Page 2 :

Srinivas University, 1st SEMESTER-BBA, Name of the Program: Bachelor of Business Administration (BBA), Course Code: 21BBAHN/LS/PM/HA/PA/CMA/IB21, Name of the Course: BUSINESS ACCOUNTING-1, Course Credits, 4 Credits, , No. of Hours per Week, 4Hrs, , Total No. of Teaching Hours, 45Hrs, , Pedagogy: Class rooms lecture, tutorials, Group discussion, Seminar, Case studies & field, work etc.,, Course Objectives., , , , , To Prepare financial statements in accordance with appropriate standards., Interpreting the business implications of financial statement information, Preparing accounting information for planning and control and for the evaluation of, products, projects and divisions., , , , Analysing transaction data and tax authorities for purposes of tax planning., , , , Applying auditing concepts to evaluate the conformity of financial statements with, appropriate auditing standards., Course Outcomes: On successful completion of the course, the students will be able., CO: 1 To gain knowledge on accounting concepts, CO: 2 Equip themselves with necessary skills from learning these concepts theoretically and, practically., Syllabus:, Hours, Module No.1: Theoretical Framework, 08, Business Accounting: Nature-scope-limitation- Accounting: Concepts and convention,, Accounting standard-significance and importance- IFRS-Needs and procedures, Difference, between IAS and AS., Module No.2: Accounting Process, 08, Accounting process- Classification of Accounting Transactions and Accounts- Rules of Debit, and Credit as Per Double Entry System- Journal Entries- Ledger posting – Subsidiary BooksCash Book., 08, Module No.3: Depreciation, Deprecation Account- Meaning-Causes- Depreciation V/s Fluctuations, Methods of, Depreciation – Problems on Straight line method, written down value method and Annuity, method., Module No. 4: Bank Reconciliation Statement and Rectification of Error, 08, Bank Reconciliation - Meaning, causes of differences, need & importance, preparation &, presentation of BRS, Rectification of errors: Classification of errors- before preparing the trial balance after, preparing the trial balance and before preparing final account., Module No 5: Final Accounts of Sole Proprietorship, 08, Final Accounts of sole proprietorship- Preparation of Trading Account,, , Business Accounting-1, , 2

Page 3 :

Srinivas University, , 1st SEMESTER-BBA, , profit and Loss A/C and Balance Sheet (with Basic Adjustments)., Books for Reference:, 1., 2., 3., 4., 5., 6., 7., , Advanced Accountancy, Advanced Accountancy, Advanced Accountancy, Advanced Accountancy, Accounting – 1, Advanced Accountancy, Advanced Accounting, , Business Accounting-1, , - R.L. Gupta, - S.N. Maheshwari and S.L. Maheshwari, - M.C. Shukla, - B.S. Raman, - B.S. Raman, - Jain and Narang, - Dr B.M Agarwal and Dr. M.P Gupta, , 3

Page 4 :

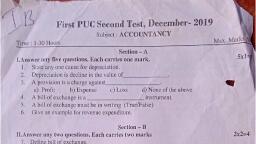

Srinivas University, , 1st SEMESTER-BBA, Teaching Plan, , SESSION, , CONTENT, , TIME, 1, , Module No.1, , Theoretical Framework, , Session 1:, , Introduction to Business Accounting, , 1, , Session 2:, , Meaning, definition and features of Business Accounting, , 1, , Session 3:, , Nature, scope and limitation of Business accounting, , 1, , Session 4:, , Accounting: objectives, role or function and terms, , 1, , Session 5:, , Accounting principles, Accounting Concepts and convention, , 1, , Session 6:, , Accounting Standard: list, Significance and, importance of accounting standard, , 1, , Session 7:, , IFRS- meaning, need and procedures, , 1, , Session 8:, , Difference between, IAS and AS, , 1, , Module No.2:, , Accounting Process, , Session 9:, , Classification of Accounting transactions and Accounts, , 1, , Session 10:, , Double entry system: Meaning, objectives, and advantages, , 1, , Session 11:, , Classification of Accounts and rules of debit and credit as per, double Entry system, , 1, , Session 12:, , Journal Entries: Meaning and steps, , 1, , Session 13:, , Journal Entries: Meaning and steps, , 1, , Business Accounting-1, , 4

Page 5 :

Srinivas University, , 1st SEMESTER-BBA, , Session 14:, , Ledger: Meaning. Relationship between journal and Ledger,, advantages, procedure for posting and Problems on ledger, , 1, , Session 15:, , Problems on posting journal into ledger, , 1, , Session 16:, , Subsidiary books and cash book, , 1, , Module No.3:, , Depreciation, , Session 17:, , Meaning, definition and causes of Depreciation, , 1, , Session 18:, , Difference between Depreciation and Fluctuations, Methods of, Depreciation, , 1, , Session 19:, , Problems on Straight line method, , 1, , Session 20:, , Continuation of problems on Straight line method, , 1, , Session 21:, , Problems on written down value, method, , 1, , Session 22:, , Problems on written down value method, , 1, , Session 23:, , Problems on Depreciation fund Method, , 1, , Session 24:, , Continuation of problems on Depreciation fund Method, , 1, , Module No .4:, , Bank Reconciliation Statement and Rectification of Errors, , Session 25:, , Meaning, Definition, Need and importance of BRS, , Session 26:, , Causes of differences between cash book and pass book, , Session 27:, , Preparation and presentation of bank reconciliation statement, , 1, 1, 1, , Business Accounting-1, , 5

Page 6 :

Srinivas University, , 1st SEMESTER-BBA, , 1, Session 28 :, , Problems on BRS, , 1, Session 29:, , Rectification of errors: Classification of errors, , 1, Session 30:, , Problems on Rectification of errors, , Session 31:, , .Continuation of problems on Rectification of errors, , Session 32:, , Continuation of problems on Rectification of errors, , 1, 1, 1, Module No .5:, , Final Accounts of Sole Proprietorship, , Session 33:, , Meaning, definition and objectives, , 1, 1, Session 34:, , Preparation of profit and losses, , 1, Session 35:, , Preparation of balance sheet, , Session 36:, , Problems on profit and losses, , Session 37:, , Problems on profit, losses and balance sheet, , 1, 1, 1, Session 36:, , Continuation on problems on profit, losses and balance sheet, , Session 37:, , Continuation on problems on profit, losses and balance sheet, , Session 38:, , Problems with basic adjustment, , 1, 1, , Business Accounting-1, , 6

Page 7 :

Srinivas University, , 1st SEMESTER-BBA, CONTENTS, , SL No., , Chapters (Question Bank), THEORETICAL FRAMEWORK, , 1, ACCOUNTING PROCESS, , 2, , DEPRECIATION ACCOUNTING, , 3, , 4, , BANK RECONCIALIATION STATEMENT AND RECTIFICATION OF, ERRORS, FINAL ACCOUNTS OF A SOLE TRADER, , 5, , Business Accounting-1, , 7

Page 8 :

Srinivas University, , 1st SEMESTER-BBA, , UNIT I, THEORETICAL FRAMEWORK, , 1.1 ORIGIN AND DEVELOPMENT OF ACCOUNTING THOUGHT, Accounting is as old as money itself. Accounting had emerged not by chance, but in response to, the economic and social developments in developed countries of the world. This is clear from the, fact that, in developed countries like the U.K., Germany, France, Switzerland, U.S.A., etc.,, where there were remarkable economic and social developments, there was a major revolution in, accounting theory and practice during the past sixty years, while in developing and underdeveloped countries, where the economic and social developments were not significant, there, was not much development in accounting theory and practice., In India, Chanakya in his Arthashastra has emphasized the existence and need of proper, accounting and auditing., Accounting today, therefore, cannot be the same as it used to be about half century back. It has, also grown in importance and change in its structure with the evolution of complex and giant, industrial organizations. In the early stages accounting developed as a result of the needs of the, business firms to keep track of their relationship with outsiders, listing of their assets and, liabilities. In recent years changes in technology have also brought a remarkable change in the, field of accounting., , 1.2 DEFINITION AND MEANING OF ACCOUNTING:, The American Institute of Certified Public Accountants (AICPA) has defined accounting as “the, art of recording, classifying and summarizing in a significant manner and in terms of, money transactions and events which are, in part at least, of a financial character and, interpreting the results thereof”., According to the American Accounting Association (AAA), "Accounting is the process of, identifying, measuring and communicating economic information to permit informed, judgments‟ and decisions by users of the information"., From the above definitions, it is clear that accounting is (i) identifying and measuring business, transactions in terms of money, (ii) recording business transactions of financial character, soon, after their occurrence, in a book or books of original entry, (iii) classifying the entries found in, Business Accounting-1, , 8

Page 9 :

Srinivas University, , 1st SEMESTER-BBA, , the book or books of original entry into appropriate accounts in the ledger, the book of final, entry, periodically, (iv) summarising or presenting, at the end of the accounting period, the, information found in the ledger accounts through financial statements, (v) analysing and, interpreting the financial statements (i.e., drawing conclusions from the financial statements) and, (vi) communicating the results of the interpretation of the financial statements to the end-users, for making sound decisions., , 1.3 ESSENTIAL ASPECTS OF ACCOUNTING:, (i) Identifying, i.e., determining the business transactions to be recorded in the book or books of, original entry., (ii) Measuring, i.e., expressing the value of business transactions in terms of money., (iii) Recording, i.e., entering, in terms of money, business transactions, as and when they occur., iv)Classifying, i.e., grouping of entries of like nature into appropriate accounts in the ledger or, posting of the entries to the ledger accounts, balancing the ledger accounts and the preparation of, trial balance., v) Summarizing, i.e., presenting the effects of the business transactions classified in the ledger, accounts upon the profit and the financial position of the business at the end of the accounting, period., vi) Analyzing, i.e., rearranging the items in the financial statements in a suitable form and, establishing the relationship between the various items or groups of items in the financial, statements so as to provide the basis for interpretation., vii) Interpreting, i.e., explaining the significance of the relationship established by the analysis,, and drawing meaningful conclusions about the profit, the financial position and the future, prospects of the business., viii) Communicating, i.e., intimating, the results of interpretation of the financial statement to, the end- users of accounting information for decision-making., , Business Accounting-1, , 9

Page 10 :

Srinivas University, , 1st SEMESTER-BBA, , 1.4 BOOK-KEEPING, According to Northcot, "Book-Keeping" is the art of recording in the books of account the, monetary aspect of commercial and financial transactions"., In the words of "A. J. Favell, "Book-keeping is the recording of the financial transactions of, a business in a methodical manner so that information on any point in relation to them, may be quickly obtained"., From the above definitions, it is clear that book-keeping is the process of recording business, transactions in appropriate books of account in a systematic manner so as to ensure the, availability of financial information on any point of the business, particularly about the profit or, loss and the financial position of the business., , 1.4.1 Essential Aspects or Features of Book-Keeping:, i) Book-keeping is the recording of only business transactions., ii) It is the recording of only the monetary or financial aspects of business transactions, iii) It is the recording of business transactions in terms of money., iv) It is the recording of business transactions in a set of books known as books of account or, account books., v) Book-keeping covers certain processes, viz., identifying the business transactions to be, recorded, measuring those business transactions in terms of money, recording the identified and, measured business transactions in the book or books of original entry., , 1.5ACCOUNTANCY, Definition and Meaning of Accountancy:, In the words of Eric Kohler, "Accountancy is the theory and practice of accounting"., From these definitions, it is clear that accountancy is a discipline (i.e., a body of knowledge or a, subject of study) which explains the art and principles of recoding business transactions. In other, words, accountancy is the science of accounting, which explains why books of accounts should, be maintained, how to maintain the books of accounts, how to prepare the financial statements,, how to interpret the financial statements, and how to communicate the results of the, interpretation to the end-users., , Business Accounting-1, , 10

Page 11 :

Srinivas University, , 1st SEMESTER-BBA, , 1.5.1 OBJECTIVES OF ACCOUNTING, (i) Maintaining proper records of business transactions:, One of the important objectives of accounting is to maintain complete, proper and systematic, records of all the business transactions of the business so that the financial information required, on any matter can be had readily and easily., (ii) Ascertaining the profit or loss of the business:, Another important objective of accounting is to ascertain the profit or loss of the business for an, accounting period by preparing the profit and loss account., (iii) Knowing the sources of revenue and the items of expenses:, Another important objective of accounting is to know how the profit is earned or the loss is, incurred, i.e., to know the various sources of revenue and the various items of expenses which, have resulted in profit or loss., (iv) Ascertainment of the financial position of the business:, Ascertainment of the true financial position (i.e., the assets, liabilities and owner's capital) of the, business at the end of every accounting year by preparing the balance sheet or position statement, is another important objective of accounting., (v) Ascertaining the amounts due to the business, and the amounts due from the business:, Ascertaining the amounts due to the business from its debtors, and the amounts due from the, business to its creditors is another important objective of accounting., (vi) Ensuring effective control over the performance of the business:, Accounting reveals the actual performance of a business in terms of cost of production and sale,, profit or loss and book values assets and liabilities. Thus, accounting is intended to ensure, effective control over the performance of the business., (vii) Protection of the properties of the business:, , Business Accounting-1, , 11

Page 12 :

Srinivas University, , 1st SEMESTER-BBA, , Another important objective of accounting is to protect the properties of the business. By, keeping proper records of the various properties of the business and providing up-to-date, information about the various properties of the business to the management, accounting helps the, management to exercise proper control over the use of the properties of the business., (viii) Prevention of errors and frauds:, Another important objective of accounting is to prevent errors and frauds in the business by, facilitating their quick detection and correction and by introducing suitable measures for their, prevention in future., ix) Satisfying legal requirements:, Various laws like the Companies Act, the Income-tax Act, the Sales Tax Act, etc. require a, business concern to maintain necessary financial records and submit the required financial, statements to the Government. Accounting satisfies the requirements of these laws by, maintaining the necessary accounting records., x) Making financial information available to various groups of persons:, Accounting communicates (i.e., makes available) the financial results (i.e., profit or loss and the, financial position) and other valuable financial information to various groups., , 1.5.2 ROLE OR FUNCTIONS OF ACCOUNTING, 1. The basic function of accounting is to keep a systematic record of the financial transactions of, the business., 2. Just as a language is used as a means of communication, accounting is used to communicate, the financial information about the profit or loss and the financial position of the business to the, interested parties., 3. Accounting protects the properties and assets of the business. By maintaining proper records, of the various properties and assets of the business and providing up-to-date information about, the properties and assets of the business to the management., 4. Accounting meets the legal requirements by maintaining proper records., 5. Accounting provides a continuous record of business activities, and thereby, helps the business, enterprise to make a meaningful comparison of its current year's activities with the activities of, the previous years., , Business Accounting-1, , 12

Page 13 :

Srinivas University, , 1st SEMESTER-BBA, , 6. For the efficient planning of a business for the future, a complete knowledge of its past and, present activities is needed., , 1.5.3 Basic Accounting Terms, The understanding of the subject becomes easy when one has the knowledge of a few important, terms of accounting. Some of them are explained below., Transactions, Transactions are those activities of a business, which involve transfer of money or goods or, services between two persons or two accounts. For example, purchase of goods, sale of goods,, borrowing from bank, lending of money, salaries paid, rent paid, commission received and, dividend received. Transactions are of two types, namely, cash and credit transactions., Cash Transaction, Cash Transaction is one where cash receipt or payment is involved in the transaction. For, example, When Ram buys goods from Kannan paying the price of goods by cash immediately, it, is a cash transaction., Credit Transaction, Credit Transaction is one where cash is not involved immediately but will be paid or received, later. In the above example, if Ram, does not pay cash immediately but promises to pay later, it, is credit transaction., Proprietor, A person who owns a business is called its proprietor. He contributes capital to the business with, the intention of earning profit., Capital, It is the amount invested by the proprietor/s in the business. This amount is increased by the, amount of profits earned and the amount of additional capital introduced. It is decreased by the, amount of losses incurred and the amounts withdrawn. For example, if Mr.Anand starts business, with Rs.5,00,000, his capital would be Rs.5,00,000., Assets, Assets are the properties of every description belonging to the business. Cash in hand, plant and, machinery, furniture and fittings, bank balance, debtors, bills receivable, stock of goods,, investments, Goodwill are examples for assets. Assets can be classified into tangible and, intangible., Business Accounting-1, , 13

Page 14 :

Srinivas University, , 1st SEMESTER-BBA, , Tangible Assets: These assets are those having physical existence. It can be seen and touched., For example, plant & machinery, cash, etc., Intangible Assets: Intangible assets are those assets having no physical existence but their, possession gives rise to some rights and benefits to the owner. It cannot be seen and touched., Goodwill, patents, trademarks are some of the examples., Liabilities, Liabilities refer to the financial obligations of a business. These denote the amounts which a, business owes to others, e.g., loans from banks or other persons, creditors for goods supplied,, bills payable, outstanding expenses, bank overdraft etc., Drawings, It is the amount of cash or value of goods withdrawn from the business by the proprietor for his, personal use. It is deducted from the capital., Debtors, A person (individual or firm) who receives a benefit without giving money or money's worth, immediately, but liable to pay in future or in due course of time is a debtor. The debtors are, shown as an asset in the balance sheet. For example, Mr.Arul bought goods on credit from, Mr.Babu for Rs.10,000. Mr.Arul is a debtor to Mr.Babu till he pays the value of the goods., Creditors: A person who gives a benefit without receiving money or money's worth, immediately but to claim in future, is a creditor. The creditors are shown as a liability in the, balance sheet. In the above example Mr.Babu is a creditor to Mr.Arul till he receives the value of, the goods., Purchases, Purchases refer to the amount of goods bought by a business for resale or for use in the, production. Goods purchased for cash are called cash purchases. If it is purchased on credit, it is, called as credit purchases. Total purchases include both cash and credit purchases., Purchases Return or Returns Outward, When goods are returned to the suppliers due to defective quality or not as per the terms of, purchase, it is called as purchases return. To find net purchases, purchases return is deducted, from the total purchases., , Business Accounting-1, , 14

Page 15 :

Srinivas University, , 1st SEMESTER-BBA, , Sales, Sales refer to the amount of goods sold that are already bought or manufactured by the business., When goods are sold for cash, they are cash sales but if goods are sold and payment is not, received at the time of sale, it is credit sales. Total sales include both cash and credit sales., Sales Return or Returns Inward, When goods are returned from the customers due to defective quality or not as per the terms of, sale, it is called sales return or returns inward. To find out net sales, sales return is deducted from, total sales., Stock, Stock includes goods unsold on a particular date. Stock may be opening and closing stock. The, term opening stock means goods unsold in the beginning of the accounting period. Whereas the, term closing stock includes goods unsold at the end of the accounting period. For example, if, 4,000 units purchased @ Rs. 20 per unit remain unsold, the closing stock is Rs.80,000. This will, be opening stock of the subsequent year., Revenue, Revenue means the amount receivable or realised from sale of goods and earnings from interest,, dividend, commission, etc., Expense, It is the amount spent in order to produce and sell the goods and services. For example, purchase, of raw materials, payment of salaries, wages, etc., Income, Income is the difference between revenue and expense., Voucher, It is a written document in support of a transaction. It is a proof that a particular transaction has, taken place for the value stated in the voucher. It may be in the form of cash receipt, invoice,, cash memo, bank pay-in-slip etc. Voucher is necessary to audit the accounts., Invoice, Invoice is a business document which is prepared when one sell goods to another. The statement, is prepared by the seller of goods. It contains the information relating to name and address of the, seller and the buyer, the date of sale and the clear description of goods with quantity and price., , Business Accounting-1, , 15

Page 16 :

Srinivas University, , 1st SEMESTER-BBA, , Receipt, Receipt is an acknowledgement for cash received. It is issued to the party paying cash. Receipts, form the basis for entries in cash book., Account, Account is a summary of relevant business transactions at one place relating to a person, asset,, expense or revenue named in the heading. An account is a brief history of financial transactions, of a particular person or item. An account has two sides called debit side and credit side., , 1.6 ACCOUNTING PRINCIPLES, Definition and Meaning of Accounting Principles:, According to the American Institute of Certified Public Accountants (AICPA), U.S.A., "An, accounting principle is a general law or rule adopted or professed as a guide to action, a, settled ground or basis of conduct or practice"., From the above definitions, it is clear that accounting principles are generally decided rules,, derived from the basic accounting concepts, which are followed by accountants widely in writing, up the accounts and in preparing the financial statements of business concerns. In short,, accounting principles are rules of action or conduct which are adopted by accountants, universally, while recording accounting transactions and preparing financial statements., 1.6.1 GENERALLY ACCEPTED ACCOUNTING PRINCIPLE (GAAPS), Accounting principles, which are widely accepted by accountants, are known as generally, accepted accounting principles. In other words, generally accepted accounting principles are the, set of guidelines and rules which are widely accepted by accounting practioners (i.e., chartered, accountants) at a given time., 1.6.2 Classification of accounting principles, Traditionally, accounting principles have been classified as:, 1. Accounting concepts, 2. Accounting conventions, 1. Accounting concepts, The term 'concept' means an idea or thought. Basic accounting concepts are the fundamental, ideas or basic assumptions underlying the theory and practice of financial accounting. They are, , Business Accounting-1, , 16

Page 17 :

Srinivas University, , 1st SEMESTER-BBA, , evolved (and are still evolving) over a period in response to the changing business environment, and the specific needs of the users of accounting information., The concepts guide the identification of events and transactions to be accounted for, their, measurement and recording, and the method of summarising and reporting to interested parties., The concepts, thus, help in bringing about uniformity in the practice accounting., a. Business Entity Concept, Business entity means a unit of organised business activity. From the accounting point of view, every business enterprise is an entity separate and distinct from its proprietor(s)/owner(s). The, accounting system gives information only about the business and not its owner(s). In other words, we record those transactions in the books of account which relate only to the business. The, owner's personal affairs (his expenditure on housing, food, clothing, etc.) will not appear in the, books of account of his business. However, when personal expenditure of the owner is met from, business funds it shall also be recorded in the business books. It will be recorded as drawings by, the proprietor and not as business expenditure., Another implication of business entity concept is that the owner of business is to be treated as a, creditor who also has a claim over the assets of the business. As such, the amount invested by, him (capital) is regarded as a liability for the business., The business entity concept is applicable to all forms of business organisations. This distinction, can be easily maintained in the case of a limited company because the company has a legal entity, of its own. But such distinction becomes difficult in case of a sole proprietorship or partnership, because in the eyes of the law the partner or the sole proprietors are not considered separate, entities. They are personally liable for all business transactions. But, for accounting purposes, they are to be treated as separate entities. This enables them to ascertain the profit or loss of, business more conveniently and accurately., b. Money Measurement Concept, Usually, business deals in a variety of items having different physical units such as kilograms,, quintals, tons, metres, litres, etc. If the sales and purchases of different items are recorded in, terms of their physical units, adding them together will pose problems. But, if these are recorded, in a common denomination, their total becomes homogeneous and meaningful. Therefore, we, need a common unit of measurement. Money does this function. It is adopted as the common, measuring unit for the purpose of accounting. All recording, therefore, is done in terms of the, Business Accounting-1, , 17

Page 18 :

Srinivas University, , 1st SEMESTER-BBA, , standard currency of the country where business is set up. For example, in India it is done in, terms of Rupees, in USA it is done in terms of US Dollars, and so on., Another implication of money measurement concept is that only those transactions and events, are to be recorded in the books of account which can be expressed in terms of money such as, purchases, sales, payment of salaries, goods lost in accident, etc., other happenings, (nonmonetary) like death of an efficient manager or the appointment of an accountant,, howsoever important they may be, are not recorded in the books of account. This is because their, effect is not measurable of quantifiable in terms of money., This approach has its own drawbacks. The value of money changes over a period of time. The, value of rupee today is much less than what it was in 1961. Such a change is nowhere reflected, in accounts. This is the reason why the accounting data does not reflect the true and fair view of, the affairs of the business., Hence, now-a-days, it is considered desirable to provide additional data showing the effect of, changes in the price level on the reported income and the assets and liabilities of the business., c. Objective Evidence Concept, The term objectivity refers to being free from bias or free from subjectivity. Accounting, measurements are to be unbiased and verifiable independently. For this purpose, all accounting, transactions should be evidenced and supported by documents such as bills, invoices, receipts,, cash memos, etc. These supporting documents (vouchers) form the basis for making entries in, the books of account and for their verification by auditors afterwards. As for the items like, depreciation and the provision for doubtful debts where no documentary evidence is available, the policy statements made by management are treated as the necessary evidence., d. Historical Record Concept: According to the historical record concept, we record only those, transactions which have actually taken place and not those which may take place (future, transactions). It is because accounting record presupposes that the transactions are to be, identified and objectively evidenced. This is possible only in the case of past (actually happened), transactions. The future transactions can hardly be identified and measured accurately. You also, know that all transactions are to be recorded in chronological (datewise) order. This leads to the, preparation of a historical record of all transactions. It also implies that we simply record the, facts and nothing else., , Business Accounting-1, , 18

Page 19 :

Srinivas University, , 1st SEMESTER-BBA, , e. Cost Concept, Business activity, in essence, is an exchange of money. The price paid (or agreed to be paid in, case of a credit transaction) at the time of purchase is called cost. According to the cost concept,, all assets are recorded in books at their original purchase price. This cost also forms an, appropriate basis for all subsequent accounting for the assets. For example, if the business buys a, machine for Rs. 80,000 it would be recorded in books at Rs. 80,000. In case its market value, increases later on to Rs. 1,00,000 (or decreases to Rs. 50,000) it will continue to be shown at Rs., 80,000 and not at its market value., This does not mean, however, that the asset will always be shown at cost. Hence it may, systematically be reduced from year to year by charging depreciation and the asset be shown in, the balance sheet at the depreciated value. The depreciation is usually charged as a fixed, percentage of cost. It bears no relationship with changes in its market value. In other words, the, value at which the assets are shown in the balance sheet has no relevance to its market value., This, no doubt, makes it difficult to assess the true financial position of the business. It is,, therefore, regarded as an important limitation of the cost concept. But this approach is preferred, because, firstly it is difficult and time consuming to ascertain the market values, and secondly, there will be too much of subjectivity in assessing the current values. However, this limitation, has been overcome with the help of inflation accounting., 2. Accounting conventions: Customs, traditions, usages and practices followed in accounting, for a long time while preparing the accounting statements are known as accounting conventions., Following are the some of the important accounting conventions:, a. Convention of consistency: According to this, Accounting practices, rules and methods, should remain unchanged for a fairly long time. However changes may be made if it is, absolutely necessary. Such changes and their effects should be clearly stated in the financial, statements., b. Convention of conservatism: This convention gives the rule ‗anticipate no profit but provide, for all possible losses‗. It suggests the policy of playing safe. According to this convention, anticipated profit shall not be taken into account. Therefore, closing stock is valued at cost or, market price whichever is lower. However provisions shall be made for all possible anticipated, losses., , Business Accounting-1, , 19

Page 20 :

Srinivas University, , 1st SEMESTER-BBA, , c. Convention of full disclosure: According to this convention, accounts and financial, statements should disclose all important information fully and fairly., d. Convention of materiality: Material facts are to be reported. Insignificant details may be, ignored while preparing financial statements. This is necessary to reduce unnecessary minute, details. It is also reduces the cost of accounting. Materiality is a subjective term., 1.7Accounting Standards, Meaning of Accounting Standards:, Accounting standards are the policy documents or written statements issued, from time to time,, by an apex expert accounting body in relation to various aspects of measurement, treatment and, disclosure of accounting transactions or events for ensuring uniformity in accounting practices, and reporting. In other words, accounting standards are the guidelines laid down by an apex, expert accounting body as to how business transactions or events are to be recorded in books of, account, and the manner in which the business transactions are to be exhibited in the financial, statements., 1.7.1 LIST OF INDIAN ACCOUNTING STANDARDS, AS 1: Disclosure of accounting policies., AS 2: Valuation of inventories (revised)., AS 3: Cash flow statement (revised)., AS 4: Contingencies and events occurring after the balance sheet date (revised)., AS 5: Net profit or loss for the period, prior period and extraordinary items and changes in, accounting policies (revised)., AS 6: Depreciation accounting (revised)., AS 7: Accounting for construction contracts (revised)., AS 8: Accounting for Research and Development (withdrawn with effect from 1.4.2003)., AS 9: Revenue recognition., AS 10: Accounting for fixed assets., AS 11: Accounting for the effects of changes in foreign exchange rates (revised)., AS 12: Accounting for Government grants., AS 13: Accounting for investments., AS 14: Accounting for amalgamations., AS 15: Accounting for retirements benefits in the financial statements of employers., Business Accounting-1, , 20

Page 21 :

Srinivas University, , 1st SEMESTER-BBA, , AS 16: Borrowing costs., AS 17: Segment reporting., AS 18: Related Party disclosures., AS 19: Leases., AS 20: Earnings per share, AS 21: Consolidated financial statements., AS 22: Accounting for taxes on income., AS 23: Accounting for investments in associates in consolidated financial statement, AS 24: Discontinuing operations., AS 25: Interim financial reporting., AS 26: Intangible assets., AS 27: Financial reporting of interests in joint ventures., AS 28: Impairment of assets., AS 29: Provisions, contingent liabilities and contingent assets., AS 30: Financial Instruments: Recognition and Measurement., AS 31: Financial Instruments: Presentation., AS 32: Financial Instruments: Disclosure., , 1.7.2 Benefits and Limitations, Accounting standards seek to describe the accounting principles, the valuation techniques and the, methods of applying the accounting principles in the preparation and presentation of financial, statements so that they may give a true and fair view. By setting the accounting standards the, accountant has following benefits:, (i) Standardisation of alternative accounting treatments: Standards reduce to a reasonable extent, or eliminate altogether confusing variations in the accounting treatments used to prepare financial, statements., (ii) Requirements for additional disclosures: There are certain areas where important information, is not statutorily required to be disclosed. Standards may call for disclosure beyond that required by, law., (iii) Comparability of financial statements: The application of accounting standards would, to a, limited extent, facilitate comparison of financial statements of companies situated in different parts, of the world and also of different companies situated in the same country. However, it should be, , Business Accounting-1, , 21

Page 22 :

Srinivas University, , 1st SEMESTER-BBA, , noted in this respect that differences in the institutions, traditions and legal systems from one country, to another give rise to differences in accounting standards adopted in different countries., There are some limitations of setting of accounting standards:, (i) Difficulties in making choice between different treatments: Alternative solutions to certain, accounting problems may each have arguments to recommend them. Therefore, the choice between, different alternative accounting treatments may become difficult., (ii) Lack of flexibilities: There may be a trend towards rigidity and away from flexibility in applying, the accounting standards., (iii) Restricted scope: Accounting standards cannot override the statute. The standards are required, to be framed within the ambit of prevailing statutes., , 1.7.3 Importance of accounting standards, 1. Lays down uniform accounting policies & practices which are to be followed by all business, enterprises in respect of particular transactions or events., 2. If uniform accounting standards are followed by all business concerns in the preparation of, accounts & in the presentation of financial statements, the financial statements of various, business concerns become comparable., 3. Accounting standards would curb the unlimited flexibility in the adoption of accounting, policies & practices., 4. Financial statements, prepared in accordance with established accounting standards, would be, useful to investors in judging the yield & risk involved in alternative investments in different, companies & in different countries., 5. Financial statements, produced on the basis of established accounting standards, will be, reliable documents for the purpose of analysis & in interpretation by analysis, researchers &, consultants for economic forecasting & planning., 6. It improves the credibility & reliability of accounting information., 7. It raises the standards of auditing in its task of reporting on the financial statements & make, charted accountants ensure commitment & integrity in their profession., , Business Accounting-1, , 22

Page 23 :

Srinivas University, , 1st SEMESTER-BBA, , 8. Accounting reports produced in accordance with established accounting standards are, regarded by government officials, tax authorities etc...As quite reliable & acceptable., , 1.8 IFRSThe Institute of Chartered Accountants of India (ICAI) has announced that IFRS will be, mandatory in India for financial statements for the periods beginning on or after 1 April 2016 in, a phased manner. There is a roadmap issued by MCA for adoption of IFRS., 1.8.1 History of IFRS, IFRS originated in the European Union, with the intention of making business affairs and, accounts accessible across the continent. The idea quickly spread globally, as a common, language allowed greater communication worldwide. Although only a portion of the world uses, IFRS, participating countries are spread all over the world, rather than being confined to one, geographic region. The United States has not yet adopted IFRS, as many view the American, GAAP. as the "gold standard"; however, as IFRS become more of a global norm, this is subject, to change if the SEC decides that IFRS are fit for American investment practices., Currently, about 120 countries use IFRS in some way, and 90 of those require them and fully, conform to IFRS regulations. IFRS are maintained by the IFRS Foundation. The mission of the, IFRS Foundation is to "bring transparency, accountability and efficiency to financial markets, around the world." Not only does the IFRS Foundation supply and monitor these standards, but it, also provides suggestions and advice to those who deviate from the practice guidelines. The goal, with IFRS is to make international comparisons as easy as possible. This is difficult because, to a, large extent, each country has its own set of rules. For example, U.S. GAAP are different from, Canadian GAAP. Synchronizing accounting standards across the globe is an ongoing process in, the international accounting community., 1.8.2 Meaning:, International Financial Reporting Standards (IFRS) are a set of international accounting, standards stating how particular types of transactions and other events should be reported in, financial statements. IFRS are issued by the International Accounting Standards Board, and they, specify exactly how accountants must maintain and report their accounts. IFRS were established, Business Accounting-1, , 23

Page 24 :

Srinivas University, , 1st SEMESTER-BBA, , in order to have a common accounting language, so business and accounts can be understood, from company to company and country to country., 1.8.3 Standard IFRS Requirements, IFRS cover a wide range of accounting activities. There are certain aspects of business practice, for which IFRS set mandatory rules., Statement of Financial Position: This is also known as a balance sheet. IFRS influence the, ways in which the components of a balance sheet are reported., Statement of Comprehensive Income: This can take the form of one statement, or it can be, separated into a profit and loss statement and a statement of other income, including property and, equipment., Statement of Changes in Equity: Also known as a statement of retained earnings, this, documents the company's change in earnings or profit for the given financial period., Statement of Cash Flow: This report summarizes the company's financial transactions in the, given period, separating cash flow into Operations, Investing, and Financing., 1.8.3 IFRS vs. American Standards, Differences exist between IFRS and other countries' generally accepted accounting standards, (GAAP) that affect the way a financial ratio is calculated. For example, IFRS are not as strict on, defining revenue and allow companies to report revenue sooner, so consequently, a balance sheet, under this system might show a higher stream of revenue. IFRS also have different requirements, for expenses; for example, if a company is spending money on development or an investment for, the future, it doesn't necessarily have to be reported as an expense (it can be capitalized)., Another difference between IFRS and GAAP is the specification of the way inventory is, accounted for. There are two ways to keep track of this, first in first out (FIFO) and last in first, out (LIFO). FIFO means that the most recent inventory is left unsold until older inventory is, sold; LIFO means that the most recent inventory is the first to be sold. IFRS prohibit LIFO,, while American standards and others allow participants to freely use either., , Business Accounting-1, , 24

Page 25 :

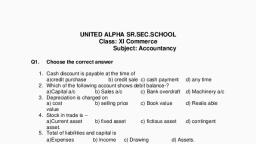

Srinivas University, , 1st SEMESTER-BBA, , QUESTIONS:, 1 mark Questions:, , 1. Accounting is emerged by, a. Developed country, , b. Under developed country, , c. Developing country, , d. a & b, , 2. In India in his Arthashastra has emphasized the existence and need of proper accounting, and auditing., a. Chanakya, , b. Northcot, , c. Eric Kohler, , d. None of the above, , 3. "Accountancy is the theory and practice of accounting" is given by, a. Eric Kohler, , b.Chanakya, , c. Northcot, , d. None of the above, , 4. Amount invested by the owner of the business is, a. Asset, , b. Capital, , c. Liability, , d. Income, , 5. Amount receivable or realised from sale of goods, a. Revenue, , b. Income, , c. Income and Revenue, , d. None of the above, , 6. A person who receives a benefit without giving money but liable to pay in future, a. Debtor, , b. Creditor, , c. Bank, , d. Proprietor, , 7. A person who gives a benefit without receiving money or money„s worth immediately but, claim in future, a. Debtor, , b. Creditor, , c. Bank, , d. Proprietor, , 8. Amount of cash or value of goods withdrawn from the business by the proprietor for, personal use, a. Capital, , b. Drawings, , Business Accounting-1, , c. Profit, , d. Dividend, , 25

Page 26 :

Srinivas University, , 1st SEMESTER-BBA, , 9. AS 19 is, a. Leases, , b. Intangible asset, , c. Earnings per share, , d. Segment reporting, , 10. AS 26 is, a. Leases, , b. Intangible asset, , c. Earnings per share, , d. Segment reporting, , 11. AS 10 is, a. Accounting for fixed asset, amalgamations, , b. Accounting for investments, , c. Accounting for, , d. Segment reporting, , 12. AS 13 is, a. Accounting for fixed asset, amalgamations, , b. Accounting for investments, , c. Accounting for, , d. Segment reporting, , 13. IFRS originated in the, a. India, , b. European Country, , c. U.S.A, , d. China, , 14. Abriavation of IFRSa. International financial reporting standard, c. International financial reporting system, , b. Indian financial reporting standard, , d. None of the above, , 15. The IFRS was announced bya. ICAI b. ICA, , c. ICAC, , d. IACA, , 16. Which concept of accounting tells that business is separate from ownera. Business entity concept, , b. Cost concept, , c. Objective evidence concept, , d. Money measurement concept, 17. The art of recording in the books of account the monetary aspect of commercial and, financial transactions is, a. Accounting, , b. Accountancy, , Business Accounting-1, , c. Book-keeping, , d. All the above, , 26

Page 27 :

Srinivas University, , 1st SEMESTER-BBA, , 18. Assets those are having physical existence is, a. Tangible asset, , b. Intangible asset, , c. Liabilities, , d. All the above, , 19. When the goods are returned from the customers due to defective quality is, a. Sales return, , b. Purchase return, , c. Return outward, , d. Returns, , 20. An acknowledgement for cash received is, a. Receipt, , b. Invoice, , c. Voucher, , d. Revenue, , 21. Accounting provides information on, a. Cost and income for manager‗s, , b. Company‗s tax liability for a particular year, , c. Financial conditions of an institution, , d. All of the above, , 22. The principles or rules which provide a rationale for accounting practices, a. Accounting concepts, , b. Accounting conventions, , c. Accounting principles, , d. None of these, , 23. They are the customs, usages or practices followed by accountants a guide in the, preparation of financial statements is, a. Accounting concepts, , b. Accounting conventions, , c. Accounting principles, , d. None of these, , 24. Accounting concepts are, a. Convention of materiality, , b. Convention of conservatism, , c. Legal aspect concept, , d. None of the above., , 25. The fundamental ideas or basic assumptions underlying the theory and practice, accounting is, a. Accounting concepts, , b. Accounting conventions, , c. Accounting principles, , d. None of these, Business Accounting-1, , 27

Page 28 :

Srinivas University, , 1st SEMESTER-BBA, , 8 Marks Questions:, 1. Define Accounting and its objectives?, 2. Explain the difference between book-keeping and accounting?, 3. Explain the various users of accounting principles?, 4. Define accountancy? Explain the difference between the Accounting and Accountancy?, 5. Explain Accounting Concepts?, 6. Explain the accounting conventions?, 7. What do you mean by Accounting Standard? Explain, 8. Explain the Benefits and Limitations of Accounting Standards., 9. Write the importance of Accounting Standards, 10. What is accounting? Explain essential aspect of accounting?, 11. Define Accounting? Explain its functions?, 12. Explain the Accounting terms:, a. Invoice b. Stock c. Assets d. Capital, , Business Accounting-1, , 28

Page 29 :

Srinivas University, , 1st SEMESTER-BBA, , UNIT II, ACCOUNTING PROCESS, 2.1 SINGLE ENTRY SYSTEM, Eric Kohler defines accounts from incomplete records or single entry system as "a system of, book-keeping in which, as a rule, only records of cash and of personal accounts are maintained;, it is always incomplete double entry, varying with circumstances.", From the above definitions, it is clear that when the rules of double entry system of accounting, are not followed completely for recording business transactions, the accounting system is called, incomplete accounting system or single entry system. In fact, any accounting system which does, not contain a complete record (i.e., a record of both the debit and credit aspects) of each and, every transaction is called incomplete accounting system or single entry system., 2.1.1 Features of Single Entry System, 1. Under the single entry system, all the transactions of a business are not recorded in the books, of account., 2. The single entry system is, sometimes, referred to as the mixture of double entry, single entry, and no entry., 3. There is no uniformity under this system as regards the recording of business transactions by, different concerns, 4. Flexibility in recording is one of the important features of single entry system., 5. Source documents play a very important role in the case of single entry system, 6. Under this system, all accounts are not-maintained. Generally, only cash and bank accounts, (i.e., cash book) and personal accounts of trade debtors and trade creditors are maintained., 7. The cash book, maintained under this system, usually, mixes up the business transactions as, well as the private transactions of the proprietor., 8. As a complete record of each and every transaction is not maintained under this system, this, system gives only partial or incomplete information, and not full information about the business., 9. As only incomplete or partial information about the business is given by this system, this, system is an incomplete, unscientific, unsatisfactory and unreliable system of accounting., 10. It is a simple and economical system of accounting, as it needs less number of books of, account to be maintained., , Business Accounting-1, , 29

Page 30 :

Srinivas University, , 1st SEMESTER-BBA, , 11. It is, usually, adopted by small business concerns like sole traders and small partnership firms, whose volume of business transactions and financial resources do not warrant the elaborate and, costly double entry system., 2.2 DOUBLE ENTRY SYSTEM, There are numerous transactions in a business concern. Each transaction, when closely analysed,, reveals two aspects. One aspect will be "receiving aspect" or "incoming aspect" or, "expenses/loss aspect". This is termed as the "Debit aspect". The other aspect will be "giving, aspect" or "outgoing aspect" or "income/gain aspect". This is termed as the "Credit aspect"., These two aspects namely "Debit aspect" and "Credit aspect" forms the basis of Double Entry, System. The double entry system is so named since it records both the aspects of a transaction., 2.2.1 Objectives of Double-Entry System of Accounting:, The double-entry system of accounting has certain objectives. They are:, (i) To record both the aspects (i.e., the debit and the credit aspects) of each and every transaction, in the books of account., (ii) To keep a complete record of all the transactions of a business in a systematic manner so that, the information required on any matter relating to business can be obtained quickly and easily., (iii) To maintain all the three types of accounts, viz., the personal accounts, real accounts and, nominal accounts in the books of account., iv) To provide reliable information through the maintenance of required accounts supported by, source documents or business documents., (v) To check the arithmetical accuracy of the entries in the books of account through the, preparation of trial balance., (vi) To help in the detection of errors in the books of account in time and to reduce the chances, of errors and frauds., (vii) To ascertain the true profit or loss of the business through the preparation of the trading and, profit and loss account., (viii) To ascertain the true financial position of the business through the preparation of the, balance sheet., ix) To know the progress of the business from year to year by facilitating the comparison of the, current year‗s figures with the figures of previous years in respect of stocks, purchases, sales,, incomes and expenses., , Business Accounting-1, , 30

Page 31 :

Srinivas University, , 1st SEMESTER-BBA, , 2.2.2 Advantages of Double-Entry System of Accounting:, a) It provides a complete or full record of all the business transactions, as it records both the, aspects of each and every transaction., b) As the transactions are recorded in a scientific and systematic manner, it provides not only, complete, but also authentic (i.e., reliable) record of all the transactions of a concern., c) As both the aspects of every transaction are recorded, it is possible to prepare a trial balance, (i.e., a list of balances of ledger accounts) and Check the arithmetical accuracy of books of, accounts., d) As the arithmetical accuracy of books of accounts can be checked by preparing a trial balance,, the opportunities for misappropriation and fraud are reduced to the minimum., e) As nominal accounts are maintained under this system, it is possible to prepare a profit and, loss account and find out the true net profit or net loss for a particular year., f) As correct information about assets, liabilities and capital are available under this system, it is, possible to prepare a balance sheet (i.e., a statement of assets, liabilities and owner's capital) and, ascertain the true financial position of the business on any particular date., (g) When books of accounts are maintained on the double-entry system, it becomes easy for a, business concern to satisfy the income-tax and sales tax authorities about the accuracy of the, business transactions., 2.3 Accounting Equation:, The system of double entry system of book-keeping can very well be explained by the, ―accounting equation. The source document is the origin of a transaction and it initiates the, accounting process, whose starting point is the accounting equation., Accounting equation is based on dual aspect concept (Debit and Credit). It emphasizes on the, fact that every transaction has a two sided effect i.e., on the assets and claims on assets. Always, the total claims (those of outsiders and of the proprietors) will be equal to the total assets of the, business concern. The claims are also known as equities, are of two types:, 1. Owners‗ equity (Capital);, 2. ii.) Outsiders' equity (Liabilities)., Assets = Capital + Liabilities (A = C+L), Capital = Assets - Liabilities (C = A-L), Liabilities = Assets - Capital (L = A-C), Business Accounting-1, , 31

Page 32 :

Srinivas University, , 1st SEMESTER-BBA, , Effect of Transactions on Accounting Equation:, 2.3.1 Example:, 1. If the capital of a business is Rs.3,00,000 and other liabilities are Rs.2,00,000, calculate the, total assets of the business., Solution, Assets = Capital + Liabilities, Rs. 3,00,000 + Rs.2,00,000 = Rs.5,00,000, 2. If the total assets of a business are Rs.3,60,000 and capital is Rs.2,00,000, calculate liabilities., Solution:, Assets = Capital + Liabilities, Liabilities = Assets - Capital, Assets - Capital = Liabilities, Rs. 3,60,000 - Rs. 2,00,000 = Rs. 1,60,000, 2.4 CLASSIFICATION OF ACCOUNTS OR KINDS OF ACCOUNTS, 1. Personal accounts, Personal accounts are accounts of persons with whom a concern carries on business. Personal, accounts may be:, (a) Accounts of natural or physical persons., (b) Accounts of artificial or legal persons., (c) Representative personal accounts., 2. Real, Asset or Property Accounts:, Real accounts are accounts of properties, assets or things owned by a concern, and in and with, which the business is carried on Real or asset accounts may be:, a) Accounts of tangible assets., b) Accounts of intangible assets., , Business Accounting-1, , 32

Page 33 :

Srinivas University, , 1st SEMESTER-BBA, , 3. Nominal or Fictitious Accounts:, Nominal or fictitious accounts are accounts of the expenses and losses which a concern incurs,, and incomes and gains which a concern earns in the course of its business., RULES OR PRINCIPLES OF DOUBLE-ENTRY SYSTEM OR RULES OF DEBIT AND, CREDIT, Personal Accounts:, Debit the receiver, And, Credit the giver, Real, Property or Asset Accounts:, Debit what comes in, And, Credit what goes out, Nominal or Fictitious Accounts:, Debit expenses and losses, And, Credit incomes and gains, , Modern Rules of accounting (Classification of Accounts):, As per modern rules of accounting, transaction will be categorised into 6 heads or accounts and, any increase or decrease in such account will either be debited or credited in the manner shown, in the table given below:, Types of Account, , Account to be, , Assets account, , Increase, , Decrease, , Liabilities account, , Decrease, , Increase, , Capital account, , Decrease, , Increase, , Business Accounting-1, , debited, , Account to be, , credited, , 33

Page 34 :

Srinivas University, , 1st SEMESTER-BBA, , Revenue account, , Decrease, , Increase, , Expenditure account, , Increase, , Decrease, , Withdrawal account, , Increase, , Decrease, , DRAWINGS, , Classification of Accounts under Modern or American Approach, The modern approach has become a standard of classifying accounts in many advanced countries., The types of accounts under this approach are mostly self-explanatory., Under modern/American approach, the accounts are classified into the following five groups:, 1. Asset accounts:, Examples are land account, machinery account, accounts receivable account, prepaid rent, account, cash account etc., 2. Liability accounts:, Examples are loan account, accounts payable account, wages payable account, salaries, payable account, rent payable etc., 3. Revenue accounts:, Examples are sales account, service revenue account, rent revenue account, interest revenue, account etc., 4. Expense accounts:, Examples are wages expense account, commission expense account, salaries expense, account, rent expense account etc., 5. Capital/owner’s equity accounts:, Examples are John‘s capital account etc., , Example, Classify the following accounts using traditional and modern approach:, 1. Plant and machinery, 2. Purchases, 3. Sales, 4. Rent expense, 5. Land and building, 6. Cash, 7. Sam‘s capital, 8. Loan from City bank, Traditional classification:, 1. Plant and machinery > Real account, 2. Purchases > Nominal account, 3. Sales > Nominal account, 4. Rent expense > Nominal account, 5. Land and building > Real account, 6. Cash > Real account, 7. Sam‘s capital > Personal account, , Business Accounting-1, , 34

Page 35 :

Srinivas University, , 1st SEMESTER-BBA, , 8. Loan from City bank > Personal account, Modern classification:, 1. Plant and machinery > Asset account, 2. Purchases > Expense account, 3. Sales > Revenue account, 4. Rent expense > Expense account, 5. Land and building > Asset account, 6. Cash > Asset account, 7. Sam‘s capital > Capital/Owner‘s equity account, 8. Loan from City bank > Liability account, , 2.5 JOURNAL ENTRY, The term 'journal' is derived from the French word ‗jour‗, which means a day. Journal, therefore,, means a day book or a daily record. It is a book of original entry in which all transactions are, first recorded chronologically (i.e., in the order of occurrence or order of dates) from the source, documents., Journal is a date-wise record of all the transactions with details of the accounts debited and, credited and the amount of each transaction., 2.5.1 Format, Journal entry in the books of ………., Date, , Particulars, , L.F. Debit, Amount, Rs., , Credit, Amount, Rs., , 1. Date: In the first column, the date of the transaction is entered. The year and the month is, written only once, till they change. The sequence of the dates and months should be strictly, maintained., 2. Particulars: Each transaction affects two accounts, out of which one account is debited and the, other account is credited. The name of the account to be debited is written first, very near to the, line of particulars column and the word Dr. is also written at the end of the particulars column. In, the second line, the name of the account to be credited is written, starts with the word 'To', a few, space away from the margin in the particulars column to the make it distinct from the debit, account., , Business Accounting-1, , 35

Page 36 :

Srinivas University, , 1st SEMESTER-BBA, , 3. Narration: After each entry, a brief explanation of the transaction together with necessary, details is given in the particulars column with in brackets called narration. The word ‗Being‗ is, used before starting to write down narration. Now, it is not necessary to use the word 'For' or, 'Being'., 4. Ledger Folio (L.F): All entries from the journal are later posted into the ledger accounts. The, page number or folio number of the Ledger, where the posting has been made from the Journal is, recorded in the L.F column of the Journal. Till such time, this column remains blank., 5. Debit Amount: In this column, the amount of the account being debited is written., 6. Credit Amount: In this column, the amount of the account being credited is written., 2.5.2 Steps in Journalising, The process of analysing the business transactions under the heads of debit and credit and, recording them in the Journal is called Journalising. An entry made in the journal is called a, 'Journal Entry'., Step 1 — Determine the two accounts which are involved in the transaction., Step 2 — Classify the above two accounts under Personal, Real or Nominal., Step 3 — Find out the rules of debit and credit for the above two accounts., Step 4 — Identify which account is to be debited and which account is to be credited., Step 5 — Record the date of transaction in the date column. The year and month is written once,, till they change. The sequence of the dates and months should be strictly maintained., Step 6 — Enter the name of the account to be debited in the particulars column very close to the, left hand side of the particulars column followed by the abbreviation Dr. in the same line., Against this, the amount to be debited is written in the debit amount column in the same line., Step 7 — Write the name of the account to be credited in the second line starts with the word 'To', a few space away from the margin in the particulars column. Against this, the amount to be, credited is written in the credit amount column in the same line., Step 8 — Write the narration within brackets in the next line in the particulars column., Step 9 — Draw a line across the entire particulars column to seperate one journal entry from the, other., 2.5.3 Problems:, Example 1:, Business Accounting-1, , 36

Page 37 :

Srinivas University, , 1st SEMESTER-BBA, , January 1, 2004 - Saravanan started business with Rs. 1,00,000., Analysis of Transaction, Step 1, , Determine the two accounts Cash, involved in the transaction. Account, , Capital Account, , Step 2, , Classify the accounts under Real, Account, personal, real or nominal., , Personal Account, , Step 3, , Find out the rules of debit 2(a) Debit what 1(b), Credit the giver, and credit., comes in., , Step 4, , Identify which account is to Cash A/c is to be Capital A/c is to be, be debited and credited., debited, credited, , Solution : Journal, Date, , Particulars, , LF Debit, (Rs.), , Credit, (Rs.), , 1 Jan 2004, , Cash A/c, Dr., To Capital A/c, (The amount invested in the business), , 12, 45, , 1,00,000, , 1,00,000, , Example 2:, Jan. 3, 2004: Received cash from Balan Rs. 25,000, Analysis of Transaction, Step 1, , Determine the two accounts Cash, involved in the transaction. Account, , Balan Account, , Step 2, , Classify the accounts under Real, Account, personal, real or nominal., , Personal Account, , Step 3, , Find out the rules of debit 2(a) Debit, and credit., comes in., , Business Accounting-1, , what 1(b), Credit the giver, , 37

Page 38 :

Srinivas University, , 1st SEMESTER-BBA, , Step 4, , Identify which account is to Cash A/c is to be Balan A/c is to be, be debited and credited., debited, credited, , Solution: Journal, Date, , Particulars, , 3rd Jan 2004, , CashA/c, To Balan's A/c, (Cash received from Balan), , Dr., , LF Debit, (Rs.), , Credit, (Rs.), , 12, 81, , 25,000, , 25,000, , Example 3:, July 7, 2004 - Paid cash to Perumal Rs.37,000., Analysis of Transaction, Step 1, , Determine the two accounts involved Perumal Account, in the transaction., , Cash, Account, , Step 2, , Classify the accounts under personal, Personal Account, real or nominal., , Real, Account, , Step 3, , Find out the rules of debit and credit., , Step 4, , Identify which account is to be Perumal A/c is to Cash A/c is to be, debited and credited., be debited, credited, , 1(a), Debit the receiver, , 2(b), Credit what goes, out, , Solution:, Date, , Particulars, , Business Accounting-1, , LF Debit, Rs., , Credit, Rs., , 38

Page 39 :

Srinivas University, 2004 July 7, , 1st SEMESTER-BBA, Perumal A/c, To Cash A/c, (Cash paid to Perumal), , Dr., , 95, 12, , 37,000, 37,000, , Example 4:, Feb. 7, 2004 - Bought goods for cash Rs. 80,000., Analysis of Transaction, Cash, Account, , Step 1, , Determine the two accounts Purchases Account, involved in the transaction., , Step 2, , Classify the accounts, personal, real or nominal., , Step 3, , Find out the rules of debit and 2(a), Debit what comes in, credit., , Step 4, , Identify which account is to be Purchases A/c is to be Cash A/c is to be, debited and credited., debited, credited, , under Real, Account, , Real, Account, 2(b), Credit what goes out, , Solution: Journal, Date, , Particulars, , 2004 Feb 7, , Purchases A/c, To Cash A/c, (Cash purchase of goods), , Dr., , LF Debit, Rs., , Credit, Rs., , 48, 12, , 80,000, , 80,000, , Example 5:, March 10, 2004 - Cash sales Rs.90,000., Analysis of Transaction, , Business Accounting-1, , 39

Page 40 :

Srinivas University, , 1st SEMESTER-BBA, , Step 1, , Determine the two accounts Cash, Account, involved in the transaction., , Step 2, , Classify the accounts, personal, real or nominal., , Step 3, , Find out the rules of debit and 2(a), Debit what comes in, credit., , Step 4, , Identify which account is to be Cash A/c is to be Sales A/c is to be, debited and credited., debited, credited, , Sales Account, , under Real, Account, , Real, Account, 2(b), Credit what goes out, , Solution: Journal, Date, , Particulars, , 2004 Mar 10, , Cash A/c, To Sales A/c, (Cash Sales), , Dr., , LF Debit, Rs., , Credit, Rs., , 95, 12, , 90,000, , 90,000, , Example 6:, March 15, 2004 - Sold goods to Jaleel on credit Rs.1,00,000., Analysis of Transaction, Step 1, , Determine the two Jaleel Account, accounts involved in, the transaction., , Sales Account, , Step 2, , Classify the accounts Personal Account, under personal, real or, nominal., , Real, Account, , Step 3, , Find out the rules of 1(a), Debit the receiver, debit and credit., , 2(b), Credit what goes out, , Business Accounting-1, , 40

Page 41 :

Srinivas University, , 1st SEMESTER-BBA, , Step 4, , Identify, which Jaleel A/c is to be Sales A/c is to be, account is to be debited, credited, debited and credited., , Solution:, Date, , Particulars, , 2004 March 15, , Jaleel A/c, , Dr., , To Sales A/c, (Credit Sales), , LF Debit, Rs., , Credit, Rs., , 95, 12, , 1,00,000, , 1,00,000, , Example 7:, March 18, 2004 - Purchased goods from James on credit Rs.1,50,000., Analysis of Transaction, Step 1, , Determine the two Purchases Account, accounts involved in, the transaction., , James Account, , Step 2, , Classify the accounts Real Account, under personal, real or, nominal., , Personal Account, , Step 3, , Find out the rules of 2(a), Debit what comes in, debit and credit., , 1(b), Credit the giver, , Step 4, , Identify, which Purchases A/c is to be James A/c is to be, account is to be debited, credited, debited and credited., , Solution: Journal, Date, , Particulars, , Business Accounting-1, , LF Debit, Rs., , Credit, Rs., , 41

Page 42 :

Srinivas University, 2004 March 18, , 1st SEMESTER-BBA, Purchases A/c, To James A/c, (Credit purchases), , Dr., , 95, 12, , 1,50,000, 1,50,000, , 2.6 LEDGER, 2.6.1 Meaning of Ledger:, Ledger is a book which contains various accounts. In other words, Ledger is a set of accounts. It, contains all accounts of the business enterprise whether Real, Nominal or personal., The term ‗Ledger‘ is derived from the Dutch word ‗Legger‘, which means to ly. ‗Ledger‗,, therefore, means a book where the various accounts ly (i.e., are kept). It is the book where, transactions of the same nature (i.e., transactions pertaining to a particular person, thing or, service) are classified and grouped together in one place in the form of an account, through a, process called posting (i.e., the transferring of entries from the journal to the ledger) to know the, position) (i.e., balance) of that account. In the words of L.C. Cropper, ―The book in which a, trader‗s all transactions are recorded in a classified permanent form is called ledger‖. A ledger, contains accounts for all the persons with whom the business deals (i.e., all personal accounts),, accounts for all the assets or things held by the business (i.e., all real accounts) and accounts for, all the expenses incurred and all the incomes earned by the business (i.e., all the nominal, accounts)., 2.6.2 Relationship between Journal and Ledger., Both Journal and Ledger are the most important books used under Double Entry System of bookkeeping. Their relationship can be expressed as follows:, (i) The transactions are recorded first of all in the Journal and then they are posted to the Ledger., Thus, the Journal is the book of first or original entry, while the Ledger is the book of second, entry., (ii) Journal records transactions in a chronological order, while the ledger records transactions in, an analytical order., (iii)Journal is more reliable as compared to the Ledger since it is the book in which the entry is, passed first of all., (iv) The process of recording transactions is termed as ―Journalising‖ while the process of, recording transactions in the Ledger is called as ―Posting‖., 2.6.3 Advantages of a ledger, Business Accounting-1, , 42

Page 43 :

Srinivas University, , 1st SEMESTER-BBA, , The main advantages of a ledger are:, A ledger is a permanent record of all the transactions of a business., It provides complete information about all accounts in one place., A ledger account is a summarised and classified record of transactions of the same nature. As, such, a ledger, which contains all the ledger accounts, is helpful in knowing the cumulative effect, of all the transactions relating to each person, thing or service, i.e., final position or balance of, each account on any particular date., Ledger is helpful in preparing the trial balance, in the, Sense that the ledger account balances form the basis of the trial balance., It facilitates the preparation of final accounts, i.e., profit and loss account and balance sheet., It helps to ascertain the various items of revenues and the various items of expenses., It helps to ascertain the amounts of purchases and sales during a particular period., It helps to ascertain the assets of the business and their values., It helps to ascertain the liabilities of the business and their amounts., It helps to know the amount due from each debtor and the amount due to each creditor., 2.6.4 Procedure of posting, The procedure of posting is given as follows:, I. Procedure of posting for an Account which has been debited in the journal entry., Step 1 — Locate in the ledger, the account to be debited and enter the date of the transaction in, the date column on the debit side., Step 2 — Record the name of the account credited in the Journal in the particulars column on the, debit side as "To.....(name of the account credited)"., Step 3 — Record the page number of the Journal in the J.F column on the debit side and in the, Journal, write the page number of the ledger on which a particular account appears in the L.F., column., Step 4 — Enter the relevant amount in the amount column on the debit side., II. Procedure of posting for an Account which has been credited in the journal entry., , Business Accounting-1, , 43

Page 44 :

Srinivas University, , 1st SEMESTER-BBA, , Step 1 — Locate in the ledger the account to be credited and enter the date of the transaction in, the date column on the credit side., Step 2 — Record the name of the account debited in the Journal in the particulars column on the, credit side as "By......(name of the account debited)", Step 3 — Record the page number of the Journal in the J.F column on the credit side and in the, Journal, write the page number of the ledger on which a particular account appears in the L.F., column., Step 4 — Enter the relevant amount in the amount column on the credit side., 2.6.5 Example:, 1. Mr. Ram started business with cash Rs. 5,00,000 on 1st June 2003., The above transaction will appear in Journal and Ledger as under., Solution:, In the Books of Ram Journal, Date, , Particulars, , LF Debit, Rs., , 2003 June 1, , Cash A/c., Dr., To Ram's Capital A/c, (Ram started business with Rs.5,00,000), , 95, 12, , Credit, Rs., , 5,00,000 5,00,000, , Note: Here two accounts are involved, Cash Account and Ram's capital account, so we should, allot in the ledger a page for each account., Ledger, Dr., , Cash Account, , Date, , Particulars, , 2003, June, 1, , To Ram's, A/c, , J.F Amount Date, (Rs.), Capital, , Dr., Business Accounting-1, , Cr., Particulars, , J.F. Amount, (Rs.), , 5,00,000, , Ram‘s Capital Account, , Cr., 44

Page 45 :

Srinivas University, Date, , Particulars, , 1st SEMESTER-BBA, J.F Amount Date, (Rs.), 2003, June 1, , I., , Particulars, , J.F. Amount, (Rs.), , By Cash A/c, , 5,00,000, , Illustration Problems on Journal entries and Ledger accounts:, , Problem 1:, Journalise the following transactions in the books of Suresh:, 2017 November,, • 1 Suresh Commenced business with cash Rs 10,000 and Goods 5000, • 5 Purchased goods from Kishore Rs 4000, • 8 Sold goods to Raman for cash Rs 6000, • 10 Paid into Bank Rs 5000, • 15 Purchased machine from Hindusthan Tools limited Rs 3000, • 18 Advanced to Govind Rs 1000 as loan, • 22 Drew for office use Rs 500, • 25 Paid rent to landlord Rs 300, • 27 Received from Raman on account Rs 1500, • 30 Paid Kishore on account Rs 2000, Solution:, In the books of Suresh:, Date, Particulars, 2011, Nov.1., , 5, , 8, , 10, , 15, , Cash A/c., Stock A/c., , L., F., Dr., , To Capital A/c., (Being the business commenced with cash and goods), Purchases A/c., Dr., To Kishore‗s A/c., (Being the goods purchased from Kishore on credit), Cash A/c., Dr., To Sales A/c., (Being the goods sold for cash), Bank A/c, Dr., To Cash A/c., (Being the cash paid into bank), Machinery A/c., Dr., , Business Accounting-1, , Dr., , Cr., , 10,000, 5,000, 15,000, 4,000, 4,000, 6,000, 6,000, 5,000, 5,000, 1,10,000, 45

Page 46 :

Srinivas University, , 18, , 22, , 25, , 27, , 30, , To Hindusthan Tools Limited‗s A/c., (Being the machinery purchased from Hindusthan, Tools Ltd. on credit), Advance to Govind A/c., Dr., (or Govind‗s Loan A/c.), To Cash A/c., (Being the advance or loan given to Govind), Cash A/c., Dr., To Bank A/c., (Being the cash withdrawn from bank for office use), Rent A/c., Dr., To Cash A/c., (Being the rent paid in cash), CashA/c., Dr., To Raman‗s A/c., (Being the cash received from Raman on account), Kishore‗sA/c., Dr., To Cash A/c., (Being cash paid to Kishore on account), , 1st SEMESTER-BBA, 1,10,000, , 1,000, 1,000, , 500, 500, 300, 300, 1,500, 1,500, 2,000, 2,000, , Problem 2:, Journalise the following transactions in the Books of Sudhama;, a. Opened Account in a Bank with Rs 10,000., b. Withdrew from Bank for office use Rs 2000., c. Withdrew from Bank for personal use Rs 500, d. Paid Sunil on Account by cheque Rs 400, e. Deposited cash in the Bank Rs 600, f. Received a cheque from Radha on account Rs 500, g. Deposited Radha‗s cheque into Bank for collection Rs 500., h. Bought goods from Amar and paid by cheque Rs 1000., i. Paid Rent by cheque Rs 500., j. Bank paid Insurance premium on our behalf Rs 100., k. Cash sales deposited into Bank Rs 1000., l. Bank collected Interest on Securities as per our instructions Rs 50., m. Loan taken from Bank Rs 2000., n. Part of Loan repaid in Cash Rs 1000., Solution:, In the books of Sudhama, Business Accounting-1, , 46

Page 47 :

Srinivas University, Date, , Particulars, , A, , Bank A/c., , 1st SEMESTER-BBA, L., F., Dr., , Dr., , Cr., , 10,000, , To Cash A/c., , 10,000, , (Being the account opened in the bank), B, , Cash A/c., , Dr., , 2,000, , To Bank A/c., , 2,000, , (Being the cash withdrawn from bank for office use), C, , Drawings A/c., , Dr., , 500, , To Bank A/c., , 500, , (Being the cash withdrawn from bank for personal use), D, , Sunil‗s A/c., , Dr., , 400, , To Bank A/c., , 400, , (Being the payment made to Sunil on account by, cheque), E, , Bank A/c., , Dr., , 600, , To Cash A/c., , 600, , (Being the cash deposited in to bank), F, , Cash A/c., , Dr., , 500, , To Radha‗s A/c., , 500, , (Being the cheque received from Radha on account), G, , Bank A/c., , Dr., , 500, , To Cash A/c., , 500, , (Being Radha‗s cheque paid into bank for collection), H, , Purchase A/c., , Business Accounting-1, , Dr., , 1000, , 47

Page 48 :

Srinivas University, , 1st SEMESTER-BBA, , To Bank A/c., , 1000, , (Being the purchase by cheque), I, , Rent A/c., , Dr., , 500, , To Bank A/c., , 500, , (Being the rent paid by cheque), J, , Insurance Premium A/c., , Dr., , 400, , To Bank A/c., , 400, , (Being the insurance premium paid by bank), K, , Bank A/c., , Dr., , 1,000, , To Sales A/c., , 1,000, , (Being the cash sales deposited into bank), l, , Bank A/c, , Dr., , 50, , To Interest on Securities A/c., , 50, , (Being the interest on securities collected by the bank), M, , Bank A/c., , Dr., , 2,000, , To Bank Loan A/c., , 2,000, , (Being the loan taken from bank and retailed in bank), N, , Bank Loan A/c., , Dr., , 1,000, , To Cash A/c., , 1,000, , (Being part of the bank loan paid in cash), , Problem 3:, Journalize the following transactions in the books of Sharma:, 2018, April 1, , Commenced business with cash Rs. 50,000 and machinery Rs. 10,000, , Business Accounting-1, , 48

Page 49 :