Page 1 :

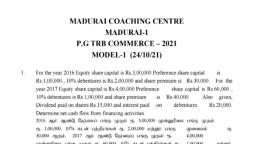

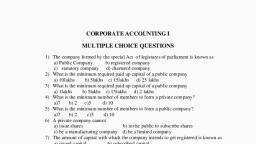

Liquidation, Introduction:, , of, , a, , Company, , artificial person created by law. Its lormation, working and dissolution are governed, , artiti, an, , companyIS, ynies, , Act. Liquidation, Act, , is the legal procedure by which the company is dissolved. When, , companies, , A, , solved or liquidated a person called liquidator is appointed. He realise al the assets, , the, , by, a compa, , pany, , t h ec o m p a, , collects calls in arrears, calls up uncalled capital, if necessary, and makes payment, and distributes the remaining balance among the sharcholders., due, orde, , n, liabilities, , iauidation: The liquidation is of two types, namely :, , of, Tipes, of, , (, , lation: (11) Compulsory, , Toh, , Liquidation., , wLiquidation: Any joint stock company may have a voluntary liquidation:, esolution if the duration of the company as fixed expires or on happening of, , untary, , by ordinary resc, (a) the event,, , or, , necial resolution to liquidate the company, voluntarily at any time., afor's Appointment : In case the company is solvent its members may resolve to wind it, Liquidator's, , 20D0int a liquidator and fix his remuneration, duties and powers in general meeting. In, mpany is insolvent its creditors may resolve to wind it up and a liquidator is appointed by, ditors in a general meeting. Soon after the appointment the liquidator takes the charge of the, , u pa n dm a y, , up a, , caset, , the credh, , sells its assets, pays the liabilities in the order of priority and adjusts the rights of, , company and s, , OITLtories. When the afftairs of the company are fully wound up he prepares a statement called, codators, Final Statement of Account and places it before the final meeting of members as, Ziquida., , well as, , creditors as the case may, , Liquidation, , under, , be., , Supervision of Gourt., , Some times voluntary liquidation may also be carried on under the supervision of the court in order, , to Safe-guard the interest of the creditors and contributories or members of the Company., , Compulsory Liquidation: According to section 433 ofthe Companies Act the compulsory, iquidation by the court akes place under the following circumstances., , (a) If the company passes a special resolution that it is to be wound up by the court, or., (b) Ifit commits a default in filling the Statutory Report with the Registrar or fails to hold the, statutory Meeting, or., , () If the company fails to commence business within one year from the date of its incorpora, tion or if it suspends its bus1ness for one year, or, , d) If the number of members falls below seven in the case of a public company and below two, in the case of a private company, or, , (e) lf the company is unable to pay its debts, or, , () Ifit is just and equitable in the opinion of court to do so., , . In case of compulsory liquidation, a statement of affairs of the company has to be prepared in the, , prescribed form and it should be submitted to the official liquidator within 21 days., ne procedure of compulsory liquidation& preparation of statement of affairs is not covered in, topic. This topic concentrates only on Voluntary Liquidation., , this, , Liquidation of a Company /55

Page 2 :

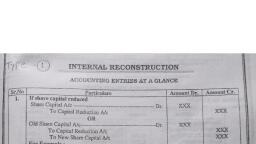

Liquidators's, , Final Statement Account, , After the decision on liquidation of company is made the liquidator is appointed and com., , are taken out from the hands of the directors and placed in the hands of liquidator Tny af, lises the assets, collects calls in arrears (if any), calls up uncalled share capital (if necquid, makes payment of the liabilities of the company in the order of prionty and tinally distrih, , es, gas to main, , remaining balance among the shareholders. In doing all thesetransaction the liquidator hastoS, , the cash account to record all the reccipts and payments. Finally when the affairs of the ., are fully wound up he has to prepare and prescnt to the company a summary of cash, maintained by him in the course, of winding up. This summary statement is called Liqi, Final Statement of Account., , aCCou, , iquidator, , Order of payments:The liquidator has to make the payments strictly in the following order, Secured Creditors to the extent of realisation of securities held., , (2) Legal charges., (3) Liquidator's Remuneration., (4), , Liquidation expenses., , (5) Preferential Creditors., (6) Debentureholder (having, floating charge, , (7) Unsecured Creditors., (8) Preference Shareholders., (9) Equity Shareholders., Proforma of, he, , I., , Liquidator's, , on, , assets), , Final Statement, , of, liquidator's final statement of account has toAccount:, be prepared, , Voluntary Winding Up Liquidatiors, , Receipts, , Liquidator's, , Final Statement, , in the, , Marketable Securities, Bills Receivable, Trade Debtors, , Loans & Advances, Stock in trade, Work in Progress, Free hold property, , Lease hold Property, Plant& Machinery, , Furniture, Fitting, Patents, Trade Marks, Investment, Surplus from Securities, Call in Arrears, Unpaid calls at the commencement, , torm:, , of Account (Elaborate), , Proforma, Final Statement of Account, , Assets, Cash in Hand, Cash at Bank, , following, , on, , ValuePayments, , Winding, , up, , Payment, , Realisable, , Legal Charges, , XX, , XXX, , Liquidatiors Remuneration, , XX, , % on Rs. realised, % on Rs. distributed, , XX, XX, , XX, XX, , Auctioneer's Charges, , XX, , Cost of Notice, , XXX, , XX, , Cost of Outlay, , XX, , XX, , Establishment and other charges, , XX, , Total Cost &, , Charges, Debenture Holders, (having floating charge;, including, , XX, , XX, XX, , interest, , XX, , Payment, , XX, , of winding up, , Calls Received, , (Amounts received from calls on, contriburories made in winding up, , on, , XXX, XXX, , debenture upto the, , date of payment), , XX, , XX, , XX, , XXXX, , XXX, , Debentue, , Returns to Contributories, (a) Pref. Shareholders, , (b) Equity Shareholders, Deferred Shareholders if any, , (c), XXX, , of Rs.. per, , Creditors, (a) Preferential ++, (b) Unsecured ++, , XXX, XXX, XXX, , XXX, XXX, XXX, , XXXX, , 56/ Corporate Accounting, , XXXX

Page 3 :

Important Notes, , Impferential, 1., , 1 ., , Creditors are given priority over, nanies Act. However, for the sake of debenture holder, , * P r e f e r e n t i a l, , in the, , legal, , form, , given, , in the, , uniformity between the legal form and, roforma statement, they have been maintaining, next to debenture holders, placed, presuming that, debentures hold the floating charges of the assets., arolus from securities =(Securities Realised Secured Creditors), referential creditors need not be shown separately if all creditors have been paid in full., , Liquidator's, , Final, , hand/Cash at, , Bank, , To Assets realised, , To, , Surplus, , arrear, , (In Brief), , Rs., , By Liquidator's Remuneration:, , from securities, , offered, , fully secured creditors., , To Calls in, To Calls on, , of Account, , Rs. Payments, By Legal Expenses, , Receipts, , in, To Cash, , Statement, , to, , By Liquidation Expenses, By Preferential Creditors, , recovered, , By Debentureholders, , partly paid shares, , (with out floating charges), , Add Interest outstanding., By Unsecured Creditors, By Preference Shareholders, , (capital, , &, , arrears, , of dividend), , By Equity Shareholders, , Note: Ifdebentures have a, , floating charge, they should be paid with interest, , in priority over preferential, , creditors., , Important Points, , be noted in the liquidation proceedings., the charge on assets of the company against, are the creditors holding, Creditors, They, :, 1. Secured, secured creditors., There are two types of, the, company., to, them, the credit given by, Secured Creditors., Creditors & (b) Partly, Secured, than, (a) Fully, creditors as security is more, asset held by the, value, the, the, of, If, Creditors:, ifa loan of, , Following important points should, , (a) Fully Secured, , secured creditors., , E.g.,, , called fully, then the creditors are, to Rs.1,12,000, the amount of credit given,, the security of machinery amounting, against, the machinery is, Rs. 1,05,000 is raised by the company, course of liquidation, creditor. During the, i.e., fully-secured, deductingloan amount, the loan is referred to as, the machinery after, form, realise, creditors and surplus, liquidator is asked to, realised by the loan, the, liquidator., to, If, is handed o v e r, amount and keep the, out of such realised, Rs.7,000 ( R s . 1 , 1 2 , 0 0 0 - 1 , 0 5 , 0 0 0 ), creditors, the loan, of the statement as, so and pay, the receipt side, on, n e machinery he may do, shown, alone is, c a s e s such surplus, Surplus. In both the, is more, creditors"., the creditors as security, "surplus form secured, held, asset, Ifthe value of the then, , by, , secured, creditors are called partly, the, Secured, Party, as security, the company,, credit given to, value of the assets given, the, and, nan the a m o u n t of, to Rs.10,000, the creditors of Rs., creditors. Out of, creditors amount, secured, the, Creditors E.g., if, called partly, assets and, sales proceeds, creditors are, of the, such, then, and, will be paid, unsecured creditors, S RS. 6,000, to Rs. 6,000, treated as, amounting, be, will, creditors, Rs.4,000), creditors (i.e., ,000 the, unsatisfied, of, statement., Dalance a m o u n t, creditors in the, unsecured, added to the rest, /57, Liquidation of a Company, Creditors, , offout, , of

Page 4 :

iasidator's remuneration: The hquidator is generally entitled to a remuneration by way of, commission based as a percentage on asscts realised and amount distributed to unsecured creditors, ar shareholders or both. Some times a fixcd amount is payable as remuneration with or without, such, , con7mission., , alif the remuneration is payalble at a fixcd percentage on assets realised, the cash and bank, halance on the date of liquidation and calls in arrears or fresh calls collected should not be taken, , intoaccount for calculation of remuneration unless otherwise stated. Sccondly, the assets given, assccurity to secured ereditors should be considered in full if they are realised by the liquidator, onl the surplus from such securities should be considered if they are realised by the, secured creditors., , (b) ifthe remuneration to liquidator is payable at a fixed percentage on the amount distributed t, , nsecured creditors or to shareholders. There is no difficulty in calculation if the amount avai, able is sufficient to pay them in full. But if the amount available is insufficient to settle them ir, full. the remuneration is calculated, , as, , follows:, , Suppose liquidator is entitled to a commission of 2% on amount paid to unsecured creditors and th, cash available is Rs. 10,200 before the settlement of unsecured creditors amounting to Rs. 25.0, , The cash available is insufficient. Hence in such case. the remuneration is calculated as follows, If amount available is Rs. 102 the remuneration will be Rs. 2, , lfamount available is Rs., , 10,200 the remuneration, , =, , 10,200, , x, , =, , Rs. 200, , 102, , Thus the amount of Rs. 10,000 will be distributed among unsecured creditors after deducting th, remunerations of Rs. 200. The method of calculation of remuneration on the amount distributed, , shareholders also will be the same when the amount available is insufficient., , If should also be noted that preferential creditors are basically unsecured creditors hence unless otherw s, stated the liquidator is entitled to remuneration on them if it is based on unsecured creditors., 3. Preferential Creditors: These, , the creditors to be paid in priority to the ordinary, creditors but after the debentureholder having a floating charge. These creditors are basical, , unsecure, , are, , unsecured creditors. Hence for calculation ofremuneration to liquidator these creditors areinclu, n the unsecured creditors unless, otherwise stated. If debentures have no floating charge,, t, the preferential creditors should be, paid first., Under section 530 of the, , (i) All, , revenue, , taxes,, , Companies. Act, following, , are, , the, , preferential creditors, , and rates due and, the company within 12 m, payable, immediately preceding the date of commencement of by, winding up., (11) All wages or salaries of, any employee due for the period not exceeding four months with, wi, the 12 months before the, commencement of winding up., (11) Any compensation, payable to any workman under Industrial, Act. 1947, pro vided, the amount, Disputes, to, payable any one claimant will not exceed, Rs. 1,000., OV) All accrued, holiday remuneration becoming, to, payable any employee on account of windusup, (v) All sums due as, compensation, under, Workmen's, (V1) Payments under, Act., employees, Provident, Fund. Pension Fund, Gratuity Fund and, State Insurance., p, cesses, , Compensation, , (V1)The expenses of any, investigation, the company., 58/ Corporate Accounting, , under section 235 and, 237 in, , so, , far, , as, , they, , a, , ayable

Page 5 :

D e b e n t u r e s, :, , stated the debentureholders are always assumed to be having a, before, assets of the company. Hence they rank for the repayment, asset, But the debentures arc holding a fixed charge on a specific, are paid., offered, asset, as, creditors and repaid out of the sale proceeds of the, ssecured, unsecured, other, are unsecured, they are repaid along with, the debentures, the, , otherwise, , less, , U n l e s, , tingcharge o n, , if, , psecured, creditorsan, , t h e ya r e t r e a t e d, , as, , them., , securityto, , If, If, , prorata,, , company, , loans having floating, Interest outstanding on debentures and other, nohentures, and upto the, case of a solvent company, in, debt, of, of, repayment, date, , scrediors, e C s o fthe, o n, , :, , D e b e n t u r e, , Interest, , paid, , 10, up, , charge., , commence, , the, , tto, o,, , o fwinding, , up in, , case, , of an insolvent company., as a, , security, , are, , holding any assets of the company, & unsecured, Creditors:, bank overdraft, d, payable,, bills, include trade creditors,, Unsecured, ledunsecured, be paid prorula., i ccreditors. They, is insolvent they will, creditors. If the company, Act the preterence, the, partly secured, the partly, the, section 85 () of Companies, to, : ACcordingg, capital in, repayment of, encement, , The creditors, , not, , p a r te, , Shareholders, , to, is, and preference as, outside claims not, the, have preference, of, after payment, ohalders, amount remaining, of capital to equity, Theretore, if the, before any return, up., first, winding, for payng, be, to, paid, of, s h a r e h o l d e r s will have, made on them, be, should, calls, forence, , 7., , as to dividends, , P r e f, , shareh, , cient preference, , chareholders., p r e f e r e n c e, , If the equity, , shares are, , Therefore,, , s h a r e h o l d e r s ., , preference, , Unless, , eash, , partly paid, even, , otherwise stated,, returm, after the, , shares, , ofpreference, , are, , deemed to be, , share capital &, , available, , non, , arrears, , participating., , of dividend,, , if any, , all, , should be, , shareholders, , are, , the preference, not paid, equity, otherwise stated,, declared but, Unless, paid to, Dividend:, already, shares, a, r, r e a r s of, Preference, cumulative preference, of, In c a s e of, capital., Arrears, dividend on, of, But, share capital., In case of, before any repayment, cumulative., equity, declared on, is payable, dividend is, In this case,, liability and, becomes a, before, so provide., any, Articles, off, cleared, available by, off, it, if the, should be, capital, only dividend c a n be made, dividend it, equity, of, such, repayment, before any, ofpreference, be, paid, to pay, can, such, it, required, shares, the a m o u n t, class of, necessary,, on, any, if, capital., shares. If any, is received, uncalled equity, class of, in advance, calls, such, of, calling, on, amount, return of capital, If any, advance :, creditors., before any, in, unsecured, preference, 9. Calls a m o u n t should be paid, included in, creditors,, settle, advance it is, advance, i n s u f f i c i e n t to, in, the calls, on calls, to make, available is, payable, right, interest is, has implied, shares and, s h a r e s : Ifcash, the liquidator, equity, paid, paid, priority),, on partly, made on partly, thereon (having, should be, dividend, 10. Calls, it, first, &, call,, share capital, distributed, While making, shares., shares., should be, preference, available, paid, on partly, paid, in that, the cash, on partly, necessary,, each, class of shares, s u f f e r e d, if, s, a, m, e, then,, by, the, called on, deficiency, shareholders., , arrears, , shareholder, , fdifferent, , among, , the, , category, , amounts, , are, , shareholders, , should, , be the, , in such, , a, , manner, , that, , same., , consists, , of:, , fully paid,, the capital, If, Shares of Rs., xample:, Preference, Rs. 80 paid,, 100 each, 1,000 8%, and all, Rs., Shares, 70 paid,, of, (a), expenses, each Rs., Equity, liquidation, 100, 1,000, of, (6), order to, Shares of Rs., (after payment, share in, shareholders, Equity, 2,000, equity, (c), the deficiency per, preference, available to, will ascertain, cash, the, follows:, the liquidator, shares as, and if, is Rs. 50,000,, on equity, made, /59, other creditors), of call to be, of a Company, Liquidation, the a m o u n t, , determine, , of the, , company, , 100 each

Page 6 :

eticiency to Pref. Shareholders Unpaidcapital Rs. 1,00,000)-Cash available 50,00, eliciency to Equity Shareholders 1,000 sharcs x Rs.80 paid, Deficiency to Equity Sharcholders 2,000 shares x Rs. 70 paid, Therefore, Total Dcficicney for 3,000 quity Shares, , Therefore. Deficiency, , Per, , Rs. 2,70,0M, , Fquity Share, , Thus in the, , 50,Rs000, 80,000, , 1,40,000, , 2,70,000, , 3,000) shares, , the deficicncy of cach cquity sharcholder is going tobe, , Rs. y, liquidation process, Nare a call of Rs. 10 per share on 1,000 Equity shares (on which amount aready paid is, cal, , of Rs.20 per share on 2,000 Equity shares (on which amount already paid is Rs, , should be made., , 11.Equity Shareholders: The surplus remainin after settlement of all the liabilities offthe, t compan, chr, , ment of preference capital as well as dividend should be handed over to equ, shares are participating preference shares, then the surni, prelerence, after renavae, repayment of equity share capital should be distributed among equity & prefere, erenci, Shareholders in a manner, provided in the Article of the company., , ndistributed Profit & LosS : The items indicating undistributed profits and lossEs in tne Balanc, S O u d not, , be considered, , unmary of Important Points, Point of Doubts, 1), , all in the, , preparation of Liquidator's Final Statement of Accoum, , of Doubt in Preparing, , or, , cash balance in hand, , liquidation?, , on, , Ifliquidator is entitled to a the commission, , on, , assets, , realised by, , him,, be calculated on assets, given, to secured creditors ?, , whether it should, as, , Liquidator's Final Statement o1 Account, , Clarification, , Ifliquidator is entitled to a commission on, assets realised, whether it should be calcu-, , lated on bank, the date of, , 2), , at, , 1) Unless it is clearly stated in the problem no, commission should be paid to the liquidator, , on cash or cash & bank balance in hand, on the date of liquidation., 2) (a) If the problem indicates that the security, is realised by creditors, the liquidator should, , security, , be given commission only on the surplus, from assets, , given, , as, , security, , (b) Ifthe problem is silent or if it clearBy indicated tha, such assets, , 3) What, , treatment, , like Income, , should be given, , Tax, Rates, , & Taxes, , the items, , to, , due, Work-, , | 3), , mens Compensation Fund Provident Fund,, , given as security are realised by liqu, , then the liquidator should be given commission, on the entire value of the, security realised., These items indicate Preferential creditors., , They should be paid in priority to the, , debentureholder having a floating charge., , Gratuity Fund, Employees State Insurance, Fund, etc. appearing in the Balance Sheet ?, , 4) If the liquidator is entitled to, , 5), , a, , fixed, , comm-4), , ission on the amount paid to, unsecured, creditors, whether his commission should, be calculated on, payment to, If the, , preferential creditors?, , liquidator, entitled to a fixed common, payment to unsecured creditors or, shareholders and if, is, , ISSion, , the amount is inadequate, settle this, in, payment, commission as well, whatfull & receive the, should be, , Unless otherwise stated, the, be paid a commission on liquidator should, amount, to, peferential creditors, if he is entitled paid, to a, fixed commission on unsecured, creditors., 5) If the balance is inadequate the, commission, should be calculated a, , to, , done?, , Amt. Available x, , After, , deducting, , 100+ Rate of, comm., the commission from, amount, , available the balance, creditors/shareholders., 60/ Corporate Accountin, , Rate of comm., , should be paid to

Page 7 :

with the nterest on, , H t od e a lwith, , debentures ?6) If the, , is solvent, interest on, ntures company, should be paid, debe, the, upto, date, of, their, repaynent and if, , the, company is insolvent,, interest on debentures, to the dale, should be paid up, the, the, , deal, with the debentures having, dea, , t0, , to, , ), , e and debentures having, , oating charge a n d, How, , 7), , fixedcharge ?, , comnencement of winding up, Unless otherwise, deemed to have stated the debentures are, loating charge on, asscts and, they rank for the cornpany, payment, before, preferential and other unsecured, creditors. But if the debentures have, fixed, charge on an asset they should be paid out, of, , to, , aal, dea with, , the arrears, , of, , How, )dividend, given in the problem ?, , preference|, , sales, , 8) If the, , proceeds, , arrears, , of such asset., , of preference dividend, , are, , given in the inner column of liability side of, the Balance Sheet or in the foot note. it, indicates a contingent liability. Such arrears of, dividend should be paid before the return of, , equity capital., What should be, arears, , done, , and calls, , regarding call in, , in advance, , shown, , in the, , balance sheet ?, , 9), , Unless otherwise stated, it will be assumed, that the calls in arrears on the date of liquidation are collected by the liquidator and, shown on the receipt side of the statement, if any., of account. The calls in advance,, side, should be returned from the payment, before the, , 0) How to make, , the payment, , to partly, , secured creditors ?, , return, , 10) The sale proceeds, , and, secured creditors first, , the other, , them prorata., , along with, undistributed, , profit or, , of the security should be, , paid to the partly, added, amount should be, the balance of unpaid, and paid, unsecured creditors, to, , ) How to deal with, liquidation ?, on date of, showm, losses, Tserves or, classes of Equity, lf there are various, how, ), amounts paid up, different, Shares with, amount or, required, the exact call for the, made, should be, capital, of, return, he exact, , of that class of shares., , inthe pre, , should be totally neglected, of, final statement, the liquidator's, of, paration, the required, exact call for, a case the, such, of equity capital, 12) In, exact return, , 11) Such items, , amount or, , the, , made, , in such, , a, , manner, , that the, , be the, share should, return of, deficiency, or after, call, the, share of, after making, same, equity, per, follows., The deficiency, as, , should be, , per equity, , capital., s h o u l d be, each type, Per Equity, , ascertained, , Deficiency, , Total, , Share, Available, , Capital, Paid up, , -, , Cash, , of Equity, Total No., , Shares., , of a, Liquidation, , Company, , /61

Page 8 :

Illustration.1 (Commission on payment to unsecured creditors)., Tho I, , nlucky Ltd., went into, , rs, Secured Creditors, , The, , voluntary liquidation when its liabilities were as under., Rs.2,00,000; Preferential Creditors Rs. 40,000; Unsecured Creditors, Credito RS. 60,00, , liquidator realised, , Rs.5,00,000, , Rs.2,50,000 from the securitics held by secured creditors, , an, , amounted to Rs. 11,000., The cost of liquidation amounted to Rs. 19,900) and the liquidaior remuneration was, Cash, form other assets., , in hand, , at 3/%, , On, , includins, , the amount of assets realised and 2% on the amount distributed to unsecured credito, preferential creditors), , Prepare the, , (Adapted), , Final Statement of Account., , Liquidator s, , M/s. Unlucky td., , Solution, , Cr., , Liquidator's Final Statement of Account, , Dr., , Rs., , Rs. Payments, , Receipts, , Remuneration, 9,300, 3% on Rs. 3,10,000, 800, 40,000, Rs., on, 2%, 1,000, 2% on Rs. 50,000, , 11,000| By Liquidator's, , hand, To Cash in, To Assets realised:, , Surplus from Securities., , =, , 11,10, , ==, , (2.50,000-2,00,000), , 50,000, , Other Assets, , 60,000 1,10,000, , 19.0, 400, , Liquidation Expenses, By, By Preferential Creditors, By Unsecured Creditors, , 50,00, , at 10 Ps. per rupee., , 1.21.00, , 1,21,000, Notes, , (1), (2), , Since the securities, value of securities., Calculation of, , are, , realised, , Liquidator's, , by the liquidator, the, , Remuneration, , @, , 2%, , commission, , on, , the, , @ 2%, , amount, , is calculated on ful, , paid to unsecured, , creditors is as under:, , 1,21,00, , Total of Receipt side, , 9,300, , assets, Less:Liquidators Commission on, Preferential Creditors., Liquidator 's Commission on, , 800, , 19,900, , Liquidation Expenses, , 40,000, , 70,00, , Preferential Creditors, Commissionn, Amount available for Unsecured Creditors & Liquidator's, 2, If the amount available is Rs.102, the Commission is Rs., Rs.51,000, Commission, amount available is Rs. 51,000, the, =, , Therefore,ifthe, Ex.1, , liquidation having the following, (a) Secured Creditors Rs. 15,000 (securities realised Rs 18,500), , The XYZ Co., , Lid,, , went, , Rs, , into voluntary, , 51,00, , x, , 102, , = Rs. 1,, , liabililles., , (b) Preferential Creditors Rs.4,500, (c) Unsecured Creditors Rs.22,000, n e gulaator S out of pocket expenses amounted to Rs. 545., , e n t i t l e d 1, , The liquidator 1s, stribue, , remuneration of 3% on the total amount realised and 1.5% on the amount as, unsecured creditors., 62/ Corporate Accounting

Page 9 :

excluding, , ccets., The, , various, , securities in the hands of, fully secured creditors, realised, , R s . 1 9 , 5 0 0 ., , the, , Liquidators, , Prepare, Tatal of, of, Ans.: Total, , Final SMatement, , of Account, , statement Rs. 23,000, Commission, , on assets, , (Adapted), realised Rs, , 1,1on40,Rs., (i.e., mission on amount paid to unsccured creditors Rs. 2475. (ie. 15%, 16.500), , A, , 3%%, , on, , Rs. 38,000)., , nmission on payment to prefential creditors Rs. 67.5 (i.e. 1.5% on Rs 4,500 ).1, 1llustration - 2: (Commission on Payment to Unsecured creditors)., , Ms Ajeet Company Ltd.. went into Voluntary Liquidation on 31.3.2018, Balance Sheet, , was, , when the follrwing, , prepared., , Rs. Assets, , Liabilities, , Goodwill, , s0.00, , 3,00,000, , Leasehold Property, , 48 0, 65 500, , 1,95,000, , Plant& Machinery, Stock, Sundry Debtors, , 64 820, , Authorised Capital, , 30.000 Equity Shares of Rs.10 each, SubscribedCapital, 19.500 shares of Rs. 10 each, , Rs, , Sundry Creditors:, , Preferential, , 24,200 Cash, , Partly Secured, , 55,310, , Unsecured, , 99,790, , 56,300, 2.500, 98,680, , Profit &Loss A/c, , 12,000, , Bank Overdraft (Unsecured), , 3,86300, , 3,86,300, assets, , as, , follows, , (1) Leasehold Property (used, , to, , pay, , The, , liquidator realised the, , Rs., , partly, , 35.000, 51,000, , secured creditors), , (2) Plant, , 39.000, , (3) Stock, , 58.500, , (4) Sundry Debtors, (5) Cash, , 2500, , remuneration was agreed at, to Rs. 1,000 and the liquidator's, of liquidation amounted, unsecured creditors incuding, 2% on the amount paid to the, 2.5% on the amount realised and, preferential creditors., (Shivaji Univ. Oct. 2000), Statement of Account., Final, Prepare Liquidator, M/s Ajet Company Ltd.,, , The, , expenses, , Solution:, , Liquidator's Final, , Statement of Account, , Rs., , Receipts, To Cash in hand, ToAssets Realised, Plant & Machinery, , Stock, S. Debtors, , Leasehold Property, , 2,500, , Rs., , Payments, By Liquidator's Remuneration, 2.5 % On Rs.1,86,000, , 51,000, , 2% on Rs.24,200, , 39,000, , 2% Rs. 1,18,300, , =, , 4,650, , 484, 2,3o0, , 500, , 1,000, By Liquidation Expenses, 58,500, 24200, Nil 1,48,500 By Preferential Creditors, By Unserured Creditors at 89.55 ps. 1,18,300, per rupeee, , 1,51,000, , I.51,000, , Liquidation of a Company, , /63

Page 11 :

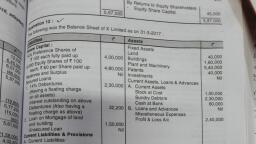

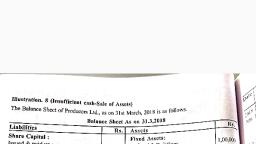

(Payment, , Mustratio, , the, lowing was, , to, , various types, of, , of, Creditors, Alpha Co. Ltd.,, as on, , Sheet, , Balanc, , Rs. ASsets, , Liabilities, , &, , commission of liquidator)., , 31.3.2018., , S h a r eC a p i t a l, , 4000Shares, , Goodwill, , of Rs.10) each, , Less:Calls in arrears, , overdra, , Buildings, Plant & Machinery, , 40,000, , called up, , 1,000, , 1,000 Debtors, , by Mortgage, , Cash in hand, , against Buildings, , Creditors partly, , secured, , 16,000 Cash, , against, , Plant& Machinery, , 15.000, , due to Government, Taxes, Pension &, , Horkmens, , Salaries & Wages, , 5,000, 30,000), 10,000, 35,000, , 39,000 | Stock, , (Unsecured), , ank, Creditors secured, , Rs., , 500, , Gratuity Fund, , at, , 20,00X), 50), 5,000, 1,50), , Bank, , Preliminary Expenses, , Profit & Loss A/c, , 22,000, , 4500, , for six months, , 2,400, , Trade Creditors, , 50,600, , 1,29,000, , 1,29,000, , The company went into liquidation and the assets realised by the liquidator were as follows:, , Plant& Machinery, , Rs., , 8,500, , Stock Rs., , 22,500 Debtors Rs.10,000., , The Building was realised by the secured creditors for Rs. 35,000. Expenses of liquidation amounted, to Rs. 4.075. The liquidator s remuneration was agreed at 2% on the amounts realised by him and, 2.5% on the amount paid to unsecured creditors other than preferential creditors., , M/s Alpha Co. Ltd.,, , Solution, , Liquidator's Final Statement of Accov, Rs. Payments, , Receipts, , By Liquidators Remuneration :, , 5,500, , ToCash&, , Bank Balance, To Assets realised, , 2%, , 22,500, 10,000, , Stock, , Debtors, Surplus from Buildings, , 19,000, , (35,000-16,000), lo Calls in arrears, , on, , Rs. 60,000, , 1,200, , =, , 1,125, , 2.5% on Rs. 45,000, By Liquidation Expenses, , NIL, , Plant &Machinery, , Rs., , 4,075, , By Preferential Creditors, , 500, , Govt. Taxes, Workmen, , 51,500, 1,000, , 's, , Pension, , &, , Gratuity Fund, , 4,500, , Salaries & wages, , 1,600, , (For four, , months, , only), , 6,600, , 45,000, , By Unsecured Creditors, , ( 7 5 paise per, , 2.325, , rupee), 58,000, , 58,000, , Notes, , remuneration, , 1. Liqui, Is not paid, Ors, 2. Liquidator, is paid, , on, , any, , plant &, from secured creditors, , bank, cash &, , call, balance and, , realised, , by, , 3. Amount realised, , balance is nil., , from, , Plant, , &, , Machinery, , arrears., , on, , trom, the surplus, , machinery, , on, , creditors, , c o m m i s s i o n, , building collected, , him &, , in, , directly., , Hence the, , secured, , is paid, , to, , partly, of, Liquidation, , a, , Connpany, , /65

Page 12 :

0, , 1y, 4 Liquidator s commiss1on (, Total of Receipts side, on assets, Less: Liquidator's Remuneration, , 58,000, , 1,200, 4,075, , Liquidation Expenses, , 6,600, , Preferential Creditors, creditors, , Amount Available to unsecured, Is less than the amount requred), , &, , ornm1ssion, , Iiquidators, , 11875, , (Which, , 46.125, , Rate of Commission, Therefore., , Liquidator's, , Commission-Amt. available, , 2.5, Rs 46,125, , x, , 100 Rate of Commission, , Rs. 1.125, , x, 102.5, , Ex. 3, , Following was the Balance Sheet of Beta Co. Lid. as on 31.3.2013., Rs., , Liabilities, Share Capital, , 20,000 Shares of Rs. 10 each, Bank Overdraft (Unsecured), , Partly Secured Creditors, Salaries and wages for 6 months, Taxes due to Government, , 2,00,000, 1,100, 29,180, 6,300, , Goodwill, , 30,000, , Buildings, , 25 000, , Plant & Machinery, Stock, , 3 400, 58 000, , Debtors, , 46. 000, , 800 Cash, , 97,600, | 3,34,980, , Trade creditors, , Rs, , Assets, , Profit &Loss Ac, , 38,080, , 3.34 980, , The company went into liquidation and the assets were realised as, 1Buildings which were used in the first instance to pay parthy secured creditors pro-rata, 2 Plant & Machinery Rs. 25,000 (3) Stock Rs. 31,000 (4) Debtors Rs., 43,500, , follows, , Expenses of liquidation amounted to Rs.1, 140. The liquidator s remuneration was, agreed, 3% on the amount realised (except cash) and 1.% on the, amount paid to unsecured creditors, other than preferential., (Mangalore Univ. April. 2001, Ans.: Total, , of statement Rs., , 1,00,000, Commission, , modified), , on assets, , realised Rs., , Commission on payment to unsecured creditors Rs. t,555 (Le. 1.5, unsecured creditors Rs. 89,000 at 81 paise in a Rupee. |, , or, , 3,525 (i.e. 3% on Rs. 1.17.500, 1a on Rs. 89,000) Pavment o, , Hint: Preferential creditors Rs. 5,000 (i.e. salary of tour months and taxes), , lllustration :4 (Commission on payment to shareholders and debenture, interest, Bad Luck Limited went into voluntary liquidation on 51.5.2018. The Balance, Sheet as on that date, was as follows:, , Liabilities, Share Capital, 3,000 cquityshares of Rs. 10 cach, 1,5008%preterencesharesof Rs l0 cach, , 9% Debenture (having a floating charge), Sundry ereditors, , Rs. Assets, , Plant, 30,00X) Sock, , 15,000, 10,000, , 18,000, , 73,000, , Debwrs, Bank, , Protit & Loss A/c, , Rs., , 25,000, 18,000, 19,500, 500, , 10,000, 73,000

Page 13 :

sed the, , assets as, , follow, , Rs., , u i d a t o rr e a l i s e, , The, , 42,000, 19,000, , Stock a n d P l a n t, , Debtors, , paid up to 31.3.17. Preference shareholders carried the right of payment of, (in addition to capital ) in arrears automatically before anything can be paid to, dividend, preterenced, iv, Preference, , lividend was, , elerehareholders. All claims were admitted. Expenses of liquidation amounted to Rs.2,000., 30.09.2018 together with interest upto date. Liquidator was to get as his, repaid on 30.09, were repaid, the amount realised and 2% of the amount paid to equity shareholders., ion 2% of, , t he, eq u i t y s h a r e h o l d, , were, , D e b e n t u r e s, , remuneration, , (Madras Univ. Sept. 2001), , inal Statement of Account, , Liquidators, Prepar, , Bad Luck Limited, Liquidator's Final Statement of Account, , Solution:, , Rs., , Rs.| Payments, 500 By Liquidation Expensess, , Receipts, , To Bank, To Assets Realised, , 2,000, , By Liquidator's Commission:, 19,000, , Debtors, , 1220, , 61,000, 2% on Rs. 13,363=, 2%, , 42,000, , Stock& Plant, , 61,000, , on, , =, , Rs., , 267, , By 9% Debentures, plus interest from, , 10,000, , 31.3.08 to 30.9.08, , 450, , 10,450, 18,000, , By Unsecured Creditors, , By Pref., , 1,487, , Share holders:, , 15,000, 1,200 16,200, , Capital, Arrears of dividend, By Equity Shareholders, , 13.363, , @Rs. 4.45 per share, , 61,500, , 61,500, , Working Note:, Calculation, , of Liquidator's, , Remuneration, , 2%, , on, , amount paid to, , 61,500, , 2,000, , Total of Receipts side, Expenses, Less : Liquidation, , commission, , 1,220, 10,450, , o n assets, , Liquidator's, , 18,000, l6,200, , Debentures, , Creditors, Pref., , Shareholders, , share, , holders, , for equity, Amount available, required), amount, the, less than, is 102, the, , Now, if amount, Therefore,, , Rs, , shareholders, , &, , liquidator's, , commission, , available, , if amount available, , is, , Rs.l3,630, the, , commission, , (Which is, , is 2., , commission, , =, , Rs.L3.630, , 102, , 47,870, , 13,630, , = Rs. 267, , Liquidation of a Company, , /67

Page 14 :

Ex. 4, The Fast Food Co. Lid., went, into, consisted of:, , voluntary liquidation, , (a) 10,000 12% Preference Shares Rs.., of, , on, , 31.3.2018, , 10 each, , at, , which date its, coms, , capitc, , fully paid;, (b) 10,000 Equity Shares, Rs., 10, each, of, fully paid., The assets realised Rs. 90,000., The expenses of, liquidation amounted to Rs.5,600 and un., cured creditors were Rs.40,000, nse, including Rs3,000 preferential creditors. The, muneration, , fixed at 4% commission, the shareholders., , was, , on, , distributed to, Preference shares carry preferential right as, arrears of dividend on, preference shares., , Prepare, , the, , Liquidators, , assets, , to, , and, , realised and 2% commnission, , payment of capital and, , assume, , Final Statement of Account., , liquidatorsr, on, , the ama, , that there is, , (Adapted), , Ans.: Total of statement Rs.90,000; Commission on assets, realised Rs.3,600 (i.e. 4% of Rs. 90,000), Commi, sion on amount paid to Pref. Shares, Holders Rs. 800 (i.e. 2% Rs. 40,000) ], , Illustration, , -, , Francisco Ltd., , 5, , : (Debenture, , was, , as follows., , Interest: Insolvent, , Company)., , placed in voluntary liquidation on 31st March,2018, , Labilities, Issued Share Capital:, , when its Balance Sheet wa, , Rs.| Assets, , 2250 Equity Share of Rs.100, , Freehold Factory, , 10% Debentures, Interest outstanding on debentures, Creditors, , 1,80,000, 89,000, , Plant&Machinery, , 2,25,000, , each fully paid, , Rs., , Motor Vehicle, , 57,500, , 1,00,000 Stock, , 86,000, , 5,000 Debtors, , 1,73,000|, , Profit &, , 75,000, , Loss A/c, , 15.500, , | 5,03,000, The, , liquidator realised the assets as follows:, Freehold Factory, Plant& Machinery, , 5,03,000, Rs., , 1,20,000., 29,000., 17,000., , Motor Vehicles, Stock, , 21,000., 45,000., , Debtors, , Creditors include preferential creditors Rs. 3,200 and a loan, freehold factory., , for, , Rs.50,000 secured by, , a, , mot, , ge, , on, , The cost of liquidation was KS.1,020. Theliquidator is entitled to a remuneration c, , assets realised by him and 5% on amounts distributed among unsecured creditors, f, , pref, , erential creditors), The debentures and creditors, , Prepare the Liquidators, , % on, , were, , discharged, , on, , 30th September,2018., , of Account, Final Statement, , 68/Corporate Accounting, , (S., , U., , October, 2002)

Page 15 :

Francisco Ltd.,, Liquidator's Final Statement of Acount., , Sohution, , Rs.P'ayments, Nil, , Receipts, , R., , By ILiquidators Remuneration, 3,4R), , 1.5% on Rs. 2,32,000, , To, Cash, Bank, , T oA s s e t s R e a l i s e d, , 3,3, , 5% on Rs. 66,000, S u r p l u st r o m, , Plant& Machinery, , By Preferential Creditors, , Motor Vehicles, , 21,000, , 45,000 1,82,000|, , Stock, , 1,20, 3.200, , By Liquidation expenses, , 70,000, 29,000, 17,000|, , Freehold F a c t o r y, , 6,780, , 1,00,000, 5,000 1,05.000, , By 10% Debentures, Add Interest due, By Unsecured Creditors, , 6600066,000, , (Rs. 1,19,800 at 55 ps.), , Debtors, , 1,82,000, , |1,82,000, 31.3.2018), of winding up (i.e. upto, could have, as, , Notes:, , interest, , on, , insolvent., , is, , the company, its creditors, , repaid, , date of discharge), 2), , paid only upto, , be, debenture can, , are, , Debentures, , in, , full), , the date, , it, , solvent (i.e. if, would have been, In case the company, 30.9.2018, from 1.4.2018 to, interest o n debentures, the, , would have been, , paid., , to have no, , assumed, , But not in this, , The Chouseco, , Lid.,, , position was a s, , went into, , voluntary, , floating charge., , Hence, , paid, , after the preferential, , Capital: 1,000, Profit&Loss Alc (Dr), , shares, , of Rs., , a, , floating, , preferential, , entitled, , 50,000, , charge, , 40,000, , 31.3.2018, , upto, Rs. 5,000), , amounted, , to, , Rs.500., , r e m m u n e r a t i o n, , t o a fixed, , distributed, , on, , 80,000, , 1,500, , of liquidation, , uquidator is, , 70,000, , realisea, , outstanding, , editors (including, , and 2%, , Rs., , 1,000, , carrying, , interest, Debe, Enures, , expenses, , which date the, , 100 each, , Cash in hand, , The, , March,2018 on, , 1,00,000, , and debtors, achinery, stock, , Debentures, , on, , 31st, , under:, , Mare, , 6%, , liquidation, , upto the, , case., , creditors., , Er.5:, , (i.e., , the amount, , realisation, , of Rs.1,, , 100, , pluS, , 3%, , of, , creditors., , unsecured, , to, on, , 30th June,, , 201s., , discharged, were, , and, , creditors, , u r e s, , ", , LIquidator's Final, , Statement, , of Accoun, , Creditors, , Ans.: Final pay, , Payment, , LOrstotal, , assets, , on, , Rs., , Debentureholder, , Payment, , Rs., , 51,.500,., , to, , 20,000., , Unsecured, , to, , remuneration, , of a, , Rs. 4,000, , liquida-, , Liquidation, , Company, , /69

Page 16 :

Illustraiton 6: (Return of Share Capital Different classes of shares)., The Cartoon Foods Ltd.. went into, voluntary liquidation on 3Ist December, 2017. The balana., -, , lances in j, , books on that day were., , Liabilities, , Rs. Assets, Land & Buildings, , Share Capital, Authorsied and Subseribed, 5.000 6°% Preferentail Shares of, , Rs.100 each fiully paid, 2.500 Equity shares of Rs.100 cach, , Rs.75 paid, , .500, , Equity, , R, 2,50.00, , Machinery & Plant, Patents, , shares of Rs. 100 each, , Rs. 60 paid, , 6,25.0, 1,00,000, 1,37 5, 2,75.M, , 5,00,000 Stock, Sundry Dcbtors, , 1.87.500 Cash at Bank, Profit & Loss A/c, , 75.0, , 3,00.00, , 4,50,000, 2,50,000, 12,500, , 5o Debentures, Interest Outstanding, , Creditors, , 3,62,500, , 17,62,500, The liquidator is entitled to a, commission, amounts distributed, unsecured, , 17.62,50, , of 3% on, , all assets realised except cash and 2,, among, creditors other than preterential creditors., Creditors include preferential creditors Rs., 37,500 and a loan for Rs. 1,25,000 secured a mor, on land and, buildings. The preference dividends were in arrears for two years. Thebyassets, , wer, , realised as follows:, Land and, , Buildings Rs. 3,00,000 Machinery and Plant Rs.5,00,000; Patents Rs.75,000:, Stock R, 1.50,000: Sundry Debtors Rs.2,00,000., The expenses of, liquidation amounted to Rs. 27,250, the, Prepare, Liquidator's Final Statement of Account., (Delhi Uni. Pune Modified & Madras, Unix.), , Solution, , Receipts, , The Cartoon Foods Ltd.,, Liquidator's Final Statement of Account., , Rs. Payments, 75,000 By Liquidation, Expenses, By Liquidator's Remuneration, , To Cash at Bank, To Assets realised, , Land & Buildings, , (3,00,000 - 1,25,000), Machinery & Plant, Patents, Stock, , Debtors, , 1,75,000, , 5,00,000, , 3% on Rs., , 12,25,000, , 2% on Rs.2,00,000=, , By Preferential Creditors, , Rs., , 27,250, , 36,750, , 4.000, , 40,750, , 37,500, By 5% Debenture Rs., 1,50,000, AddInt. upto 31/12/17 2,50,000, 12,500 2,62,500, 2,00,000 11,00,000 By Unsecured Creditors, 2,00,000, , 75,000, , By Pref. Shareholders, , Capital, Arrears of, , dividends, , By Equity Share holders, 2,500 Eq. Shs. @ Rs., , |I1,75,000|, 70/ Corporate Acco, , 7,500Eq. Shs. @Re., , 5,00,000, 60,000 5,60,000, 15.95, 0.95, , 39,875, 7,125, , 11,75,000

Page 17 :

n o r k i n g N o t e s, , er, , Equity, , Share, , of Rs. 100 each, 10,00, , iency p e r, , capital o n all, ailable for repayment, auity, , ard up cquity, , lts, , o a l, p a i c, , L e s s :C a s h, , ciency, , of 10,000, , Equity, , jency, , equity, , follows, , 6.3750, , Shares, , 47, , cquity shares, , Shares, , 5,0500, , 5959.95, , .5,90,500 10,000 shares), , Total, d e f i c, , per, , to, , Equity, , as, , share, , who have paid Rs.75 per share should be repaid Rs.(75-59.05)=, Fquity Shares, 60 per shares should be repaid, 7.500 cquity Shares who have paid Rs., a n d 7.50, and, cach, on all 10,000 equity, 60-59.05) so that the loss of capital in the liquidation process, share. (i.e. Rs.59.05)., s a m e per, ca0, , Theretore, 2 . 0, , 05, , llbe, , the, , that, Assumed, nad tha, , Debentures hold no, , of share capital:, , Return, Sheet o f Bubbles, les, , Ex.6:(Retu, , Lid,, , floating charge., , Dilferent classes, , as on, , is, , 31.03.2018, , of equity shares), as follows., , From this prepare, , Liquidators, , Balamce, , Satement o j A c c o u n t ., , Rs., , Rs. Assets, Liabilities, , Fixed Assets:, , Paid up Capital, , 006%, , Pref. Shares, , 2000 Equity, each,, , Land, , 000, of Rs.100each| 1,00,, , 3000 Eguity Shares, , of, , 2.00,000, , Buildings, , 2,20,000, , Plant, , Shares.of Rs. 100, , Current Assets, , 2,00,000, , fully paid, , &, , 1.00,000, , Stock, , Rs.100, , Rs.100, , 1,00,000, , 1,50,000| Debtors, Cash at Bank, , each Rs.50 paid, , Secured Loan:, , Misce. Expenditure, , 6%Debentures (Floating charge, 1,00,000, , on all assets), Others (Mortgage on Land & Bldgs), , 30,000, , | Profit, , 1,00,0000, , & Loss Alc, , 1,00,000, , Curent Liabilities, Sundry Creditors, Income tax, , 90,000, , 10,000, , 7,50,000, , 7,50,000, dividends, , liquidation, , on 1.4.2008., , The preference, realised, The a s s e t s realtsed, , p a n y went into, liquidation., uCe years. The a r r e a s a r e payable on, 80,000;, Rs.2,40,000: PlantRs.1,, , Stock, , Rs. 70, 000;, , were, , us, a, s, , in, , arrears, , for, , follows, follows, , Debtors, , Rs, , 60,000, , commission, , is eniitled to a, 7he liquidator, 8,000., to Rs., creditors., idation amounted, xpenses, to unsecurel, paid, amount, Univ. Nov. 2001), on, Bangulore, all assets realised and 3%, March 2000;, (Shivaji,, shares and, share o n 2,000, Rs. 58 per, @, I1,000 + Rs. 300+, Equity Capital, Return, Ans.: Total of statement, Rs., 4,80,000;, (1.e., Rs., Rs., 14,000, statem, d5ulldings, , The, , of liquid, , O, , O, , ., , per, , Rs.2,700), , of, , Commission, shares, Liquidator's, , shareson 3.000, , lints: 1. uidator, Liqui, is paid, , commission on, , entire value, , ofland & building, , . Income tax is preferential creditor., Iiquidatipn of a Company /71

Page 18 :

Tllustration 7 : (Debenture Interest of Solvent Co. & Refund of capita, A Bad Luck Lid., passeda special resolution forvoluntary winding up on 31st, , March, 2018,, 18, when', , Balance Sheet stood as under, , Balance Sheet, , Rs. Assets, Plant &Machinery, , Liabilities, , Share Capital, 5.000 Eq. Sh.of Rs. 100 fully paid up, 1.000 Equity Shares of Rs. 100 Rs.75, per share caled up and paid up, , 1.000 6 Cumulative Pref. Share, of Rs.100 each fully paid up, 7% Debentures (Secured on Plant, , &Machinery), , Rs, , 4,000, , 5,00,000 Funiturc & Fittings, , 1,9, , Stock in trade, , 50,000, , 75,00 Debtors, , 1,50,00, , Cash in hand, , 1,00,000, , 5,0, 4,215, , Profit& Loss Alc, , 1,00,000, , Unsecured Creditors, , 2,52,000, , 10,27,000, , 1027.00, , Dividend on preference shares remained, unpaid for full one year. Interest (payable annually on, December 31) on Debentures was paid, upto December, 31st 2017. Unsecured creditors inchue, Rs.2,000 of preferential creditors., Liquidator realised the assets as follows:, Rs., , Plant & Machinery, Stock, , Rs., , 3,60,000, , Debtors, , 1,00,000, , Funiture & Fittings, , 1,40,000, Nl, , The expenses of winding-up amounted to Rs., 19,500., The Liquidator's remuneration is to be at 4% on realisation, of assets and at 2% on distribution, among unsecured creditors excluding preferential creditors. The winding, up was completed on 30th, June, 2018 when the Debentures were repaid., The necessary call was made and received in full from all shareholders., Please draw up the Liquidator's Final Statement of, Account on 30th June, 2018., , Solution, , Bad Luck Ltd.,, , (Shivaji Univ. October, 2001), , Liquidator's Final Statement of Account, Rs. Payments, , Receipts, To Cash in Hand, , 5,000 By Liquidation Expenses, By Liquidator's Remuneration, , To Assets Realised :, Stock, , Debtors, , 4% on Rs. 6,00,000, , 1,00,000, 1,40,000, , 2% on Rs. 2,50,000, , By Preferential Creditors, , Nil, , Furniture & Fixtures, Surplus from plant, , & Machinery, , Rs., , 24,000, 5,000, , 2,50,000, , By Preference shareholders, , Capital, , (3,60,000- 1,03,500), To Calls on Equity Shares, 1,000 Eq. Shares (@Rs.5/- each, , Dividend, , 5,000 By Equity Shareholders, , 1,00,000, 6,000 1,06,000, , on 5,000 Eq. Shares @Rs. 20, , 5,06,500, 72/ CorporateAccounting, , 29,000, 2,000, , By Unsecured Creditors, , 2,56,5004,96,500, , 19,500, , 1,00,000, , 5,06,500

Page 19 :

H o r k i n gN V o t e s, , i0g, , er equity share of Rs. 100 each is as follows, , Rs., , fcieneauity capital on all 6,000 Equity Shares, , eficiency, , upavailable, aidash, , Tota, pla n, , L e s s :C a s, , of, , 5.75,000, , to equity shareholders alter repayment of preference sharcholder, , 95,00, , 6,000 equity shares, , 4,30), , d e f i c i e n c y, , |de, , eficiency, , Total, , Therefore, D e f i, , per equity, , share, , (Rs.4,80,000, , 6,000 shares), from 1,000 equity shares of, be, , hereto, 5 per share should be collected, refore, a callofRs., , Rs.75 per share, 20 per shares should, made to 5,000 cquity shares of, Rs. 100 per, hat the loss of capital in the liquidation process on all 6,000, equity shares will be, , of, of 1Rs., forenavment, and, and, repayment, , D, , paid, , share, paid, , 80 per share), , 8 0 per, (i.e. Ks., same, , the, , company is solve, vent,, , debenture holders, , paid, , are, the debenture amount of Rs. 1,00.000, erest upto the date ot the repayment (1.e. upto 30th June 2018) amounting to Rs. 3,50, , 2. Asthe, and, , of the, , sale, , out, , proceeds of Plant, , &, , Machinery., , Ontimist Lid., went into voluntary liquidation on 31.12.2017 at which date the dividend, reference shares Was n, , arrears jor one year. The following was its Balance Sheet as on, , that date., , Rs. Assets, , Liabilities, , Rs., , Buildings, , Share Capital, , 60,000, , L000 Eq. Shares of Rs. 100 each fully paid|1,00,000 | Machinery, Patents, 2,000 Eq. Shares of Rs. 100 each, 1,40,000 Stock, Rs.70 paid, , 1,60,000o, , 40,000, I,00,000, , 38,000, , Debtors, , 1,000 6% Preference shares of, Rs.100 each fully paid, , 1,00,000, , Cash in hand, 96Debentures (having floating charge)|1,00,000| Profit & Loss, 80,000, Creditors, , 2,000, , 1.20,000, , Alc, , 5,20,000, , S,20,000, , Creditors, , include Rs.5,000, , uldngs which, , were, , preferential creditors, and Rs.25,000 secured, , realised for, , unery realised Rs.1,50,000,, , Rs.35,000, , by the, , creditors, , on, , the, , creditors., , and, Stock Rs.90,000, Debtors Rs.30,000, , nothing, , was, , realised, , Jrom Patents. The expenses of liquidation came to Rs.0,500., , The lic, , from, , e, , remuneration was, , lor s, , Secured creditors and 2%, , (excluding, , 2.5% on realisation of assets including surplus, the unsecured creditors, amount distributed among, o n completion of winddebentureholders were repaid, , fixed, on, , The, creditors)., eferentialThe, necessary call, , g up on 30.6.2018., ne, , shareholders have, , at, , was made and was duly received, , preferential right, , as to, , payment of, , capital, , and dividend., , 2004), Ce, (Shivaji Univ. May., "repare, epare the Liquidator, 's Final Statement of Ace, 2.5% on Rs. 2,82,000) and Rs., Ans: Total of, Commission Rs. 7,050,(1.e., holders, Liquidator's, , the, , sta, to, Rs. 3,00,700., Rs. 1,04,500, Payment, 1,000, debenture holders, 1,000 (i.e. 2%Statement, to, on Rs. 50,0, Shares of Rs. 70 paid), ),000), Payment, Rs. 1,06,000,, 9.35 per share on 2,000 Eq., Rs., (at, shares Rs. 100 paid up), , call made Rs. 18,700, cquity, share on 1000 equity, dres, , Pret. Share, , Rs. 20,650, at, , Payment, , to, , (Rs. 20.65 per, , Liquidation of, , a, , Company, , / 73

Page 20 :

Illustration 8 (Return of Share Capital : Equity Shares of different face valuo., , From the following information relating to Sun Co. Ltd. prepare Liquidator's Final Statemens, , ent of Acco, , Share Capital, , ) 1,200 10% Preference Shares of Rs. 10 cach fully paid., (i) 10,000 'X' Equity Shares of Rs.10 cach fully paid, (ii) 8,000 'Y° Equity Shares of Rs. 10 cach Rs.7 paid up., , (iv) 4,000 Z Equity Shares of Rs.5 cach Rs.2 paid up., Debentures of Rs. 20,000., , Creditors, Preferential Creditors Rs. 5,000, Unsecured Trade Creditors Rs. 29,000, The preference dividends were in arrears for three years. The Articles of the company gives the rw, ence shares prionity over equity shares both for dividend and capital. The assets realised Rs.1,00,000.pe, Cost, , ofliquidation amounted to Rs.1,400. The liquidator's remuneration was fixed at 5% on assets reais, , Solution:, , M/s. Sun Co. Ltd.,, Liquidators Final Statement of Account, Rs.Rs. Payments, , Receipts, , To Assets Realised, To Z' Equity Shares, , call@ Rs.1.50, , R5, , 1,00,000| By Liquidator's Remuneration:, , per share on 4,000 shares, , 5% on Rs.1,00,000, , 6,000, , 5.0, , By Liquidation Expenses, , 14, , By Debentureholders, , 20,000, , By Preferential Creditors, , 5.000, , By Unsecured Creditors, , 29.000, , By Pref. Shareholders, Share Capital, Arrears of Dividend, , 12,000, , By X* Equity Share holders:, refund @ Rs.3 per share, , 3,600, , on 10,000 shares, , 15.600, 30.000, , 1.06,000, , | 1,06,000, , Note:, 1. As the face value of the various categories, ot Equity Shares differ, instead of calculating the, deficiency per Equity Share the percentage or deticiency is to be ascertained, as under:, (a) Calculation of Cash available for Equity Shareholders, Rs., Sales Proceeds of the assets realised, 1.00,000, 76,000, , Less: Payment to Pretference Shareholders, Cash available for Equity Shareholders, , 24,000, , (b) Total Paid-up Equity Share Capital, , Rs., , X Equity Shares (10,000 @ Rs. 10 paid), , 1,00,000, , Y Equity Shares (8,000@Rs. 7 paid), , 56,000, , Z Equity Shares (4,000 @Rs. 2 paid), , 8,000, 1,64,000, , Less Cash available for Equity Shareholders (as above), , (c)Total Deficiency, , of all Equity, , total deficiency is Rs, Total face value of, equity shares is Rs. 2,00,000 and the, x, the percentage of deficiency to face value is Rs. (1,40,000+2,00,000) 100, 1.e. (Deficiency, Face value) x 100 = Percentage of Deficiency., , all, , 24,000, , Shares, I, , =, , c40,000, , 00. Hence, , %.

Page 21 :

category, , Thus eac, , of, , refund to, , Hence, the ref, , or, , Equity Shareholder is to, recovery from Equity lose 70%, , Fauity Shareholders, (A)X Equity, Shareholders, ., , of the face, value of, is as under:, , Shareholders, , are to, , shares held, , Dy im., , lose Rs.7, shares (i.c. 70% of, refunded Rs.3 per, per, share out of Rs.10 their face value of Rs.10, them., per share already, paia Dy, Shareholders, Eauity, Equity, are, Shareholders, to lose, (B)Y Rs.7, (Dat, But as, aS they, they have already paid up Rs.7 per share, (i.e. 70% of their, face value of, per share. Ncither, anything should be paid to them., Rs. 10)., be called nor, anything, should, cZ Equity Sharesholders are, (C), to lose Rs., 3.50 (i.e. 70% of, for they should pay Rs. T.50, fore., their face value of Rs., per share in addition, 5). There, to Rs. 2, per, share, already paid by them., Ex.8:, Erom the following njormation, relating to Moon Co. Lid.,, of Account, erefore,, , they should, , be, , -, , prepare, , 1. Share Capital, (a) 1,000 6%, Preference Shares of Rs. 100 each, b) 40,000 A', fully, , 2., , c), , 30,000, , 'B°, , (d), , 20,000, , C', , Equity Shares of Rs., , Equity Shares, , Equity, , 10, , Liquidator 's, , Final Statement, , paid., , each fully, of Rs. 10 each Rs. 8 paid., paid up., , Shares of Rs. 5 each, Rs. 3, paid up., Debentures of Rs.50,000, , 3. Creditors, , Preferential Creditors, , Rs. 16,000, Unsecured Creditors Rs. 62,000., The preference dividends were in, arrears for two, years. Preference Shareholders carried the, of payment of, right, dividend (in addition to capital) in arrears, preference, before, can be, automatically, anything, paid to the equity shareholders., The assets realised Rs., 3,20,000., Cost of, liquidation amounted to, , Tealised., , & the, , liquidator's remuneration, , is fixed, , at, , 5%o, , on, , assets, , (Pune Univ. May, 2003), , 1Ans.: Total of Statement Rs., on, , Rs.4,000, , A, , Equity Shares;, 1,12,000, , Illustration. 9, , 3,40,000; Percentage of deficiency to the face value 80%. Refund @ Rs. 2 per share, at Re. 1 per share on C' Equity Shares, payment to Pref., Shareholders Rs., , Call, , (Disbursements in instalments), , went into voluntary liquidation on 31.12.2018 with the tollowing Balance Sheet., , Liabilities, Equity Share Capital, , Preference Capital, , Profit& Loss A./, Creditors, , Creditors with charge on Fixed Assets, , Rs. Assets, 5,00,000, 2,00,000, , Fixed Assets, Current Assets, , Rs, 6,00,000, , 7,00,000, , 1,00,000, 2,00,000, 3,00,000, , |13,00,000, , 13,00,000, Liquidation of a Company /75

Page 22 :

The assets, , realised by the liquidator as follows:, Fixed Assets Current Assets, 2018, Rs., Rs., 2,00,000, 1.00,000, March 1, 2,00,000, 3,00,000, May 15, were, , I,00,000, , June 24, , The liquidator is entitled to a commission of 5% on assets realised and 2% of amounts dict, , distribute, , among equity shareholders. After reserving Rs. 20,000 for expenses (which ultimately amo, Rs. 16,000), the amounts were distributed as and when received., , (Madras, , Show the Liquidator's Final Statement of accounts, , Solution :, , 2001, , Liquidator's Final Statement of Account, , Date Receipts, 2018, , Rs. Date Payments, , Fixed Assets, , Mar. By Liquidators Remuneration, , 1,00,000, , 5% on Rs. 3,00,000, , Less: Secured, , Bank Loan, , Rs., , 2018, , Mar. To Assets Realised, 1., , Univ. Sept., , nted, , 15,000, , By Unsecured Creditors(diff.) | 1,65.00, , 1,00,000, , Add Current Assets 2,00,000|, Less Reserve for Exp. 20,000, 1,80,000, , 1,80,000|, , May To Assets Realised, 15, , 1,80,000, May By Liquidator's Remuneration, , Fixed Assets, 3,00,000, Less Sec. Bank, loan2,00,000, , 15, , 1,00,000, Add Current Assets 2,00,000, 3,00,000|, , 5% on, Rs.5,00,000, 2% on, Rs. 39,216, By Unsecured Creditors, By Pref. Sha.holders, , By Eq. Shareholders, , Rs.1,00,000, , 5,000, , Rs. 97,059, , 1,941, , By Eq. shareholders, , 97,059, |1,04,000, , 1,04,000, Working Notes:, , Liquidator's Remuneration @ 2% on amount paid to equity Shareholders on, 1. May 15: Amount available for, Equity Shareholders & Commission to, If amount available is Rs. 102, the commission = Rs.2, , Liquidator, , 'amount available is Rs. 40,000 the commission -Rs. 40,000 x, 02, 2. June 24:lIfthe amountavailable is Rs. 99,000, the commission Rs.99,000 x, 102, 76/ Corporate Accounting, , 35,000, 2,00,000, , 3,00,000, , By Liquidator Remuneration, 5% on, 2% on, , 784, , 39216, , 3,00,000, June To Asset Realised, June, 24, Current Assets, 1,00,000, 24, Add Excess provision, for expenses, 4,000 | 1,04,000|, , 25,000, , Rs., , 40,000, , Rs. 784, , Rs. 1,941