Page 1 :

Problem No: 07, , Calculate operating leverage and financial leverage from the following., Sales Rs 1,00,000 at Rs 5 per unit, , Variable cost Rs 1 per unit, , Fixed cost Rs 1,00,000, , Interest expenditure Rs 20,000., , Problem N »: O8, , , , Determine the three types of leverages from the following data., Selling price per unit Rs. 10, variable cost per unit Rs. 6, fixed cost Rs.1,20,000,, 10% debt capital of Rs. 3,00,000, Numter of units sold 90,000., , Preblem No: 09, , , , , , Determine the three types of leverages from the following. Selling, price per unit Rs.250, variable cost 30%, fixed cost 6,25,900, 10% debt capital, of Rs. 5,00,000, Number of units sold 25,000., , Problem No: 10, , Sales of Re.2,00,000, variable cost 40% of sales and fixed expenses are, Rs 60,000, interest on barrowed capital is assumed to be Rs 20,000., , Calculate the leverages and show the impact of taxable income, when, sales increased by 10%., , Problem No: 11, , Following information is taken from the records of company., Sales 800 units, selling price per unit Rs. 10,, , variable cost per unit Rs. 7., , Calculate the leverages under the following situations:, Fixed cost: 1st situation Rs. 800, , 2n4 situation Rs. 1200., , , , 1, Scanned with CamScanner

Page 2 :

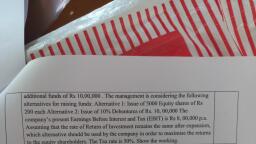

Problem No: 12, , Problem No: 12, , operating and combined, , Co: ; 10 6 — ‘am Hh, mpare two companies in terms of its financial, , leverages:, , Particulars Firm-A Firm-B, Sales 20,00,000 30,00,000, Variable cost 40% of sales 30% of sales, Fixed cost 5,00,000 7,00,000, Interest 1,00,000 1,25,000., , Interpret the results of the firm. |, ola, fh, Sort *, !, , avatlal*ty of, , e capital of Rs 5,00,000 divided into shares cf Rs, her Rs 3,00,000 for modernization., , SESH SD exin?, ee 5) emning, , , , ABC co. Itd has equity shar, 100 each. It wishes to raise furt, , The company plans the following financing schemes., , a) All equity shares., b) Rs 1,00,000 in equity shares and Rs 2,00,000 in 10% debentures., c) Allin 10% debentures., 10% preference shares., , quity shares and Rs 2,00,000 in 10, , d) Rs 1,00,000 ine, BIT is Rs 2,00,000. The corporate tax is 50%., , The company’s ©), Calculate EPS in each case and give a commentas to which capital structure, , is suitable., , , , Problem No: 14, , Problem No: i, and, , siness requiring capital of Rs 20,00,006, 44, , {%, , It proposed to start a bu, , assumed 20% return on investment., , , , Calculate EPS under following situations:, , h equity capital of, 0% interest an', , a) The entire amount throug! Rs. 100 each., d 50% through equity share, , b) If 50% raised through debt at 1, , capital., c) If all amount js raised through deb! at 12% interest., and 75% is raised thro, , d) If 25% is raised through equity ugh debt at 10%, , interest., , Problem No: 45, g capital of Rs. 10,00,000 and assumed 15% return on, , It is proposed requirin,, investment., , Calculate Earnings per share., (a) If the entire capital is raised by Rs. 100 per equity share., , (b) 50% raised by equity shares and 50% raised by 10% debentures., , (c) Ignore tax at 50%,, , 5?, , Scanned with CamScanner

Page 3 :

Problem No: 16, , Bharat Itd, has 6,00,000 equity shares of Rs 10 cach, ‘The company wants to, , raise another capital Rs 30,00,000. These are the different financial plans. Tax, rate is 50%,, , a) All debentures carrying 10% interest., b) All equity., , c) Rs 20,00,000 in equity shares and Rs 10,00,000 in debentures carrying, at 10% interest., , d) Rs 10,00,000 in equity shares and Rs 20,00,000 in 10% preference, shares., Calculate EPS if EBIT is (, 1) Rs 13,50,000 :, 2) Rs 10,80,000., , Za, , Problem No: 17, , X limited is capitalized with Rs 10,00,000 at 1,00,000 equity shares of Rs., , 10 each. The management desires to raise another capital of Rs 10,00,000 for, expansion programme., , (a) Al! equity shares, , (b) Rs. 5,00,000 ir: equity shares and balance in debentures of 10% intcrest., (c) Atl debentures carrying 8% interest., , (d) Rs. 5,00s00 in equity shares and 5,00,000 preference shares at 10% dividend., The EBIT is Rs. 1,20,000 per anum., , Calculate EPS in all plans. And ulso calculate EPS if EBIT is doubled due, to expansion programme., , Problem No: 18, , A company has EBIT of Rs._4,80,0C0 and its capital structure consists of, the following securities:, , 1. Equity share capital of Rs. 10 each Rs. 4,00,000., 2. 12% of Preference shares of Rs. 6,900,000., 3. 14.5% debentures of Rs. 10,00, G0., , The company is facing fluctuatior.s in its sales., , What would be the change in EPS., , a) {f the EBIT of the company increases by 25%. ~*, , b) If the EBIT of the company decreases by 7B”, The company tax rate is 35%., , Scanned with CamScanner

Page 4 :

Problem No: 19, fica Determine EPS of acompany which has operating profit Rs. 1,80,000 and, pital structure consists of the following:, , Equity shares of Rs. 100 each Rs 5,00,000, 10% preference shares of Rs. 2,00,000, 12% debentures of Rs. 8,00,000. |, , Calculate EPS, and ,, If EBIT increases by 25% and decreases by 25% and also tax is 45%., , Problem No: 20, , The capital structure of ABC Co., Ltd. consists of the following data., , 10% debentures of Rs. 5,00,000, 12% preference shares of Rs. 1,00,000., , Equity shares of Rs. 100 each of Rs. 4,00,000., Operating profit (EBIT) of Rs. 1,60,000 and the company is in 50% of tax., , PS., , a) Determine the companies E!, hange in EPS associated with 30% increases, , b) Determine the percentage c!, and 30% decreases in EBIT., , Problem No: 21, apital of Rs.10,00,000 in shares of Rs.10, , The POR ltd, has equity share c, each and debt capital of Rs 10,00,000 at 20% interest rates. The output of the, company is increased by 50% from 1,00,000 units to 1,50,000 units., , The selling price of Rs. 10 per unit, variable cost of Rs. 6 per unit and, fixed cost amounted to 5,00,000, tax rate is 40%., , You're required to calculate the following:, , a) The percentages increases in EPS, 1,00,000 units and 1,50,000 units., , b) The degree of financial leverage at, f operating leverage at 1,00,000 units and 1,50,000 units., , c) The degree 0, , n limited., consists of, , Problem No: 22, are) and 10,00,000 of, , The capital structure o, equity share capital of Rs. 10,00,000 (sh, , 20% of debentures, , f the progressive corporatio, ares of 10 per sh, , , , Scanned with CamScanner

Page 5 :

[0 ), , on, , Sheres! increased by 25% from 2,00,000 units to 2,50,000 units. The, sem price of Rs. 10 per unit, variable cost of Rs. 6 per unit and fixed expenses, , amount to 2,50,000, income tax rate is assumed to be 50%. You're required to, calculate the following:, , Q d) The percentages increases in EPS, be) The degree of financial leverage at 2,00,000 units and 2,50,000 units., c f) The degree of operating leverage at 2,00,000 units and 2,50,000 units., , Problem No: 23, , , , The existing capital structure of ABC Ltd. is as follows:, , Equity shares of Rs. 100 each 40,00,000. (09, ©, , Retained earnings Rs. 10,00,000 ae, , 9% preference shares of Rs. 25,00,000 ov 00, 007 +360 56 oX Ww, . 7% debentures of Rs. 2: 00, 000 yor zt bo, , The company carns 12% on its capital: The income tax at? is 50%, Company wants to raise Rs. 25) 00,000 for its expansion project tor which it is ;, considering following alternatives (for which it is considering) : ....--++-+.+++, , a) Issue of Rs. 20,000 equity shares at a premium of Rs. 25 per shares., b) Issue of 10% preference shares., ec} Issue of $% debentures., , Projected that the Price es Earning Ratio in case of equity, preference and, debentures finanzing would be 20, 17, and 16 respectively., , Calculate EPS ard Market price per share., , Problem no. 24, , The balance sheet of company is as follows, , , , , , , , , , , , , , , , , , Liabilities Amount | Assets Amount, Equity shares of Rs 10 each | 6,00,000 | Fixed assets 15,00,000, 10% debentures 8,00,000 | Current assets 5,00,0CO, P&L A/c 2,00,000, Creditors 4,00,000, , 20,00,CO0O 20,00,000, , , , The company tota! assets turnover ratio is 5 times. Its fixed operating expenses, are Rs 10,00,000 and variable cost is 30%, income tax 50%., , 1) Calculate all the leverages., , 2) Show the likely levels of EBIT, if EPS is, a) 5 b)3 ce) 2, , Scanned with CamScanner