Page 1 :

Public Expenditure and Public Revenue, Evaluation Questions and Answers, , Question 1., What is Public expenditure? Which are its two divisions?, Answer: Public Expenditure: Expenditure incurred by the, government is known as Public expenditure., Developmental Expenditure and Non Developmental, Expenditure., The Expenditure incurred by the government for, constructing roads, bridges and harbors starting up new, enterprises, setting up educational institutes etc are, considered as Developmental expenditure. Expenditure, incurred by the way of war, interest, pension etc are, considered as Non developmental expenditure, Question 2., Why does India’s, public expenditure in-crease?, Answer:, Welfare Activities, Urbanization, Increase in Defense, expenditure., Question 3., What is public revenue? Which are its main sources?

Page 2 :

Answer:, The income of the government is known as Public, revenue.There are two types of public revenue., 1. Tax Revenue, 2. Non Tax Revenue, Question 4., What is the differences between Direct tax and Indirect, tax?, Answer:, Direct Tax:, Tax is paid by the person on whom it is imposed, Tax burden is felt by the tax payer, Comparatively high expenditure is incurred for tax collection., , Indirect Tax:, Tax is imposed on one person and paid by another, Tax burden is not felt by the tax payer, Comparatively low expenditure is incurred for tax collection., , Question 5., What is Corporate tax?

Page 3 :

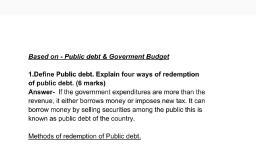

Answer:, It is the tax imposed on the net income or profit of a, company., Question 6., Differentiate ‘Surcharge and ‘Cess’, Answer:, Additional tax imposed on tax is called surcharge., Generally surcharge is imposed for a specific period., Additional tax is imposed by the government for certain, specific purposes is called Cess. Cess will be discontinued, when enough money is received., Question 7., Who imposes Entertainment tax?, Answer:, Entertainment tax is imposed by Local self government., Question 8., Increase is defence expenditure is one of the reasons for, the increase in India’s pub-lic debt. Find out 3 other for the, same., Answer:, Increase in population, Social Welfare Activities

Page 4 :

Developmental activities., , Question 9., What is ‘budget’? Which are its three types?, Answer:, Budget is the financial statement showing the expected, income and expenditure of the government during a, financial year. Three types of budget are Balanced Budget,, Surplus Budget, Deficit budget., Question 10., What is fiscal policy? What is the merit of a sound fiscal, policy?, Answer:, Government’s policy regarding public revenue, public, expenditure and public debt is called a Fiscal policy. A, sound fiscal policy helps in nourishing the developmental, activities and to attain growth., Prepared by Sajil k 7012486887