Page 1 :

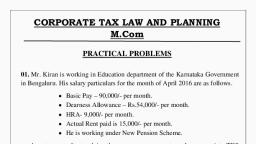

Tax planning for setting up of new Business., Introduction:, When a person decides to set up a new business, he has to consider a several factors such as nature, and size of business, location, he amount of capital requires and means to raise it, risk bearing, capacity of the entrepreneur, forms of organization from the point of view of stability, cost, legal, requirements and operational method. Along with these we should analyze tax provisions and, incentives applicable to that., Tax planning for new Business includes the following steps:, ⮚ Location., ⮚ Nature of Business., ⮚ Setting up of Business., ⮚ Form of new Business., ⮚ Capital structure., The above steps are discussed below:, LOCATIONAL ASPECTS, Tax planning is relevant from location point of view. There are certain locations which are given, special tax treatment. Some of these areas under:, ⮚ Full exemption under Section 10A for ten years in the case of a newly established industrial, undertaking in free trade zones, etc. [Not allowed w.e.f. A.Y. 2012-13]., ⮚ Full exemption under Section 10AA for initial five years, 50% for subsequent five years, and further deduction of 50% for a further period of five years in the case of newly, established units in special economic zones on or after 1.4.2005., ⮚ Full exemption under Section 10B for 10 years in the case of a newly established 100%, export-oriented undertaking. [Not allowed w.e.f. 2012-13]., ⮚ Deduction under Section 80-IAB in respect of profits and gains by an undertaking or an, enterprise engaged in the development of Special Economic Zone., ⮚ Deduction under Section 80-IB in the case of profits and gains from certain industrial, undertaking other than infrastructure development undertaking., ⮚ Deduction under Section 80-IC in case of certain undertaking or enterprises in certain, special category States., ⮚ Deduction under Section 80-ID in respect of profits and gains from business of hotels and, convention centres in specified area., ⮚ Deduction under Section 80-IE in respect of certain undertakings in North- Eastern States.

Page 2 :

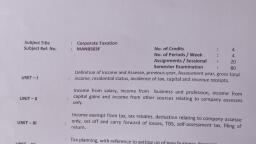

NATURE OF BUSINESS, Tax planning is also relevant while deciding upon the nature of business. There are certain, businesses which are granted special tax treatment. Some of them are as follows:, ⮚ Newly established industrial undertaking in free trade zones, etc. [Section 10A]. [Not, allowed w.e.f. A.Y. 2012-13]., ⮚ Newly established units in special economic zones [Section 10AA]., ⮚ Newly established hundred per cent export-oriented undertakings [Section 10B]. [Not, allowed w.e.f. A.Y. 2012-13]., ⮚ Tea Development Account, Coffee Development Account and Rubber Development, Account [Section 33AB]., ⮚ Site restoration fund [Section 33ABA]., ⮚ Specified business eligible for deduction of Capital Expenditure [Section 35AD]., ⮚ Amortisation of certain preliminary expenses [Section 35D]., ⮚ Expenditure on prospecting for certain minerals [Section 35E]., ⮚ Special reserve created by a financial corporation under Section 36(1)(viii)., ⮚ Special provision for deduction in the case of business for prospecting for mineral oil, [Sections 42 and 44BB]., ⮚ Special provisions for computing profits and gains of business on presumptive basis, [Section 44AD]., ⮚ Special provisions in the case of business of plying, hiring or leasing goods carriages, [Section 44AE]., ⮚ Special provisions in the case of shipping business in the case of non-residents [Section, 44B]., ⮚ Special provisions in the case of business of operation of aircraft [Section 44BBA]., ⮚ Special provisions in the case of certain turnkey power projects [Section 44BBB]., ⮚ Special provisions in the case of royalty income of foreign companies [Section 44D]., ⮚ Special provisions in case of royalty income of non-residents [Section 44DA]., ⮚ Certain income of offshore Banking Units and international Financial Service Centre, [Section 80-LA]., ⮚ Profit and gains of industrial undertakings or enterprises engaged in infrastructure, development, etc. [Section 80-IA]., ⮚ Profits and gains of an undertaking or an enterprise engaged in development of Special, Economic Zone. [Section 80-IAB]., ⮚ Profits and gains from certain industrial undertaking other than infrastructure development, undertaking [Section 80-IB]., ⮚ Special provisions in respect of certain undertakings or enterprises in certain special, category States [Section 80-IC]., ⮚ Deduction in respect of profits and gains from business of hotels and convention centres in, specified area or a hotel at world heritage site. [Section 80-ID]., ⮚ Special provisions in respect of certain undertakings in North-Eastern States. [Section 80IE].

Page 3 :

⮚ Profits and gains from the business of collecting and processing of bio- degradable waste, [Section 80JJA]., ⮚ Employment of new workmen [Section 80JJAA]. aa. Special tax rate under Sections 115A,, 115AB, 115AC, 115AD, 115B, 115BB, 115BBD, 115BA and 115D, Setting up and commencement of business, Setting up a business within the scope of the Income Tax Act is a particular point to be, considered for the purpose of tax planning strategy. It is different from the commencement, of business. The company may be incurring certain expenditure of revenue nature during, the intervening period after setting up and before the commencement of business, (production). It is provided in the tax laws that the general expenses prior to the date of, setting up are inadmissible but those incurred from the date of setting up and before the, commencement of the business may be allowed as deduction for tax purposes provided, they are of revenue nature and are incurred wholly and exclusively for the purpose of, business., Form of the organization, The first aspect of setting up of new business entity is deciding the form of, organisation/ownership pattern. The selection of particular form of organisation depends, not only on the magnitude of financial requirements and owner’s liability, but also on the, tax considerations. In the case of a company, the law interferes with the corporate planning, process from the moment it comes into existence. At times, tax laws affect even the periods, prior to the existence of a company and it can also extend up to the point of time when the, company ceases to exist. For example, a director of a private limited company in, liquidation, has to keep in view the provisions of Sections 178 and 179 of the Income Tax, Act, 1961 dealing with misfeasance etc. Normally, depending upon the level of operation,, expected profitability need for external financing and expected requirements of technical, expertise, a suitable form can be chosen. But in view of the continuity of business, the, benefits arising out of limited liability, organised accounting and the overall long-term tax, benefits flowing to the company form of organisation, the corporate enterprise may be, regarded as an effective instrument of tax planning. The company being a separate legal, entity, confers certain valuable benefits in the matter of tax planning to its shareholders and, the persons connected with the management of the company., Tax liability is an important consideration guiding the choice of a legal form of business, organisation. In some circumstances however this consideration is of no significance. For, example, large business is generally compelled to organise itself in the form of a company, as this form of organisation makes it possible to raise large amounts of capital required., Similarly, retail business of small size can only be economically operated as proprietorship, or partnership firm. When there is freedom of choice taxation becomes an important, consideration.

Page 4 :

Sole proprietorship, The most common form of ownership found in the business world is sole proprietorship., In this form of organization, the proprietor is the only owner of the business assesed and, he is solely responsible for the affairs of the business., ⮚ A sole proprietorship is easy to establish because of little interference of, government regulations., ⮚ The cost of adopting this form of organization is small because of there being no, legal requirement., ⮚ All the profits of the business go in the hands of proprietor himself., ⮚ In case of persons carrying on business on small scale and having small income, from other sources, this form of organization would be suitable because the, proprietor can avail of the tax ceiling limit of individual., ⮚ Besides the deductions which are allowed to all assesses under Chapter VIA, a sole, proprietor, being assessed as individual, is entitled to get all deductions., However, this form of organization is also not suitable due to:, ⮚ The liability of the proprietor is unlimited and it can extend even to his personal, assets. When the proprietor incurs losses and business assets are not sufficient to, meet the liabilities of business, his personal assets can be used for discharging the, business liabilities., ⮚ The proprietor does not get deduction on account of remuneration payable to him, for rendering of services. It is felt that profits are the reward for contributing capital, and taking risk and remuneration must be given for the service rendered by the, proprietor which should be allowed as deductible expenditure. However, incometax law does not allow the deduction of remuneration., ⮚ Another drawback of this form of organization is that it does not provide, opportunities to finance the expanding business activities. In the case of a, partnership firm, on the other hand, capital can be raised by the existing partners or, by admitting another partner.

Page 5 :

Tax Rate for Sole Proprietary Organisation for A/Y 2020-21, (Individuals), , Senior citizen age between 60 to 80 age, On 300000, Next 200000, Next 500000, Next balance, , Nil, 5%, 20%, 30%, , Super Senior citizen above 80 years, On 500000, Next 500000, Next balance, , Nil, 20%, 30%, , Other individuals, On 250000, Next 250000, Next 500000, Next balance, , Nil, 5%, 20%, 30%, , Surcharge:, Total income 50 lacs to 1crore, 1 crore to 2 crore, 2 crore to 5 crore, 5 crore above, ** Health and education cess 4%**, , 10%, 15%, 25%, 37%, , Hindu Undivided Family, A joint Hindu family pays tax on its total income at prescribed rates on the basis of, slab system. The family can pay reasonable remuneration to the Karta and other family, members for their services to the business and it is allowed as a deduction in computing, the business income. However, interest on capital contributed by the family for the business, is not deductible in computing business income. The member of the family, who has, received the remuneration from the family will include it in his income under the head, Salaries. A Hindu undivided family will also get a basic exemption of Rs 2,50,000 for, assessment year 2020-21. Besides the deductions which are allowed to other forms of, organization, it is allowed certain deductions under Sections 80C, 80D, 80DD, 80DDB and, 80GG like individuals. The tax rates in case of HUF are same as applicable to individual., The demerits of HUF, however, are similar to that of individuals.

Page 6 :

Partnership Firm or Limited Liability Partnership, A partnership form of organization is easy to establish. The only procedure for the formation, of partnership is to draw up a partnership deed and a nominal charge in terms of cost of stamps for, the deed is to be incurred. This form of organization is suitable due to the following factors:, ⮚ The decision making on important business matter is quick as compared to a company form, of organization because partners meet frequently together. Therefore, decision on any, important business matter cannot be delayed., ⮚ The chance of getting involved in risky activities is very less because every important, decision is made with the concurrence of all the partners., ⮚ As compared to sole proprietorship, the problem of raising additional resources is much, less. Whenever the business expands and it is necessary to raise finance, it will be easy to, raise it by admitting a new partner or raising it by way of borrowings because of number, of partners and their joint and several liabilities to pay the debts of the firm, the lenders, will be more interested in lending., ⮚ The firm can pay interest on capital and loan to partners at the maximum rate of 12% p.a., Further it can also give remuneration to its working partners subject to the limits mentioned, in Section 40(b)., ⮚ This form of organisation is suitable from income-tax point of view in such cases where, the amount of profit is not large and the partners of the firm do not have any other additional, income except by way of remuneration and interest from the partnership firm. In such a, case the profit of the firm shall be lower and the individual partners can also avail of the, maximum ceiling of income exempt under the Income Tax Act., ⮚ The share in the profit of the partnership firm is exempt from tax under Section 10(2A) of, the Income-tax Act., ⮚ The risk as to losses and liability incurred is divided amongst the partners., ⮚ As in the case of company form of organization where the change of business requires a, long procedure, there is no tedious procedure in the partnership form of organization. The, business can be changed only with the consent of partners., ⮚ The firm is taxable at a flat rate of 30% + health and education cess @4% for assessment, year 2020-21 after allowing interest and remuneration to working partners (if provided in, the partnership deed and subject to Section 40(b) of the Income-tax Act, , However, this form of organization is not suitable due to the following reasons:, ⮚ The risk taking capacity of the partners becomes limited. Every decision relating to, important business matters is made with the consultation of other partners, which restricts, the risk taking activities which may yield much higher profits., ⮚ As far as the operations of business are limited to small or medium scale, there is no, problem in financing the expansion of business operation. But when business gets, expanded to a large scale, then it will be suitable to adopt a company form of organization, because partnership can be formed up to such number as may be prescribed but not, exceeding 100.

Page 7 :

⮚ One of the main drawbacks is that one partner becomes liable for the acts of another., Therefore, a partner is liable for the wrongs of another partner if it is done within the legal, limits., ⮚ In the new scheme of assessment of partnership firms, the share of partners is exempt from, tax under Section 10(2A) but the partner’s remuneration and interest, subject to limit, mentioned in Section 40(b), is taxable in the hands of the partners under the head profits, and gains of business or profession. Also, firm cannot claim deduction in respect of interest, payable to partners in excess of 12% per annum., ⮚ Where the partnership firm does not comply with the requirements of Section 184 of the, Income Tax Act, although the firm shall be assessed as firm, it shall not be allowed any, deduction on account of interest and remuneration to its partners., ⮚ A partnership firm may come to a sudden closure of business on account of death, lunacy, or insolvency. In the case of a business running efficiently and profitably, such as, happening will cause a great loss. Also, dissolution will attract Section 45(4) which, imposes tax liability in respect of capital gain arising on transfer of capital assets from the, firms to partners., Entrepreneurs now have an alternative and innovative form of business organization i.e., Limited Liability Partnership (LLP) which combines the benefits of company and general, partnership form of business organizations. LLP has separate legal entity, perpetual succession, and limited liability of partners. From income tax point of view, it is treated same as general, partnership firm therefore its profits will be taxed in the hands of the LLP not in the hands of its, partners, Company Form of Organisation, The important tax privileges and advantages to a company over the other forms can be, summarized as under:, ⮚ Allow ability of remuneration, for the persons who are managing the affairs of the company, and also owning its shares., ⮚ The provisions relating to clubbing of income under Section 64 of the Income Tax Act,, 1961 do not apply even if the business is carried on by family members through a company., This ultimately leads to reduction of tax liability on the part of the individual members., However, if spouse of an individual having a substantial interest in a company receives, remuneration from the same company, such remuneration is added to the income of the, individual unless the spouse is technically or professionally qualified. [Section 40A (2)(b), of the Income Tax Act, 1961]., ⮚ Any income by way of dividend referred to in Section 115-O is exempt under Section, 10(34)., ⮚ Companies are subjected to flat rate of tax, regardless of the quantum of their income., ⮚ There are certain special tax concessions, allowances and deductions given under the, Income Tax Act,1961 available to the company form of business enterprises such as, deductions allowed under Section 33AC and Sections 36(1)(ix) and 35D of the Income Tax, Act, 1961 etc.

Page 8 :

⮚ Incorporation of a company has the incidental advantage of attracting large capital since, the shareholder, who has to contribute only a miniscule part of the capital requirement, is, assured of limited liability and free transferability of his shares., , Tax rate for Companies for A/Y 2020-21, Company, , Rate of income tax(Percentage), , In the case of a domestic company, Where turnover does not exceed 400crores, , 25, , In any other case, , 30, , Winning u/s 115BB, , 30, , Short term capital gains u/s 111A, , 15, , Long term capital gains u/s 112, Other income, In the case of a foreign company, Royalty received from Government or an, Indian concern in pursuance of an Agreement, made by it with the Indian concern after March, 31, 1961, but before April 1, 1976, or fees for, rendering technical services in pursuance of an, agreement made by it after February 29, 1964, but before April 1, 1976 and where such, agreement has, in either case, been approved, by the Central Government, , 10/20, 30, , 50, , Winning u/s 115BB, , 30, , Short term capital gains u/s 111A, , 15, , Long term capital gains u/s 112, , 10/20, , Other income, , 40, , Surcharge:, Total income exceeds one crore but not exceed, 10 crore., , 7, , Total income exceeds 10 crore, , 12