Page 1 :

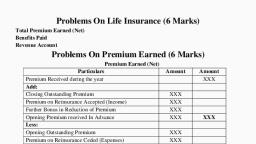

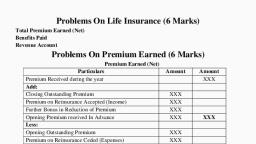

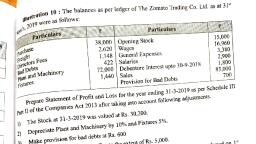

Preparation of Balance Sheet, Balance Sheet as on 31/03/2011, Particulars, Schedule, No., Sources of Funds (Liabilities), Shareholders’ Funds, , Amount, Rs., Easily remember the Insurance Schedules, , Share Capital, Reserves & Surplus, , 5, 6, , Borrowings, , 7, Total, , Applications of Funds (Assets), Investments (Shareholders), , 8, , Loans, Fixed Assets, , 9, 10, Total, , People, Can, Over, Breath, , Premium, Commission, Operating Expenses, Benefits Paid, , 1, 2, 3, 4, , Can, Raju, Buy, Ice, Lady, Friend, , Capital, Reserves & Surplus, Borrowings, Investment, Loans, Fixed Assets, , 5, 6, 7, 8, 9, 10, , C, A, C, P, M, , Cash & Bank Balance, Advances, Current liability, Provisions, Miscellaneous Expenditure, , 11, 12, 13, 14, 15, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 11, 12, , Sub-total (A), Current Liabilities (B), , 13, , Provisions, Sub-total (B), , 14, , Net Current Assets (C)= (A-B), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 15

Page 2 :

Preparation of Final Accounts, Illustration 1: (195), From the following Trail Balance was the Life Assurance, Company, Prepare Revenue Account and Balance Sheet as on, 31/03/2011, Particulars, Debit, Credit, (AE), (LI), 4, Claims, 1,15,200, 4, Surrenders, 3,300, 4, Bonus in Cash, 12,300, 3, Establishment Charges, 23,500, 3, Commission to agents, 48,500, 3, Medical fees, 10,100, 3, Director & Auditor fees, 24,000, 3, Stationary & Postage, 5,850, 3, Office Rent, 4,200, 3, Sundry Expenses, 800, 3, Bank Charges & Commission, 950, 8, Investment, 40,47,400, 2, Commission, 69,800, 12 Outstanding Premium, 23,200, 11 Cash @ Bank, 29,600, I, Fines & Fees received, 300, I, Interest, Dividend received, 2,25,300, 1, Premiums, 3,39,800, I, Consideration for annuities granted, 2,30,000, 13 Sundry Creditors, 18,000, 6, Life Fund in the 01/04/2010, 37,80,000, 9, Loans & Advances, 1,74,700, Total, 45,93,400 45,93,400, , Solution:, Schedule:1 Premium, Particulars, , Rs., 3,39,800, , Premiums, Total, Schedule:2 Commission Expenses, Particulars, Commission, , 3,39,800, Rs., 69,800, , Total, 69,800, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Establishment Charges, 23,500, Medical fees, 10,100, Director & Auditor fees, 24,000, Stationary & Postage, 5,850, Office Rent, 4,200, Sundry Expenses, 800, Bank Charges & Commission, 950, Commission to agents, 48,500, Total, 1,17,900, Schedule: 4 Benefits Paid (Net), Particulars, Rs., Claims, 1,15,200, Surrenders, 3,300, Bonus in Cash, 12,300, Total, , 1,30,800

Page 3 :

Schedule:5 Share Capital, Particulars, , Total, Schedule:6 Reserves & Surplus, Particulars, Life Fund in the 01/04/2010, 37,80,000, Add: Bal being funds for future app. 4,76,900, Total, Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, Investment, Total, Schedule: 9 Loans, Particulars, Loans & Advances, , Schedule:11 Cash & Bank Balances, Particulars, Cash @ Bank, , Rs., , Nil, Rs., 42,56,900, 42,56,900, Rs., , Nil, Rs., 40,47,400, 40,47,400, Rs., 1,74,700, , Total, , Schedule:10 Fixed Assets, Particulars, , Total, , Rs., 29,600, , 1,74,700, , Rs., , Nil, , Total, Schedule:12 Advances & Other Assets, Particulars, Outstanding Premium, Total, Schedule: 13 Current Liability’s, Particulars, Sundry Creditors, , Total, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , 29,600, Rs., 23,200, 23,200, Rs., 18,000, , 18,000, , Rs., , Nil, Rs., , Nil

Page 4 :

In the Books of Life Assurance Company, Form-A, Revenue Account for the year ended 31/3/2011, Particulars, Schedule Amount, No., Rs., Premium Earned – Net, 1, 3,39,800, Income From Investments, Interest, Dividends & Rent, 2,25,300, Other Income (to be specified), 2,30,000, Consideration for annuities granted, Fines & Fees received, 300, Total (A), 7,95,400, Commission Expenses, 2, 69,800, Operating expenses related to, 3, 1,17,900, Insurance Business, Provision for DD & Bad debts written, -off, Provision for Tax, -Provisions (other than taxation ), -Total (B), 1,87,700, 1,30,800, Benefits Paid, 4, Interim Bonuses Paid, -Total (C), 1,30,800, Surplus/Deficit (D)=(A-B-C), (7,95,400-1,87,700-130,800), 4,76,900, Appropriation, Transfer to Shareholders account, -Transfer to other Reserve (specified), -Bal being funds for future app., 4,76,900, Total (D), 4,76,900, , Form-A, Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , Nil, 42,56,900, , Borrowings, , 7, , Nil, 42,56,900, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 40,47,400, , Loans, Fixed Assets, , 9, 10, , 1,74,700, Nil, , Total, , Total, , 42,22,100, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 29,600, 23,200, , 11, 12, , Sub-total (A), Current Liabilities (B), , 52,800, 18,000, , 13, , Provisions, Sub-total (B), , Nil, 18,000, , Net Current Assets (C)= (A-B), (52,800-18,000), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 14, 34,800, 15, , Nil, 42,56,900

Page 5 :

Illustration 2: (206), From the following Trail Balance was the Life Assurance, Company, Prepare Revenue Account and Balance Sheet as on, 31/03/2011, Particulars, Debit, Credit, Rs., Rs., 9, Loan on Reversion, 80,000, 9, Loan on Policies, 6,40,000, 8, Municipal Securities, 4,00,000, 8, Government of India Securities, 6,40,000, 8, Foreign Government Securities, 1,60,000, 10 Freehold Building, 6,40,000, 4, Reversion (Bonus Paid in Cash), 4,00,000, 12 Outstanding Premium, 40,000, 12 O/S Dividend, Interest etc., 10,000, 4, Surrenders, 14,800, 11 Cash in hand, 40,000, 13 Claims admitted but not Paid, 8,000, 4, Claims on business in India, 1,60,000, 4, Claims on Business outside India, 8,000, 13 Creditors, 12,000, 6, Opening LIC Fund, 32,00,000, 3, Expenses of Management, 16,000, 1, Premium on business in India, 3,20,000, 1, Premium on business outside India, 68,800, 9, Mortgage on Property in India, 2,40,000, 9, Mortgage on Property Outside, 1,20,000, Total, 45,93,400 45,93,400, , Solution:, Schedule:1 Premium, Particulars, , Rs., , Total, Schedule:2 Commission Expenses, Particulars, , Rs., , Total, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., , Total, Schedule: 4 Benefits Paid (Net), Particulars, , Rs., , Total, , Schedule:5 Share Capital, Particulars, , Rs., , Total, Schedule:6 Reserves & Surplus, Particulars, , Rs., , Total

Page 6 :

Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, , Rs., , Rs., , Total, Schedule: 9 Loans, Particulars, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Rs., , Rs., , Rs., , Total, , Schedule:10 Fixed Assets, Particulars, , Rs., , Total, Schedule:11 Cash & Bank Balances, Particulars, , Rs., , Total, Schedule:12 Advances & Other Assets, Particulars, , Rs., , Total, Schedule: 13 Current Liability’s, Particulars, Total, , Rs., , 1. Reversions:, The bonus amount to be paid to the policyholders at time of, maturity may be invested for the time being by the insurance, company in order to earn more income. Such investment is, termed as reversion. It is an asset to the insurance Company and, is shown under the head investment Schedule No 8, 2. Reversionary Bonus:, Reversionary bonus is the bonus declared by the insurance, company. But it is neither paid in cash nor used to reduce the, premium due on the policy., 3. Surrenders:, It is the payment made by a life insurance company to the, insured on the premature termination of insurance contract. It, is an expense to the insurance Company.

Page 7 :

In the Books of Life Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedule Amount, No., Rs., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Total (A), Commission Expenses, 2, Operating expenses related to Insurance, 3, , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , Borrowings, , 7, Total, , Provision for DD & Bad debts written off, , Applications of Funds (Assets), Investments (Shareholders), , 8, , Provision for Tax, Provisions (other than taxation ), , Loans, Fixed Assets, , 9, 10, , Total (B), Benefits Paid, Interim Bonuses Paid, , Total, 4, , Total (C), Surplus/Deficit (D)=(A-B-C), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 11, 12, , Sub-total (A), Current Liabilities (B), , 13, , Provisions, Sub-total (B), , 14, , Net Current Assets (C)= (A-B), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 15, , Amount, Rs.

Page 8 :

Illustration 3: (Q P Dec-2019), From the following Trail Balance was the Life Assurance Society,, Prepare Revenue Account and Balance Sheet as on 31/03/2018, Particulars, Debit, Credit, (AE), (LI), 5 Share Capital, 12,00,000, 6 Funds for future approp. 1/4/2017, 8,00,000, 8 Government Securities, 10,00,000, I Profit on realization of assets, 2,000, 6 Investment Fluctuation A/c, 10,000, 4 Claims under policies by Death, 60,000, 4 Claims under policies by Maturities, 1,00,000, 9 Loans on Mortgage, 5,60,000, 9 Loans on Policies, 3,00,000, 10 Freehold Property & Furniture, 1,03,000, 12 Agents balances, 3,600, 13 Sundry Creditors, 5,600, 12 Outstanding Premium, 24,000, 2 Commission, 25,000, 12 Interest Accrued but not due, 3,000, 1 Premium, 2,80,000, 13 Claims admitted but not paid, 6,000, 4 Surrenders, 20,000, I Consideration for annuities granted, 50,000, I Interest, Dividend, Rent, 70,000, 3 Depreciation of Furniture, 3,000, 3 Administration & general expenses, 54,000, 11 Cash at Bank, 1,68,000, Total, 24,23,600 24,23,600, , Solution:, Schedule:1 Premium, Particulars, , Rs., 2,80,000, , Premium, Total, Schedule:2 Commission Expenses, Particulars, Commission, , 2,80,000, Rs., 25,000, , Total, 25,000, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Depreciation of Furniture, 3,000, Administration & general expenses, 54,000, Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims under policies by Death, Claims under policies by Maturities, Surrenders, Total, , 57,000, Rs., 60,000, 1,00,000, 20,000, 1,80,000

Page 9 :

Schedule:5 Share Capital, Particulars, Share Capital, , Rs., 12,00,000, , Total, Schedule:6 Reserves & Surplus, Particulars, Funds for future approp. 1/4/2017, 8,00,000, Add; Bal being funds for future app. 1,40,000, Investment Fluctuation A/c, Total, Schedule:7 Borrowings, Particulars, , 12,00,000, , Total, Schedule:8 Investments, Particulars, Government Securities, , Nil, Rs., 10,00,000, , Total, , 10,00,000, , Schedule: 9 Loans, Particulars, Loans on Mortgage, Loans on Policies, , Rs., 9,40,000, 10,000, 9,50,000, Rs., , Rs., 5,60,000, 3,00,000, , Total, , Schedule:10 Fixed Assets, Particulars, Freehold Property & Furniture, Total, , 8,60,000, , Rs., 1,03,000, 1,03,000, , Schedule:11 Cash & Bank Balances, Particulars, Cash at Bank, Total, Schedule:12 Advances & Other Assets, Particulars, Agents balances, Outstanding Premium, Interest Accrued but not due, Total, Schedule: 13 Current Liability’s, Particulars, Sundry Creditors, Claims admitted but not paid, , Total, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Rs., 1,68,000, 1,68,000, Rs., 3,600, 24,000, 3,000, 30,600, Rs., 5,600, 6,000, , 11,600, , Rs., , Nil, Rs., , Nil

Page 10 :

In the Books of Life Assurance Society, Revenue Account for the year ended 31/3/2018, Particulars, Schedule Amount, No., Rs., Premium Earned – Net, 1, 2,80,000, Income From Investments, Interest, Dividends & Rent, 70,000, Other Income (to be specified), Consideration for annuities granted, 50,000, Profit on realization of assets, 2,000, Total (A), 4,02,000, Commission Expenses, 2, 25,000, Operating expenses related to Insurance, 3, 57,000, Provision for DD & Bad debts written off, , --, , Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (4,02,000-82,000-1,80,000), Appropriation, Transfer to Shareholders account, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , ---82,000, 1,80,000, -1,80,000, 1,40,000, --1,40,000, 1,40,000, , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 12,00,000, 9,50,000, , Borrowings, , 7, , Nil, , Total, , 21,50,000, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 10,00,000, , Loans, Fixed Assets, , 9, 10, , 8,60,000, 1,03,000, , Total, , 19,63,000, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 1,68,000, 30,600, , Sub-total (A), , 1,98,600, , Current Liabilities (B), , 11,600, , 13, , Provisions, Sub-total (B), , Nil, 11,600, , 14, , Net Current Assets (C)= (A-B), (1,98,600-11,600), Miscellaneous Expenditure, Total Assets (8+9+10+ NCA), , 11, 12, , 15, , 1,87,000, Nil, 21,50,000

Page 11 :

With Adjustment, Illustration :4 (221), From the following Trail Balance was the Oriental Life Assurance, Company, as on 31/03/2013, Particulars, Debit, Credit, (AE), (LI), 5 Share Capital, 3,20,000, 6 Life Assurance Fund as on 01/04/2012, 59,44,600, Ap Dividends Paid, 30,000, I Interest & Dividend received, 2,25,400, 1* Premium Received, 2,03,000, 4 Surrenders, 14,000, 4* Claims Paid, 3,94,000, 2 Commission Paid, 18,600, 3* Management Expenses, 64,600, 9 Mortgages in India, 9,84,600, 12 Agents Balances, 18,600, 10 Freehold Premises, 80,000, 8 Investment, 46,10,000, 9 Loan against companies policies, 3,47,000, 11 Cash on deposit, 54,000, 11 Cash in hand, 14,600, 4 Bonus to Policy Holders, 63,000, Total, 66,93,000 66,93,000, Adjustment:, a. Claims admitted but not paid Rs. 18,600. (+4 & 13), b. Management expenses due Rs. 400. (+3 & 13), c. Interest accrued Rs. 38,600. (Income & 12), d. Premiums Outstanding Rs. 24,000. (+1 & 12), , Solution:, Schedule:1 Premium, Particulars, Premium Received, 2,03,000, Add: Premiums Outstanding Rs., 24,000, , Total, Schedule:2 Commission Expenses, Particulars, Commission Paid, , Rs., 2,27,000, , 2,27,000, Rs., 18,600, , Total, 18,600, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management Expenses, 64,600, Add: Management expenses due, 400, 65,000, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Surrenders, Claims Paid, Add: Claims admitted but not paid, Bonus to Policy Holders, , 3,94,000, 18,600, , Total, , 65,000, Rs., 14,000, 4,12,600, 63,000, 4,89,600

Page 12 :

Schedule:5 Share Capital, Particulars, Share Capital, Total, Schedule:6 Reserves & Surplus, Particulars, Life Assurance Fund as on 01/04/, 59,44,600, Less; Deficit trs to future Apporo, 1,12,200, Total, Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, Investment, , Rs., 3,20,000, 3,20,000, Rs., 58,32,400, , Rs., , Nil, , Schedule:11 Cash & Bank Balances, Particulars, Cash on deposit, Cash in hand, Total, Schedule:12 Advances & Other Assets, Particulars, Agents Balances, Interest accrued, Premiums Outstanding, Total, Schedule: 13 Current Liability’s, Particulars, Claims admitted but not paid, Management expenses due, , Schedule: 9 Loans, Particulars, Mortgages in India, Loan against companies policies, , 46,10,000, Rs., 9,84,600, 3,47,000, , Total, , Schedule:10 Fixed Assets, Particulars, Freehold Premises, Total, , Rs., 18,600, 38,600, 24,000, 81,200, Rs., 18,600, 400, , Rs., 46,10,000, Total, , Total, , Rs., 54,000, 14,600, 68,600, , 13,31,600, , Rs., 80,000, 80,000, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , 19,000, , Rs., , Nil, Rs., , Nil

Page 13 :

In the Books of Oriental Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedul Amount, e, Rs., No., Premium Earned – Net, 1, 2,27,000, Income From Investments, 2,64,000, Interest, Dividends (38,600+2,25,400), Other Income (to be specified), Consideration for annuities granted, -Total (A), 4,91,000, Commission Expenses, 2, 18,600, Operating expenses related to Insurance, 3, 65,000, Provision for DD & Bad debts written off, , Total (B), 4, Total (C), Surplus/Deficit (D)=(A-B-C), (4,91,000-83,600-4,89,600), Appropriation, Transfer to Shareholders dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , --83,600, 4,89,600, -4,89,600, -82,200, , 30,000, -1,12,200, -82,200, , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 3,20,000, 58,32,400, , Borrowings, , 7, , Nil, 61,52,400, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 46,10,000, , Loans, Fixed Assets, , 9, 10, , 13,31,600, 80,000, , Total, , --, , Provision for Tax, Provisions (other than taxation ), Benefits Paid, Interim Bonuses Paid, , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , Total, , 60,21,600, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 68,600, 81,200, , Sub-total (A), , 1,49,800, , Current Liabilities (B), , 19,000, , 13, , Provisions, Sub-total (B), , Nil, 19,000, , 14, , Net Current Assets (C)= (A-B), (1,49,800-19,000), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 11, 12, , 1,30,800, 15, , NIl, 61,52,400

Page 14 :

(QP Dec 2006, Dec 2010 Double figure Dec 2007, 2009, 2014, 2017), , Illustration :5 (216), From the following Trail Balance was the National Life Assurance, Company, as on 31/03/2015, Particulars, Debit, Credit, (AE), (LI), 5 Share Capital (10 each), 1,60,000, 6 Life Assurance Fund as on, 29,72,300, 01/04/2014, Ap Dividends Paid, 15,000, 4 Bonus to Policy holders, 31,500, 1* Premium Received, 1,01,500, 4* Claims Paid, 1,97,000, 2 Commission paid, 9,300, 3* Management expenses, 32,300, 9 Mortgage in India, 4,92,200, I Interest, Dividend and rent, 1,12,700, 12 Agents balances, 9,300, 10 Free hold premises, 40,000, 8 Investment, 23,05,000, 9 Loan against companies’ policies, 1,73,600, 11 Cash on deposit, 27,000, 11 Cash in hand & on Current A/c, 7,300, 4 Surrenders, 7,000, Total, 33,46,500 33,46,500, You are required to prepare Company’s Revenue A/c for the year, ended 31/03/2015 and its Balance Sheet as on that date., a. Claims admitted but not paid Rs. 9,300. (+4 & 13), b. Management expenses due Rs. 200. (+3 & 13), c. Interest accrued Rs. 19,300. (Income & 12), d. Premiums Outstanding Rs. 12,000. (+1 & 12), , Solution:, Schedule:1 Premium, Particulars, Premium Received, 1,01,500, Add: Premiums Outstanding, 12,000, , Total, Schedule:2 Commission Expenses, Particulars, Commission paid, , Rs., 1,13,500, , 1,13,500, Rs., 9,300, , Total, 9,300, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management expenses, 32,300, Add: Management expenses due, 200, 32,500, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Bonus to Policy holders, Claims Paid, 1,97,000, Add: Claims admitted but not paid, 9,300, Surrenders, , Total, , 32,500, Rs., 31,500, 2,06,300, 7,000, , 2,44,800

Page 15 :

Schedule:5 Share Capital, Particulars, Share Capital (10 each), Total, Schedule:6 Reserves & Surplus, Particulars, Life Assurance Fund as on, 29,72,300, Less: Bal of approp, -56,100, Total, Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, Investment, Total, Schedule: 9 Loans, Particulars, , Rs., 1,60,000, 1,60,000, Rs., 29,16,200, 29,16,200, Rs., , Nil, Rs., 23,05,000, 23,05,000, Rs., 4,92,200, 1,73,600, , Mortgage in India, Loan against companies’ policies, , Total, , Schedule:10 Fixed Assets, Particulars, Free hold premises, Total, , 6,65,800, , Rs., 40,000, 40,000, , Schedule:11 Cash & Bank Balances, Particulars, Cash on deposit, Cash in hand & on Current A/c, Total, Schedule:12 Advances & Other Assets, Particulars, Agents balances, Interest Accrued, Premium Outstanding, Total, Schedule: 13 Current Liability’s, Particulars, Claims admitted but not paid, Management expenses due, , Total, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Rs., 27,000, 7,300, 34,300, Rs., 9,300, 19,300, 12,000, 40,600, Rs., 9,300, 200, , 9,500, , Rs., , Nil, Rs., , Nil

Page 16 :

In the Books of National Assurance Company, Revenue Account for the year ended 31/3/2015, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 1,13,500, Income From Investments, Interest, Dividends (1,12,700+19,300), 1,32,000, Other Income (to be specified), Consideration for annuities granted, -Total (A), 2,45,500, Commission Expenses, 2, 9,300, Operating expenses related to Insurance, 3, 32,500, Provision for DD & Bad debts written off, , Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (2,45,500-41,800-2,44,800), Appropriation, Transfer to Shareholders Dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 1,60,000, 29,16,200, , Borrowings, , 7, , Nil, 30,76,200, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 23,05,000, , --41,800, 2,44,800, -2,44,800, , Loans, Fixed Assets, , 9, 10, , 6,65,800, 40,000, , Cash & Bank balance, Advances & Other Assets, , 34,300, 40,600, , -41,100, , Sub-total (A), , 74,900, , 15,000, --56,100, -41,100, , Current Liabilities (B), , 9,500, , 13, , Provisions, Sub-total (B), , Nil, 9,500, , 14, , --, , Provision for Tax, Provisions (other than taxation ), , Balance Sheet as on 31/03/2015, Particulars, Schedule, No., , Total, , Total, , 30,10,800, , Current Assets (A), , Net Current Assets (C)= (A-B), (74,900-9,500), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 11, 12, , 65,400, 15, , Nil, 30,76,200

Page 17 :

Illustration :6 (QP Nov/Dec 2014), From the following Trail Balance was the Green Life Assurance, Company, as on 31/03/2014, Particulars, Debit, Credit, (AE), (LI), 5, Share Capital (10 each), 2,00,000, 6, Life Assurance Fund as on 01/04/2013, 30,00,000, 1* Premium received, 3,20,000, I, Interest, Dividend, Rent, 2,35,000, Ap Dividend Paid, 20,000, 3* Auditors Fees, 32,000, 9, Mortgage in India, 4,93,000, 12 Agents balances, 10,000, 10 Freehold premises, 50,000, 4, Bonus to Policy holders, 30,000, 4* Claims Paid, 2,00,000, 8, Investment, 26,80,000, 9, Loan against Companies Policies, 1,73,000, 11 Cash on Deposits, 27,000, 11 Cash in hand & on Current A/c, 20,000, 4, Surrenders, 10,000, 2, Commission Paid, 10,000, Total, 37,55,000 37,55,000, You are required to prepare Company’s Revenue A/c for the year, ended 31/03/2014 and its Balance Sheet as on that date., a. Claims admitted but not paid Rs. 9,300. (+4 & 13), b. Management expenses due Rs. 200. (+3 & 13), c. Interest accrued Rs. 19,300. (Income & 12), d. Premiums Outstanding Rs. 12,000. (+1 & 12), e. Deprecation on Freehold premises @ 10% (-10 & 3), , Solution:, Schedule:1 Premium, Particulars, Premium received, 3,20,000, Add: outstanding Premium, 12,000, , Total, Schedule:2 Commission Expenses, Particulars, Commission Paid, , Rs., 3,32,000, , 3,32,000, Rs., 10,000, , Total, 10,000, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Auditors Fees, 32,000, Add: Outstanding Exp, 200, 32,200, Depreciation of FHP, 5,000, , Total, Schedule: 4 Benefits Paid (Net), Particulars, Bonus to Policy holders, Claims Paid, 2,00,000, Add; Outstanding Claim, 9,300, Surrenders, , Total, , 37,200, Rs., 30,000, 2,09,300, 10,000, , 2,49,300

Page 18 :

Schedule:5 Share Capital, Particulars, Share Capital (10 each), Total, Schedule:6 Reserves & Surplus, Particulars, Life Assurance Fund as on, 30,00,000, Add: Bal of Future Appreciation, 2,69,800, Total, Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, Investment, , Rs., 2,00,000, 2,00,000, Rs., 32,69,800, 32,69,800, Rs., , Nil, Rs., 26,80,000, , Schedule:11 Cash & Bank Balances, Particulars, Cash on Deposits, Cash in hand & on Current A/c, Total, Schedule:12 Advances & Other Assets, Particulars, Agents balances, Interest Accrued, Outstanding Premium, Total, Schedule: 13 Current Liability’s, Particulars, Outstanding Claim, Outstanding Expenses, , Total, , Total, Schedule: 9 Loans, Particulars, , 26,80,000, Rs., 4,93,000, 1,73,000, , Mortgage in India, Loan against Companies Policies, , Total, , Schedule:10 Fixed Assets, Particulars, Freehold premises, 50,000, Lee: Dep @ 10%, 5,000, Total, , 6,66,000, , Rs., 45,000, 45,000, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Rs., 27,000, 20,000, 47,000, Rs., 10,000, 19,300, 12,000, 41,300, Rs., 9,300, 200, , 9,500, , Rs., , Nil, Rs., , Nil

Page 19 :

In the Books of Green Life Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 3,32,000, Income From Investments, Interest, Dividends & Rent, 2,35,000, Interest Accrued, 19,300, Other Income (to be specified), -Consideration for annuities granted, -Total (A), 5,86,300, Commission Expenses, 2, 10,000, Operating expenses related to Insurance, 3, 37,200, Provision for DD & Bad debts written off, , Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (5,86,300-47,200-2,49,300), Appropriation, Transfer to Shareholders Dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 2,00,000, 32,69,800, , Borrowings, , 7, , Nil, 34,69,800, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 26,80,000, , --47,200, 2,49,300, -2,49,300, , Loans, Fixed Assets, , 9, 10, , 6,66,000, 45,000, , Cash & Bank balance, Advances & Other Assets, , 47,000, 41,300, , 11, 12, , 2,89,800, , Sub-total (A), Current Liabilities (B), , 88,300, 9,500, , 13, , Provisions, Sub-total (B), , Nil, 9,500, , --, , Provision for Tax, Provisions (other than taxation ), , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , 20,000, 2,69,800, 2,89,800, , Total, , Total, , 33,91,000, , Current Assets (A), , Net Current Assets (C)= (A-B), (88,300-9,500), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 14, 78,800, 15, , Nil, 34,69,800

Page 20 :

Illustration :7 (QP Nov/Dec 2015), From the following Trail Balance was the Vivek Life Assurance, Company, as on 31/03/2015., Particulars, Debit, Credit, (AE), (LI), 5, Share Capital (10 each), 1,00,000, 6, Life Assurance Fund as on, 29,72,300, 01/04/2014, 4* Bonus to Policy holders, 31,500, 1* Premium received, 1,61,500, 4* Claims Paid, 1,97,000, 2, Commission Paid, 9,300, 3* Management expenses, 32,300, 9, Mortgage in India, 4,92,200, I, Interest, Dividend, Rent, 1,12,700, 12 Agents balances, 9,300, 10 Freehold premises, 40,000, 8, Investment, 23,05,000, 9, Loan against Companies Policies, 1,73,600, 11 Cash on Deposits, 27,000, 11 Cash in hand & on Current A/c, 7,300, 4, Surrenders, 7,000, Ap Dividend Paid, 15,000, Total, 33,46,500 33,46,500, You are required to prepare Company’s Final Accounts:, a. Claims admitted but not paid Rs. 9,000. (+4 & 13), b. Management expenses due Rs. 2000. (+3 & 13), c. Interest accrued Rs. 19,300. (Income & 12), d. Premiums Outstanding Rs. 10,000. (+1 & 12), e. Bonus utilized in Reduction of Premium Rs. 2,000. (1 & +4), f. Claims Covered under Reinsurance Rs. 2,300. (-4 & 12), , Solution:, Schedule:1 Premium, Particulars, Premium received, 1,61,500, Add: Premiums Outstanding Rs., 10,000, Bonus utilized in Reduction of Premium, Total, Schedule:2 Commission Expenses, Particulars, Commission Paid, , Rs., 1,71,500, 2,000, 1,73,500, Rs., 9,300, , Total, 9,300, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management expenses, 32,300, Add: Management expenses due, 2,000, 34,300, Total, 34,300, Schedule: 4 Benefits Paid (Net), Particulars, Rs., Bonus to Policy holders, 31,500, Add: Bonus utilized in Reduction, 2,000., 33,500, Claims Paid, 1,97,000, Add: Claims admitted but not paid, 9,000, Lee: Claims Covered under Reinsurance (2,300), 2,03,700, Surrenders, 7,000, Total, , 2,44,200, , a. Claims on Reinsurance Ceded:, This is the amount received from other insurance company against, reinsurance ceded. This is an income to the insurance company., b. Bonus Reduction in Premium:, It refers to the bonus which is payable in cash but utilized by the, policyholders to adjust the premium due from them.

Page 21 :

Schedule:5 Share Capital, Particulars, Share Capital (10 each), Total, Schedule:6 Reserves & Surplus, Particulars, Life Assurance Fund as on, 29,72,300, Add:Bal being funds for future app., 2,700, Total, Schedule:7 Borrowings, Particulars, , Total, Schedule:8 Investments, Particulars, Investment, , Rs., 1,00,000, 1,00,000, Rs., 29,75,000, 29,75,000, Rs., , Nil, , Schedule:11 Cash & Bank Balances, Particulars, Cash on Deposits, Cash in hand & on Current A/c, Total, Schedule:12 Advances & Other Assets, Particulars, Agents balances, Interest accrued, Premiums Outstanding, Claims Covered under Reinsurance, Total, Schedule: 13 Current Liability’s, Particulars, Claims admitted but not paid, Management expenses due, , Schedule: 9 Loans, Particulars, , Total, , Schedule:10 Fixed Assets, Particulars, Freehold premises, , 23,05,000, Rs., 4,92,200, 1,73,600, , Mortgage in India, Loan against Companies Policies, , Rs., 9,300, 19,300, 10,000, 2,300, 40,900, Rs., 9,000, 2,000, , Rs., 23,05,000, Total, , Total, , Rs., 27,000, 7,300, 34,300, , 6,65,800, , Rs., 40,000, , Total 40,000, , Schedule:14 Provisions, Particulars, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , 11,000, , Rs., , Nil, Rs., , Nil

Page 22 :

In the Books of Vivek Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 1,73,500, Income From Investments, Interest, Dividends & Rent, 1,12,700, Interest accrued, 19,300, Other Income (to be specified), Consideration for annuities granted, -Total (A), 3,05,500, Commission Expenses, 2, 9,300, Operating expenses related to Insurance, 3, 34,300, Provision for DD & Bad debts written off, , --, , Provision for Tax, Provisions (other than taxation ), Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (3,05,500-43,600-2,44,200), Appropriation, Transfer to Shareholders dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , --43,600, 2,44,200, -2,44,200, 17,700, , 15,000, -2,700, 17,700, , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 1,00,000, 29,75,000, , Borrowings, , 7, , Nil, 30,75,000, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 23,05,000, , Loans, Fixed Assets, , 9, 10, , 6,65,800, 40,000, , Total, , Total, , 30,10,800, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 34,300, 40,900, , Sub-total (A), , 75,200, , Current Liabilities (B), , 11,000, , 13, , Provisions, Sub-total (B), , Nil, 11,000, , 14, , Net Current Assets (C)= (A-B), (75,200-11,000), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 11, 12, , 15, , 64,200, Nil, 30,75,000

Page 23 :

Illustration :8 (160A), From the following Trail Balance was the National Life Assurance, Company, as on 31/03/2016., Particulars, Debit, Credit, (AE), (LI), Ap Dividend Paid, 15,000, 4* Bonus in Reduction of Premium, 31,500, 4* Claims Paid, 1,97,000, 2 Commission, 9,300, 3* Management Expenses, 32,300, 9 Mortgage Expenses, 4,92,200, 12 Agents Balances, 9,300, 10 Freehold premises, 40,000, 8 Investment, 23.05.000, 9 Loans on policies, 1,73,600, 11 Cash on Deposit, 27,000, 11 Cash on Current A/c, 7,300, 4 Surrenders, 7,000, 3 Medical Fees, 7,000, 4 Annuities, 10,000, 5 Paid Up Capital 10,000 of Rs 10 each, 1,00,000, 6 Life Insurance Fund Bal 1/4/2016, 29,72,300, 1* Premium Less Reinsurance Premium, 1,61,500, -4 Outstanding Claims (1/4/2016), 7,000, I Interest, Dividend and Rent, 1,12,700, I Consideration for Annuities granted, 10,000, Total, 33,63,500 33,63,500, You are required to prepare Company’s Final Accounts:, a. Claims Outstanding Rs. 10,000. (+4 & 13), , b. Further bonus in Reduction of Premium Rs. 5,000. (+1 &, +4), c. Premiums Outstanding Rs. 5,000. (+1 & 12), d. Claims Covered under Reinsurance Rs. 80,000. (-4 & 12), e. Management expenses due Rs. 30,000. (+3 & 13), Solution:, Schedule:1 Premium, Particulars, Premium Less Reinsurance Premium 1,61,500, Add: Premiums Outstanding, 5,000, Further bonus in Reduction of Premium, Total, Schedule:2 Commission Expenses, Particulars, Commission, , Rs., 1,66,500, 5,000, 1,71,500, Rs., 9,300, , Total, 9,300, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management Expenses, 32,300, Add: Management expenses due, 30,000, 62,300, Medical Fees, 7,000, Total, 69,300

Page 24 :

Schedule: 4 Benefits Paid (Net), Particulars, Bonus in Reduction of Premium, 31,500, Add: Further bonus in Reduction, 5,000, Claims Paid, 1,97,000, Less: Outstanding Claims (1/4/2016), (7,000), Add; Claims Outstanding, 10,000, Less: Claims Covered under Reinsuran (80,000), Surrenders, Annuities, Total, , Schedule:5 Share Capital, Particulars, Paid Up Capital 10,000 of Rs 10 each, Total, Schedule:6 Reserves & Surplus, Particulars, Life Insurance Fund Bal 1/4/2016, 29,72,300, Bal being funds for future app., 27,100, Total, Schedule:7 Borrowings, Particulars, Total, Schedule:8 Investments, Particulars, Investment, Total, , Rs., 36,500, , Schedule: 9 Loans, Particulars, Mortgage Expenses, Loans on policies, , Rs., 4,92,200, 1,73,600, , Total, , 1,20,000, 7,000, 10,000, , Schedule:10 Fixed Assets, Particulars, Freehold premises, , 6,65,800, , Rs., 40,000, , 1,73,500, , Rs., 1,00,000, 1,00,000, Rs., 29,99,400, 29,99,400, Rs., Nil, Rs., 23.05.000, 23,05,000, , Total, Schedule:11 Cash & Bank Balances, Particulars, Cash on Deposit, Cash on Current A/c, Total, Schedule:12 Advances & Other Assets, Particulars, Agents Balances, Premiums Outstanding, Claims Covered under Reinsurance, Total, Schedule: 13 Current Liability’s, Particulars, Claims Outstanding, Management expenses due, , Total, , 40,000, Rs., 27,000, 7,300, 34,300, Rs., 9,300, 5,000, 80,000, 94,300, Rs., 10,000, 30,000, , 40,000

Page 25 :

In the Books of National Life Assurance Company, Revenue Account for the year ended 31/3/2016, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 1,71,500, Income From Investments, Interest, Dividends & Rent, 1,12,700, Other Income (to be specified), Consideration for annuities granted, 10,000, Total (A), 2,94,200, Commission Expenses, 2, 9,300, Operating expenses related to Insurance, 3, 69,300, Provision for DD & Bad debts written off, , Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (2,94,200-78,600-1,73,500), Appropriation, Transfer to Shareholders divined, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 1,00,000, 29,99,400, , Borrowings, , 7, , Nil, 30,99,400, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 23,05,000, , --78,600, 1,73,500, -1,73,500, , Loans, Fixed Assets, , 9, 10, , 6,65,800, 40,000, , Cash & Bank balance, Advances & Other Assets, , 34,300, 94,300, , 42,100, , Sub-total (A), , 1,28,600, , 15,000, -27,100, 42,100, , Current Liabilities (B), , 40,000, , --, , Provision for Tax, Provisions (other than taxation ), , Balance Sheet as on 31/03/2016, Particulars, Schedule, No., , Total, , Total, , 30,10,800, , Current Assets (A), , Provisions, Sub-total (B), , nil, 40,000, , Net Current Assets (C)= (A-B), (1,28,600-40,000), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 11, 12, , 13, 14, , 15, , 88,600, Nil, 30,99,400

Page 26 :

Illustration :9 (QP Nov/Dec 2018) (166A), From the following Trail Balance was the Suraksha Life, Assurance Company, as on 31/03/2016, Particulars, Rs., 6, 1, 3, I, Ap, I, 4, 12, 13, 8, 9, 10, 10, 4, 4, 2, I, -I, 4, 4, 15, 13, 12, 5, 10, 9, , Life Assurance Fund as on 01/04/2015, Premium received, Management expenses, Consideration for annuity’s granted, Dividend Paid, Fines, Annuities, Stamps on hand, Annuities due but not paid, Govt. Securities, Mortgages, Freehold Premises, House property, Claims by Death, Claims by Maturity, Commission, Interest, Dividends and Rent, Income Tax on Interest, Surrenders, Bonus paid in Cash, Preliminary expenses, Claims admitted but not Paid, O/S Premium, Share Capital, Furniture, Loans on company policies, , 14,70,562, 2,10,572, 19,890, 10,620, 20,000, 92, 29,420, 400, 22,380, 8,70,890, 3,09,110, 5,00,000, 1,00,000, 79,980, 36,420, 26,451, 55,461, 3,060, 21,860, 9,450, 284, 80,034, 2,500, 4,00,000, 20,000, 2,00,000, , Prepare Revenue A/c and Balance Sheet after taking into the, following:, a. Claims covered under Reinsurance Rs. 20,000. (-4 & 12), b. Further Claims intimated Rs. 4,500. (+4 & 13), c. Further Bonus utilized in Reduction of Premium Rs. 5,500., (+1 & +4), d. Reinsurance Premium Rs. 6,000. (-1 & 13), e. Premium Outstanding Rs. 8,000. (+1 & 12), Solution:, Schedule:1 Premium, Particulars, Premium received, 2,10,572, Less; Reinsurance Premium, (6,000), Add: O/S Premium, 8,000, Further Bonus utilized in Reduction of Premium, Total, Schedule:2 Commission Expenses, Particulars, Commission, , Rs., , 2,12,572, 5,500, 2,18,070, Rs., 26,451, , Total, 26,451, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management expenses, 19,890, Total, , 19,890

Page 27 :

Schedule: 4 Benefits Paid (Net), Particulars, Annuities, Claims by Death, Claims by Maturity, Less: Claims covered Reinsurance, Add: Further Claims intimated, Surrenders, Bonus paid in Cash, Add; Further Bonus of Premium, , 79,980, 36,420, (20,000), 4,500, 9,450, 5,500, Total, , Schedule:5 Share Capital, Particulars, Share Capital, Total, Schedule:6 Reserves & Surplus, Particulars, Life Assurance Fund as on 01/04/2015, Add: Bal being funds for future app, Total, Schedule:7 Borrowings, Particulars, Total, Schedule:8 Investments, Particulars, Govt. Securities, Total, , Rs., 29,420, , Schedule: 9 Loans, Particulars, , Rs., 3,09,110, 2,00,000, , Mortgages, Loans on company policies, Total, , 1,00,900, 21,860, 14,950, 1,67,130, , Rs., 4,00,000, 4,00,000, Rs., 14,70,562, 47,712, 15,18,274, Rs., Nil, Rs., 8,70,890, 8,70,890, , Schedule:10 Fixed Assets, Particulars, Freehold Premises, House property, Furniture, Total, Schedule:11 Cash & Bank Balances, Particulars, Total, Schedule:12 Advances & Other Assets, Particulars, Stamps on hand, O/S Premium, Claims covered under Reinsurance, O/S Premium, Total, Schedule: 13 Current Liability’s, Particulars, Annuities due but not paid, Claims admitted but not Paid, Further Claims intimated, Reinsurance Premium, Total, , 5,09,110, , Rs., 5,00,000, 1,00,000, 20,000, 6,20,000, Rs., Nil, Rs., 400, 2,500, 20,000, 8,000, 30,900, Rs., 22,380, 80,034, 4,500, 6,000, 1,12,910

Page 28 :

Schedule:14 Provisions, Particulars, Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary expenses, Total, , Nil, , Benefits Paid, , 284, 284, , 46,341, 4, , Total (C), Surplus/Deficit (D)=(A-B-C), (2,81,183-46,341-1,67,130), Appropriation, Transfer to Shareholders Dividend, Bal being funds for future app., Total (D), , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, , Rs., , In the Books of Suraksha Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 2,18,070, Income From Investments, Interest, Dividends & Rent (55,461-3,060), 52,401, Other Income (to be specified), Consideration for annuities granted, 10,620, fines, 92, Total (A), 2,81,183, Commission Expenses, 2, 26,451, Operating expenses related to Insurance, 3, 19,890, Total (B), , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., , Rs., , 1,67,130, , 1,67,130, 67,712, 20,000, 47,712, 67,712, , Share Capital, Reserves & Surplus, , 5, 6, , 4,00,000, 15,18,274, , Borrowings, , 7, , Nil, 19,18,274, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 8,70,890, , Loans, Fixed Assets, , 9, 10, , 5,09,110, , Total, , Total, , 6,20,000, 20,00,000, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , Nil, 30,900, , Sub-total (A), , 30,900, , Current Liabilities (B), , 1,12,910, , 13, , Nil, , 14, , Provisions, Sub-total (B), , 11, 12, , 1,12,910, , Net Current Assets (C)= (A-B), (30,900-1,12,910), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 15, , -82,010, 284, 19,18,274

Page 29 :

Illustration :10 (QP Nov/Dec 2016) (sky), From the following Trail Balance was the Suraksha Life, Assurance Company, as on 31/03/2016, Particulars, Rs., 6, 1, 3, I, Ap, I, 4, 4, 4, 2, I, -I, 4, 4, 15, 13, 12, 12, 13, 8, 9, 10, 10, 5, 10, 9, , Life Assurance Fund as on 01/04/2015, Premium received, Management expenses, Consideration for annuity’s granted, Dividend Paid, Fines, Annuities, Claims by Death, Claims by Maturity, Commission, Interest, Dividend and Rent, Income tax on Interest, Surrenders, Bonus paid in Cash, Preliminary expenses, Claims admitted but not paid, O/S Premium, Stamps on hand, Annuities due but not paid, Government Securities, Mortgage loan, Freehold premises, Household properties, Share Capital, Furniture, Loans on company policies, , 14,70,562, 2,10,572, 19,890, 10,620, 20,000, 92, 29,420, 79,980, 36,420, 26,451, 55,461, 3,060, 21,860, 9,450, 200, 80,034, 2,500, 400, 22,380, 8,70,890, 3,09,110, 5,00,000, 1,00,000, 4,50,000, 20,000, 2,50,000, , Prepare Revenue A/c and Balance Sheet after taking into the, following:, a. Claims Intimated (O/S) further Rs. 5,000. (+4 & 13), b. Claims covered Reinsurance Rs. 25,000. (-4 & 12), Solution:, Schedule:1 Premium, Particulars, , Rs., , Total, Schedule:2 Commission Expenses, Particulars, , Rs., , Total, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., , Total, Schedule: 4 Benefits Paid (Net), Particulars, , Total, , Rs.

Page 30 :

Schedule:5 Share Capital, Particulars, , Total, Schedule:6 Reserves & Surplus, Particulars, , Rs., , Schedule:11 Cash & Bank Balances, Particulars, , Rs., , Rs., , Total, Schedule:12 Advances & Other Assets, Particulars, , Rs., , Total, Schedule:7 Borrowings, Particulars, , Rs., , Total, Schedule:8 Investments, Particulars, , Rs., , Total, Schedule: 13 Current Liability’s, Particulars, , Rs., , Total, , Schedule:14 Provisions, Particulars, , Rs., , Total, Schedule: 9 Loans, Particulars, , Rs., , Total, , Schedule:10 Fixed Assets, Particulars, , Total, , Rs., , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Rs.

Page 31 :

In the Books of Suraksha Assurance Company, Revenue Account for the year ended 31/3/2011, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, Income From Investments, Interest, Dividends & Rent, Other Income (to be specified), Consideration for annuities granted, Total (A), Commission Expenses, 2, Operating expenses related to Insurance, 3, , Balance Sheet as on 31/03/2011, Particulars, Schedule, No., Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , Borrowings, , 7, Total, , Provision for DD & Bad debts written off, , Applications of Funds (Assets), Investments (Shareholders), , 8, , Provision for Tax, Provisions (other than taxation ), , Loans, Fixed Assets, , 9, 10, , Total (B), Benefits Paid, Interim Bonuses Paid, , Total, 4, , Total (C), Surplus/Deficit (D)=(A-B-C), Appropriation, Transfer to Shareholders Dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , 11, 12, , Sub-total (A), Current Liabilities (B), , 13, , Provisions, Sub-total (B), , 14, , Net Current Assets (C)= (A-B), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 15, , Amount, Rs.

Page 32 :

Illustration :11 (226), From the following Trail Balance was the LIC, as on 31/03/2012, Particulars, Debit, Credit, (AE), (LI), 6 Opening LIC fund, 15,70,562, 4* Claims by Death, 1,16,980, 4 Claims by Maturity, 96,420, 1* Premium, 2,70,572, 3 Management Expenses, 29,890, 2 Commission, 36,541, I Consideration for annuity granted, 10,620, I Interest, Dividend & Rent, 52,461, -I Income tax on Dividends, 3,000, 13 Claims admitted but not paid, 80,034, 13 Annuity due but not paid, 22,380, 5 Paid-up Capital, 6,00,000, 4 Surrenders, 21,768, 4 Annuity, 29,420, 4* Bonus paid in cash, 9,450, 4 Bonus paid in reduction of premium, 3,500, 15 Preliminary expenses, 600, 8 Government securities, 16,90,890, 12 Sundry assets, 5,68,170, Total, 26,06,629 26,06,629, Prepare revenue A/c and Balance Sheet., Adjustment:, a. Claims Covered under Re-Insurance Rs. 10,000. (-4 & 12), b. Further Claims Intimated Rs. 8,000. (+4 & 13), c. Further Bonus in Reduction of Premium Rs. 1,500. (+1 & +4), d. Interest Accrued Rs. 15,400 (Outstanding). (I & 12), e. Premium Outstanding Rs. 7,400. (+1 & 12), , Solution:, Schedule:1 Premium, Particulars, Premium, 2,70,572, Add: Premium Outstanding, 7,400, Further Bonus in Reduction, Total, Schedule:2 Commission Expenses, Particulars, Commission, , Rs., 2,77,972, 1,500, 2,79,472, Rs., 36,541, , Total, 36,541, Schedule:3 Operating Expenses related to Insurance Business, Particulars, Rs., Management Expenses, 29,890, Total, Schedule: 4 Benefits Paid (Net), Particulars, Claims by Death, 1,16,980, Claims by Maturity, 96,420, Less: Claims Covered under Re-Insu (10,000), Add: Further Claims Intimated (O/S), 8,000, Surrenders, Annuity, Bonus paid in cash, 9,450, Add: Further Bonus in Reduction, 1,500, Bonus paid in reduction of premium, Total, , 29,890, Rs., , 2,11,400, 21,768, 29,420, 10,950, 3,500, 2,77,038

Page 33 :

Schedule:5 Share Capital, Particulars, Paid-up Capital, Total, Schedule:6 Reserves & Surplus, Particulars, Opening LIC fund, 15,70,562, Add: Bal being funds, 11,484, Total, Schedule:7 Borrowings, Particulars, , Rs., 6,00,000, , Rs., 15,82,046, 15,82,046, Rs., , Rs., 16,90,890, , Total, , 16,90,890, , Nil, , Total, , Total, , Total, Schedule:12 Advances & Other Assets, Particulars, Sundry assets, Claims Covered under Re-Insurance, Interest Accrued, Premium Outstanding, Total, Schedule: 13 Current Liability’s, Particulars, Claims admitted but not paid, Annuity due but not paid, Further Claims Intimated, Total, , Schedule:14 Provisions, Particulars, , Rs., , Schedule:10 Fixed Assets, Particulars, , Rs., , 6,00,000, , Total, Schedule:8 Investments, Particulars, Government securities, , Schedule: 9 Loans, Particulars, , Schedule:11 Cash & Bank Balances, Particulars, , Nil, , Rs., , Nil, , Total, Schedule:15 Miscellaneous Expenditure, Particulars, Discount on Issue of Shares/Debentures, Underwriting Commission, Preliminary Expenses, Total, , Nil, Rs., 5,68,170, 10,000, 15,400, 7,400, 6,00,970, Rs., 80,034, 22,380, 8,000, 1,10,414, , Rs., , Nil, Rs., , 600, 600

Page 34 :

Form-A, In the Books of LIC, Revenue Account for the year ended 31/3/2012, Particulars, Schedule, Amount, No., Rs., Premium Earned – Net, 1, 2,79,472, Income From Investments, Interest, Dividends & Rent (52,461-3,000), 49,461, Interest Accrued, 15,400, Other Income (to be specified), Consideration for annuities granted, 10,620, Total (A), 3,54,953, Commission Expenses, 2, 36,541, Operating expenses related to Insurance, 3, 29,890, Provision for DD & Bad debts written off, , --, , Provision for Tax, Provisions (other than taxation ), , --66,431, , Total (B), Benefits Paid, Interim Bonuses Paid, , 4, Total (C), , Surplus/Deficit (D)=(A-B-C), (3,54,953-66,431-2,77,038), Appropriation, Transfer to Shareholders Dividend, Transfer to other Reserve (specified), Bal being funds for future app., Total (D), , 2,77,038, , -2,77,038, , Form-A, Balance Sheet as on 31/03/2012, Particulars, Schedule, No., , Amount, Rs., , Sources of Funds (Liabilities), Shareholders’ Funds, Share Capital, Reserves & Surplus, , 5, 6, , 6,00,000, 15,82,046, , Borrowings, , 7, , Nil, 21,82,046, , Applications of Funds (Assets), Investments (Shareholders), , 8, , 16,90,890, , Loans, Fixed Assets, , 9, 10, , Nil, Nil, , Total, , Total, , 16,90,890, , Current Assets (A), Cash & Bank balance, Advances & Other Assets, , Nil, 6,00,970, , 11,484, , Sub-total (A), , 6,00,970, , --11,484, 11,484, , Current Liabilities (B), , 1,10,414, , 13, , Provisions, Sub-total (B), , Nil, 1,10,414, , 14, , Net Current Assets (C)= (A-B), (6,00,970-1,10,414), Miscellaneous Expenditure, Total (8+9+10+ NCA), , 11, 12, , 4,90,556, 15, , 600, 21,82,046

Page 35 :

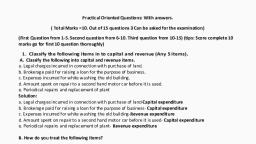

S. No, , Treatment of Adjustments in Final Accounts of Life Insurance, Item, Treatment, , Schedule No., , 1, , Premium Outstanding/admitted but not paid/due, , Add Premium, Advances & Other Assets, , +04, 12, , 2, , Reinsurance Premium Ceded, , Less Premium, Current Liability, , -04, 13, , 3, , Reinsurance Premium Accepted, , Add Premium, Advances & Other Assets, , 04, 12, , 4, , Further Bonus in Reduction of Premium, , Add Bonus in Premium, Premium, , +04, +01, , 5, , Management expenses due/Outstanding expenses/Unpaid, , Add Operating expenses, Current Liability, , +03, 13, , 6, , Claims admitted/initiated but not paid/due/Outstanding, , Add Claims, Current Liability, , +04, 13, , 7, , Claims Covered under Reinsurance/Ceded, , Less Claims, Advances & Other Assets, , -04, 12, , 8, , Claims Covered under Reinsurance Accepted, , Add Claims, Current Liability, , +04, 13, , 9, , Interest Accrued (Outstanding)., , Income RA, Advances & Other Assets, , -12, , 10, , Depreciation of any Fixed assets, , Less Fixed Assets, Operating expenses, , -10, 3