Page 1 :

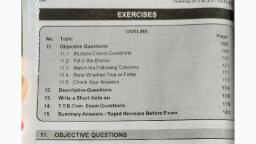

MCQ’s on Auditing., , B. Com. III, Sem. V, , B Com. III, Sem. V, Shivaji University, Kolhapur, Multiple Choice Questions on, , Advanced Accountancy (II), ( Auditing ), ( As per CBCS pattern ), From June 2020, Index, 1), 2), 3), 4), 5), 6), 7), 8), 9), 10), 11), 12), , Introduction, Relationship of Auditing with other Disciplines, Distinguish between Auditing & Investigation, Basic Principles of Governing Audit, Statutory Audit & Internal Audit, Cost Audit, Tax Audit, Management Audit, Vouching, Verification & Valuation, Audit of specific Items in Financial Statements I & II, Audit of Companies, Audit of Banks & Insurance Companies, Audit of Charitable Trust & Institutions, Audit of Hotels & Hospitals, ======××××======, , Prerna Classe, Mob. No. 8983436405, , 1

Page 2 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , Multiple Choice Questions, 1. The term audit is derived from ------------ word ‘audire’., a. British, b. Italian, c. Latin, d. None, 2. The word audire means, a. to hear, b. to see, c. to learn, d. to examine, 3. The double entry book keeping system first evolved in the year., a. 1492, b. 1494, c. 1450, d. 1488, 4. The person appointed for examination of books of accounts & other related, records, he is called as., a. Accountant, b. Auditor, c. Director, d. Manager, 5. --------- is an examination of books of accounts and other related records., a. Account, b. Audit, c. Investigation, d. None of these, 6. The work carried out by Auditor for checking (examination) of books of, accounts & other related records is called as., a. Audit, b. Accounting, c. Recording, d. None of these, , Prerna Classe, Mob. No. 8983436405, , 2

Page 3 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , 7. -------------- is instrument of Financial Control., a. Balance Sheet, b. Profit & Loss Account, c. Audit, d. Cash Flow Statement, 8. The work of audit is to be carried out by., a. Dependent Person, b. Independent Person, c. Manager, d. Director, 9. ------------ object of auditing is to ascertain whether the Balance Sheet gives, true & fair view of the state of affairs of the business at the end of the year, & to that of Profit & Loss Account gives true & fair view of the Profit or Loss, a. Primary, b. Secondary, c. Third, d. None of these, 10. To detect errors and frauds is -------- objectives of auditing., a. Primary, b. Secondary, c. Incidental, d. B & C, 11. Unintentional mistake in the books of accounts & records is called as., a. Error, b. Frauds, c. Manipulation of accounts, d. None of these., 12. Intentional errors or mistake in the books of accounts and records is called, a. Errors, b. Fraud, c. Mistake, d. None of these, 13. Wrong allocation of expenses, such as capital expenditure allocated under, the heading revenue expenditure & vice-versa is called as -------- error., a. Commission, Prerna Classe, Mob. No. 8983436405, , 3

Page 4 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , b. Omission, c. Principle, d. Compensating, 14. Some of the transactions omitted from the books of accounts is called as., a. Omission error, b. Principle error, c. Commission error, d. Compensating error, 15. Mathematical error, such as wrong posting, wrong totals etc. is called as., a. Omission error, b. Principle error, c. Commission error, d. Compensating error, 16. If the effect of one error is compensated by another error is called as., a. Omission error, b. Principle error, c. Commission error, d. Compensating error, 17.Which of the following error is affect the Trial Balance, a. Principle error, b. Complete omission error, c. Compensating error, d. Commission error, 18. Fraud includes, a. Embezzlement of cash, b. Misappropriation of goods, c. Manipulation of accounts, d. All of these, 19.Misappropriation of cash or goods generally done by, a. Employees, b. Directors, c. Top Management, d. None of these, 20.Manipulation of accounts generally done by, a. Employees, Prerna Classe, Mob. No. 8983436405, , 4

Page 5 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , b. Lower Management, c. Middle Management, d. Top Management, 21. Manipulation of accounts made by, a. Showing more profit than actual, b. Showing lower profits than actual, c. A or B, d. None of these, 22. If the Trial Balance does not tally at the end of Accounting year, then, difference is put to --------- Account & the Trial Balance is tallied., a. Suspense, b. Sundries, c. Contingencies, d. None of these, 23. For which of the following reason, that management wants to show lower, profits than actual., a. To avoid tax, b. To misguide competitor, c. To avoid demand of employees for bonus, d. All of these, 24. Which of the following method, by which profit of the business is shown, more profits than actual., a. Overvaluation of opening stock, b. Undervaluation of closing stock, c. Showing fictitious purchase, d. Overvaluation of closing stock, 25. Which of the following method by which profits of business is shown lower, profits than actual., a. Undervaluation of opening stock, b. Overvaluation of closing stock, c. Undervaluation of closing stock, d. Showing fictitious income, 26.Examination of Accounts for specific purpose is called as, a. Auditing, b. Investigation, Prerna Classe, Mob. No. 8983436405, , 5

Page 6 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , c. Vouching, d. Verification, 27. Investigation is, a. Compulsory, b. Not compulsory, c. illegal, d. None of these, 28. Investigation may involve, a. Final Audit, b. Continuous Audit, c. Re-audit, d. Balance Sheet Audit, 29. Statutory Auditor is responsible to, a. Shareholders, b. Management, c. Board of Directors, d. Suppliers, 30. Internal Auditor is responsible to, a. Shareholders, b. Management, c. Suppliers, d. Customers, 31. Internal Auditor is appointed by, a. Shareholders, b. Management, c. Supplier, d. Company Law Board, 32. The audit of certain types of undertakings are made compulsory under, statute is called as, a. Final. Audit, b. Internal Audit, c. Statutory Audit, d. Partial Audit, 33. The audit of accounts of Joint Stock Co. has been made -------- under the, Companies Act 1956., Prerna Classe, Mob. No. 8983436405, , 6

Page 7 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a. Compulsory, b. Optional, c. Not Compulsory, d. None of these, 34. Under Section 226 of the Companies Act, the appointment of qualified, Auditor is -------- for both public and private company., a. Not mandatory, b. Mandatory, c. Optional, d. None of these, 35. --------------is an independent appraisal of activities within an organization, for the review of operations by measuring and evaluation the effectiveness, of other control, a. External Audit, b. Internal Audit, c. Statutory Audit, d. None of these, 36.Object of internal audit is that of, a. To detect errors and frauds quickly, b. To improve management efficiency, c. To keep prompt preparation of final accounts, d. All of these, 37. The appointment & Remuneration of internal auditor is fixed by, a. Management, b. Shareholders, c. Creditors, d. Company law Board, 38. Internal audit is, a. Complete audit, b. Continuous audit, c. A & B, d. None of these, 39.Internal auditor is required to submit his audit report to and also, responsible to., a. Shareholders, Prerna Classe, Mob. No. 8983436405, , 7

Page 8 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , b. Management, c. Central Government, d. State Government, 40. -------------- audit is the process of verifying the cost of manufacture or, production of any article, on the basis of accounts as regards utilisation of, material or labour or other item of cost., a. Final, b. External, c. Internal, d. Cost, 41. For regulated sector companies cost audit is applicable, if the overall, turnover of all products and services during the immediately preceding the, financial year is -------- crores or more & the turnover of individual products, & services is -------- crores or more., a. 50. & 25, b. 75 & 35, c. 75 & 50, d. 60 & 35, 42. For non regulated sector companies cost audit is applicable, if the overall, turnover of all products and services during the immediately preceding the, financial year is ------ crores or more & turnover of individual products and, services is --------- crores or more., a. 50 & 25, b. 100 & 35, c. 75 & 50, d. 75 & 35, 43. The cost audit -------- the accountability for poor performance., a. Fixed, b. Change, c. Not fixed, d. None of these, 44. Cost audit is ---------- audit, a. Internal, b. External, c. Final, Prerna Classe, Mob. No. 8983436405, , 8

Page 9 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. Partial, 45. Cost Auditor is appointed by, a. Government, b. Shareholders, c. Company Law Board, d. Board of Directors, 46. Cost Auditor has to submit his audit report within prescribed time limit to, a. Shareholders, b. Central Government, c. Central Government with copy to the company, d. Board of Directors, 47. Under section ----------- cost auditor is appointed by the company in, general meetings., a. 148, b. 149, c. 150, d. 151, 48. The cost audit is conducted under the direction of, a. Shareholders, b. Board of Directors, c. Company Law Board, d. Central Government, 49. The cost audit report is to be submitted within ------- days from the close of, the financial year to which the cost audit report relates, a. 180, b. 160, c. 90, d. 60, 50. The cost audit is not included applicable to, a. Company having revenue from export of its production in foreign, exchange is more than 75% of its total revenue., b. Company which are operating from Special Economic Zone ( SEZ ), c. The company which generating electricity for captive consumption, d. All of these, 51.Which of the following person cannot be appointed as cost auditor., Prerna Classe, Mob. No. 8983436405, , 9

Page 10 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a. Body Corporate, b. Any Offers or Employee of the Company, c. Any Partner the organisation, d. All of these., 52. According to section 44 AB of the Income Tax Act 1961, any person doing, business or profession must get his accounts audited by Chartered, Accountant, if the annual sales, turnover of the business exceeds ₹ -----lakhs & for profession gross receipts exceeds ₹ ------- lakhs., a. 100 & 50, b. 75 & 25, c. 60 & 30, d. 50 & 10., 53. Tax Audit was first introduced with effect from financial year., a. 1984-85, b. 1985-86, c. 1986-87, d. 1987-88, 54. The primary object of tax audit u/s. 44AB is, a. To determine the tax liability, b. To get effective the tax planning, c. To assist the Tax Authorities in assessing the current income of the, assesse, d. None of these, 55.Tax Auditor in case of public company normally is appointed by, a. Shareholders, b. Board of Directors, c. Central Government, d. Company Law Board, 56.A person who is appointed as Tax Auditor must be., a. Chartered Accountant with holding certificate of practice, b. Chartered Accountant with holding a certificate of Registration, c. Chartered Accountant with holding a certificate of Membership, d. None of these, 57. The maximum number of tax audit that an individual Chartered Accountant, can accept in a financial year., Prerna Classe, Mob. No. 8983436405, , 10

Page 11 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a. 18, b. 25, c. 40, d. 60, 58. -------------- of the company, can remove the Tax Auditor from office, if, there were valid ground for such removal, a. Shareholders, b. Management, c. Central Government, d. Company Law Board, 59. ----------- is appraisal of management performance to ensure the, attainment of organization objectives., a. Tax Audit, b. Cost Audit, c. Management Audit, d. Statutory Audit, 60.Management Audit is an extension of, a. Tax Audit, b. Cost Audit, c. Statutory Audit, d. Internal Audit, 61. Management Auditor reports to, a. Shareholders, b. Management, c. Company Law Board ( CLB ), d. Central Government, 62.Management Audit is ----------- by law., a. Compulsory, b. Not Compulsory, c. Legal, d. None of these, 63. Management Audit begins when the work of ---------- ends., a. Financial Auditor, b. Operational Auditor, c. Internal Auditor, Prerna Classe, Mob. No. 8983436405, , 11

Page 12 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. Cost Auditor, 64. Management Audit is very close to, a. Books of Accounts, b. Balance Sheet, c. Operational Audit, d. Internal Audit, 65. Management Audit is both ---------., a. Financial & Cost Audit, b. Statutory & Internal Audit, c. Preventive & curative, d. None of these, 66. ------------- is documentary evidence by which the accuracy of the entries in, the books of accounts may be proved., a. Voucher, b. Balance Sheet, c. Profit & Loss A/c, d. None of these, 67. ------------- means the careful examination of the original evidence, such as, invoices, receipts, statements, correspondence letters, minute book, contract note etc. with a view to accuracy of the entries., a. Verification, b. Vouching, c. A & B, d. None of these, 68. ---------- is backbone of Auditing., a. Verification, b. Internal check, c. Internal control, d. Vouching, 69. Vouching may be described as, a. Verification of the accuracy & authenticity of the transaction, b. Verification of documents supporting the transaction, c. Identification of documentary evidence, d. None of these., , Prerna Classe, Mob. No. 8983436405, , 12

Page 13 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , 70. --------- comprises checking of cast, sub-cast, carry forwards & other, calculations of the books of original entry & ledger, a. Verification, b. Vouching, c. Routine checking, d. Internal checking, 71. ----------- is a method of examination to substantive an entry in the books, of account., a. Investigation, b. Auditing, c. Verification, d. Vouching, 72. Collateral voucher is an -------- voucher produced in support of business, transaction., a. Original, b. Subsidiary, c. Duplicate, d. None of these, 73. Object of vouching is that of, a. To confirm that all business transaction have been properly recorded, in the books of accounts, b. To ensure that transaction recorded pertains to business, c. To ensure that vouchers are properly authorised, d. All of these., 74. Which of the following is included in voucher, a. Date, b. Quantity, c. Rate and Amount, d. All of these., 75. As an Auditor, how it is confirm that the bill is original., a. The bill consists of GST numbers, b. The bill consist of address of business, c. The bill consists of serial number, d. The bill consist of Date of transaction, 76. Which of the following reason for rejection of voucher, Prerna Classe, Mob. No. 8983436405, , 13

Page 14 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a. If it is in the personal name, b. If not properly authorised, c. If the amount in voucher is suspicious, d. All of these., 77. Vouching is generally done by, a. Auditor himself, b. Staff of Auditor, c. Staff of the organisation, d. None of these, 78. Verification is generally done by, a. Auditor himself, b. Staff of Auditor, c. Staff of organization, d. None of these, 79. Verification of arithmetical accuracy of Accounting entries and to ensure, that ledger accounts are properly balanced is the main objective of, a. Internal audit, b. Test checking, c. Vouching, d. Routine checking, 80. ------ is the process of physical examination of assets shown in the balance, sheet, a. Verification, b. Vouching, c. Valuation, d. Investigation, 81. Vouching is generally done ----------., a. Through out the year, b. At the end of the year, c. At beginning of the year, d. None of these, 82. Verification is done, a. Throughout the year, b. At end of Financial Year, c. At middle of the year, Prerna Classe, Mob. No. 8983436405, , 14

Page 15 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. At beginning of the year, 83. -------- of assets implies an enquiry into the value, ownership & title ,, existence & possession, presence of any change in the assets., a. Verification, b. Vouching, c. Valuation, d. Investigation, 84. The value of assets after its normal working life is over, is called as, a. Cost value, b. Scrape value, c. Market value, d. None of these, 85. ------- is reliable and relevant evidence, that assets is owned by the, business concern, a. Invoice, b. Proforma invoice, c. Counter copy of cheque book, d. None of these, 86. --------- means determining the proper value of assets and liabilities shown, in balance sheet., a. Vouching, b. Verification, c. Investigation, d. Valuation, 87. Valuation of stock in trade is made at, a. Cost price, b. Market price, c. Cost price or Market price which ever is lower, d. Cost price or Market price which ever is more, 88. If the investment are held as floating Assets as in the finance company they, are to be valued at, a. At Cost price, b. At Market price, c. At Cost price or Market price which ever is more, d. At cost price or Market price which ever is lower, Prerna Classe, Mob. No. 8983436405, , 15

Page 16 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , 89. Audit of shipment of goods, the auditor has to see that shipment is done, with, a. Approval of concerned authorities, b. Agreement of customer, c. Recording in Outward Registration, d. All of these., 90. While auditing of income from rent, the auditor need to check, a. Rent Agreement, b. Tenant business, c. A & B, d. None of these, 91. The Audit of insurance Expenses, the auditor has to check, a. Policy document, b. Validity period, c. Pre-paid Insurance properly recorded, d. All of these, 92. The Audit of sale of products or services is work out by, a. Internal Auditor, b. External Auditor, c. Cost Auditor, d. Tax Auditor, 93. Ever business organisation has to pay ----- on its Profit., a. GST, b. CGST, c. SGST, d. Income-Tax, 94. ERP means, a. Enterprises Resource Planning, b. Early Resource Planning, c. Ever Resource Planning, d. None of these, 95. The most popular ERP Software is, a. Windows, b. Tally, c. MSCIT, Prerna Classe, Mob. No. 8983436405, , 16

Page 17 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. None of these, 96. The Audit of items in financial statements always goes through., a. Occurrence / evidence, b. Valuation, c. Disclosure, d. All of these, 97. -------- defines the condition on which allotment will be made, the project, on which the amount raised shall be spent & to specify limits on certain, expenses incidental to raising of capital., a. Prospectus, b. Memorandum of Association, c. Articles of Association, d. Minute book, 98. ---------- capital which is authorised by Memorandum of Association of the, Company to be maximum amount of share capital of the Company., a. Subscribed, b. Authorised, c. Issued, d. Paid-up, 99. Which of the following steps to be followed by Auditor, while audit of, share capital, a. Verify the existence of share capital, b. Ensure that correct share capital is disclosed in balance sheet, c. Check the total paid up shares capital & arrears if any., d. All of these, 100., Securities Premium A/c can be utilised to, a. Write off preliminary expenses, b. Write off Commission, brokerage paid on shares, c. To Issue bonus shares, d. All of these., 101., When the shares are repurchased by the company is called as, a. Bonus shares, b. Right shares, c. Buy Back, d. None of these, Prerna Classe, Mob. No. 8983436405, , 17

Page 18 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , 102., If shares are issued to existing shareholders, without any, consideration is called as, a. Bonus shares, b. Right shares, c. Buy back shares, d. None of these, 103., Diminishing value of tangible assets is called as, a. Depreciation, b. Amortization, c. Depletion, d. None of these, 104., Diminishing value of intangible assets is called as, a. Depreciation, b. Amortization, c. A& B, d. Depletion, 105., Audit of Long Term Borrowings means, a. Audit of mortgage loan, b. Audit of Debentures, c. A & B, d. Audit of Cash Credit, 106., Contingent Liability is shown as, a. Current Liability, b. Non-current Liability, c. Notes to Balance Sheet, d. None of these, 107., Cash & cash equivalents includes, a. Cash in hand, b. Cash at bank, c. Cheques, drafts on hand, d. All of these., 108., Which of the following is not capital expenditure, a. Purchase of land & building, b. Purchase of plant & machinery, c. Purchase of furniture, Prerna Classe, Mob. No. 8983436405, , 18

Page 19 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. None of these, 109., Wages paid to workers is classified as, a. Revenue Expenditure, b. Capital Expenditure, c. Deferred Revenue Expenditure, d. None of these, 110., Advertisement Expenses paid for next three years is classified as, a. Revenue Expenditure, b. Capital Expenditure, c. Deferred Revenue Expenditure, d. None of these, 111., Which of the following is not revenue expenditure, a. Repairs & renewal of land & building, b. Legal expenses, c. Wages & salaries paid to direct workers, d. Development Expenses on land., 112., Which of the following is not included in Intangible assets, a. Goodwill, b. Patents & Trademarks, c. Computer Software, d. Computer Hardware, 113., While audit of Trade Receivable, the auditor should obtain ------evidence, which is most reliable., a. Confirmation letter from customer, b. Debtors list, c. Credit Memos & Receipts, d. None of these, 114., Qualification of Company Auditor deals in section ---- of Co. Act. 2013, a. 141, b. 139, c. 140, d. 142, 115., Appointment of Co. Auditor deals in section ----- of Act. 2013., a. 141, b. 139, Prerna Classe, Mob. No. 8983436405, , 19

Page 20 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , c. 142, d. 143, , @@ Following are sections of Companies, Act.2013. to be remember.@@, 139:- Appointment of Auditor, 140:- Removal of Auditor, 141:- Qualification of Auditor, 142:- Remuneration of Auditor, 143:- Powers & Duties of Auditor, 144:- not to render certain services, 145:- to sign the Audit Report, 146:- Right to attend general meeting, , 116., , Which of the following services not to be rendered by Co. Auditor., a. Accounting & Book keeping services, b. Internal audit, c. Investment advisory services, d. All of these., 117., Types Audit report includes., a. Qualified, b. Unqualified, c. Disclaimer & Adverse opinion, d. All of these, 118., Companies Auditors Report Order (CARO) is applicable from, Financial Year, a. 2012-13, b. 2013-14, c. 2014-15, d. 2015-16, 119., CARO is not applicable to, a. Banking Company, b. Insurance company, Prerna Classe, Mob. No. 8983436405, , 20

Page 21 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , c. Charitable Trust, d. All of these, 120., Auditor of Public Ltd Co. are generally appointed by, a. Director, b. Shareholder, c. Company Law Board, d. Central Government, 121., The first Auditor of the Co. will hold office till the conclusion of ------of the Company., a. First Annual General Meeting, b. Statutory General Meeting, c. Extra- Ordinary General Meeting, d. Emergency General Meeting, 122., The subsequent auditor of the Company are appointed by, a. Shareholders, b. Members of the Company, c. A & B, d. Directors of the Company, 123., The Chartered Accountant Act was enacted in the year, a. 1948, b. 1949, c. 1951, d. 1956, 124., Statutory duties of the Company Auditor are determined by, a. Articles of Association, b. Memorandum of Association, c. Prospectus, d. Companies Act. 2013, 125., To report to the management of the company is ---------- duty of the, Author., a. Casual, b. Compulsory, c. Statutory, d. None of these, 126., Which of the following can be appointed as Co. Auditor, Prerna Classe, Mob. No. 8983436405, , 21

Page 22 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a., b., c., d., , A Body Corporate, Any Offers or Employee of the Company, Director, None of these, 127., All books of accounts, other books, paper & all financial statements, are required to get audited for every financial year by., a. Internal Auditor, b. External Auditor, c. Board of Directors, d. Employees or officers of the Company, 128., Due to some reason the auditor may not get the required, information & explanation, non availability of books of accounts, in that, case the auditor have to give., a. Disclaimer opinion, b. Adverse opinion, c. Qualified opinion, d. Unqualified opinion, 129., While conducting audit, the auditor found that there is misleading or, fraudulent statement in financial statements, the auditor has to give, a. Disclaimer opinion, b. Adverse opinion, c. Qualified opinion, d. Unqualified opinion, 130., Which of the following can be appointed as Co. Auditor, a. Body Corporate, b. Any Officer or Employee of the Company, c. A & B, d. A firm in which all partners are Chartered Accountant, 131., Joint auditor are required to submit ------- Audit Report, a. Separate, b. Common, c. A & B, d. Final, 132., If any joint auditor disagree with opinion or conclusion, he shall, express his opinion in --------- Audit Report, Prerna Classe, Mob. No. 8983436405, , 22

Page 23 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a., b., c., d., , Separate, Common, Joint, Final, 133., If audit of branch or branches is performed by the separate branch, auditor/ auditors required to submit his audit report to, a. Company Law Board, b. Internal Auditor, c. Head Office of Statutory Auditor, d. Government, 134., Bank Audit is also called as, a. Balance Sheet Audit, b. Partial Audit, c. Cost Audit, d. Internal Audit, 135., Bank Auditor has to attend the bank at --------- date of the financial, year., a. Beginning, b. Closing, c. Middle, d. None of these, 136., Section 17 of the Banking Companies Act is required to transfer at, least ------- % of net profits to Statutory Reserve., a. 10, b. 15, c. 20, d. 30, 137., For banking companies -------- audit is compulsory., a. Concurrent, b. Cost, c. Partial, d. Internal, 138., Statutory Auditor of Banking Companies is appointed by RBI in, association with, a. Registrar of Co., Prerna Classe, Mob. No. 8983436405, , 23

Page 24 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , b. Central Government, c. CLB, d. ICAI, 139., The Statutory Auditor should ensure that the Audit Report issued by, them complies with requirements of revised ---------., a. SA 700, b. SA 800, c. SA 500, d. SA 600, 140., Loans & Advances which are overdue or stop generating Income for, banks continuously for ----- days or more are called as NPA., a. 60, b. 90, c. 120, d. 180, 141., As an Bank Auditor, he have to check all the tax related items &, compliances that are applicable to bank, such as., a. TDS, 15G & 15H, b. TDS, 13 G & 13H, c. TDS, 14 G & 14H, d. TDS, 16 G & 16H, 142., Which one of the following is largest items on liability side of Balance, Sheet of a bank., a. Share Capital, b. Reserve & Surplus, c. Deposits, d. Borrowings., 143., Which one of the following is largest items in the Assets side of bank, Balance Sheet., a. Cash in hand & Balance with RBI, b. Investment, c. Fixed Assets, d. Advances, 144., The Bank Auditor should obtain & examine certificate for --------with/from Reserve Bank of India., Prerna Classe, Mob. No. 8983436405, , 24

Page 25 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , a., b., c., d., , Cash borrowings, Cash deposit, Cash withdrawal, None of these, 145., Life Insurance business in India nationalised in., a. 1947, b. 1948, c. 1949, d. 1956, 146., The Auditor of Insurance Company, he have the full knowledge of, Insurance Act., a. 1938, b. 1939, c. 1949, d. 1951, 147., --------- is the main source of income of Insurance Company, a. Claims, b. Premium, c. Commission, d. None of these, 148., -------- is the main expenses of Insurance Co., a. Claims, b. Premium, c. Commission, d. None of these, 149., The claims paid by Insurance Company should be vouched with, claims Register maintained u/s. --------., a. 13, b. 14, c. 15, d. 16, 150., In case of Life Insurance business whole of excess receipts over, expenses transfer to ------ ., a. Life Assurance Fund, b. Profit & Loss Account, Prerna Classe, Mob. No. 8983436405, , 25

Page 26 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , c. General Profit & Loss A/c, d. Net Revenue Account, 151., In case of General Insurance business, Reserve for Unexpired Risk is, to be maintained at ------ % of net premium., a. 100, b. 50, c. 30, d. 20, 152., In case of Marine Insurance business, Reserve for Unexpired Risk is to, be maintained at ----- % of net premium., a. 100, b. 50, c. 40, d. 30, 153., Commission paid to Agent by Insurance Company, should be, vouched with vouchers & --------- ., a. Appointment letter of agent, b. Agreement with agent, c. Agreement with policyholders, d. None of these., 154., The Author of Insurance Company has to relay on, a. Test checking, b. Detailed checking, c. Internal Audit, d. None of these, 155., As an Auditor of Insurance Company, he has to ensure that the, expenses of management do not cross the limit laid down u/s. ------., a. 14, b. 40, c. 41, d. 42, 156., The General Insurance business is nationalised in., a. 1949, b. 1950, c. 1951, Prerna Classe, Mob. No. 8983436405, , 26

Page 27 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , d. 2972, 157., Regulation of insurance business in India is done through., a. IRDA, b. RBI, c. SEBI, d. Government, 158., The annual accounts of the Insurance Company must be prepared in, accordance with --------- provisions., a. CLB, b. Legal, c. IRDA, d. None of these, 159., An Audit firm cannot accept the audit of more than -------- insurer., a. 3, b. 4, c. 7, d. 10., 160., As an Auditor of Trust, he has to check., a. Trust Bye Laws, b. Rules & Regulations, c. Application of Funds, d. All of these., 161., The Author of Charitable Trust should verify whether the ----- & ----number of trustees are maintained., a. Maximum Minimum, b. Minimum, Minimum, c. Maximum, Maximum, d. None of these, 162., The Auditor of Charitable Trust, should see whether Receipts & ------are properly recorded in the books of accounts., a. Incomes, b. Payments, c. Expenses, d. Assets, , Prerna Classe, Mob. No. 8983436405, , 27

Page 28 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , 163., Any special matter which the auditor may think fit or necessary to, bring to the notice of the., a. Government, b. Management of Trust, c. Deputy or Assistant Charity Commissioner, d. None of these, 164., The SA’s announced by ICAI introduced to the audit of charitable, trust u/s. --------- of the Income-Tax Act. 1961., a. 15A(1) (c), b. 17A(1) ( e ), c. 16A(1) (d), d. 12A(1) (b), 165., The Auditor or team of Auditors must be -------- expert, a. Technical, b. Computer, c. IT, d. None of these, 166., Private Hospital includes., a. Partnership, b. Charitable Trust, c. Private Ltd. Hospital, d. All of these, 167., If a Hotel is maintained weekly trading A/c, the Auditor has to check ------- Trading Accounts., a. 48, b. 52, c. 50, d. 47, 168., In modern days most of the hotels use ----- for room management., a. Properly management system software, b. Tally software, c. A& B, d. None of these., e., ========××××××=======, Prerna Classe, Mob. No. 8983436405, , 28

Page 29 :

MCQ’s on Auditing., , B. Com. III, Sem. V, , Answer Sheet, 1) c., 2) a., 3) b., 10) d., 11) a., 12) b., 19) a, 20) d, 21) c, 28) c, 29) a, 30) b, 37) a., 38) c, 39) b., 46) c., 47) a., 48) d., 55) b, 56) a., 57) d., 64) c, 65) c, 66) a, 73) d., 74) d., 75) a., 82) b., 83) a., 84) b., 91) d, 92) b., 93) d., 100) d. 101) c. 102) a., 109) a 110) c, 111) d, 118) d. 119) d. 120) b., 127) b. 128) a. 129) a., 136) c. 137) a. 138) d., 145) d. 146) a. 147) b., 154) a. 155) b, 156) d, 163) c. 164) a. 165) c., , 4) b., 13) c., 22) a, 31) b, 40) d., 49) a., 58) b., 67) b, 76) d., 85) a., 94) a., 103) a., 112) d, 121) a., 130) d., 139) a., 148) a., 157) a, 166) d., , 5) b., 14) C, 23) d, 32) c, 41) a., 50) d., 59) c., 68) d, 77) b., 86) d., 95) b., 104) b., 113) a, 122) c., 131) b., 140) b., 149) b., 158) b, 167) b., , 6) a., 15) c., 24) d, 33) a, 42) b., 51) d., 60) d., 69) a., 78) a., 87) c., 96) d., 105) c., 114) a, 123) c., 132) c, 141) a., 150) a., 159) a, 168) a, , 7) c., 16) d., 25) c, 34) b., 43) a., 52) a., 61) b., 70) c., 79) c., 88) d., 97) a., 106) c, 115) b., 124) d., 133) c., 142) c., 151) b., 160) d, ---., , 8) b., 17) d., 26) b, 35) b., 44) b., 53) a., 62) b., 71) d., 80) a., 89) d., 98) b, 107) d, 116) d., 125) c., 134) a, 143) d., 152) a., 161) a, -----., , 9) a., 18) d, 27) b, 36) d, 45) d, 54) c, 63) a, 72) b, 81) a, 90) a, 99) d, 108) d, 117) d, 126) d, 135) b, 144) b, 153) b, 162) b, ----, , ===========××××××××==========, , Prerna Classe, Mob. No. 8983436405, , 29