Page 1 :

Integrated and Non- integrated accounts, , 1) Non – integrated accounting system:Under this system 2 separate set of a/c books are maintained. (One for, cost a/c and another for financial a/c), 2) Integrated accounting system:Under this system cost and financial a/c are kept in a same set of books, and it is based on double entry system, , Material control a/c = stores ledger control a/c, Cost ledger control a/c = general ledger control a/c, Allocation = distribution

Page 2 :

Direct=, Indirect, Allocation of, wages

Page 4 :

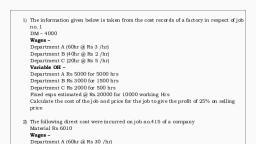

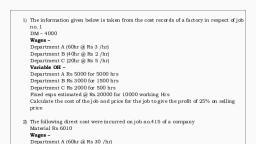

1) The following transactions have been extracted from books of a company., You are required to make journal entries as per, a) Non integrated a/c, b) Integrated a/c, , Purchase of RM for cash, , 4,00,000, , Carriage inward, , 3,000, , Stores issue, , 2,50,000, , Productive wages paid, , 2,04,000, , Unproductive wages paid, , 72,000, , Works OH incurred, , 3,65,000, , Material issued for repairs, , 2,100, , Selling exps paid, , 11,000, , Office exps paid, , 4,200, , Cost of completed jobs, , 12,15,000, , Works OH absorbed, , 410,000, , 2) B ltd. operates an integral system of accounting. You are required to, pass the following journal entries without narration, RM purchased (50% on credit), , 6,00,000, , Material issued to production (direct), , 4,00,000, , Wages paid (50% direct), , 2,00,000, , Wages charged to production, , 1,00,000, , FOH incurred, , 80,000, , FOH charged to production, , 100,000, , S & D OH incurred, , 40,000, , Finished goods at cost, , 5,00,000, , Sales (50% on credit), , 750,000, , Closing stock, , ------, , Receipts from Debtors, , 2,00,000, , Payment to Creditors, , 2,00,000

Page 5 :

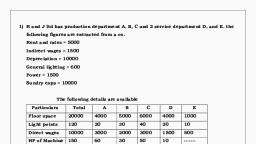

3) The following balances are expected from books of reliance company ltd., Particulars, , 1/1/17, , 31/12/17, , Stores on hand, , 3200, , 4506, , Stock of finished goods, , 4870, , 5124, , WIP, , 6200, , 4962, , Purchases, , 15000, , Carriage inward, , 226, , Stores issued, , 13800, , Wages – direct, , 13320, , Wages – indirect, , 4680, , Works exps including rent, power etc, , 13400, , Materials issued for repair, , 120, , Cost of completed production, , 49254, , Cost of finished goods sold, , 49000, , Selling exps, , 1134, , Office and administration exps, , 2650, , The cost journal shows that 18266 and 2630 were allocated to WIP in, respect of works OH and office OH respectively, You are required to show the journal entries and necessary ledger a/c, under non – integrated system., , 4) The following balance appeared in the books of ABC ltd on 1st Jan 2017, Particulars, , Dr, , General ledger adjustment a/c, , Cr, 15200, , Stores ledger control a/c, , 8750, , WIP ledger control a/c, , 4280, , Finished Goods ledger control a/c, , 2170, 15200, , 15200

Page 6 :

On 31st Dec 2017 the following information was supplied, , Purchase of stores, , 60640, , Purchase for special jobs, , 1950, , Direct wages, , 38627, , Indirect factory wages, , 9543, , Administrative salary, , 6731, , S & D salary, , 4252, , Production exps, , 10432, , Administration exps, , 9546, , S & D exps, , 6430, , Stores issued to maintenance a/c, , 2586, , Stores issued to production, , 56501, , Return to supplier, , 312, , Production OH absorbed, , 23410, , Administration OH absorbed by FG, , 15150, , Selling OH recovered on sales, , 9515, , Product finished during the year, , 1,18,517, , Finished goods sold at cost, , 1,33,382, , Sales, , 155,000, , You are required to record the entries in cost ledger for the year 2017, , 5) The following data is available to you from the cost ledger of a company., Prepare respective ledger a/c as on 31/12/17, Balance as on 1/1/17, Material control, , 1240, , WIP, , 625, , FG, , 1240, , Production OH (debit), , 84, , AOH (credit), , 120, , S & D OH (debit), , 65, , General ledger control a/c (credit), , 3134

Page 7 :

Transaction for the year ended 31/12/17, Material, Purchased, , 4801, , Issued to jobs, , 4774, , Maintenance work, , 412, , Administrative office, , 34, , Selling department, , 72, , Direct wages, , 1493, , Indirect wages, , 650, , Carriage inward (treated as FOH exps), , 84, , Production OH, Incurred, , 2423, , Absorbed, , 3591, , AOH, Incurred, , 740, , Allocation to FG, , 529, , Allocation to sales, , 148, , Sales OH, Incurred, , 642, , Absorbed, , 820, , FG produced, , 9584, , FG sold, , 9773, , Sales realization, , 12430