Page 1 :

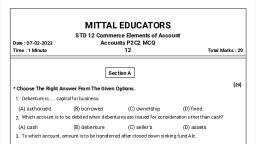

MITTAL EDUCATORS, Date : 07-02-2022, Time : 1 Minute, , STD 12 Commerce Elements of Account, Accounts P1C6 MCQ, 12, , Total Marks : 29, , Section A, [29], , * Choose The Right Answer From The Given Options., 1. In which ratio profit and loss incurred due to revaluation of assets and liabilities transfers to, partners accounts?, , (A) In capital ratio, , (B) In old profit-loss, ratio, , (C) In gain ratio, , (D) In sacrifice ratio, , 2. Loss of revaluation account at the time of retirement or death is recorded in......... side of the capital, accounts., , (A) remaining partners, (B) all partners, old, new profit-loss sharing, profit-loss sharing,, debit, credit, , (C) all partners, old, profit-loss sharing,, debit, , (D) all partners, equal, proportion, debit, , 3. A, B and C are partners of a firm. Goodwill is valued at Rs.60,000 at the time of retirement of A. How, much goodwill amount will be credited to partner A's account?, , (A) Rs. 10,000, , (B) Rs. 20,000, , (C) Rs. 30,000, , (D) Rs. 40,000, , 4. At the time of retirement or death of a partner,.......is subtracted from the total outstanding amount., , (A) Loan advanced to, firm, , (B) Interest on debit, balance of current, account, , (C) Interest on capital, , (D) Interest on loan, advanced to firm, , 5. Sagar, Harshin and Parth are partners sharing profit-loss in 2 : 2 : 1 ratio. Parth retires. Then .......Will, be the new profit-loss ratio., , (A) Equal, , (B) 2 : 1, , (C) 2 : 3, , (D) 3 : 2, , 6. If noting is clearly mentioned about , interest on loan given by partner to the firm ....... % interest is to, be allowed by firm to the partner., , (A) 5, , (B) Bank rate, , (C) 6, , (D) 8, , 7. Share of retiring partner is distributed among continuing partners, then formula to find new profitloss ratio is ......., , (A) Sacrifice + gain, , (B) New share sacrifice (C) Old share + gain, , (D) Old share new share, , 8. Sweta, Geeta and Jyoti are equal partners. Gita retires. Gita's share is gained by Sweta and Jyoti, equally. New profit and loss sharing ratio of Sweta and Jyoti will be......., , (A) 3:1, , (B) 2:1, , (C) 1:2, , (D) 1:1, , 9. Accounting year ends on 31-3-2016. A partner dies on 30-6-2016. Deceased partners' share in profit, is 3 Profit share payable to the partner is to be calculated on the basis of last year's profit, Rs.24,000........ amount will be paid as share in profit at the time of death., [1]

Page 2 :

(A) Rs. 8,000, , (B) Rs. 24,000, , (C) Rs. 1,333, , (D) Rs. 2,000, , 10.Goodwill shown in the balance sheet at the time of the retirement of a partner is become; as......., , (A) shown in new, balance sheet, if, decided by partners., , (B) debit side of all, (C) credit side of all, (D) debit side of retiring, partners‘ capital, partners‘ capital, partners' capital, accounts in their old, accounts in their old, account only., profit-loss sharing ratio. profit-loss sharing ratio., , 11.Debit balance of profit and loss account shown in the balance sheet at the time of retirement of a, partner is......., , (A) recorded on the, debit side of all, partners' capital, accounts including the, retiring partner in their, old profit-loss sharing, ratio., , (B) recorded on the, (C) credit side of the, (D) debit side of the, credit side of all, retiring partners' capital remaining partners', partners' capital, account only., capital accounts in their, accounts including the, gaining ratio., retiring partner in their, old profit-loss sharing, ratio., , 12.X, Y and Z are partners of a firm. Y retires. .......will be the new profit-loss ratio for remaining, partners., , (A) 1:2, , (B) 1:1, , (C) 2:1, , (D) 3:1, , 13.Partner A expires on 30-6-2016. Profit of the firm is Rs. 96,000. Share of partner A in profit is 1/6., Accounting year of the firm ends on 31-3-2016. ....... is the amount of profit share for partner A., , (A) Rs. 4,000, , (B) Rs. 8,000, , (C) Rs. 12,000, , (D) Rs. 16,000, , 14.At the time of retirement or death of a partner, profit of revaluation account is recorded in account,, in ....... ratio and on ....... side of capital account., , (A) Continuing partners, (B) Continuing partners, (C) Continuing partners, (D) Continuing partners,, new profit-loss, debit old profit-loss, credit, old profit-loss, debit, equal, debit, 15.At the time of retirement of a partner, credit balance of profit and loss account shown in balance, sheet is shown in........, , (A) Capital accounts of, all partners, on credit, side, in old profit and, loss ratio, , (B) Capital accounts of (C) Capital account of, all partners, on debit, retiring partner, on, side, in old profit and credit side, loss ratio., , (D) Capital account of, continuing partners on, debit side, in their gain, ratio., , 16.Goodwill payable to the retiring partner is recorded as......., , (A) credit side of all, (B) credit side of all, partners‘ capital, partners' capital, accounts, in their old accounts, in their, profit-loss sharing ratio. gaining ratio., , (C) debit side of, continuing partners', capital accounts, in, their gaining ratio., , (D) debit side of, continuing partners', capital accounts, in, their new profit-loss, sharing ratio., , 17.Alpa, Bela and Kalpana are partners of a firm sharing profit-loss in 1/4, 1/6 and 1/12 ratio. Kalpana, retires. In this case,.........is the profit-loss ratio for continuing partners., , (A) 3:2, , (B) 6:3, , (C) 3:6, , (D) 2:3, , 18.If noting is clearly mentioned about the distribution of share of old partner, how it will be distributed, among continuing partners?, , (A) In new ratio, , (B) In sacrifice ratio, [2]

Page 3 :

(C) In gain ratio, , (D) In old ratio, , 19.What is joint life insurance policy for business unit?, , (A) Capital, , (B) Debt, , (C) Expense, , (D) Asset, , 20.At the time of retirement of a partner goodwill amount is recorded in ....... account., , (A) Capital account of (B) Partners' capital, retiring partner, account, , (C) Revaluation, , (D) Cash, , (C) Nominal, , (D) Traders, , 21.Joint life insurance policy is ....... type of account., , (A) Asset, , (B) Personal, , 22.Where will you show balance of accounts like bad debts reserve, investment reserve, workmen, compensation fund etc. at the time of retirement of a partner?, , (A) In partner capital, accounts, , (B) In profit-loss, adjustment accounts, , (C) In debtors accounts (D) In new balance, sheet, , 23.At the time of retirement of a partner balance of accumulated profit or loss, distributed among, partners in ...... ratio., , (A) Old profit-loss ratio (B) New profit-loss ratio (C) Gain ratio, , (D) Sacrifice ratio, , 24.An active partner is require to give public notice for his retirement as it is ....., , (A) Legal, , (B) Compulsory, , (C) Advisable, , (D) Voluntary, , 25.Workman profit sharing fund is recorded as ....... at the time of the retirement of a partner., , (A) a liability in new, balance sheet., , (B) credited to all, (C) debited to all, (D) credited to the, partners' capital, partners' capital, retiring partners' capital, account in their old, account in their old, account., profit-loss sharing ratio. profit-loss sharing ratio., , 26.If partnership deed is silent, interest is payable at........... on unpaid amount payable to the retiring, partner., , (A) 10 % p.a., , (B) 12 % p.a., , (C) 6 % p.a., , (D) zero, , 27.Loss of revaluation account at the time of retirement or death is recorded in ....... account in ......., ratio on side of the capital accounts., , (A) remaining partners, (B) all partners, old, new profit-loss sharing, profit-loss sharing,, debit, credit, , (C) all partners, old, profit-loss sharing,, debit, , (D) all partners, equal, proportion, debit, , 28.A partner, except the retiring partner also receives goodwill when......., , (A) his capital is more. (B) new share in new, profit-loss sharing ratio, is more than his old, share., , (C) new share in new (D) new share and old, profit-loss sharing ratio share are equal., is less than his old, share., , 29.When only old profit-loss sharing ratio is given, gaining ratio of remaining partners will be, , (A) 1 : 1, , (B) old ratio, , (C) capital ratio, , [3], , (D) cannot be, calculated