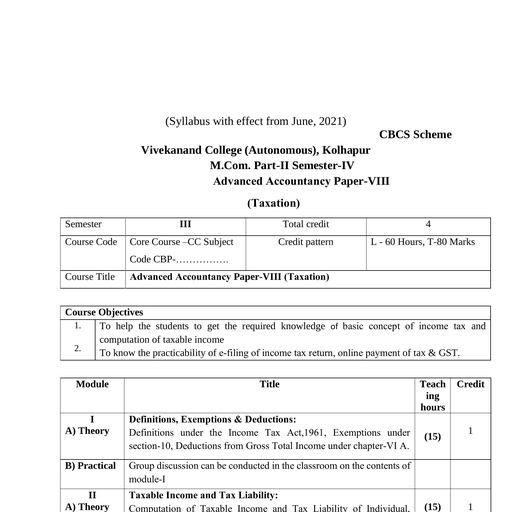

Page 1 :

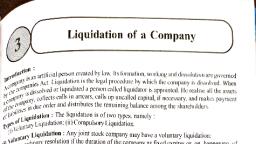

(3, , Conversion of Partnership, into a Company, , Meaning: Conversion and Sale, a) Conversion, , of Partnership, , into a Limited Company, feature in business that quite often the managements of, partnership firms a, compelled either to convert their firms into limited companies or to sell them to the limite, companies. When the- legal position and form of a partnership firm is changed by forming a jo, stock company to take over the business of such, firms, it is conversion. In case of conversio, the only change that takes, is, that, the, place, partners of the firm become shareholdrs of t, company. Assets, liabilities. nature and place of business and its, management remain the sam, The same old business is continued under new form., (b) Sale of Partnership Firm to a Limited, Company:, On the other hand, sale to a, is, company slightly different from conversion. When an, existin, businss of the firm is sold to an, altogether different but to an existing Joint Stock Company., becomes 'sale to a company'. Here,, though the assets and liabilities of the fim are transferr, to the joint stock, the, company,, nature, place and management of the, partnership business d, not remain the same. The, partners may not be given the membership of the, company., (c) Distinction between Conversion and Sale :, Thus in case of conversion only business form of, organisation is changed, management remaining ti, same. In sale to a, fom, of, business organisation as well as, compnay both,, management, are changed., (d) Practical views: Ultimate Dissolution of a, Firm:", However, from accounting point of view, the conversion as well as sale, to a company result, ultimate dissolution of an existing partnership firm. As such the, distinction between conversi, und sale does not make material difference. Both these, terms are used,, synoinymously, Objects of Conversion and Sale, Normally. the partnership firms are converted into or sold to the, joint stock companies with, intention of getting rid of the disadvantages of, form, of business, partnership, with a desire of enjoying the, of joint stock, advantages, company form of organisation. Tn, whenever a business expands and a firm feels the, need of greater amount of, capital or techni, knowhow or of better management, it cannot meet its, in, its, requirements, in partnership, the, lrability of partners is unlimited whereas in limited existingitform. Moreo", company is, paid up capital. These and many other considerations, to, tempt the partners to convert or sell, firm to a, lt is, , a common, , organisation, limited, , company., , Following are a few objectives, (a) Need for, Expansion of Business., (b) Need for Reduction of, Unlimited Liability., (c) More number of, persons with their financial ability can be made, (d) Shares of a limited, company are easily transterable., (e) Limited company enjoys certain tax, concessions., (f) A limited company is a continuous and, separate legal entity., (g) It also enjoys better status than that of a, firm., , Conversion of Partnership into a Limited Company, , to, , t, , participate in the afta

Page 2 :

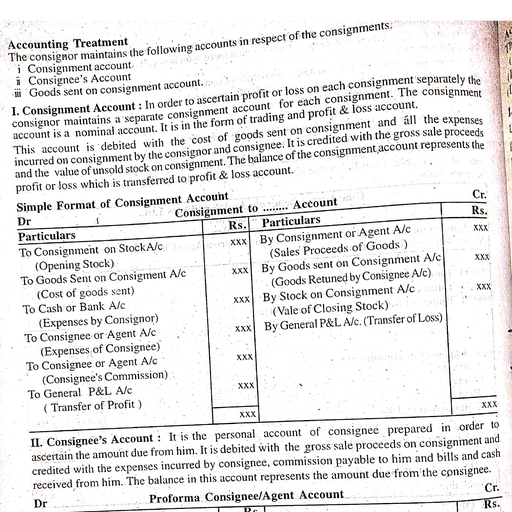

Accounting Procedure, , "Onversion or sale to company being nothing but a kind of dissolution, there is not much difference, a the aecounting procedure of ordinary dissolution and conversion or sale of partnership io a joint, :tQck company, except certain slight changes in some cases. However, before passing the closing, , ntrics in the books of the dissolving firm., the following points about the Purchase price or, , onsideration, , must be, , carefully, , noted., , I. Purchase Consideration. The price paid by the pruchasing company to the firm which has, converted or sold its business is called "Purchase Consideration". ltis a selling or sale price, , for the selling firm., , II. Payment of Purchase Consideration. The purchase consideration (i.e. sale price for the, fim) can be received in any or all of the following forms:, (a) By payment n cash., (b) By the issue of shares of the company., (c) By the issue of company's debentures., , L. Division of Purchase Consideration. The debentures and shares out of the purchase, price received from the Company should be distributed among the Partners in the ratio of, their final claims, i.e. the ratio of capitals standing after dissolution process is completed and, only final settlement is awaited. In any case, profit sharing ratio should not be used, unless, otherwise mentioned in the Agreement., , After the Debentures and Shares are thus distributed, the balance if any, in the Capital, Accountsmust be paid in cash according to their claims., IV. Methods of Ascertainment of Purchase Consideration, , Followiny are the methods of ascertaining the purchase consideration, 1. Net Assets Method:, nder this method. the purchase consideration of the business taken over by the company is, alculated on the basis of net assets taken over from the vendor firm. In other words the, Teed value of assets laken over by the purchasing company is ascertained from which the, agrecd value of liabilities taken over is deducted. The balance is deemed as the purchase price, of the business taken over., , Symbolically., PC, , A L), Purchase Consideration, , A, , Agreed, , PC, , Where, , Agreed, , values of Assets taken, values of liabilities taken, , over, over., , 2. Net Payment Method :, tinder this method the purch:ase consideration is the aggregate value ofall the payments in the, fom of shares, debentures and cash as per the agreement made by the purchasing company, to the vendor fin., , 3.1mp Sum Method :, nder this method the lumpsum price is payable by the purchasing company to the vendor firm, , or the business taken over. It is given directly in the problem. Hence the question of calculation, , purch:ase prict does not arise., , onversion, , of Partnership into a, , Limited, , Company, , 59

Page 3 :

of., of Accounts, , Treatment, , Step., , I:, , accounts, , all assets, Closureof, of all., otherwise, , es (unless, ., , ea, , them at, , efierring, , Sheet:, appearing in the Balance, cash & bank, as appearing in the balace sheet, including, to a, , booK-values, , t r a n s f e r r i n g, , ncttre, , Clost, , of all ihird party, reserve, , uing, , (external), , doubtful, , for, , excluding any losses. by, "Realisation Account"., temporary account, namely, in the balance sheet, liabilities accounts as appearing, , not taken over, , by, , the company), but, , by transferring, , debts (RDD) if any,, , them at their book-, , nclud., , Cvalues, u to the "Realisation Acoun, , with their respective, accounts of all partners, of, eapital, or rather re-opening, Maintenance, final settlement, the balance sheet until their, as appeang n, balances, unil.i, losses, r e s e r v e s, undistributed profits o r, Cap, and, acçumulated, closure of all, ratio., Transfer and, their profit sharing, lccounts ol the partners in, the, capi:al, balance sheet to, etC.. 1o, in the, as appearing, of, accounts, partners, or current, Transfer of dra Wings, accounts, , the capital, , Setp :, , Receipt, , I:, , of Purchase Price,, Realisation, , closure of, , any,, , of respeetive partners., , Recording of purchase, , of, , Realisation, , company, , through, but taken, , consideration, , due from, , Realisation, , and, , assets, , of, , Realisation Account', Over, , assets, , by, , and payment of, , purchasing, , company., , price, , of any, , the purchasing, , over, , by, , thgrough, , liabilities, , Step:, , X, , sharing, , I1I. Final, , 2.Settlement, , if, , by erediting, , taken, , Realisation, , over, , Acront, , by, , the, , of the, , in, , Purchasing, and closure of, etc., , through, , Company, , Account"., , "Realisation, , Account"., , realisation, of all, the, capital, 10. Payment of, to, Loss'", or, Account"., "Realisation Profit, Realisation, 1.Transfer of, temporary, "Closure of the, profit, , Liabilities,, , or by the partners., the purchasing company, from the, and debentures, cash and/or shares, , (consideration), , expenses, , company, , liabilities not, assets or, , the partners, , liabilities not taken, , Receipt of purchase, , and Payment of, , Account ete., , "Realisation Account"., Transfer, , Assets, , accounts, , their, partners in, , ratio and, , Settlement, , of Capital, , of PartnersCapital, , Accounts:, , Accounts, , shares & debentures, cash and/or in, payment in, , by, , amongst, , order., the purchasing conpany, elc. in the following, received from, Debentures, balaces as adjusted, and/or, franl capital, a) Distribution ofShares, claims, i.e., the, final capital, distribution of, ratio of their, he partners, , in the, , &Corrected, , realisation, transfer of, upto the, , Shares and/or, Distribution, , Case, , of cash, , ofspecific, , the, partners to, amongst the, shares/debentures,, , instructions,, , distribution, , e, , loss but before,the, , and, , debentures, , Dearest number, , and then, , cannot, , extent, , i.e., , ofcash,, , O agreement & instructions,, shares, , or, , debenetures., , distribution, Cmaining after, , c), , profit, , beissued, , issued., , RPrsian, at Prtuarelhin inlo a Limited Compay, Co, , in, , of their respective capital, , balances, , remainng balances, , debentures, shares and, , fraction:, , they, , strictly according, , to, should be rounded olf

Page 4 :

Proforma Journal Entries, Step :1: Entries to close all the accounts that appear in the Balance Sheet., (a), , Closure of all assets excep accumulated losses, Whether taken over or not, , (b)Closure of all liabilities except accumulated, , (c), , Profits & Reserves., , Transfer (Closure) of Profit. Reserves,, Accumulated Profits etc., , Realisation A/c, To All Assets 'A/cs (Including Cash &, (Transfer of all assets to realisation alc)Bank, All Liabilities A/c (Including, R.D.D.), To Realisation A/c, (Tansfer of all liabilities to realisation, , alc), , P &L A/c, Reserve Alc, To All Partners', , Capital, , A/cs, , (Transfer in profit sharing ratio), , (d)Transferof accumulated loss if any,, drawings etc, , Step II: Entries, , To Accumulated losses A/cs, To Partners' Drawings A/cs,, to, , record, , (Transfer of losses and drawings), , purehase consideration, etc., , (aPurchase Consideration receivable from, Purchasing company, , the purchasing company, , taken, , (Those, , not, , Purchase Company A/c, To Realiation A/c, , (b) Realisation of assets not takne, , (c)Assets, , All Partners' Capital A/cs., , (Purchase consideration due), over, , by, , Cash/Bank A/c, To Realsiaiton Ac, (Assets realised), , by the partner, takein overy by the, cOmpany, over, , Partners' Capital Alcs, To Realisation AWc, , (Assets taken, , (dPayment of liabilities not taken over by, the company or liabilities taken, , over, , by the Partners), , Realisation A/e, To, , Over by partners, (e)Payment of real1sation expenses etcC., , Cash/Bank/Partners' Capital A/cs., (Payment to liabilities and or liabilities taken over by partn, Realisation A/e, , To Cash/Bank Alc, , f) Purchase CConsideration received from, , the purchase cOmpany, , (Realisation expenses paid), Cash/Bank A/c, Shares A/e, , Debentures A/c, To, , Purchasing Company, , A/c, , (Purchase price received in cash and/or, shares & debentures), , (gRealisation profil transferred, (, Step :, , case, , 1II, , of loss,, , reserve, , Settlement of, , (aPartners' Capital, , entry, , be, , given), , Partners' Capital, , Balances settled by, , ayment in cash and or in shares/debentures, , Conversion, , of Partnership, , into, , a, , Limited, , Realisation A/c, To All Partners', , Capital, , in, , A/cs., , (Realisation profit transfeered, to partners in, profit sharing ratio), , Accounts:, AL Partners' Capital Alcs, To Shares A/c (Pro-rata), To Debentures A/c, (Pro-rata), To Cash/Bank A/e (Balance), (Settlenment of capital Accounts of, , Company, , Partnes

Page 5 :

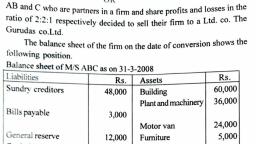

ImportaERE Notes, , r y dcbtors should be transterred to realisation account at, r Doubtful Debts, il any should be separately transferred tofull or gross value and Reserve, realisation account., of conversion/sale of partnership. cash and bank balances, are assumed to, be taken, over by the purchasng company, unlesSs otherwiSe mentioned., Hence these accounts, should, closed by transterring to realisalion account alongwith other assets, (unlike, simple, dissolution, where these two accountS are shown, , i, , Ne, , separately)., , -estiShres and debentures, ul, , should be distributed first and cash should, be paid only thereafter., Unless otherwISe stated; it i8 assumed that all assets, including cash and all liabilities are taken, , over by purchasing company., Ifthe problem states that the purchasing company has taken over the business, of the firm,, it suggests that all the assets and liabilities, (excluding those specifically stated to be not taken, over) are taken over by the company., vi) If the, , problem, , fim. it, , vii, , if the, , states that the, , purchasing, , suggests that the liabilities, , problem, , are, , company has taken, , not taken, , over, , the, , assets of the, , vendor, , over., , states that the, , purchasing conmpany has taken the trade liabilities. it suggests, that the liabilities other than ereditors and bills, payable are not taken over by the company., ence the students should read the problem carefully and properly understand the implied meanings, , the termns., , lustration 1: (Sinmple problem : Purchase Price in Shares), and Y were in partnership sharing profits and losses in the ratio 3:2. Their Balance Sheet as on, , -3-2008 was as follows:, , iabilities, , Rs.Assets, , ndry Creditors, , 20,000, , s Capital, s Capital, , 50,00, , Sundry Assets, , Rs., , 1,50,0000, , 80,000, , 1.50,000, , 1.50,0000, , n the above date, the assets and liabilities of the firm were taken over by Patson Lid for Rs.I,60,000, , yable in shares of Rs.100 each., how the necessary ledger accounts to close the books of the firm., , olution, , te: Purchase consideration is a 'Lum Sum' of Rs. 1,60,000, payable in shares., In the books of the firm, , Realisation Account, , Rs., , Rs., , Sundry Assets, , 1.50.000 By Sundry Creditors, , Profit transferred, , X's Capital (3/5)18,000, Y'sCapital (2/5)12.000, , Cr., , By Patson Ltd, , 20,000, 1,60,000, , (Purchase consideration), 30,000, , 1,80,000, e rsion of Partuership into a Limited Company, , 1,80,000, , 63

Page 6 :

Partners', , Capital Account, , Y, , Particulars, , X, Rs., , Particulars, , Rs., 68.0092.000 By Balance b/d., , Rs., 50,00080,00, , 68.000 92.0X0, , 68.000, , Rs., , To Shares in Patson Lid, , Y, , By Realisation (Profit), , Shares of Rs. 16.000 are'distributed in their, , adjusted capital ratio;, , 68,000, , 18,00012.0, 92.00, , : 92.000., , Patson Ltd., Account, , Rs, , Rs., , 1,60,000 By, , To Realisation (P.C.), , Shares in Patson Lid, , 1.60,0, 1.60.00, , I.60.000, Shares in Patson Lid Account, , Rs., To Patson Ltd, , I.60.000, , By X's Capital, By Y's Capital, , (16.000 shares Rs.100 each), , Rs, 68.00, 92.0, 1,60,0%, , |1.60,000, , Fx. 1, A &B were partners in a firm sharing profits and losses in the ratio of 4:1. The balene, Sheet aS on 3/st March. 2008 'AS us unuler:, , Liabilities, Sndry Creditors, Capital Accounts:, , Rs., , Assets, , 10,000| Sundry Asse1, , R, , 70,00, , A 40,000, , B 20.000, , 60,000, , 70,000|, , 70,00, , On Ist April the Lucky Lid took over the assets and liabilities ofthe fim for Rs.75.000 payablei, , its, , shares of, , Sho, , Rs.I 00 each., , ledger accoun1s to close the books, of the firn., , Ans.: Realisation prolit Rs.15.0KO. Shares distribution to A- Rs. 52.000 and B- Rs.23,000. J, , Hllustration. 2 : (Purchase consideration in shares & cash)., M. N & O were in partnership sharing protits and losses in tihe ratio 5:3:2. Their balance sheel, on 31st March, 2,008 was as.follows., , Liabilitics, Sundry Creditors, Bank Overdraft, , General Reserve, , Capial Accounts:, M, , N, , Rs.Assets, 30.000| Cash, 20,000Sundry Debtors, , 10,000, , Bills Receivable, Stock, , 1.00,000, 82.000, , Furniture, , 8,0, 22,0, , 8.0, I,06.0, 141, , Equipments, , 62,000| Machinery, |3,04.000, , 30104

Page 7 :

Example 1:, M& N carrying the business in, , partnership, , decided, , followingterms, a), , Agreement I: X Co. Ltd, , to, , take, , over all the, , to, , sell their business to, , assets at book value, , X Co., , Lid.,, , machinery, , except, , remaining assets were:, Furniture, b), , 25,000., , Debtors 80.000 and Bank, , book, , over, , t, , values of the, , Rs.25,000., , Agreement II :, , X Co. Ltd.. to issue its 1,000 shares of Rs.100 each at a, premium of, per share, the issue of debentures of Rs.40,000 and cash payment of Rs.25,000, for the, , Rs.i, , busines, , taken over., , c), , t, , and stoct, , hich were taken over at Rs.55,000 and Rs.60,000, respectively. It decided to take, trade creditors and bank loan at Rs.75,000 and Rs.10,000, The, , respectively., , on, , Agreement II:XLid agrees to take over the business of vendor firm, , at a, , payable in the form of 1,000 shares of Rs.100 each and balance in cash., , price of Rs.1,40,000, , Solution:, , Agreement I, , : As per this, agreement the, net assets method' as under :, , purchase consideration, , is, , to, , be calculated by, , alculation of Purchase Consideration, , Ågreed value of assets taken over:, , Rs., , Machinery (Agreed valu), , 55,000, , Stock (Agreed value), Furniture (Book value), Debtors (Book value), Bank (Book value), , 60,000, , 25,00, 80,000), , 25,000, , 2,45,000, , Less : Agreed value of liabilities taken over:, Creditors, Bank loan, , 75,000, 10,000, , Purchase Consideration (PC.), , b), , 1,60,000, , Agreement, , II: As per this agreement the, payment method' as follows:, , purchase consideration, , is, , to, , 1.000 shares of Rs.100 at Rs.I 10 each, Debentures in company at agreed value, Cash Payment, Purchase consideration, , c)Agreement III: In this agreement the purchase consideration is clearly, t is, , a, , 'lumpsum method', , of, , -85,000, , purchase consideration., , be, , calculated by 'nel, , Rs, 1,10.000, , 40,000, 25,00, 1,75,0, , given i.e. Rs.1.40,000, , Accounting Steps, During conversion,, , the, , closed on similar lines, firm can be, , business of firm gets dissolved. Hence the, books of accounts of fim'a, to that of the, ordinary dissolution. The steps for closing the, accounts ol t, follows, , explained as, , Coversion of Partnership into a Limited, Company

Learn better on this topic

Learn better on this topic

Learn better on this topic

Learn better on this topic