Page 1 :

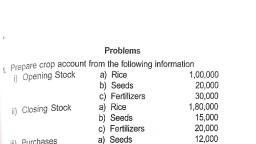

CHAPTER-8, , RECTIFICATION OF ERRORS, Introduction, Accounts are prepared by accountant, a human being is likely to commit, mistakes at time of recording and posting in the books. However, such errors, are located after some time and should be corrected by passing corrective, journal entry, which is known as rectification if errors., Learning Objectives : After studying this topic the students will be able to:, , , Explain Types of Errors and their examples, , , , Rectify the Errors : Two i.e. Errors not affecting Trial Balance and One, sided i.e. Errors which affect Trial Balance., , , , To Explain Meaning and Utility of Suspense A/c, , , , Maintain Suspense A/c., , Important : The errors whether affecting the Trial Balance or not must be, detected and rectified., Need of Rectification, 1., , For the preparation of correct Accounting Records., , 2., , Preparation of P & LA/c with corrected figures to ascertain correct, Profit or Loss., , 3., , To find out the true financial position of the firm by preparing Balance, Sheet with corrected figures., , [XI – Accountancy], , 138, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 2 :

Classification of Errors, (on the basis of Nature), Type of Error with Meaning, 1. Error of Omission, , Sub-Types with Examples, (a) Error of Complete Omission, , (When a transaction is completely, Goods sold to X on Credit but not recoror partially omitted to be record, ded in Sales Book., in the books), (b) Partial Commission, Purchase machinery Rs. 5,000 in cash, recorded in cash Book but not recorded in, Machinery A/c, II. Error of Commission, , (a) Error of Recording in the Book of, Original Entry, , (These errors are caused due to, Goods purchased from Ravi for Rs. 450,, wrong recording of transactions,, Goods as Rs. 540, in the Purchases Book, wrong totalling of subsidiary, (b) Wrong Totalling of Subsidiary Book, books or Ledger A/cs, Wrong, Example : Purchase Book has been, posting and wrong carry forward), undercast (short totalled) by Rs.100., (c) Error in Totalling or Balancing of, Ledger A/cs*, Example : Creditors A/c has been, balanced short by Rs. 500., (d) Error of Posting, (i) Posting to the wrong side but correct, account., Goods sold to X for Rs. 550, entered to the, credit of X’s A/c instead of posting to the, debit side of his account., (ii) Posting with wrong amount., (iii) Posting twice in an A/c/, (iv) Errors in posting to the wrong A/c, but correct side don’t affect Trial, Balance., (e) Error in carrying forward., Total of purchase book Rs. 2,500 is carried, forward as Rs. 2050, III. Errors of Principal., , (a) Treating capital items as revenue item, , (These errors are caused due to, , Example :Wages paid for the installation, , 139, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 3 :

the violation of accounting, principles i.e. allocation between, Capital and Revenue items., , of anew machinery charged to Wages A/c, instead of machinery A/c., (b) Treating Revenue Items as Capital Item, Example : Rs. 200 paid for the repairs of, an old Machinery but debited to Machinery, A/c instead of Repairs A/c., Example : Cash paid to Ram Rs. 5,000, , IV. Compensating Errors, (Two or ore errors committed, such a way that the net effect, of these errors is nil)., , but debited him as Rs. 500 and paid to, Mohan Rs. 500 but debited him as Rs. 5,000, so, net effect will be nil., , TYPES OF ERRORS FROM RECTIFICATION POINT OF VIEW, From Rectification point of view, errors are classified into the following, two categories only :, Case I : Errors which don’t affect the Trial Balance, or, Two Sided Errors, Case II : Errors which affect the Trial Balance, Or, one Sided Errors., Errors don’t Affecting Trial Balance, (1) Errors of complete commission., (2) Wrong recording in the books of original entry., (3) Complete ommission from posting., (4) Errors of posting to the wrong A/c but on the correct side., (5) Compensating errors., (6) Errors of principle., , [XI – Accountancy], , 140, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 4 :

Errors Affecting Trial Balance, Shown by Star in the Table showing., 1. Error in totalling of subsidiary books as undercast or over cast., 2. Error in the balancing of ledger accounts., 3. Error in posting to the correct Account but wrong amount., 4. Error of partial ommission., Rectification of Errors, When the errors are detected, these have to be rectified in the books of, accounts. Rectification of errors depends upon., , , The type of error and, , , , The time of depiction of an error., Time of Depiction of an error means., , (i) Errors of detected before the preparation of Trial Balance., (ii) Errors detected after preparing Trial Balance but before preparing final, Accounts., (iii) Errors detected after preparing Final Accounts., Rectification of Errors detected after preparing Final Accounts is not in, the syllabus. Hence we will discuss only type (i) and (ii), , RECTIFICATION OF TWO SIDED ERRORS, Two sided errors are those errors which affect two sides of Accounts., These errors don’t affect trial Balance as discussed earlier., These Errors are rectified by passing a Journal entry irrespective of the, time of depiction. In other words their rectifying entry will be same whether, (a) the error si depicted before Trial Balance or (b) after the preparation of, Trial Balance but before the Final A/cs are prepared., , 141, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 5 :

Steps for Rectification, (1) Locate the effect of Error on Different Accounts., (2) The Account showing excess credit should be Debited., (3) The Account showing excess Debit should be Credited., (4) The Account showing short Debit should be Debited., (5) The Account showing short Credit should be Credited., Examples (with Explanation), (I) When an account has wrongly been debited in place of another A/c., , , Rectification will be done by debiting the correct account and Crediting, the A/c which was wrongly debited., , Example : Machinery purchased for Rs. 10,000 has been debited to Purchases, A/c, Solution : Here two accounts are affected, , , Machinery A/c is not debited hence its debit side is short by Rs. 10,000, whereas purchases A/c debited by mistake. Purchases A/c debit side is, in excess by Rs. 10,000., , , , While rectifying this mistake Machinery A/c will be debited by Rs., 10,000 because it was not debited earlier and Purchases A/c will be, credited because it was wrongly debited., , Rectifying Entry is, Machinery A/c, , Dr., , To Purchases A/c, , 10,000, 10,000, , (For purchases of machinery, wrongly debited to Purchases A/c), , (II) When an account has wrongly been Credited in place of another, account., , [XI – Accountancy], , 142, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 6 :

Example : Rs. 5,000 received from the sale of old furniture has been Credited, to Sales A/c., Solution : This error also affects the two A/c, , , Furniture A/c is not Credited hence its credit side is short by Rs. 5,000., , , , Sales A/c is credited by mistake its credit side is excess of Rs. 5,000., , , , Therefore fore rectifying this mistake Sales A/c will be debited because, it was wrongly Credited and Furniture A/c which was not Credited, earlier will now be credited by Rs. 5,000., , Hence Rectifying entry is, Sales A/c, , Dr., , 5,000, , To Furniture A/c, , 5,000, , (Sales of old Furniture, wrongly Credited to Sales A/c), , (III) When there is a short debit in one A/c and a short Credit another, A/c., Example : Goods sold to Seema for Rs. 540 was entered in the Sales Book, as Rs. 450., Solution :, , , Here Seema’s A/c is debited by Rs. 90 short and Sales A/c is credited, by Rs. 90 short., (Instead of Rs. 540 by Rs. 450), , , , Therefore rectification will be done by Debiting Seema’s A/c and, Crediting Sales A/c. Hence Rectifying entry is:, Seema, , Dr., To Sales A/c, , 90, 90, , (For Goods sold to Seema for, Rs. 540 wrongly entered Rs.450), , 143, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 7 :

(IV) When there is an Excess Debit in one A/c and Excess Credit in, another A/c., Example : Goods purchased from Mohan for Rs. 300 was recorded in Purchases, Book as Rs. 3,000., Solution :, , , Here Purchases A/c is Debited by Rs. 3,000 instead of Rs. 300, i.e. Rs., 2,700, more., , , , Mohan’s A/c is also Credited by Rs. 2,700 more., , , , Rectification will be done by debiting Mohan’s A/c and Crediting, purchases A/c by Rs. 2,700, i.e., the entry in the reverse direction., , Rectifying Entry, Mohan, , Dr., , 2,700, , To Purchases A/c, , 2,700, , (For Purchase of goods from Mohan for, Rs. 300 wrongly entered Rs.3,000), , Problem :, Rectify the following Errors :, (1) Rs. 5,000 Paid for furniture purchased has been debited to purchases, account., (2) Wages paid Rs. 7,000 for installation of new machinery were recorded, in wages account., (3) Goods sold to Hari Rs. 10,000 not recorded., (4) Rs. 2,500 received from Monu has been credited to Sonu A/c., (5) Rent paid Rs. 1,000 wrongly debited to Landlord Account., (6) Credit Purchase from Raman Rs. 15,000 were wrongly recorded in, sales book., (7) Credit sales to Geeta Rs. 8,.800 were recorded as Rs, 8,800, [XI – Accountancy], , 144, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 8 :

(8) Goods Rs. 5,000 withdrawn by proprietor has not been recorded., Solution :, Error No., 1., , 2., , 3., , Particulars, , Furniture A/c, To Purchases A/c, (The furniture purchase wrongly, debited to purchase A/c), , L.F., Dr., , 5,000, , Dr., , 7,000, 7,000, , 10,000, , To Sales A/c, (The goods sold to Hari not recorded.), 4., , Sonu, , Dr., , 10,000, 2,500, , To Monu, (The amount wrongly credited to Sonu, instead of Monu), 5., , 6., , 7., , 8., , Cr. Rs., 5,000, , Machinery A/c, Dr., To wages A/c, (The wages for installation machinery, wrongly debited to wates A/c, Hari, , Dr. Rs., , 2,500, , Rent A/c, Dr., To Landlord, (The rent paid but wrongly debited to, landlord A/c), , 1,000, , Purchases A/c, Dr., Sales A/c, Dr., To Raman, (The Credit purchase but wrongly, credit to sale A/c., , 15,000, 15,000, , Geeta, Dr., To sales A/c, The Credit sales to Geeta Rs.8800, but recorded 8000, , 800, , Drawings A/c, Dr., To Purchases A/c, The goods withdraw by Proprietor for, personal use, , 5,000, , 145, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , 1,000, , 30,000, , 800, , 5,000, , [XI – Accountancy]

Page 9 :

Important : Rectification of double sided errors can easily be understood by, the students. These are rectified by passing the journal entries as given, irrespective of the time of detection of the errors., , RECTIFICATION OF ONE SIDED ERRORS, These errors affect only one side of An Account either debit or credit., Therefore these errors the Trial Balance., Rectification of these errors is done differently, in these two cases i.e., (i) Before preparing the Trial Balance, (ii) After preparing the Trial Balance, Case 1 : Rectification of one sided errors before preparing Trial Balance., When there errors are rectified before preparing Trial Balance i.e., transferring the difference in the Trial Balance to the Suspense Account., (Which will be explained later on), then it is done directly by debiting or, crediting the concerned ledger account., Fore Short Debit Concerned A/c is Debited., Fox Excess Credit Concerned A/c is Debited, For Short Credit Concerned A/c is Credited, For Excess Debit Concerned A/c is Credited, Example : (1) Purchases Book understand by Rs. 150, Analysis : It means that the total of the Purchases, Book is Rs. 150 short., , , This total is posted to purchases A/c- Debit side, , , , Hence Purchases A/c is debited short by Rs. 150, , , , No effect on any other A/c, , , , Therefore purchases A/c will be debited by Rs. 150 to rectify this error, as given below., , [XI – Accountancy], , 146, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 10 :

Purchases A/c, Date Particulars, , J.F., , To Undercast of, , Rs., , Date Particulars, , J.F., , Rs., , 150, , purchase book, , Here debit side of the Purchase A/c was short therefore the rectification, is done by debiting the A/c., Example 2 : Purchases Book is overcast by Rs. 300, Analysis, , , Means total of the Purchases Book is in excess by Rs. 300 which is, posted to the debit side of purchases A/c, , , , Hence purchases A/c is debited in excess by Rs. 300., , , , No effect on any other A/c., , , , Therefore to rectify this error Rs. 300 will be credited to purchases A/, c (i.e. opposite side), Purchases A/c, , Date Particulars, , J.F., , Rs., , Date Particulars, By Overcast of, , J.F., , Rs., 300, , Purchases Book, , , Here debit side of the purchases A/c was in access, therefore the, rectification is done by entering the amount on the opposite side i.e.,, Credit side of the Purchases A/c., , Case II : Rectification of one Sided Error after Preparing Trial Balance, When the errors are detected after the preparation of Trial Balance then, every single sided error is rectified by passing a Journal entry through Suspense, Account., , , For short Debit Income Account Debit that Account and Credit, the Suspense A/c, , 147, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 11 :

Excess Credit in one Account Debit that Account and Credit the, Suspense A/c, Short Credit in one AccountCredit that A/c and Debit the Suspense A/c, Excess Debit in one AccountCredit that A/c and Debit the Suspense A/c, Example : Hence for the same error as given in example No. in case I, the, following Journal Entry will be passed., Rs., Purchases A/c, , Dr., , Rs., , 150, , To Suspense A/c, , 150, , (For undercast of purchase book,, now corrected), , Example 4 : Sales Book was undercast by Rs. 200, Analysis, , , Sales book totalled short by Rs. 200 which is posted to the credit side, of sales A/c., , , , Therefore Sales A/c credit side is short by Rs. 200., , , , Hence rectification will be done by crediting the sales A/c and Debiting, the Suspense A/c by Rs. 200., Rs., , Suspense A/c, , Dr., , To Sales A/c, , Rs., , 200, 200, , (For undercast of Sales Book, now corrected), , Note : When nothing is mentioned in the question about the time of detection, of an error, the student are advised to rectify one sided errors through Suspense, A/c., Problem :Rectify the following error, (A) Without opening a Suspense A/c, , [XI – Accountancy], , 148, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 12 :

(B) By passing Journal entries through Suspense A/c., (1) Rs. 5,000 paid to Mohit were entered in the cash Book but, omitted to be posted to the ledger., (2) Rs. 5,000 paid to Mohit were debited to his A/c as Rs. 500., (3) Rs. 5,000 paid to Mohit were debited to his A/c as Rs. 50,000., (4) Rs. 5,000 paid to Mohit were credited to his A/c, (5) Rs.5,000 paid to Mohit were credited to his A/c as Rs. 500., (6) Sales Book was overcast by Rs. 2,000, (7) Sales Return Book undercast by Rs. 4,000, (8) Purchase Return Book undercast by Rs. 5,000., Solution :, (A) Without opening a suspense A/c. These errors are rectified in the, concerned ledger A/c, as these errors before trial Balance., (1) Mohit’s A/c will debited by Rs. 5,000 as it is a case of partial, ommission., (2) Mohit’s A/c was debited Rs. 45,000 (5,000-500) therefore the, rectification will be done by debiting Mohit’s A/c by 4,500., (3) Mohit’s A/c was debited in excess by Rs. 45,000 (50,000-5,000), therefore ratification will be done by crediting the Mohits A/c, by Rs. 45,000., (4) Mohit’s A/c was credited by Rs. 5,000 instead of debited by Rs., 5,000 therefore rectification will be done by debiting Mohit’s, A/c by Rs. 10,000 (5,000+5,000), (5) Mohit’s A/c was wrongly credited by Rs. 500 instead of debiting, it by Rs. 5,000, so rectification will be done by debiting the, Mohit’s A/c by 5,500., , 149, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 13 :

(6) Sales book overcast means sales A/c is credited is excess by Rs., 2,000. Hence rectification will be done by debiting sales A/c by, 2,000., (7) Sales Return Book total undercast by Rs. 4,000 means sales, return A/c is a debited short by Rs. 4,000 Hence rectification, will be done by debiting sales Return A/c by 4,000., (8) Purchase Return Book undercast by Rs. 5,000 means purchase, Return A/c is credited short by Rs. 5,000., Hence rectification will be done by crediting the purchase Return, A/c by Rs. 5,000, (B) By opening suspense A/c., Rectifying Journal Entry, Error No., 1., , 2., , 3., , 4., , 5., , Particulars, , L.F., , Dr. Rs., , Mohit, Dr., To Suspense A/c, (For cash paid to Mohit committed, to be posted to his A/c), , 5,000, , Mohit, Dr., To Suspense A/c, (for Mohit A/c was debited with excess, amount), , 4,500, , Suspense A/c, To Mohit, (fro Mohit A/c was debited with, excess amount), , Dr., , Mohit,, To Suspense A/c, (For posting to Mohit’s A/c, was done on wrong side, , Dr., , Mohit, To Suspense A/c, , Dr., , [XI – Accountancy], , Cr. Rs., 5,000, , 4,500, , 45,000, 45,000, , 10,000, 10,000, , 5,500, 5,500, , 150, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 14 :

(For posting made with wrong, wrong amount and wrong side), 6., , Sales A/c, , Dr., , 2,000, , To Suspense A/c, , 2,000, , (For overcast of sales Book rectified), 7., , Sales Return A/c, , Dr., , 4,000, , To Suspense A/c, , 4,000, , (For undercast of sales return book, rectified), 8., , Suspense A/c, , Dr., , 5,000, , To Purchase Return A/c, , 5,000, , (For undercast of purchase return, Book, rectified), , Suspense Account and its Disposal, In the chapter of Trial Balance we have learn about the Suspense A/c, Important, , , When inspite of all the efforts the Trial Balance does not tally, the, difference is put to a newly opened account named Suspense A/c., , , , Suspense A/c is an imaginary account, opened temporarily for the, purpose of reconciling a Trial Balance., , , , Later on when the errors affecting the Trial Balance are located,, rectification entries are passed through the Suspense A/c., , , , When all the errors are located and rectified, the Suspense A/c will be, auto material closed i.e., it will show zero balance., , , , But if suspense A./c still shows a balance it will indicate that some, errors are still to be discovered and rectified., , Problem : An accountant of a trading concern could not agree the Trial Balance., There was an excess credit of Rs. 100 which he transferred to the suspense A/c, The following errors were subsequently discovered., (1) Received Rs. 550 from X, were posted to the debit of his account., , 151, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Page 15 :

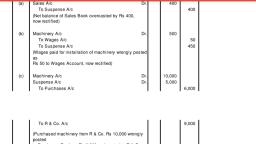

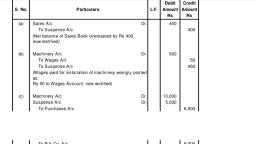

(2) Rs.100 being purchase return were pointed to the debit of purchases A/c., (3) Discount received Rs. 200 Correctly entered in the Cash Book but, posted to the debit of the discount A/c., (4) Salary paid Rs. 3,500 to X were posted to the salary A/c as Rs 2,500., (5) A purchase of Rs. 400 has been passed through Sales Book. However, the customer’s account has been correctly credited., Give Rectifying entries and Suspense A/c, Rectifying Journal Entries, Date No., 1., , Particulars, , Suspense A/c, , L.F., Dr., , Dr. Rs., , Cr. Rs., , 1,100, , To X, , 1,100, , (Amount received from X was Posted, to the wrong side now corrected), 2., , Suspense A/c, , Dr., , 200, , To Purchase A/c, , 100, , To Purchase Returns A/c, , 100, , (For the purchases return wrongly posted, to the purchases A/c), 3., , Suspense A/c, , Dr., , 400, , To Discount A/c, , 400, , (Discount received was posted to the, wrong side of discount A/c), 4., , Salary A/c, , Dr., , 1,000, , To Suspense A/c, , 1,000, , (Salary paid was posted to Salary A/c, with lesser amount), 5., , Purchases A/c, , Dr., , 400, , Sales A/c, , Dr., , 400, , To Suspense A/c, , 800, , (Purchases has been passed through sales, book but the customer’s A/c has been, correctly credited), , [XI – Accountancy], , 152, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8 # 2nd Proof.

Page 16 :

Dr., , Suspense A/c, , Date/Error, , Particulars, , To Difference in, the Trials Balance, , J.F., , Rs., , Date, , 100, , (4), (5) (i), (ii), , (1) To X, , Cr., Particulars, By Salary A/c, By Purchases A/c, , J.F., , Rs., 1,000, 400, , By Sales A/c, , 400, , Balance c/d, , Nil, , 1,100, , (2) To Purchases A/c, , 100, , (3) To Return A/c, , 100, , (4) To Discount A/c, , 400, 1,800, , 1,800, , Since the Balance of the suspense A/c is nil, indicates that all the errors, have been certified., Suggested methodology, Discussion Explanation method is suggested., , 153, , Twinkle Graphics#Laxmi Printers-2013 #Accounts-7-8# 2nd Proof., , [XI – Accountancy]

Learn better on this topic

Learn better on this topic

Learn better on this topic

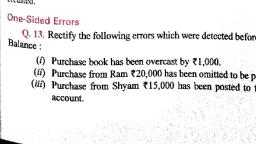

Learn better on this topic