Page 1 :

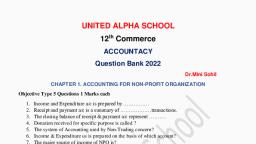

31, , F.Y.B.Com, ELECTIVE COURSES (EC), DISCIPLINE SPECIFIC ELECTIVE, (DSE) COURSES, SEMESTER - I, UBCOMFSI.1- ACCOUNTANCYAND, FINANCIAL MANAGEMENT I, SUBJECT CODE : UBCOMFSI.1

Page 3 :

CONTENTS, Unit No., , Title, , Page No., , SEMESTER - I, MODULE - 1, , 1, , Introduction to accounting standards, , 1, , 2., , AS - 1 Disclosure of Accounting Policies, , 13, , 3., , AS - 2 Valuation of Inventories, , 25, , 4., , AS- 9 Revenue Recognition, , 52, , 5., , Inventory Valuation - I, , 65, , 6., , Inventory Valuation II -, , 80, , 7., , Capital, Revenue Expenditure & Receipts, , 98, , MODULE -2, , 8., 9., , Final Accounts of Manufacturing Concern - I, (Proprietary Firm), , 134, , Final Accounts II, , 165, , MODULE -3, , 10., , Departmental Accounts - I, , 198, , 11., , Departmental Accounts - II, , 217, , MODULE -4, , 12., , Hire Purchase - I, , 241, , 13., , Hire Purchase - II, , 257, ,

Page 4 :

I, , Revised Syllabus of Courses of B.Com. Programme, , Elective Courses (EC), Discipline Specific Elective (DSE) Courses, , Accountancy and Financial Management I, Semester- I, Modules at a Glance, Sr. No., , Modules, , 1, , Accounting standards issued by ICAI and Inventory, valuation, , 2, , Final Accounts, , 3, , Departmental Accounts, , 4, , Accounting for Hire Purchase, , Sr.No., , Modules / Units, , 1, , Accounting standards issued by ICAI and Inventory, valuation, , , Accounting standards:, Concepts, benefits, procedures for issue of accounting, standards Various AS :, AS – 1: Disclosure of Accounting Policies, Purpose, Areas of Policies, Disclosure of Policies,, Disclosure of Change in Policies, Illustrations, AS – 2: Valuation of Inventories (Stock), Meaning, Definition, Applicability, Measurement of, Inventory, Disclosure in Final Account, Explanation, with Illustrations., AS – 9: Revenue Recognition, Meaning and Scope, Transactions excluded, Sale of, Goods,, Rendering, of, Services,, Effects, of, Uncertainties, Disclosure, Illustrations.

Page 5 :

II, Inventory Valuation, Meaning of inventories Cost for inventory valuation, Inventory systems : Periodic Inventory system and, Perpetual Inventory System Valuation: Meaning and, importance, Methods of Stock Valuation as per AS – 2 :, FIFO and Weighted Average Method Computation of, valuation of inventory as on balance sheet date: If, inventory is taken on a date after the balance sheet or, before the balance sheet, , 2, , Final Accounts, Expenditure: Capital, Revenue Receipts:, Revenue Adjustment and Closing Entries, , Capital,, , Final accounts of Manufacturing concerns (Proprietary, Firm), , 3, , Departmental Accounts, Meaning, Basis of Allocation of Expenses and Incomes/Receipts, Inter Departmental Transfer : at Cost Price and Invoice, Price Stock Reserve Departmental Trading and Profit &, Loss Account and Balance Sheet, , 4, , Accounting for Hire Purchase, Meaning Calculation of interest, Accounting for hire purchase transactions by asset, purchase method based on full cash price, Journal entries, ledger accounts and disclosure in balance, sheet for hirer and, vendor (excluding default, repossession and calculation of, cash price)

Page 6 :

III, , Question Paper Pattern, Question, No, Q-1, , Q-2, Q-2, Q-3, Q-3, Q-4, Q-4, Q-5, Q-5, Q-6, , Q-6, , Particular, , Marks, , Objective Questions, 20 Marks, A) Sub Questions to be asked 12 and to, be answered any 10, B) Sub Questions to be asked 12 and to, be answered any 10, (*Multiple choice / True or False / Match, the columns/Fill in the blanks), Full Length Question, OR, Full Length Question, , 15 Marks, , Full Length Question, OR, Full Length Question, , 15 Marks, , Full Length Question, OR, Full Length Question, , 15 Marks, , Full Length Question, OR, Full Length Question, , 15 Marks, , A) Theory questions, B) Theory questions, OR, Short Notes, To be asked 06, To be answered 04, , 15 Marks, , 15 Marks, , 15 Marks, , 15 Marks, 10 Marks, 10 Marks, 20 Marks, , Note:, Question of 15 marks may be divided into two sub questions, of 7/8 and 10/5 Marks.

Page 8 :

1, , Unit-1, INTRODUCTION TO ACCOUNTING, STANDARDS, Unit Structure:, 1.0, 1.1, 1.2, 1.3, 1.4, 1.5, 1.6, 1.7, 1.8, 1.9, 1.10, , Objectives, Introduction, Meaning of Accounting Standards, Formation of the Accounting Standards Board, Scope of Accounting Standards, Procedure for Issuing an Accounting Standard, Compliance with the Accounting Standards, List of the Accounting Standards as issued by ICAI, List of IAS / IFRS and corresponding IND AS notified by, MCA, List of IFRS issued by IASB, Questions, , 1.0, , OBJECTIVES, , After studying the unit students will be able to:, Understand the meaning of Accounting Standard., Know the scope of Accounting Standard., Understand the composition, objectives and functions of, Accounting Standard Board., Explain the procedure for issuing Accounting Standards., Know the list of Accounting Standards issued by ICAI, , 1.1, , INTRODUCTION, , Financial statements are prepared to summarize the endresult of all the business activities by an enterprise during an, accounting period in monetary terms. These business activities, vary from one enterprise to the other. It is very difficult to compare, the financial statements of different reporting enterprises because, of different methods and principles adopted by these business, enterprises in preparing their financial statements. Accounting, standards are evolved to make these methods and principles

Page 9 :

2, uniform and financial statements comparable to the possible extent., Following are the different group of persons interested in the, financial statements:1., 2., 3., 4., 5., 6., 7., 8., , Bankers, Shareholders, Investors, Creditors, Customers, Employees, Competitors, Income tax/Sales tax/Excise authorities, , 1.2, , MEANING OF ACCOUNTING STANDARDS, , 1.2.1 MEANING, ‘Accounting Standards are written, policy documents, issued by expert accounting body or by Government or other, regulatory authorities covering the aspects of recognition,, measurement, treatment, presentation and disclosure of accounting, transaction in the financial statement.’ The main purpose of, formulating accounting standard is to standardize the diverse, accounting policies with a view to eliminate to the extent possible, the incomparability of information provided in financial statements, and add reliability to such financial statements. Accounting, standards ensure the consistency and the comparability of the, financial statements reported by the different enterprises creating a, general sense of confidence that users have in the fairness and, reliability of the statements they rely., Accounting Standards will not, however, apply to, enterprises only carrying on the activities which are not of, commercial, industrial or business nature, e.g., an activity of, collecting donations and giving them to flood affected people., Exclusion of an enterprise from the applicability of the Accounting, Standards would be permissible only if no part of the activity of, such enterprise is commercial, industrial or business in nature., Even if a very small proportion of the activities of an enterprise are, considered to be commercial, industrial or business in nature, the, Accounting Standards would apply to all its activities including, those which are not commercial, industrial or business in nature., 1.2.2 OBJECTIVES:, 1. To standardise the diverse accounting policies., 2. To standardise the accounting practices., 3. To enhance the reliability of financial statements., 4. To eliminate non-comparability of financial statements

Page 10 :

3, 1.2.3 ADVANTAGES:, 1. It provides the accountancy profession with useful working rules., 2. It assists in improving quality of work performed by accountant., 3. It strengthens the accountant’s resistance against the pressure, from directors to use accounting policy which may be suspect in, that situation in which they perform their work., 4. It ensures the various users of financial statements to get, complete crystal information on more consistent basis from, period to period., 5. It helps the users to compare the financial statements of two or, more organizations engaged in same type of business, operation., 1.2.4, , DISADVANTAGES:, , 1. Users are likely to think that said statements prepared using, accounting standard are foolproof., 2. They have been derived from social pressures which may, reduce freedom., 3. The working rules may be rigid or bureaucratic to some users of, financial statement., 4. The more standards there are, the more costly the financial, statements are to produce., , 1.3, , FORMATION OF THE ACCOUNTING, STANDARDS BOARD, , The Institute of Chartered Accountants of India (ICAI),, recognizing the need to harmonize the diverse accounting policies, and practices in use in India, constituted the Accounting Standards, Board (ASB) on 21st April, 1977., 1.3.1 COMPOSITION OF THE ACCOUNTING STANDARDS, BOARD (ASB), The composition of the ASB is fairly broad-based and, ensures participation of all interest-groups in the standard-setting, process. Apart from the elected members of the Council of the ICAI, nominated on the ASB, the following are represented on the ASB:, 1., , Nominee of the Central Government representing the, Department of Company Affairs on the Council of the ICAI., , 2., , Nominee of the Central Government representing the Office of, the Comptroller and Auditor General of India on the Council of, the ICAI.

Page 11 :

4, 3., , Nominee of the Central Government representing the Central, Board of Direct Taxes on the Council of the ICAI., , 4., , Representative of the Institute of Cost and Works Accountants, of India., , 5., , Representative of the Institute of Company Secretaries of, India., , 6., , Representatives of Industry Associations (1 from Associated, Chambers of Commerce and Industry (ASSOCHAM), 1 from, Confederation of Indian Industry (CII) and 1 from Federation of, Indian Chambers of Commerce and Industry (FICCI), , 7., , Representative of Reserve Bank of India, , 8., , Representative of Securities and Exchange Board of India, , 9., , Representative of Controller General of Accounts, , 10. Representative of Central Board of Excise and Customs, 11. Representatives of Academic Institutions (1 from Universities, and 1 from Indian Institutes of Management), 12. Representative of Financial Institutions, 13. Eminent professionals co-opted by the ICAI (they may be in, practice or in industry, government, education, etc.), 14. Chairman of the Research Committee and the Chairman of, the Expert Advisory Committee of the ICAI, if they are not, otherwise members of the Accounting Standards Board, 15. Representative(s) of any, appropriate by the ICAI, , other, , 1.3.2 OBJECTIVES, BOARD, , ACCOUNTING, , OF, , THE, , body,, , as, , considered, , STANDARDS, , The following are the objectives of the Accounting Standards, Board:, i. To conceive of and suggest areas in which Accounting, Standards need to be developed., ii. To formulate Accounting Standards with a view to assist the, Council of the ICAI in evolving and establishing Accounting, Standards in India., iii. To examine how far the relevant International Accounting, Standard/International Financial Reporting Standard can be, adapted while formulating the Accounting Standard and to, adapt the same.

Page 12 :

5, iv. To review, at regular intervals, the Accounting Standards from, the point of view of acceptance or changed conditions, and, if, necessary, revise the same., v. To provide, from time to time, interpretations and guidance on, Accounting Standards., vi. To send comments on various consultative papers such as, exposure drafts, discussion papers etc., issued by, International Accounting Standards Board and various other, International bodies such as Asian-Oceania Standard-Setters, Group (AOSSG)., vii. To carry out such other functions relating to Accounting, Standards., 1.3.3 FUNCTIONS OF THE ACCOUNTING STANDARDS BOARD, The main function of the ASB is to formulate Accounting, Standards so that such standards may be established by the ICAI, in India. While formulating the Accounting Standards, the ASB will, take into consideration the applicable laws, customs, usages and, business environment prevailing in India., The ICAI, being a full-fledged member of the International, Federation of Accountants (IFAC), is expected, inter alia, to actively, promote the International Accounting Standards Board’s (IASB), pronouncements in the country with a view to facilitate global, harmonization of accounting standards. Accordingly, while, formulating the Accounting Standards, the ASB will give due, consideration to International Accounting Standards (IASs) issued, by the International Accounting Standards Committee (predecessor, body to IASB) or International Financial Reporting Standards, (IFRSs) issued by the IASB, as the case may be, and try to, integrate them, to the extent possible, in the light of the conditions, and practices prevailing in India., , 1.4 PROCEDURE FOR ISSUING AN ACCOUNTING, STANDARD, The Accounting Standards are issued under the authority of, the Council of the ICAI. The ASB has also been entrusted with the, responsibility of propagating the Accounting Standards and of, persuading the concerned parties to adopt them in the preparation, and presentation of financial statements. The ASB will provide, interpretations and guidance on issues arising from Accounting, Standards. The ASB will also review the Accounting Standards at, periodical intervals and, if necessary, revise the same. The

Page 13 :

6, following procedure, Standards:, , is, , adopted, , for, , formulating, , Accounting, , 1. The ASB determines the broad areas in which Accounting, Standards need to be formulated and the priority in regard to the, selection thereof., 2. In the preparation of Accounting Standards, the ASB will be, assisted by Study Groups constituted to consider specific, subjects. In the formation of Study Groups, provision will be, made for wide participation by the members of the Institute and, others., 3. The draft of the proposed standard will normally include the, following:, a) Objective of the Standard,, b) Scope of the Standard,, c) Definitions of the terms used in the Standard,, d) Recognition and measurement principles, wherever, applicable,, e) Presentation and disclosure requirements., 4. The ASB will consider the preliminary draft prepared by the, Study Group and if any revision of the draft is required on the, basis of deliberations, the ASB will make the same or refer the, same to the Study Group., 5. The ASB will circulate the draft of the Accounting Standard to, the Council members of the ICAI and the specified bodies for, their comments., 6. The ASB will hold a meeting with the representatives of, specified bodies to ascertain their views on the draft of the, proposed Accounting Standard. On the basis of comments, received and discussion with the representatives of specified, bodies, the ASB will finalize the Exposure Draft of the proposed, Accounting Standard., 7. The Exposure Draft of the proposed Standard will be issued for, comments by the members of the Institute and the public. The, Exposure Draft will specifically be sent to specified bodies (as, listed above), stock exchanges, and other interest groups, as, appropriate., 8. After taking into consideration the comments received, the draft, of the proposed Standard will be finalized by the ASB and, submitted to the Council of the ICAI., The Council of the ICAI will consider the final draft of the, proposed Standard and if found necessary, modify the same in

Page 14 :

7, consultation with the ASB. The Accounting Standard on the, relevant subject will then be issued by the ICAI., , 1.5 COMPLIANCE WITH THE ACCOUNTING, STANDARDS, Accounting Standards are mandatory from the respective, dates mentioned in the standards. Hence, it is the duty of the, management to see that all the Accounting Standards are complied, with while preparing financial statement, in the case of any, deviation, necessary disclosure should be made in the audit report, so as to make the readers aware of the deviations., The mandatory status of an Accounting Standard implies, that while discharging their attest functions, it will be the duty of the, members of the Institute, (a) To examine whether ‘Statements’ relating to accounting matters, are complied with in the presentation of financial statements, covered by their audit. In the event of any deviation from the, ‘Statements’, it will be their duty to make adequate disclosures in, their audit reports so that the users of financial statements may be, aware of such deviations; and, (b) To ensure that the ‘Statements’ relating to auditing matters are, followed in the audit of financial information covered by their audit, reports. If for any reason a member has not been able to perform, an audit in accordance with such ‘Statements’, his report should, draw attention to the material departures there from., , 1.6 LIST OF THE ACCOUNTING STANDARDS AS, ISSUED BY ICAI, The council of the Institute of the Chartered Accountants of, India has so far issued 32 Accounting Standards, However AS- 8, on Accounting for Research and Development (stands withdrawn, after introduction of AS-26), thus effectively there are 31, Accounting standards.

Page 15 :

8, Accounting, Standard No., , Title of Accounting Standard, , AS-1, , Disclosure of Accounting Policies, , AS-2, , Valuation of Inventories, , AS-3, , Cash Flow Statements, , AS-4, , Contingencies and Events (Occurring after, the Balance Sheet Date), , AS-5, , Net Profit or Loss for the Period, Prior, Period Items and Changes in Accounting, Policies, , AS-6, , Depreciation Accounting, , AS-7, , Construction Contracts, , AS-8, , Accounting for Research and Development, (standard withdrawn after introduction of, AS-26), , AS-9, , Revenue Recognition, , AS-10, , Accounting for Fixed Assets, , AS-11, , The Effect of Changes in Foreign, Exchange Rates, , AS-12, , Accounting for Government Grants, , AS-13, , Accounting for Investments, , AS-14, , Accounting for Amalgamations, , AS-15, , Employee Benefits, , AS-16, , Borrowing Cost, , AS-17, , Segment Reporting, , AS-18, , Related Party Disclosures, , AS-19, , Leases, , AS-20, , Earnings per Share, , AS-21, , Consolidated Financial Statements, , AS-22, , Accounting for Taxes on Income, , AS-23, , Accounting for Investment in Associates in, Consolidated Financial Statements, , AS-24, , Discontinuing Operations, , AS-25, , Interim Financial Reporting

Page 16 :

9, AS-26, , Intangible Assets, , AS-27, , Financial Reporting of Interests in Joint, Venture, , AS-28, , Impairment of Assets, , AS-29, , Provisions, Contingent Liabilities and, Contingent Assets, , AS-30, , Financial Instruments: Recognition and, Measurement, , AS 31, , Financial Instruments: Presentation, , AS 32, , Financial Instruments: Disclosures, , 1.7 LIST OF IAS / IFRS AND CORRESPONDING IND, AS NITIFIED BY MCA, IAS No., , Title, , Corresponding, Converged IND, AS, , IAS-1, , Presentation of Financial, Statements, , IND AS 1, , IAS-2, , Inventories, , IND AS 2, , IAS- 7, , Cash Flow Statements, , IND AS 7, , IAS-8, , Accounting policies, change in, accounting estimates and errors, , IND AS 8, , IAS-10, , Events after the Balance Sheet, date, , IND AS 10, , IAS-12, , Income Taxes, , IND AS 12, , IAS-16, , Property, Plants and Equipment, , IND AS 16, , IAS- 17, , Leases, , IND AS 17, , IAS-19, , Employees Benefits, , IND AS 19, , IAS-20, , Accounting for Government, Grants and Disclosure of, Government Assistance, , IND AS 20, , IAS-21, , The Effect of Changes in, Foreign Exchange Rates, , IND AS 21, , IAS-23, , Borrowing Costs, , IND AS 23

Page 17 :

10, IAS-24, , Related Party Disclosures, , IAS-26, , Accounting and Reporting by, Retirement Benefit Plan, , IAS-27, , Consolidated and Separate, Financial Statements, , IND AS 27, , IAS-28, , Investments in Associates and, Joint Ventures, , IND AS 28, , IAS-29, , Financial Reporting in Hyper, Inflationary Economies, , IND AS 29, , IAS-32, , Financial Instruments :Presentation, , IND AS 32, , IAS-33, , Earnings per Share, , IND AS 33, , IAS-34, , Interim Financial Reporting, , IND AS 34, , IAS-36, , Impairment Assets, , IND AS 36, , IAS-37, , Provisions, Contingent Liabilities IND AS 37, and Contingent Assets, , IAS-38, , Intangible Assets, , IND AS 38, , IAS-40, , Investment Property, , IND AS 40, , IAS-41, , Agriculture, , IND AS 24, , IND AS 41, , 1.8 LIST OF IFRS ISSUED BY IASB, IFRS:The term ‘IFRS’ includes standards and interpretations approved by, IASB and the International Accounting Standards and, interpretations issued by the International Financial Reporting, Interpretations Committee., International Accounting Standards Board (IASB) has issued the, following International Financial Reporting Standards (IFRS):IAS No., , Title, , Corresponding, Converged IND AS, , IFRS-1, , First Time Adoption of IFRS, , IND AS 101, , IFRS-2, , Share based payments, , IND AS 102, , IFRS-3, , Business Combination, , IND AS 103, , IFRS-4, , Insurance Contracts, , IND AS 104

Page 18 :

11, IFRS-5, , Non-currents Assents held for, sale and discontinued, operations, , IND AS 105, , IFRS-6, , Exploration for and evaluation, of mineral resources, , IND AS 106, , IFRS-7, , Financial instruments:, disclosure, , IND AS 107, , IFRS-8, , Operating segment, , IND AS 108, , IFRS-9, , Financial instruments, , IND AS 109, , IFRS-10, , Consolidated Financial, Statements, , IND AS 110, , IFRS-11, , Joint Arrangement, , IND AS 111, , IFRS-12, , Disclosure of Interest in Other, Entities, , IND AS 112, , IFRS-13, , Fair Value Measurement, , IND AS 113, , IFRS-14, , Regulatory Deferral Accounts, , IND AS 114, , IFRS-15, , Revenue from contracts with, customers, , IND AS 115, , IFRS-16, , Leases, , -, , 1.9 QUESTIONS, 1. What do you understand by Accounting standard?, 2. What is the need and purpose of accounting standards?, 3. Briefly explain the importance of accounting standards?, 4. What is the duty of the auditor in case of non-compliance of, mandatory accounting standard?, 5. Briefly explain the procedure for issuing an accounting, standard?, 6. Select Correct Alternative:, i. Accounting standards are important, 1. For making correct financial statements, 2. For correct valuation of inventories, 3. For correct treatment of depreciation and lease and, investment, 4. All of the above

Page 19 :

12, ii. Accounting standards are statements prescribed by, 1. Law, 2. Bodies of shareholders, 3. Professional accounting bodies, 4. All of the above, iii. The Policy of ‘anticipate no profit and provide for all possible, losses’ arises due to convention of, 1. Consistency, 2. Disclosure, 3. Conservatism, 4. All of Above, iv.Accounting has certain norms to be observed by the, accountants in recording of transactions and preparation of, financial statements. These norms reduce the vagueness and, chances of misunderstanding by harmonizing the varied, accounting practices. These norms are, 1. Accounting regulations., 2. Accounting guidance notes., 3. Accounting standards., 4. Accounting framework., v. Following is the example of external users:, 1. Government., 2. Owners., 3. Management., 4. Employees., vi. Following is the example of internal users:, 1. Government., 2. Investors., 3. Creditors., 4. Employees., vii. The information provided in the annual financial statements, of an enterprise pertain to, 1. Business Industry., 2. Economy., 3. Individual business entity., 4. None of the above., Answers: i-4, ii-3, iii- 3, iv-3, v-1, vi-4, vii-3, ,

Page 20 :

13, , Unit-2, AS-1 DISCLOSURE OF ACCOUNTING, POLICIES, Unit Structure:, 2.0, 2.1, 2.2, 2.3, 2.4, 2.5, 2.6, 2.7, 2.8, 2.9, , Objectives, Introduction, Meaning and Nature of Accounting Policies, Areas of different Accounting Policies, Notes to Accounts, Disclosure of Accounting Policies, Disclosure of Change in Accounting Policies, Illustrations, Practical Applications, Questions, , 2.0, , OBJECTIVES, , After studying the unit students will be able to:, , , , , , , , Understand the meaning and nature of accounting policies., Explain the areas of different accounting policies., Know the disclosure of accounting policies., Know the disclosure of change in accounting policies., Give some examples of significant accounting policies., Solve the practical problems related to accounting policies., , 2.1, , INTRODUCTION, , Accounting Standard (AS) 1 issued by the Accounting, Standards Board, the Institute of Chartered Accountants of India on, ‘Disclosure of Accounting Policies’ deals with the disclosure of, significant accounting policies followed in preparing and presenting, financial statements. It may be noted that this Accounting Standard, is now mandatory for use by companies listed on a recognized, stock exchange and other large commercial, industrial and, business enterprises in the public and private sectors. Accounting, Standards are intended to apply only to items which are material.

Page 21 :

14, , 2.2 MEANING AND NATURE OF ACCOUNTING, POLICIES, ‘Accounting policies are the specific accounting principles, and methods of applying those principles adopted by the enterprise, in the preparation and presentation of the financial statements.’ E.g., to depreciate fixed asset of the company over a period of time is, accounting policy and which method should follow to depreciate the, asset (SLM or WDV) is method of accounting., There is no single list of accounting policies which are, applicable to all circumstances. The differing circumstances in, which enterprises operate in a situation of diverse and complex, economic activity make alternative accounting principles and, methods of applying those principles acceptable., IMPORTANCE OF ACCOUNTING STANDARD (AS) 1, The view presented in the financial statements of an, enterprise of its state of affairs and of the profit or loss can be, significantly affected by the accounting policies followed in the, preparation and presentation of the financial statements. The, accounting policies followed vary from enterprise to enterprise., Disclosure of significant accounting policies followed is necessary if, the view presented is to be properly appreciated. The disclosure of, some of the accounting policies followed in the preparation and, presentation of the financial statements is required by law in some, cases., PURPOSE OF ACCOUNTING STANDARD (AS) 1, The disclosure of significant accounting policies, manner in which accounting policies are disclosed in the, statements would facilitate better understanding of, statements and a more meaningful comparison between, statements of different enterprises., , and the, financial, financial, financial, , FUNDAMENTAL ACCOUNTING ASSUMPTIONS, The Financial Statements are prepared with the following three, Fundamental Accounting Assumptions. Unless otherwise, specified, it is assumed that the Financial Statements are prepared, according to following assumptions:, 1. Going Concern,, 2. Consistency,, 3. Accrual.

Page 22 :

15, They are explained as follows:, 1. Going Concern:, The enterprise is normally viewed as a going concern, that, is, as continuing in operation for the foreseeable future. It is, assumed that the enterprise has neither the intention nor the, necessity of liquidation or of curtailing materially the scale of the, operations., 2. Consistency:, It is assumed that accounting policies are consistent from, one period to another., 3. Accrual:, Revenues and costs are accrued, that is, recognized as they, are earned or incurred (and not as money is received or paid) and, recorded in the financial statements of the periods to which they, relate., It is mandatory to disclosure if the above mentioned, assumptions are not followed., , 2.3, , AREAS OF DIFFERENT ACCOUNTING POLICIES, , The following are examples of the areas in which different, accounting policies may be adopted by different enterprises., Methods of depreciation, depletion and amortization, Treatment of expenditure during construction, Conversion or translation of foreign currency items, Valuation of inventories, Treatment of goodwill, Valuation of investments, Treatment of retirement benefits, Recognition of profit on long-term contracts, Valuation of fixed assets, Treatment of contingent liabilities., CONSIDERATIONS IN THE SELECTION OF ACCOUNTING, POLICIES, The primary consideration in the selection of accounting, policies by an enterprise is that the financial statements prepared, and presented on the basis of such accounting policies should, represent a true and fair view of the state of affairs of the enterprise, as at the balance sheet date and of the profit or loss for the period, ended on that date.

Page 23 :

16, For this purpose, the major considerations governing the, selection and application of accounting policies are:—, 1. Prudence, 2. Substance over Form, 3. Materiality, They are explained as follows:, 1. Prudence: In view of the uncertainty attached to future events,, profits are not anticipated but recognized only when realized, though not necessarily in cash. Provision is made for all known, liabilities and losses even though the amount cannot be, determined with certainty and represents only a best estimate in, the light of available information. Example of Prudence is to, select an accounting policy where inventory valuation is at lower, of cost or net realizable value., 2. Substance over Form: The accounting treatment and, presentation in financial statements of transactions and events, should be governed by their substance and not merely by the, legal form. Best example of this assumption can be state is hire, purchase. If company is purchasing any asset on hire purchase, system then purchaser is not legal owner at the time of, purchase. In hire purchase ownership is transferred on the, payment of the last installment but actually the asset is in the, possession of purchaser and he is using in his business, operation, so substantially he is better owner than legal. It, should be recorded in the books of purchaser., 3. Materiality: Financial statements should disclose all “material”, items, i.e. items the knowledge of which might influence the, decisions of the user of the financial statements. That means if, profit & loss accounts contains an irregular transaction which is, not routine and probably effects shareholders or investors, the, same should be disclosed separately. Example- Any expense, having amount more than Rs.5000 or 1% of turnover whichever, is higher should be disclosed separately rather to club with, miscellaneous expenses., , 2.4, , NOTES TO ACCOUNTS, , Notes to accounts are the explanation given by the, management about the items in the financial statements i.e. Profit, and Loss Account and Balance Sheet. The management of the, institute has to give more explanation and information as regards, the items given in the Profit and Loss Account and Balance Sheet, and any other item in the way of notes to accounts. E.g. Disclosure

Page 24 :

17, of details of contingent liability by notes to accounts. Notes to, accounts are part and parcel of the financial statement., , 2.5, , DISCLOSURE OF ACCOUNTING POLICIES, , To ensure proper understanding of financial statements, it is, necessary that:1. All significant accounting policies adopted in the preparation and, presentation of financial statements should be disclosed., 2. The disclosure of the significant accounting policies as such, should form part of the financial statements and the significant, accounting policies should normally be disclosed in one place., 3. Disclosure of accounting policies or of changes therein cannot, remedy a wrong or inappropriate treatment of the item in the, accounts., 4. If the fundamental accounting assumptions of Going Concern,, Consistency and Accrual are followed in financial statements,, specific disclosure is not required. If a fundamental accounting, assumption is not followed, the fact should be disclosed., , 2.6 DISCLOSURE OF CHANGE IN ACCOUNTING, POLICIES, A change in the accounting policies should be made in, the following conditions:, 1. Adoption of different accounting policies is required by statue, or for compliance with an Accounting Standard., 2. It is considered that change would result in more appropriate, presentation of financial statements., In case if there is a change in accounting policies, the, following information must be disclosed:, 1. Any change in the accounting policies which has a material, effect in the current period or which is reasonably expected to have, a material effect in later periods should be disclosed., 2. In the case of a change in accounting policies which has a, material effect in the current period, the amount by which any item, in the financial statements is affected by such change should also, be disclosed to the extent ascertainable. Where such amount is not, ascertainable, wholly or in part, the fact should be indicated.

Page 25 :

18, , 2.7, , ILLUSTRATIONS, , Significant accounting policies can be found in financial, statements of public companies. Some examples of significant, accounting policies are as follows:, 1. Inventories, This significant accounting policy comes from 2017-18, annual financial statements of Zimmer Holdings, Inc., Inventories are stated at the lower of cost or market, with, cost determined on a first-in first-out basis., 2. Property and Equipment, This significant accounting policy comes from 2017-18, annual financial statements of Google, Inc., We account for property and equipment at cost less, accumulated depreciation and amortization. We compute, depreciation using the straight-line method over the estimated, useful lives of the assets, generally two to five years. We, depreciate buildings over periods up to 25 years. Depreciation for, equipment commences once it is placed in service and depreciation, for buildings and leasehold improvements commences once they, are ready for our intended use. Land is not depreciated, 3. Cash and Cash Equivalents, This significant accounting policy comes from 2017-18, annual financial statements of Hill-Rom, Inc., We consider investments in marketable securities and other, highly liquid instruments with a maturity of three months or less at, date of purchase to be cash equivalents. Investments which have, no stated maturity are also considered cash equivalents., , 2.8, , PRACTICAL APPLICATIONS, , 1. A Company has switched over to weighted average formula for, ascertaining the cost of inventory, from the earlier practice of using, FIFO. The closing inventory by using FIFO is Rs. 4 lakh and that by, weighted average formula is Rs.3.85 lakh. Explain the Accounting, Treatment/Disclosures as necessary, Ans: The fact that change in accounting policy pull down profit and, value of inventory by Rs.15,000 is to be disclosed., 2. Shreya’s Ltd. prepared Profit and Loss Account and the Balance, Sheet for the year 2017-18.The accounting policies about Profit and

Page 26 :

19, Loss Account have been disclosed below Profit and Loss Account, and accounting policies about Balance Sheet have been disclosed, before Balance Sheet. Comment, Ans: As per AS-1, the accounting policies adopted for preparation, of final accounts should form part of the final accounts. These, policies should be disclosed at one place only forming part of the, accounts. It should not be disclosed separately., 3. PG Ltd. prepared Profit & Loss Account and Balance Sheet on, cash basis. Comment., Ans: As per AS-1, accrual basis is the fundamental accounting, assumption. The company follows cash basis. The fundamental, accounting assumption is not followed; it should be disclosed in the, form of a note to the accounts., 4. Akshata Ltd. prepared final accounts for the year 2017-18., During the year accident took place in the factory, the worker who, got injured lodged a claim of Rs.3,00,000 against the company .The, claim is under dispute, the accountant did not mention this in the, accounts, Comment., Ans. Claim for compensation under dispute is a contingent liability., As per AS-1, it should be disclosed as a foot-note to the final, accounts. The company must make a disclosure about the, contingent claim., 5. Draft the Accounting policies to be disclosed in the financial, statements for the following items:, i. Revenue Recognition-Sale of goods, Ans. Sales are recognized when good are invoiced and dispatched, to customers and are recorded inclusive of excise duty, net trade, discount and sales tax., ii. Revenue Recognition-Sale of Equipment, Ans. Sale of Equipment is recognized when (1) it has a firm, contract, (2) the product has been shipped to and accepted by the, customer or the service has been provided, and (3) amounts are, reasonably assured of collection. Most equipment sales require, installation of the product. As such, revenue is recognized at the, time of delivery and installation at the customer location. Equipment, revenues are based on established prices by product type and, model and are net of discounts.

Page 27 :

20, iii. Revenue Recognition-Sales Return, Ans. A sales return is accepted only when the equipment is, defective and does not meet product performance specifications., iv. Inventories, Ans. Inventories, other than scrap, are valued at cost, on weighted, average basis. Scrap is valued at realizable value., v. Depreciation – Machinery Spares, Ans. Machinery spares which can be used only in connection with, an item of fixed asset and whose use is expected to be irregular are, capitalized and depreciated over the residual useful life of the, related plant and machinery., vi. Depreciation- Fixed Assets, Ans. Fixed assets ( Other than leasehold land, technical knowhow, and temporary structure) are depreciated on straight-line method, (SLM) at the rate and in the manner prescribed in schedule XIV to, the Companies Act, 1956 by writing off 95% of the cost of the, assets over the specified period of the assets., , 6. Explain requirement in the following cases with reference to, DISCLOSURE OF ACCOUNTING POLICIES (AS-1), 1. Where proper disclosures regarding changes in accounting, policies have not been made by a company, in the method of, providing depreciation on plant and machinery from straight line, method to written-down value method and due to the change the, net profit for the year, the net block as well as the reserves and, surplus lowered by Rs.50,00,000., Ans. The company has not disclosed in its accounts the fact of, change, from this year, in the method of providing depreciation, on plant and machinery from straight line method to written-down, value method, as also the effect of this change. As a result of this, change, the net profit for the year, the net block as well as the, reserves and surplus are lower by Rs.50,00,000 each as compared, to the position which would have prevailed had this change not, been made., 2. Where a company has not disclosed all significant accounting, policies like treatment of research and development costs and has, also not disclosed the accounting policies at one place.

Page 28 :

21, Ans. The company had disclosed those accounting policies the, disclosure of which is required by the Companies Act, 1956. Other, significant accounting policies, viz., those relating to treatment of, research and development costs have not been disclosed nor have, all the policies been disclosed at one place, which is contrary to, Accounting Standard (AS) 1, `Disclosure of Accounting Policies', issued by the Institute of Chartered Accountants of India., , 2.9, , QUESTIONS, , 1. What is an accounting policy?, 2. List out different Accounting policies?, 3. Mention the areas in which different policies may be adopted, by different organizations?, 4. Write a short note on selection of accounting policies?, 5. What are basic accounting assumptions?, 6. What are the disclosure requirements of AS-1 issued by ICAI?, 7. What do you understand by “notes to accounts”?, 8. Select Correct Alternative:, i., 1., 2., 3., 4., , ii., 1., 2., 3., 4., , Accounting policy is, accounting postulate, accounting convention, accounting standard, specific accounting principle or method, management out of permissible alternatives, , chosen, , by, , Example of accounting policy is, Method of depreciation chosen by management, Separate entity concept, Balance sheet, Standard audit, , iii., , RPC Ltd. follows the written down value method of, depreciating machinery year after year due to, 1. Comparability., 2. Convenience., 3. Consistency., 4. All of the above., , iv., , A change in accounting policy is justified, To comply with accounting standard., To ensure more appropriate presentation of the financial, statement of the enterprise., To comply with law., All of the above., , 1., 2., 3., 4.

Page 29 :

22, v., 1., 2., 3., 4., vi., , Fundamental accounting assumptions are, Materiality., Business entity., Going concern., Dual aspect, M/s ABC Brothers, which was registered in the year 2000,, has been following Straight Line Method (SLM) of, depreciation. In the current year it changed its method from, Straight Line to Written down Value (WDV) Method, since, such change would result in the additional depreciation of, Rs. 200 lakhs as a result of which the firm would qualify to, be declared as a sick industrial unit. The auditor raised, objection to this change in the method of depreciation., , The objection of the auditor is justified because, 1. Change in the method of depreciation should be done only with, the consent of the auditor., 2. Depreciation method can be changed only from WDV to SLM, and not vice versa., 3. Change in the method of deprecation should be done only if it is, required by some statute and change would result in, appropriate presentation of financial statement., 4. Method of depreciation cannot be changed under any, circumstances., vii., , State the case where the going concern concept is applied?, 1. When an enterprise was set up for a particular purpose,, which has been achieved, or to be achieved shortly., 2. When a receiver or liquidator has been appointed in case of, a company which is to be liquidated., 3. Fixed assets are acquired for use in the business for earning, revenues and are not meant for resale., 4. When an enterprise is declared sick., , viii., 1., 2., 3., 4., , Principle requires that the same accounting method should, be used from one accounting period to the next., Conservatism., Consistency., Business entity., Money measurement.

Page 30 :

23, ix., , 1., 2., 3., 4., x., 1., 2., 3., 4., xi., 1., 2., 3., 4., , The cost of a small calculator is accounted as an expense, and not shown as an asset in a financial statement of a, business entity due to __________, Materiality concept., Matching concept., Periodicity concept., Conservatism concept., It is generally assumed that the business will not liquidate in, the near foreseeable future because of, Periodicity., Materiality., Matching., Going concern., The accounting concept requiring the practice of crediting, closing stock to the trading account, Going concern, Cost, Matching, All of Above, , xii., , Accounting Principles are generally based on, 1. Practicability, 2. Subjectivity, 3. Convenience in recording, 4. All of Above, , xiii., , “Substance of any transaction should be considered while, recording them and not only the legal form” is the statement, which holds true for, 1. Substance over form., 2. Disclosure of accounting policies., 3. Both (a) and (b)., 4. None of the three., , xiv., , Change in the method of depreciation is change in, ________., 1. Accounting estimate., 2. Accounting policy., 3. Measurement discipline., 4. None of the above., , Answers: i-4, ii-1, iii-3, iv-4, v-3, vi-3, vii-3, viii-2, ix-1, x-4, xi-1, xii-1,, xiii-3, xiv-2, , 8. State whether the following statements are true or false:, 1. The ‘materiality concept’ refers to the state of ignoring small, , items and values from accounts.

Page 31 :

24, 2. Accounting principles are rules of action or conduct which are, , adopted by the accountants universally while recording, accounting transactions., 3. The ‘conservatism concept’ leads to the inclusion of all, , unrealized profits., 4. Accounting concepts are broad assumptions., 5. India is a member of IASC (International Accounting Standards, , Committee)., 6. The Institute of Chartered Accountants of India (ICAI), the apex, , body of accounting and auditing, constituted an Accounting, Standards Board (ASB) on April 21, 1977, to pronounce, standards on various items of the financial statements., Answers: True: 1, 2, 4, 5, 6, False: 3., ,

Page 32 :

25, , Unit-3, , , AS-2 VALUATION OF INVENTORIES, Unit Structure:, 3.0, 3.1, 3.2, 3.3, 3.4, 3.5, 3.6, 3.7, 3.8, 3.9, 3.10, , Objectives, Introduction, Objective and Scope of AS-2, Measurement of Inventories, Net Realisable Value, Disclosures, Disclosure Practice on Valuation of Inventories (AS-2), Guidance Note on MODVAT / CENVAT issued by the ICAI, and Valuation of Inventory, Cost of Inventories, Practical Applications, Exercises, , 3.0, , OBJECTIVES, , After studying the unit students will be able to:, Understand objective and scope of AS-2., Make the measurement of inventories at various cases., Solve the examples related to allocation of Fixed Overheads, Calculate the cost of inventories., Solve the problems on calculation of the cost of inventories., , 3.1 INTRODUCTION, Accounting Standard (AS) 2 'Valuation of Inventories', issued, by the Council of the Institute of Chartered Accountants of India, supersedes Accounting Standard (AS) 2, 'Valuation of Inventories',, issued in June, 1981. The revised standard comes into effect in, respect of accounting periods commencing on or after 1.4.1999 and, is mandatory in nature. Inventories consist of Finished Goods, which are held for sale in the ordinary course of business, Raw, Material & Work in Progress.

Page 33 :

26, DEFINITION, 1. INVENTORY, Inventories are assets:, Held for sale in the ordinary course of business,, In the process of production for such sale or, In the form of materials or supplies to be consumed in the, production process or in the rendering of services., Inventories encompass goods purchased and held for, resale, for example, merchandise purchased by a retailer and held, for resale, computer software held for resale, or land and other, property held for resale. Inventories also encompass finished goods, produced, or work in progress being produced, by the enterprise, and include materials, maintenance supplies, consumables and, loose tools awaiting use in the production process. Inventories do, not include machinery spares which can be used only in connection, with an item of fixed asset and whose use is expected to be, irregular; such machinery spares are accounted for in accordance, with Accounting Standard (AS) 10,Accounting for Fixed Assets., 2. NET REALISABLE VALUE, Net realizable value is the estimated selling price in the ordinary, course of business less the estimated costs of completion and the, estimated costs necessary to make the sale., , 3.2, , OBJECTIVE AND SCOPE OF AS-2, , 3.2.1 OBLECTIVE, A primary issue in accounting for inventories is the, determination of the value at which inventories are carried in the, financial statements until the related revenues are recognized. This, Statement deals with the determination of such value, including the, ascertainment of cost of inventories and any write-down thereof to, net realizable value., 3.2.2 SCOPE, This Statement should be applied in accounting for inventories, other than:, a. work in progress arising under construction contracts, including, directly related service contracts (see Accounting Standard (AS), 7, Accounting for Construction Contracts 3);, b. work in progress arising in the ordinary course of business of, service providers;, c. shares, debentures and other financial instruments held as, stock-in-trade; and

Page 34 :

27, d. producers' inventories of livestock, agricultural and forest, products, and mineral oils, ores and gases to the extent that, they are measured at net realizable value in accordance with, well established practices in those industries., The inventories referred to in paragraph (d) are measured at net, realizable value at certain stages of production. This occurs, for, example, when agricultural crops have been harvested or mineral, oils, ores and gases have been extracted and sale is assured under, a forward contract or a government guarantee, or when a, homogenous market exists and there is a negligible risk of failure to, sell. These inventories are excluded from the scope of this, Statement., , 3.3, , MEASUREMENT OF INVENTORIES, , Inventories should be valued at the lower of cost and net, realizable value., 3.3.1 Cost of Inventories, The cost of inventories should comprise all costs of, purchase, costs of conversion and other costs incurred in bringing, the inventories to their present location and condition., 3.3.2 Costs of Purchase, The costs of purchase consist of the purchase price, including duties and taxes (other than those subsequently, recoverable by the enterprise from the taxing authorities), freight, inwards and other expenditure directly attributable to the, acquisition. Trade discounts, rebates, duty drawbacks and other, similar items are deducted in determining the costs of purchase., 3.3.3 Costs of Conversion, The costs of conversion of inventories include costs directly, related to the units of production, such as direct labour. They also, include a systematic allocation of fixed and variable production, overheads that are incurred in converting materials into finished, goods. Fixed production overheads are those indirect costs of, production that remain relatively constant regardless of the volume, of production, such as depreciation and maintenance of factory, buildings and the cost of factory management and administration., Variable production overheads are those indirect costs of, production that vary directly, or nearly directly, with the volume of, production, such as indirect materials and indirect labour.

Page 35 :

28, , Fig 3.1: Measurement of Inventory, 3.3.4 Allocation of fixed Overheads, The allocation of fixed production overheads for the purpose, of their inclusion in the costs of conversion is based on the normal, capacity of the production facilities. Normal capacity is the, production expected to be achieved on an average over a number, of periods or seasons under normal circumstances, taking into, account the loss of capacity resulting from planned maintenance., The actual level of production may be used if it approximates, normal capacity. The amount of fixed production overheads, allocated to each unit of production is not increased as a, consequence of low production or idle plant., Unallocated overheads are recognized as an expense in the, period in which they are incurred. In periods of abnormally high, production, the amount of fixed production overheads allocated to, each unit of production is decreased so that inventories are not, measured above cost. Variable production overheads are, assigned to each unit of production on the basis of the actual use, of the production facilities.

Page 36 :

29, 1.3.5 Examples - Allocation of Fixed Overheads, Example 1., Total Production, , 100 Units, , Normal Capacity, , 50 Units, , Goods Sold, , 80 Units, , Closing Stock, , 20 Units, , Direct Cost, , 10 per unit, , Fixed Overhead, , Rs.80, , Variable Overhead, , Rs.120, , Ans: Valuation of Stock = Direct Cost + Fixed Cost + Variable Cost, =10 + 0.8 + 1.2, = Rs.12, Fixed Cost= (80/100) = Rs.0.8, Variable cost= (120/100) = Rs.1.2, Note: In case of Actual Production is abnormally high then, Fixed, Overhead is allocated to Finished Goods on actual Production, basis., 3.3.6 Joint Products, A production process may result in more than one product, being produced simultaneously. This is the case, for example,, when joint products are produced or when there is a main product, and a by-product. When the costs of conversion of each product, are not separately identifiable, they are allocated between the, products on a rational and consistent basis. The allocation may be, based, for example, on the relative sales value of each product, either at the stage in the production process when the products, become separately identifiable, or at the completion of production., Most by-products as well as scrap or waste materials, by their, nature, are immaterial. When this is the case, they are often, measured at net realizable value and this value is deducted from, the cost of the main product. As a result, the carrying amount of the, main product is not materially different from its cost., 3.3.7 Other Costs, Other costs are included in the cost of inventories only to the, extent that they are incurred in bringing the inventories to their, present location and condition. For example, it may be appropriate, to include overheads other than production overheads or the costs

Page 37 :

30, of designing products for specific customers in the cost of, inventories., Interest and other borrowing costs are usually considered as, not relating to bringing the inventories to their present location and, condition and are, therefore, usually not included in the cost of, inventories., 3.3.8 Exclusions from the Cost of Inventories, In determining the cost of inventories in accordance with, paragraph 6, it is appropriate to exclude certain costs and, recognize them as expenses in the period in which they are, incurred. Examples of such costs are:, (a)Abnormal amounts of wasted materials, labour, or other, production costs;, (b)Storage costs, unless those costs are necessary in the, production process prior to a further production stage;, (c) Administrative overheads that do not contribute to bringing the, inventories to their present location and condition; and, (d) Selling and distribution costs., 3.3.9 Cost Formulae, 1. Specific Identification Method for–, i) Goods not ordinarily interchangeable;, ii) Goods/services produced and segregated for specific, projects., Specific identification of cost means that specific costs are, attributed to identify items of inventory. This is an appropriate, treatment for items that are segregated for a specific project,, regardless of whether they have been purchased or produced., However, when there are large number of items of inventory which, are ordinarily interchangeable, specific identification of costs is, inappropriate since, in such circumstances, an enterprise could, obtain predetermined effects on the net profit or loss for the period, by selecting a particular method of ascertaining the items that, remain in inventories., 2. FIFO, Weighted Average Method in other cases., The cost of inventories, in other cases should be assigned, by using the first-in, first-out (FIFO), or weighted average cost, formula. The formula used should reflect the fairest possible, approximation to the cost incurred in bringing the items of inventory, to their present location and condition.

Page 38 :

31, A variety of cost formulae is used to determine the cost of, inventories other than those for which specific identification of, individual costs is appropriate. The formula used in determining the, cost of an item of inventory needs to be selected with a view to, providing the fairest possible approximation to the cost incurred in, bringing the item to its present location and condition. The FIFO, formula assumes that the items of inventory which were purchased, or produced first are consumed or sold first, and consequently the, items remaining in inventory at the end of the period are those most, recently purchased or produced. Under the weighted average cost, formula, the cost of each item is determined from the weighted, average of the cost of similar items at the beginning of a period and, the cost of similar items purchased or produced during the period., The average may be calculated on a periodic basis, or as each, additional shipment is received, depending upon the circumstances, of the enterprise., 3.3.10 Techniques for the Measurement of Cost, Techniques for the measurement of the cost of inventories,, such as the standard cost method or the retail method, may be, used for convenience if the results approximate the actual cost., Standard costs take into account normal levels of consumption of, materials and supplies, labour, efficiency and capacity utilization., They are regularly reviewed and, if necessary, revised in the light of, current conditions., The retail method is often used in the retail trade for, measuring inventories of large numbers of rapidly changing items, that have similar margins and for which it is impracticable to use, other costing methods. The cost of the inventory is determined by, reducing from the sales value of the inventory the appropriate, percentage gross margin. The percentage used takes into, consideration inventory which has been marked down to below its, original selling price. An average percentage for each retail, department is often used., , 3.4, , NET REALISABLE VALUE, , 3.4.1 MEANING, It means the estimated selling price in ordinary course of, business, less estimated cost of completion and estimated cost, necessary to make the sale. Estimation of NRV also takes into, account the purpose for which the inventory is held., 3.4.2 When cost of inventories may not be recoverable?, i. If inventories are damaged,, ii. If they have become wholly or partially obsolete,, iii. If their selling prices have declined., iv. If the estimated costs of completion or the estimated costs, necessary to make the sale have increased.

Page 39 :

32, The practice of writing down inventories below cost to net, realizable value is consistent with the view that assets should not, be carried in excess of amounts expected to be realized from their, sale or use. An assessment is made of net realizable value as at, each balance sheet date., 3.4.3 Net Realizable Value for Raw Material - Para 24 of AS 2, 1) If finished goods in which Raw Material is used, is sold at or, above cost, then net realizable value of Raw Material is considered, more than its cost., 2) If finished goods in which Raw Material used is sold below cost,, then net realizable value of Raw Material is equal to replacement, price of Raw Material., 3.4.4 Analysis of Inventory valuation under cost and NRV, Aspects

Page 40 :

33, Example 2:, Suppose, there are 1,00,000 units in stock, of which 60,000 are to, be delivered for Rs.40 each as per contract with one of the, customer. Cost of stock is Rs.45 per unit & NRV is estimated of, Rs.50 per unit. What will be the value of stock?, Ans. In this case, 60,000 units will be valued at Rs.40 & balance, stock of 40,000 units will be valued at Rs.45 per unit., Example 3:, Items, Cost, NRV, , X, 20, 14, , Y, 16, 16, , Z, 8, 12, , Total, 44, 42, , How will you value the stock under provisions of AS-2?, Ans:, Items, Cost, NRV, Value, (under AS 2), , 3.5, , X, 20, 14, , Y, 16, 16, , 14, , 16, , Z, 8, 12, , Total, 44, 42, , 8, , 38, , DISCLOSURES, , The financial statements should disclose:, i. Accounting policies relating to inventories, ii. Cost formula used, Iii.Carrying amount of inventories with appropriate classifications, Information about the carrying amounts held in different, classifications of inventories and the extent of the changes in these, assets is useful to financial statement users. Common, classifications of inventories are raw materials and components,, work in progress, finished goods, stores and spares, and loose, tools., , 3.6, , DISCLOSURE PRACTICE ON VALUATION OF, INVENTORIES (AS-2), , Illustration:, This significant accounting policy comes from 2006 annual financial, statements of Bharat Forge America Inc.

Page 41 :

34, Inventories are stated at the lower of cost or market, with the cost, determined on the First-In, First-Out (FIFO) method., Explain requirement in the following cases with reference to, VALUATION OF INVENTORIES (AS-2), 1. The company is valuing its stocks at `cost' instead of `lower of, cost or net realizable value". Further, in valuing the closing stock at, cost, the company has included interest and other borrowings in, `cost'., Ans. That the company is valuing its stocks at ‘cost' instead of, `lower of cost and net realizable value’. Further, in valuing the, closing stock at cost, the company has included interest and other, borrowings in ‘cost'. This is not in accordance with principles of, valuation of inventory as laid down in Revised Accounting, Standard AS-2 on Valuation of Inventories , issued by the, Institute of Chartered Accountants of India, which recommends,, inter alia, that the inventories should be valued at `lower of cost, and net realizable value' and that the interest and other borrowing, should not normally be included in the cost., 2. The Company in respect of its Chemical Division followed the, practice of valuing its inventories on FIFO basis. This year it, changed the basis of valuation from FIFO to LIFO basis. If this, change had not been made, the profit of the Company would have, been higher by Rs.20 lakhs and inventories would have been, higher by Rs.20 lakhs., Ans. The Company in respect of its Chemical Division followed the, practice of valuing its inventories on FIFO basis. This year it, changed the basis of valuation from FIFO to LIFO basis. Had this, change not been made, the profit of the Company would have been, higher by Rs.20 lakhs and inventories would have been higher by, Rs.20 lakhs. This is not accordance with principles of valuation of, inventory as laid down in Revised Accounting Standard AS-2 on, `Valuation of Inventories', issued by the Institute of Chartered, Accountants of India, which recommends, inter alia, that the, inventories should be value at FIFO and at LIFO., 3. As per the past practice, the excise duty paid on finished, goods inventory amounting to Rs.3 crores has been treated as, prepayment till the goods are sold and estimated excise duty of, Rs.2 crores on finished goods lying in the factory premises but not, cleared from excise bonded warehouse as on March 31, 2011 has, not been included in inventory valuation.

Page 42 :

35, Ans. As per the past practice, the excise duty paid on finished, goods inventory amounting to Rs.3 crores has been treated as, prepayment till the goods are sold and estimated excise duty of, Rs.2 crores on finished goods lying in the factory premises but not, cleared from excise bonded warehouse as on March 31, 2011 has, not been provided and hence, not included in inventory valuation., This treatment, however, has no effect on the profits for the year., , 3.7 GUIDANCE NOTE ON MODVAT/CENVAT ISSUED, BY THE ICAI AND VALUATION OF INVENTORY, ICAI issued a “Guidance Note on Accounting Treatment for, MODVAT / CENVAT”, with the substitution of the MODVAT Credit, Scheme with CENVAT w.e.f. 1-4-2000. The revised Guidance Note, has provided clarification on the above anomaly, with examples on, both the inclusive method (Sec.145A) and exclusive method (AS2), where it is clear that the above anomaly is only in respect of the, disclosure, with no effect on the total profit/loss of the enterprise., Therefore, for purposes of tax filings and tax audit forms, the, inclusive method should be used as per section 145A of the, Income-tax Act, whereas for purposes of general purpose financial, statements, the exclusive method under AS-2 should be followed., Inclusive Method (Gross Value Approach), , , , , Raw material is accounted for at gross value inclusive of, specified duty., CENVAT credit available on final products can be accounted for, through a separate account CENVAT Credit Availed Account., Inputs may be consumed partly. CENVAT Credit available, should be segregated into two parts:, - CENVAT Credit on inputs consumed in respect of final, products;, - CENVAT credit on inputs lying in the stock., , CENVAT credit available on inputs consumed for final products is, adjusted with the cost of raw material consumed., CENVAT credit available on inputs lying in the godown should be, adjusted against the value of closing stock of raw material., Exclusive Method (opening separate CENVAT Credit Account), , , Specified duty (i.e., duty paid against which CENVAT credit is, available) paid on inputs is debited to a separate account,, namely CENVAT Credit Receivable (Input) Account.

Page 43 :

36, , , As and when CENVAT credit is actually utilized against, payment of excise duty on final products, CENVAT Credit, Receivable (Input) Account is credited., , , , Inputs consumed and inventory is valued excluding specified, duty., , Balance standing in the CENVAT Credit Receivable (Input), Account is shown on the asset side of the Balance Sheet, under Advances., , 3.8, , COST OF INVENTORIES, , A] Cost of Purchase:, I] Purchase Price, ii] Duties & Taxes, iii] Freight Inward, iv] Other Expenditure directly, attributable to acquisition, Less: i] Duties and Taxes recoverable, from tax authorities, ii] Trade discount, iii] Rebate, iv] Duty Drawback, v] Other similar items, B] Cost of Conversion:, Direct Materials, Direct Labour, Direct Expenses, Systematic allocation of:, Variable Production Overheads, Fixed Production Overheads, , xx, xx, xx, xx, , xx, , xx, xx, xx, xx, xx, , xx, , xx, xx, xx, xx, xx, , C] Other Costs:, Cost incurred for bringing the, inventories to their present, location and condition, , 3.9, , xxx, , xxx, , xxx, xxx, , PRACTICAL APPLICATIONS, , Illustration 1: (Duties and taxes not recoverable), Ambalal furnishes you following details, Ascertain the cost of purchase of inventory, i] Purchase of Raw materials, ii] Duties and Taxes paid on the, acquisition and are not recoverable, iii] Carriage inward, iv]Others paid for acquisition of inventory, , Rs. 10 lakhs, Rs. 2 lakhs, Rs. 1 lakhs, Rs. 1 lakhs

Page 44 :

37, Solution:, Cost of Purchase, Cost of Purchase of Raw Materials, Duties & Taxes not recoverable, Carriage inward, Other Expenses, Total, , Rs. in lakhs, 10, 02, 01, 01, 14, , Illustration 2, Big Bagha Associates furnishes you following details from which, you are required to ascertain cost of purchase of inventories., i] Cost of Purchase of Inventory, Rs. 20 lakhs, ii] Duties & Taxes paid and are, recoverable from Tax Authorities, Rs. 5 lakhs, iii] Trade Discount, Rs. 2 lakhs, iv] Duties & Taxes paid and not recoverable, Rs. 2 lakhs, v] Freight Inwards, Rs. 1 lakhs, vi] Other Expenses directly attributable, to Acquisition of Inventory, Rs. 2 lakhs, Solution : Big Bagha Associates, Calculation of Cost of Purchase, Cost of Purchase, Duties & Taxes paid and not recoverable, Freight Inward, Other Expenses, Less : Duties & Taxes recoverable from, Tax Authorities, Trade Discount, Total, , Rs. in lakhs, 20, 02, 01, 02, 25, 05, 02, , 07, 18, , Illustration 3, Chrome Ltd. manufactures different types of Dichromates., From the following information find the value of inventory per kg, of Sodium Dichromate, Material cost, Rs. 150 per kg, Direct Labour Cost, Rs. 50 per kg, Direct Variable Production Overheads, Rs. 20 per kg, Fixed production overheads for the year on normal capacity of, 1,00,000 kgs is Rs.15 lakhs., Finished goods on stock at the end of the year 3,000 kgs., Solution:, , Chrome Ltd., Cost per kg of Sodium Dichromate, As per AS-2 cost of conversion includes a systematic, allocation of fixed and variable production overheads, which are

Page 45 :

38, incurred for converting materials into finished goods. The allocation, of fixed production overheads is based on normal capacity., Statement of Cost (Per Kg), Material Cost, Direct Labour, Direct Variable Production Overheads, 15,00,000 , Fixed Production Overheads , , 1,00,000 , , Rs., 150, 50, 20, 15, 235, , Value of Stock, , = 3,000 kgs @ Rs. 235, = Rs. 7,05,000, , Illustration 4, Ind Ltd. manufacture computers, during the year ended 31st March,, 2008 the company manufactured 550 computers, it has the policy, of valuing finished stock of goods at a standard cost of Rs.1.8 lakhs, per computer. The details of the cost are as under;, (Rs. in Lakhs), Raw material consumed, 400, Direct Labour, 250, Variable production overheads, 150, Fixed production overheads, 290, (Including interest of Rs. 100), Compute the value of cost per computer for the purpose of, closing stock., Solution: As per AS-2 (Revised) (refer point 3.6), on valuation of, Inventories, finished stock of goods should be valued on the basis, of absorption costing. While absorbing fixed production overheads, the normal production capacity is considered. In this case, finished, stock has been valued at a standard cost of Rs.1.8 lakhs per, computer which incidentally synchronizes with the value computed, on the basis of absorption costing as under:, ,, (Rs. in lakhs), Materials, 400, Direct Labour, 250, Fixed production overheads, 150, Fixed production overheads, 290, Less : Interest, 100, 190, Total Cost, 990, Number of computers produced, (Assumed to be normal production), Cost per computer 990/550 = Rs. 1.80 lakhs, , 550, , Policy of the company to value closing stock is not as per, AS-2. As per para 18 of AS-2, (refer point 3.9-1) the techniques of

Page 46 :

39, standard cost method may be used for convenience if the result, approximates to the actual cost and standard cost is regularly, reviewed if necessary. In the instant case, the cost of inventory can, be conveniently calculated as per absorption costing. Therefore,, there is no reason that standard costing method should be adopted., Illustration 5, Dolphin Simulators Ltd. manufactures simulators., Raw material was purchased at Rs. 100 per kg. Price of raw, material is on the decline. The finished goods in which the raw, material is incorporated are expected to be sold at below cost., 10,000 kgs of raw material is in stock at the year-end. Replacement, cost is Rs. 80 per kg. How will you value the inventory?, Solution :, Dolphin Simulators Ltd., As per para 24 of AS-2, on valuation of inventories, material and, other supplies held for use in the production of inventories are not, written down below cost if the finished products in which they will, be incorporated are expected to be sold at or above cost. However,, when there has been a decline in the price of materials and it is, estimated that the cost of the finished products will exceed net, realisable value, the materials are written down to net realisable, value. In such circumstances, the replacement cost of the material, may be the best available measure of their net realisable value., Hence, in this case, the stock of 10,000 kgs. of raw material will, be valued at Rs.80 per kg. The finished goods, if on stock, should, be valued at cost or net realisable value, whichever is lower., Illustration 6, Lurcko Pvt. Ltd. manufactures computers. During the year, ended 31st March, 2017, the company manufactured 1000, computers. The break up of cost is as under:, Raw Material, Rs. 450 lakhs, Direct Labour, Rs. 300 lakhs, Variable Production Overheads, Rs. 200 lakhs, Fixed Production Overheads, (Includes interest of Rs.100 lakhs), Rs. 300 lakhs, Compute the cost per computer for the purpose of closing, stock., Solution:, As per AS-2 Inventory should be valued as per absorption, costing. The cost is calculated as under :

Page 47 :

40, Calculation of Cost of Purchase, Rs. in lakhs, Raw Material, 450, Direct Labour, 300, Variable Production Overheads, 200, Fixed Production Overheads, 300, Less Interest, 100, 200, 1150, Cost per computer = 1,150 Lakhs /1,000 = Rs. 1.15 lakhs, Note: Interest is excluded from cost of inventory., Illustration –7, Gurecha Pvt. Ltd. furnishes you following information from, which you are required to value inventory of Finished Goods., Material cost, Rs. 200 per kg., Direct Labour cost, Rs. 40 per kg., Direct variable production overhead, Rs. 20 per kg., Fixed production charges for the year on normal capacity of, one lakh kgs. is Rs. 20 lakhs. 2000 kgs. of finished goods are on, stock at the year-end., Solution: Gurecha Pvt. Ltd., In accordance with paras 8 & 9 of AS-2, (refer point 3.6) the, cost of conversion include a systematic allocation of fixed and, variable production overheads that are incurred in converting, materials into finished goods. The allocation of fixed production, overheads for the purpose of their inclusion in the cost of, conversion is based on the normal capacity of the production, facilities., Thus, cost per kg. of finished goods can be computed as, follows:, Rs, Rs., Material cost, 200, Direct Labour cost, 40, Direct variable production overhead, 20, Fixed production overhead, (Rs. 20,00,000/100000), 20, 80, 280, Thus, the value of 2000 kgs. of finished goods on stock at, the year-end will be Rs.5,60,000 = (2000 kgs. X Rs. 280), Illustration 8, Hirel Techno points Associates is a company situated at MIDC,, Pune. The company deals in three products A, B and C, which are, neither similar nor interchangeable. At the time of closing of its

Page 48 :

41, accounts for the year 2016-17; the historical cost and net realisable, values of the items of closing stock are given below:, Items :, A, B, C, , Historical Cost, (Rs. in lakhs), 25, 20, 10, 55, , Net Realisable Value, (Rs. in lakhs), 20, 20, 15, 55, , What will be the value of stock?, Solution: HIREL TECHNOPOINTS, PUNE, Historical Cost or Net Realisable Value whichever is less is, the value of stock. This should be done item by item as given, below:, Rs. in lakhs, A. Net Realisable Value, 20, B. Historical Cost, 20, C. Historical Cost, 10, Value of Closing Stock, 50, Illustration 9, The company deals in three products, A, B and C, which are, neither similar nor interchangeable. The Historical Cost and Net, Realizable Value of the items of closing stock for the year 2016-17, are determined as follows:, Items, A, B, C, , Historical Cost, (Rs. in lakhs), 40, 32, 16, , Net Realizable Value, (Rs. in lakhs), 28, 32, 24, , What will be the value of Closing Stock?, Ans: As per Para 5 of AS 2 on Valuation of Inventories, inventories, should be valued at the lower of cost and net realizable value., Inventories should be written down to net realizable value on an, item-by item basis in the given case., Items, , Historical Cost, , Net Realizable, Valuation of, Value, closing stock, (Rs. in lakhs), (Rs. in lakhs), (Rs. in lakhs), A, 40, 28, 28, B, 32, 32, 32, C, 16, 24, 16, Total, 88, 84, 76, Hence, closing stock will be valued at Rs. 76 lakhs.

Page 49 :

42, Illustration 10, X Co. Limited purchased goods at the cost of Rs.40 lakhs in, October, 2011. Till March, 2012, 75% of the stocks were sold. The, company wants to disclose closing stock at Rs.10 lakhs. The, expected sale value is Rs.11 lakhs and a commission at 10% on, sale is payable to the agent. Advice, what is the correct closing, stock to be disclosed as at 31.3.2012., Ans: As per Para 5 of AS 2 “Valuation of Inventories”, the, inventories are to be valued at lower of cost and net realizable, value. In this case, the cost of inventory is Rs.10 lakhs. The net, realizable value is 11, 00,000 @ 90% = Rs.9, 90,000. So, the stock, should be valued at Rs.9, 90,000., Illustration 11, The Company X Ltd. has to pay for delay in cotton clearing, charges. The company up to 31.3.2017 has included such charges, in the valuation of closing stock. This being in the nature of interest,, X Ltd. decided to exclude such charges from closing stock for the, year 2006-07. This would result in decrease in profit by Rs.5 lakhs., Comment., Ans: As per Para 12 of AS 2 (revised), interest and other borrowing, costs are usually considered as not relating to bringing the, inventories to their present location and condition and are therefore,, usually not included in the cost of inventories. However, X Ltd. was, in practice to charge the cost for delay in cotton clearing in the, closing stock. As X Ltd. decided to change this valuation procedure, of closing stock, this treatment will be considered as a change in, accounting policy and such fact to be disclosed as per AS 1., Therefore, any change in amount mentioned in financial statement,, which will affect the financial position of the company should be, disclosed properly as per AS 1, AS 2 and also a note should be, given in the annual accounts that, had the company followed earlier, system of valuation of closing stock, the profit before tax would, have been higher by Rs. 5 lakhs., Illustration 12, Normal capacity = 20,000 units, Production = 18,000 units, Sales = 16,000 units, Closing Stock = 2,000 units, Fixed Overheads = Rs. 60,000, Calculate cost of fixed overheads to closing stock, Ans:, , Fixed Overheads = Rs.60,000 / 20,000 = Rs. 3 per unit, Fixed Overheads will be bifurcated into three parts:, Cost of Sales: 16,000*3 = 48,000, Closing Stock: 2,000 *3 = Rs. 6,000, Under normal capacity: 2,000 *3 = Rs. 6,000, (to be charged to P/L A/c)

Page 50 :

43, Illustration 13, Normal capacity = 20,000 units, Production = 25,000 units, Sales = 23,000 units, Closing Stock = 2,000 units, Fixed Overheads = Rs 60,000, Calculate Cost of fixed overheads to closing stock, Ans: Fixed Overheads = Rs 60,000/20,000 = Rs.3 per unit, But, Due to production above normal capacity = Rs.60,000 / 25,000, = Rs. 2.40 per unit, Cost of Sales: 23,000 * 2.4 = Rs. 55,200, Closing Stock: 2,000 * 2.4 = Rs. 4,800, Illustration 14, Ascertain the cost of Inventory by using the data given below:, i. Purchase Price, , Rs.20 lakhs, , ii. Duties and Taxes paid on acquisition and are, not recoverable, , Rs.2 lakhs, , iii. Freight inward, , Rs.2 lakhs, , iv .Others paid for acquisition of inventory, , Rs.1 lakhs, , Ans. Cost of Purchase:, Cost of Inventory, Rs. in lakhs, Purchase Price, 20, Duties and Taxes paid on acquisition and are not, 02, recoverable, Freight inward, 02, Others paid for acquisition of inventory, 01, Total, 25, Illustration 15, Zenith Ltd. manufactures computers. During the year ended 31st, March 2017, the Company manufactured 5,000 computers and, incurred following cost:, i. Raw Material, ii. Direct Labour, iii.Variable Production overheads, iv. Fixed Production overheads, (including interest 50 lakhs), , Rs.400 lakhs, Rs.400 lakhs, Rs.150 lakhs, Rs.250 lakhs, , Compute cost per computer for the purpose of closing stock.

Page 51 :