Page 1 :

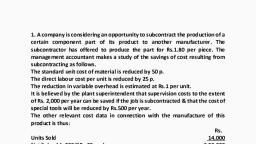

1) Sun, moon ltd produces 200000, 30000, 25000, 20000, and 75000 units of its 5, product A, B, C, D, and E respectively in a manufacturing process and sells them, at Rs 17, 13, 8, 10, and 14 per unit respectively. Except product D, remaining, product can be further processed and then can be sold @ Rs 25, 17, 12, 20 per, unit in case of A, B, C, and E respectively. Raw material cost Rs 3590000 and, other manufacturing cost Rs 547000 in the manufacturing process which are, absorbed on the product on the basis of their NRV, The further processing cost of A, B, C, and E are Rs 1250000, 150000, 50000,, and 150000 respectively. Fixed cost is Rs 473000. You are required to prepare the, following in respect of coming year., a) Statement showing income forecast of the company assuming that none of its, product are to be further processed., b) Statement showing income forecast of the company assuming that products A,, B, C, E are to be processed further, c) Can you suggest any other production plan whereby the company can, maximize its profit? If yes then submit a statement showing income forecast, arising out of that plan., , 2) The oil company purchases crude vegetable oil. It does refining of the same. The, refining process results in 4 products at split up point M, N, O, and P. product O, is fully processed at the split up point. The product M, N, and P can be, individually refined further into super M, super N, and super P. In the most recent, month the output at the split up point are as follows, Product M = 300000 gallons, N = 100000 gallons, O = 50000 gallons, P = 50000 gallons, The joint cost of purchasing crude vegetable oil and processing crude vegetable oil, were 4000000. The company had no beginning and no ending inventory. Sales of, product O in the recent month were Rs 2000000. The output of product M, N, and, P was further refined and then sold data related to most recent month are as, follows, Product, Further processing cost to Sales, make super product, Super M, 80,00,000, 120,00,000, Super N, 32,00,000, 40,00,000, Super P, 36,00,000, 48,00,000, Company had the option of selling products @ the split up point and the, alternative would have yielded the following sales product, M, 20,00,000, N, 12,00,000, P, 28,00,000

Page 2 :

You are required to answer, a) How the joint cost of Rs 4000000 would be allocated between each product, under each of the following methods, Sales value method, Physical unit method, Estimated NRV method, b) Could the company increase its profit by making different decision, about, further refining product M, N, and P show the affect of any change you, recommend on the company’s profit, 3) A pharma company purchases raw material which is then processed to yield 3, chemical anorol, estyl, betryl, In October 2017, the pharma company purchase 10000 gallons of raw material at, a cost of Rs 12,50,000 and incurred joint cost for conversion Rs 7,50,000, Sales and production information during the month are as follows, Product, Gallons, Price @ split Further, Eventual sales, produced, off, processing cost price, Anarol, 2000, 350, Estyl, 3000, 240, Betryl, 5000, 200, 30, 360, Anrol and Estyl are sold to other pharma company @ the split off point, Betryl can be sold @ split off point or processed further for sale as an asthama, medication, Required:a) Allocate the joint cost to 3 products using physical unit method, sales value @, split off method and NRV method, b) Suppose that half of October production of estyl could be purified and mixed, with all of anarol to produce great anesthetic and all the further processing, cost amounted to Rs 2,25,000. The selling price of the new product will be, 650/ gallons. Should the pharma company further processed anarol into, anesthetic? Assume the required result of anesthetic would be only 2000, gallons., 4) Two product P and Q are obtained in a crude for require further processing @ a, cost of Rs 5 for P and Rs 4 for Q per unit before sales., Assuming a net margin of 25% on cost and their sales price are fixed at Rs 13.75, and 8.75/unit respectively., During the period joint cost was Rs 88000 and output were P – 8000 units, Q – 6000 units, Ascertain the Joint cost / unit

Page 3 :

5) In a organic chemical purchases salt and processing it into more refinery product, such as costic soda, cloring, and PVC, During the month of April in organic chemical purchases salt for Rs 10,00,000, Conversion cost of Rs 15,00,000 were incurred up to the split off point @ which, time two salable product were produced i.e. costic soda and cloring. Cloring can, be further processed into PVC. The April production and sales information are as, follows, Product, Costic soda, Clorin, PVC, , Production, 1200 ton, 800 ton, 500, , Sales, 1200, , SP/ ton, 1250, , 500, , 5000, , All 800 ton of clorin was further processed @ the incremental cost of Rs 5,00,000, to yield 500 ton of PVC. There were no by product or scrap from this further, processing of clorin. There was no beginning or ending inventories for the product., There is an active market for clorin. The company could have sold it all @ Rs 1875, / ton, a) Calculate how the JC of Rs 25,00,000 would be allocated between costic soda, and clorin under the following methods, Sales value @ split off, Physical unit method, NRV method, b) What is the gross margin % of costic soda and PVC under 3 methods stated, under point one, c) X ltd offers to purchase 800 ton of clorin @ Rs 1875/ ton. These sales would, mean that no PVC would be produce in the month., How would accepting the offer affects the company operating income?, , 6) ABC ltd operates a simple chemical process to convert a single material into as X,, Y and Z. All the 3 products are separated simultaneously @ a single split off point., Product X and Y are ready for sale immediately upon split off without further, processing or any other additional cost. Product Z is however processed further, before being sold and there is no available market price for Z @ split off point. The, selling price quoted here are expected to remain the same in the coming year, During the year selling price of the items and total quantity sold were as fallows, X – 186 tons sold for Rs 1500/ ton, Y – 527 tons sold for Rs 1125 / ton, Z – 736 tons sold for Rs 750 / ton, The total joint manufacturing cost for the year were 625000 and additional Rs, 310000 was spent to finish product Z. there was no inventory of opening of X, Y, and Z. At the end of the year following inventory of completed units were on hand., X- 180 tons, Y – 60 tons, Z – 25 tons, There was no opening / closing WIP.

Page 4 :

Required, a) Compute the cost of inventory of X,Y,Z for balance sheet purpose and cost of, goods sold for income statement purpose for the year ending using, i), NRV method of JC allocation, ii), Constant gross margin % NRV method of JC allocation, b) Compare the gross margin % for X, Y, Z using 2 methods given in above, requirement a), , 7) Product X yield to produce A and B. the Joint cost of manufacturing is 65800., From the following information show how would you apportion the joint cost, manufactured?, , Sale, Manufacturing cost, after separation, Estimated selling, exps on sales, P&L, , X, 100,000, , A, 40,000, 5,000, , B, 25,000, 4,000, , 20%, , 20%, , 25%, , 30%, , 8) Z ltd. manufactures product A which yields 2 by product B and C. the actual joint, exps of manufactures for a period were Rs 8000. It was estimated that profits on, each product as a % of sales would be 30%, 25% and 15% respectively., Subsequent exps were, , Material, DW, OH, , A, 100, 200, 150, 450, , B, 75, 125, 125, 325, , C, 25, 50, 75, 150, , Sales 6000, 4000, 2500 respectively. Prepare a statement showing apportionment, of joint exps of manufacturer over a different product. Also presume that selling, exps were apportioned over a product as a % to sales., 9) In a manufacturing of a certain product A yields by product B and C. The joint, exps of manufacture are material Rs 10200, labour 11400, and cost 7500. Show, how you would apportion the JC of manufacture. While subsequent exps are, , Material, Labour, On cost, Sales, Estimated profit, , A, 2500, 1900, 1500, 5900, 30000, 40%, , B, 1200, 1600, 900, 3700, 20000, 30%, , C, 1400, 2000, 1050, 4450, 15000, 25%

Page 5 :

10), In the course of manufacture of main product P, by product A and B also, emerged. The joint exps of manufacture amount to Rs 1,19,550, All the 3 product are processed further after separation and sold as per detail, given below, P, Sales, 90,000, Cost incurred after 6000, separation, Profit as % of sales 25, , A, 60,000, 5000, , B, 40,000, 4000, , 20, , 15, , Total fixed selling exps are 10% of total cost of sales which are apportioned to the, 3 products in the ratio of 20:40:40, Prepare a statement showing apportionment of JC to the main and By products, 11), A factory is engaged in production of chemical X and in course of its, manufacture a byproduct Y is produced which after a separate process has a, commercial value., For the month of January following are summarized costing data, Joint Exps, Separate Exps, X, Y, Material, 19200, 7360, 780, Labour, 11700, 7680, 2642, On cost, 3450, 1500, 544, 34350, 16540, 3966, The output for the month was 142 tons of X and 49 tons of Y and selling price of Y, averaged Rs 280/ton. Assume that the profit on Y is estimated @50% of SP., Prepare an a/c showing cost of X/ton, 12), A manufacturing unit in production of chemical A. in the course of its, manufacture the B is produced which after a separate process has a commercial, value. Following data are available for particular month., Joint cost, Material, Labour, Exps, , 1,00,000, 40,000, 25,000, , Separate cost, A, 20,000, 25,000, 14,000, , B, 28,000, 25,000, 10,000, , The output for the month was 1500kgs of A and 50kgs of B. SP of product B is Rs, 2000/kg. The profit on B is 33 1/3 % on cost price. Prepare a main product and, byproduct a/c and show a cost of each product/kg

Page 6 :

13), A factory is engaged in production of chemical bomex and in course of its, manufacture a byproduct brucel is produced which after further processing has a, commercial value., For the month of April following data are available, Joint Exps, Separate Exps, Main (bomex), By (brucel), Material, 1,00,000, 6000, 4000, Labour, 50,000, 20000, 18000, OH, 30,000, 10000, 6000, Selling price /, 98, 34, unit, Estimated, profit per unit, of brucel Rs 4, No. of units, 2000, 2000, produced, The factory uses reverse cost method of accounting for by product where by sales, value of by product after deduction of estimated profit Post separation cost and S, & D exps relating to the by product is credited to joint process cost a/c., a) You are required to prepare statement showing JC allocable to bomex, b) Product wise and overall profitability of the factory for April, 14), From the following information find out the profit made by each product, apportioning JC on sales value basis, JC:DM, 1,26,000, Power, 25,000, Petrol, 5000, Labour, 7500, Other charges, 4100, Selling cost, Product X, 20,000, Product Y, 80,000, Sales, Product X, 1,52,000, Product Y, 1,68,000, 15), From the following estimate the separation cost / ton byproduct Y and Z, Main product is X and two byproduct are Y and Z and the selling price are as, follows, Y – 500/ton, Z – 800/ton, S & D exps are estimated to be 25% of SP and net profit is expected to be 10% of, SP, Further processing cost is Rs 95/ton for Y and Rs 145/ton for Z

Page 7 :

16), X ltd. manufactures product A which yields 2 byproduct B and C. In a, period the amount spent up to point of separation was 20600, The subsequent exps were as follows, , Material, DW, OH, , A, 300, 400, 300, 1000, , B, 200, 300, 270, 770, , C, 150, 200, 280, 630, , The sales value of production A, B, C were 15000, 10000 and 5000 respectively. It, was estimated that net profit as % of sales in B and C would be 25% and 20%, respectively. Ascertain JC of each and also profit of A