8., , 9., , (b), , MCA., , (c), , Central Government Advisory Committee., , 1.27, , Global Standards facilitate, (a), , Cross border flow of money., , (b), , Comparability of financial statements., , (c), , Both (a) and (b)., , Additional guidance given in Ind AS over and above what is given in IFRS are, called, (a), , Carve-outs., , (b), , Carve-ins., , (c), , Carve clarifications., , IASB stands for, (a), , International Accounting Standards Bureau, , (b), , International Advisory Standards Board, , (c), , International Accounting Standard Board., , IFRS stands for, (a), , International Financial Reporting System, , (b), , International Finance Reporting Standard, , (c), , International Financial Reporting Standard., , Phase I of Ind AS was applicable to:, (a), , All listed companies in India or outside India, , (b), , Companies with turnover INR 500 crores or more, , (c), , Companies with net worth INR 500 crores or more., , Theoretical Questions, 1., , Explain the objective of “Accounting Standards” in brief. State the, advantages of setting Accounting Standards., , 2., , Briefly explain the process of issuance of Indian Accounting Standards., , © The Institute of Chartered Accountants of India

Page 28 :

1.28, , ACCOUNTING, , 3., , Explain the significance of emergence of IFRS as Global Standards., , 4., , What do you mean by Carve outs/ins in Ind AS? Explain., , ANSWER/HINTS, MCQs, 1., 7., , (c), (c), , 2., 8., , (c), (c), , 3., 9., , (c), (c), , 4., , (b), , 5., , (c), , 6., , (b), , Theoretical Questions, 1., , Accounting Standards are the written policy documents issued by, Government relating to various aspects of measurement, treatment,, presentation and disclosure of accounting transactions and events., Following are the objectives of Accounting Standards:, a., , Accounting Standards harmonize the diverse accounting policies and, practices followed by different companies in India., , b., , Accounting Standards facilitates the preparation of financial statements, and make them comparable., , c., , Accounting Standards give a sense of faith and reliability to the users., , The main advantage of setting accounting standards are as follows:, , 2., , a., , Accounting Standards makes the financial statements of different, companies comparable which helps investors in decision making., , b., , Accounting Standards prevent any misleading accounting treatment., , c., , Accounting Standards, management., , prevent, , manipulation, , of, , data, , by, , the, , Due to the recent stream of overseas acquisitions by Indian companies, there, is need for adoption of high quality standards to convince foreign enterprises, about the financial standing as also the disclosure and governance standards, of Indian acquirers., The Government of India in consultation with the ICAI decided to converge, and not to adopt IFRSs issued by the IASB. The decision of convergence rather, than adoption was taken after the detailed analysis of IFRSs requirements and, extensive discussion with various stakeholders., , © The Institute of Chartered Accountants of India

Page 29 :

INTRODUCTION TO ACCOUNTING STANDARDS, , 1.29, , The ICAI has worked towards convergence of global accounting standards by, considering the application of IFRS in Indian corporate environment., Recognising the growing need of full convergence of Ind AS with IFRS, ICAI, constituted a Task Force to examine various issues involved., Ind AS are issued by the Central Government of India under the supervision, and control of ASB of ICAI and in consultation with NFRA. NFRA recommends, these standards to the MCA and MCA has to spell out the accounting, standards applicable for companies in India., 3., , Global Standards facilitate cross border flow of money, global listing in, different bourses and comparability of financial statements. Global Standards, improve the ability of investors to compare investments on a global basis and, thus lowers their risk of errors of judgment. It facilitates accounting and, reporting for companies with global operations and eliminates some costly, requirements say reinstatement of financial statements., , 4., , Certain changes have been made in Ind AS considering the economic, environment of the country, which is different as compared to the economic, environment presumed to be in existence by IFRS. These differences are due, to differences in economic conditions prevailing in India. These differences, which are in deviation to the accounting principles and practices stated in, IFRS, are commonly known as ‘Carve-outs’. Additional guidance given in Ind, AS over and above what is given in IFRS, is termed as ‘Carve in’., , © The Institute of Chartered Accountants of India