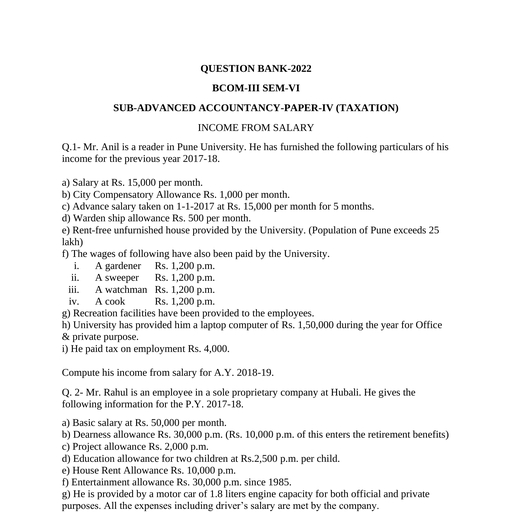

Page 1 :

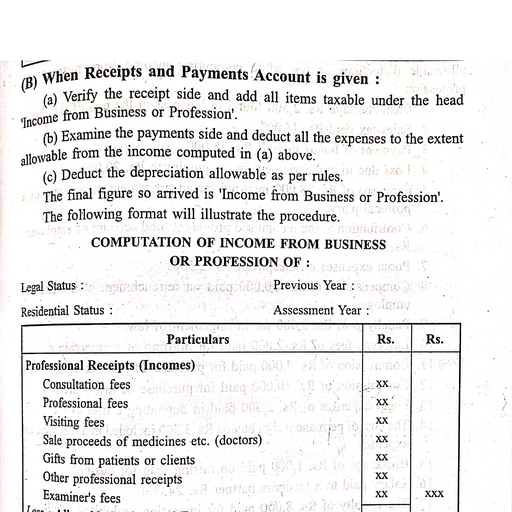

Accounts of Professionals, , , , , , , , , , , , , , , , , , , , , , , , , , , professional othe persons, individuals or firms who render special proficient services to others:, monet considerations known as fees. However, they do not, , elas agents or contractor They, Fe use of thei, , , , , , specially ae quired: skill & proticioney while providing. their s ‘These profesJ include legal practitioners such as lawyers & solicitors; professional accountants samely characcountants & COSE ACCOUNLNES, architects & surveyors; medical practitioners namely doctors,, , , , sir associations and firms of such persons., , licitors and Lawyers :, , iE must be noted here that solicitors are different from advocates: & lawyers though they too are, , Fmembers of the legal profession, Actually solicitors are the link between advocates & the clients, , are competent to advise & instruct them, They may also act as executors on behalf of the chents, , may buy or sell properties or receive & pay money on behalf of them. As such, they have to, , inlain separate accounts for themselves (i.e. for their own office) and also for the clients. Particu, their cash book contains an extra column for the clients, They are expected to keep their clients, , phey in a separate bank account., , er on the other hand is a comprehensive term that may include solicitor., , Doctors :, , Doctors are the members of medical profession and are categorised as ‘General Practitioners’, , GPs) and specialists” as surgeons, cardiologists, pathologists, dentists and so on. They are well, lifted & well-equipped to examine and advise their patients. Even the professions of druggists,, , Nists, nursing homes and dispensaries are included in this category., , Architecture and Civil Engineering :, , Architects, interior désigners & decorators, valuers, and surveyors are the members of the profes, of architecture and. civil engineering who are competent to advise their clients in the matters of, , King construction and engineering. Valuers are the professionals who make estimates of money, , Hreas Surveyors are the person whose job 1s to make survey or examination (measurement) of land, , pes) buildings ete. :, , Chartered Accountants, Cost Accountants, Auditors :, , he the persons who belong to the profession of accountancy. They examine business, , icine ct a advice to their clients,, , lcs he Acsotinte by Professionals, , Wink th a Wns individuals normally do not maintain accounts of their day-to-day affairs as, , Messicmals : Is unnecessary for them and itis a wastage of time and money. However in case of, , ‘ als individuals and their firms, maintenance of of accounts is quite necessary and useful for, , irements a ~ are required to maintain accounts sunts systematically & scientifically as per legal, as well as for their own good. Financial outcome, i.e. profit or loss of their profession, , * judge, buh th ie through Income & Expenditure Account, whereas financial position can be ascertain, e pr —, , OME Se BXPENG un, stems ti eparation of their Balance Sheet., 1, , epi Accounts by Professionals :, three systems of accounting, namely , Ual of, tal or mercantile system:, System, and, , onals ISS

Page 2 :

y, , “ce. Mixed or hybrid system., , These professionals can maintain their accounts under any one of these systems, a. Accrual or Mercantile system :, , Under this system. all items of income and expenditure, both cash as well as Donecash jy,, particular period are duly recorded. Income earned but not received, i.e. accrued income and >, ture incurred but not paid. i.e. accrued or outstanding expenses are considered along with the i, income actually received and expenses paid in cash. . ', , However income received in advance and expenses paid in advance are ignored,, , “Most of he (professionals, fhowever do not Tollow this System OT ACCOURTAR Pecan ty, either very small or no credit {ransactions at all and therefore no accruals. :, b. Cash System or Receipts System :, , As the name indicates. under this system actual cash receipts and actual cash Payments, corded, Credit transactions are not considered ay long as they are not converted into cash. Ty, noncash items ie ignored. Even sometimes the advances. (though cash-items) are non con, under this system. In view of the fact that most. of the professionals perform their services i!, cash basis. this system of accounting is widely followed. Under this system a “Receipts & Py), Statement” or Cash Account” containing only cash transactions is prepared., , This is not a complete system of accounting as it ignores the “accruals, c. Mixed or Hybrid System SS, , This is purty a_mereantile and partly a cash system of accounting. Under this system allin, items are recorded only on Ga whereas expenses are recorded on cash i 3, , s. under the principle o atism all ‘noncash income flems, namely accrued incor, considered and recorded., , This system is normally followed by those professionals who have credit transactions ay, Books of Accounts :, , Normally, most of the professionals arc required to maintain the following records., , 1. Cash Book or Receipts and Payments Account, >">, , 2. Receipts and Expenditure Account, , 3. Stock Register, , 4, Memorandum Book., 1, Cash Book or Receipts & Payments Account :, , This is @ Main_or principal book that contains all cash receipts and cas, and revenue nature concerning the profession for a Particular period. Tt is similar wo a cash bok!, , : . i, other concern. It records the o pening balance of cash & all cash receipts on debit or receipts, per ny, mw u, , —, ill cash paymerits & closing balance of cash on credit or payment side. Banking transaction’, , are recorded separately ina bank account. It there are any credit Transactions, they too are eA, separately in a memorandum book so that they may not be forgotten. Such credit transz!"”, ulumately recorded through cash book only when they are converted into cash. a, , At the end of the accounting period the items of cash book are summarised under relev", , of accounts so as to know the receipts & payments under each such head. rs, ; Here the term “Receipts” connotes. all cash receipts pertaining to past, present and fue, , of capital & revenue nature. Similarly, the term “Payments” denotes all cash payments olt, , revenue nature pertaining to the Past. present and future periods., , 2. Receipts and Expenditure Account :, , This account is different from “Receipts & Payments Account” in the sense that ber?, “Receipts” indicates only cash receipts of income j, accrued income items and the term "Fp, expenditure of the profession as wellas7, of the profession relevant to a particul, , , , , , , , , , , , , , , , , , consery, , , , , , , , , , , , , , , , , iy, in, , , , , , Remy let ff vec, a Of the profession ignoring capt! real, penditure” indicates all cash payments, in respect ©, , ach, Ne C critals or outstanding ttems of such revenue ext, ar accounting period., , , , , , , , Account of Professionals

Page 3 :

xpenditure paid & payable is meeonded on the debit side of this account and only the _, ded ont > ignoring income receivable., & closing re not Seana through this account. Similarly, capital receipts, Secs Is —, Is Sincluding their accruals are ‘ignored while ¢ preparing @ this account. ca, This aecoul is similar (but not the same) to that of an “Income & Expenditure Account” of a, ye concern or “P & L Account” of a trading concern, Professionals prepare “Receipts (i.e., and Expenditure Account” so as to ase certain their net professional income for a particular, , , , The everue ¢, e income received, , , , , , , ort, Ope eninge, pital pay men, , qrading, ome), , jo < " ,, ial Features of Receipts and Expenditure Account :, , t Creation of reserves (provisions) for fees outstanding., \ Taking credit of “Re serves” at the beginning of the period., ¢ Giving direct credit to professional partners for fees carned and allocation of balance of surplus, , he agreed profit sharing ratio., , Stock Register +, This book is maintained to record (Ne stocks of the following items pertaining to the profession., , a. Consumables such as stationery, tools. etc., , b, Medicines for resale in case of medical profession., , Articles for use in profession, namely furniture, books, surgical equipments. computer, ors, drawing boards, drafters, ete. These articles are not for resale. When any of such articles is, carded for any reason, a note is to be made to that effect in the stock register,, , Memorandum Book :, , This book is specially used to record all those credit transactions which cannot be recorded in the, ove records, Such transactions may be of revenue nature as fees receivable or of capital nature,, mnely purchase or sale of an asset on credit., , This book is a kind of diary maintained for the sake of memory. Transaction recorded in this, , calcu, , , pak are Wansferred to Cash beok as Soon as they are converted into cash,, xinction between Receipts & Payments Account and Receipts & Expenditure Account :, , , , Bee areas, R ee eE, oint of Difference, , Receipts & Payments Account, , Receipts & Expenditure Account, , , , Receipts, , !, }, |, , , , , , Payments, and, , Expenditure, Opening and clos ing, , balance of cash, , Nature of closing, Balance, , Ritter, Nature of Account, , Dr & Cr. sides, , , , Receipt include all cash receipts both, revenue as well as of capital nature, pertaining to accounting (current) as, well as fast and future periods,, Payments include all cash payments,, both of revenue and capital nature, of, accounting period as well as of the past, and future periods., , Opening balance of cash is recorded, , pts side and closing, , , , on debit or, balance on the credit side of the account., , Closing balance of this account represents closing balances of cash or cash, in hand at the close., , It is a cash book or cash account., , , , Dr side indicates Receipts and Cr, side, payments,, , equut of Professionals, , , , Receipts include cash receipts of only, revenue items pertaining to accounting period., , Expenditure includes the cash payment of revenue nature only and all, the outstanding expenses both pertaining to the accounting period only., Opening and closing balances of cash, have no place in this account., , Closing balaces ie. the difference, between the totals of two sides is either “surplus” or “Deficit”., , It is a revenue statement of income, and expenditure, , Dr: side indicates Expenditure and Cr:, , side Receipts. i.e, Income

Page 4 :

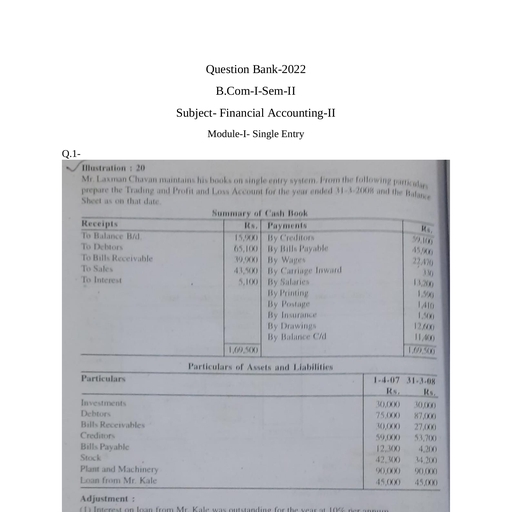

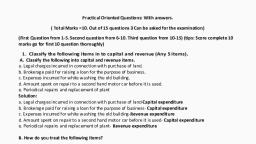

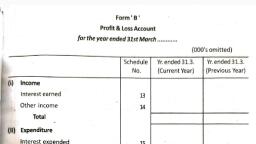

B: Di, , , , inction between Income & Expenditure (or P & L, , , , , , , , , , , , , , , , , , Account ) and Receipts & Expenditure Account sa mescsscetees wage, , Point of Difterence | Income & Expenditure Account [~ Receipts & Expend, , I, Income Income means all revenue income re- Income means only the Cah g, ceived in cash as well as receivable, | ceipts of revenue items Of ine, Le, aecured in the accounting year, relating to the ACLOUDLNE poy,, , Accruals or receivables are |, nored, Or in case, accruals ,, recognised then 100% reserve, credited there of,, , Expenditure covers all revenue ex- Expenditure has the same mean;, , penses paid in cash as well as payable | as applicable to Income & Expen, , (outstanding) during the accounting | ture Account, thar is, all revenue, , period, penses, paid & payable,, , 2. Expenditure (No, distinctions), , , , , , Accounts of Doctors / Medical Practitioners :, Normally a practising doctor maintains & memorandum book or diary wherein he records |, details relating to his patients, the charges made to them, and any other details about them. Sub, quently he sorts out & groups his income into visiting fees prescription receipts, consultation ie, cle. and records them into the Cash Book with or without columns for specific fees or groups, Similarly he analyses his expenses under various heads such as me, , penses, cost of medicines, drugs, provisions, equipment & instruments, the Cash Book., , In addition to a cash book, a doctor may maintain, “Receipts & Expenditure Account” in order to asee, , dical expenses, surgical ¢, + aSsets, cle, and enters if, , , , a stock register, and then finally prepate Mi, , rain his net income. Any ace, are taken into account while preparing this account, He may also m, A dentist records the purchases of dentures (i.e, artificial te, Dispensing chemists and druggists maintain sal, Prescriptions served. various drugs, patient medicines,, Nursing homes mamtain cash book purchase, , , , uls and depreciil, aintain as patients ledger., eth, ete.) and connected materials, & purchase books in columnar form to, baby foods, bandaging materials ew., book, charges book, ete. to record cabin &, rents expenses. collections from patients, supply of drugs & medicines ete,, Mustration - 1 (Accounts of Medical Practitioner), Dr. Hemant Nimbalkar started his practise as, ing Rs, 20,900,000 in buildings & equipment., 31st March, 2008 was as under:, , , , 5a syed, a physician at Kothapur on Ist April, 2007 by, , : . en, Ilis Reecipts and Payments Account for the year om", , Receipts and Payments Account, For the year ending 31-03-2008, , , , , , , , , , , , , , , , , , , , , To 1 400,000 fants &, Th Visitine Fees 4 1.00,000 | By Salary to Attendants &, , To Operation Fees 7,.00,000. By Library Books CLAhO7)A, ‘To Sale of Medicines 180,000 i, , By Surgical Equipment A, (Bought on 110,07), By Management Expenses, By Purchase of Medicine, By Personal Drawings, , wont By Balance at Bank, 0,000_, , ‘To Sundry Rex cipts 20,000, , , , fecanpl of Prefect