Page 3 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, Bachelor of Commerce (General), B.Com. (Gen.), (Effective from Academic Year July 2021 Onwards), , 1

Page 4 :

B.Com (CBCS), , University of Jammu, , PROGRAMME CONTENTS, S.No. Content, , Page No., , 1, , Introduction to Programme, , 3, , 2, , Structure of B.Com. (General)., , 3, , 3, , Semester-wise Distribution of Courses, , 4, , Syllabi, , 7-124, , 4a, , Semester 1, , 8-15, , 4b, , Semester 2, , 16-24, , 4c, , Semester 3, , 25-42, , 4d, , Semester 4, , 43-59, , 4e, , Semester 5, , 60-89, , 4f, , Semester 6, , 89-124, , 2, , 4-6

Page 5 :

B.Com (CBCS), , University of Jammu, , B. Com (General) Programme, 1. Introduction, The hallmark of any academic excellence is the highest standards of teaching, research and an, environment and culture conducive to learning. University of Jammu is making rapid strides in, all areas of its functioning. Redesigning of academic programmes under Choice based Credit, system and semester system have undertaken other examinations and administrative reforms., University endeavors to introduce new job oriented programmes that are in sync with emerging, national and global trends as well as relevant to the regional and local needs., As an institution of higher education, the institution understands the responsibility of increasing, access, promoting equity and ensuring quality and excellence. Thus, under the Learning, Outcome-based Curriculum Framework (LOCF), the syllabi of B.Com (Gen.) has been revised, in order to provide enriching, vibrant and a contemporary learning experience to the students, by, keeping pace with the dynamic environment., With the Industrial Liberalization and Globalization of trade and emphasis on global markets,, there is a great scope for employment as well as self-employment. Thus, the courses of B.Com, are designed in such a way in which the students are able to develop business acumen, analytical, skills, financial literacy and managerial skills. This course will help in building competence in a, particular area of business among students. It imparts knowledge of accounting principles,, economic policies, export and import law and other aspects which tends to impact business and, trade. The B.Com (Gen.) course content is well prepared to sustain as a corporate employee or as, an entrepreneur. The student will attain adequate knowledge of adapting to the changes in the, flexible business world, can focus internationally, and will have an in-depth understanding of the, business world’s market-relevant aspects. On the other hand, if the student who chooses to start, his/her own business, he/she can run it successfully and professionally without having to pay to, expert accountants or market consultants., The course syllabi will provide systematic and subject skills within various disciplines of, finance, auditing and taxation, accounting, management, communication, computer. Students, can also get the practical skills to work as accountant, audit assistant, tax consultant, and, computer operator, as well as other financial supporting services. Students will learn relevant, advanced accounting career skills, applying both quantitative and qualitative knowledge to their, future careers in business. Thus, this highly structured, student-centered syllabus of B.Com, (Gen.) will provide a learning pathway to study the ever-evolving field in an organized manner., , 2. Structure of B.Com. (Gen.), The programme aims to nurture the students in intellectual, personal, interpersonal and social, skills with a focus on holistic education and development to make informed and ethical decisions, and equip graduates with the marketable skills. The curriculum of B.Com. (Gen.) degree, provides a carefully selected subject combination of Accounting, Management, Tax, Corporate, Laws, Economics, Finance, etc., , 3

Page 6 :

B.Com (CBCS), , University of Jammu, , 3. Semester-wise Distribution of Courses, B.Com (General) Three Year (6-Semester), CBCS Programme, PROGRAMME STRUCTURE, Semester-wise Distribution of Courses, Course Title, , Course No., , Course, Type, SEMESTER FIRST, , CORE COURSE, English, English, DISCIPLINE SPECIFIC CORE COURSES (DSC), Financial Accounting, UBCTC101 DSC-1, Business Organisation and, Management, UBCTC102 DSC-2, ABILITY ENHANCEMENT COMPULSORY COURSES, (AECC), Environmental Science (EVS-1), AECC-1, Communication English/MIL-1, AECC-2, TOTAL CREDIT, SEMESTER SECOND, CORE COURSE, English, English, DISCIPLINE SPECIFIC CORE COURSES (DSC), Advanced Financial Accounting, UBCTC201 DSC-3, Contemporary Management, UBCTC202 DSC-4, ABILITY ENHANCEMENT COMPULSORY COURSES, (AECC), Environmental Science (EVS-2), AECC-3, Communication English/MIL-2, AECC-4, TOTAL CREDIT, SEMESTER THIRD, DISCIPLINE SPECIFIC CORE COURSES (DSC), Fundamentals of Business, Communication, UBCTC301 DSC-5, Corporate Accounting, UBCTC302 DSC-6, Indian Contract Act, UBCTC303 DSC-7, SKILL ENHANCEMENT COURSES (SEC), Any one of the following, SEC-1, E-Commerce, UBCTS304, Corporate Tax Planning, UBCTS305, Computer Applications in Business, UBCTS306, Entrepreneurship for Small Business, UBCTS307, Management Information System, UBCTS308, TOTAL CREDIT, 4, , %, Change, , Credit, , Nil, , 6, , Nil, , 6, 6, , Nil, , Nil, Nil, , 2, 2, 22, , Nil, , 6, , 10%, Nil, , 6, 6, , Nil, Nil, , 2, 2, 22, , 6, 5%, Nil, Nil, , Nil, 100%, 100%, 25%, Nil, , 6, 6, , 4, 4, 4, 4, 4, 22

Page 7 :

B.Com (CBCS), , University of Jammu, , SEMESTER FOURTH, DISCIPLINE SPECIFIC CORE COURSES (DSC), Business Communication and Skill, Development, UBCTC401 DSC-8, Direct Tax Laws, UBCTC402 DSC-9, Corporate Laws, UBCTC403 DSC-10, SKILL ENHANCEMENT COURSES (SEC), Any one of the following, SEC-2, Office Management and Secretarial, Practice, UBCTS404, Personal Finance and Planning, UBCTS405, Monetary Economics, UBCTS406, Collective Bargaining and Negotiation UBCTS407, Customer Relationship Management, UBCTS408, TOTAL CREDIT, SEMESTER FIFTH, ABILITY ENHANCEMENT CORE COURSE (AECC), Communication English, AECC-5, SKILL ENHANCEMENT COURSE (SEC), Cost Accounting, UBCTS501, SEC-3, DISCIPLE SPECIFIC ELECTIVE COURSES (DSE), Group 1 Any one of the following, Auditing-I, UBCTE502 DSE-1, Investing in Stock Market, UBCTE503, Fundamentals of Marketing, UBCTE504, Security Analysis and Portfolio, Management, UBCTE505, Group II Any one of the following, E-Filing of Returns, UBCTE506 DSE-2, Personal Tax Planning, UBCTE507, Statistics for Managers, UBCTE508, Project Management, UBCTE509, GENERAL ELECTIVE (GE), Any one of the following, Tourism Management, UBCTE510 GE-1, Public Finance -I, UBCTE511, Computerised Accounting and, Taxation, UBCTE512, TOTAL CREDIT, SEMESTER SIXTH, ABILITY ENHANCEMENT CORE COURSE (AECC), Communication English, AECC-6, SKILL ENHANCEMENT COURSE (SEC), Management Accounting, UBCTS601 SEC-4, DISCIPLINE SPECIFIC ELECTIVE (DSE), Group 1 Any one of the following, DSE-3, Auditing-II, UBCTE602, Business Environment, UBCTE603, 5, , 6, 30%, Nil, 5%, , 6, 6, , 4, 100%, 100%, 100%, 100%, 60%, , 4, 4, 4, 4, 22, , Nil, , 2, , Nil, , 4, , Nil, 100%, 10%, , 6, 6, 6, 6, , 50%, 100%, 100%, Nil, 100%, , 6, 6, 6, 6, , Nil, 30%, , 6, 6, 6, , Nil, 24, , Nil, , 2, , Nil, , 4, , Nil, Nil, Nil, , 6, 6

Page 8 :

B.Com (CBCS), Indian Banking System, Retail Management, Group II Any one of the following, Financial Management, Sales Management, Business Ethics, Leadership and Team Development, GENERAL ELECTIVE (GE), Any one of the following, Indian Economy, Consumer Affairs and Customer Care, Public Finance II, TOTAL CREDIT, , University of Jammu, UBCTE604, UBCTE605, , 100%, Nil, , 6, 6, , 25%, Nil, 100%, 100%, , 6, 6, 6, 6, , 100%, 100%, 100%, , 6, 6, 6, 24, , DSE-4, UBCTE606, UBCTE607, UBCTE608, UBCTE609, GE-2, UBCTE610, UBCTE611, UBCTE612, , 6

Page 10 :

B.Com (CBCS), , University of Jammu, , 4a. B.COM (GENERAL) FIRST SEMESTER, UNIVERSITY OF JAMMU, , SCHEME OF COURSES UNDER CHOICE BASED CREDIT SYSTEM FOR B.COM, , Course, , Course, Number, , English, Financial Accounting, Business, Organisation and, Management, Environmental, Science (EVS-1), Communication, English/MIL-1, Total credit, , UBCTC, 101, UBCTC, 102, , UGC, classification, , %, Change, , Credit, , English, , Nil, , 6, , DSC-1, , Nil, , 6, , DSC-2, , Nil, , 6, , AECC-1, , Nil, , 2, , AECC-2, , Nil, , 2, , Total, credit, , 22, , 22, , 8

Page 11 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), , English, Common Syllabus to be provided by respective Department, , 9

Page 12 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), FINANCIAL ACCOUNTING (DSC-1), , C.No. UBCTC101, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in Dec. 2020, 2021, 2022), OBJECTIVE To impart conceptual knowledge of financial accounting and also skill for, recording business transaction., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, CO3, CO4, , understand the theoretical framework of accounting., learn to prepare financial statements., prepare accounting for departments., understand different methods of branch accounting and differentiate between branch, accounting and departmental accounting., CO5 know accounting treatment of consignment in the books of consignor and consignee and, develop conceptual skill of different methods of maintaining Joint venture accounts., COURSE CONTENTS, UNIT - I INTRODUCTION (12 hours), Accounting as an information system, various stake holders, objectives, limitations and various, branches of accounting; Basis of accounting- Cash basis, accrual basis and hybrid accounting;, Generally accepted accounting principles (GAAP); Basic terms used in accounting; Brief, introduction to various books viz. subsidiary and ledger, numerical problems related to, preparation of accounting equation, journal, ledger, trial balance and cash book; Systems of, accounting viz., single entry and double entry system; Introduction to IFRS., UNIT - II PREPARATION OF FINANCIAL STATEMENTS OF NON–CORPORATE, ENTITIES (12 hours), Preparation of financial statements (Manufacturing account, trading account, profit and loss, account, profit and loss appropriation account and balance sheet) of non-corporate manufacturing, and non-manufacturing entities (Excluding not-for-profit organisations) with and without, adjustments., UNIT - III DEPARTMENTAL ACCOUNTING (12 hours), Meaning and objective of departmental accounts; Basis of allocation of common expenses; Interdepartmental transfers; Preparation of departmental trading and P&L account (Including general, P&L account and balance sheet), UNIT - IV BRANCH ACCOUNTING (INLAND BRANCHES ONLY) (12 hours), Meaning, objective and methods including debtor system, stock and debtor system, final account, system; Wholesale branch system and independent branch system excluding foreign branches;, Difference between branch and departmental accounting., , 10

Page 13 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), FINANCIAL ACCOUNTING (DSC-1), , C.No. UBCTC101, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in Dec. 2020, 2021, 2022), UNIT - V CONSIGNMENT AND JOINT VENTURE (12 hours), Consignment- Meaning and features; Distinction between consignment and sale; Distinction, between normal loss and abnormal loss in consignment; Accounting treatment including journal, and ledger in the books of consignor and consignee; Joint Ventures- Meaning, features and, distinction of Joint venture with partnership; Methods of maintaining Joint venture accounts, (theory only)., BOOKS RECOMMENDED, , , , , , Jain S.P. and Narang K.L. Financial Accounting, Kalyani Publisher, Delhi., Monga J.R. Financial Accounting Concept and Application, Mayur Paper Book, New, Delhi., Maheshwari S.N. Financial Accounting, Vikas Publication, New Delhi., Singhal. Financial Accounting, Taxman Publication., , Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., Note 60% weight age should be given to problems demanding numerical solutions., , 11

Page 14 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), , BUSINESS ORGANISATION AND MANAGEMENT (DSC-2), C.No. UBCTC102, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in Dec. 2020, 2021, 2022), OBJECTIVE The basic objective of this course is to provide fundamental knowledge about, business management & organization., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, CO3, CO4, , understand the nature, scope and types of business organization., know contributions of eminent personalities in the field of management., explain managerial functions such as planning, organizing and directing., comprehend the controlling function of management and analyze its relationship with, planning function., CO5 understand need of information system and quality management in business organization., , COURSE CONTENTS, UNIT-I BUSINESS ORGANISATIONS (12 hours), Definition, characteristics and objectives of business organization; Evolution of business, organizations; Team based organization-Concept of team, effective team, team creation,, committee, task force; Free-form organization- Virtual organization, virtual offices, boundary, less organizations., UNIT-II EVOLUTION OF MANAGEMENT THOUGHT (12 hours), Concept, nature, scope and significance of management; Contribution to management thought by, F.W. Taylor, George Elton Mayo, H. Fayol and C.K. Prahalad; Role of Managers., UNIT-III FUNCTIONS OF MANAGEMENT (12 hours), Planning-Meaning, types and steps in the process of planning; Organizations Meaning of, authority, delegation & decentralization; Maslow’s and Herzberg’s theories of motivation, Leadership-Concept and leadership styles; Coordination and cooperation-Concept and, techniques., UNIT-IV MANAGERIAL CONTROL (12 hours), Nature, definition, need for control; Process of control; Principles of control; Factors determining, good control; Techniques of control- PERT and CPM., UNIT-V INFORMATION SYSTEM AND QUALITY MANAGEMENT (12 hours), Information system- Need, types, developing an information system; TQM- Concept, need,, advantages and disadvantages; Concept of ISO 9000 and ISO 14000 quality systems; Statistical, process control., , 12

Page 15 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), , BUSINESS ORGANISATION AND MANAGEMENT (DSC-2), C.No. UBCTC102, Credit : 6, Time 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in Dec. 2020, 2021, 2022), BOOKS RECOMMENDED, Vasisth, C.N. Business Organisation and Management, Taxman Academics, New Delhi., Rao, S.P. Principles of Management, Himalaya Publishing House, New Delhi., Bhalla, N.K, Sharma, R.S, and Gupta, S.K. Principles of Management, Kalyani, Publishers, New Delhi., Prasad, L.M. Management –Theory and Practice, Sultan Chand, New Delhi., Koontz, O’D. Principles of Management, Tata McGraw Hill, New Delhi., Note Latest edition of readings may be used, NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 13

Page 16 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), Ability Enhancement Compulsory Course (AECC-1), Environmental Science (EVS-1), Common Syllabus to be provided by respective Department, , 14

Page 17 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) FIRST SEMESTER (CBCS), Ability Enhancement Compulsory Course (AECC-2), Communication English/MIL-1, Common Syllabus to be provided by respective Department, , 15

Page 18 :

B.Com (CBCS), , University of Jammu, , 4b. B.COM (GENERAL) SECOND SEMESTER, UNIVERSITY OF JAMMU, , SCHEME OF COURSES UNDER CHOICE BASED CREDIT SYSTEM FOR B.COM, , Course, , Course, Number, , English, Advanced Financial, Accounting, Contemporary, Management, Environmental, Science (EVS-2), Communication, English/MIL-2, Total credit, , UGC, %, classification Change, , Credit, , English, , Nil, , 6, , UBCTC201, , DSC-3, , 10%, , 6, , UBCTC202, , DSC-4, , Nil, , 6, , AECC-3, , Nil, , 2, , AECC-4, , Nil, , 2, , Total, credit, 22, , 22, , 16

Page 19 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), English, Common Syllabus to be provided by respective Department, , 17

Page 20 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), ADVANCED FINANCIAL ACCOUNTING (DSC-3), C.No. UBCTC201, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2021, 2022, 2023), OBJECTIVE This course provides the students with a detailed knowledge of accounting, principles, concepts, techniques and their application to develop ability and skills in practical, work situation., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, , learn accounting for hire purchase transactions., understand various terms used in royalty and prepare journal and ledger accounts in the, books of Lessor and Lessee., CO3 explain and calculate value of goodwill and shares., CO4 develop an understanding of accounting of insolvency and laws governing settlement of, insolvency accounts., CO5 learn to compute insurance claims., COURSE CONTENTS, UNIT - I HIRE PURCHASE SYSTEM (12 hours), Meaning and importance; Basic terms used in hire purchase and installments system; Difference, between hire purchase and installment system; Journal entries and ledger accounts in the books, of both the parties viz. vendor and vendee-when cash price is given,when cash price is not given,, when rate of interest is given, when rate of interest is not given, when amount of installment is, given, when amount of installment is not given;Annuity method and default and repossession., UNIT - II ROYALTY (12 hours), Meaning of various terms used & types of royalties. Rights of short-working recouped and its, methods. Conditions for the recoupment of short-working.Journal entries and ledger accounts in, the books of both the parties viz, Lessor and Lessee., UNIT - III VALUATION OF GOODWILL AND SHARES (12 hours), Goodwill Meaning, nature,factors, classification, need and methods of valuation. Valuation of, Shares Need for valuation, factors affecting the value of shares, methods for computation of, value of shares.Average profit method- Simple Average profit method and Weighted Average, profit method; Super profit method; Capitalisation method- Capitalisation of super profit method, and capitalisation of average profit method; Annuity Method. Numerical problems related to, calculation of net assets value method, yield basis method and fair value method, , 18

Page 21 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), ADVANCED FINANCIAL ACCOUNTING (DSC-3), , C.No. UBCTC201, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2021, 2022, 2023), UNIT - IV INSOLVENCY ACCOUNTS (12 hours), Insolvency of sole proprietor-Meaning, conditions, various types of creditors- List to be, prepared; Laws governing settlement of accounts; Difference between Presidency Towns, Insolvency Act, 1909 and Provincial Insolvency Act,1920. Preparation of statement of affairs, and deficiency accounts., UNIT - V INSURANCE CLAIMS (12 hours), Meaning of Insurance claims, steps for ascertaining insurance claims; Computation of loss of, stocks with abnormal items including consequential loss of profit and application of average, clause., BOOKS RECOMMENDED, 1., 2., 3., 4., 5., 6., 7., 8., , Gupta, R.L. Advanced Financial Accounting, S. Chand & Sons., Kumar, A.S. Advanced Financial Accounting, Himalaya Publication House., Shukla, M.C. and Grewal, T.S. Advanced Accounts, S. Chand & Ltd., New Delhi., Jain, S.P. and Narang, K.L. Advanced Accounts, Kalyani Publishers, Ludhiana., Paul, Sr. K. Accountancy, Volume –I and II, New Central Book Agency, Kolkata., Lele, R.K. and Jawaharlal. Accounting Theory, Himalaya Publishers., Porwal, L. S Accounting Theory, Tata McGraw Hill., Anthony, R. Hawkins D.F. and Merchant. K. A. Accounting Text & Cases, Tata, McGraw Hill., 9. Maheshwari, S. N. Corporate Accounting, Vikas Publishing House Pvt. Ltd, New Delhi., 10. Sehgal, A. and Sehgal, D. Advanced Accounting, Taxmann, New Delhi., Note Latest edition of readings may be used, NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., , 19

Page 22 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), ADVANCED FINANCIAL ACCOUNTING (DSC-3), , C.No. UBCTC201, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2021, 2022, 2023), Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., Note 60% weightage should be given to problems demanding numerical solutions., , 20

Page 23 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), CONTEMPORARY MANAGEMENT (DSC-4), C.No. UBCTC202, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2021, 2022, 2023), OBJECTIVE The basic objective of this course is to provide knowledge about contemporary, issues in the business management & organisation., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 comprehend the business environment from global scenario perspective., CO2 understand various aspects of knowledge management., CO3 appreciate the changing dynamics of management practice., CO4 recognise the essence of ethics in business., CO5 develop an understanding of contemporary issues in management., COURSE CONTENTS, UNIT - I GLOBALISATION & COMPARATIVE MANAGEMENT (12 hours), Globalisation of management, changing profile of business environment; Different forms of, international business; Managerial functions in global business; Diversity in management, practices; Management styles in different nations; Japanese vs. Korean management style;, Comparative analysis of American, Japanese and Chinese leadership style., UNIT - II KNOWLEDGE MANAGEMENT (12 hours), Concept, drivers and cross functional areas of knowledge management; Total quality, management- Evolution, basic of TQM, approaches to quality management by Deming, Juranand, Crosby; Six sigma- Concept, steps involved in launching six sigma and benefits derived., UNIT - III MANAGEMENT OF CHANGE (12 hours), Concept of change, nature of change, factors affecting change; Planned change- Objectives of, planned change, process of planned change; Human response to change- Causes for resistance to, change, overcoming resistance to change, conditions favouring change management, challenges, before managers., UNIT - IV BUSINESS ETHICS (12 hours), Concept of ethics; Theories of ethics; Ethics in marketing, accounting & finance, HRM; Social, responsibility-Concept and areas; Corporate governance- Concept; Corporate citizenshipconcept., UNIT - V ADVANCES IN MANAGEMENT (12 hours), Time management- Concept, need, techniques for effective time management, motivation for, time management; Cross cultural management- Concept, need and importance; Disaster, management- Concept and agencies., 21

Page 24 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), CONTEMPORARY MANAGEMENT (DSC-4), C.No. UBCTC202, Credit : 6, Time 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2021, 2022, 2023), BOOKS RECOMMENDED, 1. Rao, P.S. Management & Organisational Behaviour, Himalaya Publishing House, New, Delhi., 2. Rao, V.S.P. and Krishna, V.H. Management-Text and Cases, Excel Book Pub., New, Delhi., 3. Singh, P.K. Singh, R.H. Principals of Management, Kalyani Publishers, New Delhi., 4. Prasad, L.M. Management, Theory and Practice, Sultan Chand, New Delhi., 5. Koontz, O’D. Principles of Management, Tata McGraw Hill, New Delhi., 6. Chandan, J.S. Management Concepts and Strategies, Vikas Publications, New Delhi., 7. Gupta S.K. and Joshy, R. Human Resource Management, Kalyani Publishers, New, Delhi., 8. Robbins, S.P and Coulter, M.A. Management, Prentice Hall of India,, 9. Robbins, S.P. and David, D. Introduction of Management Science Essential Concepts, and Applications, Pearson Education., 10. Awad, E.M and Ghaziri. H.M. Knowledge Management, Pearson Education, New, Delhi., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 22

Page 25 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), Ability Enhancement Compulsory Course (AECC-3), Environmental Science (EVS-2), Common Syllabus to be provided by respective Department, , 23

Page 26 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) SECOND SEMESTER (CBCS), Ability Enhancement Compulsory Course (AECC-4), Communication English/MIL-2, Common Syllabus to be provided by respective Department, , 24

Page 27 :

B.Com (CBCS), , University of Jammu, , 4c. B.COM (GENERAL) THIRD SEMESTER (CBCS), UNIVERSITY OF JAMMU, , SCHEME OF COURSES UNDER CHOICE BASED CREDIT SYSTEM FOR B.COM, , Course, , Course, Number, , UGC, %, classification Change, , Credit, , Fundamentals of Business UBCTC301, Communication, , DSC-5, , 5%, , 6, , Corporate Accounting, , UBCTC302, , DSC-6, , Nil, , 6, , Indian Contract Act, , UBCTC303, , DSC-7, , Nil, , 6, , SEC-1, , Nil, , 4, , Any one of the following, courses, , Total, credit, , 22, , E-Commerce, , UBCTS304, , Corporate Tax Planning, , UBCTS305, , Computer Application, , UBCTS306, , Entrepreneurship for Small UBCTS307, Business, Management, System, , Information UBCTS308, , Total credit, , 22, , 25

Page 28 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM (GENERAL) THIRD SEMESTER (CBCS), FUNDAMENTALS OF BUSINESS COMMUNICATION (DSC-5), C.No.UBCTC301, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To impart knowledge about basic communication to enable the students to think,, observe and express effectively in this competitive world., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 basic understanding of business communication, CO2 understanding communication channels, CO3 differentiate between verbal and non verbal communication, CO4 writing business letters, CO5 use of technology in business communication, COURSE CONTENTS, UNIT-- I INTRODUCTION (12 hours), Communication - Meaning, definition, features and importance; Difference between general and, technical communication; Process of communication; Basic Models of communication One way,, two way and noise model; Self development and communication How self development leads to, effective communication, how effective communication leads to self development; Barriers to, communication and measures to overcome them; General principles of effective communication;, 7 Cs of effective communication., UNIT-II COMMUNICATION CHANNELS (12 hours), Concept of organizational communication; Factors affecting organizational communication;, Formal communication- Meaning, importance, merits, demerits and types of formal, communication; Informal communication – Meaning, importance, merits, demerits and types of, informal communication; Formal vs. informal communication., UNIT-III VERBAL AND NON VERBAL COMMUNICATION (12 hours), Oral communication-Meaning, salient features, methods, need for learning oral communication, skills; Advantages and disadvantages of oral communication; Written Communication- Meaning,, characteristics, methods, merits and demerits of written communication; Types of non-verbal, communication; How to improve non-verbal communication., UNIT-IV LETTER WRITING AS A TOOL OF COMMUNICATION (12 hours), Business letters- Meaning, essentials of an effective business letter, structure of a business letter;, Guidelines for drafting an enquiry letter; Circular letter – Meaning, objectives and situations, , 26

Page 29 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM (GENERAL) THIRD SEMESTER (CBCS), , FUNDAMENTALS OF BUSINESS COMMUNICATION (DSC-5), C.No.UBCTC301, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), when circular letter is written; Office memorandum - Meaning and drafting a memo; ReportMeaning, characteristics of a good business report and types of business reports, UNIT-V TECHNOLOGY AND BUSINESS COMMUNICATION (12 hours), Role of technology in communication; Advantages and disadvantages of technology in business, communication; Concept and importance of E-communication; Concept & importance of Emails, text messaging, instant messaging, video conferencing, social networking., BOOKS RECOMMENDED, 1. Rayudu, C.S. Business Communication, Himalaya Publishing House, New Delhi, 2. Kumar, V. & Raj, B. Business Communication, Kalyani Publishers, New Delhi., 3. Pal,R. & Korlakalli, J.S. Essentials of Business Communication, Sultan Chand and Sons., 4. Bovee and Thill. Business Communication, Pearson Education, New Delhi Media K, Principles of Effective Oral Communication. Business Communication Today, Pearson, Publication., Note Latest edition of readings may be used, NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., , 27

Page 30 :

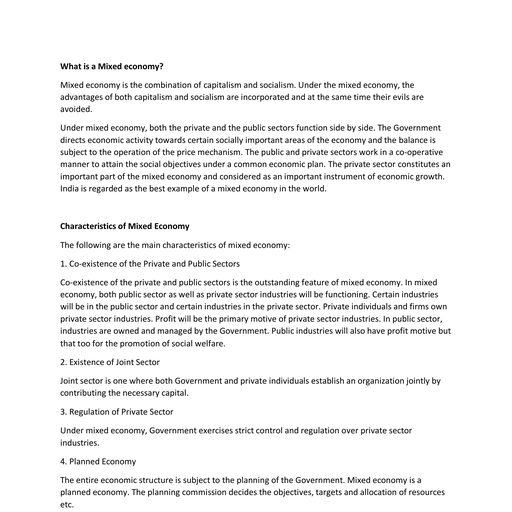

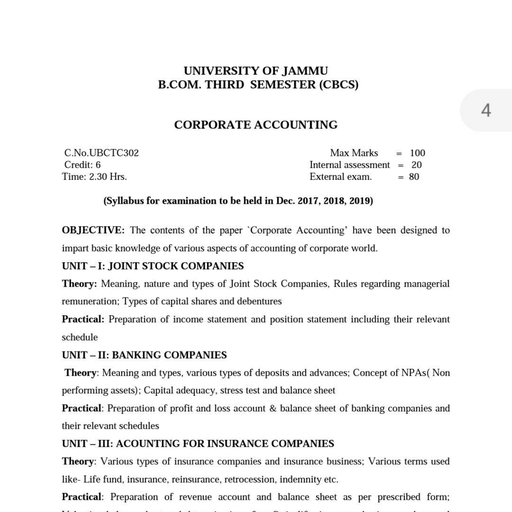

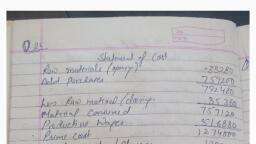

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), CORPORTE ACCOUNTING (DSC-6), , C.No. UBCTC302, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To acquaint the students with the concept and methods of corporate accounting., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, CO3, CO4, CO5, , prepare financial statements of Joint stock company., develop an understanding of financial statements of banking companies., understand the accounting for insurance companies., develop skills to prepare accounts for mergers and acquisition., prepare consolidated balance sheet for holding company., , COURSE CONTENTS, UNIT - I JOINT STOCK COMPANIES (12 hours), Theory - Meaning, nature and types of joint stock companies; Rules regarding managerial, remuneration; Types of capital shares and debentures., Practical - Preparation of income statement and position statement including their relevant, schedule., UNIT - II BANKING COMPANIES (12 hours), Theory - Meaning and types, various types of deposits and advances; Concept of NPAs (Non, performing assets); Capital adequacy, stress test and balance sheet., Practical - Preparation of profit and loss account & balance sheet of banking companies and, their relevant schedules., UNIT - III ACCOUNTING OF INSURANCE COMPANIES (12 hours), Theory - Various types of insurance companies and insurance business; Various terms used likeLife fund, insurance, reinsurance, retrocession, indemnity etc., Practical - Preparation of revenue account and balance sheet as per prescribed form; Valuation, balance sheet and determination of profit in life insurance business and general business., UNIT - IV MERGERS AND ACQUISITIONS (12 hours), Theory - Concept of mergers and acquisitions, demergers; Computation of purchase, consideration by various methods., Practical - Passing of journal entries and preparation of accounts for mergers and acquisition., , 28

Page 31 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), CORPORTE ACCOUNTING (DSC-6), , C.No. UBCTC302, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), UNIT - V HOLDING AND SUBSIDIARY COMPANIES (12 hours), Theory- Concept of holding and subsidiary companies; Introduction to various terms like cost of, control, capital reserve, minority interest, capital and revenue profit, consolidated balance sheet., Practical- Preparation of consolidated balance sheet; Computation of capital and revenue profit,, minority interest, cost of control, treatment of unrealized profit, revaluation of assets and, liabilities of subsidiary company, mutual owing, bonus issue and proposed dividend (simple, problems only)., BOOKS RECOMMENDED, 1. Jain, S.P. and Narang, K.L. Corporate Accounting, Kalyani Publishers, New Delhi., 2. Gupta, R.L. and Swamy, R Advanced Company Accounts, Sultan Chand & Son, New, Delhi., 3. Maheshwari, S.N. Corporate Accountancy, Vikas Publishing House, New Delhi., 4. Shukla, M.C. Grewal ,T.S. and Gupta, S.C. Advanced Accounts, S. Chand & Co., New, Delhi., 5. Mehra and Pankaj. Accounting in Corporate Business, Alpha Pub., New Delhi., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., Note 60% weight age should be given to problems demanding numerical solutions., , 29

Page 32 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM (GENERAL) THIRD SEMESTER (CBCS), INDIAN CONTRACT ACT (DSC-7), , C.No. UBCTC303, Credit : 6, Time: 2.30 Hrs., , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE The basic objective of this course is to provide knowledge about Indian Contract, Act., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 understand basic aspects of contracts for making the agreements, contracts and, subsequently enter valid business propositions., CO2 gain deeper understanding of varied elements of contract., CO3 be able to recognise and differentiate the special contracts and identify their appropriate, usage at varied business scenarios., CO4 understand the concepts of contract of agency., CO5 equip the students about the legitimate rights and obligations under The Sale of Goods Act., COURSE CONTENTS, UNIT - I FUNDAMENTALS OF CONTRACT (12 hours), Contract-Definition and essential elements of a valid contract; Kinds of contract–Void, voidable,, valid, express, implied, executed unilateral and bilateral contract; Offer -Definition, legal rules, as to offers; Acceptance – Definition, legal rules as to acceptance; Free consent-Definition, legal, implications of coercion, undue influence, fraud, misrepresentation and mistake., UNIT - II CONSIDERATION, CAPACITY & DISCHARGE OF CONTRACT(12 hours), Consideration-Definition, legal rules as to consideration; Capacity to contract-Contract with, minor, contract with persons of unsound mind, persons disqualified from contracting by law;, Discharge of contract; Remedies for breach of contract., UNIT - III CONTRACTS OF BAILMENT, PLEDGE, INDEMNITY AND GURANTEE, (12 hours), Bailment and pledge-Bailment definition, rights and duties of bailer and bailee; Rights and, obligation of finder of lost goods; Pledge-Definition, rights and duties of pawnor and pawnee;, Indemnity and guarantee – Contract of indemnity, definition, rights of indemnity holder when, sued and rights of indemnifier; Contract of guarantee - Definition, features, rights and liability of, surety., UNIT - IV CONTRACT OF AGENCY (12 hours), Definition & essentials of agency; Test of agency; Requirements for becoming a principal & an, agent; Creation of agency; Kinds of agents; Extent of agents authority; Rights & duties of an, agent; Rights & duties of a principal; Difference between sub-agent & substituted agent;, Termination of agency., , 30

Page 33 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM (GENERAL) THIRD SEMESTER (CBCS), INDIAN CONTRACT ACT (DSC-7), , C.No. UBCTC303, Credit : 6, Time: 2.30 Hrs., , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), UNIT - V SPECIAL CONTRACTS (12 hours), Sale of Goods Act-Essential of contract of sale, difference between sale and agreement to sell,, rights of an unpaid seller; Conditions and warranties-Difference between condition and, warranty, implied conditions and warranties; Unpaid seller – Meaning and rights of unpaid seller, against goods and buyer., BOOKS RECOMMENDED, 1. Bulchandani, K.R. Business Law for Management, Himalaya Pub. House, New Delhi., 2. Chawla and Garg. Business Law, Kalayani Publishers, New Delhi., 3. Kapoor, N.D. Business Law, Sultan Chand & Sons, New Delhi., 4. Gulshan, J.J. Business Law Including Company Law, New Age International Publisher., 5. Kuchhal, M.C. Business Law, Vikas Publications., 6. Singh,A. The Principles of Mercantile Law, Eastern Book Company, Lucknow., 7. Maheshwari and Maheshwari. Business Law, National Publishing House, New Delhi., 8. Chadha, P.R. Business Law, Galgotia Publishing Company, New Delhi., 9. Khergamwala, J.S. The Negotiable Instruments Act, N.M Tripathi Pvt. Ltd., Mumbai., 10. Bhushan, B. and Abbi, R. Business & Industrial Law, Sultan Chand, New Delhi., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 31

Page 34 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), E-COMMERCE (SEC), , C.No. UBCTS304, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To provide knowledge to students about use of e-commerce in the day to day, business world., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 understand the basics of E-commerce., CO2 familiarise with planning online business operations., CO3 enhance the students' skills for e-retailing., CO4 identify the emerging modes of e-payment., C05 understand the importance of security, privacy and legal issues of e-commerce., COURSE CONTENTS, UNIT- I INTRODUCTION (12 hours), Meaning & definition of e-commerce; Forces fuelling electronic commerce; Types of electronic, commerce - B2B, B2C, C2C, C2B; Different types of online intermediaries; Functions, benefits, and constraints of e-commerce; Scope of e-commerce; Application of e-commerce; Framework, of e-commerce., UNIT - II PLANNING ONLINE-BUSINESS (12 hours), Nature and dynamics of the internet; Typical business models in EC, web- site design Web sites, as market place; E-commerce, pure online vs. brick and click business; Requirements for an, online business design; Procedure for developing and deploying the system., UNIT - III E-RETAILING (12 hours), An overview of e-retailing; Growth & characteristics of successful e-retailing; Changing retail, industry dynamics; Management challenges in online retailing; E- tailing business models., UNIT - IV ELECTRONIC PAYMENT SYSTEM (12 hours), E-payment methods; Features of successful e-payment methods; Types of electronic cards ; EWallets- Meaning & application; E-cash and innovative payment methods; Risk management, options for e-payment systems., UNIT - V SECURITY AND LEGAL ASPECTS OF E-COMMERCE (12 hours), Threats in e-commerce; Security of clients and service provider; Cyber laws- Relevant, provisions of Information Technology Act- 2000, offences, secure electronic records and digital, signatures penalties and adjudication., , 32

Page 35 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), E-COMMERCE (SEC), , C.No. UBCTS304, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), BOOKS RECOMMENDED, 1. Kalakota, R. and Whinston, A.B. Electronic Commerce, Pearson Education., 2. Turban, E., King, D., Lee, J. and Viehland, D. Electronic Commerce 2004- A, Managerial Perspective, Pearson Education., 3. Agrawala, K.N., Lal,A. and Agarwala, D ng]65cub . Business on the Net An, Introduction to the Whats and Hows of e-commerce, Macmillan India Ltd., 4. Bajaj, D.N. E-commerce, Tata McGraw Hill Company, New Delhi., 5. E Turban et al. Electronic Commerce A Managerial Perspective, Pearson Education,, Asia., 6. Divan, P. and Sharma, S. Electronic Commerce-A Manager’s Guide to e-Business,, Vanity Books International, Delhi., 7. Dietel, H.M., Paul,J. and Steinbuhler, K. E-business and E-commerce for Managers,, Pearson Education., 8. Greenstein, M. and Feinman. T.M. Electronic Commerce Security, Risk Management and, Control, Tata McGraw Hill., 9. Kosiur, D. Understanding Electronic Commerce, Prentice Hall of India Private Ltd., New, Delhi., 10. Whitely, D. E-Commerce, McGraw Hill, New York., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 33

Page 36 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), CORPORATE TAX PLANNING (SEC), , C.No. UBCTS305, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To provide basic knowledge of corporate tax planning and its impact on decision, making., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, , CO3, CO4, CO5, , differentiate between various tax planning concepts and understand the procedure of, assessment of corporate assesses., devise strategies for tax planning in respect of a new business, understand the specific tax, issues for start-ups, and comprehend the Income Tax provisions relevant for financial, management decisions., decipher the tax factors relevant for managerial decisions., understand how to claim relief in case of double taxation of income., understand tax planning with reference to business restructuring., , COURSE CONTENTS, UNIT - I TAX PLANNING (12 hours), Meaning of tax planning, tax management, tax evasion tax avoidance; Types of companies;, Residential status of companies and tax incidence; Tax liability and minimum alternate; Carry, forward and set off of losses in case of certain companies; Deductions available to corporate, assessees; Tax on distributed profits and units of mutual funds., UNIT - II TAX IMPLICATIONS & CONSIDERATIONS I (12 hours), Tax planning with reference to setting up of a new business-Location of business, nature of, business, form of organisation; Tax planning with reference to financial management decisionsCapital structure, dividend and bonus shares; Tax planning with reference to sale of scientific, research assets., UNIT - III TAX IMPLICATIONS & CONSIDERATIONS II (12 hours), Tax planning with reference to specific management decisions- Make or buy decision, own or, lease, repair or replace; Tax planning with reference to receipt of insurance compensation., UNIT - IV DOUBLE TAXATION RELIEF (12 hours), Double taxation relief; Provision regulating transfer pricing; Computation of Arm’s Length, pricing; Advance rulings; Advance pricing agreement., , 34

Page 37 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), CORPORATE TAX PLANNING (SEC), , C.No. UBCTS305, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), , UNIT - V TAX IMPLICATIONS & CONSIDERATIONS III (12 hours), Tax planning with reference to business restructuring-Amalgamation, demerger, slump sale,, conversion of company into LLP, transfer of assets between holding and subsidiary companies., BOOKS RECOMMENDED, 1. Singhania, V.K. and Monica Singhania. Corporate Tax Planning, Taxmann Publications, Pvt. Ltd., New Delhi., 2. Ahuja, G and Gupta, R Corporate Tax Planning and Management, Bharat Law House,, Delhi., 3. Acharya, S. and Gurha, M.G. Tax Planning under Direct taxes, Modern Law Publications,, Allahabad., 4. Mittal, D.P. Law of Transfer Pricing, Taxmann Publications Pvt. Ltd., New Delhi., 5. IAS-12 and AS-22., 6. Ghosh, T.P. IFRSs, Taxmann Publications Pvt. Ltd., New Delhi., Note Latest edition of readings may be used., , NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 35

Page 38 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), COMPUTER APPLICATION IN BUSINESS (SEC), C.No. UBCTS306, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To provide computer skills and knowledge for commerce students and to enhance, the students understanding of usefulness of information technology tools for business operations., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 understand the various concepts and terminologies used in computer networks and internet, and be aware of the recent developments in the fast changing digital business world., CO2 handle document creation for communication., CO3 acquire skills to create and make good presentations, CO4 Aware the students about usage and functions of spreadsheet, CO5 Enhancing ability of students regarding creation of spreadsheet in business, COURSE CONTENTS, UNIT - I INTRODUCTION (12 hours), Introduction to computer-Characteristics of computers, the computer system, parts of computers;, Computer H/W setup, configuration, networking, mobile H/W device and types wireless, networking; Operating system-Introduction to operating system, an overview of various, computer & mobile OS, Features of latest Windows operating systems & its management &, networking (Installation, backup, security, user control); Usage of payment gateways., UNIT - II WORD PROCESSING (12 hours), Introduction to word Processing, word processing concepts, use of Templates, working with, word document Editing text, find and replace text, formatting, spell check, autocorrect, autotext;, Bullets and numbering, tabs, paragraph formatting, indent, page formatting, header and footer,, tables Inserting, filling and formatting a table; Inserting pictures and video; Mail Merge, Including linking with databases and spreadsheet files; Printing documents; Citations and, footnotes., Creating Business Documents using the above facilities, UNIT - III PREPARING PRESENTATIONS (12 hours), Basics of presentations Slides, fonts, drawing, editing; Inserting Tables, images, texts, symbols,, hyperlinking, media; Design; Transition; Animation and slideshow.Creating Business, Presentations using above facilities, , 36

Page 39 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), COMPUTER APPLICATION IN BUSINESS (SEC), , C.No. UBCTS306, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), UNIT - IV SPREADSHEET (12 hours), Spreadsheet Concepts Managing worksheets; Formatting, conditional formatting, entering data,, editing, printing and protecting worksheets; Handling operators in formula, project involving, multiple spreadsheets, organizing charts and graphs; Working with multiple worksheets;, Controlling worksheet views, naming cells and cell ranges., Spreadsheet Functions Mathematical, statistical, financial, logical, date and time, lookup and, reference, database functions, text functions and error functions., Working with Data Sort and filter; Consolidate; Tables; Pivot tables; What–if-analysis, Goalseek, data tables and scenario manager; Data analysis Tool Pak Descriptive statistics,, moving averages, histogram, covariance, correlation and Regression analysis (only for, projection)., , UNIT-V, CREATING, BUSINESS, SPREADSHEET, AND, ITS, BUSINESS, APPLICATIONS (12 hours), Creating Business Spreadsheet Loan and lease statement; Ratio analysis; Payroll statements;, Capital budgeting; Constraint optimization, Assignment problems, Depreciation accounting;, Graphical representation of data; Frequency distribution and its statistical parameters;, Correlation and regression analysis., BOOKS RECOMMENDED, Elmasari, R. and Navathe, S.B. Fundamentals of Database Systems, PearsonEducation, Jain Hem Chand and Tiwari H. N.Computer Applications in Business, Taxmann, Madan, S. Computer Applications in Business, Scholar Tech Press., Mathur, S. and Jain, P. Computer Applications in Business, Galgotia Publishing Company, Sharma S.K. and Bansal Mansi, Computer Applications in Business, Taxmann, Wayne, W. Data Analysis & Business Modeling, PHI., Rajaraman,. V. Introduction to Information Technology, PHI, Note The latest editions of the books should be referred., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., 37

Page 40 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), COMPUTER APPLICATION IN BUSINESS (SEC), C.No. UBCTS306, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), , Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 38

Page 41 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), ENTREPRENEURSHIP FOR SMALL BUSINESS (SEC), C.No. UBCTS307, Credit : 4, Time: 2.30Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To provide exposure to the students regarding entrepreneurial culture so that they, can set and manage their own small units., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 understand the concept of entrepreneurship., CO2 know the role of EDPs and State in fostering entrepreneurial development., CO3 understand social support system for gaining strength towards entrepreneurial preferences., CO4 gain knowledge about varied project and financial related aspects for initiating new venture, creation., CO5 develop understanding of MSMEs and its role in economic development., COURSE CONTENTS, UNIT - I INTRODUCTION TO ENTREPRENEUR AND ENTREPRENEURSHIP (12, hours), Entrepreneur-Meaning, characteristics of an entrepreneur, role; Entrepreneurial traits; Types of, entrepreneurs; Entrepreneur, intrapreneur vs. professional manager; Entrepreneurship concept;, Factors responsible for emergence of entrepreneurship; Relevance of entrepreneurship in career, growth; Women entrepreneurs-Importance and factors hindering their growth; Case study- Any, one successful Indian woman entrepreneur; Concept of rural entrepreneur and rural, entrepreneurship in India., UNIT - II ENTREPRENEURIAL BEHAVIOUR AND ENTREPRENEURIAL, DEVELOPMENT PROGRAMME (12 hours), Entrepreneurial behaviour- Definition, characteristics; Reasons for promoting entrepreneurs;, Psychological theories (Maslow and McClelland–Achievement motivation); Definition and, objective of EDPs, features of a sound EDP; Role of state in fostering entrepreneurial, development-NSIC, SSIC& DICs., UNIT - III ENTREPRENEURIAL SUSTAINABILITY (12 hours), Public and private system of stimulation, support and sustainability of entrepreneurship;, Requirement, availability and access to finance , marketing assistance , technology and industrial, accommodation; Role of entrepreneurs associations and self-help groups; The concept, role and, functions of business incubators, angel investors, venture capital and private equity funds., , 39

Page 42 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), ENTREPRENEURSHIP FOR SMALL BUSINESS (SEC), C.No. UBCTS307, Credit : 4, Time: 2.30Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), UNIT - IV PROJECT ANALYSIS AND FINANCIAL ANALYSIS (12 hours), Concept of project and classification of project; Project report; Project design; Project appraisal;, Financial analysis (Basic concepts) - Ratio analysis, break even analysis, profitability analysis,, social cost- benefit analysis; Budget and planning process., UNIT - V ENTREPRENEURSHIP AND MICRO SMALL AND MEDIUM SCALE, INDUSTRIES (12 hours), MSMEs-Conceptual framework, definition of MSME undertakings, MSME policies of the govt., of J&K for small scale sector; Challenges before micro, small and medium enterprises in the era, of globalisation; Role of small business in economic development; Export potential of small, units; Concept and process of TQM; Brief introduction to International Standard Organisation, (ISO)., BOOKS RECOMMENDED, 1. Agarwal, P. and Kaur, A. Entrepreneurship and Small Business, S. Pub.Vikas & Co.,, New Delhi., 2. Desai, V. Dynamics of Entrepreneurial Development and Management, Himalaya, Publishing House, Mumbai., 3. Gupta, C.B. Entrepreneurial Development in India, Sultan Chand Publishers, New Delhi., 4. Gupta, C.B. and Khanka,S.S. Entrepreneurship and Small Business Management, Sultan, Chand Publishers, New Delhi., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., 40

Page 43 :

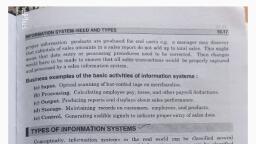

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), MANAGEMENT INFORMATION SYSTEM (SEC), , C.No. UBCTS308, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), OBJECTIVE To provide exposure to the students regarding the management information, system., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 familiarize with the concept of management information system., CO2 understand varied aspects of information systems., CO3 comprehend planning and control of information system., CO4 learn application of information system in business operations., CO5 gain knowledge of advanced concepts in information system such as ERP, SCM, CRM., COURSE CONTENTS, UNIT - I AN OVERVIEW OF MANAGEMENT INFORMATION SYSTEMS (MIS) (12, hours), Concept & definition of MIS - MIS vs. data processing; MIS & decision support systems; MIS, & information resources management; End user computing, MIS structure; Managerial view of, IS; Role and functions of MIS at different levels of management., UNIT - II FOUNDATION OF INFORMATION SYSTEMS (12 hours), Introduction to information system in business; Fundamentals of information systems; Solving, business problems with information systems; Types of information systems; Effectiveness and, efficiency criteria in information system; Frame work for IS and process of IS development., UNIT - III CONCEPT OF PLANNING & CONTROL OF IS (12 hours), Concept of IS organisational planning, planning process; Computational support for planning;, Characteristics of control process; Nature of IS control in an organisation; IS planning;, Determination for information requirements; Business systems planning; End means analysis;, Organising the plan., UNIT - IV BUSINESS APPLICATIONS OF INFORMATION TECHNOLOGY (12, hours), Internet & electronic commerce; Intranet, extranet & enterprise solutions; Information system for, business operations; Information system for managerial decision support; Information system for, strategic advantage., UNIT - V ADVANCED CONCEPTS IN INFORMATION SYSTEMS (12 hours), Enterprise resource planning; Supply chain management; Customer relationship management, and procurement management; Systems analysis and design; System development life cycle;, Cost benefit analysis; Detailed design-Implementation., , 41

Page 44 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) THIRD SEMESTER (CBCS), MANAGEMENT INFORMATION SYSTEM (SEC), , C.No. UBCTS308, Credit : 4, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in December 2021, 2022, 2023), BOOKS RECOMMENDED, 1. Brian, O. Management Information System, TMH., 2. Davis, G.B. and Olson, M.H. Management Information System, TMH., 3. Murdick, R.G. Information System for Modern Management, PHI., 4. Jawadekar, W.S. Management Information System, TMH., Note Latest edition of readings may be used., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each questions shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 42

Page 45 :

B.Com (CBCS), , University of Jammu, , 4d.B.COM (GENERAL) FOURTH SEMESTER (CBCS), UNIVERSITY OF JAMMU, , SCHEME OF COURSES UNDER CHOICE BASED CREDIT SYSTEM FOR B.COM, , Course, , Course, Number, , UGC, Percentage Credit, classification, Change, , Business Communication and UBCTC401, skill development, , DSC-8, , 30%, , 6, , Direct Tax Laws, , UBCTC402, , DSC-9, , Nil, , 6, , Corporate Laws, , UBCTC403, , DSC-10, , 5%, , 6, , SEC-2, , 100%, , 4, , Any one of the following, courses, Office, Management, Secretarial Practice, , Total, credit, , 22, UBCTS404, , 100%, , UBCTS405, , 100%, , UBCTS406, , 100%, , UBCTS407, , 100%, , UBCTS408, , 60%, , and, , Personal Finance and Planning, Monetary Economics, Collective Bargaining, Negotiation, Customer, Management, , and, , Relationship, , Total Credits, , 43, , 22

Page 46 :

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), BUSINESS COMMUNICATION AND SKILL DEVELOPMENT (DSC-8), C.No. UBCTC401, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), OBJECTIVE The basic objective of this course is to develop the communication skills., COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 basic understanding of business Models, CO2 understanding of reading and writing skills, CO3 understanding of listening skills, CO4 deep insight of group communication, CO5 understanding of Conflict resolution and negotiating skills, COURSE CONTENTS, UNIT-I INTRODUCTION (12 hours), Nature of communication; Purpose of communication; Essential of global communication;, Concept of effective communication; Communication models, IMPRESS and KISS model;, Audience analysis, meaning and importance of audience analysis and types of audience; Myth, and realities of communication; Communication as an aid to self development., UNIT-II READING AND WRITING SKILLS (12 hours), Reading, components of reading skills, factors affecting reading skills, techniques for improving, reading efficiency, guidelines for effective reading., Writing- Process of written communication, essentials of effective written communication;, Methods of organised presentation of matter, informative, instructional, arousing, persuasive,, decision making; Problems relating to written communication; Writing Resume, nature and, importance of resume; Components of resume; Difference between resume and curriculum vitae;, Preparation of curriculum vitae., UNIT-III LISTENING SKILLS (12 hours), Listening, definition and meaning, nature of listening, significance of listening; Types of, listening; Steps in process of listening; Barriers to effective listening; Guidelines to develop, listening skills; Role of empathy in listening., UNIT-IV GROUP COMMUNICATION (12 hours), Meaning and nature of groups; Types of groups; Techniques of group decision; Advantages and, disadvantages of group decision making; Meetings, meaning and importance of meetings, role of, chairperson and participants in a meeting; Methods of effective participation, tips for the conduct, of an effective meeting., , 44

Page 47 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), , BUSINESS COMMUNICATION AND SKILL DEVELOPMENT (DSC-8), C.No. UBCTC401, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), UNIT- V CONFLICT AND NEGOTIATING SKILLS (12 hours), Conflict- Meaning and nature of conflict; Process of conflict; Types of conflict; Sources of, conflict; Management of conflict; Negotiation- Meaning and nature of negotiation, elements of, negotiation, concept of distributive and integrative negotiation; Approaches to negotiation,, guidelines/tips for developing negotiation skills; Barrier to negotiation., BOOKS RECOMMENDED, 1., 2., 3., 4., 5., 6., 7., 8., 9., , Chhabra, T.N. & Bhanu, R. Business Communication, Sun India, New Delhi, Chaturvedi, P.D. Business Communication, Pearson Education, New Delhi, Raman, M. Technical Communication, Oxford University Press, Rajinder, P. & Korlakalli, J.S. Essentials of Business Communication, Sultan Chand, Publishers, New Delhi, Ramesh, M.S & Pattanshetti, C.C. Business Communication, R. Chand and Co.,New, Delhi, Aggarwal, R. Business Communication, Organisation and Management, Taxman’s, Publisher, New Delhi, Lesikar, R.V. & Pettet, Jr. J.D. Business Communication Theory and Application, Tata, McGraw Hill, Shirley,T. Communication for Business, Pearson Education, New Delhi, Bovee, C.L. et al. Business Communication Today, Pearson Education, New Delhi, , Note Latest edition of readings may be used, NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section A Five short questions selecting one from each unit will be set. Each question carries, three marks and answer to each question shall be of 70-80 words. All questions are compulsory., Section B Five medium answer questions, selecting one from each unit will be set. Each, question carries 7 marks and answer to each question shall be within 250-300 words. All, questions are compulsory., Section C Five long questions, selecting one from each unit will be set. A candidate has to, attempt any two. Each question carries 15 marks and answer to each question shall be within, 500-600 words., , 45

Page 48 :

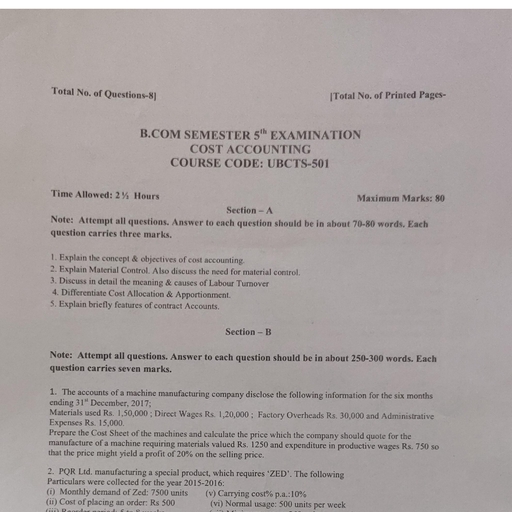

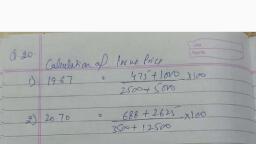

B.Com (CBCS), , University of Jammu, , UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), DIRECT TAX LAWS (DSC-9), C.No. UBCTC402, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), OBJECTIVE The basic objective of this course is to provide knowledge of basic concepts and, practice of income tax to the students, COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1, CO2, CO3, CO4, CO5, , develop an understanding of basic concepts of income tax, calculation of income under the head “salaries”, concept and calculation of income from “house property” and “capital gains”, calculation of income from head “business and profession”, calculation of income from “other sources” and “Gross total income”, , COURSE CONTENTS, UNIT - I BASIC CONCEPTS OF INCOME TAX (12 hours), Basic concept-Income, agricultural income, person, assesses and its types, assessment year,, previous year, exempted incomes u/s 10; Basis of charge-Residential status and incidence of tax;, Set off and carry forward of losses., UNIT- II INCOME UNDER THE HEAD ‘SALARIES’ (12 hours), Theory :Meaning and characteristics of salary; Provident funds and its types; Allowances and its, types; Perquisites (Perks) and its types; Profits in lieu of salary, gratuity, commuted pension and, leave encashment., Practical Calculation of taxable income under the head salaries., UNIT-III INCOME UNDER THE HEAD ‘HOUSE PROPERTY’ AND ‘CAPITAL, GAINS’ (12 hours), Theory: House Property, types of rental values-ARV, MRV, FRV, ERV, NAV and Standard, rent; Deduction u/s 24; Determination of annual value under let-out house and self-occupied, house., Capital Gains :Meaning of capital assets and its types, short term capital gain, long term capital, gain, indexing of cost of acquisition and improvement, net consideration. Practical Computation, of ‘Income from house property’; Computation of LTCG and STCG., UNIT – IV INCOME UNDER THE HEAD ‘BUSINESS AND PROFESSION’ (12 hours), Theory :Meaning of business and profession; General principles governing assessment of, business income, various systems of accounting; Expenses expressly allowed to be deducted;, Inadmissible expenses; Professional receipts and professional payments. Practical Computation, of income under the head ‘Business and Profession’., 46

Page 49 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), DIRECT TAX LAWS (DSC-9), , C.No. UBCTC402, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), UNIT – V INCOME UNDER THE HEAD ‘OTHER SOURCES’ (12 hours), Theory :General and specific incomes; Grossing up of income; Interest on securities, various, types of securities; Concept of casual income; Aggregation of income. Practical Computation of, income under the head ‘Other sources’, BOOKS RECOMMENDED, 1. Gaur and Narang. Income Law and Practice, Kalyani Pub, New Delhi., 2. Singhania, V.K & Singhania, M. Students Guide to Income Tax, Taxman Pub., New Delhi, 3. Ahuja, Garish and Gupta, Ravi. Systematic Approach to Income Tax, Bharat Law House,, New Delhi., 4. Tuli, Arvind & Chadha Neeru. Income Tax and Wealth Tax, Kalyani Pub., New Delhi, 5. Chandra, Goyal, Shukla. Income Lax and Practice, Pragati Prakashan, Delhi, 6. Pagare, Dinkar. Law and Practice of Income Tax, Sultan Chand, New Delhi, Note Latest edition of readings may be used, NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., Note 60% weight age should be given to problems demanding numerical solutions, , 47

Page 50 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), CORPORATE LAWS (DSC-10), , C.No. UBCTC403, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), OBJECTIVE The basic objective of this course is to provide knowledge about Corporate Laws, COURSE LEARNING OUTCOMES, After completing the course, the student shall be able to, CO1 understand basic aspects of corporate Laws., CO2 gain deeper understanding of various documents used in companies, CO3 understand how directors are appointed in the companies, CO4 familarise with the procedure of company meetings, CO5 gaining knowledge regarding modes of winding up of companies, COURSE CONTENTS, UNIT- I INTRODUCTION TO CORPORATE LAW (12 hours), Meaning and features of a company; Stages in formation of company; Types of companies;, Difference between private and public company; Conversion of private company into public, company, special privileges of a private company; Concept of lifting of corporate veil., UNIT- II DOCUMENTS (12 hours), Memorandum of Association Meaning, contents and procedure for alteration of memorandum of, association; Doctrine of ultra vires; Articles of Association Meaning, contents and its alteration;, Doctrine of indoor management; Prospectus Meaning and contents., UNIT- III APPOINTMENT OF DIRECTORS (12 hours), Appointment of directors; Qualifications, powers, duties and liabilities of directors; Legal, provisions relating to remuneration., UNIT- IV COMPANY MEETINGS (12 hours), Meaning, essentials of a valid meeting; Legal provision pertaining to statutory meeting, annual, general meeting and extra ordinary general meeting; Resolution Meaning, legal provision, pertaining to ordinary, special and resolution requiring special notice, registration of resolution, and agreements., UNIT V WINDING UP OF A COMPANY (12 hours), Introduction, modes of winding up, legal provisions for compulsory winding up, voluntary, winding up, members and creditors winding up; Consequences of winding up., , 48

Page 51 :

B.Com (CBCS), , University of Jammu, UNIVERSITY OF JAMMU, B.COM. (GENERAL) FOURTH SEMESTER (CBCS), CORPORATE LAWS (DSC-10), , C.No. UBCTC403, Credit : 6, Time: 2.30 Hrs, , Max Marks, = 100, Internal Assessment = 20, External Exam, = 80, , (Syllabus for examination to be held in May 2022, 2023, 2024), , BOOKS RECOMMENDED, 1., 2., 3., 4., 5., 6., , Garg, C. Company Law, Kalyani Publisher, New Delhi, Kapoor, N.D. Elements of Mercantile Law, Sultan Chand Publications, Gogna, P.P.S. A Text Book of Company Law, Sultan Chand Publications, Singh, H. Indian Company Law, Galgotia Publishing Company, Kapoor, N.D. A Book of Company Law, Sultan Chand Publications, Bagrial, A.K. Company Law, Vikas Publishing House, New Delhi, , Note Latest edition of readings may be used, ., NOTE FOR PAPER SETTER, Equal weight age shall be given to all the units of the syllabus. The external paper shall be of the, three sections viz, A, B & C., Section-A This section will contain five short answer questions selecting one from each unit., Each question carries 3 marks. A candidate is required to attempt all the five questions. Total, weight age to this section shall be 15 marks., Section-B This section will contain five questions selecting one from each unit. Each question, carries 7 marks. A candidate has to attempt all the questions. Total weight age to this section, shall be 35 marks., Section-C This section will contain five questions selecting one from each unit. Each question, carries 15 marks. A candidate has to attempt any 2 questions. Total weight age to this section, shall be 30 marks., , 49

Page 52 :