Page 1 :

March, 2014: y, z : ‘, Capital 19,000 | “Cash at Bank ee, —Drawings ns 700 | Salaries, + Plant and Mactinery a> ++ 42,000 | Repairs, + Delivery Vehicle ——— - 2,600 | Stock, Bundy Debtors — ~> "53.600 | «Rent, —Sundy Crectors --~+2,600 | Manufacturing Expenses, ~ Purchases ae 2.000 }.Gills Payable, = Seles 4,206) | *Bad Debts =, waWWages 800 | Camiage, , after meeting the following adjustments:, (i) Closing Stock was = 1,600., , he following were ‘the balances extracted fro, , , , , 7" PRACTICAL PROBLEMS, , , , m the books of Manish Gupta on sist ., , , , , , , , , , , Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2014, , (i) Depreciate Plant and Machinery at 10% and Delivery Vehicle at 15%. P| ~D A , Gii) Unpaid rent amounted to = 50_——, , PLy, , [Gress Profit—t 1,090; Net Loss—% 2,490; Balance Sheet Total—% 20,810), , Y Prepare Trading and Profit and Loss Account and Balance Sheet from the following, balances, relating to the year ended 31sMarch, 2014:, , z, _Capital 10,000, Aresios 1,200, Fetums Outward 500, . Seles 16,400, —Béis Payahie 500, ~ Plant and Machinery 4,000, Sundry Debtors 2,400, — Drawings 1,000, _Purchases 10,500, ; Retums inward 300, , Additional Information:, , & Closing Stock was valued at % 1,450., , ~Wages, Bank, — Repairs, «Stock (1st April, 2013), -Rent, --Manufacturing Expenses, - Trade Expenses, ~ Bad Debts, artiage ., Fuel and Power, , pad, , (i) Depreciate Plant and Machinery by & 400. = PL PAs, , (iit) Write off Bad Debts 500. —=, , Pt, , flv) Asum of & 40 is due for repairs. Care, , 0 0- fam ys, , z, 5,000, 1,066, , 50, 2,000, , 400, , 800, , 700, , 200, , 150, , 100, , (Gross Loss—z 500; Net Loss— 2,790; Balance Sheet Total—z 7,950]

Page 2 :

eho are asked to prepare ‘frading and Profit and Loss Account and Balance Sheet for the, year ended 31st March, 2014 of Dov Morarji from the following information:, x, , , , , , , , , , Debit Balances Debit Balances (Contd) == z, Stock (1.4.2013) ‘ 21,000 | -Offico Exponses °° | clea 650, Purchases *} : 21,650 | 4nterestpaidonLoan =. + 7 200, ~€arriage Inwards 250 | Bills Recoivable 1,800, Larrlage Outwards 800 |-Legal Chargos x 1,900, Wages 4 6,000 | | ¢Plant and Machinery / artgeiy 25,000, ‘AMotive Power, Heating ' JeTurls ¢ 4 5,000, and Lighting 1,600 -| Credit Balances ;, Printing and Stationery . 2,660 | Sales / . 48,590, _ Sundry Debtors “~~__ 28,100 feserve { 500, « Fumiture and Fixtures ; 2,000 | Loan [ os Ria 38,000, , sInvestments ‘4,000 |_Discount Received j-/2 C.F 8 ie 580, , Freehold Premisos 10,000 | Gundry Creditors 1 ; i 2,430, Travelling Expenses : 400 “Capital 1 42,710, , Depreciate Furniture and Fixtures @ 5%, Plant-und Machinery @ 10%. Tools were valued, on 31st March, 2014 at % 4,500. Stock on 31st March, 2014 was @ 18,000., [Gross Profit—® 16,090; Net Profit--® 7,160; Balance Sheet Total—= 90,800], . Following Trial Balance has been extracted'from the books of M/s. Ram Prasad & Sons on, 31st March, 2014:, Debit Balances % | Credit Balances Pas, Machinery j | 4,000 | Capital . 9,000 _, Cash at Bank 1,000 | Sales :, 5 3 500 | Sundry Creditors, 1,000 | Interest Received, , , , , , , , , , , , , , , , meno on 1st April, 2013 4,000}, ~~"Sundry Debtors 4,400, * Bills Receivable 2,900, Rent e150, «Commission on, General Expenses ae, Salaries 3580, 29,800 « L ct, Additional before ioe: 2450— 0 et poy RK Kus jes, andi alar: : i vt ), (i) Outstanding y DG a PD >), , ii) Depreciate Machinery at 1 ‘4, dis Waves outstanding amounted to%50\_ op w _ =, (a) Rent prepaid amounted 0 1200, tog xe — Mr, , a | c, 10 Stork on Bist Me Profit and Loss Account for the year ended 31st March, 2014 and, , a i a a efor Neo Provit—© 6,500; Balance Sheet Total—¥ 20,500], , i 1 on 31st March, 2014:, following are the balances extracted fon the books of Narain La S, 1,50,00, ~Harain Lat's Capital 30,000 }-Sales coe, AHtarain Lal's Drains 5,000 Sales Return ioe, -Farniture and Fittings 2,600 |Discounts (Dr.) 2000, ark Overdratt _---=.4,200 | Discounts (Cr.) om, Credits a a 13,800 |+Taxes and Insurance 4000, sEusiness Premises 20,000 | General Expenses ame, Baek Ist Api, 2043) 22,000 | xSalaries oN, ee 18,000 {Commission (Or.) 1300, Pent from Tenants 1000 | Carriage on Purchases ae, a 1,10,000 L-Bad Debts Written off, , apne Information: 5, J, Stock on Hand on 31st March, 2014 was ¢ 20,060. ; ae 50., 4if Write off Depreciation: Business Premises ¢ 300, Furniture and Fittings = 25

Page 3 :

et), ) Making a Provision ‘of 5% on Debtors for Doubtful Debts., Carry forward &% 200. for unexpired.insurance. * vw, Outstanding salary: 1,500. 0 °- - ‘, repare Trading’ ‘and, Profit and Loss’ Account for the year ended 31st March; 2014 ‘and, Balance Sheet'as at that date, °° 60", “(Gross Profit—% 34;260* Net Profit—% 14,910; Balance Sheet Total? 59, 410), Hint: % 200 of Insurance are prepaid expenses.], / From the following Trial Balance of M/s. Shradha & Sons as on 81st Herc, 2014, prepare, Trading and Profit and Lose Account and Balarice Sheet: |, , 2, , , , , , , , , , , , , , , , , , , , , , , , , , Heads of Account: ° Debit Balances (2) Cred Baaces @), Capital : SIP yh dq, Drawings 18,000 . ., —Sales~ - Sy, , Purchases 82,600 *, Stock (ist April, 204 ', ®etums Outward AA3,008, , Carriage Inwards 1,200, , Wages 4000, , Power = 6,000, , Machinery esrtsststusan |-———~ 50,000, , _Fumiture ; 14,000, pi 22,000, , alary 15,000, , - Insurance 3,600, - 8% Bank Loan — 25,000 se, , Debtors ai ike, , , , , , , , , , , , , , , , , , , Adjustments:, SD Closing Stock = 64,000., i) Wages outstanding & 2,400. = |, Gt) Bad Debts % 600.c.-~ { _ », {Provision for Bad and Doubtful Debts to be 5%. =~ R . pet foe, ) Rent is paid for 11 months... ° ( 36° ., (vi) Insurance premium is paid per annum, ended 31st May, 2014=— eer ibs, (vii) Loan from the bank was taken on 1st October, 2013.—~ lao Co, (viii) Provide Depreciation on machinery @ 10% and on Furniture @ 5%.—, (MSE Chandigarh 2013, Modified), , [Gross Profit—¥ 82,400; Net Profit—% 32,100; Balance Sheet Total—t 1, 43,400], 7. Following balances are taken from the books of Mr. Niranjan. You are required to prepare, Trading and Profit and Loss Account and Balance Sheet for the year ended 31st March, 2014:, , , , , , , , , , , , Heads of Account zg Heads of Account z, , pe 7,20,000 | Drawings sae, Opening Stock 45,000 | Plant and Machinery 24,000, iuits 1,500 | Purchases 2,95,000, ae 4,35,000 | Insurance 1,500, Rent ases Return 4,000 | Sales Return 7.000, Salty ; 5,000 | Trade Expenses 2,000, Bad Deb 24,000 | Wages 40,000, Debtors is 1,000 | 6% Investments 50,000, Bad Debts R 40,000 | Sundry Creditors 19,000, Advertisem eee 800 | Cash 12,200, Patents Expenses 6,000 | Miscellaneous Receipts 1,200, , — 4,800

Page 4 :

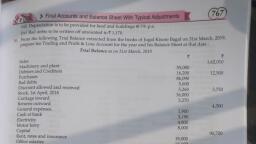

Adjustmenta: weinitie q, i) Cloning Stoc, i Deprecite Machinery by Sepa genie by ees HK, oa 25,000 and Salaries are outstan!, His Wnts off 7 600 as Bad Debte and create ‘5% Provision’ ae ; Bad Debis, es create a,, , t on Debtors @ 2%. ,, Reserve for Discount o! 2014 and no inte sthas been feceived so far:, , , , , , ; ; le on Tat a, (v) Investme ate were made “(Delhi 2008, Modified), Profit—® 1,22,000; Net Profit—t 78, 04; BAGH Sheet Tolal~? 2,03,824], “"[Grosa Profi Final Accqunts for the year, , 8. From the following Trial Balance of Shri O.P. Yaday, prepare |, onded Blat March, 201A: x29 i, : _ TAAL BALAICE s, , , , , , , , , , , , , Hoads of Account, Purchases and Sales, Retums Inward and Returns Outward, Carriage s, Wages, , Trade Expenses ., Insurance .. eg, , Repairs, , , , , , , , , , saad cemaamananel, , a, , 2 Debtors and Creditors , i, 7 Printing and Stationery —, Advertisement., Bills Receivable and Bills Payable, Opening Stock, Cash in Hand, | inigrest on Bank Loan, Machinery, Furniture, Drawings, Commission, Loan from Bank @ 12%, Capital, Rent Received, yy Cash at Bank, , 8,88.000, , , , , , , , , , , , Additional Information:, -(i) Closing Stock on 31st March, 2014 was % 21,000., ~-(iiy-Rent of 7 1,200 has heen received in advance., —{ii)-Obtstanding liability for trade expenses Z 12,000., fi Commission earned during the year but not received was % 2,100., (Gross Profit 1,71,000; Net Profit—z 1,30,100; Balance Sheet Total—t 4,96, 100}, (2) The following balances were extracted from the books of Vijay Kumar on 31st March. 2014:, , , , z z, Capital 24,500 | Loan a, Drawings 2,000 | Sales “47,000, General Expenses 4,740 | Purchases 2000., Building 11,000 | MotorCar ao & 900, Machinery 9,340 Debts Provision ‘~~ 1,320", Stock 16,200 | Commission (Cr) » VL & i

Page 5 :

Taxes and Insurance 1,315 | Car Expenses, , 1,800 ©, , 7,200 | Bills Payable 3,850.“, Dano ‘ 6,280 |. Cash ‘ 80, Creditors tee v 2,500. |. Bank Overdraft vrs. 3,800, Bad Debts ~. > 350 | Charity P| A905", , _ Prepare Trading and Profit 3 A, Balance Sheet as at that date after giving ¢, (a) Stock-on 31st March, 2014 was valued at % 23,000.02", , (b) Write off further % 180. as Bad Debts and, , at 5% on Debtors. way, (c) Depreciate the Machinery at 10%., , (d) Provide % 700-as outstanding interest:on loan. -*, , [Gross Profit 17,960; Net Profit 9,561; Balance Sheet Total—¥ 50,281), [Hint: Percentage of Provision for Doubtful Debts is always calculated only on good, debtors, i.e., after deducting the further Bad Debts as 5% of € 6,280 —& 180).J, .JOn Sist March, 2014 following Trial Balance was extracted from the books of Mohan:, , and Loss Account for the year ended 31st, g effect to the.following adjust, , pew, , maintain:the Provision for Doubtful Debts , March, 2014 and, ments;, , , , , , , , , , , , , , Particulars Debit | ~ Credit ~, Balances | Balances, x z., , eee 5 30,000, rawings . 5,000, , -2Bebtors and Creditors t- . 20,000 10,000, , Loan ¥ 9,500, —Interest on Loan 300, , , , , , , , Bank” =, _Aand and Building, Bad Debts, , , , , , , , Burchases and Sales - 4,10,000, —Retums Pt 1,500, Carriage Outwards =, es _Lattiage Inwards, _esalaries |, Ment and Insurance:, Advertisement, Discount, General Expenses me, 7 Bills Receivable and Bills Payable, RentReceived ona a 00, 1,64,500 | 1,64,500, , , , , , , , , , Prepare Trading and Profit and Loss Account for the year ended 31st March, 2014 and, , Balance Sheet as at that date after taking into account the following:, ef Depreciate Land and Building at 24% and Motor Vehicles at 20%., Lb) Salaries outstanding % 200., ey Prepaid Insurance % 200., , Ady Provision for Doubtful Debts is to be maintained at 5% on Debtors., Ag Stock on 31st March, 2014 was valued at % 7,000., , [Gross Profit—z% 34,700; Net Profit—z 10,700; Balance Sheet Total—® 57,400], , 1. ite Balance has been extracted from the books of Shri Sunder Lal on 31st