Page 1 :

Problems On Life Insurance (6 Marks), Total Premium Earned (Net), Benefits Paid, Revenue Account, , Problems On Premium Earned (6 Marks), Premium Earned (Net), Particulars, Amount, Amount, Premium Received during the year, XXX, Add:, Closing Outstanding Premium, XXX, Premium on Reinsurance Accepted (Income), XXX, Further Bonus in Reduction of Premium, XXX, Opening Premium received In Advance, XXX, XXX, Less:, Opening Outstanding Premium, XXX, Premium on Reinsurance Ceded (Expenses), XXX, Closing Premium Received In Advance, XXX, XXX, Premium Earned (Net), XXX, 1. Premium:, Premium is the amount payable by the policy holder to the Insurance Company. It may be of first, year Premium, renewal Premium and Single Premium., First Year Premium is paid by the Policy holders in the first year of the Policy., Premium paid in later year are known as renewal premium., When a Policy holder pays the entire Premium in Lump-sum in the beginning it is called Single, Premium. It is an Expenses., There are Three types of premium., a. Premium on Direct business:, This is the premium received by the insurance company on insurance contract entered into, directly with the insured. This is the income to the company., b. Premium on reinsurance ceded:, Sometimes the insurance company may pass on the risk of insurance cover to another insurance, company. Such an activity is known as reinsurance ceded and the premium paid by it is called, as reinsurance premium ceded. This is an expense to the company., c. Premium on reinsurance accepted:, This is the premium received by the insurance company on contracts entered into with another, insurance company on account of reinsurance accepted. This is an income to the insurance, company.

Page 2 :

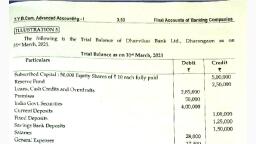

Problem 1, The following information relates to National Life Assurance Com. Ltd as on 31/03/2017., Particulars (160), Amount, Premium Received during the year, 1,61,000, Further Bonus in Reduction of Premium, 3,000, Premium on Reinsurance Ceded, 6,000, Premium Outstanding, 8,000, Find out the amount of premium to be credited to Revenue Account, Solution: Calculation of Net Premium Earned, Particulars, Premium Received during the year, Add:, Further Bonus in Reduction of Premium, 3,000, Premium Outstanding, 8,000, , Less:, Premium on Reinsurance Ceded, , 6,000, Premium Earned (Net), , Amount, 1,61,000, , 11,000, , (6,000), 1,66,000, , Problem 2, The following information relates to Jeevan Life Assurance Com. Ltd as on 31/03/2017., Particulars (160), Amount, Premium Received during the year, 2,10,572, Outstanding Premium, 5,000, Bonus in Reduction of Premium, 8,000, Premium on Reinsurance Ceded, 6,000, Premium on Reinsurance Accepted, 10,000, Find out the amount of premium to be credited to Revenue Account, Solution:, Particulars, Premium Received during the year, Add:, Outstanding Premium, 5,000, Bonus in Reduction of Premium, 8,000, Premium on Reinsurance Accepted, 10,000, Less:, Premium on Reinsurance Ceded, 6,000, Premium Earned (Net), , Amount, 2,10,572, , 23,000, (6,000), 2,27,572

Page 3 :

Problem 3 (Q P 2014,2015,2016), The Following relates to a Life Insurance Corporation for the year 31/03/2016, Particulars, Amount, Premium Received during the year, 22,66,000, Outstanding Premium on 01/04/2015, 1,74,000, Outstanding Premium on 31/03/2016, 2,18,000, Premium received in advance 01/04/2015, 56,000, Premium received in advance 31/03/2016, 44,000, Reinsurance premium ceded for 2015-2016, 3,20,000, Bonus in reduction of premium for 205-2016, 14,000, Find out the amount of premium to be credited to Revenue Account, Solution:, Particulars, Amount, Premium Received during the year 2015-2016, 22,66,000, Add:, Closing Outstanding Premium, 2,18,000, Premium on Reinsurance Accepted (Income), --Further Bonus in Reduction of Premium, 14,000, Opening Premium received In Advance, 56,000, 2,88,000, Less:, Opening Outstanding Premium, 1,74,000, Premium on Reinsurance Ceded (Expenses), 3,20,000, Closing Premium Received In Advance, 44,000, 5,38,000, Premium Earned (Net), 20,16,000, Problem 4 (Q P 2016), The Following relates to a Life Insurance Corporation for the year 31/03/2016, Particulars, Amount, Premium Received during the year, 11,33,000, Outstanding Premium on 01/04/2013, 87,000, Outstanding Premium on 31/03/2014, 1,09,000, Premium received in advance 01/04/2013, 28,000, Premium received in advance 31/03/2014, 22,000, Reinsurance premium paid during the year 2013-2014, 60,000, Bonus in reduction of premium for 2013-2014, 7,000, Find out the amount of premium to be credited to Revenue Account

Page 4 :

Solution:, Particulars, Premium Received during the year 2015-2016, Add:, Closing Outstanding Premium, Premium on Reinsurance Accepted (Income), Further Bonus in Reduction of Premium, Opening Premium received In Advance, Less:, Opening Outstanding Premium, Premium on Reinsurance Ceded (Expenses), Closing Premium Received In Advance, Premium Earned (Net), , Amount, 11,33,000, 1,09,000, -7,000, 28,000, 87,000, 60,000, 22,000, , 1,44,000, , (1,69,000), 11,08,000, , Illustration 5:, The Following relates to a Life Insurance Corporation for the year 31/03/2014, Particulars, Premium Received during the year, Outstanding Premium on 01/04/2013, Outstanding Premium on 31/03/2014, Premium received in advance 01/04/2013, Premium received in advance 31/03/2014, Reinsurance premium paid during the year 2013-2014, Bonus in reduction of premium for 2013-2014, Find out the amount of premium to be credited to Revenue Account, , Amount, 14,16,250, 1,08,750, 1,36,250, 35,000, 27,500, 75,000, 8,750, , Solution:, Particulars, Premium Received during the year 2015-2016, Add:, Closing Outstanding Premium, Premium on Reinsurance Accepted (Income), Further Bonus in Reduction of Premium, Opening Premium received In Advance, Less:, Opening Outstanding Premium, Premium on Reinsurance Ceded (Expenses), Closing Premium Received In Advance, Premium Earned (Net), , Amount

Page 5 :

Problems On Benefits paid (6 Marks), Benefits Paid, Particulars, 1. Claims, Claims by Death, Add: E, Closing Outstanding Claims, Claims and Reinsurance Accepted, Further Claims Intimated, Less: I, Opening Outstanding Claims, Claims and Reinsurance Ceded, Claims by Maturity, 2. Annuities, 3. Surrenders, 4. Bonus in Cash, 5. Bonus in Reduction in Premium, Add: Further Bonus in Reduction of Premium, Benefits paid, , Amount, , Amount, , XXX, XXX, XXX, XXX, XXX, XXX, , XXX, XXX, , XXX, , XXX, XXX, XXX, XXX, XXX, XXX, XXX, , 1. Claim:, Claim is the amount payable by the insurance Company. It is an expenses., There are three types of Claims. They are., a. Claims on Direct business:, This is the amount paid against the insurance contracts entered into directly with the insured., This is an expense to the insurance company., b. Claims on Reinsurance Ceded:, This is the amount received from other insurance company against reinsurance ceded. This is, an income to the insurance company., c. Claims on Reinsurance accepted:, This is the amount paid to another insurance company against reinsurance accepted. This is an, expenses to the insurance company., 2. Annuity:, It is periodical payment mane by a Life Insurance Company to the insured on the premature, termination of insurance contract. It is an expense to the insurance company., 3. Surrenders:, It is the payment made by a life insurance company to the insured on the premature termination, of insurance contract. It is an expense to the insurance Company., 4. Bonus:, Bonus is the Share of surplus of a life insurance company, distributed to the policy holders., 5. Bonus Reduction in Premium:, It refers to the bonus which is payable in cash but utilized by the policyholders to adjust the, premium due from them.

Page 6 :

Illustration 1: (181), From the following Calculation the Benefits Paid as per Insurance Regulation Act., Claims by death, 8,41,200, Annuities, 1,61,800, Surrenders, 2,25,600, Bonus in cash, 15,600, Bonus in reduction of Premium, 20,400, Additional information:, i., Further bonus in reduction of premium Rs 10,000., ii., Claims recovered under re-insurance Rs 95,000., , Solution:, Benefits Paid, Particulars, 1. Claims, Claims by Death, Add:, Closing Outstanding Claims, Claims and Reinsurance Accepted, Further Claims Intimated, Less:, Opening Outstanding Claims, Claims and Reinsurance Ceded, Claims by Maturity, 2. Annuities, 3. Surrenders, 4. Bonus in Cash, 5. Bonus in Reduction in Premium, Add: Further Bonus in Reduction of Premium, Benefits paid, , Amount, , Amount, , 8,41,200, ----(95,000), , 7,46,200, 1,61,800, 2,25,600, 15,600, , 20,400, 10,000, , 30,400, 11,79,600, , Illustration 2:, From the following Calculation the Benefits Paid as per Insurance Regulation Act., Claims by death, 4,20,600, Annuities, 80,900, Surrenders, 1,12,800, Bonus in Cash, 7,800, Bonus in Reduction of Premium, 10,200, Additional information:, iii., Further bonus in reduction of premium Rs 5,000., iv., Claims recovered under re-insurance Rs 47,500.

Page 7 :

Solution:, Benefits Paid, Particulars, 1. Claims, Claims by Death, Add:, Closing Outstanding Claims, Claims and Reinsurance Accepted, Further Claims Intimated, Less:, Opening Outstanding Claims, Claims and Reinsurance Ceded, Claims by Maturity, 2. Annuities, 3. Surrenders, 4. Bonus in Cash, 5. Bonus in Reduction in Premium, Add: Further Bonus in Reduction of Premium, Benefits paid, , Amount, , Amount, , 4,20,600, ----(47,500), , 3,73,100, 80,900, 1,12,800, 7,800, , 10,200, 5,000, , 15,200, 5,89,800, , Illustration 3:, From the following Information relating to Deepthi Life Insurance Company Ltd. For the year, ending 31/03/2013, calculate the amount of Benefit Paid as per Schedule-4., Particular, Amount, Claims, By Death paid, 2,00,000, By Maturity, 1,40,000, Annuities, 12,600, Surrenders, 4,000, Claims Outstanding on 01/04/2012, By Death, 80,000, By Maturity, 60,000, Additional information:, a. Claims Outstanding on 31/03/2013 by Death Rs 50,000; By Maturity Rs 40,000., b. Claims by Death covered under reinsurance Rs 20,000., c. Further Claims by Death intimated Rs 10,000., d. Further Bonus declared in Reduction of Premium Rs 15,000., e. Surrender Value of Policies payable Rs 10,000.

Page 8 :

Solution:, , Benefits Paid, Particulars, , 1. Claims, Claims by Death, Add:, Closing Outstanding Claims, Claims and Reinsurance Accepted, Further Claims Intimated, Less:, Opening Outstanding Claims, Claims and Reinsurance Ceded, Claims by Maturity, Closing Outstanding Claims, Less; Opening Outstanding Claims, 2. Annuities, 3. Surrenders, Add: Outstanding, 4. Bonus in Cash, 5. Bonus in Reduction in Premium, Add: Further Bonus in Reduction of Premium, Benefits paid, , Amount, , Amount, , 2,00,000, 50,000, 10,000, (80,000), (20,000), 1,40,000, 40,000, (60,000), 4,000, 10,000, -15,000., , 1,60,000, , 1,20,000, 12,600, 14,000, , 15,000, 3,21,600, , Illustration 4: (Q P 2019), From the following Information relating to Deepthi Life Insurance Company Ltd. For the year, ending 31/03/2019, calculate the amount of Benefit Paid as per Schedule-4., Particular, Amount, Claims by Death paid, 7,90,000, Outstanding Claims by Death (01/04/2018), 50,000, Claims by maturity paid, 3,60,000, Re-Insurance Premium paid*, 80,000, Consideration for annuities granted received*, 5,00,000, Annuities paid, 2,90,000, Surrender value of policies paid, 1,20,000, Bonus paid in Cash, 99,400, Additional information as on 30/03/2019:, a. Outstanding Claims by Death Rs 65,000., b. Claims by Death covered under reinsurance Rs 90,000., c. Further Claims by Death intimated Rs 20,000., d. Further Bonus declared in Reduction of Premium Rs 12,000., e. O/S Surrender Value of Policies payable Rs 10,000.

Page 9 :

Solution:, , Benefits Paid, Particulars, , Amount, , Amount, , 1. Claims, Claims by Death, 7,90,000, Add:, Closing Outstanding Claims, 65,000, Claims and Reinsurance Accepted, -Further Claims Intimated, 20,000, Less:, Opening Outstanding Claims, (50,000), Claims and Reinsurance Ceded, (90,000), 7,35,000, Claims by Maturity, 3,60,000, 2. Annuities, 2,90,000, 3. Surrenders, 1,20,000, Add: Outstanding, 10,000, 1,30,000, 4. Bonus in Cash, 99,400, 5. Bonus in Reduction in Premium, -Add: Further Bonus in Reduction of Premium, 12,000, 12,000, Benefits paid, 16,26,400, Note: Consideration for annuities granted received is an income, it will go to Revenue Account

Page 10 :

Preparation of Revenue Account, Revenue Account for the year ended 31/12/2013, Particulars, Premium earned – net, (a) Premium, (b) Reinsurance ceded, (c) Reinsurance accepted, Income from Investments, (a) Interest, Dividends & Rent- Gross, (b) Profit on sale/redemption of investments, (c) (Loss on sale/redemption of investments), (d) Transfer/Gain on revaluation/change in fair value, Other Income (to be specified), Consideration for annuity, Total (A), Commission, Operating Expenses related to Insurance Business, Provision for doubtful debts, Bad debts written off, Provision for Tax, Provisions (other than taxation ), (a)For diminution in the value of investments (Net), (b) Others (to be specified), Total (B), Benefits paid (Net), Interim Bonuses Paid, Change in valuation of liability in respect of life policies, (a) Gross, (b) Amount ceded in Reinsurance, (c) Amount accepted in Reinsurance, Total (C), SURPLUS/(DEFICIT) (D) = (A)-(B)-(C), APPROPRIATION, Transfer to Shareholder Account, Transfer to Other Reserves (to be specified ), Balance being Funds for Future Appropriation, Total (D), People -Premium, Can - Commission, Over – Operating Expenses related to Insurance, Breath – Benefits Paid, Illustration 1, , Schedule, No., 1, , 2, 3, , 4, , Amount, (Rs)

Page 11 :

From the following details, Prepare the Revenue Account of the Life Assurance Company on, 31/12/2013., Particulars (183*), Amount, 6 Opening LIC Fund, 60,00,000, 1 Premium, 37,50,000, I Interest, Dividend & Rent, 22,50,000, I, 4, 4, 2, 4, Solution:, , Consideration for annuity, Claims paid, Surrenders, Commission, Bonus in Reduction of Premium, , 1,50,000, 4,50,000, 1,50,000, 75,000, 7,500, , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 37,50,000, Income From Investments, 22,50,000, Interest, Dividends & Rent, Other Income (to be specified), 1,50,000, Consideration for annuities granted, Total (A), 61,50,000, Commission Expenses, 2, 75,000, Nil, Operating expenses related to, 3, -Insurance Business, -Provision for DD & Bad debts written off, -Provision for Tax, Provisions (other than taxation ), Total (B), 75,000, 6,07,500, Benefits Paid, 4, -Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (61,50,000-75,000-6,07,500), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future, appropriation, Total (D), , 6,07,500, 54,67,500, --54,67,500, 54,67,500

Page 12 :

Schedule:1 Premium, Particulars, , Rs., 37,50,000, , Premium, , Total, Schedule:2 Commission Expenses, Particulars, Commission, , Total, , 37,50,000, , Rs., 75,000, , 75,000, , Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., , Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims paid, Surrenders, Bonus in Reduction of Premium, Total, , Nil, , Rs., 4,50,000, 1,50,000, 7,500, 6,07,500, , Note 1: Opening LIC Fund will appear in schedule 6 on Reserves and surplus, , Illustration 2:

Page 13 :

From the following details, Prepare the Revenue Account of the LIC on 31/12/2010., Particulars (184*), Amount, 4 Claims Paid, 8,90,000, 4 Surrenders, 85,200, 1 Premium, 13,80,000, I Consideration for annuities granted, 45,000, 4 Bonus in Cash, 1,58,400, 4 Bonus in reduction of premium, 1,976, 3 Expenses of management, 1,75,000, 2 Commission, 54,000, 12 Income tax on dividends, 1,18,500, I Interest, Dividend & Rent, 7,50,000, I Fines & Fees, 5,520, -1 Re-Insurance Ceded Premium, 1,250, 6 Balance of fund on 01/01/2010, 24,50,000, Solution:, In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 13,78,750, Income From Investments, 7,50,000, Interest, Dividends & Rent, Other Income (to be specified), 45,000, Consideration for annuities granted, 5,520, Fines & Fees, Total (A), Commission Expenses, Operating expenses related to Insurance Business, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (21,79,270-2,29,000-11,35,576), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), Schedule:1 Premium, , 2, 3, , 21,79,270, 54,000, 1,75,000, ---2,29,000, , 4, , 11,35,576, , -11,35,576, 8,14,694, --8,14,694, 8,14,694

Page 14 :

Particulars, , Rs., 13,80,000, (1,250), , Premium, Less: Re-Insurance Ceded Premium, , Total, Schedule:2 Commission Expenses, Particulars, Commission, , Total, , 13,78,750, , Rs., 54,000, , 54,000, , Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Expenses of management, 1,75,000, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims Paid, Surrenders, Bonus in Cash, Bonus in reduction of premium, Total, , 1,75,000, Rs., 8,90,000, 85,200, 1,58,400, 1,976, 11,35,576, , Note:, 1. Income tax on dividends is a TDS and will appear in Schedule 12 under Advances & Other, assets, as per the IRDA form., 2. Balance of fund will appear in schedule 6 on Reserves and surplus., , Illustration 3:

Page 15 :

From the following figures are extracted from the general ledger of Bharath Life Assurance, Company Ltd., for the year 2011, Particulars (186*), Amount, 6, Life Fund on 01/04/2010, 70,11,150, 1, Premiums, 7,11,348, I, Consideration for annuities to be granted, 22,676, I, Interest & Dividends, 4,47,070, I, Fines for revival of policies, 716, 4, Claims by Death, 6,75,910, -4, Claims Covered under reinsurance, 54,000, 4, Claims by survivance (maturity), 64,452, 4, Surrenders, 74,606, 4, Annuities, 77,376, E, Interim bonus paid, 22,312, 2, Commission, 22,834, App Dividends to Share holders, 19,756, 3, Expenses of management, 80,140, E, Bad Debts, 60,000, E, Income Tax, 17,186, Solution: Workings, Schedule:1 Premium, Particulars, Rs., Premiums, 7,11,348, Total, Schedule:2 Commission Expenses, Particulars, Commission, , 7,11,348, Rs., 22,834, , Total, 22,834, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Expenses of management, 80,140, Total, , Schedule: 4 Benefits Paid (Net), , 80,140

Page 16 :

Particulars, , Rs., 6,75,910, (54,000), 64,452, 74,606, 77,376, , Claims by Death, Less ;Claims Covered under reinsurance, Claims by survivance (maturity), Surrenders, Annuities, Total, , 8,38,344, , Note 1: Opening LIC Fund will appear in Schedule 6 on Reserves and surplus, In the Books of Bharat Assurance Company, Revenue Account for the year ended 31/03/2011, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Fines for revival of policies, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (11,81,810-1,80,160-8,60,656), Appropriation, Transfer to Shareholders Dividend account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), , Illustration 4:, , Amount, Rs., 7,11,348, 4,47,070, 22,676, 716, 11,81,810, 22,834, 80,140, 60,000, 17,186, -1,80,160, 8,38,344, , 22,312, 8,60,656, 1,40,994, 19,756, -1,21,238, 1,40,994

Page 17 :

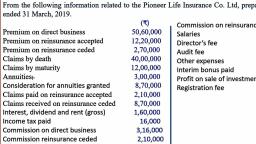

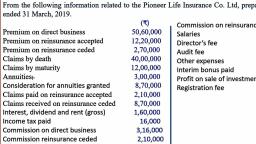

From the following figures are extracted from the general ledger Life Insurance Corporation Ltd.,, for the year 2008. Prepare Revenue Account., Particulars (190*), Amount, 4, Claims, 39,000, 3, Management expenses, 14,000, 3, Directors fees, 4,000, 3, Audit Fees, 3,000, 3, Medical expenses, 500, 2, Commission, 5,000, 3, Depreciation, 4,000, 4, Bonus in reduction of Premium, 1,500, I, Consideration for annuities granted, 16,500, 4, Surrenders, 9,000, 1, Premiums, 1,51,000, 6, Life Fund (01/04/2008), 11,50,000, I, Interest received, 40,000, I, Rent Received, 10,000, -4, Claims Cancelled, 500, 4, Annuities, 1,500, Additional Information:, 1. Premium Outstanding Rs 9,000. (+1), 2. Claims Outstanding Rs 3,000. (+4), Solution:, Schedule:1 Premium, Particulars, Rs., Premiums, 1,51,000, Add: Premium Outstanding, 9,000, 1,60,000, , Total, , Schedule:2 Commission Expenses, Particulars, Commission, , Total, , 1,60,000, , Rs., 5,000, , 5,000, , Schedule:3 Operating Expenses related to Insurance Business

Page 18 :

Particulars, Management expenses, Directors fees, Audit Fees, Medical expenses, Depreciation, , Rs., 14,000, 4,000, 3,000, 500, 4,000, 25,500, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims, 39,000, Less: Claims Cancelled, (500), Add:Claims Outstanding, 3,000, Bonus in reduction of Premium, Surrenders, Annuities, , 41,500, 1,500, 9,000, 1,500, , Total, , 53,500, , Rs., , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent (40,000+10,000), Other Income (to be specified), Consideration for annuities granted, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (2,26,500-30,500-53,500), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), Illustration 5:, , Amount, Rs., 1,60,000, 50,000, 16,500, 2,26,500, 5,000, 25,500, ---30,500, 53,500, -53,500, 1,42,500, --1,42,500, 1,42,500

Page 19 :

From the following details, Prepare the Revenue Account in statutory form of the Star Assurance, Co., Ltd., for the year ending 31/03/2013., Particulars (188), Amount, 4, Claims Paid by Death, 1,42,000, 4, Claims paid by maturity, 70,200, 1, Premiums, 14,12,000, I, Consideration for Annuities granted, 1,64,000, 4, Annuities Paid, 1,06,900, 4, Bonus Paid in cash, 4,800, 3, Expenses in management, 63,800, 2, Commission, 19,140, I, Interest, Dividend & rents, 1,95,700, 4, Surrenders, 26,300, 4, Bonus in Reduction of premium, 1,800, App Dividend paid to Shareholders, 9,000, 6, Life Assurance Fund (1/4/2012), 30,45,000, -4, Claims Outstanding (1/4/2012), 22,000, +4, Claims Outstanding (31/3/2013), 16,000, Solution:, , Schedule:1 Premium, Particulars, , Rs., 14,12,000, , Premiums, Total, Schedule:2 Commission Expenses, Particulars, Commission, , 14,12,000, Rs., 19,140, , Total, 19,140, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Expenses in management, 63,800, Total, , Schedule: 4 Benefits Paid (Net), , 63,800

Page 20 :

Particulars, Claims Paid by Death, Less: Claims Outstanding (1/4/2012), Add: Claims Outstanding (31/3/2013), Claims paid by maturity, Annuities Paid, Bonus Paid in cash, Surrenders, Bonus in Reduction of premium, , Rs., 1,42,000, (22,000), 16,000, , Total, , 1,36,000, 70,200, 1,06,900, 4,800, 26,300, 1,800, 3,46,000, , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (17,71,700-82,940-3,46,000), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), , Illustration 6: (QP 2014 & 2017), , Amount, Rs., 14,12,000, 1,95,700, 1,64,000, 17,71,700, 19,140, 63,800, ---82,940, 3,46,000, , -3,46,000, 13,42,760, 9,000, -13,33,760, 13,42,760

Page 21 :

From the following details, Prepare the Revenue Account of National Life Assurance Company for, the year ending 31/03/2017., Particulars (2.83) sky, Amount, 6 Life Assurance Fund on 01/04/2016, 7,50,000, 1 Premium, 3,72,000, I, Interest, Dividend and Rent, 2,26,000, I, Consideration of Annuities granted, 12,500, I, Fines for Revival of lapsed policies, 200, 4 Claims paid, 42,500, E Bad Debts, 400, 3 Expenses of management, 35,000, 2 Commission, 16,000, 4 Bonus in Reduction of Premium, 500, 4 Annuities paid, 18,500, 4 Surrenders, 25,500, I, Surplus on Revaluation of Reversions Purchased, 1,500, E Income tax Paid, 32,000, 4 Bonus in Cash, 18,000, Solution:, Schedule:1 Premium, Particulars, Rs., Premium, 3,72,000, Total, Schedule:2 Commission Expenses, Particulars, Commission, , Total, , 3,72,000, Rs., 16,000, , 16,000, , Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Expenses of management, 35,000, Total, , Schedule: 4 Benefits Paid (Net), , 35,000

Page 22 :

Particulars, , Rs., 42,500, 500, 18,500, 25,500, 18,000, , Claims paid, Bonus in Reduction of Premium, Annuities paid, Surrenders, Bonus in Cash, Total, , 1,05,000, , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Fines for Revival of lapsed policies, Surplus on Revaluation of Reversions Purchased, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (6,12,200-83,400-1,05,500), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), , Illustration 7: (QP 2018), , Amount, Rs., 3,72,000, 2,26,000, 12,500, 200, 1,500, 6,12,200, 16,000, 35,000, 400, 32,000, 83,400, 1,05,000, , -1,05,500, 4,23,300, --4,23,300, 4,23,300

Page 23 :

From the following details, Prepare the Revenue Account of Blue Diamond Insurance Company for, the year ending 31/03/2014., Particulars, Amount, 1, Premium, 10,25,000, 4, Claims Paid, 1,08,500, I, Fines for revival of lapsed Policies, 1,250, E, Bad Debts, 1,800, I, Interest, Dividends etc., 4,54,000, I, Consideration of annuity granted, 32,300, 6, Life Assurance fund on 01/04/2013, 8,20,000, 3, Management Expenses, 85,000, 2, Commission, 24,200, 4, Bonus in Reduction of Premium, 6,300, 4, Annuities paid, 26,300, 4, Surrenders, 61,250, E, Income Tax Paid, 84,000, Solution:, Schedule:1 Premium, Particulars, , Rs., 10,25,000, , Premium, , Total, Schedule:2 Commission Expenses, Particulars, Commission, Total, , 10,25,000, , Rs., 24,200, 24,200, , Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management Expenses, 85,000, , Total, Schedule: 4 Benefits Paid (Net), , 85,000

Page 24 :

Particulars, Bonus in Reduction of Premium, Annuities paid, Surrenders, , Rs., 6,300, 26,300, 61,250, Total, , 93.850, , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2013, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Fines for revival of lapsed Policies, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (15,12,500-1,95,000-93,850), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), , Illustration 8:, , Amount, Rs., 10,25,000, 4,54,000, 32,300, 1,250, 15,12,500, 24,200, 85,000, 1,800, 84,000, -1,95,000, 93.850, , -93,850, 12,23,650, --12,23,650, 12,23,650

Page 25 :

From the following details, Prepare the Revenue Account of the ICICI Life Assurance Company on, 31/12/2010., Particulars (184*), Amount, 4, Claims Paid, 22,25,000, 4, Surrenders, 2,13,000, 1, Premium, 34,50,000, I, Consideration for annuities granted, 1,12,500, 4, Bonus in Cash, 3,96,000, 4, Bonus in reduction of premium, 4,940, 3, Expenses of management, 4,37,500, 2, Commission, 1,35,000, 12, Income tax on dividends, 2,96,250, I, Interest, Dividend & Rent, 18,75,000, I, Fines & Fees, 13,800, -1, Re-Insurance Premium, 3,125, 6, Balance of fund on 01/01/2010, 61,25,000, Note:, 3. Income tax on dividends is a TDS and will appear in Schedule 12 under Advances & Other, assets, as per the IRDA form., 4. Balance of fund will appear in schedule 6 on Reserves and surplus., , Solution:, , Schedule:1 Premium, Particulars, , Rs., 34,50,000, (3,125), , Premium, Less: Re-Insurance Premium, , Total, Schedule:2 Commission Expenses, Particulars, Commission, , Total, , 34,46,875, , Rs., 1,35,000, , 1,35,000, , Schedule:3 Operating Expenses related to Insurance Business

Page 26 :

Particulars, Expenses of management, , Rs., 4,37,500, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims Paid, Surrenders, Bonus in Cash, Bonus in reduction of premium, Total, , 4,37,500, , Rs., 22,25,000, 2,13,000, 3,96,000, 4,940, 28,38,940, , In the Books of Life Assurance Company, Revenue Account for the year ended 31/12/2010, Particulars, Schedule, No., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Fines & Fees, Total (A), Commission Expenses, 2, Operating expenses related to Insurance Business, 3, Provision for DD & Bad debts written off, Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, 4, Interim Bonuses Paid, Total (C), Surplus/Deficit (D)=(A-B-C), (54,48,175-5,72,500-28,38,940), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (to be specified), Balance being funds for future appropriation, Total (D), , Amount, Rs., 34,46,875, 18,75,000, 1,12,500, 13,800, 54,48,175, 1,35,000, 4,37,500, ---5,72,500, 28,38,940, , -28,,38,940, 20,36,735, --20,36,735, 20,36,735

Page 27 :

Balance Sheet as on 31/03/2011, Particulars, Schedule, No., Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, , 5, , Reserves & Surplus, , 6, , Borrowings, , 7, Total, , Applications of Funds (Assets), Investments (Shareholders), , 8, , Loans, , 9, , Fixed Assets, , 10, Total, , Current Assets (A), Cash & Bank balance, , 11, , Advances & Other Assets, , 12, Sub-total (A), , Current Liabilities (B), , 13, , Provisions, , 14, Sub-total (B), , Net Current Assets (C)= (A-B), Miscellaneous Expenditure, Can, Raju, Buy, Ice to, Lady, Friend, C, A, C, P, M, , Capital, Reserves & Surplus, Borrowings, Investment, Loans, Fixed Assets, Cash & Bank Balance, Advances, Current liability, Provisions, Miscellaneous Expenditure, , 15, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, , Amount, Rs.