Page 1 :

Capital and Revenue, , , , Capital and Revenue, , Capital is different from money. Money is used simply to purchase goods and, services for consumption. Capital is more durable and is used to generate wealth, through investment. Examples of capital include automobiles, patents, software and, brand names., , Revenue is the amount of money that a company actually receives during a specific, period, including discounts and deductions for returned merchandise. Revenue is the, amount of money that is brought into a company by its business activities. Revenue is, also known as sales, as in the price-to-sales ratio, an alternative to the price-to-earnings, ratio that uses revenue in the denominator., , Capital and Revenue are mainly classified into:, , , , Capital and Revenue, , , , , , , , , , , , , , Capital and Revenue Receipts, , For income tax purpose, a clear understanding of the distincti, ‘ ion between the two is, essential because income tax is charged on revenue incomes and not on capital incomes, unless they are expressly taxable., , Differences between Capital and Revenue receipts, , 1. Sale proceeds of a fixed asset is a capital receipt. w, trading asset is a revenue receipt. pt. Whereas, the sale proceeds of a, , 2. A receipt in substitution of a source of income i, is, in substitution of income is a revenue receipt @ capital receipt. Whereas, a receipt

Page 2 :

J a a eae, , 3. Compensation received for loss of business is a capital receipt. Whereas, compensation, received for loss of profit is a revenue receipt., , 4. Subsides or grants received from the government for any development scheme is a, capital receipt. Whereas, subsidy or grants received from the government for, meeting foreign competition is a revenue receipt., , 5. Insurance money received for loss of a capital asset is a capital receipt. Whereas,, insurance money received for the loss of a trading asset is a revenue receipt., , Example of Capital Receipts, , (i) Compensation received for nationalization., , (ii) Insurance Many received for the loss of a capital asset., , (ili) Profits due to fluctuations in the rate of exchange of foreign currency., (iv) Premium on the issue of new shares., , (v) Compensation received for termination of agency before the expiry of stipulated, period, the only source of income being agency., , (vi) Compensation received from the employer for premature termination of services., (vil) Annuity received under LIC scheme., , Examples of Revenue Receipts, , (i) Annuities received Periodically., , (ii) Compensation received for loss of profits., , (ill) Proceeds of sale of forest trees., , (iv) Damages received for breach of contract., , (v) Dividends and interest from investments., , (vi) Amount received by an assessee for digging and removing earth from his land for, brick-making., , (vii) Sales tax collected from purchasers/customers., , (vill) Compensation received for the injury suffered in an accident., , (ix) Compensation received for the compulsory vacation of the place of business., (x) Money received as the consideration for not resigning directorship., , (xi) Money received by a tyre manufacturing company for sale of techical know how, regarding manufacturing of tyre., , (xii) A Pugree received by the house owner from the tenant., , Note: Unclaimed dividend cannot be deemed to be profit of business. It is not a, taxable receipt., Capital and Revenue Expenditures, , The distinction between the two is vital because only revenue expenses are allowed, and capital expenses are disallowed.

Page 3 :

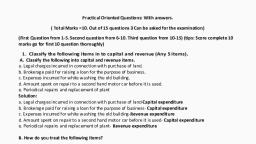

Distinction between Capital and Revenue Expenditure, , 1) An expenditure which increases the earning capacity of a fixed asset % 3 capital, expenditure whereas an expenditure incurred for maintaining 2 fixed asset s 2, revenue expenditure., , 2) Cost of acquisition and installation of a fixed asset is 2 Capital expenditure where as, Purchase price of goods bought for resale is revenue expenditure., , 3} An expenditure incurred for the acquisition of a source of income i a capital, expenditure whereas an expenditure incurred for the purpose of earning of an, income is @ revenue expenditure., , 4) An expenditure incurred by a person to free himself from a capital liability is 2 capital, expenditure. Whereas an expenditure incurred by a person to free himself from a, revenue liability is a revenue expenditure., , 5) An expenditure incurred in obtaining capital by issuing shares is & Capital, expenditure whereas an expenditure incurred for raising joans or iSsuing, debentures is a revenue expenditure., , Capital and Revenue Loss, The distinction between the two is vital because only revenue losses are allowed, , and capital losses are disallowed., , Differences between Capital and Revenue Loss, , (i) Capital losses do not arise in the course of reguiar business. Whereas, Revenue, losses arise in the course of regular business., , (%) Loss on sale of capital asset in a capital loss whereas, loss on sale of trading asset, in a revenue loss., , (i) Loss sustained by a person for being surety to another person is @ capital loss., Whereas, loss suffered by a business on account of embezzlement by empioyees is, a revenue loss., , (tv) Loss due to withdrawal of money from bank is a capital loss. Whereas, loss due to, embezzlement is a revenue loss., , State whether the following are capital or revenue nature,, 1) Cost of Acquisition and installation of fixed asset., 2) Expenditure incurred in raising loan., 3) An expenditure incurred for the purpose of increasing the earning capacity., 4) A reward given to the employee in consideration of his good service., 5) oss sustained on account of embezzlement done by an employee.

Page 4 :

Solution:, , 1), 2), 3), 4), 5), , 6), 7), 8), , 9), , (1) Capital expenditure (2) Revenue expenditure (3) Capital expenditur, (4) Revenue expenditure (5) Revenue loss, , Determine the nature of the following transactions:, Compensation received for nationalisation., Dividends and interest from investments., Unclaimed dividend., , Premium on the issue of new shares., , Amount received by an assessee for digging and removing earth from his land for, brick-making., , % 50,000 received as premium on hiring out 50 shops., Sales tax collected from Purchasers/customers., , Compensation received for termination of agency before the expiry of stipulated, period, the only source of income being the agency., , Bonus shares received by a dealer of shares., , 10) Annuity received., , 11) Compensation received from the employer for premature termination of services., , Solution:, (1) Capital receipt (2) Revenue receipt (3) Neither Capital nor Revenue, (4) Capital receipt (5) Revenue receipt (6) Capital receipt, (7) Revenue receipt (8) Capital receipt (9) Revenue receipt, , (10) Revenue receipt (11) Capital receipt

Page 5 :

True/False, , 1. Sale proceeds of a fixed asset is a capital receipt., , 2. Sale proceeds of a trading asset is a revenue receipt., , 3. Premium on the issue of new shares is the example of capital expenditure., 4. Annuity received under LIC scheme is the example of capital recipits., , 5. Expenditure incurred in raising loan comes under revenue expenditure., , Answer:, , , , Fill in the Blanks, 1. Capital is different from, 2. Expenditure incurred in comes under revenue expenditure., 3. Sale proceeds of a trading asset is a, 4. Sale proceeds of a fixed asset is a, , Answer:, , , , Multiple Choice Questions (MCQ), , 1. The following is capital receipt, [a] Salary paid by HUF to a member, [b] Dividend from investment, {c] Bonus shares, [d] Sale of technological know, 2. Following is not a capital receipt, [a] Dividend on investment, [b] Bonus shares, [c] Sale of know-how, [d] Compensation received for vacating business place, 3. Cost of Acquisition of fixed asset is the example of, [a] Capital expenditure, [b] Revenue expenditure