Page 2 :

(Shares, , 1,0ck l!, , pi(' ..ifRODUCTION, , I, , 1, , 269, , 111, f, ·, l• Buyback o equity shares is a process of, ., a company to buy its equity shares issue~ap1t~-1 restructuring. It is a financial strategy which, ,11101'.6, permission of the Company Law B dear ier. A company can buyback its own shares by, 110t:i, ~, ,nt, d, oar , under the p · ·, 1, ,v11ich correspon s to Section 77A to th C, ., rovis1ons of the Companies Act 2013, 1111', 8, 115 6 nY to buy back its own shares subject to ~lfi~mpames Act: 1956, it has become possible for a, 1B, L11n ~, ,a purchasing its own stock a comp, ment of certain conditions., )', d, . ., . ', any reduces the n b, f, ., ., . ina its reporte eammgs, mcreasing the c, ,, . um er o shares outstanding without, ,111ec~LJRPOSES, ompany s earnings per share., , 2-, , suying back a portion of equity Share Ca . ., _ To facilitate reduction of share capital or r!~:is ~referre~ for thefollowing purposes:, 1, 2 To generate higher return to be left o, ?tton of capital., ·, ver to equity shareholders, 3- To return Surplus cash to the shareholder . th, ·, ., investment opportunities., s m e form of buyback when there 1s no proper, value in the situ a t'ion of poor secondary market, 4. To maintain shareholder's, ., 5. To arrest d owntrend m the value of shares., ·, , ~i! are the purposes ~[.~'!_yback? I Write_a _;~t;~-n Purpose ofBuyback ofShares., 1 Distinction Between Buyback and Redemption of Prei erence Shares, Buyback of Shares, Redemption of Preference Shares, AJIYshares can be bought back, Preference shares can be redeemed., ~Date of buy back is not known on the date of Date ·of redemption of preference shares is, issue., known on the date of issue., SEBI rules govern buyback., SEBI rules do not govern redemption of, preference shares., Source of buyback is free reserves and Source of redemption of preference shares is, securities premium., divisible profits ., Section 68 of the Companies Act 2013 which Section 80 & 80 A of Companies Act govern, corresponds to Section 77 A of Companies Act redemption of preference shares., 1956 govern buyback of shares., Companies Act is silent about the adjustment The Companies Act specifies that the premium, on redemption is adjusted out of the profits., of premium on buyback of shares., , 2', ,----, , ,Q, 2. Distinguish between Buyb,ack of shares and redemption ofpreference shares., , 3., , SOURCES OF BUYBACK (SECTION 68 (1), , A Company can buyback its own shares or other specified securities out of three, sources:, • Free Reserves., • Securities Premium Account., • Proceeds of earlier issue of any shares or other specified securities., No buyback of shares can be made out of the proceeds of an earlier issue of the same kind of, shares. Preference shares can be issued for buyback of equity shares. However, equity shares, cannot be issued for buyback of equity shares. Buyback is allowed by utilizing the proceeds from, issue of hybrid instruments e.g. Convertible Debentures, Bonds, Secured and Unsecured Loans., 3·1 Free Reserves (Divisible Profit), ·, The term 'free reserve' has been defined as the reserve which, as per the latest audited balance, sheet, is free for distribution as dividend and includes balance of Securities Premium Account., Generally free reserves include the following :, ., a) Amount of surplus as shown in the Profit & Loss Account earned forward under the, ., ., heading "Reserves and Surplus"., b) Subsidy received under the Central Government outright Grant or Subsidy Scheme 1971., c) General Reserve., d) Profit & Loss Account., e) Dividend Equalisation Reserve or Dividend Fluctuation Reserve., D Sinking Fu11d., g) Investment Allowance (Unutilized) Reserve .

Page 3 :

- t, , .. ,,, , ll, , - - -d, ainst free reserv es to arrive, ,., Follow ing adjustments sho:1,d :;is:1 :f:r :;yba ck:, at th~, amount of free reserve that can e u, ., • Unamo rtised miscellaneous expenditur~., • Unamortised deferred revenu e expenditure., • Purchased Goodwill., ·d d for., • Contingent liabilities likely to mature and not pro~ e, • Any diminution of long-term investments not proVIded ~or., • Any impairment in the value of tangible assets not proVIded for., Other Reserves not available for Buyba ck (Non- Divis ible Profi t):, a) Revaluation Reserve., b) Capital Redemption Reserve., c) Debenture Redemption Reserve., d) Forleited Shares Account., e) Profit prior to incorporation., f) Capital Reserve., g) Statutory Reserve., 3.2 Securities Premium Accou nt, It is a broade r term than Share Premium Account. Share Premi um Accou nt balance repr:12, only premium on issue of equity and prefer ence shares where as securities premium, ace, balance represents premium on issue of deben tures, bonds and other financial instrum ents., -~, the Companies (Amendment) Act, 1998 the term "Share Premi um Accou nt" has been substituicc, the term, "Securities Premium Account"., It is possible that loss on redemption of deben tures and issue expen ses remain unamof..'under the head "Miscellaneous Expenditure" while the balanc e on Securities Premium, AccourutiUsed for buy back. Securities Premium Account, after makin g all the adjustments, forms, pd:'., free reserves., Statutory Reserve, Statutory Reserves sue~ as, Investment Allowance Reserve, "Deve lopme nt Rebate Re:r:~:, Export Profits Reserve, Foreign Project Reserve, Foreign Excha nge Earnin gs Reserve after, 1, ·, are free reserves., 3.3 Proceeds of Any Shares or Other Speci fied s, 8, , b, , ., , ., , · ·, , ecunt 1es, kindshare s: s::eo~~~a~~so~i~any kin_d_ is not allowed out of fresh issue of shares of the sarne, ., r secunt1es., .,, Hence , issue of preference share fi b b, ', Pref~rence shares carry fixed rate of di . s or uy ac~ of equity share makes a financial, Buybae~·, ~, , 11, , l"~:~1:~·~;;•s.a. Y". .o"~-1?., s Y~S!~e~!~11Y;~~;~r~h;a;r;~~!~~:~:::::: shareho}de~~--/, !, , ri.~e-..~t. .h~1.?e...., , urce.~ n.,- 1-<u,.,i. __ , _, , to, , ,,.~., , I

Page 4 :

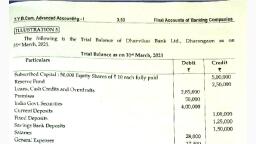

1, , ., 18 (Maximum Buybaci:~~ce, Maxtmum, ~, Buyback), ., ., tJStfP, Jl l f llowing is the summanzed Balance sheet of M M, 0, , Liabilities, gquity Shares of< 100, .d, aoo, fully pai, 40,, ea.cb 1oo/o Redeemable, 10,oOO, ence Shares of~ 100, ., " prefer, b fully paid, e~~ Redemption Reserve, ., pit, C8 ·ty premium, cufl ., se ral Reserve, c;ene and Loss Account, p ofit, r ¾Debentures, l 1oo, creditors, , •H, and a ngad I ,td . J\ s on 1 1 M:-,rc 1, 20 18 ·, , S., , ~, , 4 0 ,00 ,ooo, , 20 ,00,000, 4,00,000, 3,20,000, 8,00,000, 4,00,000, 40,00 ,000, 411601000, 1!60 ,80!000, , -Fixed Assets, , A s~ rt :c;, , <, , L,2 0,00,000, 8 ,80,000, 14 ,00 ,000, l 4 ,00 ,000, 4 ,00 ,000, , Investments, Stock, Debtors, Bank Balance, , 1,60!80,000, , On the same date 1t was decided to buyback the maximum number of eqmty shares at the maximum, . possible under the law., pnce, In case of shortage of funds , Bank overdraft was to be arranged., The company decided to utilize profit and loss account to the minimum extent., Pass Journal entries for the above transactions and prepare the Balance sheet after buyback in Revised, October, 2013, Schedule Ill format., , I, , I, , solution, Analysis :, Books of Mis Mandangad, I., , 2., , 3., , Sources of funds :, Security Premium, General Reserve, Profit and Loss Ale, , 3,20,000, 8,00,000, 4,00,000, 15,20,000, , Maximum limit on Buyback (25% of own funds), Own Funds, Paid up equity Share Capital, Paid up Preference Share Capital, Source of Fund, 25% of own funds, Minimum own funds required after Buyback, = Own fund- 50% of Debts, , = 55,20,000, , = 75,20,000 - 20,00,000, , 4., , Limit on Nominal Value of shares, Paid up equity Shares = 40,00,000, = 10,00,000, 25% of 40 00 000, ' ', 10,00,000, =, No. of Shares, 100, , 5. Maximum offer price, , = 10,000 shares, = Least of 1, 2, 3/10,000 Shares, =, , Face Value = ( 100, = ( 52, Premium, , 40,00,000, 20,00,000, 15.20.000, 75,20,000, 18,80,000, , 15,20,000 = ( 152, 10,000

Page 6 :

◄, 310, , Financial Accounting (T. Y B..Com.) (Sem. _ VJ, , LEARNIN G O BJECTIV ES ..., After studying this chapter, you should be able to understand :, •, Why Investments are made?, •, Types of Investments, •, Accounting of Purchases and Sales, •, Apportioning Income Pre and Post Acquisition Period, •, Treatment of Bonus Shares, •, Treatment of Right Shares Subscribed and Rights Renounced or Sold, •, Valuation of Investments at the end ofAccounting Period, •, Accounting Standard Applicable, , ~S~YN, ~ O;;P~S;;IS~!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!~!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!~!!!!!!!!!!!!!!!!!!!!!!!!!!!l!!!!~~_, ,, J., , Introduction, 'T'. ,-,.o, , ,-..I" f.,,uo, , 31, , j /:

Page 7 :

~, Financial Accounting (T. Y. B.Com.) (Se 111 . - VJ, , 312, , INTRODUCTION, finan, An individual or an organization docs investment out of savings or out of surplus, idle, it~~, available and not req~ired for a specific period. If extra money is with us and it is kept, 1., , not increase or appreciate., s, it, On the other hand, if that money is used to keep it in fixed deposit or to acquire securitie, will increase on the maturity date due to income earned., money, It may also appreci ate due to increase in prices of securities. Investm ent is parting, today in anticipation of getting more money in future., s, According to AS-13 investments are assets held for earning income by way of dividend, se. Wrnl~, interest and rentals, for capital appreciation or for other benefits to the investing enterpri, doing investment, three factors are to be considered, which are :, a) Liquidity,, b) Security,, ., c) Profitability., Assets held as stock in trade are not investment., , IQ. 1., , What are the types ofInvestm ents on the basis ofperiod ofholding ?, , ., Liquidity is characteristic of investment to get it convert ed into cash, whenev er required, be satisfied, Security means safety of funds. If one wants more security and liquidity then he has to, then, reward,, i.e., profits, with less profitability. Risk and reward go hand in hand. If you want more, you should be ready to bear risk and sacrifice to certain extent security and liquidity., , i Q. 2. What is Liquidi ty?, profi:s, The objective of doing investment may be to earn fixed periodical income or to earn, after selling at higher price., 2., , TYPES OF INVESTMENTS, , Investments are of different types as given below :, Investments, , On the basis of, Nature of Investments, , On the basis of, Period of Holding, , Long-term, Investment, , Current, Investment, , Variable Earning, Securities, , Fixed Earning, Securities, , Fig. 4.1, , -, , J, , -·-·--/ Q. 3. What are the types ofInvestments?' Write short note on : Types of Investm ents, nts, _The investments can take various forms and classified accordin~-i;~-As"' i-3~lassifies i~~~~e, as given below :, a) Government and Trust Securities issued by Government and Local Authorities., b) Bonds and Debentures Issued by Companies., c) Shares Issued by Companies., d) Deposits with Companies or Banks., e) Immovable Property., f) Others e.g. Partnership Firm or J ewellery, Insuran ce Policies etc., Out of these the present chapter relates to securities, shares, bonds and Debentu res., , --,.-------_---·--· . _____, ,___, , , . . .__, ,, {~.ssif!..ed as per AS ii~, _ e~-t-_~-rQ. 4. Ho-w- is- ,-.n-ve_s_tm, , I, I

Page 9 :

6., , CUM INTERE ST/ EX-INTEREST QUOTA TIONS, , t, When an investment is purchas ed or sold before the date of paymen t, a queS ion may arise, whethe r the quotation price includes interest (upto the date of purchas e I sale) or not. In such a, case, the quotation price may be ex-interest or cum-interest., 'Cum' means with and 'Ex' means without. The term 'Cum-interes_t' and 'Ex-i?teres_t' are ~elating, to fixed interest bearing securities. 'Cum interest' means cumulative of interest or 1nclus1ve of interest, and Ex-interest means exclusive of interest., Interest on fixed interest bearing security accrues on specific due dates. The importa nt point to, be noted is that the holder of the securit ies is entitle d to the .whole amo1:1nt of interest, that accrues on the due date irrespective of the period of holdin g. Becaus e a company pays, interest only to the person whose name appears in the books of accoun ts of the compan y as a, holder on the date of payment of interest., Cum-interest price covers cost of investment and interest accrued upto the date of purchase ., When interest become s due, it would be the right of the buyer to claim it., Ex-interest price covers only the cost of ·the investments and the buyer is liable to pay, additional amount as interest accrued upto the date of purchas e of investments.

Page 10 :

4., , Date, , 1, , 1, , 2, , 5, , 8, , 1o ascenaIn p1u11L u1 1v~, , -, , v » ~ ·- · -, , Invest01 ent Acco;::u rities), ), bearing t 11:.or Interest, Interest, (Fixed, -(Du e Dae•', for the year ending Nominal, particular s, , Particulars, , To Balance b / d, (Opening, Balance), To Bank, (Purchase, Ex-interest ), To Bank, (Purchase, Cum Interest), To P & L A/c, (Profit on, Sale), To P & L A/c, (Transfer of, Interest), , Nominal, Value, , Income, , t, xx, , f, xx, , xx, , xx, , xx, , xx, , ., , Capital, or Cost, f, xx, , ', , Date, , xx, , 4, , xx, , 5, , xx, , 6, , 7, , xx, , 9, , 10, , - -, , xx, , -, , xx, , - -, , xx, , Value, ~, , 3, , Income, , By Bank, (Sale, Ex-Interes t), By Bank, (Sale Cum, Interest), By Profit &, Loss A/c, (Loss on Sale), By Bank, (Interest, received), By Balance c / d, (Accrued, ,, Interest), By Balance c / d, (Value at the, end), ByP & LA/c, (Loss on, Valuation ), , ~, , {, , xx, , xx, , xx, , xx, , xx, , xx, , xx, xx, , xx, , xx, xx, , -, , -, , xx, , - -, , _xx, , 14. RECORDING OF TRANSACTIONS OF FIXED INCOME EARNING SECURITIES, I. Purchase (ex-inter est), , Enter N.V. in NV column on Debit side, Enter cost of purchase in Capital column, Enter accrued interest in income column., , c--", apita1, or Co"t, , - -, , _xx, , I, !

Page 11 :

A. When ,rariable Income Bearing Securities are given, , Illustration : 14 (Bonus Issue is given), The following transactions of Miss Naina took place during the year ended 31/03/2018 :, Transactions, Date, Purchased 1,00,000, Equity Shares of~ I?/- each in "ABC" Ltd. for~ 50,0o,oo, 12-04-2017, "ABC".Ltd. made a Bonus issue of 3 Equity Shares for every 2 shares held . O/,, 15-05-2017, ·, Naina sold 1 25 000 Bonus shares for~ 20/- each., 30-06-201 7, ' ', Prepare 'Equity Shares in ABC Ltd.' Account in the Books of Miss Naina for the year ended 3l-3_2018, November, 201 ., , Solution, , Date, , In the Books of Naina, Equity Shares in ABC Ltd. for t he year ende d 3 1/ 03/2018, N.V., Particulars, Dividend, Date, Cost, N.V, Dividend, Particulars, ~, , ~, , ~, , ~, , -, , ~, , -, , 12,50,000, 30 /6/ 17 By Cash &, BankA/c ·, 31/ 3 / 18 By Balance c / d 12,50,000, , - 25,00,000, , - 50,QQ,QQQ, , 25,QQ,QQQ, , - 50,QQ,QQQ, , 12/4/1 7 To Cash & Bank 10,00,000, , - 50,00,000, , 15/5/17 To Bonus Share~ 15,00,000, , -, , 25,QQ,QQQ, , ~, , Cost, , - 25,0o,ooo

Page 12 :

Investment Accounting, , 327, , .., , Date, , Particulars, , 12-04-2017, 15-05-2017, , Purchases, Bonus Issue, , N. Value, , Cost, , f, , f, , 10,00,000, 15,00,000, -, , 30-06-201 7, , 31-03-2018, , i, I, , Sale, , Closing Balance, , 25!00,000, 12,50,000, , Calculation, Held, 2, 1,00,000, , 50 ,0 0 ,000, , -, , X, , X, , 1,00,000, , =, , X, , 2, , 3, , = 1,50,000 Shares, , 50!0Q 1000, 25,00,000 Weighted Average Cost, 12,50,000, , 12,50,000, , Bonus, 3, , X, , 50,00,000, , 25,00,0000, 25,00,000 Profit, = SP _- Weighted avg. cost, = 25,00,000 - 25,00,000, = Nil

Page 13 :

Wustration : 2S (Ex-Interest Purchase & Sale given), , On I st April, 201 7, Miss Prachiti had 1,000, 9% Debentu res of ~ JOO each at~ 108 (in K.K. Lini"11, , held as investments., st, K.K. Ltd. pays interest on 30 th June and 31 Decemb er every year Prachiti had following transacf, , ed1, , '%, during the year., est., - Purchased 800, 9% Debentu res at f 98 ex-inter, 1st June, 20 I 7, 1st December, 2017 - Sold 900, 9% Debentures at f I 05 ex-inter est st, Prepare Investments in 9% Debentures Accoun t for the year ending 31 March, 2018 . Apply AS-lJ, March, 2~13, , Soluti on, , I:n the books of M/ s Prachi ti, 9% Deben tures A/ c, , Cost, Interest, F.V, f, ~, f, 1,08,000, 1-4-17 To Balance b / d 1,00 ,000 2 ,250, 78,4 00, 80,000 3,000, 1-6-17 To Bank A/c, 1,300, 1-12- 17 To P & L A/c, 3 1-3-1 8 ToP& L, - 12,.300, (Bal. Fig.), l18Q,QQQ lL.Sfill l18Z 1ZQQ, , ', , 30 -6- 17, 1- 12- 17, 31-1 2- 17, 31-3- 18, , By Bank A/ c, By Bank A/c, By Bank A/c, By Bal. c/d, , F.V., , Interest, , ~, , t, -, , 90,00 0, 90,000, l,BQ, 000, , t, , 8,100, 3,375, 4,050, 2,025, -, , 17,550, , Weighted Average Cost, Particu lars, , I, , 1-4- 17, 1-6-17, , 1-12-17, , Openin g Balanc e, Purcha ses, , Sold, , ~, , 94,soo, , -, , 93,200, , -=-=--=, , ~, , J, , . . zWoltdng .,. __, I., , Cost, , Cost, , Face-V alue, ?, 1,00,00 0, 80Z000, , ?, 1,08,00 0, 78z400, , 1,80,00 0, , 1,86,40 0, , 90Z000, 90~000, , 93z200, 93,200, , 90,000, 1,80,00 0, , X, , 1,86,400

Page 14 :

. 11®11®,,~, , Investment Accounting, , I., , 1-4-2017, , 1,00,000, , X, , 2., , 1-6-2017, , 80,000, , 9%, , 3., , 30-6-2017, , 1,80,000, , 4., , 1-12-2017, , 5., , 1-12-2017, , X, , X, , 9%, X, , 9%, , X, , 3, 12, , tz, X, , fz, , 31-12-2017, 31-3-2018, , 2,250, , -, , 3,000, , -, , 8,100, , 94,500, 93~200, 1!300, Profit, Jul~, August, Se2tember, October, November= 5 months = 3,375, -, , Sold 900@ 105 Ex-Interes_t, Less weight Average cost, , 90,000, , .6, 6., , -, , 90,000, 90,000, , X, , X, , 9%, 9%, , X, , 9%, , X ~;, , X, , 12, , -, , 4,050, , X, , 3, }2, , -, , 2,025, , .,., , -:, , ,,...,,., , \, , 339

Page 16 :

374, , 1., , Financial Accounting (T. Y. B.Corn.) (Sem . _ VJ, , INTRODUCTION, , The fraud oft 11, 400 crores committed by Nirav Modi in Punjab National Bank comes out as, one of the most ill-famous scam in the country. It took manipulative bank officials and a deeply, compromised banking system. Uptill now it is considered as one of the biggest banking frauds in our, nation., This fraud reminds us about the Harshad Mehta and Ketan Parekh scams of frauds. After, finding the loopholes of the banking system and misusing that is not a new thing in our country. RBI, report says during 2012 to 2017 altogether 8,670 loan fraud cases were reported., The Times of India based on the Reserve Bank of India Report revealed that One bank official, is held for fraud every four hours in a public sector bank (PSB).Over 5200 Officials were held for, fraud in PSB between 1st Jan, 2015 to 31 st March 2017., Hence, ethical behaviour by employees is important to the practicality of all the organisations., "Doing what is Right" matters to the company, their employees, stakeholders and society as a, whole. Unethical behaviour by employees can affect individuals organisations and even the entire, standards of ethics and social behaviour and public accounting., 2., , CONCEPT OF ETHICS, , - The term "ethic" is frequently used in the tax and legal worlds. There is a positive stroke, experiment that one can use to decide what is and is not suitable for ethical behaviour?, When we think about the words like integrity, moral obligation, individual and corporate, responsibility, truth comes to our mind. Ethics do not only apply at the individual level but it applies, to organizations and groups such as cultures, societies, professions, corporations, among others., Numerous professional organizations suggest ethical codes for their members - professional, journalists, CPA's, Attorneys, Engineers, Medical Professionals, Human Resources professionals,, government related offices, Taxpayer Bill of Rights and Justice in Tax out Administration, members, of Federal, State and Local legislative bodies etc., Many establishments (including governments) have what could be careful ethical codes, which, are normally called a "Code of Conduct" for their employees., Ethics are moral principles and values that act as a foundation to human behavior. They are, also known as moral philosophy that involves systematizing, defending and recommending, concepts of right and wrong conduct., The term "ethics" comes from the Greek word, "ethos" that means 'character'., Ethics is primarily divided into 4 major areas;, Ethics, , Meta, Ethics, , Normative, Ethics, , Applied, Ethics, , Descriptive, Ethics

Page 18 :

[g:·~: ~~;~~i~-l~~-~~~~-~i~iii f : ·_-·:· :: · -:·: - ---·:· :: :·_ - -: - ·:-, , -:-.~~~: :~=::J, , 4.2 Corporate Social Responsibility, . ., · ., . ., Corporate social responsibility refers to the contmu!ng . comm~tment by bu~mess t_o behave, ethically and contribute to economic development while _improving. the quahty of_ hfe of the, workforce and their families as well as of the local community_ aD d society a~ large. It 1s a form of, corporate regulation integrated into a business model. CSR pohc~ helps a busine~s by developing a, built-in, self-regulating mechanism whereby busines~ would mo_ni_t?r and ens':-lre Its sup~on to law,, ethical standards, and international norms; embracing responsibility for the impact of its activities, on the environment, consumers, employees, communities, stakehol~ers and all o~her members of, the public sphere; promoting the public interest by encouraging community growth and, development, and volunta1;1y eliminating practices that harm the public sphere, regardless of, legality; and honoring of a triple bottom line, i.e., people, planet, profit., Business ethics is an umbrella term that covers all ethics-related issues that come up in the, context of_doing business. Everything from issues in supply-chain management to marketing to, acc<?unting, etc. Professionals in all the areas of business face ethical challenges. This also applies on, the gro~p level. So, teams or departments face their own ethical challenges. This applies to private, companies and public corporations as well., ·, . CSR is widely acknowledged by corporations and they know that they have responsibilities to a, van~ty of other stakeholders including: employees, customers, local communities, and the, environ~~:1.t. In other words, corporations are legal persons with legal rights, but also a set of moral, respons1b1ht1es that persons with impact on others have.

Page 19 :

s., , Professional Behavior, A profe~ional accountant should co~ply with th~ r~levant laws a~d regulations and should, avoid any action that discredits the profession. The pnnc1ple of professional behavior imposes a, obligation on professional accountants to comply with relevant laws and regulations and avoid ann, action that may bring discredit to the profession. This includes actions which a reasonable an~, informed third party, having knowledge of all relevant information, would conclude negatively, affec ts the go od reputation of the profession.

Page 20 :

.,u,.,.. • v .........., . . . . . ....... .......................... . . . ., ., ,,, ., ., ., ., .", ., ., •, ., ., ., ., .., ., ., .., ., ., ·•, .., ·, ·, ·, ·, ·, ·, :.:, ·, ., ·, .., ···, .., ····, ..., ·, ·, ., ·, ., ·, ., ·, ·, ·, ...., ·, ·... . . . . . . ........., ··· · · · · ·· · · · ····· ······· · · · · · · · · ····· ··, ····, ·, ·, ·, ·, ·, ·, ··, ···, ····, -··, S, ····, ····, IC, ·, ··, H, ···, a lu es ,, ··, T, ., ., v, ., .., E, ., 's, y, n, a, p, m, o, c, e, 1 1 · C O DE O F, th, de, sets o u t, o, c, l, a, ic, th, e, r, o, t, c, u, c. o d e o f c o n d, a, d, s, e, ll, ie, a, it, c, il, o, ib, s, ls, n, a, o, ,, p, s, deal with, estha ic, n d res, f, to, o, w, e, e, o, d, v, h, o, ti, c, n, C, o, je, A, s, b, e, ., o, e, ,, y, s, e th ic, ce to e m plo, n, a, ·, id, u, g, e, iv, g, o, ls, ics sh o uld a, th, e, f, o, e, d, ., o, s, c, n, o, n, ti, e, a, sitttu, al ri, ic-W, in eWthe ll, c e r ta A, , ', , ···· -··- ··-· ··- i

Page 21 :

....,_.........,~,...•_t-J•.....,......,'--' •• "" _,.,. . . ,, , y .. -_y ....... ... a, , - -, , JI., , SEBI and WHISTLEBLOWING, The Securities and Exchange Board of India .CSEBI') vide ~ts circular dated_ .~ ugust 26, 2003, amended the Principles of Corporate Governance incorporated 1n the standar~ L1st1ng Agreement., Clause 49 of the Listing Agree1nent to the Indian stock exchange now also mentions the formulation, of a Whistle blower policy for companies. Fallowing is the text from Annexure I D of the Clause 49, of the Listing Agreen1ent:, "The company may establish a mechanism for employees ~o r~port to the management, concerns about unethical behaviour, actual or suspected fraud or v1olatton of the company s code, of conduct or ethics policy. This mechanism could also provide for adequate safeguards against, victitnization of e111ployees who avail of the mechanism and also provide for direct access to the, Chairman of the Audit committee in exceptional cases. Once established) the existence of the, mechanism may be appropriately co111municated within the organization., At present, a listed company in India can establish as a non-mandatory requirement, a whistle, blower mechanism for employees to report their concerns about unethical behaviour, actual or, suspected fraud or violation of the company's code of conduct. However) it is currently not, mandatory for companies to have a whistle blowing policy in place. Besides thisJ the company also, has a mandatory requirement to disclose, in its report on corporate governance, the extent of, adoption of such non-mandatory practice. It is heartening to see that numerous companies have, started to adopt the practice of formulating a whistle-Blower Policy either in their quest to uphold, the highest corporate governance standards or in the fear of being regarded as late entrants to the, 'well-governed companies' group., , 2., , 1, , 1, , '