Page 1 :

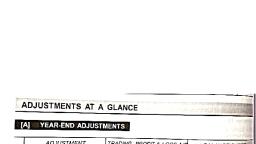

ADJUSTMENTS AT A GLANCE, [A] YEAR-END ADJUSTMENTS, ADJUSTMENT, TRADING, PROFIT & LOSS A/C, BALANCE SHEET, 1., Closing Stock, Show on Credit side of Tr. A/c, Show on Asset side, 2., Outstanding Expenses, Add to Expense A/c, Show on Liability side, Deduct from Expense A/c, Prepaid Expenses, Income Received in Advance Deduct from Income A/c, 3., Show on Assets side, 4., Show on Liability side, 5., Accrued Income, Add to Income A/c, Show on Asset side, Show on Debit side of, Deduct from Debtors on, Assets side, 6., Bad Debts, P &L A/c, Bad Debts, Add : New Reserve, Less : Old Reserve, Final Figure*, Deduct from Debtors on, Assets side, XX, 7., Reserve for Doubtful Debts, XX, XX, XX, P & L A/c., Scanned By Scanner Go

Page 2 :

Final Accounts of Manufacturing Concerns, Note If final figure is positive (+) show on Debit side; if negative (-) show on Credit side of, 23. Loss on Sale of Asset, 22. Profit on Sale of Asset, 21. Capital Receipt treated as, 163, Reserve for Discount on, Discount, Deduct from Debtors on, Assets side, Debtors, XX, Add : New Reserve, Less : Old Reserve, Final Figure*, XX, XX, XX, P&L A/c., Reserve for Discount from, Creditors, Discount, XX, Deduct from Creditors on, Add : New Reserve, Less : Old Reserve, Final Figure*, Note : If final figure is positive (+) show on Credit side: if negative (-) show on Debit side of, XX, Liability side, XX, XX, P&L A/c., 10. Depreciation, Show on Debit side, Deduct from Gross Cost of, Each Asset, 11. Interest on Investment &, Show on Credit Side of P & L, Add to concerned, Investment A/c or Loan A/c, on Assets side., Loans, 12. Goods Entirely Lost, (a) Show Cost on Cr. of, Trading A/c, (b) Show Cost on Dr. of, P & L A/c, 13. Goods Lost; Insurance, Claim Due, (a) Show Full Cost on Cr. of, Trading A/c, (b) Show Loss (Cost-Claim) on, Dr. of P & LA/c, Show Insurance Claim Due, on Assets side, 14. Goods given away as, Samples, (a) Show Cost on Cr. of, Trading A/c, (b) Show Cost on Dr. of, P &L A/c, 15. Goods Taken by Proprietor, Show Cost on Cr. of Trading, Debit to Capital A/c, A/c, Add to Purchases as per T.B., Add to Creditors as per T.B., 16. Purchases Not Recorded, Add to Sales as per T.B., Add to Debtors as per T.B., 17. Sales Not Recorded, Add to Asset A/c, Deduct from Expenses A/c, 18. Capital Exp. treated as, Revenue Exp., Add to Debtors Deduct from, 19. B/R Dishonoured, B/R, Add to S/Creditors and, Deduct from B/P, both on, Liabilities side, 20. Bills Payable Dishonoured, Deduct from Income A/c, Add to Liability or Deduct, from Asset A/c, Revenue Receipt i, Show Profit on Cr. of P &L A/c | Deduct W.D.V. from, Assets A/c, Deduct W.D.V. from, Show Loss on Dr. of P & L A/c, Assets A/c, Credit Capital A/c, Show on Dr. side of P & L A/c, Debit Capital A/c, Net Profit Transferred, Net Loss Transferred, Show on Cr. side of P & L A/c, Scanned By Scanner Go, DIAL BALANCE, Asaid s oadnua

Page 3 :

goods, outstandıng expenses, various provisions for expenses, Income received in advance, 9., WORKSHEETS (FINAL ACCOUNTS), WORKSHEET 5: MANUFACTURING & TRADING ACCOUNT (OF A MANUFACTURER, Dr., Manutacturing Account tor the year ended...., Particulars, To Work-in-process (opening), To Raw materials consumed, Opening Stock, Add Purchase, Particulars, XXx| By Work -in process (closing), By Sale of scrap, By Trading Account, (cost of production na ), XXX, XXX, Scanned By Scanner Go

Page 4 :

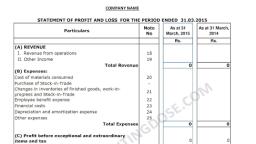

To Direct manufacturing expenses, Financial Expenses & Interest, To Carriage outwards, freight, duties, Add : Purchase expenses, To Goods given as free samples, i dccounts of Manufacturing Concerns, 173, Carriage Inward, Octroi duty, - Dock dues, Custom duties, XXX, XXX, XXX, L ess : Purchase Returns, Less : Closing stock, To Direct Wages, XXX, (xxx), (xx), XXX, XXXX, Royalty related to manufacture, Hire of special machinery, - Design Expenses, To Direct factory expenses, - Stores, oil, grease, Salary to supervisors, XXX, XXX, XXX, XXXX, XXX, XXX, - Power and fuel, Repairs of factory assets, Depreciation on factory assets, - Rent, lighting of factory building, XXX, XXX, XXX, XXX, XXXX, Total, XXXX| Total, XXXX, Dr., Trading Account for the year ended..., Cr., Particulars, Particulars, To Opening stock (FG), To Manufacturing Account, (cost of production tfd.), XXXX | By Sales, XXXX, Less : Return inwards, By Goods lost or destroyed, By Goods taken by proprietor, By Goods given as free sample, By Closing stock (FG), XXXX, XXXX, XXXX, XXXX, XXXX, XXXX, XXXX, To Gross profit c/d... ., XXXX By Gross loss c/d, XXXX, or, XXXX, XXXX | Total, Total, WORKSHEET 6: PROFIT & LOSS ACCOUNT, Cr., Dr., Profit & Loss Account for the year ended..., Particulars, Particulars, XXXX, XXXX By Gross profit b/d, or, To Gross loss b/d..., Administrative Expenses, To Rent, insurance & repairs, To Office salaries, Other Income or Gains, XXXX By Commission received, XXXX By Discount received, XXXX By Provision for discount from, creditors, XXXX, XXXX, 10 Postage, telephones, telex etc., lo Printing & stationery, To Fees (legal/audit etc.), lo Sundry / general expenses, Selling & Distribution Expenses, 10 Salesmen's salaries, commission, rla, etc., To Travelling, XXXX, XXXX, XXXX By Interest on loans given to, XXXX, outsiders, By Income (dividend) on, investments, XXXX, Did, XXXX, XXXX, neesouoit XXXX, XXXX, istoT, XXXX, lo Warehousing charges, lo Packing expenses, To Royalties, XXXX, oitastesil!, XXXX, on sale, 1o Advertising & sales promotion, expenses, XXXX, XXXX, XXXX|Scanned By Scanner Go, 10 Interest & bank charges