Page 1 :

Agriculunal Finanee, , 1. INTRODUCTION, Agricultural tinance play an important role in agro-socio-economic development of, , the country. Agricultural finance is one of the important factors in agriculture, means that agriculture development argely depend upon the, development of agricultural finance., , development. This, , Farmers requires finance for various purposes such as for buying seed, fertilizers,, , implements, cattle etc. and also for making any temporary and permanent improvement, on his land. Apart from this, he also require finance for certain unproductive expenses, , such as marriage, testival or any religious function. AII these above mentioned purposes, the tarmers borrow from institutional sources such as money lenders etc. But in India, the, sourves such as co-operative credit institution, NABARD, RRBs etc. and non-institutional, sourves such as money lenders etc. But in India, the sources of supply of finance for, , agriculture are inadequate due to erratic performance of the Indian agriculture. Thus, inadequate finance is one of the important causes for agricultural production in India., , 2 CLASSIFICATION /TYPES OF AGRICULTURAL FINANCE, Agricultural finance is classified, 1., , On the basis of time, , 2., , On the basis of purpose, , 1., , On the basis of time, , Agricultural finance is classified on the basis of time such as (i) short term finance (ii), medium term finance and (ii) long term finance, , i) Short term finance: The farmer require short term finance to buy seeds, manure,, fertilizers, pesticides, fodder of livestocks, payment of wages to labourers etc., Such loans are taken from moneylenders or family members/ relatives. Such, loans are repaid immediately after the harvest. The period of such loan is upto 15, months., ii) Medium term finance: The farmer need medium term finance to purchase cattle,, small agricultural implement, for making temporary improvement on land. These, , loans are larger than short term loans. Such loans are taken from money lender,, co-operative societies and commercial barnks. The period of such loans is from 15, months to 5 years., ii) Long term finance : The farmer need long term finance for buying additional, land, far paying old debts, for purchasing heavier agricultural machinery, , (tractors), for digging tube wells etc. Such loans are taken from Land, Development Banks. The period of such loans is more than 5 years., 2., , On the basis of purpose, Agriculture credit is classified on the basis of purpose such as (i) productive purpose, , and, , (i) unproductive purpose, i) Productive Finance: Productive finance is the loan taken by the farmers and used, to increase agricultural productive of their farm. Such as buying of seeds,, fertilizers, manure, digging wells etc. It is not difficult to repay such loans because, they contribute to the productivity of farmers., ii) Unproductive Finance: Unproductive finance is the loan taken by the farmers, and used for unproductive purposes such as marriage, any festivals or religious, , functions etc. It is difficult to repay such loans because they do not contribute to, the productivity of farmers.

Page 2 :

Business, , Economics, , em.(T, Y.B.Com.) (Sem, , b8, , |3., , SOURCES OF AGRICULTURAL, n e two, , main, , sources, , of agricultural, , A., , Non-Institutional Sources, , B., , Institutional Sources, , A., , Non-Institutional sources, , he, , 1., , finance, , follows:, are as, , of agricultural, traders, relatives and friends, , non-institutional, , landlords,, , FINANCE, , finance, , consist, , of, , money, , lenders, , source, , Money lenders, , In rural areas, there, professional money lenders., , are two, , lenders, types of money, , -, , agricultural money, , lenders and, , lenders whose main occupation is, are those money, Agricultural money lenders, Professional money lenders aro, lending., is, money, (business), tarming and side occupation main ocupation is money lending and side occupationis, those money lenders whose, Sahukars etc., trading such as Banias, Mahajans,, , Advantages, , less paper work., , requires, i) Their method of business is simple, purpose., as well as for unproductive, i) They provide loans for both productive, and, , i ) They give loans on spot., , iv) They know their borrower very well and, , maintain close, , and, , personal contact with, , the borrowers., , Disadvantages:, of interest., i) They give loans to the farmers at a very high rate, for the growing, ii) Such high rate of interest have been responsible, , indebtedness of, , the farmers., , ii), , They deduct the interest in advance., , iv) They manipulate the account and do lots of malpractices., v, , 2., , They sometimes compel the borrower to sell their product of low prices., , Traders and Agents, , Traders and agents give loans to the farmers for productive purposes and charge high, rate of interest. They even force the farmers to sell their produce at lower price and they, This, commission for their services. They play an active role in rural areas., a, , charge heavy, , source of rural finance still exist in India., 3., , Landlords, , Big land lords give loans to the farmers and charge high rate of interest. Like money, , lenders, they indulge in unfair practices to cheat the poor and innocent farmers. They, force the farmers to sell their produce at lower price. Today, this source of finance has, gone down considerably because of the various steps taken by the government from time, to time., , 4., , Relatives, Friends and others, , Farmers also take loans from their relatives or friends at times of emergency. The loa, may be in cash or in kind. They may be low or no interest charge. This source of finance, uncertain., , B., , Institutional Sources, , The institutional sources of agricultural finance consist of the government, the c, operatives, commercial banks and the regional rural banks

Page 3 :

69, , AgriculburalFinamce, Ciovernment of India, Rescrve Bank of India, , NABARD, , Rural Co-operative, Credit Institution, 1., , Regional Rural, , Commercial, , Banks, , Banks, , Co-operative Credit Institutions (Societies), , Co-operative credit Institutions (Societies) were established to provide rural credit, , at, , a lower cost. They provide short term and long term loans., Structure of Co-operatives, , Long term credit structure, , Short term credit structure, , State Co-operative Banks, , State Land Development Banks, , (at State level), , (at State level), Central Co-operative Banks, , Primary Land Development Banks, , (at district level), , (at district and village level), , Primary Agricultural Credit Societies, , (at village level), A., , Short Term Credit, i) State Co-operative Banks : State Co-operative Banks are the apex bank of the coloan to, operative credit structure. They are organized at the state level. They give, central co-operative banks so that in turn they provide loan to the primary, agricultural credit societies at village level. They co-ordinate and regulate the, of the Central Co-operative banks., , working, , ii) Central Co-operative Banks : Central Co-operative Banks are organized at the, district level. These banks act as a link between state co-operative banks and, , primary agricultural credit societies. They give loans to the primary agricultural, credit societies so that they carn fulfill their requirements., , Agricultural credit societies: Primary agricultural credit societies are, ii)Primary, organized at village level. They can be formed by ten or more than 10 persons., They give loan only for productive purposes such as for buying seeds, fertilizers,, , insecticides, agricultural equipmene's etc. They provide short term loans to the, farmers. The main objective is to serve the financial requirements of weaker, , sections of the society, B. Long Term Credit, For long term credit, Land Development Banks are established. Land development, bank provide credit for a period of 10 to 20 years at low interest rate. Earlier LDBs were, called Land Mortgage Banks. They work at two level:, , a) State Land Development Banks: State land development banks are operating at, state level. The period of loans are 10 to 15 years.

Page 4 :

Business Economics (T. Y.B.Com.) (Sem,-V), , b) Primary Land Development Banks : Primary land development banks are, operating at district and village level. The period of loans are upto 20 years., 2., , Regional Rural Banks (RRBs), The Working Group on Rural Banks (1975) recommended the establishment of, , Regional Rural Banks (RRBs) to supplement the efforts of commercial banks. RRBs were, established in 1975 on the recommendation of Narsimha Committee. Initially 5 RRBs were, established on October 2, 1975. At present there are 56 RRBs. The RRBs are imited to a, specified region comprising one or more districts of a state. RRBs give loans to weaker, , sections of the rural community, small and marginal farmers, landless labourers, rural, artisans etc. The rate of interest is lower than commercial banks., , Objectives of RRBs, i) To provide credit and other facilities to small and marginal farmers, landless, labourers, artisans, small entrepreneurs to develop agriculture, trade, commerce,, industry in rural areas., ii) To provide alternative source of credit to rural people to free them from the, clutches of money-lenders., , ii) To provide employment opportunities, iv) To provide credit at lower rate of interest., RBI provides many subsidiaries and concessions to RRBs to carry its function, , effectively. They are allowed to maintain CRR at 3% and SLR at 25%. They are provided, refinance facilities through NABARD., 3., , Commercial Banks, , Government felt that co-operative banks alone cannot meet the growing demand and, therefore number of institutions were developed to give rural credit. In India initially, , commercial bank did not take any initiatives in providing credit to the farmers. There was, a severe complaint against the commercial banks with this regards. Then since 1967,, commercial bank started giving loans to farmers but contributiorn to agricultural finance, was quite disappointing. Then the commercial banks was nationalized. In 1969, 14 major, banks were nationalized and in 1980 6 more banks were nationalized and it started giving, loans to agriculture., , Commercial Banks are providing loans to farmers in different ways., 1) Direct Finance : Commercial Banks give direct loans to farmers for purchasing, pumpsets, tractors, agricultural machinery, construction of well, purchasing cattle, and for various other agricultural activities. Nearly 45% of short term loan was, given by commercial banks to farmers, 35% long-term loans and 20% of loans was, given for dairying, poultry farming, bee-keeping, fisheries etc., , ii) Indirect Finance: Commercial bank provide finance to farmers not only directly, but also indirectly through Co-operative credit Societies, Co-operative Marketing, societies etc. Then these Co-operative credit and marketing socieites provide loan, , directly to farmers to carry out various agriculture activities., i) Type of finance: Shortterm, medium term and long term finance., Short term finance: Commercial banks provide short term finance to farmers for, , purchasing, seeds, manure, fertilizers, pesticides and other inputs., Medium and long term finance : Commercial banks also provide medium term, finance to farmers to purchase cattle, small agricultural implements and for, marking temporary improvement on land. Earlier commercial banks did not, encourage long term finance but later they have extended the term of finance, , Now they are providing long term finance for buying additional land, heavier, agricultural machinery etc.

Page 5 :

71, , ericulturalFinance, , iv) Small tarmers: Commercial banks did not provide any loans to small farmers, , then Small Farmers Development Agencies (SPDA) and Marginal Farmers and, Agricultural, , labourers, , Arca, , have been, , setup, , to, , provide credit, , to smal, , and, , marginal farmers., v)IRDP: Commercial banks also provide finance to small and marginal farmerS ana, , agricultural labourers under Integrated Rural Development Programme., 4., , NABARD, , The National Bank for Agriculture and Rural Development Bank (NABARD) was, an, established in 1982. NABARD is an apex bank in the field of agricultural finance. It is co-, , and rural credit. It, banks and RRBs., operative,, Functions of NABARD, , bank for, , apex, , agriculture, , Commercial, , i), , provide credit, , to farmers, , through, , It is the apex bank for rural sector, , i) The major functions of NABARD include credit function, development and, , promotional functions, supervisory function etc., ii) its, It has, Agricultural, authority Credit, to, the functioning of the co-operative banks and RRBs through, its Agricultural Credit Department., iv) It promote research in agriculture and rural development., , v, , It reduces regional imbalance in the availability of finance., , vi) It maintain a close link with RRBs., , Agricultural Finance by NABARD, i), , NABARD provides short-term loan upto 18 months to State Co-operative Banks, for crop loan, marketing of crops, purchase and distribution of fertilizers., , i) It provides medium term loan from 18 months to 7 years to State Co-operative, Bank and RRBs for purchase of shares, for conversion of short term crop loan into, medium term loan in area affected by natural calamities., i) It provides medium and long term loan upto 25 years to State Co-operative Banks,, Central Co-operative Banks, RRBs and Commercial banks for investing in, , agriculture., iv) It provide all sorts of refinance facilities to Co-operative, RRB and Commercial, banks. It has also granted assistance for undertaking research, seminar and, conference., , v) It helps the Integrated Rural Development Programme (IRDP) through refinance, facilities to help the weaker sections in schemes like minor irrigations, dairy, , development, fisheries etc., vi) NABARD also provide financial assistance to non-farm sector. It pays special, attention for promoting small scale industries, village artisans, handlooms,, , tertiary activities in the rural areas., NABARD has been providing finance to help small scale industries, industrial cooperative societies and cottage and small scale industries to meet their working, , capital., vii) NABARD also promote agricultural investment in backward and under banked, , states like Madyapradesh, Orissa, Uttarpradesh, Rajasthan etc. Such states have, received major benefit from such assistance., Vii) It inspect the state and district co-operative banks and RRBs.

Page 6 :

Business Economics (T.Y.B.Com.) (Sem.-y, , 72, , AE, 5., , Reserve Bank of India (RB), , have played a vital role in, government and Reserve Bank of India (RBI), not provide loans directly to farmerTs, providing loans to lndia farmers. But RBl does, , he, , nstead it provide loans and advances to NABARD. NABARD provide loan to State Co, credit to Central Co-operate bank, Bank, State Co-operate Bank in turn provide, , Operate, which in turn lead to village Co-operative credit socities which lend directly to the, tarmers. i.e. RBI lend to farmers through State Co-operative Bank. RBI also lend to State, and Central and Land Development Banks and NABARD., , RBI has also setup a separate Agricultural Credit Department for agriculture sector in, country. Its main function is to provide loan to central government, state government and, , state co-operative banks to promote rural credit., RBI provide short term, medium term and long term credit., , i), , Short term Loan: RBI give loan for period of 15 months. This loan is given to, state co-operative banks for seasonal agricultural operation and marketing of crop, , of 2% below bank rate., ii) Medium term loan, , RBI give loan for period of 15 months to 5 years. They are, , given for specified agricultural purposes., ii) Long-term loan: RBI given loan for 12 years but may be extended upto 20 years., It give loan to state government., 6., , Recent Development in the field of Rural finance, i), , Micro finance : NABARD introduced Micro Finance in 1992. Micro finance, , provides micro credit or micro loans to the poor without any collateral. These, loans are provided through Micro Finance Institutions (MFIs). NABARD play an, important role in developing the MFIs by providing them refinance facility at low, rate of interest., Micro finance provide micro credit to marginal farmers, landless labourers,, , artisans and small businessman in the rural areas. The scheme has been, implemented through Self Help Group-bank linkage programme., ii) Kisan Credit Card (KCC): The Kisan Credit Card (KCC) Scheme was introduced, by NABARD in 1998-99 to provide short term credit to farmers to India. RBI, along with NABARD took up initiative to introduced KCC in India., , Each farmer is given with a KCC and passbook for providing solving cash credit, facilities. NABARD provide refinance facility to commercial banks and co, , operatives to provide credit under this scheme., KCC scheme has become very popular with farmers., Features, , a) Farmers eligible for production credit of T 5000 or more are eligible for issue of, KCC., b) Eligible farmers are provided with Kisan Card and Passbook., , ), , Card valid for 5 years, , subject to annual review, , d) Each withdrawal to be repaid within 12 months., e) Security, margin, rate of interest as per RBI norms., , Withdrawals, , through slip / cheque with card and passbook., , g) Limit to be fixed on the basis of operational land holding, cropping pattern, and scale of finance., h) Operations may be through issuing branch or at the discretion of bank,, , through other designated branches.

Page 7 :

73, , KCC scheme, , institutional, , was, , introduced, , sources, , reduce the dependence of Indian farmers on non, like money lendera, KCC are offered, by co-operative banKS, to, , commercial banks and RRBs., , KCC scheme has been taken up by comnercial banks, 187 RRB and 334 CC. Banks., , PROBLEMS OF INSTITUTIONAL FINANCE IN INDIA, The major problems of institutional sources of finance are as follows:, 1. Formalities : For obtaining loans from the banks, farmers have, , througn, , to, go, number ot formalities. This discourage the farmers from approaching the banks, , tor any loan and ultimately force the farmers to depend more on non-institutional, sources of finance such as money lenders who, charges a high rate or, , intere, , 2. Inadequate security : Institutional sources like commercial banks, co-operative, banks etc. insist on security for sanctioning loans. Thus absence of securities, , prevent commercial banks from lending loans to farmers., , 3. Only productive loans : Most of the institutional sources provide loans for, productive purpose only. But the farmers also require loan for unproductive, , purposes such as marriage, festivals etc. Under such circumstances, money, the, lenders grants loans. Thus the farmer find it more convenient to approach, money lender who charges a high rate of interest., 4., , 5., , 6., , 7., , 8., , 9., , volume. The, do not, institutional sources like co-operative banks provide cheap credit but they, credit is insufficient as, provide sufficient funds at right time. The volume of rural, Indian farmers. Thus small and, compare to its growing requirements of the, credit from financial institutional, marginal tarmers are unable to raise adequate, rate of interest., sources so they turn to money lenders who charges high, of finance are not willing to, Poor recoveries: Most of the institutional sources, rich, recoveries. The loan given to big and, grant loans to farmers due to poor, & poor, financial institutions than the small, farmers are not being repaid to the, institution, the most of the financial, farmers. Poor recoveries makes it difficult for, waives off the, become worst, when the government, to survive. The condition, loans granted to farmers., is delay, sources of finance there, loans: In the institutional, in, sanctioning, Delay, four to five, The farmers have to visit the bank, in getting the loans sanctioned., the, The visit becomes difficult in, Insutficient finance, , :, , Indian farmers, , require cheap credit in large, , are sanctioned., times before their loans, involve the loss of money and manpower., cultivation activities. This, leaders and higher officials in, interference, political, The, interference:, Political, loans to farmers and also, to the banks in providing, a, also, problem, government is, number of bad debts., This results in the large, loans., of, in the recovery, and ignorant. They are, of the farmers are illiterate, Majority, farmers:, turn to village, Illiteracy of, procedures for loans. So they, comnplicated, the, understand, unable to, to get loans immediately., money lenders, to big farmers. The, Some banks are giving preference, farmers:, Preference to big, amount because of small, , of, , are not able to, , get higher, , marginal farmers, capacity is also less., repayment, and, land holdings, and fertilizers,, small and, , loans for seeds, 10. To obtain short term, of these inputs, , receipts for payments, farmers, This m e a n s that the, , had to, , farmers, , betore obtaining, , spend in advance, , to, , are, , required, , to submit, , from banks., banks., get the loans from, loan, , amount

Page 8 :

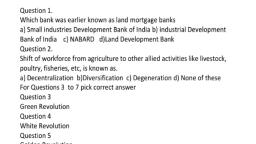

R'R'R, , 74, , M O D E L Q U E S T I O N S, , Answer in bricf:, , I., , types of, , agricultural, , credit., , finance in India., of agricultural, in India, agricultural credit, different, in providing, institutional agencies, finance in India., role of, the, Discuss, agricultural, 3, finance in India., . E x p l a i n the, institutional, limitation/ problems, Discuss the, 5, need and, , Explain the, What are the, , sources, , sources, , non-institutional, , of, , of, , 11. Write short noteson:, 1., , Non, , 3, 4., , finance, , of agricultural, finance, of agricultural, institutional s o u r c e s, , Classification, , Institutional, , sources, , of agricultural, , finance, , Co-operative credit institutions, , Rural Banks, , 5., , Regional, , 6., , Commercial Bank, , 7., , NABARD, , 8., 9., , Micro finance, Kisan Credit Card, , 10., , Limitation/ Failure of institutional, , finance in India, , OBJECTIVE QUESTIONS, , A., , Fill in the blanks:, , 1., , The apex bank ofthe Co-operative credit, , 2., 3., , 4, , 5., , act, , as a, , link between state, , structure is, , credit societies., co-operative societies and primary, , RRBs was established in, is the apex bank for rural sector., , Kisan Credit Card was introduced by ., 1975, [Ans. (1) State Co-operative Bank, (2) Central Co-operative Banks, (3), (4) NABARD, (5) NABARD], , B., , Choose the correct answer:, , 1, , Institutional sources of agricultural finance consists of _, a) Commercial banks, b) RRBs, , c) Co-operative credit institutions, d) All of the above, 2., , Non-institutional source of, a) Money lenders, , agricultural finance consists of, , b) Traders, , c) Relatives and friends, d) All of the above, 3., , Co-operative Credit Institutions include, a) State Co-operative Banks, , b) Primary Land Development Banks, c) Both (a) and (b), d) None of the above

Page 9 :

Agricultnrl Finane, , State, , A, 4., , 75, , Co-operative Banks operate at, , a) State level, , b) District level, , c) Village level, d) None of the above, , Primary agricultural credit societies, operateat, a) State level, , 5., , b) district level, c) Village level, d) All of the above, 6., , For long term credit., a) State Co-operative, , banks are established., , b) Land development, , c, , Central Co-operative, , d) Primary Agricultural credit, i s an apex bank for rural sector., , 7., , a) NABARD, , b) Commercial Bank, , c) Foreign Bank, d) None of the above, 8., , NABARD refers to-, , a) National Bank for Agriculture and Regional Development, b) National Bank for Agriculture and Rural Development, , c)National Branch for Agriculture and Regional Development, d) None of the above, 9., , Kisan credit card was introduced by, , a), , RBI, , b) RRB, , c) NABARD, d) Commercial Banks, 10. RRBs, provide credit to ., , a) Small and marginal farmers, , b, , landless labourers, , c) artisans, d) all of the above, , 11. Agricultural finance has playeda crucial role in bringing., a), , Green Revolution, , b) White Revolution, c), , Yellow Revolution, , dall ofthe above

Page 10 :

(T.Y.B.Com.) (Sem.-V), (Sem, , Busincss, , 3., , development of, upon, depend, Agriculture development largely, , 4.Short, , term, , 5., , Long, , term finance, , 6., , Long term finance are provided by Land Development, RRBs provide credit to rural people., , 7., , 8., , Economics, , finance, , Commercial, , provide loan upto 5 years., are, , provided by State Co-operative, , agricultural, , fina, ance., , Banks., Banks., , banks provide credit directly and indirectly, , to, , the, , farmers., , 9., , RRBs is an apex bank for agriculture and rural credit., 10. RBI provide loans indirectly to farmers through NABARD., 11., , KIsan, , Credit, , scheme, , was, , Credit, introduced by commercial banks and Co-operative, , societies, D., , [Ans. True: (3, 6, 7, 8, 10), Match the following:, , 1., , Institutional Finance, , 2, , False:, , (1, 2, 4, 5, 9, 11), , a), , Non-institutional Finance, , b), , Kisan Credit Card, Small and, , Marginal Farmers, , 3., , NABARD, , c), , 4., , RRBs, , d) Money lenders/Traders, , [Ans. (1- c), (2- d), (3 a), (4 - b)], -, , Co-operative Banks, , landlords