Page 1 :

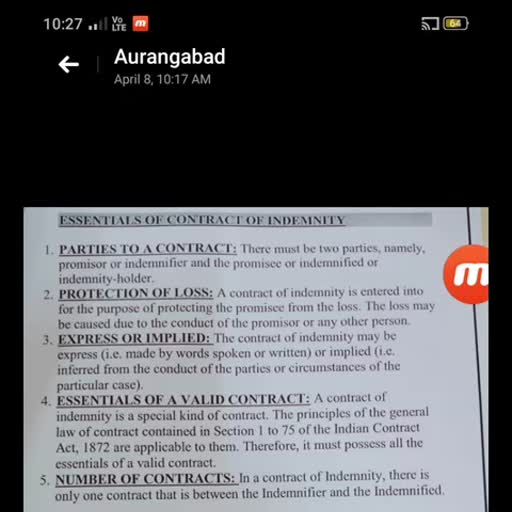

Unit -1, Indian contract act1872, The Indian Contract Act, 1872 prescribes the law relating to contracts in India and is the key act regulating Indian contract law. The Act is based on the principles of . It is applicable to all the states of India. It determines the circumstances in which promises made by the parties to a contract shall be legally binding. Under Section 2(h), the Indian Contract Act defines a contract as an agreement which is enforceable by law., Indian Contract Act, 1872 defines the term “Contract” under its section 2 (h) as “An agreement enforceable by law”. In other words, we can say that a contract is anything that is an agreement and enforceable by the law of the land., The Act as enacted originally had 266 Sections,, General Principles of Law of Contract – Sections 01 to 75, Contract relating to Sale of Goods – Sections 76 to 123, Special Contracts- Indemnity, Guarantee, Bailment & Pledge and Agency – Sections 124 to 238, Contracts relating to Partnership – Sections 239 to 266, At present the Indian Contract Act may be divided into two parts:, Part 1: Deals with the General Principles of Law of Contract – Sections 1 to 75, Part 2: Deals with Special kinds of Contracts such as, Contract of Indemnity and Guarantee, Contract of Bailment and Pledge, Contract of Agency., 1. Offer 2(a): An offer refers to a promise that is dependent on a certain act, promise, or forbearance given in exchange for the initial promise., 2. Acceptance 2(b): When the person to whom the proposal is made, signifies his assent there to, the proposal is said to be accepted., 3. Promise 2(b): A proposal when accepted becomes a promise. In simple words, when an offer is accepted it becomes promise., 4. Promisor and Promisee 2(c): When the proposal is accepted, the person making the proposal is called as promisor and the person accepting the proposal is called as promisee., 5. Consideration 2(d): When at the desire of the promisor, the promisee or any other person has done or abstained from doing or does or abstains from doing or promises to do or to abstain from doing something such act or abstinence or promise is called a consideration for the promise. Price paid by one party for the promise of the other Technical word meaning QUID-PRO-QUO i.e. something in return., 6. Agreement 2(e): Every promise and every set of promises forming the consideration for each other. In short,, a g r e e m e n t = p r o m i s e + c o n s i d e r a t i o n . {\displaystyle agreement=promise+consideration.}, 7. Contract 2(h): An agreement enforceable by Law is a contract. Therefore, there must be an agreement and it should be enforceable by law., 8. Reciprocal Promises 2(f): Promises which form the consideration and part of the consideration for each other are called 'reciprocal promises'., 9. Void agreement 2(g): An agreement not enforceable by law is void., 10. Voidable contract 2(i): An agreement is a voidable contract if it is enforceable by Law at the option of one or more of the parties there to (i.e. the aggrieved party), and it is not enforceable by Law at the option of the other or others., Features of a Valid Contract:, Offer and Acceptance, A is basically formed when an offer is accepted. This makes it vital that the offer is clear, definite and final when it is communicated to the offeree. Once the original proposal is accepted it becomes an agreement. The agreement must be consensual on both sides and both parties must agree to all facets of the agreement. There are important things to remember in regards to offers and acceptance:, Offers can be revoked at any time before occurs., Offers must be distinguishable from an invitation, so the other party knows they are entering into a contract., The acceptance must be for the offer made if not, it will be considered a counter-offer., Acceptance of an agreement occurs when it is received., Intention to Create Legal Relationship, To create a legally binding agreement, both parties must intend to enter into a legal relationship. For example, social agreements are not considered valid contracts because the parties don't expect them to be legally binding. Once both parties agree to a contract, they are bound by it, though the contract could be conditional based on other matters., Lawful Consideration, The consideration portion in a contract is something that you expect to get in return. Consideration can take numerous forms such as:, Cash, Goods, Act, Abstinence, Every contract must be supported by consideration and the consideration must be valuable. The consideration cannot be unlawful or gratuitous and it cannot be considered a past consideration., Certainty and Possibility of Performance, If a contract meaning is uncertain or the contract is not capable of being certain, then the contract would be deemed void. This means that the terms and conditions of the contract should always be certain especially in regards to:, Parties, Subject, Matter, Price, The terms of the agreement cannot require an impossible act and both parties of the contract must agree to the terms and conditions., Proving a Contract, Contracts exist for the parties involved but also in case any legal action occurs. If the contact is part of a case, proving its existence may become necessary. In this situation, oral contracts are extremely difficult to prove. Other contract types like written ones are easier to prove because of the paper trail involved., Enforceability of a Contract, Even if a contract has all of the essential elements there is still a risk of it being deemed unenforceable due to other issues such as:, Lack of capacity of one party to enter into the contract., Mistakes in the nature of the contract,, of facts included in the contract., An illegal or immoral contract, or a contract that was created under duress., A contract that restricts one person's trade., Both persons need to be legally able to enter into a contract and meet the eligibility requirements called the . Every person entering into a contract should be:, Of legal age to enter into a contract., Of sound mind., Not disqualified from entering into a contract., Entering the contract of their own free consent., A contract can also be voidable in the event of unilateral as well as mutual mistakes. Additionally, when a contract is gained through unfair means it could also be considered voidable., There are some contracts that are required to be in writing in order for them to be enforceable. This includes contracts such as:, Sale, Lease, Mortgage, Gift, Immovable property, It is important that all legal formalities be satisfied for a contract to be valid such as stamp duty. To be enforceable it is also required that the contract create a legal obligation. A one-directional consideration is considered friendly relations and a two-directional consideration a legal one., What are the Different Types of Contract?, If you are wondering what are the different types of contract, you're also thinking about the differences in one of the most fundamental aspects of business.4 min read, Contract Types Overview, If you are wondering what are the different types of contract, then you are wondering about the differences between one of the most fundamental aspects of a business. A contract is a legally binding agreement between two or more parties in which an exchange of value is made. The contract’s purpose is to set out the terms of the agreement and provide a record of that agreement which may be enforceable in a court of law. Contracts may come in many forms, each with its own use and purpose. If you need legal help to review a contract, on UpCounsel's marketplace you can get custom quotes from experienced within hours. You will save up to 60% compared to law firms., Express and Implied Contracts, An express contract has terms that are stated expressly, or openly, in either writing or orally, at the time of contract formation. These are the kinds of contracts that most people think of when they think of contracts., , on the other hand, have terms that must be inferred by actions, facts, and circumstances that would indicate a mutual intent to form a contract. Such contracts may be as binding as express contracts, despite their lack of formal agreement, although if a court perceives doubts in minds of the parties as to whether or not a contract existed, it may choose not to enforce such a contract., Unilateral and Bilateral Contracts, Unilateral contracts involve only one party promising to take action or provide something of value. These are also known as one-sided contracts, and a common example of them is when a reward is offered for something being found: the party to whom the reward is offered is under no obligation to find the lost item, but if they do find it, the offering party is under contract to provide the reward., Bilateral contracts, on the other hand, involve both parties agreeing to exchange items or services of value. These are also known as two-sided contracts and are the kind of contract that is most commonly encountered., Unconscionable Contracts, Unconscionable contracts are contracts that are considered unjust by being unfairly weighted to give advantage to one side over the other. Examples of elements that may make a contract unconscionable include:, A limit on the damages a party may receive for breach of contract., A limit on the rights of a party to seek satisfaction in court., An inability to have a warranty honored., Whether or not a contract is unconscionable is a matter left for . They usually rule a contract to be unconscionable if it is perceived as being a contract that no mentally able person would sign, that no honest person would offer, or that would undermine the court’s integrity where it was enforced., Adhesion Contracts, An adhesion contract is one that is drafted by a party with a great deal more bargaining power than the other party, meaning that the weaker party may only accept the contract or not. Often called “take it or leave it” contracts, these contracts lack much, if any negotiation, since one party will have little to nothing to negotiate with. Such contracts should not be , since a lack of bargaining power does not necessarily mean that the terms set out will be unfair. That said, courts may still not enforce adhesion contracts if they believe a never existed., Aleatory Contracts, Aleatory contracts are agreements that are not triggered until an outside event occurs. Insurance policies would be examples of this, as they are agreements involving fiscal protection in the face of unpredictable events. In such contracts, both sides assume risks: the insured that they are paying for a service they will never receive, and the insurer that they must pay out potentially more than they receive from the insured., Option Contracts, Option contracts allow a party to enter another contract with another party at a later time. Entering into a second contract is called exercising the option, and a good example of this is in real estate, where a prospective buyer will pay a seller to take a property off the market, then, at a later date, have a new contract made to buy the property outright, should they choose to do so., Fixed Price Contracts, Fixed price contracts involve a buyer and seller agreeing on a fixed price to be paid for a project. Also known as lump sum contracts, these contracts entail a great deal of risk for the seller, since if the project takes longer or is more extensive than anticipated, they will still only be paid the agreed-upon price., The Concept of Offer and Acceptance under the Indian Contract Law, Introduction, An agreement enforceable by law becomes a contract. It involves both rights and obligations. An agreement involves promises from both sides, and thus, there is the creation of both rights and obligations. The agreement between the parties is one of the essentials of a valid contract. The constitution of an offer occurs by an offer or the proposal by one of the parties and the acceptance of such an offer or proposal by the other party. Offers refer to the significance of willingness by one party to a contract to do or abstain from doing anything, with a motive to obtain the assent of the other party to such act or abstinence. Acceptance refers to the significance of the assent by one party to the proposal made by the other party and if such assent is signified, the proposal is said to be accepted and such accepted proposal is called a promise., The distinction between Offer and Invitation to Offer, There is a distinction between an offer and an invitation to offer. The offer and acceptance of the offer are essential for the constitution of a valid contract. An offer, as defined above, refers to signifying willingness to do or to abstain from doing something and to obtain the assent of others to such an act or abstinence. In case of an invitation to offer/treat, there is an offer to negotiate or may be considered as an offer to receive offers. When a party, without expressing his/her final willingness, offers/proposes certain terms on which he is willing to negotiate, he/she is only making an invitation to the other party to make an offer on those terms., Intention to Create a Legal Relationship: An Essential of a Valid Offer, An important essential of a valid offer is the intention to create a legal relationship, that is, the parties must have intended their agreement to be legally binding. A mere social contract arrangement, such as an agreement with a friend to meet for a meal or visit a cinema will not be treated as a contract because of the lack of intention to create a legal relationship., Communication of the offer: An Essential of a Valid Offer, Another important essential of a valid offer is the communication of the offer. An offer is valid only when it is brought to the notice of the offeree. The communication of the offer can be both expressed or implied. The communication of the offer has been elaborated in section 4 of the Indian Contract Act, 1872 which states that the communication of the offer is complete when it comes to the awareness/knowledge of the offeree. It has been stated that acting in ignorance of the offer will not amount to the acceptance of the offer., Classification of Offer, There are many kinds of offers such as general and specific offers, express and implied offers, cross offers, counteroffers, etc. A general offer is accepted by any person, that is, the offer is made to the public at large, then such an offer is called a general offer. For instance, the reward for an individual who finds a lost commodity is a general offer as the reward will be given to anyone who finds the lost commodity. Specific offer, on the other hand, is made to a specific person or a group of persons and can be accepted by the same, not by anyone else. For instance, A offers to sell his plot of land to B. In this case, the offer is made to a specific person, that is, Y and thus, it is a specific offer., An express offer is an offer made by the express words, written or spoken. For instance, A offers to sell his car to B for Rs. 200,000 by sending him a letter containing the offer. This is an expressed offer. Implied offer, on the other hand, may be derived from the actions or circumstances of the parties. For instance, entering the bus for reaching a certain place is acceptance of the offer to pay the ticket fare indicates an implied acceptance of the offer., Cross offer arises when the offers made by two parties to each other contain similar terms of bargain cross each other in the post. It means that both the parties make the same offer at the exact time to each other. A counteroffer is an answer given to an initial offer or proposal. A counteroffer signifies the rejection and subsequent replacement of the original offer by another offer., Essentials of a Valid Acceptance, Just like an offer, certain essentials need to be fulfilled to ensure the valid acceptance of the offer made. These essentials are:, 1. Acceptance Shall Be Communicated To The Offeror By The Offeree, If the offeree just accepts the offer without communicating the same to the offeror, then it cannot be considered a valid acceptance. In case the parties are face to face, then the communication can be oral and when the parties are at a distant place, then communication of the acceptance can be made through telegram, post, or any other reasonable manner. Acceptance can also be implied. Thus, to constitute a valid contract, acceptance of the offer and the intimation of the same to the offeror by some external manifestation, which the law regards as reasonable and sufficient is necessary., 2. Acceptance Should be Absolute And Unqualified, The basic contention behind this necessity is to state that a rejection or a counteroffer would not amount to acceptance of the offer. Acceptance must be absolute and unqualified to constitute a valid acceptance. The offeree’s acceptance of the offer should be unconditional. For instance, if the letter of acceptance contemplates future negotiations for the finalization of the terms and conditions of the contract, then there exists no contract as the acceptance is not valid., 3. Acceptance Should be Expressed in a Usual/Prescribed Manner, It has been stated in section 7(2) of the Indian Contract Act, 1872 that acceptance should be expressed in some usual or reasonable manner, in case, there is no prescribed manner of acceptance mentioned in the agreement. The acceptance through telegram, post, and telephone are some examples of the usual manner of acceptance. It has also been held that a mere silence will not amount to the acceptance of the offer. But there are some exceptional situations where silence amounts to acceptance of the offer., 4. Acceptance Should be Made while the Offer is still Subsisting, Another important essential of a valid acceptance is the acceptance of the offer while the offer is still existing. Under section 5, it has been stated that an offer can be invoked any time before the communication of the acceptance of the offer is complete. If the offer is revoked by the offeror or lapses because of reasons such as lapse of reasonable time, etc., then nothing can be done to accept the same. Thus, acceptance of the offer while the offer is still subsisting is an important essential of a valid acceptance., What Is a Breach of Contract?, A breach of contract is a violation of any of the agreed-upon terms and conditions of a binding contract. The breach could be anything from a late payment to a more serious violation such as the a promised ., A contract is binding and will hold weight if taken to court. To successfully claim a breach of contract, it is imperative to be able to prove that the breach occurred., Understanding a Breach of Contract, A breach of contract is when one party breaks the terms of an agreement between two or more parties. This includes when an obligation that is stated in the contract is not completed on time—you are late with a rent payment, or when it is not fulfilled at all—a tenant vacates their apartment owing six-months' back rent., Sometimes the process for dealing with a breach of contract is written in the original contract. For example, a contract may state that in the event of late payment, the offender must pay a $25 fee along with the missed payment. If the consequences for a specific violation are not included in the contract, then the parties involved may settle the situation among themselves, which could lead to a new contract, , or another type of resolution., Types of Contract Breaches, One may think of a contract breach as either minor or material. A "minor breach" happens when you don't receive an item or service by the due date. For example, you bring a suit to your tailor to be custom fit. The tailor promises (an oral contract) that they will deliver the adjusted garment in time for your important presentation, but in fact, they deliver it a day later., A "material breach" is when you receive something that is different from what was stated in the agreement. Say, for example, that your firm contracts with a vendor to deliver 200 copies of a bound manual for an auto industry conference. But when the boxes arrive at the conference site, they contain gardening brochures instead., Further, a breach of contract generally falls under one of two categories: an "actual breach"—when one party refuses to fully perform the terms of the contract—or an "anticipatory breach"—when a party states in advance that they will not be delivering on the terms of the contract., Legal Issues Concerning a Breach of Contract, A plaintiff, the person who brings a suit to court claiming that there has been a breach of contract, must first establish that a contract existed between the parties. The plaintiff also must demonstrate how the defendant—the one against whom a claim or charge is brought in a court—failed to meet the requirements of the contract., UNIT-2 SALE OF GOODS ACT 1930, What is the Sale of Goods Act, 1930?, This act defines a contract wherein the seller of particular goods transfers or agrees to transfer the goods to the buyer for some price. This mercantile law was formed on the 1st of July 1930 when India was under the British Raj. This law had borrowed mostly from the Sale of Goods Act, 1893 of Great Britain. The law is applicable all over India except for Jammu and Kashmir. As per section 2 of this act, a contract of sale is a generic term which refers to both sale and agreement to sell and is characterized by:, An offer to buy goods for a price or an offer to sell goods for a price and, Acceptance of the offer., Important Terms In the Sale of Goods Act, 1930, Buyer – This is mentioned in section 2(1) and defined as a person who either purchases or agrees to purchase certain products. The buyer appears as one of the parties in the contract of sale., Seller - This is defined in section 2(13) and defined as a person who either sells or agrees to sell certain products. The seller appears as one of the parties in the contract of sale., By combining the definitions of a buyer and seller, we can conclude that it is not mandatory to transfer goods to be deemed as a buyer or a seller. Just by agreeing or promising to sell and buy goods, you become buyer and seller as per the contract of sale., Goods – Goods are any merchandise or possession. An important clause in the contract for sale goods is described in Section 2(7) as:, It is a moveable property (except for money and actionable claims), Stocks and shares, Growing crops, grass, standing timber, Sale of Goods Act, 1930 – Important Terms, The Sale of Goods Act, 1930 herein referred to as the Act, is the law that governs the sale of goods in all parts of India. It doesn’t apply to the state of Jammu & Kashmir. The Act defines various terms which are contained in the act itself. Let us see below:, I. Buyer And Seller, As per the sec 2(1) of the Act, a buyer is someone who buys or has agreed to buy goods. Since a sale constitutes a contract between two parties, a buyer is one of the parties to the contract., The Act defines seller in sec 2(13). A seller is someone who sells or has agreed to sell goods. For a sales contract to come into existence, both the buyers and seller must be defined by the Act. These two terms represent the two parties of a sales contract., A faint difference between the definition of buyer and seller established by the Act and the colloquial meaning of buyer and seller is that as per the act, even the person who agrees to buy or sell is qualified as a buyer or a seller. The actual transfer of goods doesn’t have to take place for the identification of the two parties of a sales contract., II. Goods, One of the most crucial terms to define is the goods that are to be included in the. The Act defines the term “Goods” in its sec 2(7) as all types of movable property. The sec 2(7) of the Act goes as follows:, “Every kind of movable property other than actionable claims and money; and includes , growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale will be considered goods”, As you can see, shares and stocks are also defined as goods by the Act. The term actionable claims mean those claims which are eligible to be enforced or initiated by a suit or legal action. This means that those claims where an action such as recovery by auction, suit, refunds etc. could be initiated to recover or realize the claim, Types of Goods under Sale of Goods Act 1930, Section 6 of the act explains in detail all types of goods in the Sale of Goods Act. There are mainly three categories of goods:, Existing Goods – If the goods exist physically at the time of contract and the seller is in legal possession of the goods, then it is termed as existing goods. They are further divided into three types:, Specific Goods – They are defined under section 2(14) and refer to goods that are identified and agreed to be transferred, at the time of making the contract. For example, A wants to sell a Bike of a certain model and year of manufacture, and B agrees to buy the bike. Here the bike is a specific good., Ascertained Goods – These types of goods are identified by judicial interpretation and not by law. Any good where the whole or part of the good is identified and marked for sale at the time of the contract comes under ascertained goods. These goods are earmarked for sale., Unsanctioned or Unascertained Goods – Those goods that are not specifically identified for sale, at the time of the contract, fall under the category of unsanctioned goods. For example, there is a bulk of 1000 quinols of wheat out of which 500 quinols are agreed to be sold. Here the seller can choose the good from the bulk and is not specified., Future Goods – The definition of future goods appears in section 2(6). The goods which do not exist at the time of contract but are supposed to be produced, acquired, or manufactured by the seller are called future goods. For example, A sells chairs and B wants 300 chairs of a specific design which A agrees to manufacture them at a future date. Here chairs are future goods., Contingent Goods – You can find the answer to what is contingent goods in section 6(2) of the Sale of Goods Act. A contingent good is a kind of future good, but it is dependent on the happening (or the absence of) certain conditions. As an example, X has agreed to sell 100 mangoes from his farm to Y at a future date. But this sale depends on the fact whether the trees in X’s farm give a yield of 100 mangoes by the date of the contract., Essential Elements in a Contract of Sale, Two parties: A contract of sale is between two parties, where one party transfers goods to another party., Goods: The subject of the contract must be goods. This is usually the most important element in a contract of sale because if the goods are not described precisely, confusion could result., Transfer of ownership: Ownership of the goods must be moved from the seller to the buyer, or there should be an agreement in which the transfer of ownership is made., Price: The buyer in the contract must pay a price for the goods., A sales contract is a special type of contract. In order for it to be valid, it must contain clauses about free consent and the competency of the signing parties., A sale and an agreement to sell are part of a ., No formalities. There is no particular form to define a valid contract of sale. A contract of sale can be made simply by offering and accepting., Two Different Parties, The ownership of the goods is transferred from one of the to the other. The buyer and the seller have to be different people. Otherwise, it's not possible to create a contract., For example, Parties A and B both own a TV. Party A can transfer complete ownership to Party B because they are partners in business, and Party B becomes the sole owner of the TV., Goods, are defined as any type of movable property such as crops, stocks, and things attached to the land that can be separated from it. While writing a contract, make sure to describe the goods for purchase exactly, including details such as weight, color, size, type, and model number. You can avoid future problems by writing a detailed goods description so that buyer gets what he or she wants., For example, Party A agrees to sell wheat crops to Party B. Both parties agree that Party B can cut the crops and take them, once he pays the agreed price. Since wheat crops are considered a good, this is a valid contract of sale. Every kind of movable property is a good except for cash and actionable claims. Contracts for services are not contracts of sale. Sale of immovable property and book debt are dealt with differently., Transfer of Ownership, In every contract of sale, the has to be agreed upon. General property is transferred in a contract of sale. Special property is transferred in a pledge of goods. In a contract of sale, the transfer of ownership is final., Price, Price is the money consideration for a sale of goods. Consideration in a contract of sale has to be in the form of money. Barter of exchange is used when the consideration is in the form of goods. This method was used before the prevalence of currency., For a sale to exist, goods have to be sold for a given amount of money, or price. The consideration can consist partly of money and partly of goods that have been assigned a value. Payment is not needed at the time of creating the sales contract., Other Contract Essentials, If any elements are not met, the sales contract is not valid. For example, Party A agreed to sell her car to Party B. Party B forced Party A to sell her car through excessive persuasion. Therefore, the contract is invalid because there is no free consent by the transferor., Contract Sale, A sale is an absolute contract, while an agreement to sell is an executory contract that suggests a conditional sale. A sales contract consists of an offer to sell or buy goods for a price and acceptance of that offer. The payment or delivery of goods is not necessary at the time of creating the sales contract unless it's agreed to., A contract can be made in the following ways:, Orally, In writing, Partly in writing and partly orally, Through actions, and implied by those actions, Concept of Condition and Warranty, All contracts must contain specific warranty terms and conditions to be considered valid. According to the Sale of Goods Act, 1930, the purchase of goods and service can also be regarded as a contract law; hence one should know the condition and warranty in contract law., Warranty and conditions can be defined as stipulations, obligations or provisions directly associated with goods or services that buyers and sellers impose on each other. Any breach in conditions will lead to rejection or cancellation of agreements., Apart from this meaning of condition and warranty, one should note that breach in conditions will also lead to a violation of warranty. In such a situation, the non-defaulting party can not only cancel the contract but also claim appropriate reimbursement on condition warranty., Hence, conditions are an indispensable part of a sales agreement which all parties need to fulfill for the successful execution of the contract., Types of Conditions, An agreement of sale can contain two types of conditions & warranty. These are as follows –, Implied Conditions, Implied condition contract law refers to those terms and obligations that are not mentioned but as per law should have been stated in the agreement. These include –, Implied Understanding Regarding Title, Unless otherwise stated, it is implied on the part of a seller that he or she holds the right to sell the goods. Additionally, during a sale, it is also implied that the seller is the owner and therefore holds the rights of transferring the title of goods to a buyer., Consequently, if later the goods turn out to be defective, then the buyer can claim damage according to condition and warranty in the contract. It is also implied that the goods will be free from any fraudulent charge from a third party., Implied Knowledge of Quality and Fitness, There is no implied condition and warranty in the law regarding product quality and fitness. However, it is implied that the product should be suitable for the purpose mentioned in situations where, A buyer is relying on a seller’s skill and judgment for a particular product, Has informed him or her regarding the purpose of a product,, The seller can supply the product, Sale by Description, If goods are being sold through descriptions only, warranty and conditions imply that goods will conform to the description given. Furthermore, in situations where goods are sold through both sample and description, then the end-product should be in accordance with both., Sale by Sample, In case of agreements where products are being sold by samples, then as per implied warranty and conditions, bulk products will be according to the quality of this model shown. Moreover, buyers should be given ample time to compare bulk products with samples. End products will also be free of any defect which cannot be detected during examination of a model and which will prevent the buyer from utilising them., Expressed Conditions, Terms and stipulations, which are stated explicitly on an agreement of sale, are called expressed warranty and conditions. A buyer should go through these conditions to gain a thorough understanding of the product and sale agreement before buying. It is crucial as buyers cannot take any action against a seller if they have any issue regarding any condition which was mentioned on the contract of sale., What is a Warranty?, Warranty Sale of Goods Act, 1930, is a kind of certification provided by the manufacturer to the buyer regarding the quality and authenticity of the product. Unlike condition, it is indirectly associated with the primary object of the agreement of sale., Any breach in warranty and conditions does not result in cancellation of the contract. However, buyers can claim reasonable reimbursement in case the product is defective or damaged and do not perform as effectively., Like conditions, a warranty can either be expressed or implied. Seller’s certification or statement regarding the capacity, quality, and the authenticity of the product on the agreement of sales can be considered an express warranty. If an electrical appliance contains the statement ‘made in India’, then the seller or manufacturer is expressly guaranteeing that it has been manufactured in India., RIGHTS OF THE BUYER, When the seller breaches a contract of sale, the following remedies may be available to the buyer:, The buyer may sue for damages for non-delivery under Section 57of the Sale of Goods Act, In case the price has been paid by the buyer, he may recover it in a suit for money, According to Section 61(2)(b), the buyer is also entitled to interest on the amount of the price from the date of payment of the price to the date of the refund of the same. However, if the buyer has not served to seller a notice under Section 55 of the Indian Contracts Act, the buyer cannot claim damages. In the case of non-delivery, damages will be the difference between the contract price and the market price at the time of the breach., Right to examine the goods, According to Section 41(2) the seller has a duty to give an opportunity to the buyer to examine the goods to ensure that they are in conformity with the contract. However, if there is an agreement to the contrary, the buyer may have to take the delivery of the goods even without examining them depending upon the agreed terms of the contract., Sometimes the buyer may have taken the delivery of the goods before he had examined them. Taking delivery of the goods by the buyer does not necessarily imply that he has accepted those goods. Section 41(1) of the Act states that the buyer is not deemed to have accepted the goods until, after taking the delivery of the goods; he has had a reasonable opportunity of examining them to ensure that they are in conformity with the contract. After examining the goods, he has a right to reject them if he finds out that they are not in conformity with the contract., If, after taking delivery, he does not reject the goods within a reasonable time, he is deemed to have accepted the goods. Section 63 of the Act provides that “the question what is a reasonable time is a question of fact”., Remedy for breach of warranty, According to Section 59, a breach of warranty does not entitle the buyer to reject the goods. He could sue the seller for damages for breach of warranty. When there is a breach of condition and the buyer intends to treat it as a breach of warranty, he is bound to give a notice to the seller of the same. The amount the buyer has to pay will be the difference between the amount of price payable and the amount of damages recoverable for the breach of warranty. If the however the amount of damages for the breach of warranty is higher than the price payable by the buyer then, he can then sue for the same breach of warranty., Damages for the breach of warranty are to be determined in accordance with the provisions of Section 73 of the Indian Contract Act. Thus the damages which naturally arise in the usual course of things can be recovered., Right to sue seller for specific performance, Section 58 entitles the buyer to sue the seller for damages if the latter refuses to deliver the goods. This stipulates that the Court may pass a decree directing the seller to specifically perform the contract, that is, to deliver the goods which were agreed to by both the parties in the Contract of Sale. A suit for specific performance cannot be maintained unless the contract is for the delivery of specific or ascertained goods. This right is available only to the buyer and not to the seller., To sue the seller the damages for anticipatory breach of contract, Anticipatory breach of contract means breach of contract before the due date of the performance of the contract. The promise in such a situation has two options:, He may bring an action even before the due date of the performance has arrived OR, He may still treat the contract as subsisting and wait till the due date to perform the same. In such this scenario, the promisor maybe discharged from performing the contract if there is a frustration of contract, DUTIES OF THE BUYER, Duty to accept the goods, According to Section 31 of the Act, the buyer is bound to accept the goods if they are being properly tendered. He is not bound to accept the goods if the quantity of the goods being supplied is less or more than what was agreed between the parties, or when the whole or the part of the goods are not in accordance with the description given in the contract. Section 38 (1) states that unless there is an agreement to the contract, he is not bound to take the delivery of the goods by installments. According to Section 43, if the buyer rejects the goods, he is not bound to return them; he needs to merely intimate the seller that he refuses to accept the goods., Section 44 of the Act states that the buyer is liable to the seller for any loss occasioned by his neglect or refusal to take delivery. In Demby Hamilton & Co. v. Barden,[1] the buyer wrongfully refused to take delivery of apple juice. The Court held that the buyer was liable for the deterioration of the same as it was refusal to take in the goods that caused damage to it., Section 42 of the Act provides that the buyer is deemed to have accepted the goods when, the buyer intimates to the seller that he has accepted the goods or, the goods have been delivered to the buyer and he does any act in relation to them which is inconsistent with the ownership of the seller or, the buyer on receiving the delivery of the goods retains those goods and does not reject them within a reasonable time, An act on the part of the buyer in relation to the goods may lead to the inference that the buyer, has accepted the goods. For example, if the buyer sells the goods or pledges them or starts using them, can be regarded as the buyer having accepted the goods. It was held in Humur v. Groves[2] that when the buyer on receiving the delivery of 25 sacks of flour discovered that the same is not of the contract description but sells one sack and consumes the other two himself, this amounts to the acceptance of the goods by the buyer and he cannot subsequently reject them., Section 42 is not subject to the provisions of Sec. 41 and therefore even if the buyer did not have a reasonable opportunity to examine the goods, he may be deemed to have accepted them if he does any act inconsistent with the ownership of the seller., In Kailah Sharma v. Patna Municipal Corpn[3], the petitioner supplied machines to the respondent as per the contract between them. The machines were accepted and accordingly certified by the representative of the Corporation as satisfactory for the purpose. After having used the machine and retained them for a long time, the Corporation wanted to repudiate the sale transaction. The Court held that once the supply was accepted, it did not lie with the Corporation to repudiate the transaction. And the refusal to make the payment by the Corporation was held arbitrary and improper. In terms of Section 42 of the Sale of Goods Act, 1930, once goods are accepted, there is a simultaneous obligation to pay for them., Duty to pay the price, The buyer’s duty is to pay the price in accordance with the contract. If the buyer does not pay the price after it has become due, the seller may sue him for the price. If the price remains unpaid, apart from the right to sue the buyer for the price, the seller has also got certain rights against the goods, those rights being – Lien, Stoppage in transit and Re-sale., It is also necessary that the price should be paid by the buyer in time in accordance with the agreement. In case there is delay in the payment of the price, the seller may either treat the contract as repudiated or sue the buyer for damages, depending on whether the time of payment of the price is a condition or a warranty. Section 61(2)(a) of the Act states that, where there is a delay in payment of price, the court may order interest on the price from the date of tender of goods, if no date for the payment of the price has been decided, or from the date on which the price was payable., What is the difference between Sale and Hire Purchase?, UNIT-3, NEGOTIABLE INSTRUMENT ACT 1881, What Is a Negotiable Instrument?, A negotiable instrument is a signed document that promises a sum of payment to a specified person or the assignee. In other words, it is a formalized type of : A transferable, signed document that promises to pay the bearer a sum of money at a future date or on-demand. The payee, who is the person receiving the payment, must be named or otherwise indicated on the instrument., KEY NOTES:, A negotiable instrument is a signed document that promises a sum of payment to a specified person or the assignee., Negotiable instruments are transferable in nature, allowing the holder to take the funds as cash or use them in a manner appropriate for the transaction or according to their preference., Common examples of negotiable instruments include checks, money orders, and promissory notes., Understanding Negotiable Instruments, instruments are transferable in nature, allowing the holder to take the funds as cash or use them in a manner appropriate for the transaction or according to their preference. The fund amount listed on the document includes a notation as to the specific amount promised and must be paid in full either on-demand or at a specified time. A negotiable instrument can be transferred from one person to another. Once the instrument is transferred, the holder obtains a full legal title to the instrument., These documents provide no other promise on the part of the entity issuing the negotiable instrument. Additionally, no other instructions or conditions can be set upon the bearer to receive the monetary amount listed on the negotiable instrument. For an instrument to be negotiable, it must be signed, with a mark or signature, by the maker of the instrument—the one issuing the draft. This entity or person is known as the drawer of funds., Examples of Negotiable Instruments, One of the more common negotiable instruments is the personal check. It serves as a draft, payable by the payer’s upon receipt in the exact amount specified. Similarly, a cashier’s check provides the same function; however, it requires the funds to be allocated, or set aside, for the payee prior to the check being issued., Money orders are similar to checks but may or may not be issued by the payer’s financial institution. Often, cash must be received from the payer prior to the money order being issued. Once the money order is received by the payee, it can be exchanged for cash in a manner consistent with the issuing entity's policies., function differently, as they require two signatures to complete a transaction. At the time of issue, the payer must sign the document to provide a specimen signature. Once the payer determines to whom the payment will be issued, a countersignature must be provided as a condition of payment. Traveler's checks are generally used when the payer is traveling to a foreign country and is looking for a payment method that provides an additional level of security against theft or fraud while traveling., Promissory note and checque, The Law of Cheques and Promissory Notes is a treatise on the Canadian law of bills of exchange, including negotiable instruments, cheques, and promissory notes, with reference to the federal Bills of Exchange Act and other federal and provincial legislation that deal with the subject., Written by a specialist in commercial litigation, Law of Cheques and Promissory Notes sets out all conceivable issues with respect to:, The treatment of negotiable instruments as a medium of payment, Their properties and requirements, Their limitations, Their legal standing, This new publication is an essential reference to the Canadian law of bills of exchange and an invaluable tool for commercial lawyers and businesses in managing risk in business transactions., Although negotiable instruments are widely used commercially instead of cash, or to advance credit, not all businesses are aware of the legal implications attached to these payment methods, and whether the kind of payment is appropriate to the transaction., Law of Cheques and Promissory Notes provides:, A detailed review of negotiable instruments, such as cheques, promissory notes, bank drafts, and money orders, Expert interpretation of Canada's Bills of Exchange Act and the related federal and provincial legislation, Guidance on handling negotiable instruments, Discussion on the rights and obligations arising from negotiable instruments, Commentary on key cases and extensive references to the case law, PROMISSORY NOTE AND CHEQUE DIFFERENCE, Characteristics of Negotiable Instruments, As per Section 13(a) of the Act, “Negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer, whether the word “order” or “ bearer” appear on the instrument or not.”, As per Section 13(a) of the Act, “Negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer, whether the word “order” or “ bearer” appear on the instrument or not.”, Important characteristics of Negotiable Instruments are:, Property: The possessor of negotiable instrument is acknowledged to be the owner of property contained therein. Negotiable instrument does not simply give ownership of the instrument but right to property as well. The property in negotiable instrument can be moved without any formality. In the case of bearer instrument, the possessions pass by meager delivery to the transferee. In case of order instrument, endorsement & delivery are necessary for transfer of property., Title: The transferee of negotiable instrument is called ‘holder in due course.’ A genuine transferee for value is not affected by any flaw of title on the part of transferor or of any of the previous holders of instrument., Rights: The transferee of negotiable instrument can take legal action in his own name, in case of dishonour. A negotiable instrument can be reassigned any number of times till it is attains maturity. The holder of instrument need not give notice of transfer to the party legally responsible on the instrument to pay., Presumptions: Certain presumptions are applicable to all negotiable instruments i.e., a presumption that deliberation has been paid under it. It is not essential to write in promissory note the words ‘for value received’ or alike expressions for the reason that the payment of consideration is acknowledged. The words are typically included to generate additional substantiation of consideration., Prompt payment: A negotiable instrument facilitates the holder to anticipate prompt payment because dishonour refers to the ruin of credit of all persons who are parties to the instrument