Page 1 :

GROUP —F, ECONOMIC AND FISCAL ADMINISTARTION GR, PAPER - I, , INDIRECT TAXES, , UNITI, , Goods and Services Tax: Nature and scope of GST. Overview of the Central Goods and Services, Tax Act, 2017 and the Uttar Pradesh Goods and Services Tax Act, 2017., , Important terms and definitions under the Act. Meaning and Scope of Supply. Time of Supply., Valuation in GST. Input Tax Credit. Tax Invoice. Credit and Debit Notes. Electronic Way Bill., Impact of GST on Job Work and Electronic Commerce. Input Service Distributor. Registration, Procedure. GST Rates and Exemptions. Composition Scheme., , UNIT I, , General Procedures: Returns-Types and Filing Procedure. Payment of Tax. Interest on delayed, payment of tax. Deduction of Tax at Source. Collection of Tax at Source. Refund of tax. Accounts, and other records., , An Overview of the Integrated Goods and Services Tax Act, 2017. Determination of Nature of, Supply, Inter-State supply. Intra-State supply. Supplies in territorial waters. Place of supply of goods., Zero rated supply. Apportionment of tax and settlement of funds. Transfer of input tax credit., , UNIT I, , GST Administration: GST Council. GST Network- Ecosystem of GST Suvidha Providers. Dual, Control in GST-Division of Jurisdiction and Administrative Powers over Assessees., , Authorities and Powers: Officers under the Act. Powers of officers. Levy and collection of tax., Power to grant exemption from tax. Assessment and Audit by Authorities. Inspection, search and, seizure. Demands and Recovery. Advance Ruling. Appeals, Reviews and Revision. Offences,, Penalties and Prosecution., , UNIT IV, , Customs: Role of customs in international trade: Important terms and definitions under the customs, act 1962: Assessable value: Baggage: Bill of entry: Dutiable goods: Duty : Exporter: Foreign going, vessel: Aircraft goods: Import: Import Manifest: Importer: Prohibited goods: Shipping bill: Store:, Bill of lading : Export manifest: Letter of credit: Kinds of duties basic, auxiliary, additional or, countervailing: Basic of levy advalorem, specific duties: Prohibition of export and import of goods, and provisions regarding notified & specified goods: Import of goods-free import and restricted, import: Types of Import-import of cargo, import of personal baggage, import of stores., , Clearance Procedure-for home consumption, for warehousing, for re-export: Clearance procedure for, import by post: Prohibited exports: Canalized exports: Exports against licensing: Types of exports,, export of cargo, export of baggage: Export of cargo by land, sea and air routes.

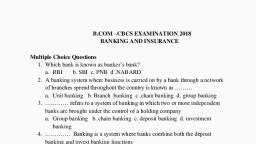

Page 2 :

GROUP —F, PAPER - II, , INDIAN BANKING SYSTEM, COURSE INPUTS, , UNIT Indian banking System: Structure and Organization of banks: Reserve Bank of India: Apex, banking institutions: Commercial Banks: Regional Rural Banks: Co-Operative Banks:, Development Banks., , UNITUState Bank of India: Brief History: Objectives: Functions: Structure and Organization:, working and Progress., , UNIT_T1Banking Regulation Act 1949: History: Social Control: Banking Regulation Act as, applicable to banking companies and public sector banks: Banking Regulation Act as, applicable to co-operative banks., , UNIT IVRegional Rural and Co-operative Banks in India: Functions: Role of regional rural and, cooperative banks in rural India: Progress and Performance., , UNIT VReserve Bank of India: Objectives: Organization: Functionsand working: Monetarypolicy:, Credit control measures and their effectiveness.

Page 3 :

GROUP _-F, PAPER — I, PUBLIC FINANCE, , COURSE INPUTS, , UNIT _IMeaning & Scope of Public Finance Public goods vs. Private goods , Principle of Maximum, Social Advantage, Public Budget , Techniques of Budgeting(ZBB PBB), Deficit, Financing., , UNIT IPublic Expenditure: Meaning&Nature, Wagner’s views on increasing state activities, Wiseman-peacock hypothesis, Canons and classification of public expenditure effects, on production, distribution and economic stability., , UNIT__ITPublic Revenue: Main sources of revenue, Tax revenue , Direct and Indirect Taxes,, Progressive, proportional & Regressive Taxes, Value added tax, The Division of tax, burden, Incidence of a tax, effects on production & distribution., , UNIT _IVPublic Debts: Role and classification of Public debts and methods of their, redemption., , UNIT Vindian Public Finance: Financial Federalism under constitution, Financial Adjustments in, India, Finance Commission, review of Indian Tax System. Budgetary Procedure and, Financial Control in India.

Page 4 :

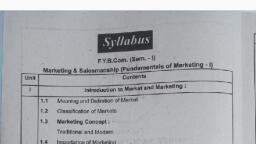

GROUP —D, PAPER -I, PRINCIPLES OF MARKETNG, , COURSE CONTENTS, , UNIT Introduction: Nature and Scope of Marketing: Importance of Marketing as a business, function and in the economy: Marketing concepts-traditional and modern: Selling VS, marketing: Marketing Mix: Marketing environment., , UNIT IConsumer Behavior and Market Segmentation: Nature, scope and significance of, consumer behavior : Market segmentation-concept and importance: Bases for market, segmentation. Marketing Research; Nature Scope, Process and Limitations., , UNIT I1IProduct: Concept of Product, Consumer and Industrial goods: Product planning and, development: Packing-role and functions: Brand name and trade mark: After sales, services: Product life cycle concept., , UNIT IVPrice: Importance of Price in the Marketing Mix, Factors affecting price of a, Product/Services., , UNIT _VDistributions Channels and Physical Distribution: Distribution channels-concept and role: Types, of distribution channels: Factors affecting choice of a distribution channel: Retailer and, , Wholesaler: Physical distribution of goods: Transportation: storage and Warehousing., , UNIT ViPromotion: Methods of promotion: Optimum promotion mix:

Page 5 :

GROUP -—D, PAPER — II, , ADVERTISING AND SALES PROMOTION, COURSE INPUTS, , UNIT IPersonal Selling, Process of Selling, Communication Process: Basic Communication Process,, role of source: Encoding and Decoding of message, media, audience, feedback and, noise., , UNIT. If = Advertising and Communication mix: Different advertising functions: Types of, advertising: Economic aspects of advertising: Advertising process an overview: Setting, advertising objectives and budget., , UNIT III Creative Aspects of Advertising: Advertising appeals, copy writing, headlines,, illustration, message , copy types; campaign planning., , UNIT TVAdvertising Media: Different types of media: Media planning and scheduling., UNIT _Vimpact of Advertising: Advertising agency roles, relationship with clients, Advertising, , department ; Measuring advertising effectiveness, Legal and Ethical aspects of, advertising., , UNIT_VISales Promotion, Meaning, Nature and Functions: Limitation of sales promotion: Types of, Sales promotion schemes: Consumer and trade, sales promotion., , UNIT _VUSales Promotion Schemes: Sampling: Coupon: Price Off: Premium plan: Consumer, contests and sweeps takes: POP displays: Demonstration: Trade fairs and exhibitions: