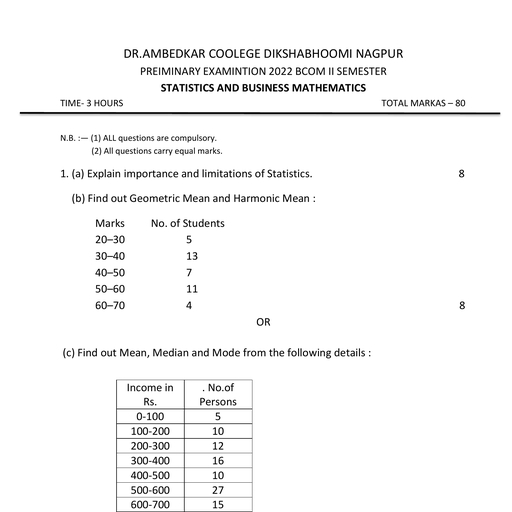

Page 1 :

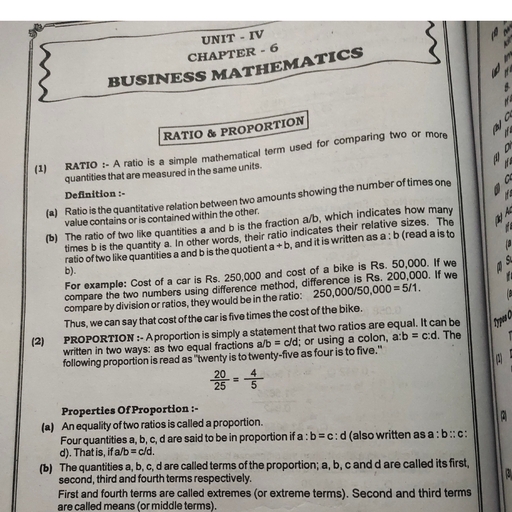

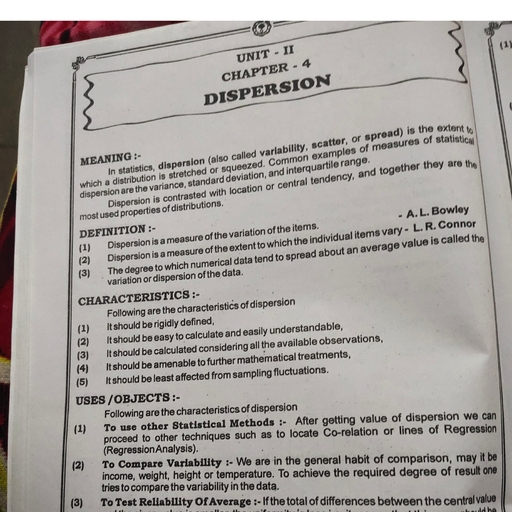

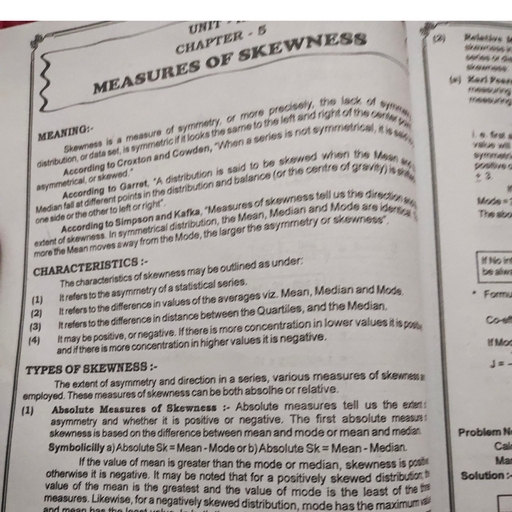

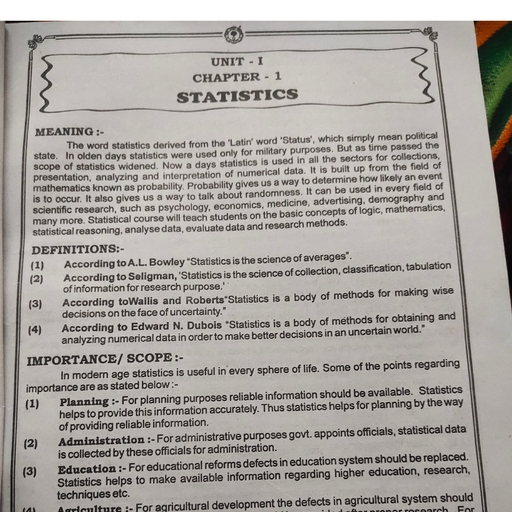

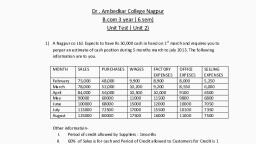

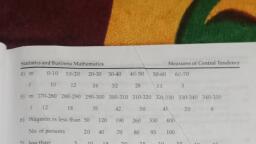

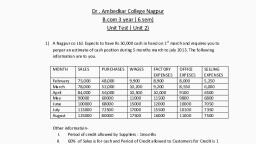

Control/ 157, , and Budgetary, , Budgeting, , Review Problems, , Cash Budget, , Ex.1, The, , of Cash, , Company expects to, , have F25.000 in Bank on 1st, October, 2016 and requires, during the Three Months October, November, December, 2016., The following information is, supplied to you., Position, , you, , to, , &, , Sales, , Months, , August, , Wages, , Purchases, , 50,000, , prepare an estimate, , Factory, , Selling, , Expenses, , Expenses, , 30,000, , 6,000, , 5,000, , 7,000, , 56,000, , 32,000, , 6,500, , 5.500, , 7,000, , 60,000, , 35,000, , 7,000, , 6,000, , 7,500, , 80,000, , 40,000, , 9,000, , 7,500, , 8 00, , 90,000, , 40,000, , 9,500, , 8,000, , 8.500, , September, October, , November, December, , Other Information:, , 20% of Sales are, , (i), , (ii), , in, , Suppliers Supply, , cash, remaining amount, , Goods at, , two months, , (ii)Wages and Other Expenses are, Giv)The Company, in, , pays Dividends, , is, , collected, , in, , the month followingthe Sales., , Credit., , in the month, following in which they are incurred., Shareholders and, Bonusto Workers of T10,000 andT15,000respectively, , paid, , to, , the month of October., , ()Plant have been, , ordered and, , is, , expected, , to, , be received, , November., , in, , It, , will, , Cost T80,000, , &, , to, , be, , paid, , in, , November., , (vi), , IncomeTax F25,000is, , Ans.:, , Closing, , payable in December, 2016., October 7,800, November (Deficit,, , (C)Fo0,700. December, , Balance:, , (Deficit, , (Cr) F63,700., , Ex.2, Mayur Co. Ltd. expects F32,000, Cash Position for the four months Sept.,, , in, , Bank Account on, , 2016 to, , 1st Sept.,, , 2016and, , Dec., 2016. The following, , requires, , information, , prepare an estimate of, supplied to you., , you, is, , Wages, , Sales| Purchases, , Months, , to, , Factory, , Selling, , Expenses, , Expenses, , July, , 78,000, , 52,000, , 12,000, , 8,000, , 9,000, , August, , 80,000|, , 58,000, , 15,500, , 9,500, , 10,000, , September, , 85,000, , 62,000, , 17,500, , 10,000, , 11,000, , October, , 88,000|, , 67,000, , 20,500, , 12,000, , 12,000, , November, , 90,000, , 80,000|, , 21,000, , 13,500, , 13,000, , 82,000, , 25,000, , 14,000, , 14,000, , December, , 95,000, , (i) 40% of Sale are, , in, , cash, remaing, , amountis collected, , in, , the month following that of Sales., , two months Credit., (i)Suppliers Supply Goods on, in the next month, they occurs., (ii)Wages Other Expenses paid, to pay Dividend to SharesholdersF15,390, Company thinking, , &, , in, , the month, , of December,, (iv)The, to, 70,000, &, in, Nov., and, Dec., R50,000, respectively., amounting, (v)Call on Shares are expected, to be paid in Sept. & Oct. F25,000 each., installed, in August, (vi), The Machine, payable in December., Income, Tax 5,555, (v), is, , is, , Ans.:, , Closing Balance:, , Sept.-4,000,, , Oct.:-43,300, Nov, , :, , +4,000,, , Dec., , -2,445., , 2016.

Page 2 :

158/, , Management Accounting, , Ex.3:, You, the, , Ist Oct., 2016 to, prepare a Cash Budget for, lirm, at, the, end, of, cach month., by the, required, , are required, , Overdraft, , facility, , to, , 3 1st, , 2016 from the, , Dec.,, , data, , following, , indicatino, , Sales Purchases, , Months, , Wages, , (Credit), , (Credit), , 3,60,000, , 2,41,600, , 24,000, , 3,80,000, , 2,88,000, , 28,000, , October, , 2,16,000|, , 4,86,000, , 22,000, , November, , 3.50,000, , 4,92,000, , 20,000, , 2,52,000, , 5,36,000, , 30,000, , 2016, , August, September, , December, , 60%, , (1), , Credit, , Sales, , are realised, , in, , montlh, , and remaing, , the Sales, , following, , 40%, , collected, , is, , one month, , aller the, , due date., Creditors are paid, , (ii), , (i) Estimated Cash, Ans.:, , at, , one month Purchases., , after, , Bank on, , 40,000., , 2016 is estimated, , Ist Oct.,, , December:, Closing Balance: October: 1,24,000, Nov.: -s0,400,, -2,76.000, 80,400, Dec.:, RI,95,600, Overdraft Required: Oct.: NIL, Nov.: TS0,400,, (2,76,000, , -, , Ex.4, From, 1,, , the following expectation, , of Income and Expenditure prepare a Cash Budget, , for, , the period, , January to, , 2016., , Months, , Sales, , 2015-20166, , Credit, , Purchases, Credit, , November, 2015, , 30,000, , 15,000, , December, 2015, , 35,000, , Junuary, 2016, February,2016, March, 2016, , 20,000, , 25,000, , 2016, , April,, , Wages, , 15,000, , Manufacturing|, , Adminitrative, , Selling, , Expenses, , Expenses, , Expenses, , 3,000, , 1,150, , 1,060|, , 500, , 3,200, , 1,225, , 1,040, , S50, , 2,500, , 990, , 1,100, , 600, , 1,050, , 1,150, , 620, , 1,220, , 570, , 1,180, , 710, , 30,000, , 20,000|, , 3,000, , 35,000, , 22,500, , 2,400, , 40,000, , 25,000, , 2,600, , 100, , ,, , 1,200, , Additional information, , (ii), , The Customers are allowed a Credit Period of two, The Creditors allowed a Credit of two months., , ii), , Wages, , (iv), , Lag-in-Period for, , (v), , Balance, , (vi), , A, , (vii), , Capital, , (1), , are paid, , on the, , months., , day ofthe next month., payment of Other Expenses is one month., 1st, , in Hand on Ist, of Cash, of January,2016expected to be, Dividend of 10,000 is payableinApril,2016., , Expenditure, , been Purchased on, , be incurred, , to, , Ist, , :Plant, , be Purchased on, , will, , March and Payment are, , to, , be made, , in, , 15,000., 15th, , monthly, , January for T5,000, a Building has, instalment, , of F2,000till December, , 2017., , Ans:, , Closing Balance:, , Jamuary:F18,985, February:, , 28,795, March: 30,975, April: F23,885, , Ex.5:, The summarised, is, , as under, , Income, , & Expenditure, , information, , ofRatan, , Co. Lid., , the month, , for, , ofMarch, , to, , August, 2016, , -, , You are required to, preparea Cash Budget, a Cash Balance of F8,000 on the said date., , for three, , months, , staring, , from, , I, , May, 2016. When, , there, , is, , estimated

Page 3 :

Budgeting and Budgetary Control/ 159, Sales, , Months, , Wages, , Purchases, , Office, , Manufacturing, , Credit, , Expenses, , &, , Selling, , Distribution, , Expenses, , Expenses, , March, April, , May, June, , 60,000|, 62,000, , 36,000, , 9,000, , 4,000, , 2,000, , 4,000, , 38,000|, , 8,000, , 3,000, , 1,500, , 5,000, , 64,000|, , 33,000| 10,000, 8,500, 35,000|, , 4,000, , 2,500, , 4,500, , 3,000, , 2,000, , 3,500, , July, , 58,000|, 56,000, , August, , 60,000, , 39,000|, , 9,000, , 4,000, , 1,000, , 4,500, , 34,000, , 8,000, , 3,000, , 1,500, , 4.500, , Additionalinformation, Plant Costing, , (i), , 16,000, , is, , due, , for, , Delivery in, , payable, , July, , 10% on, , Delivery, , and the balance aftcr, , three, , months., (ii), , ii), , Advancc Income Tax of, Period for Credit, , 8,000, , is, , payable, , March, , in, , & June., , (a) By Supplicrs two months and, (b) To Customers one month., (iv), , (v), , Lag-in-Pcriod for payment of Manufacturing, Expenses is half a month., Lag-in-Period for payment all Other Expenses: one month., , Ans.: Closing Balance: May, , 15,750,June, , 12,750,July, , T18,400., , Ex.6, , A Company cxpects to have37,500, ofCash, , Position, , during the three months,, , Sales, , in Hand on Ist, April,2016and requires you to prepare an, June, 2016. The followinginformation supplied to you., , Cash, to, , April, , Purchases, , Wages, , Months, , Factory, Expenses, , February, March, , Office, Expenses, , estimate, , Selling, Expenses, , 75,000, , 45,000, , 3,000, , 7,500, , 6,000, , ,500, , 84,000, , 48,000, , 9,750, , 8,250, , 6,000, , 4,500, , 90,000, , 52,500, , 10,500, , 9,000, , 6,000, , 5,250, , May, , 1,20,000, , 60,000, , 13,500, , 11,250, , 6,000, , 6,750, , June, , 1,35,000, , 60,000, , 14,250, , 14,000, , 7,000, , 7,000, , April, , Information:, , Additional, , (1), (2), , 2, , Period of Credit allowed by Suppliers months., 20% of Sales are for Cash and period ofCredit allowed, is, , allowed, , (4), , Payment of All Expenses, to be paid, Income Tax 757,000 is due, , (5), , The Company, , (3), , Delay, , in, , &, , respectively, , (6), , in, , is to, , pay Dividend, of April., , to, , in, , for, , to, , Customers, , for, , Credit Sales, , &, , to, , be, , received, , Sharcholders and Bonus, , &, , one month., , June., to, , Workers of T15,000 and F22,500, , the month, , Plant has been ordered, , is, , one month., , paid, , in, , May. It, , will, , Cost, , 20,000., , Prepare a Cash Budget, , Ans.:Closing Balance:April: 1,700, May: R8,950,.June:, , R-15,050.

Page 4 :

160/ Management Accounting, , Ex.7:, Coal, , Industries, , Lid., , with ils Bankers during the period Oct to, arrenge Overdraft facility, Dec., 2016, from, the, data and determine the amount, above, period, follow ing, of Bank oNee, , wished, , said, , Prepare a Cash Budget for the, for the, , required, , above, , to, , rdrait, period., , Sales, , Purchases, , Wages, , Months, 2016, August, , 70,000, , 40,000, , 8.000, , September, October, , 80,000, , 50,000, , 8.000, , 92,000, , 52,000, , 9,000, , Expenses, , 7,000, 7.000, 8,000, , November, , 1.00.000, , 60.000, , 10,000, , December, , 1,20,000, , 55,000, , 14,000, , 9.000, 9.000, , Other Information:, allowed by Suppliers two months., and the period, of Credii allowed to Customers for Credit Sales: One nonth, in, Delay, Payment of Wagesand Expenses: 1/2 month., Inconme Tax F25,000 is to be, paid in December, 2016., , (1), , Period, , (2), , 75% of Sale, , (3), (4), , of, , Ans., , Credit, , is for Credit, , Oct., , Closing Balance:, , :F27,000, Nov.: F53,000, Dec., , :F82,500., , Ex.8, Chandra, , Jyoti, , a new, , Ltd., , March, 2017, April, 2017. The, , company wishes, , started, , to, prepare a Cash Budget from Janu.. 2017,, Revenue and Expenses are, given for the purpose., , estimatcd, , following, , Sales, , Materials, , Months, , Wages, , Feb.,, , Production, , Selling, , Overheads, , January, , 20,000, , 20,000, , 4.000, , Fcbruary, March, , 22,000, , 14,000, , 4.400, , 28,000, , 14,000, , 36,000, , 22.000, , ), , April, , Cash Balance on, Credit to, , (i), (ii), , equal, , Lo, , &, , Commission@5%on Total Sales is to be paid within a month, 10,000 being the amount of second call may, bereceived in March., obtainable wi, , 800, 900, , 4,600, , ,300|, 3,400, , 4,600, , 3,500, , is to, , be, , installed, , at, , 900, 1,000, , F20.000 on, , the, , second call., , following, , actua', , Share Premium, , Sales., , amounting2.000is, , Terms of, , Collections, and Payments., (a) Period of Credit allowed by Creditors:, , (b) Periud of, Delay, , in, , (d) Delay, , in, , (c), , (v), , January, , be repaid by two, , 3 200, , be F10,000., A New Machinery, instalments, in March, April., , estimated, , Expenses, , Sales, , also, (iv), , Ist, , 2017&, , Credit, , allowed, , Payment, , of, , Payment, , of, , AssumeCash, , io, , 2 Months., , Customers:, , Overhcads:, , I, , 1, , Month., , Month., , 2, , Wages: Month., 50% of Total Sales., , Sales to be, , s.: ClsingBalance:, , January F18,000, Februa, , y F29,800, March:, , 727,000. April:T24,700, , Ex.9, Mudgal Music Co. wishes to arrange temporary Overdralt, facility with its Bankers, during the period October to, it will, be producing, mostly for Stock. Prepare a Cash Budget for the above, from the, period, following data, indicating the extent as the Overdraft facilities, reqired by the Company at the end of the each month., A Company is expectingto have 78,600 Cash in Hand on 1, October, 2016., , December 2016, when

Page 6 :

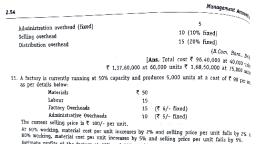

162/ Management Accounting, , E., , 11, are the, , The following, , Budgeted Expenses of Kumar, , Plastic, , Industries,, , Akola, , at, , 60%, , the, , activity, , level tsa, , 0,000, , Units), for 70"%, , Budget, , a llexible, , Prepare, , and, , 90% capacity, , level., , Costsat60% Capacity:, (A) Prime Cost:, (i), , Direet, , (i), , Direct, , Materials, , 3,00,000, , (i) Other Direet, Variable, Overheads, (B), Consumable, (i), (i), , Expenses, , 60,000, , Materials, , Shop Wages, Maintenance, , (ii), , 1,20,000, , Wages, , 15,000, 6,000, , and, , Repairs, , 8,000, , (C) Fixed Overheads:, (i), , Inspection, , (i), , Depreciation, , (i), , Insurance, , (iv), , Salaries, , 1,600, 10,000, 5,000, 6,000, , Cost, , Total, , 5,31,600, , Profit, , 68,4, , Sales, , 6,00,000, , Ans.: 7096 Capacity:, , 83,567,80% Capacity:, , Profit, , 1,, , 13,900., , Ex. 12, , & R Manufacturing Company, , The Budget Expenses ofR, , ofTable Fans, , ., , at, , 100% capacity, , Ltd., , of, , Bhusaval,, , for, , the Production of 10,000 Units, , as follows., , are, , Cost Per Unit, , Particulars, , Direct Material, , 2., , Direct Labour, , 3., , Direct Expenses, , 60, 30, 20, , 4, , Factory, , Overheads, , (Variable), , 25, , 5., , Factory, , Overheads (Fixed), , 15, , 6., , Administrative, , 7., , Distribution, , Expenses (Fixed), , (50% Fixed), , Expenses, Cost, , Total, , Selling, , 160, , Price, , 200, , Prepare a Flexible, , Ans., , Budget for the Production, of 6,000, 7,000 and 8,000 Units., Units: Profit1,50,000, At 7,000 Units. Profit 2,12,500,, At6,000, At 8,000, , :, , Uinits:, , Profit, , r2,75,000, , Ex. 13, , The following, December, 2016, 1., , 2., , Fixed, , 3., , Sales&Costs, 50% (5,000Units) Capacity utilisation., , at, , Expenses remain, , Semi-Variable, , 65%, At, , from, , availhble, , figures are, , to, , constant, , Expenses, , will, , for, , all, , level, , Material, , both, , 4., , At 100%, , 5., , Semi-Variable, , 6., , Fixed Expenses, , Cost, , Material, , Expenses, , are, , of Jai, , Enginering Co., , ofProduction and Sales., at 50% to 65%, capacity, 80% to 100% capacity., , Lid., , but will increase, , by 59% and Selling Price is reduced by, and Labour Costs inereses by 10% and Selling Price, , increased, , T50,000., , are58,000., , for, , the year ended3, , levels, , remain unchanged, , 80% Capacity and 30% between, , 90% level,, , forccasts, , by, , 10% between, , 5%, , is, , reduced by, , 8%

Page 7 :

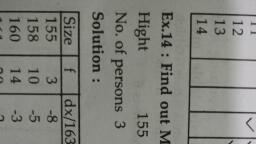

7, , Variable, , 8., , Selling, , Prepare a, , Ienses are, , S, , Per, , Material, , Unit,, , Labour, , 50% and 75% Capacity, statementthough Flexible, , Price between, , Profit, , forecast, , Ans., , is, , and Budgetary Control/163, ?1 Per Unit., , Budgeting, , Per Unit, , F25 Per, , Budget, Sales, , Level, , 60%, 75%, 90%, 100%, , 2, , & Direct Expenses, , Unit., , 60%,75%, 90% and 100% Capacity., Profit/ Loss, , at, , 1,50,000, , -6,000, , 1,87,500, , +14,500, , 2,13,750, , +16,500, , 2,30,000, , +20,000, , Ex.14:, , The followingdata are taken from, , the, , manufacturing records of Atul, , Industries,, , Jalgaon for a halfyeard Period., , Fixed Expenses:, Wages&Salaries, Taxes, Rent, Rates, , 70,000, , &, , 56,000, Drpreciation, , Sundry, , 89,000, , Adm. Expenses, , Semi-Variable Expenses, Indirect Labour, , 84,000, , (At50% Capacity):, 99,000, , Sundry Admi. Expenses, Maintenance, Sundry, , & Repairs, , 26,000, , Expenses, , 26,000, , Selling, , 25,000, , Variable Expenses, Materials, , 2,40,000, , Labour, , 2,56,000, , Others, , between, , 38,000, , Assume, remain constant for all level of Production,, Semi-Variable Expenses remain constant, that Fixed Expenses, 45% and 65%, increasing, by 10% betwecn 66% and 80% Capacity and by 20% between 81% and, capacity,, various levels, , of, , 100%Capacity.Sales, , at, , are, , Capacity, , 60%, 75%, 90%, , 10,15,000, 12,30,000, 15,00,000, , 100%, , 17,40,000, , Prepare a Flexible Budget for half year and, , forecast, , Profits, , at 60%,75%,, , 90% and 100% of capacity., , Ans.:, Level, , Total, , Cost, , Profit/Loss, 1,03,800, , 60%, 75%, 90%, , 12,96,900, , -66,900, , 14,75,000, , +25,000, , 100%, , 15,81,800, , 11,18,800, , +, , 1,58,200, , Ex.15:, The Cost, in, , capacity, , either, , Material, , of, , an, , Article, , at a capacity, , above or below, the, , Cost, , Labour Cost, , level, , Individual, , of 5,000 units, , is, , given below under heading 'A'. For, under heading 'B'., , Expenses vary as indicated, , A, , 50,000, 30,000, , Power, , 2,500, , Repairs& Maintenance, , 4,000, , a variation, , B, , 100%, 100%, , 80%, 75 %, , Varying, Varying, Varying, Varying, , of 25%

Page 8 :

164/, , ManagementAccounting, 2.000, , 100%, , I,000, , 20%, , 20,000, , 100%, , 10,000, , 25%, 50%, , Stores, Inspection, Depreciation, , Overheads, , Administrative, Selling, , Overheads, , 6,000, , Vary ing, Varying, Vary ing, Vary ing, Varying, , 1,25,500, , Cost Per Unit, Prepare a Flexible, , Ans.:, , Total, , 25.10, , Budget for Production Levels of 4.000 Units and 6.000 Units, , Costfor 4,000, , Units1,02.0, , & For 6,000 Units, , T1.48,040, , Ex. 16, , The Expenses Budgeted, , lor, , Production of 10,000 Units in a Factory are furished below., , PerUnit, Materials, , 140, , Labour, , S0, , 0, , Overheads, , Variable, , Overheads (2.00,000), , Fixed, , Variable, Selling, , Expenses, , 20, , (Direct), , 10, , Expenses (10% Fixed), , Administrative, Distribution, , 26, , Expenses (F1,00,000), Expenses, , 10, , (20% Fixed), , 14, , Total Cost, , 310, , Prepare a Budget for the Production of (a)8,000 Units and, (b)6,000 Units., Assume that Administrative, Expenses are right for all levels of Production., , Ans., , Unit, , Total, , 10,0001 its, , 31,00,000, , 8,000 Units, , 25,50.800, , 6,000 Units, Ex., , Cost, , 20,01,600, , 17:, Rajat, , Industries, , Dircct, , Materials, , Direct, , Labour, , the following, , incures, , Expenses, , to, , Produce 1,000 Units, ofan, , 30.000, 15.000, , Pow r(20% Fixcd), Repairs& Maintenance, Depreciation, , 10,000, , (15% Fixed), , 6,000, , Expenses, Average Labour Hours, Prepare a, also find, , 8.000, , (6% Fixed), , Administration, , lFlexible, , (100% Fixed), , Budget showing, , Individual, , out the Average Cost Rate Per Hour., , Ans., , :, , Units, Total, , 1,000, , 12.000, Expenses of Productivon, , Cost (F), 81,000, , 1,500, I,12.100, , 2,000, , Article., , 1,00,000 Hours, Levels at 1,500 Units and, 2,00, , Cust Rate Per Hour, , 0.81, , 0.75, 0.72, , Units, , and

Page 9 :

Budgeting, , and Budgetary, , Control/ 165, , Ex. 18:, , The lollowinginlormationrelates to the Production activities ofHousehuld, , Pvt., , Lid., , for three, , months ended, , 3ist, , Dcc. 2016, Fixed Expenses, , :, , Mnagement Salaries, Rent& Taxes, , 2.10,000, , 140,000, , Depeciation on Machinery, Office Expenses, , 1,75,000, , 2.22.500, 7,47,500, , Semi-Variable Expenses, , at50%, , Capacity, , Plant Maintenance, Indirect, , 62,500, , Labour, , 2.47,500, , Salesmen's Salaries, , 72,500, , Sundry Expenses, , 65,000, 4,47,500, , 50% Capacity:, , Variable Expenses at, Materials, , 6.00.000, , Labour, , 6.40,000, , Salesmen's Commission, , 95,000, 13,35,000, , notcd that Scmi-Variable Expenses remain constant between 40% and 70% capacity, increase by 10%, It is further, above, between 70% and 90% capacity and increse by 15% ofthe above figures betweon 90% and 100%, figures, the, Fixed, Expenses remain constant whatever the level of activity may be, capaicity., 7, and 100% Capauity, 12.00,000., Sales at 60% Capacity is, 25.50.000. at, Capacity 36,00,000, Production, at, 80%, Produced, are, Sold., a, Flexible, 60%., Budget, Prepare, Assuming thut ail items, u, , of, , 80%, , Capacity., , Ans., , 50%, 60%, , 23 30,000, , Profit/Loss, 4.05,000, , 27,97,000, , -247.000, , 80, , 35,75,750, , 24,250, , 39,32,125, , 3,17,875, , Capacity, , 10, , %, , Total, , Expenses, , Ooo