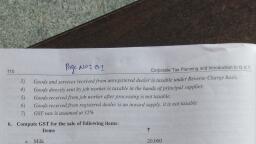

Page 1 :

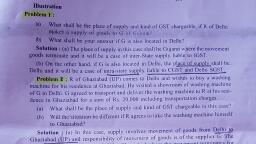

2.7.1 Value of Supply, GST = Value of Supply x Rate, , |, , , , , , Transactioni value [(ws 15(1)] Valiition Rates (u/s 15(4)], L T al i, Means [u/s15(1)] Excludes[(u/s 15(3)] Includes [(u/s 15(2)], -Price Actually -Discount shown -Taxes, Duty, Cess [except GST], paid or payable in the invoice -Amount paid by recipent, -Discount by supplier -Incidentat Exp. like packing,, after supplies commission, -Internal for delay, in payment, , 2.7.2. Illustration, , Mr, Ramakant, a manufacturer provided the following particulars. Compute the, value of machine when Mr. Ramakant has to deliver machine to factory of recipient., , Particulars Rs., Price of the machine 2,00,000, 20,000, , Packing charges, , Designing charges 40,000, Transit insurance a, i 6,0, , Freight outward, a 10,000, , Installation, , Cash discount 4% on price of machine |, , 147

Page 2 :

Solution 3, , Rs., Price of the machine 2,00,000, Add : Items to be added u/s 15(2), "Packing charges 20,000, Designing charges 40,000, [as incident to supply], Transit insurance 2,000, Freight outward 6,000, Installation 10,000, : [as connected to supply] 78,000, Less : Items to be deducted u/s 15(3) 2,78,000, : Cash discount [2,00,000x4%] (8,000), Value of supply 2.70.000, , , , Note : Here value of suply is based on transaction value as, (i) Supplier and receipient are not related, : Gi) Price is the sole consideration., Problem:2 :, Mr. Rah] privodes the following information about taxable supplies—, , Value of ‘machine (including GST @ 12%) = Rs. 5,00,000, Already added :, , 1. Testing charges Rs. 10,000, 2. Installation Planning, , (Pre-delivery) Rs. 20,000, 2, Weighing charges Rs. 30,000, , Note: :, , 1, Subsidy from Government Rs, 40,000., 2. Subsidy from NGO Rs. 10,000, 3. Trade discount Rs. 20,000, , Calculate the value of supply.

Page 3 :

Solution:, , Add:, , Less:, , Less:, , Value of machine, , Testing charges, , (as already included), Instalation charges, , (as already included), Weighting charges, , (as already included), Subsidy from NGO, Subsidy from Government, , Trade Discount, [assuning not deducted], value including GST, GST [4,90,000 x12/112], , Value of supply, , Problem 3:, , From the following information determine the val, provisions of Section 15 of the CGST Act, 2017. C, , Rs,, , 5,00,000, , 10,000, , 5,10,000, , 20,000, , 4,90,000, 52,500, 4,37,500, , , , tie of taxable supply as per, ‘ontracted value of supply of, , goods (including GST @ 18%) Rs. 11,00,000, The contracted value of supply includes, the following : :, , (1) Cost of primary packing, (2) Cost of protective packing at recipient's request for safe, , transportation, Design and engineering charges, , Other information:, , (3), , (i) Commission paid to agent by recipient on instruction of supplier, Gi) Freight and insurance charges paid by recipient on behalf of supplier, , Rs., 10,000, , 15,000, 85,000, , 5,000, 75,000, , Give reasons with suitable assumptions where necessary,

Page 4 :

Solution:, , f taxable supply_of goods :, , , , , , , , , , jon of value ©, — _— : Particulars Rs. Rs,, Contracted value of supply of goods 11,00,000, (1) Cost of primary packing Nil, (2) Cost of protective packing at recipient's request for safe Nil, transportation, (3) Design and engineering charges Nil, Add: Commission paid to agent by recipient on 5,000, instruction of supplier, Freight and insurance charges paid by recipient 75,000, on behalf of supplier 80,000, : Cum tax value 11,80,000, Less: GST @ 18% [Rs. 11,80,000 x 18 / 118] 1,80,000, Value of taxable supply 10,00,000, , , , , , , , , , , , , , , , ‘Working Notes :, For the purpose of determining the value of taxable supply, the following, adjustments shal] be made, Gg), , (2), , G), , 4), , cost of primary packing and protective packing at recipient’s request for safe, transportation charged by supplier from the recipient shall be included for, determining the value of taxable supply. Since it is already included in the, value, no treatment is required., , any amount charged for anything done by the supplier in respect of the, supply of goods at the time of, or before delivery of goods shall be included, piace! “ bee supply. Hence design and engineering charges shall, also be included in the value of taxable supply. Since it i i, , in the value, no treatment is required, i ibaecseticl eee pases, , oy sae that the supplier is liable to pay in relation to such supply but, oak as | "1 incurred by the recipient of the supply and not included in, = ae a ly paid or payable for the goods shall be included in the value, sen t ; fet en paid 2 agent by recipient on instruction of, upplier and nce charges incurred by recipi f of, ois shall form part of value of taxable ae ee, , value of supply shall not include any taxes or cesses levied under CGST Act,, , SGST Act UTGST Act; :, . bs ot and S onsati 4 if, S€par ‘ately by the supplier. the GS T(compensation to States) Act if charg, , 150

Page 5 :

Problem 4:, , From the following ; ‘|, ue f Fee information determine tj, provisions of section 15 of the CGST Act, 9 ne value of taxable sup,, Value of machine (inclu Res, , ply as per, ep ding GST @ 129, The invoice value includes the following, (1) Taxes (other than CGST/SGS, iy ee ies T/AIGST) charged Separately, , ): Rs, 15,00,000, , , , , , , , , , , , , , 15,000, (2) Weighment and loading charges, . cE 25,000, (3) Consultancy charges in relation to pre-installation 10,000, planning :, 4) Testing Chai, . Ins ee Chan eee, p arges 4,500, Other information: i, (i) Subsidy received from Central government for setting 51,000, up factory in backward region i, (ii) Subsidy received from third party for timely supply : 50,000, of machine to recipient ;, Gii) Trade discount actually allowed shown separately : 24,000, in invoice, Solution:, Computation of Value of taxable supply of Goods :, ; Rs. Rs., Particulars, , , , Value of Machine 15,00,000, , Less : Deductions, , (1) Taxes other than CGST/SGSTAGST charged separately by, the supplier, , (2) Weighment and loading charges, (3) Consultancy charges in relation to pre-inst, (4) Testing Charges, (S) Inspection charges charged before supply, , in invoi 24,000), (6) Trade discount actually allowed shown separately in invoice 24,000} ¢, , tallation planning , , , , , , , , , Add: Subsidy received from third party for timely supply of 50,000, , machine to eg me wie era, Less: GST @ 12%[Rs.15,26,000 * a2/1a) 13,62 500, Le Value of taxable supply, , , , , , , , 151 i