Page 1 :

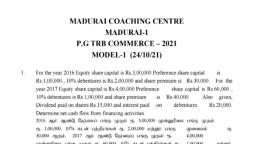

CORPORATE TAX LAW AND PLANNING, M.Com, PRACTICAL PROBLEMS, 01. Mr. Kiran is working in Education department of the Karnataka Government, in Bengaluru. His salary particulars for the month of April 2016 are as follows., •, •, •, •, •, , Basic Pay – 90,000/- per month., Dearness Allowance – Rs.54,000/- per month., HRA- 9,000/- per month., Actual Rent paid is 15,000/- per month., He is working under New Pension Scheme., , As a tax consultant, advice the company manager to make appropriate TDS, for the year., Solution:As tax consultant, responsible class of society, in one hand, it’s my duty to, work in sprit of law, and in other hand, it’s my duty to work for as beneficial to my, client., By considering all the dimensions of the law and company, following TDS, is advised to company manager., Assumptions:a. As the problem provides only particulars of April 2016, it is further, assumed that, Mr. Kiran receives the same salary components throughout, financial year 2016-17., b. Tax liability is calculated as per the details provided by company manager., c. Mr. Kiran has income under salary head only., , NN, , Page 1

Page 2 :

Computation of Total Taxable Income of Mr. Kiran, For the Assessment Year 2017 – 2018,, Relevant to the previous year 2016 – 2017, Particulars, , Amount, , Basic Salary ( 90,000 x 12 ), , 10,80,000, , Dearness Allowance ( 54,000 x 12 ) (Note 1), , 6,48,000, 1,00,800, 18,28,800, , Taxable House Rent Allowance (Note 2) (8,400x12), Gross Salary Income, Less : Deduction u/s16 (iii), Professional / Employment Tax (200 x 12 months), Taxable salary, , 2,400, 18,26,400, , Gross Total Income, , 18,26,400, , Less: Deduction u/s 80CCD, New pension scheme (10% of salary*), , 1,72,800, , (14,400x12 = 1,72,800), (1,72,800 or 2,00,000, W.E.Less) (Note 3), Total Taxable Income, , 16,53,600, , Working Notes:*Salary = Basic salary + Dearness allowance (as per service benefits), i.e., 90,000 + 54,000 = 1,44,000/Note-1: As problem doesn’t provide that whether Dearness Allowance is entered, into service benefits OR not. So, Dearness Allowance is assumed as Dearness, Allowance in entered into service benefits., , NN, , Page 2

Page 3 :

Note-2: Computation of Exempted and Taxable HRA., Particulars, Amount, Actual HRA Received, 9,000, Less : Exempted HRA(Least of following), i. Actual HRA Received or, 9,000, 600, ii. Rent Paid, less 10% of Salary* or, 600, (15,000 – 14,400), iii. 40% of Salary*, 57,600, Taxable HRA, 8,400, *Salary for the Computation of Exempted HRA = Basic salary + Dearness, allowance (as per service benefits) i.e., 90,000 + 54,000 = 1,44,000/Computation of Tax Liability of Mr. Kiran, For Assessment Year 2017 – 2018, Relevant to the Previous Year 2016-2017, Particulars, Amount Amount, Total Income, 16,53,600, Add : Agricultural Income, --Aggregate Income, 16,53,600, Tax on Casual Income @ 30 %, --Tax on STCG u/s 111a @ 15 %, --Tax on LTCG @ 20 %, --Tax on Deemed Income @ 30 %, --Tax on remaining Income*, 3,21,080, 3,21,080, Add : Education cess, 1. Primary education cess @ 2%, 6,422, (3,21,080 x 2/100), 2. Higher education cess @ 1%, 3,211, (3,21,080 x 1/100), 9,633, 3,30,713, Tax Liability, 3,30,713, Rounded off u/s 288B = Rs.3,30,710/NN, , Page 3

Page 4 :

*Calculation of Tax on remaining income, Slab, Rate, Calculation, Up to- 2,50,000, Nil, 2,50,000-5,00,000, 10%, 2,50,000 x 10/100, 5,00,000-10,00,000, 20%, 5,00,000 x 20/100, 10,00,000 - 16,53,600, 30%, 6,53,600 x 30/100, Total Tax on remaining income, , Tax amount, ---25,000, 1,00,000, 1,96,080, 3,21,080, , Note-3: From AY 2016-17, the ceiling in case of NPS has been extended to, additional of 50,000, subjected to where other deductions u/s 80C and 80CCC are, Nil. Therefore, the total amount eligible for NPS is Rs.2,00,000/Computation of Monthly Tax to be deducted at source for FY 2016-17, = Total tax liability as per available information / no. months in a year, = 3,30,710 / 12, = Rs.27,560/Therefore, it is advised to company manager to deduct Rs.27,560/- as tax, from the salary income of Mr. Kiran., 02.Calculate ARV (Annual Rental Value), for previous year 2016-17., From the particulars given below,, • MunicipalRental Value (MRV) – 1,20,000/• Fair Rental Value (FRV) – 1,32,000/• Actual Rent – 14,000 p.m., • Standard Rent – 13,800 p.m., a. The house was vacant for full year., b. The house was vacant for 2 months., c. Actual rent of the house is Rs.8000 per month and was vacant for 2, months., , NN, , Page 4

Page 5 :

Solution:, Assumptions:, a. Assesse is in sprit of law, and vacancy period given by him is truth and he, is able to produce required documents to prove such vacancy., b. There will be no unrealized during the year in the time of vacancy., Case-1: House was vacant for full year., Computation of Gross Annual Value for given House, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Municipal Value, 1,20,000, a), OR, whichever is Higher, Fair Rent, 1,32,000, Value determined by(a)-(Reasonable Expected Rent), 1,32,000, b), OR whichever is Less, Standard Rent (13,800 p.m x 12), 1,65,600, Value determined by (b) -(Expected Rent), 1,32,000, c), (Note), Actual Rent Received(14,000 x 0 months), NIL, Gross Annual Value, NIL, Note: This Problem provides the information about monthly rent and full year, vacancy of the house. Therefore, Actual Rent Received will be NIL. And, due to, vacancy, Expected Rent and Actual Rent Received are not comparable, and actual, rent received will be annual rental value/Gross Annual Value, as per sec 23(1)(c), of income tax act, 1961., Case-2: House was vacant for two months., Computation of Gross Annual Value for given House, For Assessment year 2017-18, Relevant to previous year 2016-17, , NN, , Page 5

Page 6 :

Particulars, Municipal Value, a), OR, whichever is Higher, Fair Rent, Value determined by (a) -(Reasonable Expected Rent), b), OR, whichever is Less, Standard Rent (13,800 p. m x 12), Value determined by (b)-(Expected Rent), c), (Note), Actual Rent Received, (14,000 x 10 months), Gross Annual Value, , Amount, 1,20,000, 1,32,000, 1,32,000, 1,65,600, 1,32,000, 1,40,000, 1,40,000, , Note: This Problem provides the information about monthly rent and vacancy, period of the house. Therefore, Actual Rent Received will be for 10 (12-2)months., And, due to vacancy, Expected Rent and Actual Rent Received are not comparable,, and actual rent received will be annual rental value/Gross Annual Value, as per sec, 23(1)(c) of income tax act, 1961., Case-3: House was vacant for two months. (Actual rent is 8000 pm), Computation of Gross Annual Value for given House, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Municipal Value, 1,20,000, a), OR, whichever is Higher, Fair Rent, 1,32,000, Value determined by (a) (Reasonable Expected Rent) 1,32,000, b), OR, whichever is Less, Standard Rent, (13,800 p. m x 12), 1,65,600, Value determined by (b), (Expected Rent), 1,32,000, c), (Note), Actual Rent Received, (8,000 x 10 months), 80,000, Gross Annual Value, 80,000, , NN, , Page 6

Page 7 :

Note: This Problem provides the information about monthly rent and vacancy, period of the house. Therefore, Actual Rent Received will be for 10 months. And,, due to vacancy, Expected Rent and Actual Rent Received are not comparable, and, actual rent received will be annual rental value/Gross Annual Value, as per sec, 23(1)(c) of income tax act, 1961., , Just for knowledge: The logical reasoning behind this provision is, as assesse is, already harassed by annual rent (i.e., non-receipt of rent, due to vacancy), he/she is, has to be relived, where he will be liable for expected rent, which may be higher, than actual rent received by assesse., , 03.Mr. Z is engaged in the business of manufacturing of computer. Given below is, the information of previous year, Particulars, , Amount (Rs.), , Sales revenue (Domestic), Sales revenue (Export), Less:- Expenses, Depreciation, Salary & wages, Entertainment expensed, Miscellaneous, Income Tax (2014-15), Provision for Contingencies, Proposed Dividend, , Rs.25,40,000, Rs.15,50,000, Rs.40,90,000, 19,00,000, 5,50,000, 1,10,000, 50,000, 4,50,000, 1,70,000, 2,50,000, , Rs.34,80,000, , For tax purpose, he creates to claim the following deductions u/s 80 HHC,, foreign exchange remittance Rs.50,000/NN, , Page 7

Page 8 :

Unabsorbed depreciation carried forward 2010-11 Rs.50,000/Depreciation u/s 32(1) (iia) Rs.1,80,000/Calculate the tax liability on total taxable income of Mr. Z for assessment year, 2017-18., Solution:Assumption:, 1. Z ltd. is assumed to be domestic company., 2. Following tax liability is computed in spirit of law., 3. Depreciation provided in the statement of information is about the normal, depreciation and depreciation u/s 32(1)(iia) address for additional, depreciation. As it is further assumed that, depreciation provided in, statement doesn’t include such depreciation u/s 32(1)(iia). Therefore, both, normal and additional depreciation are admissible., 4. Miscellaneous are assumed to be business related expenses., 5. Deduction u/s 80 HHC is not allowable from AY 2005-06., 6. As the problem doesn’t provide any turnover information, and tax liability, is calculate in spirit of law, corporate tax rate of 30% is chosen., Computation of Tax liability as per total taxable income of Z Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, , Amount, , Amount, , Admissible income:, a. Sales revenue (Domestic), b. Sales revenue (Export), , 25,40,000, 15,50,000, , 40,90,000, , Less: Admissible expenses:, a. Depreciation (19,00,000 + 1,80,000), b. Salary & wages, c. Entertainment expensed, d. Miscellaneous, , 20,80,000, 5,50,000, 1,10,000, 50,000, , 27,90,000, , NN, , Page 8

Page 9 :

Profit for the year, Less: Unabsorbed depreciation:, Gross total Income, Less: Deduction under chapter VI-A, Total Taxable Income, , 13,00,000, 50,000, 12,50,000, ---12,50,000, , Tax at 30% - (12,50,000 x 30%), Add: Education cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, , 3,75,000, 7,500, 3,750, , Tax liability as per total taxable income, , 11,250, 3,86,250, , 04. Mr. Ramesh, a resident purchased a capital asset in September 2007 for, Rs.2,50,000/-. He sold that particular capital asset in January 2017 for, Rs.50,00,000/- for which he paid brokerage of Rs.75,000/-. He made the following, improvements to capital asset., a) In 2010-11 which costs- Rs.1,00,000/b) In 2014-15 costs Rs.75,000/Compute taxable income from capital gain for the assessment year 2017-18., [CII→ 2016-17: 1125, 2014-15: 1024, 2010-11: 711, 2007-08: 551], Solution:Computation of Taxable Capital Gain of Mr. Ramesh, For assessment year 2017-2018, Relevant to the Previous Year 2016-2017, Particulars, Amount, Amount, Capital Asset (Long term capital asset), Sales proceeds, 50,00,000, Less : selling expenses, 75,000, Net sales proceeds, 49,25,000, NN, , Page 9

Page 10 :

Less : (i) Indexed cost of acquisition*, (ii) Indexed cost of Improvement**(a+b), Long Term Capital Gain, Less : Exemption, Taxable long term capital gain, , 5,10,436, 2,40,626, , Total Taxable Capital Gain, , 7,51,062, 41,73,938, ----41,73,938, 41,73,938, , *Determination of Indexed cost of acquisition:, Cost of acquisition X Current previous year’s cost of Inflation Index, Cost Inflation Index for 2007-08, i.e., = 2,50,000 x 1125, 551, = 5,10,436., **(a) Determination of Indexed cost of improvement : (2010 - 11), Cost of improvement X Current year’s cost of Inflation Index, Cost Inflation Index for 2010-11, i.e., = 1,00,000 x 1125, 711, = 1,58,228.(a), **(b) Determination of Indexed cost of improvement : ( 2014-15), Cost of improvement X Current year’s cost of Inflation Index, Cost Inflation Index for 2014-15, i.e., = 75,000 x 1125, 1024, = 82,398.(b), (a+b) = 1,58,228 + 82,398 = 2,40,626., , NN, , Page 10

Page 11 :

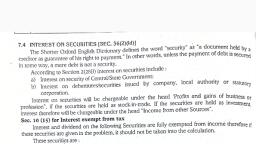

05.ABC Company Ltd. Has made following Investments during the year ended, 31/03/2016, which constitutes the following information•, •, •, •, •, •, •, , Rs.17,500/- ,10% Govt. Securities, Rs.10,000/-12% Agra Municipal Bonds, Rs.20,000/- 9% Bombay Port Trust Bonds, Rs.10,000/- 7 years post office nations saving certificate, Rs.10,000/-, 9% securities issued by a foreign Govt., 7% Government bonds Rs.18,000/7% National plan Certificate Rs.5,000/The Company paid Rs.600/- as commission for collecting the interest, taxable under the head interest on securities., , Find out the taxable income of ABC Co. Ltd. from other sources., Solution:Assumptions:, a. Assesse has maintained the books of accounts in mercantile system of, accounting., b. Investments are accrued and still not received., Note: Problem provides only the investment portfolio of company., Computation of Taxable Income from other sources of ABC Company Ltd, For Assessment Year 2017-2018, Relevant to previous Year 2016-2017, Particulars, a. 10% Govt. Securities (17,500 x 10/100), , Amount Amount, 1,750, , (Assumed to be less-tax govt. securities), b. 12% Agra Municipal Bonds(10,000 x 12/100), , 1,200, , c. 9% Bombay Port Trust Bonds (20,000 x 9/100), , 1,800, , d. 7 years post office nations saving certificate, NN, , ---Page 11

Page 12 :

(Exemption u/s 10(15)), e. 9% securities issued by a foreign Govt. (10,000 x 9/100), f. 7% Government bonds (18,000x7/100), , 900, 1,260, , (Assumed to be less-tax govt. securities), g.7% National plan Certificate. (Exempt), , ---6,910, , Less: a) Collection charges., , Total Taxable Income from other sources, , 600, , 6,310, , 06. An employer paying salary of Rs.1,25,000/- per month [Basic SalaryRs.75,000/-, Dearness Allowance-Rs.35,000/-, HRA-Rs.15,000/-]. Addition to the, above salary he has also received a perquisite of Rs.23,000 as medical treatment, for himself. He is recently joining to the organization and he borrow the house, building loan of Rs.10,00,000/- and he is paying EMI of Rs.12,000/[8,000+4,000]., As a tax consultant, advice the company manager to make proper TDS for the, financial year 2018-19., Solution:As tax consultant, responsible class of society, in one hand, it’s my duty to, work in sprit of law, and in other hand, it’s my duty to work for as beneficial to my, client., By considering all the dimensions of the law and company, following TDS, is advised to company manager., Assumptions:, a. Problem provides the salary details of one month, and it is further assumed that,, whole of the financial year, employee receives same amount of salary., b. It is assumed that, dearness allowance is provided in the terms of service, benefits., NN, , Page 12

Page 13 :

c. Medical treatment is received once in year. It is further assumed that, such, medical treatment has been taken in private hospital., d. Employee has recently joined the company, and paying EMI for house, it, assumed that, employee resides in his own house. Thus, HRA received is fully, taxable., e. As loan is recently taken, it is common that, Outstanding loan is more. Thus, in, case of EMI, principal will be less and interest will be more., f. It is assumed that, Employee has completed the construction for house and, awarded the construction completion. Thus, he is eligible to take u/s 24(ii) benefit., Due to unclear information about pre construction period, only u/s 24 (iia) i.e.,, previous year interests paid are considered., g. Tax liability is calculated as per the details provided by company manager., f. Employer and employee relate to Karnataka, and thus, pay professional tax., i. Given employee has income under salary head and loss under house property, only., Following is calculation of monthly TDS for given employee, to advise TDS, to deduct same., Computation of total taxable income of employee, For Assessment Year 2019 – 2020, Relevant to the financial Year 2018-2019, Particulars, A. Income from salary, a) Basic pay (75,000 x 12), b) Dearness allowance (35,000 x 12), c) House Rent Allowance (15,000 x 12), d) Perquisite: Medical treatment, Less: Professional tax (200 x 12), Less: Std. deduction [17(2)(viii)], Income from salary, , NN, , Amount, , Amount, , 9,00,000, 4,20,000, 1,80,000, 23,000, 15,23,000, 2,400, 40,000, 14,80,600, , Page 13

Page 14 :

B. Taxable Income from house property, Annual Value, Less: Deduction u/s 24(iia), Previous year interest (8,000 x 12), Maximum qualifying amount, Gross total Income, Less : Deduction u/s 80C to 80U, 1. 80C, Principal amount in EMI (4000 x 12), Maximum eligible u/s 80CCE, , Nil, 96,000, 2,00,000, , (96,000), 13,84,600, , 48,000, 1,50,000, , Total taxable income, , 48,000, 13,36,600, , Computation of Tax liability of employee, For Assessment Year 2019 – 2020, Relevant to the Financial Year 2018-2019, Particulars, Total Income, , Amount Amount, 13,36,600, , Tax on Casual Income @ 30 %, Tax on STCG u/s 111a @ 15 %, Tax on LTCG @ 20 %, Tax on Deemed Income @ 30 %, Tax on remaining Income*, Add : Health and education Cess @ 4%, Tax Payable, Rounded off u/s 288B = Rs. 2,22,020 /-, , --------2,13,480, 2,13,480, 8,539, 2,22,019, , *Tax on remaining Income(as per slab rate) :, Given Total Remaining Income = 13,36,600., Therefore, Tax on first 2,50,000 = NIL., NN, , Page 14

Page 15 :

Tax on next 2,50,000 =12,500(a).(5% of 2,50,000), Tax on next 5,00,000 =1,00,000(b).(20% of 5,00,000), Tax on Balance = 1,00,980(c).(30% of 3,36,600), Tax on remaining income = (a+b+c) = 12,500 + 1,00,000 + 1,00,980 = 2,13,480., Therefore, from the above computation, tax liability of employee is Rs. 2,22,020/Computation of Monthly Tax to be deducted at source for FY 2018-19, = Total tax liability as per available information / no. months in a year, = 2,22,020, 12, = Rs. 18,502/Therefore, it is advised to company manager to deduct Rs. 18,502/- as tax, from the salary income of employee., 07. Following are the income X. Ltd. For the year ending,, Particulars, Business profit, Dividend from Indian public sector (Gross), Dividend from Indian Company (Whose 80%, income is, agricultural income-Gross), Income from Mutual funds (Gross), Royalty received from foreign concerns providing technical, knowledge, Fee for Indian Company for technical advice, Dividend from foreign company, , Amount, 82,000, 10,000, 2,000, 50,000, 16,000, 12,000, 8,000, , Company has donated to National Rural Development fund during the assessment, year- Rs.88,000/Compute the total taxable income of the company for the assessment year 2017-18, and the tax liability, if the book profit of the company is Rs.10,00,000 u/s 115., , NN, , Page 15

Page 16 :

Solution:Computation of Total Taxable Income of X Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Profits and gains from business :, Business profit, Income from other sources:, a)Dividend from Indian public sector, ----b)Dividend from Indian Company (Whose 80%, income is agricultural income-Gross), ----c) Income from Mutual funds - Exempt u/s 10(23D), ----d)Royalty received from foreign concerns providing, technical knowledge, 16,000, e) Fee for Indian Company for technical advice, 12,000, f) Dividend from foreign company, 8,000, Gross Total Income, Less: Deduction u/s 80G, Donation to National Rural Development fund – Not eligible, Total Taxable Income, , Amount, 82,000, , 36,000, 1,18,000, ---1,18,000, , Computation of Tax liability as per total taxable income of X Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Total taxable income, 1,18,000, Tax at 30% (1,18,000), Add: Education cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, Tax liability as per total taxable income, , NN, , 35,400, 708, 354 1,062, 36,462, , Page 16

Page 17 :

Computation of MAT of X Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, , Amount, 10,00,000, , Total book profit, Tax at 18.5% (10,00,000 x 18.5/100), Add: Education cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, , 1,85,000, 3700, 1850, , Tax liability as per book profit, Computation of Tax liability of X Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Highest of the following :, a) Tax liability as per total taxable income- Rs.36,462, b) Tax liability as per MAT provision - Rs.1,90,550, Tax liability, , 5,550, 1,90,550, , Amount, , 1,90,550, 1,90,550, , 08.Discuss whether the company is liable to pay Advance Payment of tax and if, yes, then what amount should be paid by what date? The income of the company is, estimated 2,50,00,000/-. The company turnover of the financial year is 50 crores., Solution:Every assesse is liable to pay Advance tax, if his tax liability for current, financial year (income estimated year) exceeds Rs.10,000. In order to know,, whether company mentioned is liable to pay advance tax or not, tax liability is to, be computed., Assumption:, a) It is assumed that, company is domestic company., , NN, , Page 17

Page 18 :

b) The estimate income provided in the problem is estimated for financial year, 2016-17, thus corporate tax as per finance act 2016 is applicable., c) The problem is limited to the information of income, and further details, regarding book profit are not found. It is assumed that, tax liability as per given, income (under normal provision) is more than tax liability as per MAT provision., d) It is assumed that, income provided is taxable income of company., Computation of Estimated Tax liability as per normal provisions of company, For Assessment year 2017-18, Relevant to financial year 2016-17, Particulars, Amount, Total taxable income (estimated), 2,50,00,000, Tax at 30% (2,50,00,000 x 30/100), Add: Education cess:, a) Primary Education cess @ 2%, b)Secondary and higher education cess @ 1%, , 75,00,000, 1,50,000, 75,000, , Estimated Tax liability as per normal provisions, , 2,25,000, 77,25,000, , From the above computation, Estimated tax liability of given company stands, for Rs.77,25,000/-. Thus, company is liable to pay advance tax., Following table shows the dates and amount of tax to be paid as advance tax in, financial year 2016-17., [Tax liability: Rs.77,25,000/-], Advance tax, payment date’s, 15th June 2016, 15th September 2016, 15th December 2016, 15th March 2017, , NN, , Percentage of tax, liability to be paid, as advance tax on, respective date, 15%, 30%, 30%, 25%, , Amount of tax, liability to be paid, as advance tax on, respective date, 11,58,750, 23,17,500, 23,17,500, 19,31,250, , Total Amount of, tax liability to be, paid as advance, tax, 11,58,750 (15%), 34,76,250 (45%), 57,93,750 (75%), 77,25,000 (100%), , Page 18

Page 19 :

09. Mr. Akash, a resident gives the following information.Compute his gross total, income for the assessment year 2017-18., •, •, •, •, •, •, •, •, , Dividend on equity shares – Rs.5,000/Dividend on Preference shares -Rs.4,500/Income from Undisclosed source- Rs.7,000/Income from letting on hire of building and Machinery – Rs.30,000/Interest on Bank deposits – Rs.15,000/Income received from ground rent –Rs.6,000/Winning from Lottery- Rs.35,000/- (Net), Gift received, a) From his friend worth – Rs.80,000/b) Received gift worth Rs.1,40,000/- from his elder brother on the, occasion of his marriage., , Following deductions are claimed by him, i), ii), iii), , Bank charges for collecting his dividends –Rs.250/Depreciation on building & machinery- Rs.2,000/Fire insurance on Plant and machinery- Rs.450/-, , Solution:Computation of Gross Total Income of Mr. Akash, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Head 5: Income from other sources:, a) Dividend on equity shares –Exempt u/s 10(34), b) Dividend on Preference shares –Exempt u/s 10(34), c) Income from Undisclosed source, d) Income from letting on hire of building and, Machinery, e) Interest on Bank deposits, f) Income received from ground rent, NN, , Amount, , Amount, --------7000, 30,000, 15,000, 6,000, Page 19

Page 20 :

g) Winning from Lottery (35,000/70 x 100), h) Gift received, 1. From friend (Worth More than 50,000), 2. From relative, Less: Allowable expenses:, a) Bank charges for collecting his dividends, (As the dividend income is exempt, expenses are, not allowable), b) Depreciation on building & machinery, c) Fire insurance on Plant and machinery, , 50,000, 80,000, ----, , 80,000, 1,88,000, , ----, , 2000, 450, , Gross Total Income, , 2,450, 1,85,550, , 10.The WDV of the machine at the end of the previous year 2015-16 was, Rs.10,50,000/• Rate of depreciation is 25% p.a., • A new Plant & machinery was bought for Rs.6,50,000/- on 30th Nov 2016., • A part of old machinery was sold on 10th June 2016 for 2,00,000/- and, unobserved depreciation for the year 2015-16 was Rs.50,000/Calculate depreciation allowance and WDV of Plant and machinery for the, assessment year 2017-18., Solution:Assumption:, a) Given information is about manufacturing concern., b) New machinery is assumed to be installed on 30th Nov 2016 itself., c) Depreciation allowance is calculated by assuming, that, given business concern, doesn’t have any brought forward business loss., Calculation of Depreciation and WDV of plant and machinery, For Assessment year 2017-18, Relevant to previous year 2016-17, NN, , Page 20

Page 21 :

Particulars, W.D.V on 1.4.2016, Add: Addition of new plant & machinery, Less: sale of machinery, Less: Depreciation for PY 2016-17, 1) Normal depreciation*, a) 8,50,000 x 25/100, b) 6,50,000 x 12.5/100, 2) Additional depreciation**, a) 6,50,000 x 10/100, , Amount Amount Amount, 10,50,000, 6,50,000, 17,00,000, 2,00,000, 15,00,000, , 2,12,500, 81,250 2,93,750, , 65,000, , Written down Value on PY ending 2016-17, , 65,000, , 3,58,750, 11,41,250, , Calculation of depreciation allowance for previous year 2016-17, Particulars, Depreciation for PY 2016-17, Add: Unabsorbed depreciation of PY 2015-16, Depreciation allowance for PY 2016-17, , Amount, 3,58,750, 50,000, 4,08,750, , *As new machinery is bought in November 2016, it is used less than 180 days in, the PY 2016-17. Thus, only 50% of depreciation rate is applicable., Thus, 8,50,000 (15,00,000-6,50,000) is normally depreciate at 25% and new, machinery 6,50,000 is depreciated at 12.5% (25 x 50%), **As per section 32(1)(iia) of income tax act, 1961; Additional depreciation is, allowable for new plant and machinery at 20% (10% , if new plant and machinery, is used less than 180 days)., Thus, new plant and machinery is bought in November 2016, it is used less than, 180 days in the PY 2016-17. Thus, only 10% of additional depreciation rate is, applicable., NN, , Page 21

Page 22 :

11. ABC Ltd has a taxable income as per normal provisions of income tax act, Rs.40,00,000/- and Book Profit Rs.75,00,000/- for the financial year 2016-17., What is the tax liability of company whether the company comes under the, purview of MAT. If yes what will be the MAT credit?, Solution:Computation of Tax liability as per normal provisions of ABC Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Total taxable income, 40,00,000, Tax at 30% (40,00,000 x 30/100), Add: Education cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, , 12,00,000, 24,000, 12,000 36,000, , Tax liability as per normal provisions, , 12,36,000, , Computation of MAT of ABC Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Total book profit, , Amount, 75,00,000, , Tax at 18.5% (75,00,000 x 18.5/100), Add: Education cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, , 13,87,500, , Tax liability as per book profit, , NN, , 27,750, 13,875, , 41,625, 14,29,125, , Page 22

Page 23 :

Computation of Tax liability of X Ltd., For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Highest of the following :, a) Tax liability as per total taxable income- Rs. 12,36,000, b) Tax liability as per MAT provision - Rs.14,29,125, 14,29,125, Tax liability, 14,29,125, Rounded off toRs.14,29,130/Yes, ABC Ltd. is eligible to get MAT credit. Because, tax liability as per, MAT is more than tax liability as per normal provisions, and thus, tax is paid as per, MAT provisions., ABC Ltd. is eligible to get MAT credit of Rs. 1,93,125/(14,29,125 – 12,36,000) i.e., difference between tax liability as per normal, provisions and tax liability as per MAT provisions. It is eligible for first following, 10 assessment years. However, cess is not eligible for MAT credit., , 12.Mr. X owns the house, it was constructed out of housing loan Rs.20,00,000/borrowed from housing financial corporation paying EMI of Rs.24,000/- out of, which Rs.18,000/- for interest and remaining for principal. Compute taxable, income from House property of Mr. X for the assessment year 2017-18 from the, following information., a) Municipal Valuation – Rs.60,000/b) Standard Rent – Rs.90,000/c) Municipal Tax paid by the owner – Rs.12,000/d) Repairs – Rs.3,000/e) Ground Rent – Rs.4,000/f) Fire Insurance Premium – Rs.1,200/During the previous year 75% of the floor are is let out for residential purpose for, monthly rent of Rs.3,200/-, It was Vacant for 2 months during the year and, remaining floor area is utilized for the purpose of his residence., , NN, , Page 23

Page 24 :

Solution:Computation of Taxable Income from House Property of Mr. X, For the assessment year 2017-2018,, Relevant to the previous year 2016 -2017, Particulars, Amount, Amount, House I : Let-out Property (75% of house), Gross Annual Value*, 32,000, Less : a) Unrealized Rent, b) Municipal Tax (paid by owner), 9,000, Annual Value, 23,000, Less : Deduction u/s 24, (i) 30% of Annual Value (23,000 x 30/100), 6,900, (iia) Interest paid during the Previous year, 1,62,000, (18,000x75%x12), (iib) Pre-construction period Interest, ----(1,45,900) (1,45,900), House II : Self-occupied (25% of house), Annual Value, Less : Deduction u/s 24, (iia) Interest paid during the Previous year, (18,000x25%x12), (iib) Pre-construction period Interest, , Loss from House Property, , NIL, 54,000, ----(54,000), , (54,000), (1,99,900), , *Computation of Gross Annual Value for House I (LOP), Particulars, Amount, Municipal value (60K x 75%) (Reasonable Expected Rent), 45,000, a), OR, whichever is Less, Standard Rent (90K x 75%), 67,500, Value determined by (a), (Expected Rent), 45,000, b), OR, Actual Rent Received** (3,200 x 10), 32,000, Gross Annual Value, 32,000, NN, , Page 24

Page 25 :

**This Problem provides the information about monthly rent and vacancy period, of the house. Therefore, Actual Rent Received will be for 10 months. And, due to, vacancy, Expected Rent and Actual Rent Received are not comparable, and actual, rent received will be Gross Annual Value, as per sec 23(1)(c) of income tax act,, 1961., 13. The Company paying salary of Rs.95,000/- per month.[Basic SalaryRs.54,000/-, Dearness Allowance-Rs.30,200/-, HRA-Rs.10,800/-]. As a TDS, officer of the Company from the following information, calculate the tax payable, and prepare Form-16 for the assessment year 2017-18., •, •, •, •, •, , EMI on housing loan Rs.10,000/- (Int.-3,000/-+ Principal-Rs.7000/-), LIC monthly premium- Rs.400/Professional Tax- Rs.200 per month., Children tuition fee – Rs.45,000/Tax deduction from salary for month Rs.10,000/-, , Solution:, As TDS officer, responsible person of company, in one hand, it’s my duty to, work in sprit of law, and in other hand, it’s my duty to work for as beneficial to my, employer., By considering all the dimensions of the law and company, following TDS, is calculated., Assumptions:, a. Problem provides the salary details of one month, and it is further assumed that,, whole of the financial year, employee receives same amount of salary., b. As Employee is paying EMI for house, it assumed that, employee resides in his, own house. Thus, HRA received is fully taxable., c. It is assumed that, Employee has completed the construction for house and, awarded the construction completion. Thus, he is eligible to take u/s 24(ii) benefit., Due to unclear information about pre construction period, only u/s 24 (iia) i.e.,, previous year interests paid are considered., d. Tax liability is calculated as per the details provided by employee., e. Given employee has income under salary head and loss under house property, only., NN, , Page 25

Page 26 :

f. TDS officer is working within the due date, for crediting deducted TDS,, uploading quarterly TDS details, and issue of FORM-16., Following is calculation of monthly TDS for given employee, to deduct, same., Computation of total taxable income of employee, For Assessment Year 2017 – 2018, Relevant to the previous Year 2016-2017, Particulars, A. Income from salary, a) Basic pay (54,000 x 12), b) Dearness allowance (30,200 x 12), c) House Rent Allowance (10,800 x 12), Less: Professional tax (200 x 12), , Amount, , Amount, , 6,48,000, 3,62,400, 1,29,600, 11,40,000, 2,400, 11,37,600, , Income from salary, B. Taxable Income from house property, Annual Value, Less: Deduction u/s 24(iia), Previous year interest (3,000 x 12), Maximum qualifying amount, Gross total Income, Less : Deduction u/s 80C to 80U, 1. 80C, Principal amount in EMI (7000 x 12), LIC Premium (400 x 12), Children tuition fee, Maximum eligible u/s 80CCE, Total taxable income, , NN, , Nil, 36,000, 2,00,000, , (36,000), 11,01,600, , 84,000, 4,800, 45,000, 1,33,800, 1,50,000, , 1,33,800, 9,67,800, , Page 26

Page 27 :

Computation of Tax liability of employee, For Assessment Year 2017 – 2018, Relevant to the previous Year 2016-2017, Particulars, Total Income, Tax as per slab rate:, Tax on first 2,50,000 - Nil, Tax on next 2,50,000 – 10%, Tax on next 5,00,000 - 20%, (4,67,800 x 20%), , Amount Amount, 9,67,800, , Nil, 25,000, 93,560, , Add : Education Cess @ 3%, a. Primary education cess@ 2%, 2,371, b. secondary an higher primary cess @ 1% 1,186, Gross tax payable, Less: Tax deducted at source (10,000 x 12), Tax liability, Rounded off u/s 288B = Rs. 2,120 /-, , 1,18,560, , 3,557, 1,22,117, 1,20,000, 2,117, , Therefore, from the above computation, net tax liability of employee, after, deducting TDS paid, is Rs. 2,120/-., , FORM – 16, Form 16 is a certificate/document issued by an employer or TDS officer to all, his employees, who fall under tax bracket, for a particular financial year at the end, of the said year reflecting the total salary income, other income of employee and, amount of tax deducted ('TDS') during the year., It is responsible work of TDS officer to prepare and issue FORM – 16 for, every employee the TDS has been made., Form 16 consists of 2 parts, whereas Part-A deals with personal details of, employer and employee, and Part-B deals with salary and other income details., NN, , Page 27

Page 28 :

Preparation of FORM – 16 for Assessment year 2017-18, Form No.16, PART A, Certificate under section 203 of the Income-tax Act, 1961 for TDS on salary, 1. Certificate No: ________, 2. Name and address of employer:, 3. Name and address of employee:, 4. PAN and TAN of employer:, 5. PAN of employee:, 6. Assessment year: 2017-18, 7. Period with the employer: 1st April 2016 to 31st March 2017, 8. TDS paid, deducted and deposited details: 1,20,000 (10,000 per month), 9. BIN details:, 10. CIN details:, , PART-B, Details of Salary paid and any other income and tax payable, Particulars, Amount, 1. Gross salary, Total :, 11,40,000, 2. Deduction :, 16(iii) Professional tax (200 x 12), 2,400, 3. Income from salary (1-2), 4. Any other income reported by employee, (Loss from house property), 5. Gross total Income (3+4), 6. Deduction under chapter VI-A, a. Deduction u/s 80C, 1. 80C, Principal amount in EMI, LIC Premium, NN, , 11,37,600, (36,000), 11,01,600, , 84,000, 4,800, Page 28

Page 29 :

Children tuition fee, Maximum eligible u/s 80CCE – 1,50,000, 7. Aggregate deductible under chapter VI-A, 8. Total income (5-7), 9. Tax on total income, 10. Education Cess at 3%, 11. Tax Payable (9+10), , 45,000, 1,33,800, 9,67,800, 1,18,560, 3,557, 1,22,117, , 14. ABC Ltd. furnishes the following particulars. Compute the total taxable income, of the company for the assessment year 2017-18 (accounting year ended March 31,, 2017), 1. Net income Rs.31.34 lakh, which includes penal interest of Rs.31,000 paid for, the delayed payment of sales tax and interest of Rs.2 lakhs paid on fixed deposits, from public subjected to the following adjustments :, a) Depreciation which includes Rs.0.50 lakh for guest house building – Rs.1.65, lakh, b) Unabsorbed depreciation of the assessment year 2009-10 – Rs.7.35 lakh, c)Unabsorbed business loss forward – Rs. 24.48 lakh, 2. Short term capital gain on sale of shares (trade investment) – Rs. 0.99 lakh, 3. Long term capital gain on sale of equity shares on May 10, 2016 computed u/s, 48 - Rs. 2.52 lakh, 4. Brought forward short term capital loss -Rs. 0.45 lakh, 5. Brought forward long term capital loss of the assessment year 2012-13 on sale of, shares – Rs. 0.50 lakh, 6. Gross interest from Government securities – Rs. 1.27 Lakh, 7. Bank Commission etc., for realizing interest – Rs. 0.07 Lakh, Solution:Assumptions:, 1. Net income includes penal interest and interest on fixed deposits refers to Penal, interest and interest on fixed deposits is already deducted from income., 2. Guest house in meant for business guests only., NN, , Page 29

Page 30 :

Computation of total taxable income of ABC Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount Amount Amount, Income from business:, Net income, 31,34,000, Add: Disallowed expenses,-debited, a. Penal interest (allowable), ---b. Interest on fixed deposits, ------31,34,000, Less: Allowable expenses – Not debited, a. Depreciation, 1,65,000, Profit for the year, 29,69,000, Less: B/F business loss, 24,48,000, 5,21,000, Less: Unabsorbed depreciation, 5,21,000, Nil, Capital Gains:, A. Long term capital gain, Less: Long term capital loss, , 2,52,000, 50,000, , B. Short term capital gain, Less: short term capital loss, , 99,000, 45,000, , Income from other sources:, a. Interest from Govt. securities(Gross), Less: Bank Commission, Gross total income before unabsorbed deprecation, Less: Unabsorbed depreciation, [7,35,000 – 5,21,000(already set-off)] = 2,14,000, Gross total income, Total taxable income, NN, , 2,02,000, , 54,000 2,56,000, , 1,27,000, 7,000 1,20,000, 3,76,000, 2,14,000, 1,62,000, 1,62,000, Page 30

Page 31 :

15. Profit & Loss account of XYZ Company Ltd. disclosed the profit of Rs.80, lakhs. For the year ending March 31st 2017, before making any appropriation for, taxes, reserve for dividends. You are required to state with reasons how you treat, the following while computing the total income., I] Interest debited to P&L a/c include, a) Rs.4,00,000 on a loan borrowed for redeeming Pref. shares., b) Rs.16,00,000 on deposited accepted from public, II] The company acquired sick business on January 1st 2012 in receipt of the, business., a) A trade debtor went bankrupt. The company received Rs.40,00,000 as, against the bank balance of Rs.10,00,000, b) A trade debtor creditor to whom a sum of Rs.2,80,000 is payable as on, January 1st 1999 is not transferable., c) A due loan of Rs.20 lakhs. Granted by the state govt. or operator has been, received to the extent of 20%, The company has considered the above as revenue and accordingly adjusted its, account by debiting or crediting the P&L a/c as the above case may be., III] A company has paid a lump sum amount of Rs.60 lakhs to know technical, know-how from laboratory owned by the government in September 2016. This, is being treated as deferred revenue expenditure and sum of Rs.10 lakhs has, been charged to P&L a/c., IV] Details of sale, a) Domestic sales Rs.16,00,000, b) Export to USA Rs.4,00,000, It is ascertained that the export price is less by 20% when compared to the, domestic price., V] The company paid the annual remuneration of Rs.6,00,000/- to its Production, manager who’s retained on 2009-10 for supervising the creation of new plant. This, amount has been debited to capital work in progress., NN, , Page 31

Page 32 :

VI] The company has collected charity at @ 0.1% of its domestic sales. It has spent, Rs.60,000/- and other balances is been shown as liability., VII] The audit fees debited to P&L a/c includes Rs.20,000/- for appearing before, the assessing officer and Rs.40,000/- for conducting the tax credit., Solution:Note: Problem is asked to draft the treatment, and reason for same. Thus, it is, not required to compute taxable income or tax liability., I] a) Interest debited to P&L a/c includeRs.4,00,000 on a loan borrowed for, redeeming Pref. shares., Treatment: Interest Rs.4,00,000 is allowable.No adjustment is required., Reason: Interest on loan barrowed for redeeming pref. shares is nothing but capital, brought to business or business loan., I] b) Interest debited to P&L a/c include Rs.16,00,000 on deposits accepted from, public., Treatment: Interest Rs.16,00,000 is allowable.No adjustment is required., Reason: Interest paid on public deposits is business expenses., II] a) A trade debtor went bankrupt. The company received Rs.4,00,000 as against, the bank balance of Rs.10,00,000, Treatment: Rs. 4,00,000 chargeable to tax. i.e., No adjustment is required., Reason: As per section 36(1)(vii), a successor of the business will be entitle to, claim for an allowance for bad debts, even though the debt is not related to his, business., It is assumed that Balance of such trade debtor is shown in the books of, accounts in computing income if predecessor. After the transfer of sick business to, ABC ltd, as per section 36(1)(vii), such debt is subsequently written off as, irrecoverable debt in the books of ABC ltd., Thus, Debt is written off. Any income from such debt will be treated as, income of ABC ltd., , NN, , Page 32

Page 33 :

II] b) A trade creditor to whom a sum of Rs.2,80,000 is payable as on January 1st, 1999 is not transferable., Treatment: Rs.2,80,000 chargeable to tax. i.e., No adjustment is required., Reason: u/s 41(1), any trade creditor of business is not traceable. Such amount, should be treated as income., II] c) A due loan of Rs.20 lakhs. Granted by the state govt. or operator has been, waived to the extent of 20%, Treatment: Rs. 2,00,000 chargeable to tax. i.e., No adjustment is required., Reason: From assessment year 2017-18, any waived amount will be considered as, such respective business income., III] A company has paid a lump sum amount of Rs.60 lakhs to know technical, know-how from laboratory owned by the government in September 2016. This is, being treated as deferred revenue expenditure and sum of Rs.10 lakhs has been, charged to P&L a/c., Treatment: Additional Rs.5,00,000 has to debited to P & L account., Reason: As per section 32, any sum paid to technical know-how can be chargeable, to depreciation at 25%. Thus, 15,00,000 allowable and only 10,00,000 is charged., IV] Details of sale, a) Domestic sales Rs.16,00,000, b) Export to USA Rs.4,00,000, It is ascertained that the export price is less by 20% when compared to the, domestic price., Treatment: Deduction u/s 80HHC: NIL, Reason: From assessment year 2005-06, deduction is not allowed u/s 80HHC., V] The company paid the annual remuneration of Rs.6,00,000/- to its Production, manager who’s retained on 2009-10 for supervising the creation of new plant. This, amount has been debited to capital work in progress., Treatment: Rs.6,00,000 has to be debited. i.e., No adjustment is required., NN, , Page 33

Page 34 :

Reason: As remuneration is deducted from the capital work in progress. It has, reduced the ABC ltd’s income to that extent., VI] The company has collected charity at @ 0.1% of its domestic sales. It has spent, Rs.60,000/- and other balances is been shown as liability., Treatment: As capital receipt. i.e., No adjustment is required., Reason: ABC ltd is assumed profit oriented business. It has collected Rs.1600, (16,00,000 x 0.1%) as charity i.e., non-trading receipt. Assuming that, ABC ltd. is, at spirit of law, any such balance of charity is treated as liability., VII] The audit fees debited to P&L a/c includes Rs.20,000/- for appearing before, the assessing officer and Rs.40,000/- for conducting the tax credit., Treatment: Rs. 60,000 is allowable. i.e., No adjustment is required., Reason: Audit fees relating to appearing before assessing officer and conducting, tax credit is business related expenses., 16.Mr.Sunil furnished the following information of the income for the Assessment, year 2017-18 (Financial year- 2016-17), •, •, •, •, •, , Gross Total Income amounted to Rs.4,70,000/Insurance Premium paid (Policy amounted to Rs.1,20,000) - Rs.26,000/Donation towards National Defense Fund Rs.20,000/Deposited in PPF Rs.60,000/He has paid medical insurance premium of Rs.500/- by cheque., Compute Tax liability of Mr. Sunil., , Solution:Assumption:, a) Information of income given in the problem is related to financial year 2016-17., Such income is assessed to pay tax in financial year 2017-18., b) It is assumed that, policy has been issued on or after 1 st April 2012. Such policy, is for normal life coverage., NN, , Page 34

Page 35 :

Thus, financial year 2016-17 is termed as previous year 2016-17. And, financial, year 2017-18 is termed as assessment year 2017-18., Computation of tax liability of Mr. Sunil, For previous year 2016-17, Relevant to assessment year 2017-18, Particulars, Amount Amount, Gross total Income, 4,70,000, Less: Deduction u/s 80C to 80U, 1. 80C:, a) Insurance premium (Note), 12,000, (26,000 or 10% of policy amount, w.e.less), b) Deposited PPF, 60,000, Maximum eligible amount u/s 80CCE (1,50,000), 72,000, 2. 80D: medical premium (500 x 12), 6,000, 3. 80G: 100% deductible : National defense fund, 20,000 98,000, Total taxable income, Tax as per slab rate: (Note), Tax on first 2,50,000 – Nil, Tax on next 2,50,000 – 10%, (1,22,000 x 10%), , 3,72,000, , ---12,200, 12,200, , Less: Rebate u/s 87A (Total income less than 5 lakh), Add: Education Cess:, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, Tax liability, Rounded off u/s 288B = Rs. 7,420/-, , 5,000, 7,200, 144, 72, , 216, 7,416, , Note: As it is assumed that, policy has been issued on or after April 1 st 2012. Only, 10% of policy amount or actual premium paid, whichever is less, is eligible for, deduction., NN, , Page 35

Page 36 :

17. X Ltd. A closely held Indian company is engaged in the business of, manufacture of chemical goods (Value of the Plant and Machinery owned by the, company is 60 lakhs). The following information’s for the year 2016-17 are given., Profit and Loss account, Sale proceeds of goods ( domestic sales), Sale proceeds of goods (export), Other receipts, Total, Less:- Depreciation, Salary and wages, Income Tax, Proposed Dividend, Loss of subsidiary company, Tax consultation fees, Salary and Perquisites of MD, , Rs., 25,33,000, 5,37,000, 5,00,000, 35,70,000, 4,25,000, 3,50,000, 3,45,000, 75,000, 28,000, 25,000, 2,50,000, Net Profit 20,72,000, For the tax purpose the company wants to claim the following:, Deduction under section 80IB (30% of Rs.20,72,000), Deduction under section 32 (Rs.5,25,000), The company wants to set-off the following:, For Tax purpose For Accounting Purpose, Brought forward loss (2014-15), Unabsorbed depreciation, , Rs.12,00,000, ----, , Rs.1,85,000, Rs.1,00,000, , Compute the total income and tax liability for assessment year 2017-18., Solution:Assumption:, 1. X ltd. is assumed to be domestic company., 2. Following tax liability is computed in spirit of law., 3. Other receipts are treated as trade receipt only., 4. Depreciation provided in the statement of information is as per the, accounting purposes., NN, , Page 36

Page 37 :

5. Loss of subsidiary company is not allowable as deduction. Because, it is, treated as diminishing value in investment made by holding company., 6. As the problem doesn’t provide any turnover information, and tax liability, is calculate in spirit of law, corporate tax rate of 30% is chosen., Computation of Tax liability as per total taxable income of Z Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Amount, Amount, Net Profit as per Profit and loss account, 20,72,000, Add: Inadmissible expenses:, a. Depreciation, 4,25,000, b. Income tax, 3,45,000, c. Proposed Dividend, 75,000, d. Loss of subsidiary company, 28,000, 8,73,000, 29,45,000, Less: admissible expenses, a. Depreciation u/s 32, 5,25,000, Profit for the year, 24,20,000, Less: Brought forward loss, 12,00,000, Less: Unabsorbed depreciation:, ---- 12,00,000, Gross total Income, 12,20,000, Less: Deduction under chapter VI-A, 80IB (20,72,000 x 30/100), 6,21,600, Total Taxable Income, 5,98,400, Tax at 30% - (5,98,400 x 30%), Add: Education Cess, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, Tax liability as per total taxable income, Rounded off u/s 288B = Rs.1,85,270/NN, , 1,79,520, 3,590, 1,795, , 5,745, 1,85,265, , Page 37

Page 38 :

Computation of Book Profit and MAT of X Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Net Profit as per Profit and loss account, Add: Disallowed for book profit, a. Income tax, b. Proposed Dividend, , Amount, , 3,45,000, 75,000, , Less: 1. Least of the following (a or b), a. Brought forward loss : 1,85,000, b. Unabsorbed depreciation : 1,00,000, Book Profit, Tax at 18.5% - (23,92,000 x 18.5%), Add: Education Cess, a) Primary Education cess @ 2%, b) secondary and higher education cess @ 1%, MAT, Rounded off to Rs.4,55,800/-, , Amount, 20,72,000, , 4,20,000, 24,92,000, , 1,00,000, 23,92,000, 4,42,520, 8,850, 4,425, , 13,275, 4,55,795, , Computation of Tax liability of X Ltd, For Assessment year 2017-18, Relevant to previous year 2016-17, Particulars, Highest of the following :, a) Tax liability as per total taxable income- Rs.1,85,270, b) Tax liability as per MAT provision - Rs.4,55,800, Tax liability, , NN, , Amount, , 4,55,800, 4,55,800, , Page 38

Page 39 :

18. The Company is paying salary of Rs.1,50,000/- to its employees., (1,00,000+40,000+10,000) as Basic pay, DA & HRA from the following, information as a consultant, advice the drawing officer to make further TDS from, the, month, of, January,, February, and, March, of, 2018., Make statutory and proper assumption as a part of TDS officer’s duties and, responsibilities under Income Tax Act., Additional Information:, i) He is paying House built EMI of Rs.25,000/-(Principal-Rs.4,000+InterstRs.21,000/-), ii) He is paying Higher education fees for his children (2) of Rs.15,000/-each to, KEA., iii) He is contributing 10% of his salary towards NPS., iv) He also pays stamp duty charges of Rs.25,000/- for his property registration., v) He is paying medical insurance premium of Rs.2,000/- per month. And he also, spent Rs.1,00,000/- for his medical treatment., The employer is making TDS of Rs.10,000 per month from April 2017 and the 2 nd, Employer pays Rs.2,00,000/- with a TDS of Rs.40,000/- and credited to his, account., Solution:, As tax consultant, responsible class of society, in one hand, it’s my duty to, work in sprit of law, and in other hand, it’s my duty to work as beneficial to my, client., By considering all the dimensions of the law and company, TDS provisions, are advised to drawing officer., Following are the assumptions, in order to advise the TDS officer, as his part of, duties and responsibilities under income tax act:, a) Company/employer have TAN., b) PAN of every employee is collected by TDS officer., NN, , Page 39

Page 40 :

c) TDS officer has collected and listed out the salary and other income, and auto, payment like EMI, etc. details of every employee in company., d) TDS officer has calculated tax payable by employee, as per relevant slab rates,, by advice of tax consultant., e) He has calculated monthly TDS to be made in the salary of respective employee., f) He has deducted such monthly TDS in salary of respective employee, up to, December 2017., g) He has credited such deducted TDS to tax authorities account, within due date., h) He is providing TDS details for tax authorities quarterly, within due date., i) He is preparing FORM – 16, and issuing the same to respective employee, within, due date, in case of previous financial year., Ancillary assumption:, a. Employer and employee relate to Karnataka, and thus, pays professional tax., b. As employee is paying EMI for House and also paid stamp duty charges, it is, assumed that, employee is resided in his own house. Thus, HRA is fully taxable., c. 2nd employer has paid Rs. 2,00,000 has salary for employee. Further, he has, made TDS of Rs. 40,000. i.e., employee received 1,60,000 as net salary., , Following is calculation of TDS for the month of January, February and March, 2018, to advise TDS to deduct same., , Computation of total taxable income of employee, For Assessment Year 2018 – 19, Relevant to the financial Year 2017-2018, , NN, , Page 40

Page 41 :

Particulars, A. Income from salary, a) Basic pay (1,00,000 x 12), b) Dearness allowance, (Assumed to be provided as per service), c) House Rent Allowance, , Amount, , Amount, , 12,00,000, 4,80,000, 1,20,000, , Employer 2: salary income, Less: Professional tax (200 x 12), Income from salary, , 18,00,000, 2,00,000, 20,00,000, 2,400, 19,97,600, , B. Taxable Income from house property, Annual Value, Less: Deduction u/s 24(iia), Previous year interest (21,000 x 12), Maximum qualifying amount, Gross total Income, Less : Deduction u/s 80C to 80U, 1. 80C, a. Principal amount in EMI (4000 x 12), b. Education fees (15,000 x 2), c. Stamp duty charges, 2. 80 CCD: NPS at 10% of salary*, (1,40,000 x 12 x 10%) (Note 1), Maximum eligible u/s 80CCE, 3. 80D: Medical insurance premium (Note 2), (2000 x 12), Total taxable income, , Nil, 2,52,000, 2,00,000 (2,00,000), 17,97,600, , 48,000, 30,000, 25,000, 1,03,000, 1,68,000, 2,71,000, 1,50,000, 1,50,000, 24,000, , 1,74,000, 16,23,600, , *Salary = Basic pay + Dearness allowance = 1,40,000 (1,00,000 + 40,000), NN, , Page 41

Page 42 :

Note 1: Additional deduction of Rs. 50,000/- in case of 80CCD is not applicable., Note 2: 80D is not eligible for medical treatment, as medical insurance premium is, allowable., Computation of Tax payable of employee, For Assessment Year 2018 – 2019, Relevant to the Financial Year 2017-2018, Particulars, Total Income, , Amount Amount, 16,23,600, , Tax on Casual Income @ 30 %, Tax on STCG u/s 111a @ 15 %, Tax on LTCG @ 20 %, Tax on Deemed Income @ 30 %, Tax on remaining Income*, Add : Education Cess, a. Primary education cess@ 2%, b. secondary an higher primary cess @ 1%, , --------2,99,580, 2,99,580, 5,992, 2,996, , Tax Payable, Rounded off u/s 288B = Rs.3,05,570 /-, , 8,988, 3,05,568, , *Tax on remaining Income(as per slab rate) :, Given Total Remaining Income = 16,23,600, Therefore, Tax on first 2,50,000 = NIL., Tax on next 2,50,000 =12,500(a).(5% of 2,50,000), Tax on next 5,00,000 =1,00,000(b).(20% of 5,00,000), Tax on Balance = 1,87,080(c).(30% of 6,23,600), Tax on remaining income = (a+b+c) = 12,500 + 1,00,000 + 1,87,080 = 2,99,580., Therefore, from the above computation, tax liability of employee is Rs. 3,05,568., , NN, , Page 42

Page 43 :

Computation of TDS to be deducted for January, February and March 2018, Amount, Particulars, Tax liability, Less : TDS made, a) 2nd employer, 40,000, b) 9 months (10,000 x 9), 90,000, (For April to December 2017), Remaining TDS to be made for, 3 month (Jan, Feb, March), Monthly TDS (1,75,570/3), , Amount, 3,05,570, , 1,30,000, 1,75,570, 58,523, , Finally, it is advised to deduct monthly Rs.58,523/- TDS for January, February,, and March 2018., ******************************************************************, Disclaimer:, Above cases are solved in different perspectives and by making various, assumptions, along with right spirit of law. It is suggested to go through such, assumption to clearly understand., In case of any clarification, Contact Sathish P at 88674 33687- WhatsApp only., ******************************************************************, , NN, , Page 43