Page 1 :

BY: SUMIT SINGLA , 9467652599, , TEST 2, Q1. Explain different methods of cost accounting. Explain the steps of installing cost accounting., Q2. . A manufacturing company uses material of Rs. 100000 per year. The administration cost per, purchase is 100 and the carrying cost is 20% of the average inventory. The company cuurently has an, optimum purchasing policy but has been offered a 0.4% discount if it purchase five times per year., Should the offer be accepted. (Ans 102000, After discount 102092), Q3. The purchase price of material Y is 400 per kg. the carrying cost of material in store comes out to, be 10% of purchasing price per annum and the ordering cost per order is 400. If the sum of total, ordering cost and carrying cost of the year is 4000. Determine:, 1., Economic order size (100 kg), 2., Total annual demand of material (500 kg), 3., Annual total cost of material consumed. (204000), Q4. (a) The standard time for a job is 60 hours. The hourly rate of guaranteed wages is .75 per hour., Because of the saving in time, a worker ‘A’ get an hourly wages of rs. .90 under the rowan premium, plan. For the same saving in time, calculate the hourly rate of wages a workers ‘B’ will get under, Halsey premium plan. Assuring premium is 40% to worker., (b) find out the earning of the worker in the basis of the worker on the basis of merriks differential, piece rate system from the following information, Piece rate 0.10 per unit, Output, X, 90 units, Y, 100 units, Z, 130 units, Standard production 120 units, Ans Actual time 48 hours., Wages under merrick X 9.00, Y 11, Z 15.6, Q5. What are the objects of Inventory/ material control. What are methods and techniques of, inventory or material control., Q6. A company manufacture two type of pens namely Hero& Raja “. Following are the details of cost, for the year ended as on 31st march, 2009., Direct material, 130000, Direct labour, 110000, Production overhead, 75000, Following additional information is given:, 1.The direct materials in Raja pen was 40% of that in Hero pen., 2. The direct labour cost in hero pen was twice as much as that in Raja pen., 3. Production overhead was in the ratio of 5:3., 4. Administration overhead for each type of pen was 100% of direct labour cost., 5. Selling and Distribution overhead was rs. 1 per pen., Following was the production & sale of pen during the year., , page no.1, .

Page 2 :

BY: SUMIT SINGLA , 9467652599, , Production in units, sale in units, sale price per unit, Hero pen, 20000, 18000, 22, Raja pen, 15000, 14000, 14, Prepare a statement Showing the cost detail. Profit on Hero pen 101812.5 & Raja pen 71750., Q7. The pen manufacturing company is producing Two types of Pens- Delux and Popular.the, manufacturing costs for the year ended 31st march 2013., Direct materials, 200000, Direct wages, 112000, Production overhead, 48000, It is ascertained that, 1. direct material in deluxe type cost twice as much as that of popular type., 2. direct wages of popular type were 60% of those for deluxe type., 3. production overhead was 30 paise per pen for both types., 4. administration overhead for each type was 200% of direct labour., 5. selling cost was .25 paise per pen for both the types., 6. production during the year was:, Deluxe type – 40000 pens of which 36000 were sold., Popular type – 120000 pens of which 100000 were sold., 7. selling prices were 7 per pen of deluxe type and 5 per pen of popular type., Q8. The summary of statement of profit and loss of ravi metals for the year ended 31st march 2015., Revenue from operation(sale unit 3000), 300000, Other income, 1900, Total revenue, , 301900, , Cost of material, Change in inventory, Other expenses, Employee benefit expenses, , 137000, (14000), 75500, 87120, , Total expenses, , 285620, , profit, Notes of accounts, Closing inventories(100Units), Work in progress:Wages, 1800, Factory ex, 1000, Material, 3200, , 16280, 8000, , page no.2, .

Page 3 :

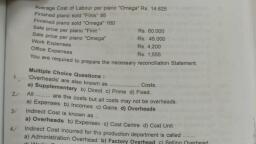

BY: SUMIT SINGLA , 9467652599, , Other expenses:-Work ex, 41500, Adminsitation expens, 19120, Selling expenses, 22500, Preliminary ex, 4000, The company manufactures a standard product. In cost account:, 1. The factory expenses have been 20% of prime cost., 2. Administrative expenses at 6 per unit, 3. Selling expesnses at 8 per unit sold., 4. Prepare reconciliation statement (cost profit17032), Q9. A contract account is debited with the cost of material labour, overhead and plant at the end of the, year and is credited with material at site 10000. Plant at site 40000 after charging deprecation @20%., Net cost of the contract is 150000 which is debited in contract a/c in the proportion of 3:2:1 for, material , labour, and overheads respectively. Contract price is 250000 and architect has certified 4/5, of the work as completed 15 days before end of the year. 80% of the certification has been received in, cash. The accountant informs you that 2/3 of the profit on the basis of cash has been creditied and, transferred to profit and loss account which is 40000. From the given information prepare contract, account showing the cost of work done but not yet certified. (Ans= Notional profit =75000, ), Q10. In an oil refinery the product passes through three different process. The following information, is available for the month of January 2010., Cursing, Refining, Finishing, Raw material (500 ton of copra), 225000, -Wages, 8000, 5900, 5875, Power, 1200, 1000, 1500, Sundry material, 500, 1900, -----Factory expenses, 600, 1000, 950, Cost of drums for storing finished oil was 21025. 200 tone of cake were sold for 15000 and, 275 ton of crude oil were obtained. Sundry by product of the crushing process fetched 900. By, product after refining the oil was sold for 900 (20 ton) and 250 ton of refined oil were obtained. 240, ton of finished oil were stored in drums and 10 ton were sold for 1200., The establishment expenses for the period amounted to 3500 which are to be charged to the, three processes in proportion of 3:2:2. Prepare the process accounts., Q11. What is transport operating costing. Discuss the accounting procedure to determine the cost of, transport service., , page no.3, .