Page 1 :

Meaning of Business Finance, , The requirement of funds by business to carry out its various, activities is called business finance. It is basically concerned, with acquisition of funds, use of funds and distribution of, profits by a business enterprise., , Nature of Business Finance, , + The concept of business finance is very wide and is used in, every type of business house., , + It includes all types of funds needed to start, run, expand, and diversify the business., , « The primary goal of business finance is to increase the, corporate value., , Importance of Business Finance, , 1. Necessary to Start Business Every new venture needs, finance to buy plant and machinery, land and building,, raw material, etc., , 2. Necessary to Face Economic Cycle During recession, and depression, business needs finance to overcome, , problems of decreased profitability., , 3. Necessary for Growth A company needs significant, financial investment to acquire new capital, staff or, inventory to fuel the growth., , 4. Necessary for the Payments of Debts Prompt payment, of debts can be possible only because of adequate, arrangement of finance.

Page 2 :

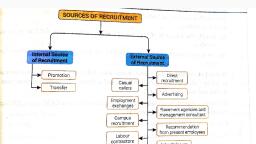

Classification of Sources of Finance, , Sources of funds can be classified on the basis of period, ownership and source of generation, as illustrated in the chart below, , I, On the basis of period, , , , Long-term Short-term, = Equity shares » Trade credit, # Retained earnings » Factoring, = Preference shares » Banks, = Debentures * Commercial, = Loan from financial paper, , institutions, = Loan from banks, , Medium-term, , « Loan from banks, , « Public deposits, , * Loan from financial, institution, , » Lease financing, , Sources of Funds Classification, , |, | l, On the basis of ownership, , -—t—,, , Borrowed Funds, * Debentures, 2 Loans from banks, # Loans from financial, ions, » Public deposits, ® Lease financing, # Commercial papers, , Internal Sources, # Equity share capital, # Retained earnings, , Owner's Funds, = Equity shares, # Retained earnings, , , , On the basis of source of generation, , >—_—_, , External Sources, » Financial institutions, » Loan from banks, » Preference shares, # Public deposits, * Debenture, « Lease financing, » Commercial papers, ® Trade credit, = Factoring

Page 3 :

The broad classification of these sources have been discussed ahead., , Classification on the Basis of Period, , On this basis of period, sources of funds can be classified as, hese sources provide finance to business firms for a period exceeding five years., , for a period exceeding one year but less than, , 1. Long-term Sources i., 2. Medium-term Sources These sources provide finance to business firms, , five years., 3, Short-term Sources These sources provide finance to business firms for less than one year., , Classification on the Basis of Ownership, , On this basis of ownership, sources of funds can be classified as, 1. Owner’s Funds Funds or finance provided by the owners of the business is re, 2, Borrowed Funds The funds that are raised by way of loans and credit from the p, , are termed as borrowed funds., , ferred to as owner’s funds., ublic, banks and financial institutions

Page 4 :

Owner's Funds, , Funds or finance provided b:, , iS ; y the :, referred fo as"OWwner’s funds, Cay Owners of the busine, » Equity Shares her's fund include ee, + Preference Shares, - Retained Earnings, + Global Depository Rece;, , . elpt, Depository Receipt (IDR) (GDR)/International, , « American Depository Receipt (ADR), , Equity Shares, , The capital obtained by issue, , : of shares j, , capital. Equity share capital is a Gece tedthe ahaa,, ofa Sonee Equity shareholders do not get ‘ fixe oem, dividend but are paid on the basis of earnings by the, , company. They are kno :, business. wn as the residual owner of the, , SS ig, , Merits of Equity Shares, , + Equity shares are suitable for investors who are willing to, assume risk for higher returns., , ¢ There is no burden on the company to pay the dividend., , « Equity capital serves as permanent capital as it is to be, repaid only at the time of liquidation of a company., , + Equity capital provides credit worthiness to the company., , « Funds can be raised through equity issue without creating, any charge on the assets of the company., , Demerits of Equity Shares, , . Equity shares get fluctuating returns., , * The cost of equity shares is generally, the other sources of funds., , + Issue of additional equity shares, , existing equity shareholders., * More formalities and procedural delays are involved while, , raising funds through issue of equity shares., , more as compared to, , dilutes the voting power o!

Page 5 :

Preference Shares, The preference shares gi |, , two rights give eee shareholders following, » Right to receive a fixed rate of dividend, out of the net, , profits of the company, before any dividend is declared for equity shareholders., , » Right to receive their capital after the claims of the company’s, creditors have been settled, at the time of liquidation. —, , Merits of Preference Shares, * Preference shares provide reasonably steady income in the, , form of fixed rate of return., » It does not affect the control of equity shareholders 0, , the management., , ver