Page 1 :

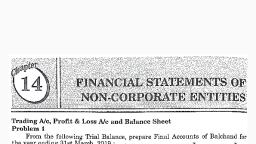

—., , , , , , FINANCIAL STATEMENTS 7.21, (i) Horizontal Format of Trading Account:, Trading Account, For the year ended on.........., Dee rea Ye te Ci, r., Particulars Amount (Rs.) Particulars Amount (Rs., /To Opening Stock By Sales ™, To Purchases Less: Sales Returns, Less: Purchase Returns or, , or, ——Returns outward, , To Wages, , To Wages & Salaries, , Jo Direct Expenses, , To€arriage, or, , Carriage inward, or, , Carriage on Purchase, , To Duty on Purchase, , To Gas, Fuel and Power, , To Freight/ cartage, , To Manufacturing Expenses, or Productive Expenses, , To Factory Expenses, such as:, Factory Lighting, Factory Rent etc., , To Ogtroi, To Dock charges, , To Clearing charges, , To Import L Duty or, Custom Duty, Excise Duty, , To Insurance Premium, (factory), , ToRoyalty on production, , To Profit and Loss A/c, (Gross Profit transferred), , [Balancing Figure], , , , Returns inward, By Closing Stock _~, , By Profit and Loss A/c, (Gross loss transferred ), (Balancing figure), , ey Leas bod ne, , , , , , , , , , , , , , P |, ~ —————seanned with CamScanner

Page 2 :

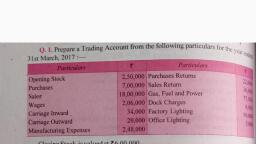

Illustration 6. From the following information of Khemka Brothers prepare a, Trading A Account for the year ended 31st March, 2010., , , , , , , , , , , , , , , , , , Rs., Stock on 1st April, 2009 9,000, Purchases 30,230, Sales Return. — 86, Purchases Return— 530, Sales ts a a 67,500, Wages. ~ 6,000, Carriage Inward me AOD, Manufacturing Expenses — 5,000, Stock on 31st March, 2010- 7,550, Wages Outstanding TT ye, , \ cone outward . 400 ~ ., [AHSEC 2000], , Scanned with CamScanner

Page 3 :

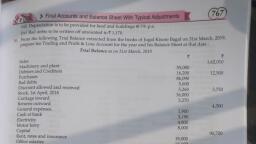

. FINANCIAL STATEMENTS - , 7.23, , Kote * Normally, Manufacturing Expenses are taken to Manufacturing A/c., but from i, }@ question it appears that the firm is. engaged in Trading activities and hence the |, Same has been taken to Trading A/c. ~, , , , , , , , , , Ilustration 7, - |, Following is the extract of the Trial Balance of Ram and Shyam firm as on |, 31.3.2010. / |, Particulars Debit Credit’, Y Rs. Rs. |, Stock on 1.4.09 ——~CS~«~<CSs~S*S:*S 0,000 |, Carriage on Sales — : —____ 2,000, Purchases ———————— 80,000 ; i, Discount ——————-— ~~ ~4,000__, 2,000, Sales:-—$—$—${___—_$__?_ arr tn a 4,20,000 ‘, Purchase returns ~~ a 2,000 |, Octroi duty — $$ = 500, Returns inward ———— = 8,000, Productive wages 45,000, Freight 22> pss 2,000, Excise Duty ~~~ TPT a OOO, Coal, gas and. water?! = ~1,500, 6,000, , Salaries___=-———_-—___——, , rade Expenses —— eT 1000, , Additional information : |, (i) “Stock on 31.3.2010 Rs. 15,000 |, (ii) Outstanding wages 500, (iii), Goods taken by Ram for Personal Use .. . 1,000 ,, , Prepare the Trading Account of the firm for the year ended 31. 3. 2010., , p - ford - pe: DV ige [AHSEC 2001], , , , eet, , en ., scanned with irisfenner, , licen im

Page 4 :

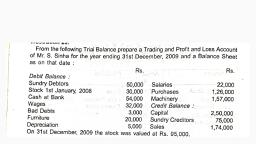

Illustration 8.@ gf, al, , From the following information o', , Account for the year ending 31.3.2010., , f Mr. Nayandeep Barua, prepare a Trading, , Rs. Rs., , Stock on 1.4.2009 12,000 Royalty 1,000, Purchases , 90,250 Stock lost by fire 3,800, Sales. 4,28,000 —_ Import duty 600, Returns Inward 2,000 Carriage Inward 900, Returns Outward 1,800 Wages 9,000, Carriage Outward 800 Wages Outstanding 650, 1,500 Stock on 31.3.2010 18,400, , Installation charges of Machinery, , [AHSEC 2002], , Trading Account, , , , , , , , , , , , , , Solution:, For the year ended 31st March, 2010, Dr. “Cr., Particulars Amount Particulars Amount, Rs. Rs., To Stock on 1.4.'09 12,000} By Sales 1,28,000, To Purchases 90,250 Less :Return Inward _2,000}1,26,000, Less:Returns outward 1,800 | 88,450 ea, To Carriage Inward 900} By Stock lost by fire 3,800, To Wages 9,000 By Stock on 31.3.2010 18,400, Add: Outstanding __650} 9,650, To Royalties 1,000, To Import Duty 600, To Profit and Loss Alc 35,600, (Gross Profit c/d), 1,48,200 1,48,200, , , , , , , , , , , , , , , , , , Note : (i) It is as:, (ii) Installa, added to machine, , sumed that the balances given are before adjustment., , tion charges of Machinery is capital expenditure. This will be, ry in the balance sheet., , , , Se, , Scanned with CamScanner

Page 5 :

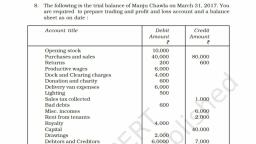

THEORY & PRACTICE OF ACCOUNTANCY, 7.28, , Ilustration 10., , From the following information of Nath Brothers prepare a Trading Account, rom the, , Rs., 10, for the year ended 31st March, 20 ts00, Purchases (Adjusted), Sales: —_, e a 40,780", red, Carriage on goods purchased Sales Return ; m0, Carriage on goods sold, Cash Discount: ~ 400, Wages (paid upto 28.2.2010 @Rs. 200 per month) 2,200, Railway Freight 100, Selling Expenses 800, Stock on 31st March, 2010 5,000, Solution:, , Trading Account, , For the year ended 31st March, 2010, Dr., , , , Particulars Amount, Rs., , To Purchases (Adjusted) | 45,000 By Sales :, To Carriage on goods, , Particulars Amount, Rs., , , , , , Credit 40,780, Purchased 200 Cash 35,000, To Wages 2,200 75,780, Add: Outstanding 200} 2,400] Less: Sales return 500 | 75,280, To Railway freight ! 100), , To Profit and Loss A/c 27,580, (Gross Profit transferred ), , , , , , , , , , , , 75,280, ——, , , , , , 75,280, , , , Notes :, , () Adjusted purchases means: Opening Stock + Pi » 5 k, Therefore, closing stock will not be taken to oiaeee Closing Stock, , item has already been considered. Trading A/c again because this, , (i) Wages Rs. 200 per Month h i i, woatrme ave been paid upto 28.2.2010 which means, , th of March, 2010 have no :, ° t ; for the, month of March, 2010, Rs. 200 is outstanding. Beenie. Weta, , , , scanned with Camscanner