Page 1 :

M.Com Part I – MCQs – April 2021, Cost and Management Accounting (SEM 1), , UNIT 1, 1) A company makes and sells a single product. If the fixed cost incurred in making and selling the, product increase:, a. The breakeven point will increase, b. The breakeven point will decrease, c. The breakeven point will remain the same, d. Neither (a) nor (b) or (c), 2) Which of the statements about the profit -volume graph are true?, a. The profit lines passes through the origin, b. Other things being equal, the angle of the profit line becomes steeper when the selling price, increases, c. Contribution cannot be read directly from the chart, d. Fixed costs are shown as line parallel to the horizontal axis, 3) When comparing the profits reported under marginal and absorption costing during a period when, the level of stocks increased., a. Absorption costing profits will be higher and closing stock valuations lower than those under, costing, b. Marginal costing profits will be higher and closing stock valuations higher than those under, marginal costing, c. Marginal costing profits will be higher and closing stock valuations lower than those under, absorption costing, d. Marginal costing profits will be lower and closing stock valuations higher than those under, absorption costing., 4) Contribution margin is also known as, a. Gross profit, b. Net profit, c. Earning before tax, d. Marginal income, 5) Contribution is the difference between, a. Sales and variable cost, b. Sales and fixed cost, c. Sales and total cost, d. Factory cost and profit, 6) Period cost means, a. Variable cost, b. Fixed costs, c. Prime cost, d. Factory cost

Page 2 :

7) The valuation of stock in marginal costing as compared to absorption costing is, a. Higher, b. Lower, c. Same, d. None of the above, 8) In cost-volume-profit analysis, profit is determined by, a. Sales Revenue x P/V ratio – Fixed Cost, b. Sales Units X contribution per unit -fixed costs, c. Total contribution – Fixed cost, d. All the above, 9) Variable costs per unit, a. Goes on increasing with reduction, b. Goes on decreasing with production, c. Remains constant with change in production, d. None of these, 10) Variable cost are those which, a. Are directly apportioned to cost unit or cost centre, b. Varies directly with production, c. Depends upon the demand, d. Depends upon the sale, 11) In accounting, marginal cost per unit____________ with increase in production., a. Increases, b. Decreases, c. Remains constant, d. None of these, 12) Which is not a fixed cost?, a. Property tax, b. Power, c. Insurance premium, d. Rent, 13) Fixed cost per unit _______ with increase in production., a. Increases, b. Decreases, c. Remains constant, d. Can’t say, 14) Semi variable cost is segregated into fixed and variable costs with the help of, a. Scatter diagram, b. Method of least square, c. High and low points method, d. All the above, 15) Telephone charges is a, a. Fixed cost, b. Variable cost

Page 3 :

c. Semi-variable cost, d. Marginal cost, 16) The break even points in units is equal to, a. Fixed cost/PV ratio, b. Fixed cost x sales/total contribution, c. Fixed cost/contribution per unit, d. Fixed cost/total contribution, 17) At the break-even point, which equation will be true?, a. Variable cost – fixed cost = contribution, b. Fixed cost x sales /total contribution, c. Fixed cost/contribution per unit, d. Fixed cost/total contribution, 18) When fixed costs increases, the breakeven point, a. Increases, b. Decreases, c. No effect, d. Can’t say, 19) When variable costs decrease, then breakeven point, a. Increases, b. Decreases, c. No effect, d. Can’t say, 20) When selling price decreases, then breakeven point, a. Increases, b. Decreases, c. No effect, d. Can’t say, 21) When sale increases then breakeven point, a. Increases, b. Decreases, c. Remains constant, d. None of these, 22) Contribution is, a. Fixed cost + profit, b. Sales – Variable cost, c. Fixed cost – loss, d. All the above, 23) P/V ratio is, a. Profit / Volume, b. Contribution / Sales, c. Profit / Contribution, d. Profit / Sales

Page 4 :

24) Profit – volume ratio is improved by reducing, a. Variable cost, b. Fixed cost, c. Both of them, d. None of them, 25) The price reduction policy, ______ the P/ V ratio and ______ the breakeven point., a. Reduces, reduces, b. Reduces, increases, c. Increases, reduces, d. Increases, increases, 26) The sales volume in value required to earn the target profit, the formula is, a. Target profit/contribution per unit, b. (Fixed cost + Target Profit) P/V ratio, c. Fixed cost + Target profit/ Contribution on per unit, d. (Fixed cost + Target profit) / PV ratio, 27) Margin of safety is expressed as, a. Profit / P/V ratio, b. (Actual sales – sales at BEP) /Actual sales, c. Actual sales -Sales at BEP, d. All of the above, 28) The margin of safety point lies, a. To the left of breakeven point, b. To the light of breakeven point, c. On breakeven point, d. Can’t say, 29) A particular cost is classified as being ‘semi – variable’., if activity increases by 10% what will happen to the cost per unit?, a. Increase, b. Reduce but not in proportion to the change in activity, c. Reduce in proportion to the change in activity, d. Remain constant, 30) Which of the following describes the margin of safety?, a. Actual contribution margin achieved compared with that required to break-even, b. Actual sales compared with sales required to break-even, c. Actual versus budgeted net profit margin, d. Actual versus budgeted sales, 31) What distinguishes absorption costing from marginal costing?, a. Product costs include both prime cost and production overhead., b. Product costs include both production and non-production costs, c. Stock valuation includes a share of all production costs, d. Stock valuation includes a share of all costs, 32) A particular cost is classified as ‘semi-variable’, what effect would a 15% reduction in activity have on the unit cost?

Page 5 :

a., b., c., d., , Increase by less than 15%, Increase by 15%, Reduce by less than 15%, Remain constant, , 33) A Company sells more than it manufactures in a period., Which of the following is true in the above situation?, a. Absorption costing profit is higher because of the difference in inventory levels, b. Absorption costing profit is lower because of the difference in inventory levels, c. Absorption costing profit is higher because of overhead over-absorption, d. Absorption costing profit is lower because of overhead over-absorption, 34) What will be the effect on the margin of safety if unit variable costs and total fixed costs both, increase, assuming no change in selling price or sales volume?, a. Decrease, b. Increase, c. Stay the same, d. Impossible to determine without more information, 35) If inventory levels have increased during the period, the profit calculated using marginal costing, when compared with that calculated using absorption costing will be, a. Higher, b. Lower, c. Equal, d. Impossible to answer without further information, 36) Which ONE of the following statements is true?, a. The total variable cost varies with a measure of activity., b. A variable cost is an unavoidable cost., c. A variable cost is not relevant for decision-making., d. A variable cost becomes fixed in the long run., , UNIT 2, , ( Standard Costing ), , 1. The standard which can be attained under the most favorable conditions possible, a. Ideal Standard, b. Expected Standard, c. Current Standard, d. Normal Standard, 2. A standard which is established for use unaltered for an indefinite period is called, a. Ideal Standard, b. Expected Standard, c. Current Standard, d. Basic Standard, 3. Which of the following is not a type of standard, conceptually speaking?, a. Ideal Standards, b. Expected Standards

Page 6 :

c. Current Standards, d. Expected Standards, 4. Which of the following statements about ideal standards is false?, a. It is called theoretical or maximum efficiency standard, b. These are standard costs that are set for production under optimal condition, c. It makes no allowance for wastage, spoilage and machine breakdowns, d. It can be used for cash budgeting or product costing, 5. The cost of product as determined under standard cost system is, a. Fixed cost, b. Historical cost, c. Direct cost, d. Predetermined cost, 6. The amount of work achievable in an hour, at standard efficiency levels, is, a. An ideal standard, b. The direct labor usage per hour, c. A standard hour, d. The direct labor efficiency variance, 7. While computing variances from standard costs, the difference between the actual and the standard, prices multiplied by the actual quantity yields a, a. Yield variance, b. Volume variance, c. Mix variance, d. Price variance, 8. While evaluating deviations of cost from standard cost, the technique used is, a. Regression analysis, b. Variance analysis, c. Linear progression, d. Trend analysis, 9. Which of the following statements is/are true?, (i)The standard cost per unit of materials is used to calculate a materials price variance, (ii)The standard cost per unit of materials is used to calculate a materials usage variance, (iii)The standard cost per unit of materials cannot be determined until the end of the period, a. Only (i) above, b. Only (ii) above, c. Only (iii) above, d. Both (i) and (ii) above, 10. The labour cost variance may be expressed as, a. Budgeted labour cost – Actual labour cost, b. (Standard Wage rage x output achieved) – Actual wage cost, c. (Standard hours – Actual hours) X Actual wage rage, d. (Standard hours – Actual hours) X Standard wage rate, 11. The labour yield variance is, a. (standard production on standard hours – actual production) (average standard labour rate per, unit)

Page 7 :

b. (standard production on actual hours – actual production) (average standard labour rate per, unit), c. (standard hours of actual production – Revised standard hours) (standard labour rate per unit), d. Actual production on standard hours – Actual production) (Standard labour rate per unit), 12. When the variance is due to the difference between actual overhead and applied overhead it is called, a. Volume variance, b. Total overhead variance, c. Spending variance, d. Efficiency variance, 13. Volume variance arises due to the differences between, a. Standard overhead applied actual hours and overhead applied to production, b. Actual overhead and fixed budget overhead, c. Actual overhead and flexible budget based on actual hours, d. Budgeted allowance based on standard hours allowed and overhead applied to production, 14. Expenditure variances arise due to the difference between, a. Standard overhead applied actual hours and overhead applied to production, b. Actual overhead and fixed budget overhead, c. Actual overhead and flexible budget based on actual hours, d. Budgeted allowance based on standard hours allowed and overhead applied to production, 15. Efficiency variance arises due to the differences between, a. Standard overhead applied actual hours and overhead applied to production, b. Actual overhead and fixed budget overhead, c. Actual overhead and flexible budget based on actual hours, d. Budgeted allowance based on standard hours allowed and overhead applied to production, 16. Fixed overhead cost variance is the difference between, a. Actual fixed cost and Budgeted fixed cost, b. Actual fixed cost and Standard fixed cost, c. Actual fixed cost and Applied fixed cost, d. Budgeted fixed cost and Applied fixed cost, 17. The difference between budgeted fixed overhead costs and applied fixed overhead costs is known as, a. Fixed overhead costs variance, b. Fixed overhead expenditure variance, c. Fixed overhead volume variance, d. Fixed overhead efficiency variance, 18. Fixed overhead efficiency variance is equal to, a. Actual fixed overhead rate per hour x (actual hours – budgeted hours), b. Actual fixed overhead rate per hour x (Actual hours – Standard hours for actual production), c. Standard fixed overhead rate per hour x (actual hours – standard hours for standard, production), d. Standard fixed overhead rate per hour x (actual hours -standard hours for actual production), 19. Sales volume variance is the difference between, a. Actual quality sold at actual price and standard quantity at actual price, b. Actual quality sold at actual price and standard quantity at standard price

Page 8 :

c. Actual quality sold at standard price and standard quantity at standard price, d. Actual quality sold at standard price and standard quantity at actual price, 20. When a company produces more than one product, the sales volume variance can be divided into, a. Sales mix variance and sales price variance, b. Sales efficiency variance and sales price variance, c. Sales mix variance and production volume variance, d. Sales quantity variance and sales mix variance, 21. Which of the following is a purpose of standard costing?, a. To determine profit at different levels, b. To determine break even production level, c. To control costs, d. To allocate cost with more accuracy, 22. Which of the following best describes a basic standard?, a. A standard set at an ideal level, which makes no allowance for normal losses, waste and, machine downtime, b. A standard which assumes an efficient level of operation but which includes allowances for, factors such as normal loss, waste and machine downtime., c. A standard which is kept unchanged over a period of time, d. A standard which is based on current price levels., NUMERICAL MCQs ------ UNIT 2, 23. A ltd. Used 4,538 kgs of material at standard cost of Rs 2.50 per kg. the material usage variance was, Rs. 280 (Favourable). The standard usage of material for the period is, a. 4,700 kgs, b. 4,650 kgs, c. 4,600 kgs, d. 4,588 kgs, 24. R ltd. A manufacturer of portable radios, purchases the components from subcontractors and, assembles them into a complete radio. Each radio required three units each of part X which has, standard cost of Rs. 145 per unit., following is the result pertaining to part x for the month of December 2010:, Particulars, Units, Purchases (Rs. 18,00,000), 12,000, Consumed in manufacturing, 10,000, Radios manufactured, 03,000, The material usage variance for the month of December 2010 is, a. Rs. 1,45,000 unfavourable, b. Rs. 1,45,000 favourable, c. Rs. 4,35,000 unfavourable, d. Rs. 4,35,000 favourable, 25. X lt. has furnished the following data for the month of March 2010:, Particulars, Standard, Actual, Material cost per kg(Rs.), 70, 72, Material used (Kgs), 3,500, 3,420, The material price variance is

Page 9 :

a., b., c., d., , Rs 7,000 (Adverse), Rs 6,840 (Adverse), Rs 7,000 (Favourable), Rs 6,840 (Favourable), , 26. During the month of September 2010, 7,800 Kg. of material was purchased at a total cost of Rs., 16,380. The stocks of material increased by 440 kg. It is the company’s policy to value the stocks at, standard purchase price. If the material price variance was Rs 1,170(Adverse), the standard price per, kg. of material is, a. Rs. 1.95, b. Rs. 2.10, c. Rs. 2.23, d. Rs. 2.25, 27. The standard and the actual requirement of material of a company are as under:, Standard -2,400 units at the rate of Rs 20 per unit, Actual – 2,600 units at the rate of Rs 19 per unit, The material cost variance is, a. Rs 2,600 (Adverse), b. Rs. 1,400 (Favourable), c. Rs 2,400 (Adverse), d. Rs. 1,400 (Favourable), 28. Last month 27,000 direct labour hours were worked at an actual cost of Rs. 2,36,385 and the, standard direct labour hours of production were 29,880. The standard direct labour cost per hours, was Rs. 8.50, What was the labour efficiency variance?, a. Rs 17,595 Adverse, b. Rs. 17,595 Favourable, c. Rs 24,480 Adverse, d. Rs. 24,480 Favourable, 29. In the four-week production period just completed, B Ltd. Produced 570 units. The standard labour, cost for each unit was Rs 13.50, based on budgeted production of 550 units. The actual labour cost, for the period was Rs 8238., What was the labour efficiency variance?, a. Rs. 543 adverse, b. Rs. 543 favourable, c. Rs. 813 adverse, d. Rs. 813 favourable, , UNIT 3, , ( Budgetary Control ), , 1. Which of the following is / are true with regard to the period of budget?, (i) the budget period depends on the nature of industry, (ii)Master budge is prepared annually, while functional budgets may be for different periods., (iii) Basic budget is the long-term budge, a. Only (i) above, b. Only (ii) above, c. Both (i) and (ii) above, d. All (i) , (ii) and (iii) above

Page 10 :

2. Which of the following statements is / are true with regard to flexible budgeting?, a. It is a system of budgeting under which budgets are recast quickly for changes in the volume, of activity, b. It involves a careful differentiation between fixed and variable expenses, c. A flexible budget is one which changes from year to year, d. Both (a) and (b) above, , 3. The classification of fixed and variable cost has a special significance in the preparation of, a. Total cost, b. Cash budget, c. Capital budget, d. Zero-based budget, 4. When a flexible budget is used, then increase in the actual production level within a relevant range, would increase, a. Total cost, b. Variable cost, c. Fixed cost, d. Both (a) and (b) above, 5. When a flexible budget is used, a decrease in the actual production level within a relevant range, would, a. Decrease variable cost per unit, b. Decrease variable costs, c. Increase total fixed costs, d. Increase variable cost per unit, 6. If the activity level is reduced from 80% to 70%, the fixed cost, a. Will increase by 10%, b. Will decrease by 10%, c. Per unit will decrease, d. Per unit will increase, 7. Which of the following are purposes of a budget?, (i) Establishing strategic options, (ii)Motivating management, (iii)Establishing long term objectives, (iv)Planning operations, a. (i) and (iii) only, b. (i) and (iv) only, c. (ii) and (iv) only, d. (ii), (iii) and (iv) only, 8. Which of the information below should be contained in a budget manual, a. An organization chart, b. Timetable for budget preparation, c. A list of account codes, d. All (a), (b) and (c)

Page 11 :

9. A budget that gives a summary of all the functional budgets is known as, a. Capital budget, b. Flexible budget, c. Master budget, d. Fixed budget, 10. A master budget comprises, a. The budgeted profit and loss account, b. Budgeted cash flow, budgeted profit and loss, budgeted balance sheet, c. Budgeted cash flow, d. Entire sets of budgets prepared, 11. A master budget comprises the, a. Budgeted income statement and budgeted cash flow only, b. Budgeted income statement and budgeted balance sheet only, c. Budgeted income statement and budgeted capital expenditure only, d. Budgeted income statement, budgeted balance sheet and budged cash flow only, 12. Which of the following is normally the most appropriate sequence of events in the preparation of the, indicated budgets?, a. Sales budget, cash budget, budgeted balance sheet, production budget, b. Sales budget, cash budget, production budget, budgeted balance sheet, c. Sales budget, production budget, cash budget, budgeted balance sheet, d. Sales budget, production budget, budgeted balance sheet, cash budget, 13. When preparing production budget, the quantity to be produced equals:, a. Sales quantity + opening stock + closing stock, b. Sales quantity - opening stock + closing stock, c. Sales quantity - opening stock - closing stock, d. Sales quantity + opening stock - closing stock, 14. Which one of the following items would NOT be included in cash budget?, a. Capital repayments on loans, b. Depreciation charges, c. Dividend payment, d. Proceeds of sale of fixed assets, 15. Which of the following item should be included in a cash budget?, (i) loan repayments, (ii) depreciation charge, (iii) tax provision, (iv) wages paid, a. (i) and (ii), b. (i) and (iv), c. (ii) and (iii), d. (iii) and (iv), NUMERICAL MCQs ------ UNIT 3, 16. The company estimates its direct material requirements for the month of November 2014 to be Rs., 2,40, 000 and the direct labour to e Rs. 1,50,000. It is the policy of the company to absorb overheads, as under:

Page 12 :

Factory overheads, 60% of direct wages, Administrative overheads, 20% of works cost, Selling and distribution overheads 25% of works cost, It is estimated that the selling and distribution overheads will increase by 15% in November 2014., The company sells goods at a profit of 16.67% on sales., the budgeted sales for the month of November 2014 is, a. Rs. 9,21,600, b. Rs. 8,56,800, c. Rs. 9,09,900, d. Rs. 6,87,150, 17. A company is preparing a production budget for the next year. The following information is relevant:, Budgeted Sales 10,000 Units, Opening stock 600 units, Closing stock 5% of budgeted sales., The production process is such that 10% of the units produced are rejected., What is the number of units required to be produced to meet demand?, a. 8,900 units, b. 9,900 units, c. 10,900 units, d. 11,000 units, 18. PP ltd. Is preparing the production and material purchases budgets for on of their products the, SUPERX. For the forthcoming year., The following information is available:, Sales demand (Units), 30,000, Material usage per unit, 7 kgs, Estimated opening inventory, 3,500 units, Required closing inventory, 35% higher than opening inventory, How many units of the SUPERX will need to be produced?, a. 28,775, b. 30,000, c. 31,225, d. 38,225, 19. A company has the following budget for the next month:, Finished product, Materials, Sales – 7,000 units, Usages per unit – 3 kg, Production units – 7,200 units, Opening stock - 400 kg, Closing stock - 500 kg, What is the material purchases budget for the month ?, a. 20,900 kg, b. 21,100 kg, c. 21,500 kg, d. 21,700 kg, 20. ABC Ltd. Uses the following flexible budget formula for annual maintenance cost:, Total Cost = Rs 6,720 + Rs 0.64 per machine hour, The current month’s budget is based on 20,000 hours of planned machine time. The maintenance, cost included in this flexible budget for the current month is, a. Rs. 12,240, b. Rs. 12,800, c. Rs. 13,360, d. Rs. 13,600

Page 13 :

21. ABC Ltd. Has furnished the following information for 4,000 units of a product for the year 2014 2015, Particulars, Rs., Direct materials, 2,50,000, Direct labour, 2,00,000, Manufacturing overheads, 2,80,000 (40% fixed), Selling and administrative overheads, 2,70,000 (30% fixed), The total cost of 4,380 units is, a. Rs. 10,95,000, b. Rs. 10,42,500, c. Rs. 10,80,000, d. Rs. 10,76,665, 22. The budgeted cost of electricity is Rs. 62,500 for 5,000 units of production per month and Rs 71,500, for 6,200 units of production per month, If the company manufactures 6,900 units in the month of, May 2014, the budgeted amount of electricity for the month is, a. Rs. 74,360, b. Rs. 76,750, c. Rs. 77,770, d. Rs. 79,572, 23. ABC Ltd. Prepared the cash budget for the year 2014-2015 and provided the following information, pertaining to sales value:, Month, Rs., April 2014, 2,50,000, May 2014, 2,80,000, June 2014, 3,20,000, July 2014, 3,50,000, 20% of the monthly sales are expected to be on cash basis. 60% of the credit sales are expected to be, realized in the month following the month of sales and remaining 40% are expected to be realized in, the second month following the month of sale., The estimated cash receipts in the month of June 2014 are:, a. Rs. 3,32,000, b. Rs. 3,20,000, c. Rs. 3,00,000, d. Rs. 2,78,400, 24. The following details have been extracted from the debtor collection records of X Limited:, Invoices paid in the month after sale, 60%, Invoices paid in the second month after sale, 20%, Invoices paid in the third month after sale, 15%, Bad debts, 05%, Credit sales for June to August 2014 are budgeted as follows:, June, Rs. 1,00,000, July, Rs. 1,50,000, August, Rs. 1,30,000, Customers paying in the month after sales are entitled to deduct a 2% cash discount. Invoices are, issued on the last day of the month. The amount budgeted to be received in September 2014 from, credit sales is, a. Rs. 1,15,190, b. Rs. 1,16,750, c. Rs. 1,21,440, d. Rs. 1,23,000

Page 14 :

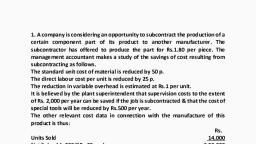

UNIT 4 (Operating Costing ), 1. Passenger transport, a. Per Passenger – Seat, b. Per Passenger -K.M, c. Per Passenger – Day, d. Per Passenger – Hour, 2. Goods transport, a. Per Ton – Day, b. Per Ton – Trip, c. Per Ton – Hour, d. Per Ton – K.M, 3. Electricity Undertaking, a. Per Kilowatt – Hour, b. Per Consumer - Hour, c. Per Consumer – Points, d. Per K.G / Cubic Ft., 4. Effective Kilometers, a. Run x Load, b. One way trip (Km) x Trips per day x Days operated, c. Carriage capacity x Usage rate, d. Takings x Distance of Trip, 5. _________ Costing is the method used to ascertain the cost of providing a service such as transport,, hotel, hospital, gas or electricity, a. Operation, b. Operating, c. Process, d. Job, 6. Operating Costing uses the methods of ________ costing when ascertain the cost of supply of, electricity, steam etc.,, a. Operation, b. Marginal, c. Process, d. Job, 7. Operating Costing uses methods of _______ Costing when costing a particular trip by a bus., a. Operation, b. Standard, c. Process, d. Job, 8. In case of passenger transport, Carriage capacity is in terms of __________, a. Seats, b. tonnes, c. KM, d. CC

Page 15 :

9. In case of goods transpot, Carriage capacity is in terms of ________, a. Seats, b. tonnes, c. axles, d. CC, 10. Which of the following would be classified as a fixed cost in the operation of a motor vehicle?, a. Oil change every 10000 kilometers, b. Petrol, c. Insurance, d. Tyre replacement, 11. Which of the following would be regarded as a variable cost in the annual operation of a motor, vehicle?, a. Hire purchase payments, b. Insurance, c. Petrol, d. Tyre replacement, , NUMERICAL MCQs ------ UNIT 4, 12. From the following particulars, calculate the cost-unit., Distance (KM), 10, No. of Trips to and fro, 05, No. of Days of operation in a month 25, No. of Vehicles – Total, 10, Capacity of each vehicle in tonnes 02, No. of Vehicles-laid up for repairs daily, 10%, Capacity of vehicle actually used, 80%, a. 2,000, b. 22,500, c. 18,000, d. 21,600, 13. From the following particulars, calculate the cost-unit., Distance (KM), 10, No. of Trips to and fro, 05, No. of Days of operation in a month 25, No. of Vehicles – Total, 05, Capacity of each vehicle in tonnes 06, No. of Vehicles-laid up for repairs daily, 10%, Capacity of vehicle actually used, 80%, a. 3,000, b. 33,750, c. 27,000, d. 32,400, 14. From the following particulars, calculate the cost-unit., Distance (KM), 10, No. of Trips to and fro, 05, No. of Days of operation in a month, 25

Page 16 :

No. of Vehicles – Total, Capacity of each vehicle in tonnes, No. of Vehicles-laid up for repairs daily, Capacity of vehicle actually used, a. 10,000, b. 1,12,500, c. 90,000, d. 1,08,000, , 20, 05, 10%, 80%, , 15. There are 100 rooms in the hotel 80% of the rooms are generally occupied in summer and 30% in, winter. The period of summer and winter may be considered to be of 6 months in each case. A month, may be assumed to be 30 days. Wages of the room attendant Rs 20 per day. There is a room, attendant for each room. He is paid wages when the room is occupied. Room attendant wages for, summer are, a. 2,88,000, b. 3,60,000, c. 1,08,000, d. 72,000, 16. There are 100 rooms in the hotel 80% of the rooms are generally occupied in summer and 30% in, winter. The period of summer and winter may be considered to be of 6 months in each case. A month, may be assumed to be 30 days. Wages of the room attendant Rs 20 per day. There is a room, attendant for each room. He is paid wages when the room is occupied. Room attendant wages for, winter are, a. 2,88,000, b. 3,60,000, c. 1,08,000, d. 72,000, 17. A hospital is having 25beds for 120days in the year, it had the full capacity of 25 patiets per day and, for another 80 days, it had on an average 20 beds only occupied per day. Year is taken as 360 days., The cost unit is, a. 9000 patient Days, b. 4600 patient Days, c. 200 patient Days, d. 45 patent Beds, 18. the cost unit of a transport business with a single vehicle is tonne/kilometer. Total costs were Rs, 4,558 in a week during which the following journeys were made:, Journey, 1, 2, 3, 4, 5, , Load (tonnes), 5, 7, 3, 5, 4, , What was the cost per tonne/kilometer in the week?, a., b., c., d., , Rs 0.44, Rs 2.15, Rs 10.60, Rs 57.57, , Distance (Kms), 80, 100, 40, 60, 150

Page 17 :

19. A hotel has 60 available rooms. Room occupancy was 80% during a 90 day period during which, total costs incurred were Rs. 1,04,976., what was the cost per occupied room per night in the period?, a. Rs 12.44, b. Rs 15.55, c. Rs 19.44, d. Rs 24.30