Page 1 :

INTERNATIONAL FINANCIAL REPORTING STANDARDS, (IFRS), SOLVED QUESTION PAPER – NOV / DEC 2017, SECTION – A (2 MARKS), , a. Write any two demerits of IFRS., • It would increase the cost of implementation for small businesses., • It would lead to concerns with standards manipulation., • It would require global consistency in auditing and enforcement., • It would increase the amount of work placed on accountants., b. What are the criteria for investment properties?, • The definition of Investment Property., • It is probable that future economic benefits ill flow to the entity., • The cost is reliably measurable., • The property under construction, which will be used as Investment Property in future., c. List the items included in the shareholders’ fund., Four components that are included in the shareholders' equity calculation are outstanding, shares, additional paid-in capital, retained earnings, and treasury stock., d. What is cost of sales?, Cost of sales (also known as cost of revenue) and COGS both track how much it costs to, produce a good or service. These costs include direct labor, direct materials such as raw materials,, and the overhead that's directly tied to a production facility or manufacturing plant., e. How do you treat pre-acquisition profit or loss?, Pre-acquisition profit is the profit earned by the company before it is being acquired. It, is treated as capital profit and not revenue profit and is not available for distribution of dividend., f. What do you mean by unrealized profits?, An unrealized gain is a potential profit that exists on paper, resulting from an investment. It, is an increase in the value of an asset that has yet to be sold for cash, such as a stock position that, has increased in value but still remains open. A gain becomes realized once the position is sold for, a profit.

Page 2 :

g. What is meant by related party transaction?, The term related-party transaction refers to a deal or arrangement made between, two parties who are joined by a preexisting business relationship or common interest., In business, a related party transaction is a transaction that takes place between two parties, who hold a pre-existing connection prior to the transaction., , SECTION – B (6 MARKS), , 2. List out any nine international accounting standards issued by IASB., Ind AS 101, Ind AS 102, Ind AS 103, Ind AS 104, Ind AS 105, Ind AS 106, Ind AS 107, Ind AS 108, Ind AS 109, Ind AS 110, Ind AS 111, Ind AS 112, Ind AS 113, Ind AS 114, Ind AS 115, Ind AS 1, Ind AS 2, Ind AS 7, IndAS 8, Ind AS 10, Ind AS 12, Ind AS 16, Ind AS 116, Ind AS 19, Ind AS 20, Ind AS 21, Ind AS 23, Ind AS 24, Ind AS 27, , First-time Adoption of Indian Accounting Standards, Share-based Payment, Business Combinations, Insurance Contracts, Non-current Assets Held for Sale and Discontinued Operations, Exploration for and Evaluation of Mineral Resources, Financial Instruments: Disclosures, Operating Segments, Financial Instruments, Consolidated Financial Statements, Joint Arrangements, Disclosure of Interests in Other Entities, Fair Value Measurement, Regulatory Deferral Accounts, Revenue from Contracts with Customers, Presentation of Financial Statements, Inventories, Statement of Cash Flows, Accounting Policies, Changes in Accounting Estimates and Errors, , Events after the Reporting Period, Income Taxes, Property, Plant and Equipment, Leases, Employee Benefits, Accounting for Government Grants and Disclosure of Government Assistance, , The Effects of Changes in Foreign Exchange Rates, Borrowing Costs, Related Party Disclosures, Separate Financial Statements

Page 3 :

Ind AS 28, Ind AS 29, Ind AS 32, Ind AS 33, Ind AS 34, Ind AS 36, Ind AS 37, Ind AS 38, Ind AS 40, Ind AS 41, , Investments in Associates and Joint Ventures, Financial Reporting in Hyperinflationary Economies, Financial Instruments: Presentation, Earnings per Share, Interim Financial Reporting, Impairment of Assets, Provisions, Contingent Liabilities and Contingent Assets, Intangible Assets, Investment Property, Agriculture, , 3. Narrate the disclosure under insurance contracts as per Ind. AS 104., A contract under which an insurer accepts significant insurance risk from policyholder by, agreeing to compensate the policyholder if a specified uncertain future event affects adversely., An insurer shall disclose information that identifies and explains the amounts invested its, financial statements arising from the insurance contract., An insurer shall disclose information that enables the users to evaluate the nature and extent, of risks arising from the insurance contract., • ACCOUNTING POLICIES, Premiums,, Charges & Expenses,, Claim benefits,, Embedded options & guarantees,, Reinsurance, • ASSETS, LIABILITIES, INCOME & EXPENSES, Disclosure on insurance contracts specifically, Gains or losses on buying reinsurance, • SIGNIFICANT ASSUMPTIONS AND SOURCES OF UNCERTAINTY, Process of determining assumptions most significantly affecting assets, liabilities,, income and expenses,, Where possible, quantified disclosure of assumptions, • CHANGES IN ASSUMPTIONS, Effect of change, Consistent with Ind AS 8 -> disclosure of nature and extent of change in accounting, estimate (current period or in future), •, , CREDIT RISKS, Financial loss due to reinsurer default

Page 4 :

Impairment of reinsurance assets, Loss on balances due from agents or brokers, 4. X Ltd, obtained a loan of Rs.6,00,000 on 1st April, 2916 form Vijaya bank, to be, capitalized as under:, Construction of company building – Rs.20,00,000, Purchase of Plant and Machinery – Rs.15,00,000, Working capital required – Rs.10,00,000, Purchase of vehicle – Rs.15,00,000, In March 2017, construction of company building was completed and plant and, machinery was ready for its intended use. Total interest charged by vijaya bank for the, financial year ending 31st March, 2017 was Rs.7,20,000. How do you treat the total interest, charged on loan?, , CALCULATION OF EFFECTIVE RATE OF INTEREST, Effective Rate Of Interest = Total Interest / Total Loan x 100, Effective Rate Of Interest = 7,20,000 / 6,00,000 x 100, Effective Rate Of Interest = 12%, CALCULATION OF TOTAL INTEREST CHARGED ON LOAN, SL.NO, , PARTICULARS, , 1, 2, 3, 4, , Construction of company building, Purchase of Plant and Machinery, Working capital required, Purchase of vehicle, , LOAN AMOUNT, , RATE OF INTEREST, , BORROWING COST, , 20,00,000, 15,00,000, 10,00,000, 15,00,000, , 12%, 12%, 12%, 12%, , 2,40,000, 1,80,000, 1,20,000, 1,80,000, 7,20,000, , TOTAL INTEREST CHARGED ON LOAN, , 5. From the following particulars of M/s Ravinandan Ltd, prepare a statement of P/L for the, year ended 31st March, 2017 as per schedule III of companies act, 2013., PARTICULARS, Revenue from operations, Printing and stationery, Advertisement, Salaries and allowances, Interest on long term loans, Goodwill written off, Material consumed, Discount allowed, Interest on investment received, Depreciation on fixed assets, , AMOUNT, , 1,00,000, 2,000, 4,000, 6,000, 4,500, 1,500, 35,000, 1,000, 1,500, 2,000

Page 5 :

STATEMENT OF PROFIT AND LOSS ACCOUNT OF Mr. Ravinandan company as, on 31st March 2019, AMOUNT AMOUNT, PARTCULARS, 1. Revenue from operations, 1,00,000, 2. ADD: Other incomes (Interest on investment received), 1,500, 3. TOTAL REVENUE (A), 1,01,500, 4. EXPENSES, Printing and stationery, 2,000, Advertisement, 4,000, Salaries and allowances, 6,000, Interest on long term loans, 4,500, Goodwill written off, 1,500, Material consumed, 35,000, Discount allowed, 1,000, Depreciation on fixed assets, 2,000, TOTAL EXPENSES (B), 56,000, 5. Profit before tax (3 - 4 ) / (A – B) (1,01,500 – 56,000), 45,500, 6. Tax during the year, NIL, 7. Profit after tax (5 – 6) (45,500 – 0), 45,500, Profit attributable to:, 1. Owners of the parent (B/F), NIL, 2. Non – Controlling interest, NIL, TOTAL, 45,500, 6. Sri Rama Ltd acquired 60% of Equity shares in Laxman Ltd, on 01.10.2016. The following, balances are extracted from the balance sheet of Laxman, ltd as on 31.03.2017., i. Share capital: 40,000 equity shares of Rs.100 each fully paid., ii. General Reserve on 01.04.2016 Rs.80,000, iii. Profit and Loss account (Credit) on 1.4.2016 Rs.30,000, iv. Net profit for the year ended 31.03.2017 Rs. 60,000, Calculate cost of control., , STEP 1 : CALCULATION OF RATIO, PARTICULARS, Number of Shares in Selling Company (‘B’ Limited), Number of Shares in Purchasing / Acquiring Company ‘A’ Limited, (40,000 x 60%), Minority Shareholders (Selling company – Acquiring company), (40,000 – 24,000), Ratio = (Acquiring company ratio: Minority Shares), (24,000 : 16,000) (24 : 16) (6 : 4) (4 x 6 = 24) (4 x 4 = 16), ( 3 : 2) (2 x 3 = 6) (2 x 2 = 4), , AMOUNT, , 40,000, 24,000, 16,000

Page 6 :

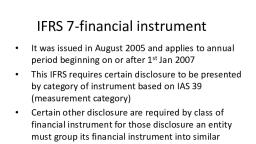

STEP 2 : CACLUATION OF NON CONTROLLING INTEREST, AMOUNT, AMOUNT, PARTICULARS, Share capital / Minority Shareholders (16,000 x 100), 16,00,000, ADD: SHARES OF CAPITAL PROFITS, , 1. Profit and Loss account as on 01 - 04 - 2016, 2. Reserves as on 01 -04 - 2016, 3. Profits during the year (60,000 x 6 months / 12) (1.10.2016 –, 31.03.2017), TOTAL SHARES OF CAPITAL PROFITS, , Capital Profit = Capital Profit Amount X Minority shares ratio), (1,40,000 x 2/5), SHARES OF REVENUE PROFITS, 1. Profits during the year (60,000 x 6 months / 12) (1.10.2016 –, 31.03.2017), , 30,000, 80,000, 30,000, 1,40,000, 56,000, , 30,000, , TOTAL SHARES OF REVENUE PROFIT, , Revenue Profit = Revenue Profit Amount X Minority shares, ratio) (30,000 x 2/5), NON CONTROLLING INTEREST (NCI), , 12,000, 16,68,000, , SECTION – C (14 MARKS), , 7. a. Explain in brief, any two international financial reporting standards., IFRS 1 First-time Adoption of International Financial Reporting Standards, IFRS 1 requires an entity that is adopting IFRS Standards for the first time to prepare a, complete set of financial statements covering its first IFRS reporting period and the preceding year., The entity uses the same accounting policies throughout all periods presented in its first IFRS, financial statements. Those accounting policies must comply with each Standard effective at the end, of its first IFRS reporting period., IFRS 2 Share-based Payment, IFRS 2 specifies the financial reporting by an entity when it undertakes a share-based payment, transaction, including issue of share options., It requires an entity to recognize share-based payment transactions in its financial statements,, including transactions with employees or other parties to be settled in cash, other assets or equity, instruments of the entity., IFRS 3 Business Combinations, IFRS 3 establishes principles and requirements for how an acquirer in a business combination:

Page 7 :

•, •, •, , Recognizes and measures in its financial statements the assets and liabilities acquired, and, any interest in the acquire held by other parties;, Recognizes and measures the goodwill acquired in the business combination or a gain from a, bargain purchase; and, determines what information to disclose to enable users of the financial statements to evaluate, the nature and financial effects of the business combination., IFRS 4 Insurance Contracts, , IFRS 4 specifies some aspects of the financial reporting for insurance contracts by any entity, that issues such contracts and has not yet applied IFRS 17., An insurance contract is a contract under which one party (the insurer) accepts significant, insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if, a specified uncertain future event (the insured event) adversely affects the policyholder., IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, •, •, •, , a non-current asset or disposal group to be classified as held for sale if its carrying amount, will be recovered principally through a sale transaction instead of through continuing use;, assets held for sale to be measured at the lower of the carrying amount and fair value less, costs to sell;, depreciation of an asset to cease when it is held for sale;, , mprise a s tatem ent of financial position, a statement of pr ofit or l oss and other c ompr ehensive inc om e, a s tatem ent of chang es i n equity and a statement of c ash fl ows., , 7. b. Discuss the various merits of IFRS., , IA, , •, •, •, •, •, •, •, •, •, •, •, •, •, •, •, •, •, , To develop a unified set of accounting and reporting standards, To build a single global financial reporting language, An accounting framework with global acceptance, High quality, transparent, understandable, globally enforceable, More cross border transactions, Access to international capital and investments, Enhance confidence of global stakeholders, Facilitate international acquisitions and mergers, Peer to Peer Comparison, It allows for greater comparability, It is beneficial to new and small investors, It creates more flexibility, IFRS save cost, Unifies business transaction, Provides consistency, Better capital market, Improves internal communication

Page 8 :

•, •, •, •, , Merger and takeover activity, Investments, Increasing the level of confidence, Risk evaluation, , Improved financial reporting and tax planning:, Under IFRS, companies will produce a standardized and consistent set of accounting and, financial reports for complying with local statutory and consolidated requirements. This will help, improve the analysis of financial reporting and tax planning processes., Improved day-to-day operations:, Businesses will get faster access to more in-depth financial performance information to use, in analyzing and making better decisions about day-to-day operations., Better managed resources:, By standardizing processes and accounting, companies will be able to standardize and, streamline accounting systems across the enterprise and reduce the cost of auditing and statutory, reporting., Improved financial controls:, By standardizing the approach and control over statutory reporting, businesses will reduce, the risk of penalties and compliance problems enterprise-wide and in individual countries., Lowered cost of capital:, Increased insight into financial results and adherence to high-quality financial standards, as, specified by IFRS, can benefit both companies and their investors with reduced cost of capital., , 8. a. Evaluate the requirements and disclosure of EPS under Ind AS 33., Earnings per share is a method used to review the performance of an entity. As the term itself, denotes it simply means determining the profit attributable to each share., Such information is required to understand the return on investment for the shareholders and, prospective investors., •, , •, , An entity shall calculate basic earnings per share attributable to ordinary equity holders of the, entity and, if presented, profit or loss from continuing operations attributable to those equity, holders., Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary, equity holders of the entity (numerator) by the weighted average number of ordinary shares, outstanding (denominator) during the period., , DISCLOSURE, If EPS is presented, the following disclosures are required :

Page 9 :

•, •, •, , •, , The amounts used as the numerators in calculating basic and diluted earnings per share, and, a reconciliation of those amounts to profit or loss attributable to the entity for the period., The weighted average number of ordinary shares used as the denominator in calculating basic, and diluted earnings per share, and a reconciliation of these denominators to each other., Instruments (including contingently issuable shares) that could potentially dilute basic, earnings per share in the future, but were not included in the calculation of diluted earnings, per share because they are antidilutive for the period(s) presented., A description of those ordinary share transactions or potential ordinary share transactions,, that occur after the reporting period and that would have changed significantly the number of, ordinary shares or potential ordinary shares outstanding at the end of the period if those, transactions had occurred before the end of the reporting period., , EXAMPLE INCLUDE :, •, •, •, , An issue of shares for cash, Redemption of ordinary shares outstanding, Issue of options, warrants, or convertible instruments., , 8. b. What are the objectives, scope and disclosure of related party as per Ind AS 24., OBJECTIVE, The objective of this Standard is to ensure that an entity’s financial statements contain the, disclosures necessary to draw attention to the possibility that its financial position and profit or loss, may have been affected by the existence of related parties and by transactions and outstanding, balances, including commitments, with such parties., The objective of IAS 24 is to ensure that an entity’s financial statements contain the, disclosures necessary to draw attention to the possibility that its financial position and profit or loss, may have been affected by the existence of related parties and by transactions and outstanding, balances, including commitments, with such parties., A related party is a person or an entity that is related to the reporting entity:, •, , •, , A person or a close member of that person’s family is related to a reporting entity if that, person has control, joint control, or significant influence over the entity or is a member of its, key management personnel., An entity is related to a reporting entity if, among other circumstances, it is a parent,, subsidiary, fellow subsidiary, associate, or joint venture of the reporting entity, or it is, controlled, jointly controlled, or significantly influenced or managed by a person who is a, related party., , SCOPE, This Standard shall be applied in:, (a) Identifying related party relationships and transactions;

Page 10 :

(b) Identifying outstanding balances, including commitments, between an entity and its, related parties;, (c) Identifying the circumstances in which disclosure of the items in (a) and (b) is required;, and (d) determining the disclosures to be made about those items., DISCLOSURES, Relationships between parents and subsidiaries. Regardless of whether there have been, transactions between a parent and a subsidiary, an entity must disclose the name of its parent and,, if different, the ultimate controlling party., If neither the entity's parent nor the ultimate controlling party produces financial statements, available for public use, the name of the next most senior parent that does so must also be disclosed., This Standard requires disclosure of related party relationships, transactions and outstanding, balances, including commitments, in the consolidated and separate financial statements of a parent,, venturer or investor presented in accordance with Indian Accounting Standard (Ind AS) 27, Consolidated and Separate Financial Statements., This Standard also applies to individual financial statements., Related party disclosure requirements as laid down in this Standard do not apply in, circumstances where providing such disclosures would conflict with the reporting entity’s duties of, confidentiality as specifically required in terms of a statute or by any regulator or similar competent, authority., A related party relationship could have an effect on the profit or loss and financial position of, an entity., Related parties may enter into transactions that unrelated parties would not., For example, an entity that sells goods to its parent at cost might not sell on those terms to, another customer. Also, transactions between related parties may not be made at the same amounts, as between unrelated parties., , 9. a. Calculate the borrowing cost in the case of Indraprastha co. Ltd., i. 30 crores arranged by 12% p.a. Debentures payable after 10 years, 10 crores by 12 years’, loan from SBI and 10 crores form Indian Bank. The SBI interest rate 14% p.a. and Indian, Bank interest rate is 16% p.a., ii. Debentures repayable at 10% premium., iii. The cost of issue of debentures is Rs.22 lakhs., iv. The service charges for SBI loan 8%., CALCULATION OF BORROWING COST, SL.NO, , PARTICULARS, , AMOUNT

Page 11 :

1, 2, 3, 4, 5, 6, , Interest on Debentures (30,00,00,000 x 12%), Interest on SBI (10,00,00,000 x 14%), Interest on Indian Bank (10,00,00,000 x 16%), Premium on Debentures (30,00,00,000 x 10% / 10 years), Cost of issue of Debentures (22,00,000 / 10 years), Service Charges for SBI loan (10,00,00,000 x 8% / 12 years), TOTAL BORROWING COST, , 3,60,00,000, 1,40,00,000, 1,60,00,000, 30,00,000, 2,20,000, 6,66,666, 6,98,86,666, , 9. b. The cost of a machine is Rs.3,00,000, which has 5 years of useful life. Depreciation is on, straight line method at 10% p.a. Machine is expected to generate Rs.30,000 p.a. net calshflow, for 5 years., The net realizable value of the machine on current date is Rs. 1,40,000., The required rate of return is 10% p.a., i. Carrying amount of the machine., ii. Impairment loss, iii. Revised carrying amount., (The present value of an annuity at 10% p.a for 5 year is 3.79), , CALCULATION OF CARRYING AMOUNT OF THE MACHINE, PARTICULARS, Cost of machinery, LESS: Depreciation (3,00,000 x 10%) = (30,000 x 5 years), CARRYING AMOUNT, Value in use 30,000 x 3.79 = 1,13,700, , AMOUNT, 3,00,000, 1,50,000, 1,50,000, , CALCULATION OF IMPAIRMENT LOSS, PARTICULARS, Value in use, Less: Net realizable value of the machine, IMPAIRMENT LOSS, , AMOUNT, 1,50,000, 1,40,000, 10,000, , CALCULATION OF REVISED CARRYING AMOUNT, PARTICULARS, Carrying Amount, Less: Impairment Loss, IMPAIRMENT LOSS, , AMOUNT, 1,50,000, 10,000, 1,40,000

Page 12 :

10. a. Prepare a statement of Profit and Loss account of Mr. Sachidanand company limited as, on 31st March 2019., PARTICULARS, Goods acquired, Stock of goods on 1-1-2016, Stock of goods on 31-12-2016, Sales, Depreciation on fixed assets, Preliminary expenses written off, Salaries to the employees, Rent of showroom, Interest on loan, Discount received from suppliers, Office expenses, Printing and stationaries, Carriage outwards, Advertisement, Income tax at 40%, , AMOUNT, , 6,00,000, 80,000, 90,000, 10,00,000, 10,000, 8,000, 19,000, 12,000, 10,000, 5,000, 2,000, 1,800, 1,200, 800, , STATEMENT OF PROFIT AND LOSS ACCOUNT OF Mr. Sachidanand company, as on 31st March 2019, AMOUNT AMOUNT, PARTCULARS, 1. Revenue from operations (Sales), 10,00,000, 2. ADD: Other incomes (Discount received from suppliers), 5,000, 3. TOTAL REVENUE (A), 10,05,000, 4. EXPENSES, Goods acquired, 6,00,000, Changes in inventories (Stock of goods on 1-1-2016 - Stock, (10,000), of goods on 31-12-2016) (80,000 – 90,000), Depreciation on fixed assets, 10,000, Preliminary expenses written off, 8,000, Salaries to the employees, 19,000, Rent of showroom, 12,000, Interest on loan, 10,000, Office expenses, 2,000, Printing and stationaries, 1,800, Carriage outwards, 1,200, Advertisement, 800, TOTAL EXPENSES (B), 6,54,800, 5. Profit before tax (3 - 4 ) / (A – B) (10,05,000 – 6,54,800), 3,50,200, 6. Tax during the year (3,50,200 x 40%), 1,40,080, 7. Profit after tax (5 – 6) (3,50,200 – 1,40,080), 2,10,120, Profit attributable to:, 1. Owners of the parent (B/F), NIL

Page 13 :

2. Non – Controlling interest, TOTAL, , NIL, 2,10,120, , 10. b. The Trail balance of Mysore ltd, on 31.03.2017 was given as under., PARTICULARS, Dr., Cr., Share capital: Share of Rs.100 each, - 4,00,000, 8% mortgage debentures, - 1,00,000, Plant and Machinery, 4,50,000, Furniture, 50,000, Land and Building, 1,00,000, Accounts Payable, - 1,20,000, Long term loans, - 2,00,000, Provisions for depreciation, 50,000, Inventories, 1,80,000, Accounts receivable, 20,000, Investments in flats, 1,60,000, Technical know – how, 40,000, Cash and cash equivalents, 20,000, P/L A/c, - 1,30,000, Revenue received in advance, 20,000, TOTAL, 10,20,000 10,20,000, Prepare a statement of financial positon of Mysore Ltd, as on 31.03.2017 as per schedule III, of companies act 2013., STATEMENT OF FINANCIAL ANALYSIS OF Mr. MNC LIMITED AS ON 31st MARCH 2019, , PARTICULARS, EQUITY AND LIABILITIES, Share capital, 8% mortgage debentures, Account payable, Long term loans, Provision for depreciation, Profit and loss account, Revenue receded in advance, TOTAL LIABILITIES, ASSETS, Plant and machinery, Furniture, Land and building, Inventories, Accounts receivable, Investment in flats, , AMOUNT, , AMOUNT, , 4,00,000, 1,00,000, 1,20,000, 2,00,000, 50,000, 1,30,000, 20,000, 10,20,000, 4,50,000, 50,000, 1,00,000, 1,80,000, 20,000, 1,60,000

Page 14 :

Technical know how, 40,000, Cash and cash equivalents, 20,000, TOTAL ASSETS, 10,20,000, _______________________________________________________________________________, , 11. a. The statements of financial of Keerthi Ltd, and Murthy Ltd, as on 31.03.2017., Keerthi Ltd, PARTICULARS, LIABILITIES:, Share capital: Shares of Rs.10 each,, 4,00,000, General Reserve on 1.4.2016, 1,00,000, P/L A/c on 1.4.2016, 60,000, Profit for 2016 – 2107, 2,40,000, Accounts Payable, 40,000, TOTAL, 8,40,000, ASSETS, Tangible fixed assets, 3,90,000, Investments: (8,000 shares of Rs.20 each in Murthy Ltd) 1,60,000, Accounts receivables, 2,40,000, Other current assets, 50,000, TOTAL, 8,40,000, Keerthi Ltd. Acquired the shares in Murthy Ltd, on 01.08.2016., Calculate Non – Controlling interest., , Murthy Ltd, , 1,00,000, 40,000, 15,000, 2,00,000, 20,000, 3,75,000, 1,40,000, 1,60,000, 75,000, 3,75,000, , STEP 1 : CALCULATION OF RATIO, PARTICULARS, Number of Shares in Selling Company (‘Murthy’ Limited) (1,00,000 /, 10) (Table value), Number of Shares in Purchasing / Investments, Minority Shareholders (Selling company – Acquiring company), (10,000 – 8,000), Ratio = (Acquiring company ratio: Minority shares), (8,000 : 2,000) (8 : 2) (4 : 1) (2 x 4 = 8) (2 x 1 = 2), , AMOUNT, , 10,000, 8,000, 2,000, , STEP 2 : CACLUATION OF NON CONTROLLING INTEREST, AMOUNT, AMOUNT, PARTICULARS, Share capital / Minority Shareholders (2,000 x 10), 20,000, ADD: SHARES OF CAPITAL PROFITS, , 1. Profit and Loss account as on 01 - 04 – 2016 (Selling company,, Table value), 2. Reserves as on 01 -04 – 2016 (Selling company, Table value), , 15,000, 40,000

Page 15 :

3. Profits during the year (2,00,000 x 4 months / 12 months), (1.4.2016 – 1.8.2016), TOTAL SHARES OF CAPITAL PROFITS, , Capital Profit = Capital Profit Amount X Minority shares ratio), (1,21,666 x 1/5), SHARES OF REVENUE PROFITS, 1. Profits during the year (2,00,000 x 8 months / 12 months), (1.8.2016 – 31.3.2017), , 66,666, 1,21,666, 24,333, , 1,33,333, , TOTAL SHARES OF REVENUE PROFIT, , Revenue Profit = Revenue Profit Amount X Minority shares ratio), (1,33,333 x 1/5), NON CONTROLLING INTEREST (NCI), , 26,666, 71,000, , 11. b. Friends company ltd. Acquired 6000 shares in Enemies company Ltd on 1.1.2016., The summarized financial position of the above two companies as on 31.3.2017 was as under., Friends Ltd Enemies Ltd, LIABILITIES, Share capital: Shares of Rs.100 each fully paid up 4,00,000, 2,00,000, Reserves on 1.4.2016, 20,000, 30,000, P/L Accounting, 1,00,000, 80,000, Current Liabilities, 70,000, 60,000, Total Liabilities, 5,90,000, 3,70,000, ASSETS, Investment in real estate, 50,000, 80,000, Investment in shares of Enemies Ltd, 2,00,000, Machinery, 1,50,000, 90,000, Current Assets, 22,000, 20,000, Building 1,68,000, 1,80,000, Total Assets, 5,90,000, 3,70,000, P/L Account balance of Enemies company Ltd on 1.4.2016 was Rs.30,000, Compute the controlling interest and Goodwill or Capital Reserve., , STEP 1 : CALCULATION OF RATIO, PARTICULARS, Number of Shares in Selling Company (Enemies Limited) (2,00,000 / 100), Number of Shares in Purchasing / Acquiring Company (Friends Limited), Minority Shareholders (6,000 – 2,000), , AMOUNT, , 2,000, 6,000, 4,000, , Ratio = (Acquiring company ratio: Minority Shares) (6,000 : 4,000) (3 : 2), STEP 2 : CACLUATION OF NON CONTROLLING INTEREST, AMOUNT, AMOUNT, PARTICULARS, Share capital / Minority Shareholders (4,000 x 100), 4,00,000

Page 16 :

ADD: SHARES OF CAPITAL PROFITS, , 1. Profit and Loss account, 2. Reserves, 3. Profits during the year (30,000 x 3 months / 12) (1.1.2016 –, 1.04.2016), TOTAL SHARES OF CAPITAL PROFITS, , Capital Profit = Capital Profit Amount X Minority shares ratio), (1,17,500 x 2/5), SHARES OF REVENUE PROFITS, 1. Profits during the year (30,000 x 3 months / 12) (1.1.2016 –, 1.04.2016), , 80,000, 30,000, 7,500, 1,17,500, 47,000, , 7,500, , TOTAL SHARES OF REVENUE PROFIT, , Revenue Profit = Revenue Profit Amount X Minority shares ratio), (7,500 x 2/5), NON CONTROLLING INTEREST (NCI), , 3,000, 4,50,000, , GOOD WILL CALCULATION / CAPITAL RESERVE, AMOUNT, PARTICULARS, Share Capital of purchasing company (Selling company, Table, , AMOUNT, , 2,00,000, , value), , LESS: 1. Face value of share (6,000 x 100) (Adjustment value), 2. Capital Profits (1,17,500 x 3/5) (Ratio of purchasing company), GOODWILL / CAPITAL RESERVE, , 6,00,000, 70,500, 6,70,500, 4,70,500