Page 1 :

Decisions under, and Output Decici, , and Ouput, Pricing, , 33, , Imperfect Competition, , MODULE, , T, , PRICING AND OUTPUT DECISIONS UNDER, , IMPERFECT COMPETITION, , SYNOPSIS, Monopolistic, , Competition, , Competitive and monopolistic elements o, , monopolistic competition - equilibrium of a firm under monopolistic competition,, , monopolistic competition versus perfect competition excess capacity and inefficieney, - debate over the role of advertising (topics to be taught using case studies from real, , life examples), , Oligopolistic Markets Key attributes of oligopoly-collusive and non-collusive, , oligopoly market - price rigidity - cartels and leadership models (with practical, , examples), ., , -, , Free!!!, Questions and Answers availabte with scratch card provided n, , Pleasefolow instructions provided for downloading., , the book

Page 2 :

Business Economics, , 34, 1., , N (FY.B.Com.) (Sem.-, , s's'*, , Pricing and Ouiput DecIsions, , There, , INTRODUCTION, , conditions like, of imperfect market, with the different types, these imperfect, This module deals, a n idea of, module, gives, and oligopoly. The, monopolistic competition, their, and, working., conditions, market, , under, , Imperfect Competition, , product differentiation. F'irstly,, on certain characteristics, base, of the product itself such differentiation may De, as exclusive, patented, features, trade marks and trade names,, of packaging difference, peculiarities, colour, design,, or, in, quality,, style. Imaginary differences, also be created througn, advertising or the use of attractive packets. Many times may, there may be no difference in, the actual products., , Secondly,, , 2., , MONOPOLISTIC COMPETITION, , Elements of Monopolistie Competition, Competitive and Monopolistie, of monopolistic competition. Monopolistic, Chamberlin introduced the concept, to perfect, realistic market situation compared, and, a, is, revolutionary, competition, chamberlin, in most of the reäl, to, competition and pure monopoly. According, and conpetitive elements are, world economie situations. both monopoly, is thus a, of monopolistic competition, present., , Chamberlin's, , concept, , blending of competition and monopoly,, which' makes it as a, The most striking feature of monopolistic competition, of the product. This, differentiation, the, blending of competition and monopoly is, but differentiated, not, homogenous,, a, r, e, firms, m e a n s that the products of various, does not mean, differentiation, Product, though they are closely related to each other., The differences in the, different., are, altogether, that the products of various firms, similar and serve as close substitutes for, product are only slight. In fact they are quite, , of products, monopoly element, each other. When there is any type of differentiation, the greater the element of, enters the situation. The greater the differentiation,, a, number of, there, situation., When, involved in the, , monopoly, market, producing differential products each one has, , are, , large, , of its own|, substitutés., Thus, since, close, each is a monopolist of its own product, but is subject to the competition of, close substitutes. This market situation is called monopolistic competition., , firms, , a, , monopolý, , roduct, but is subject to the competition of, , It is thus clear that monopolistic competition involves both the monopoly and, competitive, , elements., , According, , to, , Chamberlin, , ", , With, , differentiation, , appears, , monopoly and as it proceeds further, the element of monopoly becomes greater. Where, there is any degree of differentiation whatever, each seller has an absolute monopoly, of his own product, but is subject to the competition of more or less imperfect, substitutes. Since each is a monopolist and yet has competitors we may speak of them, as "competing monopolists" and with peculiar appropriateness, of the forces at work as, those of monopolistic competition"., , The above explanation amply makes it clear that in monopolistic competition, products are not identical as in perfect competition but neither are they remote, substitutes as in monopoly. The products of the various sellers are fairly similar but, not the same) an serve as close substitutes of each other., Every seller has a monopoO, of his own differentiated product, but he has to face a, stiff competition from his riva, , sellers which are selling close substitutes of his product. Product differentiation can be, made clearer with some, examples. For, are, , example in India there, , man, manufacturers of toilet soap which produce under, different brand names sucn, Vivel, Lux, Rexona, Lifebuoy, Dove etc. The manufacturers, of Lux' has a monopo1y, producing it (since he is the only producer for this item, Lux). But he a, competition from the manufacturers of Rexona,, Dove, which are L, Vivel,, etc..., substitutes of Lux. The manufacturers of, Lux soap has to take into, reactions of rival firms, accou, producing close substitutes, while taking decisions, output policies. Thus, it is clear that, O to the, monopolistic competition corresponds more the, real world economic, situation than perfect, competition or monopoly., , 35, , are two bases for, , the, , differentiation, , may be, , based, , surrounding the sale of the product. The services rendered in selling theconditions, product, differentiates the product. Example - way of doing business, reputation for, fair, dealing, courtesy, efficiency ete., on, , the, , 8MONOPOLISTIC COMPETITION, Introduction, , We have, , so far, studied market situations under, perfect competition ana, Tul 1933, it was believed that, economic forces were working under pertfect, competition, and monopoly was an exceptional situation. However, an economist, Mr., Sraffa, wrote in his article, The Law of Returns under, which was published in the Economic Journal in 1926. "It Competitive, is necessary to abandon the, path of free competition and turn in the opposite direction, namely, towards, monopoly.", , monopoly., , Conditions,, , In the actual world,, perfect competition is conspicuous by its absence. Pure, monopoly is also rare. In reality, a market situation lies between these two extremes., , The theory of price was, therefore, reformulated by Prof. (Mrs.) Joan Robinson and, Professor Edward Chamberlin. Mrs. Robinson's Economics of, imperfect, Competition and Professor Chamberlin's Theory of Monopolistic Competition, were published about the same time in 1933, in Great Britain and the U.S.A., respectively. In this chapter, we shall study the theory of monopolistic competition, which is Professor Chamberlin's brain-child., What is Monopolistie Competition?, Under monopolistic competition, both the elements are presentmonopolistic and, competitive. Since there are many producers producing a product, there is an element, of competition., But the, , differentiates, , product they sell is not homogeneous. Every individual producer, product in quality, by branding, packaging, trade mark, etc. Here, , his, , enters an element of monopoly. There is monopoly in the form of a differentiated, product. Each producer has a monopoly of his product., At the same time, close substitutes, hence there is competition among them., , are, , produced by different producers,, , and, , While commenting on the aptness of the term monopolistic competition, Professor, , Chamberlin observes. "Where there is any degree of differentiation whatever, each, eller has an absolute monopoly of his own product, but is subject to the competition of, more or less imperfect substitutes. Since each is a monopolist and yet has competitors,, we, may speak of them as, monopolists, and, with the, appropriateness of forces at work, as those of monopolistic competition"., , competing, , peculiar

Page 3 :

Bsiness Economics, , Table 2.1: Monopolistie, , -Il (F.Y.B.Com.) (Sem.-), , and Output Decisions under Imperfect, Competition, 37, ''R, a) A product may be, differentiated in several ways. One way of, differentiation is based upon certain, proauc, characteristics, Buch as exclusive, patented feature, trade mark, trade of the product itselt,, name, peculiarities or, packaging or container, singularity in quality,, colour or styie., design,, Product differentiation may be real, or fancied; what is, important here, that it leads, , Oleind, , Competition, , Brand Name, , Product, , Magic, Nirma, Point,, .Washing Powder Click, Det. Jag. Key,, Swastik, Sway, Vimal., , Ranjit, Sassa,, , Robin. Shine it Surf, , 2. Talcum Powder, , buyers, , Cinthol, Cuticura,, Bouquet, Charmis,, Lakme, Nycil,, Johnson's, Electrique, Emami, Hypnothic,, Ponds, Dreamflower, Talc., , Podar,, , Dinesh, Gwalior, Kohinoor, Mafatlal,, OCM., Raymond, Subhash, Thackersey, Vimal,, Dhariwal., , 3. Suitings, 4., , Television, , 5., , Toothpaste, , Crown,, BPL. Bharat. Bush. Choice, Cinevista, Cosmic,, Onida., Dyanora, EC TV, Keltron, Nelco, NikyTasha,, T. Series,, Standard,, Solidaire,, Optonica, Orson, Pyramid,, Telerad, Televista, Videocon, Westen., , Babul, Binaca, Close up, Colgate, Forhans, Kolynos,, McClean, Neem, Promise, Prudent, Signal, Vicco Vajradanti., , Indian Examples, Let us take an Indian example of monopolistic competition. There are various, , manufacturers of bathsoap-Breeze, Gold Mist, Jai, Hamam, Lux, Liril, Moti, Mysore, Sandal, Palmolive, Pears, Rexona, Turkish Bath, Crowning Glory, ete. The, , producer of, from the, , Hamam has the monopoly to produce it. But he has to face competition, because, manufacturers of Breeze, Liril, Moti, Mysore Sandal, Pears,, these are close substitutes or similar products. The other examples of monopolistic, competition in India are given in Table 2.1 above., Features of Monopolistic Competition, , Rexona,etc.,, , Monopolistic competition has the following main features, , i)Large Number of Firms, , to, , a, , preference, , a), , Each firm, produces, firm controls, , No, , one, , a, , a small share of the total output of an industry., significant proportion of the total market supply., , b) The output decision of an individual firm does not affect the output decisions, of any other firm., , c), , Any small price cut by one firm would take some business away from its, rivals, in equal proportion. Its own revenue will increase, substantially, but, that of other firms will not diminish much, and, they would not take much, cognizance of the price -cut by such firm, and will not react., , Thus, since there is a large number of firms, any action, by an individual firm, either in price cut or price raise and in increasing or, decreasing, output will have n0, effect on other firms., The existence of a large number of firms, represents the, -, , ii), , competitive element., , Product Differentiation, , Even though all firms produce a similar, product, they differentiate it in several, so that buyers are, paired witth sellers, not by, chance and at random, bu, according to their preferences. rOOuet differentiation, is a method or, ot one seler, distinguishing the goods, irom those of, another. For example, 1", the case of talcum, powder, manuiacturers may use different brand names, attractive containers with different, colours,, ways, , designs, etc., , 1s, , one, , attractive plastic container., b) Product differentation may exist with, respect, , to the conditions, sale. These conditions include, its, factors such as the convenience of the sellers, location, the general appearance of his, shop or attractive display ot the, product, his way of doing business, his reputation for fair, dealing, courteous, service, efficient handling of sales and all the, personal links, which create the, attachment of customers to a, particular seller or firm's product., A retail trader may, employ salesgirls at the counter; customers may be offered, soft drinks, tea or coffee; free, gifts may be distributed to children during, festival periods like Diwali, Ganeshpuja,, Navroz, Id-e-Milad, Christmas. All, these and other such attractions develop consumers, preferences for particular, products sold by particular traders. As Prof. Chamberlin observes,, "In so far as these and other, intangible factors vary from seller to seller, the, product in each case is different, for buyers take them into account, more or less, and, may be regarded as purchasing them along with the commodity itself. It is evident, that virtually all products are differentiated, at least, slightly, and that, over a wide, range of economic activity, differentiation is of considerable, , surrounding, , importance.", , In the case of patents and trademarks, each makes a, product unique in certain, respects; this is its monopolistic aspect. But, for each there is a competition from close, , substitutes., In retail trade, each product become, , As under perfect competition, there is a large number of firms in the market., , of, , variety over another. For example,, Forhans toothpaste may attract a, particular class of huyers who believe that, its formula is prepared, by a foreign dentist, Mr. R. J. Forhans of New, City. Sway washing powder, York, may induce buyers to buy it because of is, , Cashmere, , Bliss., , un, , que be, , aus, , the individuality of the, , establishment in which it is sold, including its location, becomes its monopolistic, aspect. Each retail seller exercises full control over the supply of his product, over the, surrounding conditions in which the product is sold and in respect of his dealings with, customers. But each is subject to the competition of other similar products sold under, different circumstances and at other locations; this becomes its competitive aspect., Thus, in the field of differentiated products, both monopoly and competition are, always present. In the case of pure monopoly, there should be control over the supply, of all economic goods, and any competition by substitutes should be totally absent., Perfect competition is the other extreme, where a product is homogeneous and, completely standardised. Each seller faces a competition of substitutes for his own, product, which is perfect. Neither of these two types of situation exists in the real, world. Between the two extremes, there are many gradations but both elements are, always present and must always be recognised., , ifi), , Free Entry and Exit of Firms, Under monopoly, the entry of new firms is blocked or prevented-be-cause of, , technical or institutional factors. But under monopolistic competition, there is no such, , difficulty. New firms can and do enter or existing firms may leave the industry. The, entry of a new firm is not blocked because of the simplicity of production techniques, and smallness of capital requirement. Those firms which are unfortunate to continue, , ncurring losses leave the group in the long-run; whereas existence of supernormal, profits attracts new entrepreneurs into the fñeld., 4/F.Y.B.Com. - Business Economics- II (Sem.-I)

Page 4 :

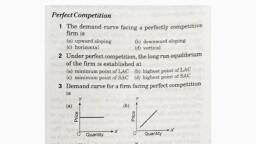

Business Bcononics - l|, , Com.) (Sem. ), , 9'9'R, , 38, , iv) Selling Costs, ong with, , under, product differentiation, firms, , undertakesales promotional activity, , described, , monopolistie, , as, , Selling, , competition, , have., , Costs. Sellhng costs, , activity is, to alter the position, heir expenditure on this, in order, Chamberlin as costs ineurred, Professor, the d e m a n a curve to th, by, detned, shifting, i.e., for, , snape, right., , of, , the demand, , curve, , for, , a, , product,, , Pricing and Ouiput Decisions unde mperfect, a, , uilbrium, , single firm., , Monopolistic, , that of his rivals, , affected by three factors, viz., , to some, , has to face, , extent. His, , severa, , sales, , are, , a) his price, , b) the nature, , of his, product,, c) his advertising outlay, , eng, , a), , the sales department.,, Sales-men's salaries and the expenses of, them, to put in greater, order to induce, Special margins granted to dealers in, manufacturer's product,, and better effort in favour of a particular, C o s t of demonstration of new goods, etc., sales volume, and hence upon, Al these become a powerful force acting upon, prices and profits., sales-promotions by different producers, is, interesting to study various ways of of different makes) through cine, t, products (e.g.. toothpastes, of the "Similar", demonstrations, exhibition, advertising. TV feature films, press-publicity, hoardings,, displays. etc., , under, , Competition, Under monopolistic competition,, an individual, producer, His, market, 18, ablems., probl, separate from, , for his product by incurring suc, rm's produet, buy a particular, , Selling costs include :, C o s t of advertising for promoting sales,, , 39, , dividually lose very negligible percentage of it and ' w ', hence they would not take auy, notice of such price-cut by, , indiv, , the demand, Every producer is eager to increase, buyers to, costs. They are incurred to persuade, , in preference to that of other manufacturers., , petition, , Price Problem, , The demand curve for a firm under perfect, competition is horizontal and the, has no price problem. It may produce any output and sell it at the, prevailing, nrice. But the demand curve for an individual firm under monopolistic, , hrm, market, competition 1s, , not horizontal, but sloping downwards to the right (see Fig. 2.1 B). It is similar to the, demand curve for a monopolist., , The demand curve for a firm under monopolistic competition maybe more, elastic,, if the degree of product differentiation is small; it may be less elastic, if the degree of, product differentiation is very great., Y, , (B), , (A), , Concept of Group, refers to, Professor Chamberlin used the word group instead of industry. Industry, competition., under, Under, perfect, a number of firms producing a homogeneous product, Professor Chamberlin, and, therefore,, is, there, heterogeneity, monopolistic competition,, closely-related, has used the concept of group to imply a collection of firms producing, , v), , Q, , but not homogeneous goods., In, , an, , industry under perfect competition, firms, , are, , price-takers and have a|, , M, , M2, , -oUTPUT, , horizontal average revenue or demand curve., Fig. 2.1 (A), DD Curve for Firm under, , But under monopolistic competition, due to qualitative differences and buyers, and, preferences, there are wide divergences in the curves of cost of production, variety of demand curves. The result i8 heterogeneity of prices and variations, , Fig. 2.1 (B), DD Curve for Firm under, , Monoploistic Competition, Perfect Competition, competition, a firm, firm, a, may, | Under monopolistic from, Under perfect competition,, over a wide range in outputs and in profits., OP to OP1; but, increase, price, A firm under monopolistic competition does not have a horizontal demand curve. sell any output at the prevailing market may, will sell less quantity (OM;); it may sell a, It has to face a downward sloping demand curve. It can sell a larger output only by price OP., larger quantity (OM) by lowering price, reducing its price or a smaller output of a higher price., (from OP to OP2)., , It is assumed that an adjustment in price or in product by an individual firm, , spreads its influence over its competitors which are many in number and that the, impact felt by them is negligible and does not lead any of them to any readjustment o, its own situation., As Professor Chamberlin puts it, a price-cut, for instance, which increases tne, , sales of one who made it, draws in appreciably small amounts from the markets 0, each of his many competitors, achieving a considerable result for the one who cuts tne, price, but without making incursions upon the market of any single competito, sufficient to cause him to do anything he would not have done anyway., a, In other words, any price cut by an individual firm would bring him, sale. .,But this additonal sale comes from the rest of the firms wh, , considerable, , has influence o v e r its customers, monopolistic competition, Since every firm under, its "product", it, o v e r the price of, control, it has s o m e, product-differentiation,, its price and, lower, through, its customers; it may, still not lose all, other "similar products". In, may raise its price and, customers, of, cannot get all, downward, attract new customers but, for its product will be, the demand c u r v e, above,, stated, other words, as, &, the, sloping. (see Fig. 2.1 (A) (B)., n c r e a s e its profits by raising, competition may, that price where, A firm under monopolistic, more. lt will seek, it and selhng, for a firm, or by lowering, adjustments become necessary, price and selling less, price-output, Thus,, ES, , profits, , are maximum., , under monopolistic competiton.

Page 5 :

b), , Business Economics, , g'R'S, , 40, , Nature of Produet, The second, , problem faced by, , a, , l I (F,Y.B.Com.), , (Sem,- ), , Prictng and Oulpui Decislons under Imperfeet Competition, and demand, costs, maximum., , is thu, monopolistic competition, producer under, sales depend upon, total, His, differentiation., , product, adjustment of his product throughdifferent from the, the extent to which his product is, , products, , Under perfect competition,, , rivals., , of his, , refers to, , change in, , such a s, container, prompt, convenient, , location,, , attractive, and, , packing, , courteous, , personal, , or, , prestige., the skill of, Thus, sales will depend upon, and, distinguish, differentiate, to, the producer, his product from the products of other rival, OUTPUT, , Fig. 2.2:A Case of Product, Differentiation, , with the, , but also the more complicated problem of equilibrium with product differentiation., CC is the average cost curve for product A and C,C1 is the average cost curve for, product B which is difflerentiated by a superior quality. At a fixed price of OP, OA of A, and OB of B are sold. The maximum profits are PQRS and PDEF from products A and, B respectively. The total cost of A and B are respectively, OARS and OBEF., , varieties of, , 2., , The possibility of changing the wants of consumers by advertising or selling, appeal., , is differentiated by, , the fixed price for both these products is OP. The maximum profit from the sale of B is, greater than that from the sale of A, because B is preferred to A by the buyers., As Professor Chamberlin points out, by making similar comparisons between the, of, and demands for, all possible varieties, the producer may choose the one, which seems to him the most advantageous., , and, , equilibrium, , with, , product, , Super-normmal profits, , SMC, SAC, , (2) product, and (3) selling outlay. It would be a, affair to discuss their, very, , much complicated, , effects simultaneously., We shall, therefore, discuss individual, with reference to prices and, equilibrium, output adjustment, assuming that the, , product variation is constant and that, selling costs are absent., , MR, , X, , OUTPUT, , Fig. 2.3: Individual Equilibrium, (Short Period with Super Normal, , Later, we shall also. briefly examine the, , Obviously. product B will be preferred by the firm., In Fig. 2.2, we have illustrated a case of product differentiation. A and B are two, a product. Product B, the use of superior-quality raw, material. The average cost curve for B is CC1, and for A it is CC. Let us assume that, , is not necessary becuase any, , Thus, there are three variables tinder&, monopolistic competition, viz. (1) price,, , product), , Monopolistic competition, thus, involves not only the problem of price equilibrium, , are, , Imperfect knowledge on the part of buyers as to what type of product would, give him the maximum satisfaction, and, , equilibrium, , choose that type of product (through, product differentiation, say, superior quality or, , gift along, , that his profits, , variation, but also the problem of equilibrium, with selling costs., , Just as a firm will seek that price which, will bring it the highest profits. So it will, , free, , ensure, , Obsertvation, Monopolistic, competition,, therefore,, involves not only the problem of price, , producers., , extra, service or attractive packing or by giving some, which will ensure maximum profits for it., , advertising outlay, , to, , 1., , or, , service,, , reputation, , as, , t is due to keen rivalry among producers under monopolistic competition to, attract customers towards their products that selling outlay becomes a "must" for, every producer. Giains from advertising expenditure under monopolistic competition, are due to two factors, viz., , or, , product,, , an, , way, , producer can sell ns much as he produces., , Here product variation, such as technical, the quality of product,, new design, use of, superiority,, or, improvement, it may refer to certain, superior material, o r, with the, associated, conditions, services, , for his product in such, , 41, , Profits), , effect of selling costs on the cost of, and demand for, a product. First, we shall discuss, , individual equilibrium and then examine group equilibrium., , 4, , INDrVIDUAL EQUILIBRIUM-MONOPOLISTICCOMPETITION, We have noted that, for maximum profits, two conditions must be satisfied under, , perfect competition and monopoly:, 1., , MR = MC and (2) MC must cut MR from below, , costs, , Under monopolistic competition also, a firm will make the maximum profits when, these two conditions are satisfied., , It is obvious that the, qualitative changes in the product alter both the cost of, producing it and the demand for it. The problem is that of selecting the product whose, cost and market allow the largest total, profits, price being given. This is one of the, , In the short period, as shown in Fig. 2.3 a firm under monopolistic competition, produces OM output at which MR and MC are equal and MC cuts MR from below., Since its average revenue is greater than the average cost, it is earning super-normal, or abnormal profits., , c)Advertising Outlay (Selling Cost), We have already discussed above the, nature of selling costs-an important feature, of monopolistic competition. Every producer tries to, influence the volume of his sales, by incurring additional expenditure (over and above his, production costs). 'The, additional expenditure, particularly on advertising, increases, both his cost and, demand for his product. Just as he adjusts, prices and products (through, differentiation) to maximise his output, so he adjusts his, advertising outlays or selling, , The main reason for these abnormal profits is that other rival firms are not able, to produce closely competitive substitutes., , important managerial decisions to be taken in a manufacturing firm., , The firm, as shown in Figure 2.3 makes supernormal profits shown by the, rectangle PQRS (shaded area). However, it is also possible that the demand may not, be favourable to a firm under. monopolistic competition, and it may incur losses, as, shown in Figure 2.4. In the long run, it may leave the industry if it is not able to, change its demand relative to its cost condition through further product, , differentiation and advertising.

Page 6 :

Rusinexs, , 42, , Evnomis, , FYB.Com.)(Sem l, , -, , SAC and SMC, In Fig. 2.3,, short-period, , AL, , curves., , Revenue, , average, , And, , cost, , respectively, , are, , marginal, or, , curve, , demand, dd is the, T, MR, At, Curve., , =, , cost, , Averng, , MC. The, , firm', , r e v e n u e QM, is OM. Average, equilibrium output, RM. The tota, cost, than the average, is greater, the total r e v e n u e is OMQI, cost is OMRS and, between the two-PQRS (shaded, The difference, super-1normal profit., maximum, area)-is the, , monopolistic competition, the price is less than it, because, incurs losses, cost, at the equilibriu, short-period average, the, average cost and, is, RM, OM., level of output, total losses are PQRS, The, the, is, price., QM, A, , OUTT, , Fig.14:Individual Equilibrium, , firm, , under, , (Shaded area), , Shert Period with Losses), , There, , MM, , is, , excesS, , The, , capacity, , firm, , very, , to, , under, , the, , Parning super-normalprofita has to keep on watching the actiona of other rival firm8., If one producer makes large profita, through auccessful product differentiation, , other rival producers will attempt to produce producta similar to. though not exaetiy, identical with, those of the rival producer making, , huge, , Normal Profits, , (AR=AC), , extent, , aWay by the existing firms and by new firma which develop very, imilar, producte, e.g. TV sets produced by a group of firma. One firm makes a huge profit by, , introducing, , a, , new, , kind of TV, , (say, with, , set, , some, , hybrid system, , or, , solid state)., , firms, certain to introduce such type of TV Bet the long period. Of, producte Canne be identical; never-the-lesa, they will be able to share huge, are, , a, , Dther, , course,, , in, , their, , profits of, , the fortunate firm,asa result of which all firms, , earn only normal profits. If all earn, new firms will enter the, profits,, group and share these profits by, Buper normal, producing 8imilar products., , LRAC, , In the long period, the group equilibrium will, therefore, be established where the, price is equal to the average cost of production (see Fig. 2.6)., , AR, , of, , monopolistic, , demand curve is tangent to the, average, cost curve at Q at the level of output OM, where, , LRMC, , LRAC, , MR, , long-run, , MR = MC. The firm makes only normal profits., , SRMC, SRAC, , M, , Mi, , OUTPUT, , Fig. 2.5:Individual Equilibrium, (Long Period with Normal Profits), AR, , Its output OM is less than the optimum., , MR, , MR, , Less than Optimum Output, , M, , OUTPUT-, , to, The long-run situation of a firm under monopolistic, of a firm under perfect competition in one respect, viz., in both these situations; a firm, can earn only normal profits in the long period., , competition is similar that, , However, there is one vital difference Under perfect competition,, equilibrium output is produced at the minimum average cost (optimum output), , the, , because the average revenue eurve of the firm is a horizontal straight line. But in, monopolistic competition, the equilibrium output is smaller than the optimum output., This is because the firm's average revenue curve is not a horizontal straight line but, , slopes downwards to the right, and hence it is impossible for it to be tangent to a given, U-shaped average cost curve at its minimum point. Thus,, , there remains some, , unused capacity called "excess capacity" under monopolistic competition. In, Fig. 2.5, the excess capacity not used by the firm is MM., , 5 GROUP, EQUILIBRIUM UNDERMONOPOLISTIC cOMPETITION, Group equilibrium refers to the adjustment of prices and products of a number of, producers whose goods are fairly close substitutes. For example, all television, manufacturing firms may regarded as one group monopolistic competitors. As, stated above, each firm, , be, , taken, , close, , output., competition does not u s e its full capacity, which, IS equal to the optimum output (OM;). The, , be, in the, , profita., , In the long period, therefore, the super-normal profita of this producer wil, , recent years. We see advertisements of these new products in the various periodicals, , LRMC, , Fig. 2.5. Its rival firms are making similar, products. New firms are started. The firm's, super-normal profits are taken away by the, producingg, , 43, , washing powder and bathsoaps, many new producers have entered these groups in the, , In the long-period. a firm under monopolistic, competition earns normal profits. as shown in, , firms, , Impersert Competition, , producers within the group. Each firm has to he careful ahout such actions. A firm, , The best modern example is that of washing powder and bath soaps. Lured or, attracted by the abnormal profits of the existing firms in the groups manufacturing, , Long Equilibrium, , competing, substitutes., , Pricing and Outmat Decisiens under, , group has a, , of, downward, , sloping demand curve, The, , shape of this demand curve is determined hy the actions of the very close rivul, , Fig. 2.6 (A), Fortunate Firm (Short, Period Super, , Normal - Profñts), , Fig. 2.6 (B), Group Equilibrium (NormalProfits for, , All Firms inLong Period), , earns, In Fig. 2.6 (A), the fortunate firm with successful product differentiation, the shaded area. Some other firms follow, shown, abnormal, by, or, normal, profits, Super, frms in the group, suit and take away these profits by producing similar products. All, then earn only normal profits as shown in Fig. 2.6 (B)., fortunate firm (Fig. 2.6 A) will, In the long period, the monopolistic profits of the, n e w firms entering the group. The, firms, and, be taken away by the other existing, in Fig. 2.6 B. All tirms earn normal profits under, group equilibrium is shown, The average cost (QM) is equal to the, monopolistic competition in the long period., is OM. The average r e v e n u e eurve, output, The, equilibrium, average r e v e n u e (QM)., than the average revenue curve, elastic, m, o, r, e, be, to, (Pig. 2.6 B) in the long period tends, (Fig. 2.6 A) in the short period., , Selling Costs and Equilibrium, as we have noted earlier, ineurs additional, A firm under monopolistic competition,, to buy its own produets rather than those of its, people, expenditure on persuading, deseribed as competitive advertising and is undertaken, rival firms. This advertising is

Page 7 :

Business Economics, , 44, , Il, , (PYB.Com) (Sem, , t, , of others in the, the expenise, their individual sales at, firm a r e called, activities, , by rival, , -Il), , group., , firms to increase, of a, The cost of advertising and oth sales-promotion, with price vaations and, positions, COsts.So far we have considered equilibriumequilibrium price-output aajustment of, influence, product variations. Selling costs also, a irm under monopolistic competition (see Fig. 2.7)., , hg., , 2.7 illustrates the effect of, , selling costs, , are, , incurred, the firm's, , selling outlay, , earns, , maximum profits,, , the, Thus,, , on, , as, , 6., , are, , Competition, , It is useful to explain, , COMPE'TITION, , how price, output equilibrium under, monopoi, competition dillers Irom that under perfect competition., It is also necessary to, between, make a, the, compari8on, two market situations, the basis of efficiency, soc1al, -, , on, , welfare, nature of pricing etc., , 1,, , shown by, , Price is greater than MC under, monopolistic, Loss of social, LMC, welfare, LAC, , per unit,, , competition., , YT, , 1, , produced., , 1.00, , 45, , MONOPOLISTIC COMPETITION VERSUS PERFECT, , competitive advertising. If the production is, , Now, the firm spends, 5000 units, unit, the average selling cost is 7 10,000.00. But when, are, units, produced, it 1s, selling cost is 2.00 per unit; when 10,000, 10,000.00, , one, , before, competitive advertising, 1s, AR1, while, and demand curves, , on, , average revenue, , cost. It, rrepresents its average production, the first shaded area., , selling, , Pricing and Output Decislons under lmperfect, , MC, , ATC, , as the output increases, the selling cost per unit goes on decreasing. ACC,, , each level, of, the average selling cost at, cost tor the, selling, the, average, output. The vertical distance between APC andACC is, various levels of output., , represents the average production cost, , plus, , P, , AR, 0, , When a sum of 7 10,000.00 is spent on advertising, the firm's demand increases, , Quanity, , and the demand curve shifts to the right (AR2). Its total profits are more than, , MR, , Output, , 10,000.00. The advertising expenditure is fruitful to the firm., , advertising. The total selling, , The firm, therefore, spends another 10,000.00 on, outlay is now 20,000.00o. The new average cost curve is ACC and the new demand, , curve is ARg which is the result of the rise in the sellig cost. The firm's total profits are, larger (third shaded area). They must be more than 20,000.00, which is the total, selling cost on advertising. Otherwise, the firm would have simply wasted its money., , It will continue as long as any addition to the revenue is greater than the addition, to the selling cost. The firm will stop incurring selling costs when the total, profits are at the highest possible level. This would be the point at which the, additional revenue due to advertising expenditure equals the extra, expenditure on advertising., Additional Revenue = Additional Advertising Expenditure., , It should be noted that the effects of, advertising on prices and output are, uncertain. Advertising by a firm may be, considered successful if the elasticity of, demand for its product falls., , ACC2, , APC, , In Fig. 2.7, APC is the basic average, production cost. The initial demand curve, is AR, the price is OP and the firm earns, , AR, AR, M, , Mi, , OUTPUT, , x, , profts shown by the first shaded rectangle., ACC is the average composite cost, which, includes both-APC plus the average selling, cost (which is equal to the vertical distance, between APC and ACC). The new demand, , Fig. 2.7, , The, , profits, , are, , curve is, , AR2 (after advertisement)., , greater (shown by the second shaded area). ACC, is the average, , composite cost when an additional selling cost is incurred. T'he new demand curve 1s, , AR2 and the profits are still greater (shown by the third shaded area)., , MR, , Fig. 2.8 (a): Inefficiency of Monopolistic, , Fig. 2.9 (b) : Efficiency of Perfect, , Competition, Competition, In equilibrium under perfect competition price is equal to MC as shown in, diagram 2.8 (5) whereas under monopolistic competition price is greater than, marginal cost. Under perfect competition, an individual firm cannot influence the, price of the produet and hence takes price as given and constant. Hence the demand or, 3, , average revenue curve facing it is a horizontal straight line and MR = AR (price)., , under perfect competition, when a firm equates, Therefore, maximize profits MC becomes equal to price. P = MR = MC., , MC with MR,, , so as, , to, , But under monopolistic competition, a firm exercises some control over the price, of the product. The demand curve slopes downward. MR curve his below the average, revenue curve (AR). In order to maximize profits when a firm under monopolistic, competition equals marginal cost with marginal revenue (condition for equilibrium), the price stands at a higher level than marginal cost. The figure 2.8 (a) shows that in, equilibrium, price determined is equal to OP or Q1 T which is greater than marginal, cost, However, producing level of output much less than at a point where, , (QE)., is, when, MC= price, implies a loss of social welfare. Social welfare is maximum this output at, happens, extended to the point where the price long run MC. In the diagram, LMC. But a firm under monopolistic competition, point G where price & AR, run. The area TEGrepresents the loss of social, in, the, even, long, produces 0Q1, =, , =, , This indicates inefficiency of, welfare. This is also called deadweight loss., , monopolistic competition., 2., , under monopolistic competition is established at, scale size, less than the technically efficient, between the equilibrium under monopolistic, difference, very important, is that a firm in the long r u n equilibrium under, , Long, , run, , equilibrium, , A, , competition and perfect competition, , than its technically efficiency scale (the, monopolistic competitionproduces less, under perfect competition, long run, whereas, output where LAC is minimum), the, established, is, minimum point of the long run, at, equilibrium of the firm, tends to be of economically, firm under pertect competition, A, c, u, r, v, e, ., average cost, most efficiency size.

Page 8 :

Brusiness Bconomics, , s's'*, , 46, But, , firm, , under, , -, , 1, , (F.Y.B.Com.), , (Sem.-), , Pricing and Oulput Decisions under Imperfect, Competition, , LMC LAc, , monopolistic, , A, , 8OCiety 's, , productive, , fully utilized when they are used to pro, LAC the level of output at which the LAC, , resources are, , LMC, , competition stops 'short of the technically, efficient scale and operates in the long run at, the point at which long run average cost 18P, , or ideal output (the output corresponding to, , produces output 0Q, while a firm under pure, or perfect competition would have produced, , the lowest point on LAC). Under perfect, competition in the long run the firm operates, , AR, , at output OR, at which LAC is minimum., The firm under monopolistic competition can, , reduce its cost of production by expanding, , O, , MR, , .2.1): Prudutionat less than, technically efficient scale, , to some, The excess capacity represents waste of resources. But according, economists QR is a small loss of output and the higher average cost is the price which, under monopolis tic, , paying for the product variety which they enjoy, , competition. Moreover, the firms under monopolistic competition spend a lot of money, on advertisement and other sales promotion activities which also represents wastes of, , Price under Monopolistic Competition is greater than Competitive Price, , In the long run, frms under monopolistic competition make only normal profits as, under perfect competition. But the price set under monopolistic competition, than competitive price, given the LAC curve. In the above diagram, , is higher, 2.10 price set in, , long run equilibrium under monopolistic competition is QT, while competitive price in, the long run is RL. The higher price under monopolistic competition is due to the, , monopoly element in the market situation (monopolistic competition). Due to this the, demand curve of the AR curve is downward sloping and is tangent to the LAC curve, oniy to the left of its minimum point., , Hence price under monopolistie competition will be higher than the perfectly, competitive price due to the monopoly element in monopolistic competition. But a firm, under monopolistic competition in the long run equilibrium charges higher price, without enjoying monopoly profits. It means that though the firms do not make super, normal profits still monopoly lement is present. Each firm has a monopoly control, over its differentiated product., Excess Capacity and Inefficiency in Monopoly Competition, A, , study, , competition, , monopolistic competition and Joan Robinson's imperfect, a firm under monopolistic competition in the long run, , of chamberlin's, revealed, , that, , produces an output which is less than socially optimum or ideal output. The firms, , at the, They do not produce the, operate, point on the falling portion of the LAC, level of output at which LAC is minimum. Thus, long run equilibrium of a firm under, curve., , Donopolistic, competition is achieved when the demand curve (AR) facing firm, becomes tangential to the LAC curve to that it earns only normal profits. Under such, a, , circumstances, a firm can reduce average cost and hence price by expanding output to, the minimum level of the LAC cost. But it will not do, so, , maximized (MR, , =, , MC), , at the level of, , average cost is minimum., , because its profits, , are, , which its, , run, , output smaller than that, , a, , long, , M, , Output, , N, , X, , ideal, , output, , is, , a, , measure, , of excess, , capacity or unutilized capacity., The existence of excess capacity under, Flg. 2.11: Excess capacity under, monopolistic competition can be understood, monopollstio competition, from the figure 2.11., The figure 2.12 depicts the long run, Y, equilibrium of a firm. At output level, ON,, LMC LAC, MC = AC. Thus, under, Price, perfect, Excess Capacity, , competition socially ideal output is produced., The production of output ON is, , at the, minimum point on LAC. At this point the, resources of the society are efficiently used andd, , allocated., , competition., 3., , output of the firm under monopolistic, competition falls short of the socially, , K, , Output, , of long run equilibrium under monopolistic competition., , are, , at the minimum point of the LAC. The, amount by which the actual long run, , AR, , MR, , will be reducing price more than the average, cost. It is clear that by producing 0Q instead, does not use its full, ot Uk in the long run. the firm under monopolistic competition, under monopolistic, firm, the, in, Capacity. Thus capacity equal to QR lies unused, feature, The unused capacity is called excess capacity. This is a prominent, competition., , people, , i8, , minimum. Thus a monopolistically competitive, firm produces less than the socially optimum, , still falling. In the figure above 2.10 the firm, , output to the point R. But it will not do so, because by expanding output beyond 0Q, it, , 17, , Under, , monopolistic, , AR MR, , P, , competition, , though the firm can expand production, it, , stops production at OM level. The firm is, producing MN less than the ideal output. Thus, MN output represents the excess capacity, , N, , Output, , +X, , Fig. 2.12: Ideal or Socially Optimum, Output under Perfect Competition, , under monopolistic competition. The concept of excess capacity refers only to the long, run. This is because in the short run, under any type of market structure (even in, perfect competition) there can be all sorts of departures from the ideal output., , Wastes of Monopolistic Competition, Under monopolistic competition, there are several wastes and both the consumers, and factors of production are exploited. These wastes of monopolistic competition have, , been pointed out by Prof. Rothschild. Let us discuss them briefly., 1. Unemployment, In monopolistic competition, the problem of unemployment is aggravated for, many reasons. One of these is the fact that the productive capacity is not fully utilised, under monopolistic competition and, therefore, employment is not increased. Further,, in order to maintain high prices, production is sacrificed and this may aggravate, , cyclical unemployment., 2., , High Price for the Consumer, Under monopolistie competition, a consumer has to pay a higher price fora, product than under perfect competition even in the long period. Even though the firm, is earning only normal profits, the price paid by the consumer is more than that under, , perfect competition., 3. Excess Capacity, Under monopolistic competition, a, , firm's equilibrium output is less than the, , optimum output. The average cost at the equilibrium level is mor than the minimum.., There is excess or unused capacity, which is regarded as a waste in monopolistic, , competition.

Page 9 :

- l (F.Y.B.Com.), Business Economics, , (Sem.-), , 48, , The, , 4., , Selling Cost, , extra expenditure, , is, , noted above,, a s w e have, individual sales. This, Under monopolistic competition,, to increase, advertising, competitive, on, firms, competition because it leads to, ncurred by, waste under monopolistic, cost is passed on, advertising is regarded a s a, the, cost. "This, firms and increases, among rival, competitive advertising is a clear, wasteful competitionthe, Thus,, form of higher price., to the c o n s u m e r s in, , 49, , large-scale production. Thus,, , consumers, , and large-scale production., under monopolistic competition. The product of, waste of cross-transport, sold in Bombay and a similar product of the Bombay, a Calcutta manufacturer maybe, c o n s u m e r s have to pay an increased price,, producer may be sold in Calcutta. The, serves the Calcutta, which would in elude transport costs. If the Calcutta producer, cost can be avoided, the, market,, transport, Bombay, market and the Bombay producer, this does not happen because of product, and the consumers would be benefited., India., differentiation, and every rival producer likes to capture the market throughout, a, , But, , advertising,, displays,, Through colourful packaging,, consumers are hypnotised and buy even inferior quality goods at higher prices. Many, attractive, , beautiful, , honest firms unable to spend lavíshly on advertising die prematurely., , Advantages, TLe only advantage, it appears, of monopolistic competition is that, under it,, varieties and alternatives are offered by rival firms through product differentiation., There is also a possibility of improvement in quality. However, in the real world, we, , find that waste in greater than benefits under monopolistic competition., Introduction, Advertising is a form of communication intended to persuade an audience to, purchase products, ideas or services. While advertising can be seen as necessary for, economic growth, it is not without social costs. Unsolicited commercial email and other, forms of spam have become so prevalent that they are a major nuisance to users of, these services, as well as being a financial burden on internet service providers., , argue, , a, , invades, , public, , spaces,, , such, , as, , schools, which, , some, , psychological, form child exploitation. Advertising frequently, the intended, uses, , pressure (for example, appealing to feelings of inadequacy), which may be harmful., , consumer,, , on, , The importance of advertising is steadily on the increase in modern society., Just as the media of social communication themselves have enormous influe nce, everywhere, even advertising, using media as its vehicle, is a pervasive, powerful force, shaping attitudes and behaviour in today's world., In, , today's society, advertising, , has a,, , profound impact, , how, , understand, life, the world and themselves, especially in regard, to their values and their, ways of, choosing and behaving. These are matters about which all of us must be, and, , sincerely concerned., , general terms, of, , purposes, , to inform and, , to persuade, and, , Advertising is not the same as marketing or public relations. In many cases,, though, it is a technique or instrument employed by one or both of these. Advertising8, can be very simple- a local, even, neighbourhood, phenomenon - o r it can be, complex, involving sophisticated research and multimedia campaigns that span the, , very, , globe. It differs according to its intended audience, so that, for example, advertising, at children raises some technical and moral issues significantly, those raised by advertising aimed at competent adults. Not only are many, media and techniques employed in advertising; advertising itself is of, , different from, ditferent, , several different, , kinds: commercial advertising for products and services; public service advertising on, , behalf of various institutions, programs, and causes; anda phenomenon of growing, importance today- political advertising in the interests of parties and candidates., Advertisers are selective about the values and attitudes to be fostered and, encouraged, promoting some while ignoring others., its, Advertising also has an indirect but powerful impact on society, influence on media. Many publications and broadcasting operations depend on, , advertising revenue for survival. This often is true of religious media as well as, commercial media. For their part, advertisers naturally seek to reach audiences; and, so, the media, striving to deliver audiences to advertisers, must shape their, attract audiences of the size and demographic composition sought. This, dependeney of media and the power it confers'upon advertisers carries with it serious, responsibilities for both., , content to, economic, , 8. THE BENEFITS oF ADVERTISING, Enormous human and material resources, in today's world,. so that, no, , 7. DEBATE OVER ROLE OF ADVERTISING, , Advertising, increasingly, is, of, , broad and diverse. In, , through, , Consumers Hypnotised, , critics, , extremely, , aimed, , Cross Transport, There is, , is, , present., , similar but not identical products,, firms producting, Since there a r e many rival, the smallness of size. There is, reduced, by, its, the scope for large-scale production, reap, cannot, advantages of economies of, firm, a, the, inadequate specialisation and, the fruits of specialisation, a r e deprived of, , 6., , feld of advertising, , course, an advertisement is simply a publie notice meant to convey information and, inyite patronage or some other response. As that suggests, advertising has two basic, , while these purposes are distinguishable- both very often are simultaneousiy, , waste of resourcers., 6. Lack of Specialisation, , 7., , Pricing and Output Decisions under Imperfect Competition, , 9'9's, , on, , people, , deeply, , is everywhere, advertising., , are, one, , devoted to, now, , can, , advertising., , Advertising, , escape the influence of, , Even people who are not themselves exposed to particular forms of advertising, confront a society, a culture, other people- affected for good or ill by advertising, messages and techniques of every sort., Advertising has significant potential for good, and sometimes it is realized., , a), , Economic Benefits of Advertising, Advertising can play an important role in the process by which an economic, , system guided by moral norms and responsive to the common good contributes to, human development. It is a necessary part of the functioning of modern market, economies, which today either exist or are emerging in many parts of the world and, provided they conform to moral standards based upon integral human, , which, , development and the common good currently seem to be "the most efficient, instrument for utilizing resources and effectively responding to needs" of a, socio-economic kind., , In such a system, advertising can be a useful tool for sustaining honest and, ethically responsible competition that contributes to economic growth in the service of, authentic human development. Advertising does this, among other ways, by informing, , people about availability of rationally desirable new products and services and

Page 10 :

Business Economicsll, 50, , Cconomic, , to make, helping them, , înformed,, , (Sem.-), , prudent consumer, and, , in existing, of, and the lowering, trade. All, contributing to efficiency, business and, of, the expansion, m, o, r e decent, through, progress, incomes and a, , improvements, decisions,, , ones,, , (P.Y.B.Com.), , prices,, , stimulating, of this can, and humane, , higher, and productions, to the creation of n e w jobs,, programming, for publications,, pay, also, helps, around the world., It, al1., Way of life for, to, people, e n t e r t a i n m e n t and inspiration, , contribute, , bring information,, Benefits of Political Advertising, , that, , b), analogous to its, to democracy, make a contribution, Political advertising c a n, moral n o r m s . As free, market system guided by, economic wellbeing in a, toward, counteract tendencies, contribution to, democratic, system help to, responsible media in a, interests, so, , and, , and special, the part of oligarchies, out the ideas, the monopolization of power on, people, informing, contribution, by, not, poitical advertising can make its, new candidates, including, and candidates,, and, policy proposals of parties, previously known to the public., , c), , Cultural Benefits of Advertising, media that depend on it for revenue,, Because of the impact advertising has on, influence on decisions about media, advertisers have an opportunity to exert a positive, intellectual, aesthetic and, excellent, of, content. This they do by supporting material, interest in view, and particularly by, moral quality presented with the public, oriented to, media presentations which are, encouraging and making pos_ible, can itself, advertising, unserved., Moreover,, otherwise, needs, go, minorities whose, might, and, and, inspiring, people, contribute to the betterment of society by uplifting, themselves and others. Advertising can, benefit, that, to, in, them, act, ways, motivating, Some advertisements, brighten lives simply by being witty, tasteful and entertaining., and elan all their o w n ., are instances of popular art, with a vivacity, , d), , Moral and Religious Benefits of Advertising, those of, In many cases, too, benevolent social institutions, including, , a, , religious, , messages of faith, of, nature, use advertising to communicate their messages, of charity toward the, service,, and, neighborly, of, compassion, tolerance,, patriotism,, and helpful messages, needy, messages concerning health and education, constructive, that educate and motivate people in a variety of beneficial ways., , 9. THE HARM DONE BY ADVERTISING, , There is nothing intrinsically good or intrinsically evil about advertising. It is a, tool, an instrument: it can be used well, and it can be used badly. If it can have, and, it also can, and, sometimes does have, beneficial results such as, , those just described,, , often does, have a negative, harmful impact on individuals and society., All those forms of advertising which, without shame, exploit the sexual instincts, simply to make money or which seek to penetrate into the subconscious recesses of the, mind in a way that threatens the freedom of the individual must be shunned., a), , Economie Harms of Advertising, Advertising can betray its role as a source of information by misrepresentation, , and by withholding relevant facts. Sometimes, too, the information function of media, , Pricing and Output Decisions under Imperfect Competition, , 51, , &'a'P, , "sex, , appeal," etc.) instead of presenting differences in product guau, tool of the, be, and often is,, price, tor rational choice. Advertising also, "phenomenon of consumerism,", fashion,, , as bases, , a, , can, , speak of it as part of their task to "create" needs for, productsand servicesthat is, to cause people to feel and act upon cravings for items, , Sometimes advertisers, , and services they do not need., , Similarly, the task of countries attempting to develop types of market economies, needs, interests after decades under centralized, state, serve, systems is made more difficult by advertising that promotes consumerist attitudes, to human dignity and the common good. The problem 1s, and, when, as often happens, the dignity and welfare of society's poorer, , that, , human, , and, , controlled, , values oftensive, particularly, acute, and weaker members are at stake., b), , Harms of Political Advertising, Political advertising can support and assist the working of the democratic, , process,, , but it also can obstruct it. This happens when, for example, the costs of advertising, limit political competition to wealthy candidates or groups, or require that otice, , seekers compromise their integrity and independence by over-dependence on special, , interests for funds. Such obstruction of the democratic process also happens when,, instead of being a vehicle for honest expositions of candidates' views and records,, political advertising seeks to distort the views and records of opponents and unjustly, , attacks their reputations. It happens when advertising appeals more to peoples, emotions and base instincts -to selfishness, bias and hostility toward others, to, racial and ethnic prejudice and the like and the good of all., c), , rather than to a reasoned sense of justice, , Cultural Harms of Advertising, , Advertising also can have a corrupting influence upon culture and cultural, values. We have spoken of the economic harm that can be done to developing nations, by advertising that fosters consumerism and destructive patterns of consumption., Consider also the cultural injury done to these nations and their peoples by, advertising whose content and methods, reflecting those prevalent in the first world., are at war with sound traditional values in indigenous cultures. Today this kind of, , "domination and manipulation" via media rightly is "a concern of developing nations, in relation to developed ones," as well as a "concern of minorities within particular, nations.", , The indirect but powerful influence exerted by advertising upon the media of, , social communications that depend on revenues from this source points to another sort, of cultural concern. In the competition to attract ever larger audiences and deliver, them to advertisers, communicators can find themselves tempted-in fact pressured,, subtly or not so Bubtly t o set aside high artistic and moral standards and lapse into, superficiality, tawdriness and moral squalor. Communicators also can find themselves, tempted to ignore the educational and social needs of certain segments of the audience, , t h e very young, the very old, the poor, , who do not match the demographic, , patterns (age, education, income, habits of buying and consuming, ete.) of the kinds of, , but, , audiences advertisers want to reach. In this way the tone and indeed the level of, moral responsibility of the communications media in general are lowered., too, that, often, advertising contributes to the, invidious stereotyping, particular, groups, places them at a disadvantage in relation to others. This often is true of the way, , institutions,, and the like., where partieular, "brand"-related advertising can raise serious problems. Often there are only negligible, differences, among similar products of different brands, and advertising may attempt, to move people to act on the basis of irrational motives ("brand loyalty," status,, , advertising treats women; and the exploitation of women, both in and by advertising,, is a frequent, deplorable abuse., "How often women are treated not as persons with an inviolable dignity but ns, objects whose purpose is to satisfy others' appetite for pleasure or for powe? Iow, , can be subverted by advertisers' pressure upon publications or programs not to treat, of questions that might prove embarrassing or inconvenient. More often, though,, is, inform, to persuade and motivate- to convince, people to act in certain waysS: buy certain products or services, patronize certain, This is, abuses can occur. The practice of, , advertising, , used not simply to, , of, , All

Page 11 :

Business Economics II (F.Y.B.Com.) (Sem.-1l), , often, , is the role of, , woman, , even, , undervalued, as wife and mother, life depicted, in business or professional, or, , ridiculed?, , How, , masculine, compassion, and, insight,, feminine, of, gifts, the civilization of love?", understanding, which so greatly contribute to, d) Moral and Religious Harms of Advertising, with high moral standards, and, Advertising can be tasteful and in conformity, be, can, vulgar and morally degrading., also, OCcasionally e v e n morally uplifting, but it motives as envy, status seeking and lust., such, to, Frequently it deliberately appeals, shock and titillate by exploiting, Today, too, some advertisers consciously seek to, are certain special problems, There, nature., content of a morbid, perverse, pornographic, as a, , role of women, caricature, a denial of the specific, often, , is the, , to specific issues with a moral, relating to advertising that treats of religion or pertains, sometimes include, advertisers, commercial, first, sort,, dimension. In cases of the, sell products. It is possible to, religious themes or use religious images or personages to, and offensive when it, do this in tasteful, acceptable ways, but the practice is obnoxious, the second sort,, involves exploiting religion or treating it flippantly. In cases of, and forms, attitudes, inculcate, and, to, promote products, advertising sometimes is used, with the, for, instance,, is, the, norms., That, case,, to, moral, behaviour, contrary, of, and with, to, harmful, health,, and, abortifacients, products, advertising of contraceptives,, campaigns for artificial birth control, so-called, government, , sponsored advertising, , "safesex",and similar practices., can, , identify several moral principles, , that, , are, , particularly, , relevaänt, , to, , advertising. They are:, a), , P'P', , 53, , their parents to buy products of no real benefit to them. Advertising like this, offends, against the dignity and rights of both children and parents; it intrudes upon, tne, parent child relationship and seeks to manipulate it to its own base ends. Also,, some, of the comparatively little advertising directed, or, to the, specifically, disadvantaged seems designed to play upon their, fears so as toelderly, persuadeculturauy, them o, allocate 8ome of their limited resources to goods or services of dubious value., , c) Advertising and Social Responsibility, , Social responsibility is such a broad, concept that we, the many 16sues and concerns relevant under this, , advertising., , The, , ecological, , issue is, , note here only a few ot, to the question ot, that fosters a lavish life style, can, , heading, , one., , which, , Advertising, , wastes resources and, despoils the environment offends against important, ecological concerns. In his desire to have and to enjoy rather than to be and grow,, man, consumes the resources of the earth and his own life, an, , in, , excessive and disordered, , way, Advertising that reduces human progress to acquiring material goods and, cultivating a lavish life style expresses a false, destructive vision of the human person, harmful to individuals and society alike. When people fail to practice a rigorous, respect for the moral, cultural and spiritual requirements, based on the dignity of the, , and, on the proper identity of each community, beginning with the family and, person, religious societies, then even material abundance and the conveniences that, technology makes available will prove unsatisfying and in the end contemptible., , 10. SOME ETHICAL AND MORAL PRINCIPLES, We, , Pricing and Output Decisions under Imperfect Competition, , Truthfuluess in Advertising, , Even today, some advertising is simply and deliberately untrue. Generally, speaking, though, the problem of truth in advertising is somewhat more subtle: it is, not that advertising says what is overtly false, but that it can distort the truth by, implying things that are not so or withholding relevant facts., o be sure, advertising, like other forms of expression, has its own conventions, and forms of stylization, and these must be taken into account when discussing, truthfulness. People take for granted some rhetorical and symbolic exaggeration in, , advertising: within the imits of recognized and accepted practice. this can be, allowable. But it is a fundamental principle that advertising may not deliberately seek, , to deceive, whether it does that by what it says, by what it implies, or by what it fails, to say. The proper exercise of the right to information demands that the content of, , what is communicated be true and, within the limits set by justice and charity,, complete. The obligation is to avoid any manipulation of truth for any reason., b) The Dignity of the Human Person, There is an imperative requirement that advertising respect the human person,, his right duty to make a responsible choice, his interior freedom; all these goods would, be violated if man's lower inclinations were to be exploited, or his capacity to reflect, , Advertisers, like people engaged in other forms of social communication, have a, serious, duty to express and foster an authentic vision of human development in its, material, cultural and spiritual dimensions. Communication that meets this standard, is, among other things, a true expression of solidarity. Indeed, the two things, communication and solidarity are inseparable, because, solidarity is a consequence of, genuineand right communication andsthe free. circulation of ideas that further, , knowedge-snd, , respeot tor thers, , 11. CONCLUSION:SOME STEPS TOBE TAKEN, The indispensable guarantors of ethically correct behaviours by the advertising, industry are the well-formed and responsible consciences of advertising professionals, themselves: consciences sensitive to their duty not merely to serve the interests of, those who commission and finance their work but also to respect and uphold the, , rights and interests of their audiences and to serve the common good., Many women and men professionally engaged in advertising do have sensitive, consciences, high ethical standards and a strong sense of responsibility. But even for, them external pressures from the clients who commission their work as well as from, the competitive internal dynamics of their profession can create powerful inducements, to unethical behavior. That underlines the need for external structures and systems to, support and encourage responsible practice in advertising and to discourage the, , and decide compromised., , irresponsible., Voluntary ethical codes, , These abuses are not merely hypothetical possibilities but realities in much, advertising today. Advertising can violate the dignity of the human person both, , Representatives of the public should participate in the formulation, application and, periodic updating of ethical codes., , through its content- whatis advertised, the, , maaner in which it is advertised- and, through the impact it seeks to make upon its audience., This problem is especially acute where particularly vulnerable, groups or classes, of persons are concerned: children and young people, the elderly, the poor, the, , ulturally disadvantaged. Much advertising directed at children apparently tries to, explcit their ctedulity and suggestibility, in the hope that they will put pressure on, , are one, , such source of support. These already exist in, , a, , number of placés. There is a need to emphasize the importance of public involvement., , The public representatives should include ethicists as well as representatives of, , consumer groups. Individuals do well to organize themselves into such groups in order, , to protect their interests in relation to commercial interests. Publie authorities also, have a role to play. On the one hand, government should not seek to control and, dictate policy to the advertising industry, any more than to other sectors of the, Communications media., S/F.Y.B.Com. - Business Economics- II (Sem.-)

Page 12 :

(Scm-I, Business Economics ll (F.Y.B.Com.), and practice, already, , &'s'*, , 54, , content, the regulation of advertising, , On the other hand, can and should extend beyond banning false ndvertinin,, public, existing în many places,, overseeing their application,, promulgating laws and, By, are not gravely, defined., narrowiy should, social progress, that public morality and, ensure, authorities, endangered' through misuse of the media., , should address such questions, , as, , the, , For exanmple, government regulations, well as the content of, in broadcast media, as, such as children, quantity of advertising, especially, exploitation,, to, vulnerable, , advertising directed at groups particularly, area for regulation:, also seems an appropriate, be rased,, and old people. Political advertising, advertising, for, money, how much may be spent, how and from whom may, the, public, to, keep, it a point, etc. The media of news and information should make, it is, social, impact,, informed about the world of advertising. Considering advertising's, of advertisers,, the, performance, and, critique, review, appropriate that media regularly, on society., whose activities have a signi cant influence, just, , as, , they, , do other groups, , communication, analysis, however, where freedom of speech and, ensure ethically responsible, to, themselves, advertisers, to, itt, is, exists,, largely up, advertisers should also, practices in their profession. Besides avoiding abuses,, that is, undertake to repair the harm sometimes done by advertising, insofar as, parties,, injured, possible: for example, by publishing corrective notices, compensating, increasing the quantity of public service advertising, and the like., It is a matter of legitimate involvement not only by industry self-regulatory, bodies and public interest groups, but also by public authorities. Where unethical, n, , the final, , practices have become widespread and entrenched, conscientious advertisers may be, called upon to make significant personal sacrifices to correct them. But people who, want to do what is morally right must always be ready to suffer loss and personal, injury rather than to do what is wrong., , No one expects to see advertising eliminated from the contemporary world., Advertising is an important element in today's society, especially in the functioning of, a market economy, which is becoming more and more widespread., , Moreover, for the reasons and in the ways sketched here, we believe advertising, can, and often does, play a constructive role in economic growth, in the exchange of, information and ideas, and in the fostering of solidarity among individuals and, groups. Yet it also can do, and often does, grave harm to individuals and to the, common good., , In conclusion we can say that all the advertising professionals and all those, involved in the process of commissioning and disseminating advertising should be, persuaded to eliminate its socially harmful aspects and observe high ethical standards, in regard to truthfulness, human dignity and social responsibility., In this way, they will make a special and significant contribution to human, progress and to the common good., , 1 . OLIGOPOLY, Meaning, The term, , 'oligopoly', , is, , pollen' meaning, , 'to sell'., , where there 'are, , a, , derived from, , two Greek words, , 'oligos' meaning, , 'a few' and, , Therefore, 'oligopoly is that form of imperfect competition, , few firms in, , a, , market, , producing, , either, , homogeneous products, , or, , differentiated products which are close but not perfect substitutes of each other.", Thus, oligopoly or competition among a few sellers occurs when an industry consists of, a few firms either producing an identical, product or producing products which are, close but not perfect substitutes. Oligopoly is thus different from, monopoly where, there is only one seller, from perfect competition where there is a, very large number of, , Pricing and Output Decisions under Imperfect Competition, , 55, , 9'n', , gellers, is sufficiently large and from, Oligopoly 18 Bometimes called limited, , duopoly where there are only two sellet, competition, incomplete monopoly or mulupie, monopolies.uch oligopoly markets are generally found in modern capitalist, countrie8. The prices and outputs of several important products like steel, gasoline,, aluminum, automobiles, lyres, heavy electrical equipments etc. are determiped Dy.a, few firms that produce them. In fact, oligopoly appears to be a characteristie or, , industries where, , modern methods of production are applicable., An oligopoly is formed when a few companies dominsate a market. Whether by, , noncompetiive practices, government mandate or technological savvy, these, companies take advantage of their position to increase their profitability. Companies, , technology. pharmaceuticals and, in, establishing oligopolies in the U.S., , health insurance have become successful in, , Computer Operating Systems, New high tech markets can become oligopolies when the companies provide, unique products that are supported by an ecosystem of supporting technology., Computer operating systems in 2012 are dominated by Microsoft's Windows, Apple's, Mac OS and the open source Linux operating aystem. These three systems capture, close to 100 percent of the computer operating system market due to their estabished, , positions, according to the StatOwl website. All other software providers make, programs that are compatible with these systems, further reinforcing the dominance, of the major players., , Smart Phone Operating Systems, The smart phone market is similarly dominated by a handful of companies, the, most powerful two being Google Android and Apple iOS. Those companies have deep, relationships with the handset providers and are able to have their system pre, installed on each phone. As with computer operating systems, these relationships, become self-reinforcing as they grow., , Pharmaceutical Industry, , The pharmaceutical industry is becoming an oligopoly due to the staggering costs, of developing and marketing new drugs and because of patents that protect new, , products from competitors. It can cost more than Rs1 billion to develop a new drug,, , get it approved by the Food and Drug Administration and bring it to market,, , according to "Forbes" magazine. With those kind of upfront costs, only a handful of, companies including Pfizer, Merck and Novartis, can afford to create and sell new, products. The government grants those companies extended patents on their drugs,, and these patents protect drug developers from competitors for many years., Health Insurance, Health insurance is a highly regulated industry with a number of government, mandates at the state and federal level. The 2010 Patient Protection and Affordable, Care Act requires insurers to accept more high risk patients as customers and to, provide comprehensive coverage to all their customers. Such constraints favor a, handful of established companies, such as Humana, Cigna, Aetna and WellPoint., Some observers suspect that companies capable of surviving new legal mandates, , wil, , evolve into an oligopoly., , Key Attributes of Oligopoly, The important characteristics of oligopoly are as follows, , Monopoly Power, The,most, , important, , characteristic, , of, , oligopoly, , is, , that, , there is, , an, , element of, , monopoly power in such a market. Though there are only a few firms in such a, market, each of them producing a differentiated product enjoys a monopoly position in

Page 13 :