Page 1 :

on, , it) Inter frm comparison (Refer Pp. No, 3), iv) Requisites of uniform costing, , V) Scheme of Ratios for interfirm comparison, , 92 Objective Questions, L Match the following :, , , , , , , , , Uniform costing, , , , , , , , , , , , Mutual trust >) area covered by uniform Costing 2, 3. Costing period ¢) document to lay down costing: Plan, 4. Uniform cost ‘manual 4) benefit of uniform costing =, | 5. Healthy competition ©) two or more firms want to follow the same, | costing system }, | 6 Comparison of one business with | f) inter firm comparison ¢, another business, , , , , , , , Incentive to increase productiv )_objective of inter firm comparison ~, (1~e); 2~a); (3-b);, , 4-05 (Sd); 6-9, 07- 8), Proper word/s :, The objective, , of uniform costing is to maxi ;, ‘uniform costing removes Competition. Cut 4 very, is uniform costing, Mutualsetot, , lation about costing system,, ing helps to control ast, , objective of Inter firm ‘comparison is, [Ans. (1) Profit, (2) cut throat, (6) increase in Productivity], , ML. State wi, , , , , , , * ompetitior, ion, , Uniform cost manual cont, , tains detailed instructions, plans and, The object of inter firm, , comparison is to improve efficiency,, Inter firm comparison does not maximice Profitability., , Central organization is necessary to analyse the data, :, Inter firm comparison helps the firm to know the point of efficiency or ine, , Procedures to be followed,, , fficiency in relation to ot, The scheme of inter firm comparison cannot be imy, Uniform costing does not eliminate competition,, Uniform costing helps to control cost., (Ans, True : (1, 2,3, 5, 6,8, 9, 10, 12). False : (4,7, 1), TV, Multiple Choice Questions ;, \/ Uniform costing is a, , 8) system of costing, b) technique of costi, ©) method of costing, Uniform costing, @) does not remove cut throat, , : f CHSting, d) unit of 7, , Competition among the members, b) removes cutthroat competition mong the members, ©) does not provide reliable date, , NOOR of she above, , a, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , Uniform Costing & rte, Firm Comperiyo, 7 m, 3. The object, 2) pening, }) toreduce labour ne, 9) free labour bsenteeism, 4 The requisite °F uniform costing ig, a) mutual Telationship, by sm flict, ©) rival, 5 '¢ document Which shows inf,, formation ir, 2) union *PoUt costing sytem toe, 5), handbag. = "sl BY po, ©) “annual report, Uniform costing helps in ‘, ) installation f costing system ' :, 5) installation of macht «i £ the above, C) installation ofequomeng 2 une! of, Rk Usform Costing helps 0 control, a) manpower |, 8 ca 9) ober: taunnover, ©) finance, 8. Uniform Costing requires i, \ 4) mutual conflict 3) toutaai tively, b) mutual exchange. f information, ©) mutual unde ing roduct, \9 The objective of inter fing Comparison is to n ae, a) imerease productivity and efi 3) increase cast: of F, increase morale of employees, ©) increase loyalty of,, [Ans (1 ~a), (2- O-A-9465-9)6-93.0-0, 06-9, 6-4), 93 Practical Problems, 1} The shar of production and the cost based fr rice computed separately fora common produ for, each of the four companies in an industry ae as falling” pu), ¥ Ltd, Ltd., ‘Shar of roductan x | £ 38, Diet Material 20 2, iba 60 8, Overheads 8 as, Return on Capital 20% 2s mie, lair Price, = Capital Employed Per Unit Rpu), z z, 200, zs 600 30, Net Fixed Assets» 230, Working Capital _ ie | a | a, 1,000 units., Fx up the uniform price for the common product. Assume ouput for each, [Ans. % 251.5] e yuted separately for a common product for, a Ths Sof ratucon nd oad ue pie comp sep : _, ofthe four firms in the industry areas follows : aa | et ae | ta, Lad. _| ted 3 15, | il! se u4, — [sie, Materials, , , , DLY.BCAF. — Cost Ale (Paper ~Iit) (Sem —V)

Page 2 :

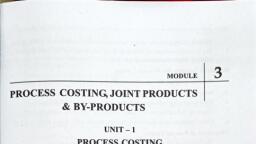

Cont Acoutng TXBEAE) ay,, , , , , , , , , , , , , , , , , , , , , , , , , , , , 170 ree, 11.2 Objective Questions 4s costing — Inter Process Prony, I. Match the following : ormal Loss is mn, i controllable wr, ¢) ascertainable New, b) Normal Loss Normal loss is calculated at a cert D None are ried, ©) Abnormal Loss a) Units introduced inthe procens PPE Of the Me AbOvE, ¢) direct materials conor, Normal loss is 9 dec ates, vi) A Method of Costing a) ee Process A/e 5, ) gn credited, (=i), e-) Normal loss arises under Nese’, II. Fill in the blanks with proper word/s : a) Normal circumstances, 1. Process costing isa__ of costing. ) Both (a) & (b) 8 Abwocnal, 2. Cement companies follow Normal wastage is classified as : ) None of the above, 3. Nommalloss is___to Process. a) Period oe ‘, 4. Normal loss is 5 0 ee cost 4 Product cost, $. Abnormal loss is To Process A/c. The type OF wastage tha should not affect the cost doing wee, 6. Loss due to improper handling of material is___- a) ead wastage oN Stock is, 7. Abnormal loss is valued at the rate applicable to the__- cc) Stan wastage - ales, Cost incurred — Scrap value ‘Abnormal loss is calculated by wastage, 8. Cost = irbut (Units) (units) a) Normal output ~ Actual output », e Al Input — Normal output ) Actual output - Normal output, 9. Balance on Abnormal loss A/c is transferred to__AVe. ¢ ® 3 ligt, ; in Ali Ab. .. Abnormal loss arises due to output, 10. Balance on Abnormal Gain A/qis transferred to A caleioonsiene, 7 11. Process costing is followed where___ goods are produced. 3 pon cn b) Abnormal circumstances, 73 8 12. Normal loss is a Al. : ; ; ST nccnal cs = valiod 4) None of the above, 13, Normal loss is calculated at a certain % of the in____ introduced in the process, Yo con scoupat ;, 14, Abnormal loss is ) Marginal cost 5 fneeleee, 15. is the wastage realisable | Abnormal loss is not allowed to a, a) Affect cost of output b) Affect i, Affect market price ; Neat rae, , , , Ill. State whether the following statements are True or False :, , i, 2, &, , 4., a, 6., a, 8., 9, , , , , , , , , , , , , , , , , , , , , , , , , [Aus. (1) Method, (2) Process costing, (3) Created, (4) Non-controllable, (5) Credi, loss, (7) Output, (8) Normal loss, (9) Costing P & L A/c, (10) Costing P & L Ale, (11), (12) Nominal A/c, (13) Input, units, (14) Controllable, (15) Scrap], , Process costing is a method where cost of a product is ascertained at each stage in production,, , Cement companies follow process costing., No, Separate A/c is maintained for each process., In process costing the product is manufactured as per customer's orders., Normal loss A/c is debited to process A/c., Abnormal loss is non controllable., Normal loss is controllable., Abnormal gain is valued at the cost of output., Abnormal loss is valued at the scrap value., Abnormal gain is excess of Normal output over actual output., Balance on Abnormal Loss A/c is transferred to,costing Profit & Loss A/c., Balance on Abnormal Gain A/c is transferred to financial Profit & Loss A/c., , [Ans. True: (1,2, 8,11). False : (3, 4, 5, 6, 7, 9, 10, 12)], , Multiple Choice Questions :, , Process costing should be used when, , a) Product is standardized,, , b) Product is made to order, , ©) Product of different categories is manufactured, d) None of the above, , In process costing, cost of a product is decided by, a) Average method periodically b) On completion of the job, ) On operation of services 4) None of the above, , Abnormal loss is valued by, , ¢), , Cost Incurred ~ Scrap Value Céad, ) Input », Cost Incurred ~ SP Set, 4) None of the above, , 9 Input — Normal Loss, After adjustment of scrap value, balance on abnormal loss A/c is transferred to, b) Costing P& L Ale, , a) Balance sheet, ©) Process A/e 4) None of the above, 18. Abnormal gain arises when, b) Actual oss is more than expected loss, , a) Actual loss is less than expected loss, , ©) Actual loss is equal to expected loss) None of the above, , . Abnormal gain arises due to, a) Increase in efficiency b) Increase in loss, ©) Increase in cost 4) None of the above, Abnormal gain is valued at, a) Cost of input b) Cost of output, ©) Standard cost d) Market value, Abnormal gain is, a) Debited 19 process Alc b) Credited to process Ale, ©) Debited to P & L Ale 4) None of the wo ;, , ). Balance on abnormal gain A/c after adjustments few sas et eit, > reaeae a Noncaflte sive, , Y.B.C.AR. ~Cost Ale (Paper ~ Ill) (Sem. -V)

Page 3 :

,, , , , i, i, , , , , , 224 rrr Cost Accounting (T.¥.B.C.4.F) (Sem a jauivatert Ur wow, ‘ in frcdieedrdittiwa yet, Ill. State whether the following statements are True or False : 2, Be 8! unis 4600 competed ngs P85 of np is noma os. Closing WIP 60%,, 1. Equivalent units are units equal to input. 00m ig 1,000 ‘ransformed to next process. Equivalent production, 2. Work in Process is raw material in the processing stage. Keath eriod iS, 3. Equivalent units are calculated on the basis of degree of completion of the elements of jo wits >) 5,400 units, 4. Equivalent units are calculated by production x stage of completion. ost, ae) go wits 4) 7,200 units, 3. The physical flow shows from where the units have come and where did the units go, 1 TAN), 2-0) BB 4-8), 5-9), (6-0), 07 -2, (8-0), 09-4), 6. The treatment of normal loss depends on the stage at which the normal loss is occurrog ca, 7. While calculating equivalent units normal loss units must be considered. : ! problems, 8. Cost of normal loss is charged to units. proctiost kein-progress : 2,000 units,, 9. — Cost of opening WIP is added to cost incurred to get Weighted Average. erin aoeto : Materials 80%. Labour 60%, Overhead 60%,, 10. As per FIFO method, the work on opening stock is completed fist before processing e oe, introduced during the period. 5 nfo, [Aus Troe :(2,3,5,6 5,5) 10) False:(1,417)1 oie gf conmpletion + Merial 00% Taowr GO Oveticad Gn., neers 300, Multiple Choice Questions: , closin§ equivalent production assuming that thee is no process loss., 1. Equivalent units are Find equivalent ‘Units : Materials 7,800; Labour & Overhead 7,600 each}, a) Notional quantity of completed units fags ee -in-progress at commencement but with process loss) 3), b) Equal units te aera its were introduced rng one moth, The norma loss was exiated t 5% of, ©) Units equal to input in Prose ead ofthe month, 460 nis were incomplete., d)_ None of the above iA are reompletion is as follows :, 2. Work in process is Te state complete. Labour 50% complete. Overhead 50% complete., a) Raw material completely processed Material al production., Y) - Ravemnaiecial ne progpeoing tee Cale aie at Units: Materials 1,785; Labour and Overhead 1,670 each}, ©) Work being carried out (Ams: Eo a ewwork-in-progress, but no process 1058) i., d) None of the above m there is opening ‘on, compute using the FIFO Method, the equivalent units, 3. Equivalent units are calculated on the basis of From the following a, a) Degree of completion in terms of elements of cost rocess A : January 2018. . its 40% complete., peat Stock Gnctinmee Ree, , b) Degree of completion in terms of materials, ©) Degree of completion in terms of wages, 4) None of the above, , inits of Production, 225, , , , , , , , , , , , Units brought into process ., “Transferred to Proves B 40,000 compe vem comet, Closing Stock (work-in-progress): and Overhead 51,000 units each], , 4. Equivalent units are calculated by he, a) Actual no: of units x stage of completion ‘Ans. Equivalent Units : Materials, Labour . E b) Production x stage of completion 0 a loss) sialent units of production to determine tbe per unit processing, c) Input x stage of completion From the following data, find out hacer of March, 2018 =, 4) None of the above , cost, which was i aot = 5,000 units, Inventory is 2000 units Degree of completion: Opening ‘Work-in-Progress 16,000 units, , how material Hl om Fresh units started ae =., abour i nit, 2 Finished goods completed) 8, ‘ ip! 2, The eo units will be: TL Ct Ee oie. seed during the month of March, 2018 without any, : No loss was permis 3 was compl, a) RM 200 units, labour 1,600 units & overheads 1,400 units. Tatie stock of opening workin PrOBTSS, » ey ‘material 2,000 units, labour 400 units, overheads 400 units loss/rejection. ries, © units 00) into Process, Ans. 16,81 introduced into Pr, d) None of the above (vo eli workin progres EM a cost of & S000 wee SE. 400 unis were produced, Equivalent production of 1,000 units, 60% complete in all respects is 5. During a particular period, °F mated at S% oF the Sea and 140 units, a) 1,000 units b) 1,600 units beginning). The normal 1OSS TF 460 units being ‘state of production :, c) 600 units 4) 1,060 units ; and transfer nis reached the folowing = $0 complete., Equivalent production of 1,500 units of opening WIP 40% completed in all respects during the curet ‘The partially complet + 50% complete., period and transferred to next process is Materials: 100% com the process WETS 700., a) 900 units b) 1,500 units ditional costs in Labour : © 33,400. Overheads : & 165!, c) 600 units 4) 2,100 units sae wir ts terial : & 174 Sia al Loss ® 2,800], In a process opening WIP (60% complete) units introduced during current period and closing sald [Ans. WIP 25,, complete) were 1,000 units, 8,000 units and 2,000 units respectively. Assume FIFO method. Eau, production during the period was :, a) 11,000 units b) 7,800 units, ©) 7,700 units d) 6,600 units

Page 4 :

eS, , ive Questions, 12 Mai ae following :, L, , B', Group 'A' "ll Ee ee |, , , , 1. F{7~ Hotel costing a) Per tonne kin,, . Transport company b) Per 1000 litres, 3, Water works i ; c) Per Cylinder, 4. Gas companies i . |d) Perman show, 5, Cinema House : e) Per cup of tea, , , , (ans (1-6); 2-8: G-b 4-0; 6-D], , , , Group 'A' Group 'B, Road Tax a) Running Cost, Petrol b) _ statutory cost, Rent of premises c) Maintenance cost, Repairs d) Standby costing, Driver's Salaries e) _ Standby cost, [Ans. (1 —e); (2 —a); (3 —b); (4—c); 6 -d)], , , , , , , , , , ere, , Fill in the blanks with proper word/s :, Operating costing is also known as costing., Cost of service is decided by cost, , Unit of cost for hospital is, , Unit of cost for Goods Transport is, Unit of cost for passenger transport is, Unit of cost for hotels is per, , Unit of cost for water works is, , Rent of premises is cost., Cost of petrol is cost., , 10. Replacement of tyres is cost., 11. Unit of cost for tourist Co., , 12. Unit of cost for cinema House is, , [Ans. (1) Service, (2) sheet, (3) per bed, (4) per ton. Km., (5) per passenger km., (6) per cup of tea,, (7) per 1000 litres, (8) fixed, (9) variable, (10) maintenance, (11) per passenger km., (12) per man show], , , , peravayeyoB

Page 5 :

Pas gw ew dS Per Visitor., , 11. Unit of cost for hotel is Per visitor., , 12. Trading comp;, (Ans. True : (, , Iv. Multiple Choice Questions ;, 1. - Classification of cos, , a) Process Costing, ©) operating Costing, , , , anies can follow operating costing, 1, 5,7, 8,9, 11, 12), False > (2,3, 4, 6, 10)}, , st as fixed and variable is of special importance in, , b) unit Costing, , 4) none of the above, 2. Operating costing is applicable to, a) Transport companies b) electricity companies, ©) cinemas 4) hospitals e), 3. Cost of service ig ascertained by preparing, a) cost sheet 5) production A/c, ©) process A/e 4) Job cost sheet, 4. The unit of cost for hospitals is, a) per bed b) per ton, 2) perkm 4) per unit, 5. The unit of cost for Goods transport companies is, a) per unit b), Per Ton km, ¢) Per passenger km qd) perton, 6 The unit of cost for tourist companies is, a) per ton b), Per tour, ©) _ per passenger km, 4) none of these, 7. The unit of cost for hotels is, 8) per visitor, b), ©) perkn, ‘a, & The Unit of cost for water works ig °, a) per litre, >) perkg, ©) er 1,000 litres these, c @, 9. Unit of cost for gas companies map nee, a) per tin is, b), 3 i : a, 10. Garage Rent is, a) Fixed cost ariab], b), ©) semi-variable cost tle cos, , 1. Cost of petrol is, , a) Fixed cost, , ©) semi variable cost, 12) Ovehauling is classified as, , d) None Of these, , b) Tunning cost, , 4) None of; these, , ; fixed cost b) Semi-fixed cost, ©) maintenance cost 4) marginal cost, 13. The object of hotel Costing is to find out cost, a) per visitor b) per Toom, ©) perbed @) per table, 14. The sheet which shows the d, , a) daily log sheet, , >) cost sheet, 1s, 2. Statement of Ave 4) none of these, - Mumbai Municipal ration es for removal of e by i, following vehicles are maintaseg ee a “ewlcle tang, No of vehicles Specifications, , 20 5 tonnes, 2 4 tonnes, , ‘0 3 tonnes, 40, , 2 tonnes, , lctails of each Journey is a, , , , , , 129, - ating Costing, rrr f its, perat 7 ies 60% of, an average each long make 6 trips g day and covers a distance S kant Bach locry Carl Oe rhs, oeacity. On a average 20% of the lorries are laid apie ie work is carried out daily., km will be, tonne, a) 194400 yy 194,000) 1,00,000 4) 1,25,000 th., __ Petrol consumption is 12 kms per Ute of petrol costing & 30 per ine, Ata. rand A000 ae pe moe, , 16: rhe cost of petrol is, FT e400) % 10,000 ) 3,000 4) <'2.10,400, , 3 ., A transport service companies runing two buy between two tons which are 150 km “All thertarses, , apacity of each bus is 40 Passengers, Actual Passengers carried were 75% of capacity. ‘ams for the, ta for 30 days during the ‘month. Each bus made one round ‘ip per day the no of passenger, , 5, ) 4,60,000 F, A transport company supplies details about a trick of 10 ton capacity no of days 25 operated distance, 200 kms each way The number of Ton kms for the month is 0,000, 40,000 b) 50,000 °) 45,000 d) 30, 11-0), (12-9,, 9 (16), 2—€), 3 ~a), (4~a), (5b, (6-0), (7~b), (8-0), (9b), (10-2), ( », ei ~ 9) 14a) 15 ~8), (16-0), (17-1), (18 by}, , 1.3. Practical Probleme, ransport Costing), , a) Cost of trucks —% 1,60,000, b) Estimated useful life ~ 5 years,, c) Resale value after 5 years — 60,000, ., d) Salary to drivers and cleaners —2 1,000 per truck per month., d insurance ~ 2,500 per truck per year. seats heen an, 5 Toul cexrkovinies as maintenance and repairs through owned workshop for all truc, ear., sy Tors ana sabes dad accessories ~¥ 7,200 per truck per year., h) Diesel, oil ete -& 40 per 100 a n, late the cost of operating the trucl per ton-km., [Ana 0s 10 per ton-kn. approximately. Total ton-kms. per month 0 ata de,, ak chemical factory rns its boiler on fernace ol ob ed fom Indian 2 ed Bhar eoleu ih :, i i f 12 and & kms. from the factory site. Transpo shige, depots are situated at a distance of I diy cael Ouind toe or : :, ‘ lorries of 5 tons capacity ps se mad only om Bl, made by the company's own tank a an! See Outre ps rem, : ee nein Biss factory i nutes for all. From, load and the lorries return empty. The me kes en San bene, i Petroleum. But the emptying tim n eis out 4224 kins. gor, to recotas ara er is seen that the average speed of the company’ lois works ; ese, mene varying operating charges average 60 paise per kin’ cov. harges, our. ;, incidence of 27.50 per hour olen oe, Calculation the cost per ton-km. for ead a, es 8 paise ', Cer eee 2 Last a soe me a ae car on a 20 kms. long route fo the Chins, Bena ns Bee promised a boo sting € 1,50,000. The annual cost of insuranc, : ae pions mate garage where he keeps the, Executive of a multi-national firm. | 2500 bee tavath fee ‘, eer is estimated to have a, Cee oe at 900 reopens ir costs are estimated at % 4,000. The car is mad to have, a lea peeled luc is likely to be % 50,000. He hires a driver, : f which the scrap value ef incidcual Coens Ce, be maid enn je plus 10% of the takings as commission. Other inci, sin trips ssuming a profit,, Perel oe net ill make 4 round trips each day. Assuming,, i \s. The car will m: ab, ee on ust els car will be on the road for 25 days on an average per month,, of 15% on takings is h, what should be charge per round-trip?, (Ans. % 88.22 per round trip]