Page 1 :

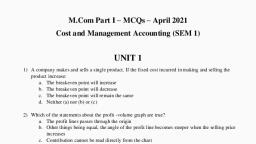

Cost management, , CHAPTER – 1, INTRODUCTION, , Accounting is the process of identifying, recording, summarizing, interpreting, thereof., Users of accounting:1) Internal users – management, shareholders etc, 2) External users – govt., financial institution etc, , Accounting information system, , Financial, Information, system, , Cost, Information, system, , Management, Information, system, , Financial, A/c, , Cost A/c, , Management, A/c, , Drawbacks of financial A/c:1) Overall cost is recorded in financial A/c, 2) Result from the financial a/c is of the whole firm. It is not as per the, individual department., , For example:a) As per Financial A/c profit is Rs 50000, b) As per cost A/c, Akkihal College of Commerce, , Page 1

Page 2 :

Cost management, Department A – 50000, B – (30000), C - 30000, Total Profit - 50000, , 3) It does not help in fixation of price of product, 4) Comparison regarding to individual department and cost per unit is not, possible., 5) No techniques are used for control cost of materials in financial a/c, Ex: - LIFO, FIFO techniques are used in Cost a/c, 6) Fixation of standards or predetermined cost in financial a/c is not possible, 7) As there are no standards in financial a/c we can’t test the efficiency and, inefficiency., 8) Financial A/c is in historical nature:It means once the thing happens then only we will record in the financial, A/c. but in cost a/c we will predict the future cost and record in the cost, a/c, Ex: - tender price, , Management Accounting, , It is a branch of accounting which helps the management in taking the, decision. It is also called as modern cost accounting., , Cost:Cost is the price paid for something., Or, As per W.M. Halker “Cost is the value of economic resources used as a result, of producing or doing the things costed.”, , Akkihal College of Commerce, , Page 2

Page 3 :

Cost management, As per ICMA “the amount of expenditure incurred on or attributable to a given, thing”, , Cost, , Unexpired, Cost, , Expired Cost, , Expenses:Expenses are the expired cost resulting from a productive usage of an, asset. Expenses are used or benefit received one., , Cost of machine (50000), , Expired Cost, 5000, depreciation, , Akkihal College of Commerce, , Unexpired Cost, 45000, Machine Value, , Page 3

Page 4 :

Cost management, Costing:Costing is a technique of ascertaining the cost, , Cost Accounting:It is a branch of accounting which deals with identification, measuring, and, recording, classifying and interpreting the result of current cost or prospective, cost., , As per wheldon, cost accounting is the classifying, recording an appropriate, allocation of expenditure for the determination of cost of product or services., , As per Charles T. hongren, cost accounting is a quantitative method that, accumulates, classifies, summarizes and interprets information for 3 major, purposes in, a) Product costing, b) Operational planning and control, c) Special decision, , Cost management:It means the process of effective planning and controlling the cost involved in, the business., It is a process of planning and controlling the budgets of a business., It is a form of management accounting that allows a business to predict future, expenditure which will help to reduce the chance of going over the budget., , Akkihal College of Commerce, , Page 4

Page 5 :

Cost management, Objectives of cost management:1) Cost reduction and control, 2) It helps in fixation of price, 3) Helps in fixing the standard for comparison, 4) It helps the management in decision making like expansion, make or, buy, replacing labour by machine etc., 5) It helps in forecasting the estimated cost, 6) It helps to find out reason behind the losses., 7) It helps in detail analysis of cost, 8) Cost management helps in determining the profitability of each, department, process or product. And also helps in maximizing the profit, 9) To utilize the available resource in an efficient manner in such a way, that no resource and labour are kept as loss., 10), , It helps to improve the quality: - As the cost minimizes we can, , use the saved amount for better quality resources., 11), , Spending timely, correctly and perspectively., , Importance of cost management:a) Importance to management:1) Decision making, 2) It helps in price fixation, 3) It helps in finding out the profitability relating to particular, department, 4) It helps in cost control, 5) It helps in inventory control: - (weather to maintain the stock or not, if we are maintaining the stock then at what level we should do etc.), 6) It helps in formulating the policies regarding expansion etc., 7) It helps in detail analysis of cost, , Akkihal College of Commerce, , Page 5

Page 6 :

Cost management, b) Importance to investor/ creditor:1) It helps in disclosing the profit per unit, 2) It helps in taking the decision., 3) It helps in building credit worthiness of the company, , c), , Importance to employees and workers:1) It helps in fixation of prices and salary, 2) It helps in fixing standards against which we can give promotion and, demotion., 3) It helps in providing the job security, 4) Accurate information about labour cost, , d) Importance to Govt.:1) It helps in economic growth, 2) It helps in finding out the GST on a cost per unit or taxation on a, product., , e) Importance to society:1) Getting the same goods and services by paying the lesser price, 2) Increase in standard of living, 3) Getting better quality product, 4) Contribution towards CSR, 5) It increases the employment opportunity, , Akkihal College of Commerce, , Page 6

Page 7 :

Cost management, Methods of costing, There are different methods of costing for different industries depending on, their nature of work., The methods of costing can be studied under the following heads: - 1. Methods, Based on the Principles of Job Costing 2. Methods Based on the Principles of, Process Costing., Some of the methods based on the principles of job costing are: 1. Job Costing, 2. Contract Costing, 3. Batch Costing., , Some of the methods based on the principles of process costing are:1. Process Costing, 2. Operation Costing, 3. Departmental Costing, 4. Single or Unit or Output Costing, 5. Operating or Operative or Working or Service Costing, 6. Multiple or Composite Costing., , Additionally, few other methods of costing are: 1. Uniform Costing, 2. Cost plus Method, 3. Target Costing Method, 4. Farm Costing, 5. Activity Based Costing, , Akkihal College of Commerce, , Page 7

Page 8 :

Cost management, The method of costing refers to a system of cost ascertainment and, cost accounting. Industries differ in their nature, in the products they produce, and the services they offer. Hence, different methods of costing are used by, different industries. For example, the method of costing employed by a building, contractor is different from that of a transport company., Job costing and process costing are the two basic methods of costing., Job costing is suitable to industries which manufacture or execute the work, according to the specifications of the customers. Process costing is suitable to, industries where production is continuous and the units produced are, identical. All other methods are combinations, extensions or improvements of, these basic methods., The methods of costing are explained in detail:, Method # 1 Job Costing:, It is also called specific order costing. It is adopted by industries where there is, no standard product and each job or work order is different from the others., The job is done strictly according to the specifications given by the customer, and usually the job takes only a short time for completion. The purpose of job, costing is to ascertain the cost of each job separately. Job costing is used by, printing presses, motor repair shops, automobile garages, film studios,, engineering industries etc., Method # 2 Contract Costing:, It is also known as terminal costing. Basically, this method is similar to job, costing. However, it is used where the job is big and spread over a long period, of time. The work is done according to the specifications of the customer., The purpose of contract costing is to ascertain the cost incurred on each, contract separately. Hence a separate account is prepared for each contract., This method is used by firms engaged in ship building, construction of, buildings, bridges, dams and roads., Akkihal College of Commerce, , Page 8

Page 9 :

Cost management, Method # 3 Batch Costing:, It is an extension of job costing. A batch is a group of identical products. All the, units in a particular batch are uniform in nature and size. Hence each batch is, treated as a cost unit and costed separately. The total cost of a batch is, ascertained and it is divided by the number of units in the batch to determine, the cost per unit. Batch costing is adopted by manufacturers of biscuits, readymade garments, spare parts medicines etc., Method # 4 Process Costing:, It is called continuous costing. In certain industries, the raw material passes, through different processes before it takes the shape of a final product. In other, words, the finished product of one process becomes the raw material for the, subsequent process. Process costing is used in such industries., A separate account is opened for each process to find out the total cost as well, as cost per unit at the end of each process. Process costing is applied to, continuous process industries such as chemicals, textiles, paper, soap, lather, etc., Method # 5 Unit Costing:, This method is also known as single or output costing. It is suitable to, industries where production is continuous and units are identical. The, objective of this method is to ascertain the total cost as well as the cost per, unit. A cost sheet is prepared taking into account the cost of material, labour, and overheads. Unit costing is applicable in the case of mines, oil drilling units,, cement works, brick works and units manufacturing cycles, radios, washing, machines etc., , Akkihal College of Commerce, , Page 9

Page 10 :

Cost management, Method # 6 Operating Costing:, This method is followed by industries which render services. To ascertain the, cost of such services, composite units like passenger kilometers and tone, kilometers are used for ascertaining costs. For example, in the case of a bus, company, operating costing indicates the cost of carrying a passenger per, kilometer. Operating costing is adopted by airways railways, road transport, companies (goods as well as passengers) hotels, cinema halls, power houses, etc., Method # 7 Operation Costing:, This is a more detailed application of process costing. It involves costing by, every operation. This method is used where there is mass production of, repetitive nature involving a number of operations. The main purpose of this, method is to ascertain the cost of each operation., For instance, the manufacture of handles for bicycles involves a number of, operations such as cutting steel sheets into proper strips, moulding, machining, and finally polishing. The cost of these operations may be found out separately., Operation costing provides a minute analysis of costs to achieve accuracy and, it is applied in industries such as spare parts, toy making and engineering., Method # 8 Multiple Costing:, It is also known as composite costing. It refers to a combination of two or more, of the above methods of costing. It is adopted in industries where several parts, are produced separately and assembled to a single product., Method # 9 Departmental Costing:, This system is applicable where the cost of a department or a cost centre is, required to be ascertained. This is similar to operating costing. This system is, resorted to where the factory is divided into distinct departments and it is, desired to ascertain the cost of production of each department rather than the, , Akkihal College of Commerce, , Page 10

Page 11 :

Cost management, cost of each article produced. This method is good for a comparative study of, the identical costs of different departments., , Under this method, the cost of operating each department is ascertained by, allocating the total expenses incurred by a concern to various departments,, and the cost per unit of product produced in each department is ascertained by, dividing the total cost of the department by the number of units produced in, that department. This method is adopted by concerns producing hosiery goods,, factories producing cosmetics, footwear manufacturing concerns, etc., , Method # 10 Cost plus Method:, Where a businessman feels hesitant to quote for a work which is absolutely, new to him and new to other persons or contractors and he is unable to, estimate the cost of the works offered to him for execution, it is decided with, the contractor that he would be paid the total cost of work whatever it be, plus, his profit at a certain percent on the total cost. Such type of work is called cost, plus method., , Method # 11 Target Costing Method:, In big business houses the cost price of the work is ascertained by experts and, experienced persons well in advance or even before the commencement of the, work. At the time of production the goal of the concern is always kept in mind., That is why this system is called ‘Target Costing Method’. This system is mostly, used in big contracts., , Method # 12 Farm Costing:, This method of costing helps in calculation of total cost and per unit cost of, various activities covered under farming. Farming activities cover agriculture,, horticulture, animal husbandry, poultry farming, pisciculture, dairy farming,, sericulture, etc., , Akkihal College of Commerce, , Page 11

Page 12 :

Cost management, Farm costing helps to improve the farming practices to reduce the cost of, production, to ascertain the profit on each line of farming activity which, ensures better control by management and to obtain loans from banks and, other financial institutions as they give loans on the basis of proper cost, accounting records., , Method # 13 Uniform costing:, Uniform costing is not a particular method of costing. It is adoption of common, accounting principles and in some cases common methods by member, companies in the same industry so that their cost figures may be comparable., Uniform costing can be defined as the ‘use by several undertakings of the same, costing principle and practices’., In other words, it is a technique or method of costing by which different firms, of a field or industry apply similar costing system so as to produce cost data, which have maximum comparability. Standard costs may be developed and, cost-control is secured in firm through mutual comparison., Method # 14 Activity Based Costing:, The activity-based costing (ABC) system is a method of accounting you can use, to find the total cost of activities necessary to make a product. The ABC system, assigns costs to each activity that goes into production, such as workers, testing a product., , Akkihal College of Commerce, , Page 12

Page 13 :

Cost management, Different types of Costs in Cost Accounting, One can understand the cost accounting properly only after knowing various, types of cost. Hence, the understanding of types of cost enables proper, application of cost accounting principles. Therefore, certain types of cost are, briefly explained below., , 1. Historical Cost, It is the post mortem of cost, which is already incurred. This type of cost, reports the past events. If the time lag between the cost incurred time and, reporting time is very short, quality decision may be taken. If not so, these, costs are irrelevant for decision-making., 2. Future Cost, These types of costs are expected and incurred in the days to come., 3. Replacement Cost, Replacement cost is the cost required to replace any existing asset at present., 4. Standard Cost, Standard cost is a scientifically predetermined cost, which is arrived at, assuming a specific level of efficiency in material utilization, labor and indirect, expenses., 5. Estimated Cost, Estimated cost is an assessment of what will be the cost approximately. It is, based on the past experience and adjusted according to the expected future, changes., 6. Product Cost, Product cost is the cost of a finished product., , Akkihal College of Commerce, , Page 13

Page 14 :

Cost management, 7. Production Cost, Production cost is the combination of both prime cost and absorbed production, overhead., , 8. Direct Cost, Direct cost is a cost, which can be easily identified with a specific saleable cost, unit., 9. Prime Cost, Prime cost is the aggregation of direct material cost and direct labor cost. The, terms direct refers to elements of costs, which are easily traceable to a, particular unit of output., , 10. Indirect Cost, Indirect Cost is the cost, which cannot be easily or directly identified to the unit, of output or to the segment of a business operation., 11. Fixed cost, Fixed cost is otherwise called fixed overhead and period cost. A cost, which is, incurred for a specific period and does not get affected by fluctuations in the, levels of activity (output or turnover). For example Rent, Salaries and the like., 12. Variable Cost, Variable cost is the cost, which is varying or fluctuating according to the levels, of activity (output or turnover) in direct proportion., 13. Opportunity Cost, Opportunity is the value of a benefit sacrificed in favor of an alternative course, of action., , Akkihal College of Commerce, , Page 14

Page 15 :

Cost management, 14. Imputed Cost, Imputed cost is otherwise called Notional Cost and Hypothetical Cost. A cost, that has not involve cash outflow from the business organization. It does not, appear in the financial records but relevant to the decision-making., For example: Interest on Capital. CIMA defines notional cost as, the value of a, benefit where no actual cost is incurred., 15. Programmed Cost, A cost which is incurred under any specific programmed of an organization is, called programmed cost. This is reflecting top management policies and, decisions., 16. Controllable Cost, Controllable cost is the cost, which can be influenced by budget holder. In, other words, a cost may be controllable by managerial supervision., , 17. Non-Controllable Cost, Non-controllable cost is the cost that cannot be easily controllable at any level, of managerial supervision., 18. Joint Cost, Joint cost is the cost of a process, which results in producing more than one, main product., 19. Sunk Cost, CIMA defines sunk cost as; the past cost is not taken into accounts in decision, making., 20. Postponable Cost, A cost can be shifted to future with little or no effect on the efficiency of current, operations is Postponable cost., , Akkihal College of Commerce, , Page 15

Page 16 :

Cost management, 21. Out of Pocket Cost, Out of pocket cost is the cost which results in cash outflow from the business, organization due to a particular managerial decision., 22. Differential Cost, Differential cost is the difference of cost between the total costs of two, alternatives that are calculated to assist decision-making., 23. Conversion Cost, Conversion cost is also called production cost. Direct material cost is not, included in the production cost. It is the cost incurred for converting the raw, material into finished product. In other words, it is the combination of direct, labor, direct expenses and factory overhead., 24. Capacity Cost, Capacity cost is an alternative term used for fixed cost. It is the cost of, providing facilities through a system for a particular period. The capacity cost, is classified into two categories. They are Standby Cost and Enabling Cost., 25. Standby Cost, Standby cost is the cost that is to be incurred continuously even though the, operations or facilities are shutdown temporarily. For example, Depreciation., 26. Enabling Cost, Enabling cost is the cost that is not to be incurred if the operations or facilities, are shutdown temporarily., 27. Committed Cost, Committed cost is a fixed cost of the company resulted from the earlier decision, of the management. For example: Insurance Premium. The amount of, insurance premium cannot be controlled at present on a short run basis., , Akkihal College of Commerce, , Page 16

Page 17 :

Cost management, 28. Avoidable Cost, Avoidable cost is the specific cost of an activity or a sector of a business that, can be avoided if that activity or sector is not in operation., 29. Decision Driven Cost, Decision Driven cost is the cost incurred by the company due to its policy, decision up to the stage of altering such decision. It does not vary with changes, in the level of output or operational activities., 30. Marginal Cost, It is the cost of one more unit of product or service, which can be avoided if, that unit is not produced or provided., 31. Quality Related Costs, These are the costs incurred for ensuring and assuring quality as well as the, loss incurred even though the quality is not achieved. Quality related costs are, classified as prevention cost, appraisal cost, internal failure cost and external, failure cost., 32. Prevention Cost, Prevention cost is the cost incurred to reduce the appraisal cost to a minimum., 33. Appraisal Cost, Appraisal cost is the cost incurred initially for ascertaining conformance of, quality of product according to the requirements. For example: Inspection and, testing cost., 34. Internal Failure Cost, A cost is arising from inadequate quality discovered before the transfer of, ownership from supplier to purchaser., , Akkihal College of Commerce, , Page 17

Page 18 :

Cost management, 35. Relevant Costs, CIMA defines relevant costs “costs appropriate to a specific management, decision.”, 36. Social Responsibility Cost, CIMA defines social responsibility cost as tangible and intangible costs and, losses sustained by third parties or the general public as a result of economic, activity., 37. Target Cost, CIMA defines target cost as, a product cost estimate derived from a competitive, market price. Used to reduce costs through continuous improvement and, replacement of technologies and processor, 38. Inventorial Cost, It is the cost incurred for manufacturing a product and considered as assets, under generally accepted accounting principles. For example: Research and, Development cost. The inventorial cost becomes expenses when the products, are sold., 39. Deferred Cost, The Company does not receive an economic benefit of a cost during the, accounting period in which the cost is incurred. Such cost is termed as, deferred cost. For example: Prepaid Insurance. It is otherwise called as, unexpired expenses or unexpired cost and treated as an asset., 40. Expense, It is an expired cost and the company has received its economic benefit., Moreover, the economic benefit is more than the expired cost. For example:, Rent paid for the accounting period., , Akkihal College of Commerce, , Page 18

Page 19 :

Cost management, 41. Loss, It is also an expired cost and the company has received its economic benefit., But, the received economic benefit is less than the expired cost., , Difference between cost accounting and financial accounting, Particulars, , Financial Accounting, , Cost accounting, , 1) Statutory requirement, , It is mandatory to, prepare as per income, tax act, , Preparation of cost, accounting is not, mandatory., , 2) Nature, , Historical in nature, , Historical as well as, estimated in nature, , 3) Records, , Transaction and events, , Cost as well as exps, , There is no classification, of cost, , There is detailed, classification of cost, , It shows the profit or, loss for the firm as a, whole, , It shows the profit and, losses for individual, department, product,, process etc., , Greater control on, financial activities and, cash position, , Greater control on, material cost, labour, cost, exps, , 7) Use of statistical, techniques, , Use of statistical, techniques are very less, in financial accounting, , Use of charts, diagram,, graph etc are more in, cost a/c, , 8) Adoption, , Adopted by all the firms, , Adopted by only large, business organizations., , Stocks are valued at, market price or cost, price whichever is less, , Always valued at cost, price, , 4) Classification of cost, , 5) Profit, , 6) Control area, , 9) Valuation of stock, , Akkihal College of Commerce, , Page 19

Page 20 :

Cost management, It is a continuous, account and also can be, prepared as and when, required, , 10), , Reporting, , Financial a/c’s are, usually prepared at the, end of financial year, , 11), , Principles followed, , As per GAAP ( generally, accepted accounting, principles ), , As per costing principles, , Inter user and for, external user, , Mostly it is prepared for, internal people, , 12) Parties to be, served, , Factors influencing cost management, 1) Global competition:Because of globalization the whole market is treated as a global market. For, this we have to give competition all over the world. Therefore by adopting cost, management we can survive., 2) Trends in industrial scenario:In olden days we were only concentrating on primary sector i.e. agriculture, sector. But now a day the secondary as well as service sector has growing, more. Therefore it is very important to adopt the management techniques., , 3) Advances in information technology:Now a day’s we are using more internet and computers and software which, helps the company to know the inflation rate and exact cost of a product., , 4) Trends towards E-Commerce:Technology like computer and internet are playing a vital role. How we are, taking benefit of these in minimizing the cost will lead to the cost management., , Akkihal College of Commerce, , Page 20

Page 21 :

Cost management, 5) New product development:We have to go on adding new features in a existing product. Because customer, need changes at low cost, , 6) Efficiency:“How better you perform that work” is called as efficiency. To check the, efficiency we have many cost management techniques. It give more importance, to quality and time., , 7) TQM:In older days people prefer low cost product but now people are preferring, quality product. As per TQM the cost should be low and quality should be, more., , 8) Consumer orientation:Requirement by the consumer is the present trend. We have to manufacture as, per the consumer requirement. More consumer satisfaction is concentrated, now days, 9) Advance in manufacturing environment:CAD (computer aided design) and CAE (computer aided engineering), JIT all, these factors come under advance in manufacturing environment., , Akkihal College of Commerce, , Page 21

Page 22 :

Cost management, Techniques of cost management or Contemporary issue in cost, management, , Techniques of cost management, , Traditional, 1., 2., 3., 4., 5., 6., 7., 8., 9., 10., 11., 12., 13., , ABC analysis, VED analysis, EOQ, Stock level, Job analysis, Merit rating, Labour turnover, Work management, Budgetary control, Standard costing, Responsibility accounting, Men power planning, Capacity planning, , Akkihal College of Commerce, , Modern/strategic, 1., 2., 3., 4., 5., 6., 7., 8., 9., 10., 11., 12., 13., 14., , ABC, Target costing, Bench marking, TQM, Kaizen, Life cycle costing, Outsourcing, Kanban costing, Learning curve, Value chain analysis, Balance score card, JIT, Theory of constraint, Business process reengineering, , Page 22

Page 23 :

Cost management, A) Traditional method:-, , 1. ABC analysis, ABC analysis is a business term used to define an inventory categorization, technique often used in materials management. It is also known as ‘Selective, Inventory Control.’ ABC analysis provides a mechanism for identifying items, which will have a significant impact on overall inventory cost whilst also, providing a mechanism for identifying different categories of stock that will, require different management and controls. When carrying out an ABC, analysis, inventory items are valued (item cost multiplied by quantity, issued/consumed in period) with the results then ranked. The results are then, grouped typically into three bands. These bands are called ABC codes., ABC – CODES:, "A class" inventory will typically contain items that account for 80% of, total value, or 20% of total items."B class" inventory will have around 15% of, total value, or 30% of total items. "C class" inventory will account for the, remaining 5%, or 50% of total items., ABC Analysis is similar to the Pareto principle in that the "A class", group will typically account for a large proportion of the overall value but a, small percentage of the overall volume of inventory., , Ex:A = cement, rods, B = carpenter equipment, C = screws, , Akkihal College of Commerce, , Page 23

Page 24 :

Cost management, 2. VED analysis, , While in ABC, classification inventories are classified on the basis of their, consumption value and in HML analysis, the unit value is the basis. Criticality, of inventories is the basis for vital, essential and desirable categorization. The, VED analysis is done to determine the criticality of an item and its effect on, production and other services. It is specially used for classification of spare, parts., , 3. EOQ, Economic order quantity is the level of inventory that minimizes the total, inventory holding costs and ordering costs. It is one of the oldest classical, production scheduling models. The framework used to determine this order, quantity is also known as Wilson EOQ Model or Wilson Formula. The model, was developed by F. W. Harris in 1913. But still R. H. Wilson, a consultant who, applied it extensively, is given credit for his early in-depth analysis of the, model., EOQ is the economic quantity to order, so that ordering cost + carrying, cost finds its minimum. (A common misunderstanding is that formula tries to, find when these are equal.) EOQ is essentially an accounting formula that, determines the point at which the combination of order costs and inventory, carrying costs are the least. The result is the most cost effective quantity to, order in purchasing, this is known as the order quantity, in manufacturing it is, known as the production lot size., The basic Economic Order Quantity (EOQ) formula is as follows:-, , EOQ, , =, , 2(Annual usage in units) (Order cost), (Annual Carrying cost per unit), , Akkihal College of Commerce, , Page 24

Page 25 :

Cost management, 4. Stock level, a) Maximum level :- maximum amount of stock can be stored, b) Minimum level:- minimum amount of stock can be stored, c) Danger level: - it is a level which goes below the minimum level., And here we stop all the activity and transfer the material to very, important department only., d) Re-order level: - when we reach minimum level, we have to order, the material. But the certain time will be required to get that order., The level at which we place an order is called reorder level., , Maximum stock level, , Re – order stock level, , Minimum stock level, Danger, stock level, , Lead time, , Lead time:Lead time is the time required to receive the order., 5. Job analysis, Studying all the aspects of the job and fixing the price or remuneration, for that job., , 6. Merit rating, Ascertaining the individual worker’s performance and efficiency, and, fixing the price based on the efficiency and merits., Akkihal College of Commerce, , Page 25

Page 26 :

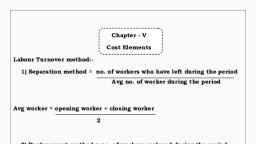

Cost management, 7. Labour turnover, If labour turnover is high then the cost will be more. If it is less then, the cost will be low., , 8. Work management, Here we have to fix standard hour and then the workers should, complete the task or job within that standard hours. It will minimize, the wastage of time., , 9. Budgetary control, If we work as per the plan, the cost will be less and we can control the, cost also., , 10. Standard costing, Fixing the predetermined cost and we have to work to go below that, standard cost., , 11. Responsibility accounting, , a) EVA (economic value added) :- additional value created above the, cost of capital, b) ROI (return on investment) :- it is a ratio between net profit and, cost of investment, c) RI (residual income) :- residual income is that income that, continues to receive after the completion of the income producing, work. Ex:- royalty, , Akkihal College of Commerce, , Page 26

Page 27 :

Cost management, 12. Men power planning, Estimating the no. of labour required to finish the project in a given, period of time., , 13. Capacity planning, There should be change in the level of capacity of the firm as per the, demand for the product. It is needed to meet the change in the demand, for its product., , Contemporary issues/Modern/strategic, Techniques of cost management, , 1., , ABC, , Activity-based costing (ABC) is a costing method that identifies activities in, an organization and assigns the cost of each activity to all products and, services according to the actual consumption by each Therefore this model, assigns, , more, , indirect costs (overhead), , into, , direct costs compared, , to, , conventional costing., 2., , Target costing, , Target costing is not just a method of costing, but rather a management, technique wherein prices are determined by market conditions, taking into, account several factors, such as homogeneous products, level of competition,, no/low switching costs for the end customer, etc. When these factors come into, the picture, management wants to control the costs, as they have little or no, control over the selling price., , Akkihal College of Commerce, , Page 27

Page 28 :

Cost management, 3., , Bench marking, , Benchmarks are reference points that you use to compare your performance, against the performance of others. These benchmarks can be comparing, processes, products or operations, and the comparisons can be against other, parts of the business, external companies (such as competitors) or industry, best practices. Benchmarking is commonly used to compare customer, satisfaction, costs and quality., , 4., , TQM, , Total quality management (TQM) is the continual process of detecting and, reducing or eliminating errors in manufacturing, streamlining supply chain, management, improving the customer experience, and ensuring that employees, are up to speed with training., , 5., , Kaizen, , Kaizen is a Japanese term meaning "change for the better" or "continuous, improvement." It is a Japanese business philosophy regarding the processes, that continuously improve operations and involve all employees. Kaizen sees, improvement in productivity as a gradual and methodical process., , 6., , Life cycle costing, , Life cycle costing, or whole-life costing, is the process of estimating how, much money you will spend on an asset over the course of its useful life., Whole-life costing covers an asset's costs from the time you purchase it to the, time you get rid of it. The cost to buy, use, and maintain a business asset adds, up., , Akkihal College of Commerce, , Page 28

Page 29 :

Cost management, 7., , Outsourcing, , Outsourcing is an agreement in which one company hires another company to, be responsible for a planned or existing activity that is or could be done, internally, and sometimes involves transferring employees and assets from, one firm to another., 8., , Kanban costing, , Kanban is a Japanese manufacturing regulation system which makes use of an, instruction manual to control the flow of work, usually the production line in a, business. It is also sometimes called as lean manufacturing system., 9., , Learning curve, , The learning curve shows that if a task is performed over and over then less, time will be required at each iteration. Learning curves are also known as, experience curve, cost curves, efficiency curves and productivity curves., 10. Value chain analysis, It is a process where a firm identifies its primary and support activities that, add value to its final product and then analyze these activities to reduce costs, or increase differentiation. Value chain represents the internal activities a firm, engages in when transforming inputs into outputs., 11. Balance score card, A balanced scorecard is a performance metric used to identify, improve, and, control a business's various functions and resulting outcomes. It was first, introduced in 1992 by David Norton and Robert Kaplan, who took previous, metric performance measures and adapted them to include nonfinancial, information. The Balanced Score Card is a tool used to evaluate the, effectiveness of Human Resource Management, , Akkihal College of Commerce, , Page 29

Page 30 :

Cost management, 12. JIT, The just-in-time (JIT) inventory system is a management strategy that aligns, raw-material orders from suppliers directly with production schedules., Companies employ this inventory strategy to increase efficiency and decrease, waste by receiving goods only as they need them for the production process,, which reduces inventory costs. This method requires producers to forecast, demand accurately., 13. Theory of constraint, The Theory of Constraints is a methodology for identifying the most important, limiting factor (i.e. constraint) that stands in the way of achieving a goal and, then systematically improving that constraint until it is no longer the limiting, factor., 14. Business process re-engineering, Business Process Reengineering involves the radical redesign of core business, processes to achieve dramatic improvements in productivity, cycle times and, quality. In Business Process Reengineering, companies start with a blank sheet, of paper and rethink existing processes to deliver more value to the customer., They typically adopt a new value system that places increased emphasis on, customer needs., , Akkihal College of Commerce, , Page 30