Page 1 :

Chapter-7 Hire Purchase System, Introduction- Today every seller wants to maximize his profit which can be achieved either by, cutting of cost of product or increasing the price of product and or maximisation of customers., First one is very difficult because there is continuous increase in the cost of factors of production, and another one is seem to be better for him. That is why he makes every effort to increase it’s, number of buyers (customer). In this regard, he tries to provide lot of opportunities to buyers to, his products. He gives incentives to buyer in terms cash voucher, gifts and financial support to, the buyer. On the other hand, every buyer also wants to buy precious commodities by investing, minimum cost at one time. So he would like some way of getting goods from seller by paying, some payment at the time of delivery and remaining in some time after. The seller, to maximize, his sales revenue, becomes ready to transfer his product on credit basis provided that some, payment at the time of delivery and remaining in certain instalments together with interest on, unpaid balance on each instalment and transfer the ownership (title) after receiving whole, payment. The buyer also agrees to get the possession of the goods by paying some payments, immediately and remaining in affordable instalments. The buyer enjoy goods like his own and, makes timely payment. If the buyer fails to pay amount due instalment , he lost the right to keep, his possession. This system of buying and selling of goods on credit is called Hire Purchase, System., In this way Hire Purchase System is the system of one credit buying and selling system in which, the buyer gets possession of goods immediately after entering in the agreement of sale and, agrees to pay price of the goods in certain instalments and enjoy the product like his own. The, sellers agrees to transfer the title of goods to buyer only after getting complete price of the, goods. In case the buyer makes default in payment of any instalment on said date, the seller has, right to repossess the goods and forfeit the amount paid by the buyer treat as rent of the goods, for the use of goods. Technically speaking, it is an agreement between the buyer, of the asset and the financing company whereby the financing company, purchases the asset on behalf of the buyer and the buyer utilized it for, business purpose and pays back to the financing company in small, installments called hire charges., , In other words, hire purchase system can be defined as an option of, financing or acquiring an asset for use whereby the financing company, let the goods on hire to the buyer against small installments called hire, charges and the buyer gets the right to use the asset with an option to, purchase the asset by paying all such installments spread over a period, of time. Hire purchase system is very prominent for vehicle financing, whether that is a personal car, commercial vehicle etc but now, equipment, machinery etc are also financed with the hire purchase, method. If the hirer makes default in the payment of any installment, the hire

Page 2 :

vendor has the right to re-possess the goods. When the vendor re-possesses the, goods due to the default of payment of installment, in this case the amount, already paid so far by the hirer will be forfeited., Features of Hire Purchase Systems- this system of purchase and sales is helpful in enhancement, of sales volume of seller and give him security of payment and goods and other hand for buyer, convenient to get precious goods on easy payment option. It is divine for the buyer who are, unable to collect heavy amount at one time. Following special features makes it more attractive1. Special credit buying and selling system- hire purchase system is a credit purchase, system which have some special feature like payment in fixed instant, possession of goods, to buyer, agreement of sale and transfer of ownership etc., 2. Transfer of goods from buyer to seller- when the buyer and seller enter in the agreement, of purchase and sale, the goods immediately transfer to the buyer and he can use the, goods like his own property., 3. Payment in instalment- the amount (price) payable by the buyer to the seller is divided, in easy parts. These part payment with interest are called instalment. The seller insures, that he would get a fixed sum on a specific date., 4. Transfer of ownership- the title of the goods vest to the seller until the last payment was, made by the buyer . The title is transferred to the buyer after last instalment is paid., 5. Sale on hire purchase price- agreement to sale is done for transfer of goods on hire, purchase price. Normally this price is greater than cash price because it includes total, interest payable on instalment., 6. Interest is chargeable at prescribed- under this system, interest payable on each, instalment is payable at prescribed rate mentioned in the agreement. Interest is charged, on unpaid cash balance on each instalment., 7. Down payment – payment made by the buyer at the time of delivery of the goods is called, down payment or Nazrana. Remaining amount is paid in prescribed instalments payable, on specific date., 8. In case of default goods return to the seller- under hire purchase agreement, it is, expected that the buyer will make payment of instalment at prescribed date. If the buyer, defaults to pay any instalment at due date, he will have to return goods to the vendor., 9. Seller forfeit amount-when the buyer makes fault in payment, the seller has right to, forfeit the amount paid by the buyer till this date. Amount paid till the date of non, payment of instalment is treated as the rent for the use of goods ., 10. Responsibility for repair and maintenance- in the agreement of hire purchase system, if, provided the seller makes necessary repair and maintenance up to warranty period. If the, goods is insured repair and replacement will be done by insurance authority., 11. Hire Vendor- the seller who agrees to sell goods under the agreement of hire purchase, and is ready to receive payment in instalment, is called hire vendor. A “Hire Vendor” is

Page 3 :

an owner or seller of the good who delivers the goods to the hirer under a hire, purchase system., 12. Hire Purchaser- a buyer or purchaser who agrees to take goods under the agreement to, sale and pay the price in specific instalments, is called hire purchaser. He use this goods, or property like his own and undertook due care. A “Hirer” in general terms implies, the buyer of a good or a person who obtains a good from the owner or the seller, under hire purchase system., 13. Hire purchase price- goods under purchase agreement are sold on hire purchase price., This is agreed price and includes interest for hire purchase periods. This price is greater, than, market, price., hire, purchase, price, 14. Statutory charges – to make agreement legal, some necessary expenses are incurred., These expenses are called Statutory expenses., Interest = C.I.×R×T÷100, Where- C.I. stands for cash balance on instalment, R stands for rate of interest, T stand for time between two payment., Conditions to be kept in mind while entering into a Hire-Purchase agreement:, 1. Before entering into such an agreement, the hire-purchaser must enquire as to the, rightful owner of the asset because it may so happen that the goods are lent on hire by, someone who is not the rightful owner., 2. Keeping a check on the cumulative installment amount as the cumulative installment, must not exceed the actual amount of the asset., 3. Both the parties to the agreement must have a copy of the agreement., 4. There must be transparency and the agreement should be mutually agreeable to both the, parties., 5. The Hire-purchase is such an agreement that can be changed as per the convenience of, both the parties as long as the parties’ consent to it., Merits of the Hire-Purchase Agreement:, 1. There is convenience in making payments for the goods. The hire-purchaser can become, the owner of the goods on payment of installments., 2. The Seller also benefits from this kind of transaction as this increases the volume of sales, and the profit from the sales.

Page 4 :

3. The amount that the seller gets from the installments includes the original price and, interest. The interest is calculated in advance and added to the installment price to be, paid by the hirer., 4. From the point of view of the seller, in case there is a default in payment by the hirepurchaser, the goods shall be returned to him., Demerits of the Hire-Purchase Agreement :, 1. The hire-purchaser has to pay a higher price for the asset as compared to buying the, product outright. The cost price includes the rate of interest., 2. The duration of most of the hire-purchase agreement is usually long and stringent., 3. Hiring never comes with actual ownership in the event of default, the seller repossesses, the goods., 4. The hire-purchase agreement creates an artificial demand for the asset. The hirepurchaser is tempted to purchase the goods even when he cannot afford to buy it., 5. The seller also runs a heavy risk under this system though he has the right to take back, the goods in the event of default of payment. The second-hand goods fetch a little price, and few customers., 6. It has been observed that the sellers don’t always get easy recovery of the goods nor do, they get installments paid on time. They have to waste a lot of time and effort to get the, recovery of the goods and leads to serious court battles between the seller and the hirepurchaser., Accounting Treatment of Hire Purchase System- under hire purchase system transactions are, occurred in between two parties Hire Vendor and Hire Purchaser. Both the parties maintain, accounting records in their own books of accounts., Journal entries in the books of Hire Purchaser, 1. When assets (goods) under hire purchase is acquiredAssets A/C, Dr., X XX, To Hire Vendor's A/C., XXX, (Being assets purchased from hire before under hire purchase system), 2. For Payment made at the time of deliveryHire Vendor's A/C., Dr. XXX, To Bank A/C., XXX, (Being payment made on delivery of goods), 3. When instalment becomes due, Interest A/C., Dr. XXX, To Hire Vendor's A/C., XXX, (Being interest becomes due on instalment), 4. For payment of instalment, Hire Vendor's A/C., Dr. XXX

Page 5 :

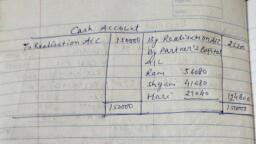

To Bank A/C., XXX, (Being payment due on instalment is made to vendor), 5. For charge of depreciation on value of Assets, Depreciation A/C, Dr. XXX, To Assets A/C., XXX, (Being Depreciation is charged @.. of on value), 6. For transfer of amount of interest and depreciationProfit & Loss A/C, Dr. XXX, To Interest A/C., XXX, To Depreciation A/C., XXX, (Being amount of interest and depreciation is transferred to P&L a/c), Note- first two entries are made only first year and remaining entries made till last payment to, the vendor. In ledger mostly two accounts are prepared- Goods (Assets) account and Hire, Vendor's account., Journal entries in the books of Hire Vendor, 1. When goods sold on hire purchase system, Hire Purchaser's A/C., Dr. XXX, To Hire Sales A/C., XXX, (Being goods sold to hire purchaser under the agreement of hire purchase), 2. For amount received on delivery of goods, Bank A/C., Dr. XXX, To Hire Purchaser's A/C., XXX, (Being amount received from hire purchaser), 3. For instalment becomes due, Hire Purchaser's A/C., Dr. XXX, To Interest A/C., XXX, (Being interest becomes due on instalment), 4. For payment on instalmentBank A/C., Dr. XXX, To Hire Purchaser's A/C., XXX, (Being amount received on instalment), 5. For transfer of sales amount in trading accountHire Sales A/C., Dr. XXX, To Trading A/C., XXX, (Being amount of sales under hire sales agreement is transferred to P&L account), 6. For transfer of interest amount in profit and loss account, Interest A/C., Dr., XXX, To Profit & Loss A/C., XXX, (Being amount of interest on instalment is transferred to P&L account)

Page 6 :

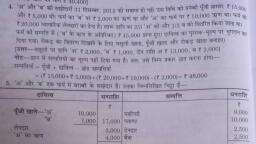

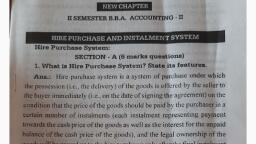

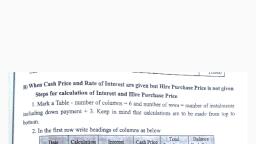

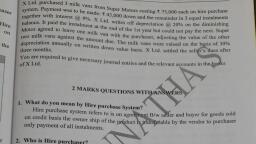

Note- entries for sale, down payment and transfer of sales amount are done only once., Remaining entries will continue till last instalment., PROCESS OF CALCULATION AND ALLOCATION OF INTEREST, Under Hire-Purchase System, the price quoted is more than what it ought to be, when such sale or purchase is on cash (Lump sum payment is made or received in, single instalment or one time) . In accounting procedure, the excess of total hirepurchase price over cash price denotes the payment for interest or statutory, charges. To put it in a simple form of equation:Interest = Total Hire-Purchase Price – Total Cash Price., In the real sense, the total hire price consists of two components:(1) Payments towards cash price – this is treated as purchase of asset – hence, this, component, in the accounting concept, is treated as capital item and so Capital, Expenditure., (2) The second component, i.e. interest is a financial gain or loss – for seller it is gain, and for buyer it is loss. In such case, it is of revenue nature, it has to be recorded in, Profit and Loss Account only., Hence, the necessity arises to separate the two. After separation, it will then be, allocated between revenue and capital., 1. When Rate of Interest is given in the problem(A) when interest is included in the instalment- in this situation interest is calculated, on the outstanding cash balance not on purchase price., Example- Ramesh Kumar purchased a Mobile phone from Balaji Mobile World on hire purchase, system. He paid रु 10000 immediately (January 1st , 2017) and remaining in 4 annual instalment, of रु 11000 each payable on at the end the year. The Cash price of mobile is रु 48500. The, vendor charges interest @ 5% per annum on unpaid balance. Purchaser made depreciation, @15% on written down value method. All the instalment were paid timely. Pass the necessary, journal entries and prepare ledger account in both the hire vendor and hire purchaser's books., Solution:Cash Price of Mobile = रु 48500.

Page 7 :

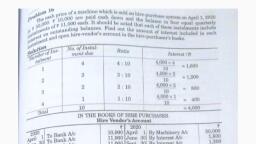

Hire Purchase Price = रु (10000 D.P. + 11000×4), = रु 54000., Interest Included = Hire Purchase Price - Cash Price., = 55000-48500 = रु 6500, , Analytical Table, Outstanding Cash Balance Calculation of Interest Interest Instalment Cash Paid on Instalment, Cash Price, , = 48500, , Down Payment =10000, 1st Instalment. =38500, Cash Paid., , 11000, , 11000-1925= 9075, , 29425×5÷100, , 1471, , 11000, , 11000-1471= 9529, , 19897×5÷100, , 995, , 11000, , 11000-995= 10005, , 11000-9891, , 1109, , 11000, , 9891, , 5500, , 44000, , 38500, , . = 9529, , 3rd Instalment = 19896, Cash Paid, , 1925, , =9075, , 2nd Instalment =29425, Cash Paid, , 38500×5÷100, , . = 10005, , 4rth Instalment = 9891, Total, , Illustration 2-