Page 1 :

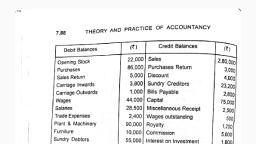

eae LIE ee, , From the following Trial Balance prepare a Trading and Profit and Loss Account, , of Mr. S. Sinha for the year ending 31st December, 2009 and a, as on that date :, , Rs., Debit Balance :, Sundry Debtors _ 50,000 Salaries, Stock 1st January, 2008 30,000 Purchases, Cash at Bank 54,000 Machinery, Wages » -: 32,000 Credit Balance :, Bad Debts 3,000 _ Capital, Furniture 20,000 Sundry Creditors, Depreciation 5,000 Sales, , On 31st December, 2009 the stock was valued at Rs. 95,000., , Balance Sheet, , Rs., , 22,000, 1,26,000, 1,57,000, , 2,50,000, , 75,000, 1,74,000, , Scanned with CamScanner

Page 2 :

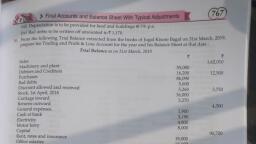

Trail Balance, , Debit Z Credit oe z, Machinery -® 23,000 Capital _ 28,000, Cash at at Bank >® 9,700 Bank loan ~~ 22,000, Cash i in hand <® 3,000 Creditors —_ 9,000, Debtors - © 15,200 Interest Received ~ 600°, Bills Receivable 11,800 Provision for doubtful debt. 400, Goodwill . 12,000 Trading A/c ., , r (Gross Profit) 35,000, Rent 4,500, , Salaries 2,800, , Closing Stock 13,000, , 95,000 95,000, , Additional Information :, , (i) Maintain Provision for doubtful debt at 5% on debtors., , (ii) Depreciate Machinery @ 10% Pa. :, (ii) Outstanding Salary Rs 1,200, , Prepare Profit & Loss Account of Mr. Rajnish for the year ended, , on 31.3.14 and a Balance Sheet as on that date. 8, scanned with CamScanner

Page 3 :

: \snrie. K. Gogoi gives you the following Trial Balance and some additional, , , , , , , , , , , , , , , , information :, Trial Balances as on 31st March, 2010, , Dr. Cr., , Rs. Rs., Capital 88,000, Opening Stock 7,300 ., Purchases and Sales 61,400 1,22,000, Debtors and Creditors 9,000 17,000, Returns 3,000 2,000, Bank Loan 20,000, Bank Overdraft 11,500, Commission Received 400, Salaries 27,400, Advertisements 11,000, Other expenses 6,900, Furniture 25,000, Building 1,10,000, Cash in Hand 800, , 2,60,900 2,60,900, I, , , , , , , , , , Closing stock on 31st March, 2010 was valued at Rs. 12,000:, , Prepare his final accounts., , Scanned with CamScanner

Page 4 :

Solution:, , ; In the books of Sri B. K. Gogoi, Trading Account and Profit and Loss Account, For the year ended 31st March, 2010, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , Be Ce, Particulars Amount Particulars Amount, Rs. Rs. |, , To Opening Stock 7,300 | By Sales 1,22,000 |, To Purchases 61,400 Less: Returns _ 3,000 4,19,000 |, Less: Returns 2,000] 59,400] By Closing stock —|_ 12,000!, , To Profit & Loss A/c ; 64,300 ., (Gross profit transferred) —S—, 41,31,000 _1,31,000, |, , To Salaries 27,400| By Trading A/c 64,300, To Advertisement 11,000} (Gross profit transferred) { ', To Other expenses 6,000} By Commission 400, To Capital A/c 20,300 |, (Net profit transferred) rr, , : __ 64,700 | _ 64,700,, , sacal,, , Balance Sheet of Sri B. K. Gogoi, as on 31st March, 2010, Liabilities Amount Assets Amount, : Rs. £ Rs., , Capital 88,000 Building |1,10,000), Add: Net profit _- 20,300) 4,08,300 Furniture 25,000, Bank Loan 20,000 Closing’ stock 12,000), Creditors 17,090 | Debtors | 9,000), Bank Overdraft 41,500} Cash in hand », 800, | 156,800 186,800, , , , , , , , , , , , Scanned with CamScanner

Page 5 :

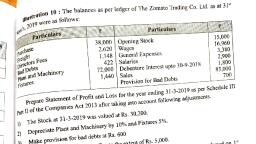

From the following balances taken from the books of Akbar & Co. prepare ;, a trading and profit and Loss account for the year ending 31 March, 2010 and a, Balance Sheet as at that date. 1, Debit Rs. Credit Rs., Building 18,750] Capital 35,000, Machinery 9,250} Bills payable 5,000, Debtors 7,000] Sales _ 63,500, General Expenses 800} Returns Outward 7,600, Rent paid 3,710] Sundry Creditors 10,700, Drawings 650 :, Electric Charges 190 Carriage Inwards 850 f, Cash at bank 3,000), Salaries 1,110, Discount allowed 200, Stock (1.4.09) 16,500, Purchases 46,850, Cash in hand 2,500), Returns Inward 10,000, Wages 440, 1,21,800 i 1,21,800, Adjustment: Closing stock Rs. 18,210, [AHSEC 1996], , , , , , il, , scanned with CamScanner