Page 1 :

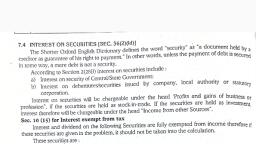

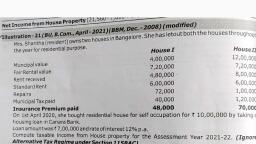

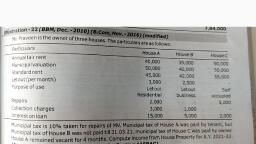

Illustration : 2, Mr. Ashok is the owner of a house at Indore. Particulars in respect of which for the year ended, , , , , , , , 31 March 2019 are :, Particulars z, , Actual rent reccived (a) 4,500, Municipal valuation (b) 4,400, Total Municipal Tax . ; 675, Municipal Tax paid by Mr. Ashok 450, Municipal Tax paid by the Tenant . 225, Interest on loan taken for renewing the house ~ % 335, Unrealised rent allowed in Assessment Year 2019-20 recovered during the year. 2,000, , , , Compute Mr. Ashok's income from House Property for the Assessment Year 2019-20,, , Solution : a, , - Computation of Income from House Property, , Sec. : 22-27 % P.Y. : 2018-19, (-) : Deduction u/s 24 : A.Y. : 2019 -20, : = Particulars * z z, , , , , , , , Gross Annual Value (a) or (b), whichever is highér 4,500, Less : Municipal taxes paid by owner ; 450, Annual Value - x 4,050, “Less: 30% of A.V. - ; . 1,215, Interest on loan - 335 1,550, Income from the House 2,500, Add : Unrealised rent recovered = 2,000, Less : 30% of ¥ 2,000 600 1,400, Income from House Property ; 3,900, , , , , , , , Illustration : 3, , Mr. P is the owner of a house property in Rourkela. It has been let out for= 90,000. The tax payable by, the owner comes to € 8,400 on the municipal valuation of & 84,000, but the landlord has taken an agreement, , from the tenant stating that the tenant would pay tax direct to the municipality. The landlord, however, bears, the following expenses on tenant's amenities :, , , , , , , , , , , , , , __ ; Particulars : | x, Water charges (as per agreement) . " “1,000, Lift maintenance ! 1,000, Salary of Gardener 1,200, Lighting of stairs ‘ 800, The landlord claims the following deductions : > :, Particulars zg, Repairs ‘ 5 30,000, Land Revenue 1,000, Collection Charges 2,000, , , , , , , , Legal charges incurred on purchase of land on which house property is situated ¥ 24,000., Compute the taxable income from house property,, 10/B.Com.-Il-Income Tax (SemIV) (Nagpur Univ,)

Page 2 :

gn ot Income from House Property, compatatle P.Y.: 2n19,, AY. : ’, , 7 - a a), ns neehieees | ,, jon 0/8 24 Fartie A 4, = = 50 ine, —— : sided to the tenants h, —a menities provic, cunt Renin! Walter by landlord on 1,000, ct st, FF 000, peduet : narges 1,0 10 |, Pee taintenance 1,200, 800 |, , 1, Lie af Gardener, . Stairs Lys, |, , yn, , golution ¢, , 2227, 4 : peauet, , , , , , 4009, al rent & 86,000, w.e. is higher) ne, ae fy, 1.098), , | Na, , RACNn,, , vatue (MRV 284,000 or Re, , 24:, . Deduction wl? 50% of Net Annual Value | 25, ae9, , rg eee House Property _ 60,205, , co, Tilustration ;: “nea house property. Its annual letting value is % 80,000, During the previous year is, Mr, Pramen' © a monthly rent of 7,000. He claimed the following expenses actually incurred hy hin), , atenant on, . oni Municipal Taxes paid @ 8,000., 2. Rent collection charges z 600., 3. Maintenance allowance paid to step-mother & 12,000, . according to his father's will., This house remained vacant for one month, , property for the Assessment Year 2019-20., , ‘olution :, =a Computation of Income from House Property, , , annually which was charge on the Proper, very, , during the previous year. Find out his income from house, , Sec. : 22-27 PLY. : 2013-15, (-}: Deduction u/s 24 A.Y. : 2019 29, Particulars ] z, , Gross Annual Value | 77,005, , Less : Municipal taxes 8,000, , Annual Value 7 69,000, , Less : 30% of Annual Value 20,700, , Income from House Property | 18,300, Note: 1. a) Expected rent % 80,000, , b) Actual Rent for 11 months & 77,000., , Actual rent is less than expected rent due to vacancy, hence, G.A.V. & 77,000., , 2. Other expenses are not deductible., , Illustration : 5, , Compute the income from house property from the following information :, , | zg, , Fair Rent | 72,000, Let out | 7.000 p.m, Standard Rent 60,000, Municipal Tax paid @20% of M.V., Previous year 2017 - 18 10,000, Previous year 2018 - 19 10,000, Other information :, , i) House remained vacant for two months during the previous year., , ii) Unrealized rent allowed as deduction in the Assessment year 2017-18 but 6, , previous year 2018 — 19, % 20,000, iii) Expenditure incurred on collecting unrealized rent % 5,000, iv) Arrears of rent received during the previous year & 12,000, , eceived during the

Page 3 :

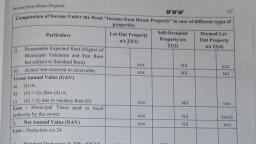

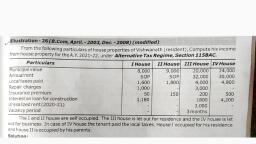

Income frem Howse Property’, , Solution : Computation 0, , SY 82's", , {Income from House Property, , Mt, , P.Y. : 2018-19, , , , , , , , , , , , , , see. 22- 27 ry. saoin, (-): Deduction u/s 24 aarirenln® |, | 70,000, ss Annual Value a, yaa Municips taxes paid om, nual Value :, pene 30% of Annual valu om, 20,000, ed ;, Ada: (i) unrealised rent realiz 2000, Less: 30% of & 20; 10 12,000, ii f rent, (ii) Arrears o! ° 108, t of £12,00!, Less: 30) Yo ' can, Income from House property 00, iG has been determined as under:, , : Fair rent, than standard rent 2 60,000. a, b) Actual rent for 10 months © 70,000., , G.AN. (a) oF (b), whichever is greater., , Mlustration : 6, , t Annual Value for the followin, , g information, , 72,000 or Municipal Value Z 50,000, whichever is more but not more, Hence, expected rent 2 60,000., , , , Compute the ne, , , , , , , , , , , , A B Cc D, zg z z | z, , — ; 60,000 | 48,000) 36,000) 96,000, Muncie yal . 75,000| 60,000} 45,000 | 1,16,000, Actual Rent 69,000 54,000 40,000 | 1,20,000, et -| 72,000| 42,000 | 1,15,000, a oil inte paid 6,000 4,800 3,600 9,600, , Solution :, Computation of Inc, , , , ome from House Property, , , , , , , , , , , , , , , , Sec. : 22-27 P.Y. : 2018-19, (-) : Deduction u/s 24 A.Y. : 2019 -20, Particulars A B Cc D, z zt - z z, 7) Municipal value 60,000, 48,000| 36,000| 96,000, ij) Fair Rental Value 75,000 60,000 45,000 } 1,16,000, iii) Standard rent _| 72,000} 42,000 | 1,15,000, a) Expected rent (i) or (ii), whichever is greater, 75,000 60,000 42,000 | 1,15,000, but not more than Standard rent, b) Actual Rent. , 69,000 54,000 40,000 | 1,20,000, G.AY. (a) or (b), whichever is greater : 75,000 60,000 42,000 | 1,20,000, Less : Municipal Taxes 6,000 4,800 3,600 9,600, Annual Value 69,000 | 55,200 38,400 | 1,10,400

Page 4 :

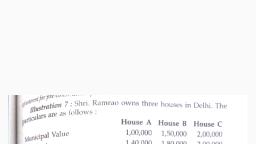

Tlustration. bh, , Shri. Shyamlal is the owner of three houses, Compute his income from house property for assessment, year 2019-20, , First House :- Self occupied for residence, municipal value % 60,000, Municipal Tax 712,000 and, interest on loan taken to purchase iton 1-5-2018 % 75,000,, , Second House :- Municipal value % 6,500 let out at % $00 per manth, Local taxes % 500, Repairs 7100,, Ground rent J 100 and collection charges & 600., , Third Wouse :- Municipal value & 3,000 used in his own business, All the above expenses have been, paid., Solution ;, , Computation of Taxable Income from House Property, , , , , , Sec. : 22 - 27 P.Y. : 2018-19, {-) : Deduction u/s 24 A.Y. : 2019 -20, Particulars | z, , Ist House (Self occupied) :, Annual Value Nil, , Less: Interest on Loan - Max. Limit 7 2,00,000 75,000, Loss 75,000, , Ind House, , G.A.V.(Expected rent § 6,500 or actual rent % 6,000, whichever is greater) * 6,500, , Less: Local Taxes paid __500, Annual Value 6,000, , Less: 30% of Annual Value 1,800, Income 4,200, , IIrd House, , Used in own business, hence not to be considered under this head, Taxable Income from House Property = 7 4,200 - 75,000, Loss = 770,800, , , , Mlustration : 12 ~~, Following are the particulars of two house properties owned by Mr. Narain., , , , , , , , , , , , | House - 1 | House - II, Municipal Valuation 96,000 90,000, Fair Rent 88,000 96,000, Standard Rent © 90,000 1,08,000, Actual rent received 9,000 p.m. 10,000 p.m., Self occupied 7 1-4-18- 30-11-18 | 1-12-18 -31-3-19, Let out 1-12-18 - 31-3-19 | 1-4-18 - 30-11-18, Municipal Taxes — Due 6,000 8,000, Paid 3,000 Nil, Interest on Borrowed Money 10,000 42,000, Loan taken to construct House-II is still outstanding. Loan was taken in 1998., Find out Mr. Swami’s income from house property ‘, Solution : ;, ‘ Computation of Income from House Property, Sec. : 22-27 P.Y. : 2018-19, {-) : Deduction u/s 24 A.Y. : 2019 -20, Particulars z z | z, Huase-! y, Municipal Valuation 96,000, Fair Rental Value * 88,000, w.e.f is higher 96,000, Standard rent 90,000, wef. is less is taken . 90,000, Actual rent received, 1-12-18 - 31-3-2019 for 4 months @ 9,000 p.m, 36,000, w.e.fis higher is gross annual value 90,000, Less : Municipal Taxes - Actually Paid 3,000, Net Annual Value | 87/000

Page 5 :

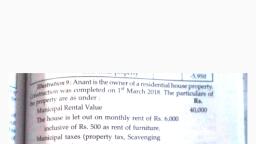

Mlustration : 14, , Mr. Raghav owns a residential house property. It has two equal residential units — Unit — I and Unit - Il., While Unit-I is self occupied by Raghav for his residential purpose; Unit — JI is let out (rent beings, % 6,000 per month, rent of two months could be recovered). Municipal value of the property is T 1,30,000,, standard rent is 1,25,000 and fair rent = 1,40,000, Municipal tax is imposed @ 15 per cent which is paid by, Raghav. Other expenses for the previous year 2018-19 being repairs 7 800. insurance 2 1,500, interest on, capital (borrowed during 1998) for constructing the property : T 63,000p.a., , Find the house property income of Raghav for the assessment year 2019-20., Solution : ., , Computation of House Property Income, of Mr. Raghav for the A/Y¥ 2019-20, , Note : Two equal residential units of a house are treated as two separate houses., , , , , , eee P.Y. : 2018-19, {-} : Deduction u/s 24 A.Y. : 2019 -20, Particulars 2 | z | z, Unit-II Let out, Municipal Value of property Rs.1,30,000 x % = 65,000, Fair rent of property ¢ 1,40,000x % =, rent 70,000, w.efis higher = ., 70,000, Standard rent of property = 1,25,000 x 4 = 4 62,500, I cannot exceed standard rent, .. value to be taken :, Actual rent receivable 7 6,000 p.m. = 72,000 se, Less : Unrealised rent for 2 months 12.000, Standard rent or Actual rent received w.e. is hi i 80,000, Gross Annual Value ethiieaials, Leas : Municipal Taxes @ 15% of M.V. (i ' 62,500, Net Annual Value Sof MLV. (ke. 15% of 65,000), , | 9,750, { 52,750