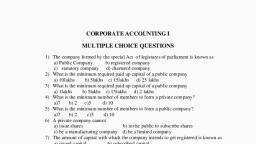

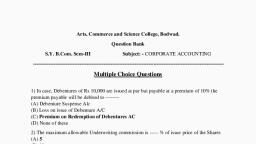

Page 1 :

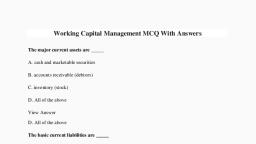

Multiple Choice Questions., , B. Com. III ( Sem. V ), , B. Com. III (Sem. V), , Shivaji University,, Kolhapur, Advanced Accountancy, (From June 2020), , Index, 1) Bank Final Accounts, 2) A) Farm Accounting, B) Hire- Purchase System, 3) Insurance Claim, 5) GST Accounting with Practical using, Tally Part I, Prerna Classes, Mb. No. 8983436405, , 1

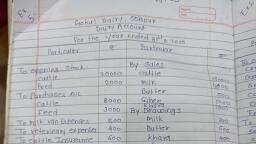

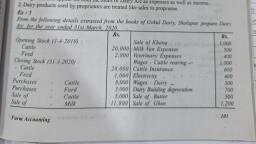

Page 2 :

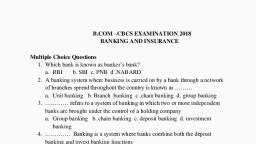

Multiple Choice Questions., , B. Com. III ( Sem. V ), , Multiple choice Questions, 1) Banking Companies in India are governed by the Banking Regulation Act, a. 1947, b. 1948, c. 1949, d. 1949., 2) Revised Format of Final Accounts were introduced by the Act in the year, a. 1990-91, b. 1991-92, c. 1992-93, d. 1993-94, 3) Section 17 of the Banking Companies Act. ------ % of the profit must be transfer to, Statutory Reserve., a. 20%, b. 25%, c. 30%, d. 40%., 4) A Banking Company may pay at most -------% of the paid up capital as Commission, brokerage, on issue of shares., a. 1%, b. 1.5%, c. 2%, d. 2.5%., 5) SLR means., a. Statutory Liquid Reserve, b. State Liability Recovery, c. Statutory Liquid Ratio, d. None of these., 6) Section 42 of the Reserve Bank of India Act. Empowers the RBI to increase the cash, reserve ratio up to., a. 10%, b. 15%, c. 20%, d. 25%, 7) NPA means, a. Non Performing Assets, b. Net Profit Allocation, , Prerna Classes, Mb. No. 8983436405, , 2

Page 3 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , c. Net Profit Assets, d. Non Profit Association, 8) CRR means., a. Credit Reserve Ratio, b. Cash Reserve Ratio, c. Confidential Reserve Ratio, d. None of these., 9) The banking companies may forfeit the assets in satisfaction of recovery of loans such, assets are called as., a. Secured Assets, b. Unsecured Assets, c. Freehold Assets, d. Non banking Assets., 10), The banking Companies can not hold non banking assets as permanently, these, are to be disposed off within period of, a. 3 Years, b. 4 Years, c. 5 Years, d. 7 Years., 11), Statutory Liquid Ratio (SLR) is to maintain by every banking companies, not less, than ----% & not more than ----% ., a. 25% & 40%, b. 15% & 30%, c. 20% & 35%, d. 10% & 30% ., 12), The guiding principle, in line with International Accounting Standards, is that the, income on ---------- should be recognised on accrual basis & should be treated as income, only when actually received., a. Secured Assets, b. Unsecured Assets, c. Non Performing Assets, d. None of these., 13), The amount of discount on bills discounted received in advance is called as, a. Rebate on bills discounted, b. Unexpired discount, c. A & B, d. None of these., 14), Rebate on bills discounted is shown under the headings., a. Contingent Liability, b. Other Liabilities, c. Reserve & Surplus, d. None of these., , Prerna Classes, Mb. No. 8983436405, , 3

Page 4 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , 15), The loans are advanced by banks having surplus funds to needed bank, loans, repayable within 24 hours are called as., a. Money at call, b. Short term loans, c. Treasury bills, d. None of these., 16), The short term obligation issued by the Govt. at discount bearing no interest &, repayable at par on maturity., a. Money at call, b. Short term loans, c. Treasury bills, d. None of these., 17), The bills are received by bank from its clients to collect them on their due dates, from the acceptor of the bill are called as., a. Rebate on bills discounted, b. Bill for collection, c. Bills Payable, d. None of these., 18), The bank may give advantages of its credit to its clients by accepting or endorsing a, bill on their behalf is called as., a. Acceptance, Endorsement & their obligations, b. Bills for Collection, c. Treasury Bills, d. None of these., 19), Bills Payable includes., a. Unpaid bank drafts, b. Telegraphic transfers, c. Mail transfers, d. All of these., 20), Investment in gold is shown under the headings, a. Other Assets, b. Investment, c. Fixed Assets, d. None of these., 21), Investment in silver is shown under the headings, a. Other Assets, b. Investment, c. Fixed Assets, d. None of these., 22), Cash Certificate is shown under the headings., a. Advances, b. Investment, c. Deposit, , Prerna Classes, Mb. No. 8983436405, , 4

Page 5 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , d. Other Assets., 23), Cash Credit is shown under the headings., a. Advances, b. Investment, c. Deposit, d. Other Assets., 24), Treasury bills is shown under the headings., a. Other Assets, b. Investment, c. Advances, d. Other Liabilities., 25), Liability on bills rediscounted is shown under the headings., a. Other Assets, b. Other Liabilities, c. Contingent Liability, d. None of these., 26), Accrued interest on Investment is shown under the headings., a. Investment, b. Other Assets, c. Other Liabilities, d. None of these., 27), The banks are not allowed to keep more than -------% of investment in permanent, category., a. 70, b. 60, c. 50, d. 40., 28), The assets which have remained NPA for a period exceeding two years & which is, unsecured is required to make provision for doubtful debts is., a. 10%, b. 20%, c. 40%, d. 100% ., 29), The Loss Assets which has been identified by the bank or internal auditor or the RBI, inspection,. It is to provided for., a. 100%, b. 80%, c. 60%, d. 40%., 30), Non banking assets should be shown under the headings., a. Investment, b. Advances, c. Fixed Assets, , Prerna Classes, Mb. No. 8983436405, , 5

Page 6 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , d. Other Assets., 31), As per New formats of final Accounts of Banking Companies, a provision for, doubtful debts is shown under the headings ---------in Profit & loss A/c & headings of ------------in Balance Sheet., a. Provisions & Contingencies , Advances, b. Provisions & Contingencies, Other Liabilities, c. Provisions & Contingencies, Other Assets., d. None of these., 32), The value of premises appear in Trial Balance ₹ 50000, During the year ₹ 10000, were added in premises. Depreciation is charged at 5% p.a. on opening balance. What is, amount of depreciation., a. ₹ 2000, b. ₹ 2500, c. ₹ 3000, d. ₹ 3500., 33), Loss on Revaluation of Investment is shown under the headings, a. Operating Expenses, b. Other Incomes, c. Provisions & Contingencies, d. Other Losses., 34), Profit on Revaluation of Investment is shown under the headings., a. Other Incomes, b. Operating Expenses, c. Provisions & Contingencies., d. Other Losses., 35), Claims against the bank not acknowledged as debt is to be shown under the, headings., a. Other Liabilities, b. Contingent Liability, c. Advances, d. Other Assets., 36), Endorsement made on behalf of customer is to be shown under the headings., a. Contingent Liability, b. Other Liabilities, c. Advances, d. Other Assets., 37), Interest on Cash Certificate is ------- of banking companies., a. Incomes, b. Expenses, c. Assets, d. Liabilities, 38), Interest on Cash Credit is ---------- of the banking companies., a. Incomes, , Prerna Classes, Mb. No. 8983436405, , 6

Page 7 :

Multiple Choice Questions., , 39), , 40), , 41), , 42), , 43), , 44), , 45), , 46), , 47), , B. Com. III ( Sem. V ), , b. Expenses, c. Assets, d. Liabilities., Loans credit balance is to be shown under the headings., a. Advances, b. Other Liabilities, c. Borrowings, d. Other Assets., Loans debit balance is to be shown under the headings., a. Borrowings, b. Advances, c. Deposits, d. Other Assets., Interest on loan is -------- of banking companies., a. Income, b. Expenses, c. Assets, d. Liabilities., Interest on deposits is -------- of banking companies., a. Incomes, b. Expenses, c. Assets, d. Liabilities., Interest on Balance with RBI is ------ of the banking companies., a. Assets, b. Liabilities, c. Incomes, Which of the following is not included in Schedule No 5., Other Liabilities., a. Unexpired Discount, b. Unexpired Insurance, c. Unpaid dividend, d. Provision for tax., U. K. Loan debit balance is shown under the headings., a. Borrowing, b. Advances, c. Investment, d. Other Assets., Bills purchased & discounted is to be shown under the headings., a. Borrowing, b. Other Liabilities, c. Other Assets, d. Advances., Commission, Exchange & brokerage is to be shown under the headings., , Prerna Classes, Mb. No. 8983436405, , 7

Page 8 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , a., b., c., d., , Operating Expenses, Other Incomes, Provisions & Contingencies, Other Assets., 48), Credit balance of Interest accrued is to be shown under the headings., a. Investment, b. Other Assets, c. Other Liabilities, d. Contingent Liability., 49), Debit balance of Interest accrued is to be shown under the headings, a. Investment, b. Other Assets, c. Other Liabilities, d. Contingent Liability., 50), Contingencies Accounts is to be shown under the headings., a. Contingent Liability, b. Other Liabilities, c. Deposits, d. Other Assets., 51), Claim by employees for bonus is pending for award of arbitration., a. Contingent Liability, b. Other Liabilities, c. Deposits, d. Other Assets., 52), Claim by employees for bonus is to be provided, is to be shown under the headings, of Balance Sheet., a. Contingent Liability, b. Other Liabilities, c. Deposits, d. Other Assets., 53), Which of the following is not included in Advances., a. Bank Overdrafts, b. Loans & Advances, c. Cash Credit, d. Cash Certificate., 54), Which of the following is not included in Deposits., a. Savings deposits, b. Cash credit, c. Cash Certificate, d. Current accounts, 55), Which of the following is not included in Other Assets, a. Unexpired Insurance, b. Unexpired discount, , Prerna Classes, Mb. No. 8983436405, , 8

Page 9 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , c. Pre-paid Expenses, d. Advance salaries., 56), Which of the following is not included in Bills Payable., a. Bank drafts, b. Telegraphic transfers, c. Mail transfers, d. Money at call., 57), Interest on balance with RBI is to be shown under the headings., a. Interest earned, b. Interest expended, c. Other Incomes, d. Operating Expenses., 58), Adjustment of current accounts overdrawn is made as., a. Added in deposits & Deducted from Advances, b. Added in deposits & Added in Advances, c. Deducted from deposits & Added in Advances, d. Deducted from deposits & Deducted from Advances., 59), Which of the following is not included in agricultural activities., a. Agriculture, b. Animal husbandry, c. Poultry farming, d. Stone quarries, 60), The transaction which includes exchange of articles (excluding cash) for example, agricultural products given to the workers as their wages is called as., a. Credit transaction, b. Barter transaction, c. Cash transaction, d. Social transaction., 61), Consumption of agricultural products by owner is called as, a. Drawings, b. Capital, c. Expenses, d. Incomes., 62), Land development expenses is treated as, a. Revenue Expenses, b. Capital Expenses, c. Recurring Expenses, d. None of these., 63), Standing crops is treated as., a. Raw materials, b. Finished products, c. Work in progress, d. None of these., , Prerna Classes, Mb. No. 8983436405, , 9

Page 10 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , 64), , Objectives of Farm Accounting is that of., a. To find out profit or Loss of each activities, b. To obtain loan from banks & other Institutions, c. To ascertain return on capital employed, d. All of these., 65), Which is non depreciable assets., a. Tractor, b. Development, c. Land, d. Farm House., 66), Which of the following is not included in Crop Account., a. Growing Crops, b. Wheat, c. Fertilizer, d. Feeding material, 67), Which of the following is not included in Live Stock., a. Cattle, b. Feeding material, c. Paddy, d. Sheep., 68), Which of the following is not included in Cattle A/c., a. Butter, b. Milk, c. Cattle feed, d. Eggs., 69), Which of the following sales is not included in Cattle A/c., a. Sale of offal, b. Sale of hide, c. Sale of carcasses, d. Sale of grass., 70), The manager of the farm resides in the farm house as free residence, but, chargeable 1/3 of the farm house expenses. The total farm house expenses ₹ 12000., What is amount of farm house expenses chargeable to Crop A/c., a. 12000, b. 4000, c. 8000, d. 9000., 71), The Profit of live stock activities ₹ 11000 before charging Commission. The, manager is entitled to a commission at 10% of net profit after charging such commission., What is amount of Commission., a. 1000, b. 1100, c. 1200, , Prerna Classes, Mb. No. 8983436405, , 10

Page 11 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , d. 1300., 72), The contract between seller & purchaser to sale of goods, in which purchaser agree, to pay the price in easy instalments, as & when last installment is paid, only on then, ownership of goods is transferred is called as., a. Hire Purchase System, b. Cash System, c. Credit System, d. None of these., 73), In Hire Purchase System the purchaser fails to pay any installment the seller has, right to., a. Suite against the purchaser for recovery of debt., b. Forfeit the goods, c. Recover the Installment, d. None of these., 74), In Hire Purchase System, the purchaser cannot resell goods to any other party till., a. The agreement is made, b. First installment is paid, c. Last installment is paid, d. None of these., 75), In Hire Purchase System, which of the following installment is excluding interest., a. Down Payment, b. 1st Installment, c. 2nd Installment, d. 3rd Installment, e. 4th Installment., 76), If Cash price of the assets & total of all installment is equal, then interest is, calculated at given % on., a. Total Cash Price, b. Outstanding balance of cash price at beginning of each year, c. On installment, d. None of these., 77), In Hire Purchase System, total of all Installment is higher than cost price of assets,, then excess is called as interest & also interest rate is not given, it is to be distributed in the, ratio of., a. Equal in each year, b. Equal installment, c. Outstanding balance ratio, d. None of these., 78), In Hire Purchase System, only instalments are given, cash price & rate of interest is, not given, then interest is find out by., a. Reverse method, b. Equation method, c. Outstanding balance ratio, , Prerna Classes, Mb. No. 8983436405, , 11

Page 12 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , d. None of these., 79), In Hire Purchase System, Installment s are including interest amount & interest rate, is given, then Interest is calculated by., a. Reverse method, b. Equation method, c. On Cash Price, d. Outstanding balance ratio., 80), On 1st January 2018, Vijay Transport Ltd. Purchased a motor truck from Tata, motors Ltd. On Hire Purchase basis. The cash paid to Vendor is as under. On 1-1-2018 ₹, 100000 Down Payment, On 31-12-2018 ₹ 130000, On 31-12-2019 ₹ 120000, On 3112-2020 ₹ 110000. What is interest for 3 years respectively., a. 13000, 12000, 11000., b. 10000, 13000, 12000., c. 13000, 12000, 11000., d. 30000, 20000, 10000., 81), Maharashtra Co. Purchased a machine on Hire Purchase System, the hire prchase, price was ₹ 160000, payable at ₹ 40000 down & rest in three annual installment s of ₹, 40000 each, the cost price was ₹ 148600. What is interest for three years respectively., a. 1900, 3800, 5700., b. 5700, 3800, 1900., c. 4000, 4000, 4000., d. 6000, 4000, 2000., 82), Delhi Motors Ltd. Sells tractor on Hire Purchase System, the term of payment for, the sale of tractor are ₹ 20000 on delivery, ₹ 20800 at the end of the 1st year, ₹ 19200, at the end of the 2nd year, & ₹ 17600 at the end of the 3rd year inclusive of interest. What, is interest for 3 years respectively., a. 4800, 3200, 1600., b. 1600, 3200, 4800., c. 2080, 1920, 1760., d. 1760, 1920, 2080., 83), On 1st April 2016, a Colliery Co. Purchase wagon on hire purchase system over a, period of 5 years, payable by annual installment of ₹ 70000. The Wagon Co. charges at the, rate 5% p.a. on the yearly balances. Find the cash price of the wagon.( The present value, of an annuity of one rupee for 5 years @5% is 4.329477.), a. 35000, b. 30306, c. 30300, d. 35300., 84), The method in which full cash price of the assets is debited in the books of, purchaser is called as, a. Proportion method, b. Cash price method, c. Full cash price method, Prerna Classes, Mb. No. 8983436405, , 12

Page 13 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , d. None of these., 85), In Hire Purchase System the seller of goods is also called as., a. Hire Vendor, b. Hire Purchaser, c. A & B, d. None of these., 86), National Dry Cleaners purchased from the Vendor two machine of ₹ 10500 each, on Hire Purchase System. Depreciation is charged at 10% p.a. on written down value. What, depreciated value of machinery at the end of 2nd year., a. 21000, b. 16900, c. 10500, d. 17010, 87), The Insurance Company undertake the risk of loss of stock by fire is called as., a. Loss of stock policy, b. Loss of profit policy, c. Loss of premises policy, d. None of these., 88), The Insurance Company undertake the risk of loss of profit after the fire event is, called as., a. Loss of stock policy, b. Loss of profit policy, c. Loss of premises policy, d. None of these., 89), The stock which is saved from the fire is called as., a. Salvaged stock, b. Closing stock, c. Opening stock, d. None of these., 90), If loss of stock policy is for less than the value of closing stock, then Insurance, Company use --------- method to determine the amount of insurance claim., a. Proportion method, b. Average Clause method, c. A & B, d. None of theses., 91), ABC Co. Ltd. Valued it’s stock at ₹ 44000, which is 10% above cost. What is, original cost price., a. 40000, b. 44000, c. 48000, d. 36000., 92), A fire occurred in the premises of M/s. Poonawala on 15th January 2020. It’s, average Gross Profit ratio is 30%, the stock on 1st January 2020, ₹ 30000, purchases &, , Prerna Classes, Mb. No. 8983436405, , 13

Page 14 :

Multiple Choice Questions., , B. Com. III ( Sem. V ), , sales for the period 1st January to 15th January 2020 were ₹ 147000 & ₹ 150000, respectively. What is stock on date of fire., a. 70000, b. 71000, c. 72000, d. 75000., 93), Sundry Debtors balance as on 30th June & on 31st December 2020 were ₹, 160000 & ₹ 120000 respectively, the cash received from customer during the period 30th, June to 31st Dec. 2020 was ₹ 576000. What is amount of sales during the same period., a. 576000, b. 616000, c. 536000, d. 456000., 94), Trading A/c for the period from last Accounting year to the date of fire is called as., a. Memorandum Trading A/c, b. Memorandum Profit & Loss A/c, c. Adjusted Profit & Loss A/c, d. None of these., 95), The period during which sales are expected to be affected due to fire is stated in, policy is called as., a. Policy Period, b. Indemnity Period, c. Prior Period, d. Post Period., 96), The ratio of policy amount to adjusted sales of 12 months before fire is called as., a. Gross profit ratio, b. Net profit ratio, c. Indemnity ratio, d. None of these., 97), VAT means., a. Value Added Tax, b. Volume Added Tax, c. Value after Tax, d. None of these., 98), GST means., a. Gross service Tax, b. Goods & Service Tax, c. Gift & Service Tax, d. None of these., 99), GST implemented in India from., a. 1st July 2017, b. 1st July 2018, c. 1st July 2016, , Prerna Classes, Mb. No. 8983436405, , 14

Page 15 :

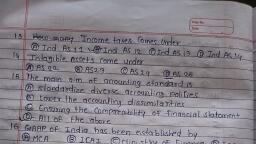

Multiple Choice Questions., , 100), , 101), , 102), , 103), , 104), , 105), , 106), , 107), , B. Com. III ( Sem. V ), , d. 1st July 2015., CGST means., a. Commission of Goods & Service Tax, b. Central Goods & Service Tax, c. Cost of Goods & Service Tax, d. None of these., SGST means., a. State Goods & Service Tax, b. Software Goods & Service Tax, c. A & B, d. None of these., UGST means, a. Urban Goods & Service Tax, b. Union territory Goods & Service Tax, c. Uniform Goods & Service Tax, d. None of these., IGST means., a. Indian Goods & Service Tax, b. Introduction of Goods & Service Tax, c. Integrated Goods & Service Tax, d. None of these., HSN means., a. Horizontal System of Nomenclature, b. Harmonize System of Nomenclature, c. A&B, d. None of these., SAC means, a. Standard Accounting Code, b. Systematic Accounting Code, c. Service Accounting Code, d. None of these., WCO means., a. World Custom Organization, b. World Consumer Organization, c. Wide Custom Organization, d. None of these., GST slab rates are., a. 0 %, 5%, 10%, 12%, 18%., , b. 0 %, 5%, 12%,18%, 20%, c. 0 % , 5%, 12%, 18%, 28%, d. 0 % , 5%, 10%, 15%, 18%., 108), ITC means., , Prerna Classes, Mb. No. 8983436405, , 15

Page 16 :

Multiple Choice Questions., , a., b., c., d., 109), a., b., c., d., 110), a., b., c., d., , B. Com. III ( Sem. V ), , Input Tax Credit, Indian Tax Credit, Institutional Tax Credit, None of these., The condition for claiming Input Tax Credit., Must have GST Complaint Invoice, Must have paid GST, GST return must be filled, All of these., ITC can not be claimed on the goods purchased for, Personal use, A trader who is registered under the composition scheme of GST, A&B, Goods purchased for re-sale purpose., , =====×××××=====, , Answer Sheet, 1., , c, , 2., , b, , Prerna Classes, Mb. No. 8983436405, , 3., , a, , 4., , d, , 5., , c, , 16

Page 17 :

Multiple Choice Questions., , 6., , b, , 7., , B. Com. III ( Sem. V ), , a, , 8., , b, , 9., , d, , 10. d, , 11. a, , 12. c, , 13. c, , 14. b, , 15. a, , 16. c, , 17. b, , 18. a, , 19. d, , 20. b, , 21. a, , 22. c, , 23. a, , 24. b, , 25. c, , 26. b, , 27. a, , 28. d, , 29. a, , 30. d, , 31. b, , 32. a, , 33. b, , 34. b, , 35. b, , 36. a, , 37. b, , 38. a, , 39. c, , 40. b, , 41. a, , 42. b, , 43. c, , 44. b, , 45. c, , 46. d, , 47. b, , 48. c, , 49. b, , 50. c, , 51. a, , 52. b, , 53. d, , 54. b, , 55. b, , 56. d, , 57. a, , 58. b, , 59. d, , 60. b, , 61. a, , 62. b, , 63. c, , 64. d, , 65. c, , 66. d, , 67. c, , 68. d, , 69. d, , 70. c, , 71. a, , 72. a, , 73. b, , 74. c, , 75. a, , 76. b, , 77. c, , 78. b, , 79. a, , 80. d, , 81. b, , 82. a, , 83. b, , 84. c, , 85. a, , 86. d, , 87. a, , 88. b, , 89. a, , 90. b, , 91. a, , 92. c, , 93. c, , 94. a, , 95. b, , 96. c, , 97. a, , 98. b, , 99. a, , 100., , b, , 101., , a, , 102., , b, , 103., , c, , 104., , a, , 105., , c, , 106., , a, , 107., , c, , 108., , a, , 109., , d, , 110., , c, , Prerna Classes, Mb. No. 8983436405, , 17