Page 1 :

246, , - OLIGOPOLY, , , , , , , , 16.1 Meaning, , 16.2 Characteristics of Oligopoly, , 16.3 Collusive and Non-Collusive Oligopoly, 16.4 Price Rigidity (Kinky Demand Curve), 16.5 Collusive Oligopoly - Cartel Formation, 16.6 Price Leadership ., , SSE RS SS SE, , , , Oligopoly is a market form in which there are few sellers of homogeneous, or differentiated products. If the commodity is homogenous, it is called, pure oligopoly. It is a differentiated oligopoly market, if the product is, differentiated. Theoretically, entry into the oligopoly market is allowed, but in reality it is very difficult. In India we have the oligopoly market in, automobiles where each group - cars, scooters, trucks - is an oligopoly, market. Domestic airlines, refrigerators, T. V. sets, air conditioners are some, , other examples of oligopoly markets in India., , , , 1. Few Sellers : Oligopoly form of market consists of few sellers, usually, is not more than ten. In case there are more sellers, a few will be, , dominant firms, others being insignificant.

Page 2 :

oligopoly 247, , ), Homogeneous or Differentiated product : Oligopolists usually sell, differentiated products. Differentiation is in the form of trade mark,, design or service. Developing brand equity has become important for, oligopoly firms., , , Entry is possible but difficult : A new firm can enter the oligopoly, market. In reality, however, it is highly difficult to enter due to, financial, technological and other barriers to the entry. Whenever the, profits are high, new firms do enter the market., , 4, Interdependence : Due to few firms in the market, an individual firm, is neither free nor independent to take its own decision about the, output and price. Any decision resulting in a change in the price or, output attracts reaction from the rival firms. There may be different, reactions from different firms., , This situation makes a firm dependent on others for its own decisions., It is essential for a firm to keep in mind the possible reactions of its, competitors while taking a decision. Oligopoly comprising a group, of few sellers requires the understanding of Group Behaviour., , 5, Uncertainty : Interdependence on other firms for one’s own decision, creates an atmosphere of uncertainty about the output and price. If, an oligopolist increases his output to capture the larger portion of the, market, others too will react.ina similar way. Incase he increases the, price others are unlikely to do so. The rivals will not increase the price, so that they may sell more at a lower price. On the contrary when an, oligopolist decreases the price others will also reduce the price in order, to prevent any reduction in sale due to non-competitive price. An, , oligopolist therefore is highly uncertain about the reaction of his rivals, to his decision., , An individual firm is highly uncertain about his rivals reaction for, any decision involving price and output. Therefore in oligopoly a wide, variety of behaviour pattern is possible., , Indeterminateness : The demand curve faced by an oligopolist is, indeterminate. Under perfect competition a firm being one of the large, number of firms, has a perfectly elastic (horizontal) demand curve., Here the firm is a price taker from the market. A monopolist, being a, single seller is in a position to decide the price and thus produce and, sell the output accordingly. His demand curve is therefore definite in, the form of downward sloping demand curve., , A firm under monopolistic competition can change the price since, the number of firms being many, the impact’on them is negligible.

Page 3 :

248 ., Business Economics - I (BMS, BAF, BFM, BBI.: SEM - 1), , The di 5, , Thereeorent Price can be justified by product differentiation,, , O58tbin a firm in this form of market need not worry about the, © Teaction of the rivals. Therefore a monopolistic competitive, , fir : ee, d = too like the firm in perfect competition and monopoly, faces a, etinite demand curve., , An oligopoly firm bein:, output decision does n, curve of an oli, , to dependenc, , g dependent on other firms for its price and, ot face a definite demand curve. The demand, 80polist loses its definiteness and determinateness due, y and uncertainty factors., , 16.3 COLLUSIVE, OLIGoPoL, , , , The oligopoly nis, , ‘ y be collusive or non-collusive markets. Firms operating, in oligopoly markets tend to invest heavily innew machinery and processes, to try and reduce their cost and make more profit. Business and, , development expenditure is also high as they try and differentiate their, products from their competitors., , Businesses in non-collusive oligopoly use advertising and marketing to, build strong recognition which allows them to compete on factors other, than price and act as a barrier to entry for new firms., , Non-collusive oligopoly market has features such as a few large firms,, , entry barriers, non-price competition, product branding and differentiation, and interdependence in decision making., , When oligopoly firms do not enter into any agreement or collusion and, function independently, a simple solution for price and output is not, possible since the firm cannot ascertain its rivals reaction. An example of, non-collusive oligopoly is the kinked demand curve model., , Collusion occurs when the firms work together to reduce uncertainty in, the market. Firms may become involved in price fixing or cartel formation., , Price fixing takes place where all firms in the market try and control supply,, to achieve a 'monopoly' like situation. For this to happen firms need to, have an influence over supply. This is most likely when the market is, ‘dominated by a few large firms, demand is inelastic, market demand does, not fluctuate and the firms can easily quantify the output of each firm., , NK,, , a, Q, , SVS \o\r, , ~

Page 4 :

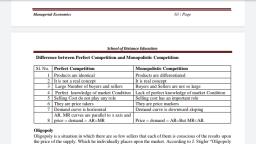

cota. Saeeeeees | STI, , 249, , oligoP oly, , minant firm may take the role of price leader, do: 'y P. hich reduces t, , setting the price for, , fhe he competition, , ihe market. They may create tacit collusion W!, mong, the companies., , ND NON4 MAIN DIFFERENCE BETWEEN THE COLLUSIVE 4, , cOLLUSIVE OLIGOPOLY ARE:, , , , Non-Collusive Oligopoly, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , Collusive Oligopoly, [7 Firms do not compete but Firms compete with each other., co-operate. Act like monopoly firm| They do not co-operate., 2, Same price , Price may differ., 3, Maximise the profit of the group.| Maximises individual profit., 4. Non-price competition Price competition possible., 5, Price leadership Rigid price, 6. No interdependence Interdependence among sellers., 7. No price war / : Price war is possible., 8. Beneficial for sellers. Beneficial for buyers /consumers., 9, Price may remain stable. Price may vary OT fluctuate., 10. Entry is highly restricted. Entry is possible though difficult., 11. Takes the form of cartels. No cartel formation., 12. Examples : OPEC and other Some examples : Airlines,, cartels in different commodities mobile phones, refrigerators, and services. and automobiles., , , , , , , , An Example of Non-Collusive Oligopoly, , , , —, , The dependency and uncertainty aspect of the oligopoly leads to, indeterminateness of the demand curve. The rigid price in oligopoly leading, toa Kink in demand curve of an oligopolist was put forward independently, by Paul Sweezy, an American economist and Hall and Hitch, Oxford, economists. Taking an example of an extremely limited case of oligopoly, ie. a case of duopoly where there are only two firms, we can explain an, | oligopolists demand curve - known as Kinky demand curve. Fig. 16.1, s explains the derivation of Kinky demand Curve.

Page 5 :

250 ;, Business Economics - I (BMS, BAF, BEM, BBI.: SEM - 1), © demand curves in the Fig. 16.1, DD, of firm A and DD, of, , ormer is more elastic and latter less elastic. At Point T the two, Ves intersect,, , ithe, Bepolist's demand curve has the shape shown in Fig. 16.1. At point T, art j . ink. The TD part of the demand curve is more elastic and the TD,, Part is inelastic, Kinky demand curve is obtained by taking TD part of firm, , There are tw,, firm B. The f,, demand cur, , , , , , , , , , , , Aand TD, part of firm B., Y ‘t, |b, ‘ v, 2 ze? \, = a, Dp, x a >X, . Oo . ° :, Quality Quality, Fig. 16.1 Fig. 16.2, , In Fig. 16.2 we have OP price at which OM quantity is sold. The price OP is, expected to remain without further change hence it is rigid. Let us understand, why oligopolists do not like to reduce or increase price of their product., , Reduction in Price : If the oligopolist reduces the price below OP to have, more sales of his product, his rivals will be quick in reducing their price, inorder not to lose the market. It is possible the rivals may cut price bya, higher margin to capture a larger share of the market. Ina process of price, reduction, finally oligopolists may succeed in getting a share of increased, total sales due to reduction in price. Each one's gain will be a marginal one., Such weak response of demand for a change in price below OP makes TD,, part of the demand curve less elastic., , Increase in Price : If an oligopolists increases the price above the prevailing, price that is OP, he would lose his customers. The buyers would purchase, from other oligopolists as the rival firms would not increase the price due, to the fear of losing the customers and consequent decline in sales. The, decline in sales of the firms which increase their price depends on the type, of product (differentiated or homogenous, if differentiated customers may