Page 1 :

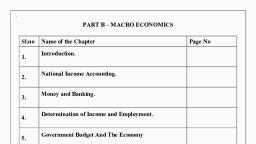

CIRCULAR FLOW OF INCOME, Introduction And Structure Of Macroeconomics:, 1. Macroeconomics is the part of economic theory that studies, the economy as a whole, such as :, national income, aggregate employment, general price level,, aggregate consumption, aggregate investment, etc. Its main, instruments are aggregate demand and aggregate supply. It is, also called the ‘Income Theory’ or ‘Employment Theory’., 2. Structure of macro economy: As we know,, Macroeconomics is concerned with economic problems at the, level of an economy as a whole. Structure of Macroeconomics, implies study of different sectors of the economy., An economy may be divided into different sectors depending on, the nature of study., (a) Producer sector engaged in the production of goods and, services., (b) Household sector engaged in the consumption of goods and, services., Note: Households are taken as the owners of factors of, production., (c) The government sector engaged in activities like taxation, and subsidies, (d) Rest of the world sector engaged in exports and imports., (e) Financial sector (or financial system) engaged in the activity, of borrowing and lending., 3. Circular flow of income., It refers to flow of money, income or the flow of goods and, services across different sectors of the economy in a circular, form., There are two types of Circular flow:, (a) Real/Product/Physical Flow, (b) Money/Monetary/Nominal Flow, (a) Real flow, (i) Real flow of income implies the flow of factor services from, the household sector to the producing sector and, corresponding flow of goods and services from the producing

Page 2 :

sector to the household sector., (ii) Let us consider a simple economy consisting only of 2, sectors:, • Producer Sector., • Household Sector., , (iii) These two sectors are dependent on each other in the, following ways:, • Producers supply goods and services to the households., • Household (as the owners of factors of production) supplies, factors of production (or factor services) to the producers., This interdependence can be explained with the help of the, diagram given here., (b) Money Flow, (i) Money flow refers to the flow of factor income, as rent,, interest, profit and wages from the producing sector to the, household sector as monetary rewards for their factor services, as shown in the flowchart.

Page 3 :

(ii) The households spend their incomes on the goods and, services produced by the producing sector. Accordingly, money, flows back to the producing sector as household expenditure as, shown in the flowchart., Circular Flow Of Income In Two Sector Model:, The following assumptions with regard to a simple, economy with only two sector of economics activity are:, (i) There are only two sectors in the economy; that is,, household and firms., (ii) Household supply factor services to firms., (iii) Firms hire factor services from Households., , (iv) Households spend their entire income on consumption., (v) Firms sell all that is produced to the households.

Page 4 :

(vi) There is no government or foreign trade., Such an economy described above has two types of markets., (i) Market for goods and services, that is product market., (ii) Market for factors of production, factor market., , As a result we can derive the following, in the case of our, simple economy:, (i) Total production of goods and services by firms = Total, consumption of goods and services by Household Sector., (ii) Factor Payments by Firms = Factor Incomes of Household, Sector., (iii) Consumption expenditure of Household sector = Income of, Firm., (iv) Hence, Real flows of production and consumption of Firms, and households = Money flows of income and expenditure of, Firms and Households., Phases Of Circular Flow:, There are three types of phases of Circular flow., (i) Production Phase:, • It deals with the production of goods and services by the, producer sector., • If we study it in term of the quantity of goods and services, produced, it is a Real Flow. But, it is a Money flow, if we study it, in terms of the market value of the goods produced., (ii) Distribution Phase: It means the flow of income in the form, of rent, interest, profit and wages, paid by producer sector to, the household sector. It is a Money Flow., (iii) Disposition Phase:, • Disposition means expenditure made. This phase deals with, expenditure on the purchase of goods and services by, households and other sectors., • This is a Money Flow from other sectors to the producer

Page 5 :

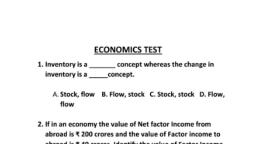

sector., , 3. Stock, (a) Any economic variable which is calculated at a particular, point of time is known as stock., (b) It is static in nature, i.e., it do not change., (c) There is no time dimension in stock variables., For example, Distance, Amount of Money, Money Supply,, Water in Tank, etc., 4. Flow, (a) Any economic variable which is calculated during a period, of time is known as flow., (b) It is dynamic in nature, i.e., it can be changed., (c) There is time dimension in flow variables., For example, Speed, Spending of Money, Water in River,, Exports, Imports, etc.