Page 1 :

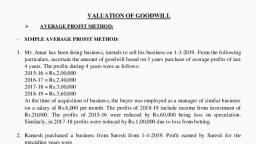

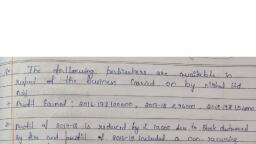

aah arian ad 3 at oe aq aad, , The net profits of the company ROU % Sap % yay art S Ge at Pet sare & :, taxation, were as under : leducting all working charges and providing for depreciation and, , Year ended 31st March, 2011 ., 2012 85,000, 2013 96,000, 2014 90,000, 2015 1,00,000, , 31 AP 2015 at aH a wax 250,000 z OS ae 150,000 & oe yeaifea at wat, , Sere ele Fae @ ae aren Ta Re a Sh ae 10% sara fa BI, We a ae & shes am oe orafta atari & da at & aa & ona oe wa a RE Aa wT, , On 31st March 2015, Land and Buildings were valued at Z 2,50,000 and Plant and Machinery at, , 1,50,000. In view of the nature of the business, it is considered that 10% is a reasonable retum on, tangible capital. f, , Find out the value of goodwill based on the five years’ purchase of th fits based on thi, profit of the last five years, : —— es, , (Answer : © spital Employed 7 6,88,000; Value of Goodwill Z 1,22,000), , Annuity of Super Profit \victhod, , 14. A fefo @ stead fatratiort Soi 3,00,000 F 21 gq sent & aa dH aut F ara BM: 35,000 F, 45,000 X, GH 46,000 F 21 fas sary 12% sitet 31 atarat S ax aa S aa S oar wx arial Aft a eae, St TT sr |, 12% vicad 8 ax at % fer 0.32923 F am ada yea 1 TBI, Average capital employed of A Ltd. is € 3,00,000. Profit of this company during the last three years, respectively are % 35,000, % 45,000 and % 46,000. Fair return is 12% p.a. Calculate goodwill by, Annuity Method on the basis of four years’ purchase of super profits., The present value of f 0.32923 annuity for 4 years at 12% p.a. is = 1., , : . (Answer : Goodwill = 18,224), , 15. Fra Genet} ora oe eae a arate ails gh vat F omer oe si, @ staat farraticta git 4,00,000 %; (ii) AAA AH-2T 10%; (iii) A 2013 ¥ 62,000 %, 2014 ¥, 59,000 & aa 2015 ¥ 66,000 &; (iv) 2014 4 ara 4 TT 2,000 F Ht aaa a auieiaa aS, am Ht 72 % atx 2015 af % cra F 3,000 & at arrade ona abate @; (v) ata A TTT aa S, am aot & ma a atte afr overt We SA; (vi) Ga at S fea 10% ofoat we 1 ea atte a, ASAT APA 2.4868 F FI, From the following information, compute the value of goodwill as per Annuity Method :, (i) Average capital employed ¥ 4,00,000; (ii) Normal rate of profit 10%; (iii) Profit for 2013 F 62,000,, 014 & 59,000 and 2015 ¥ 66,000; (iv) Profit for 2014 has been arrived at after writing off abnormal, oss of & 2,000 and profit for 2015 includes a non-recurring income of F 3,000; (v) Goodwill is to be, lated on the basis of annuity of 3 years’ purchase of super profits. (vi) The present value of an, y of <1 for 3 years at 10% p.a. is Z 2.4868., r ; Goodwill € 54,709.60), , , , , , , , , , , aad ert a at a See OH HTH T qa 4 3,00,000 & aft at a stad a, aaa 4 dt at et fea (@) Sa ee aT, writ st 40,000 & afte ar aaa a Paar wat, , 2, Sp, i, 4, al,, at, 3”, ata

Page 2 :

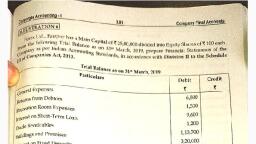

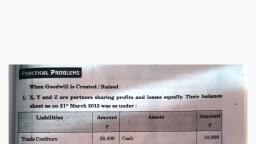

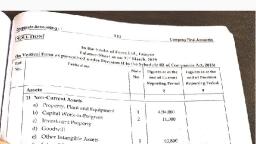

11.36 Pris 2a-Rit, , 3a Gt) a4 3 aoe 3 ey oe BS 1 ee Bs Se ESE, 38 Sex 3 occa 9 RRSRa GS wt Gs ee OS ET TE, , Sear & Gem 4 Re 2 ae a ee a ST :, A company desirous of selling its business to another company has camed in the past an average profit, of Z 3,00,000 per annum. It is considered that such average profit are likely to be maintained in future, also except that (2) Directors’ fees of Z 26,000 per annum will not be payable by the purchasing, company. (b) Rent of building at ¥ 40,000 p.a will not be paid by the purchasing company., , The value of net tangible assets of the vendor company at the beginning of the year, L¢., 12 months, before the date of purchase, was % 36,50,000. in this type of business 8% is considered to be reasonable, return on capital invested., , Calculate the value of goodwill by capitalisation of super profit method., , (Answer : Average capital invested Z 38,00,000; Super Profit ¥ 56,000; Goodwill & 7.00.00), , fete ¢ fact @ dita Pe?, , o ing is an abstract of the Balance Sheet of B Led. :, , , , , , , , , , , , , , , , Equity and Liablites, Assen, 00, 60,000, 40,000, 3,00.000, , fio & art re: 50,000 %; 60,000 % wa 70,000 fF) waht & FSR PS er, , ‘fier 40,000 %, Far We wet Se SIT 15% sit ate, @ @ wen aA ar fit wo eas 4 afm Fae, for the last three years respectively are T 50,000, Z 60,000 and % 70,000., under :, % 40,000, Debtors at book value. Normal rate of return is 15% p.a. Use only, ‘out goodwill by Capitalisation Method., },000), , aa Pacer Prefafea 2 :, heet of A Ltd. as on 31st March 2015 :, , , , 5,00,000, , 1,50,000, 25,000, 45,000, , 1,50,000, , 2,30,000, 1,00,000, 12,00,000