Page 1 :

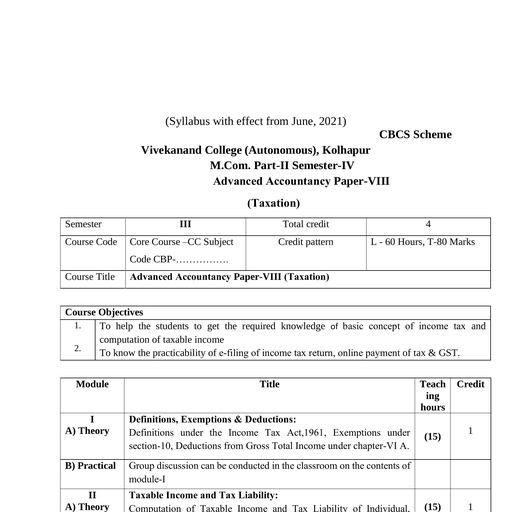

H, , I, , SHIVAJI UNIVERSITY, KOLHAPUR, CENTRE FOR DISTANCE EDUCATION, , Advanced Accountancy, Paper-II (Auditing), Paper - DSE A-II, , For, , M. Com. Part-I, Semester - I, , K, , (From Academic Year 2020-21), , J

Page 2 :

Copyright ©, , Registrar,, Shivaji University,, Kolhapur. (Maharashtra), First Edition 2020, , Prescribed for M. Com. Part-I, All rights reserved, No part of this work may be reproduced in any form by mimeography, or any other means without permission in writing from the Shivaji University, Kolhapur, (MS), , Copies : 1,000, , Published by:, Dr. V. D. Nandavadekar, Registrar,, Shivaji University,, Kolhapur-416 004, , Printed by :, Shri. B. P. Patil, Superintendent,, Shivaji University Press,, Kolhapur-416 004, , ISBN- 978-93-89327-68-7, , H, , Further information about the Centre for Distance Education & Shivaji University may be, obtained from the University Office at Vidyanagar, Kolhapur-416 004, India., , (ii)

Page 5 :

Preface, It gives us immense pleasure to bring forward the Self Instructional Material (SIM) of, Advanced Accountancy Paper-II (Auditing). This book has been written keeping in mind the, requirements of students of distance education to a large extent though the students of regular, programme and teachers may use the same for reference., The book has been devided into four units. The first unit elaborates the basic concepts of, audit. It introduces the concept of audit and elaborates the scope of audit. The feature of this, unit is the comprehensive explanation about the concept of 'true and fair view' in audit. This, unit also discusses the concept of independence of auditor, basic principles of audit and, difference between audit and investigation., The second unit describes the concept of dividend and divisible profit. It throws light on, some operational aspects like methods of payment of dividend, provisions about unpaid dividend, and failure to distribute dividend and corporate dividend policy. It also discusses the financial,, legal and policy considerations in dividend decision., The third unit comprehensively discuss various types of audit. As the scope of audit is, determined by its types, like cost audit, tax audit, management audit and social audit. Similarly, this unit also covers the details about audit of insurance companies, educational institutes and, limited companies. The concepts of adverse and disclaimer of opinion as well as audit of, computerised accounting have been explained with illustrations in this unit., The fourth unit throws light upon the important Auditing and Assurance Standards. The, standards relating to objectives, documentation, audit evidence, risk assessment, planning,, materiality, sampling and anditor's report have been discussed in this unit., As far as possible, an attempt has been made to keep the language simple and apply 'teach, yourself' technique. The illustrations have also been provided wherever necessary. Each unit, has been annexed with long answer questions, short notes as well as objective type of questions., We are thankful to the authors who have contributed significantly in this book. We are also, thankful to the office bearers of the University as well as the Centre for Distance Education, for facilitating this book to readers. We hope that the stakeholders find this book useful. We, also welcome the suggestions from readers to improve the quality in future., n, , Editors, , Prof (Dr.) S. S. Mahajan, , n, , Dr. K. V. Marulkar, , Department of Commerce and Management, Department of Commerce & Management,, Shivaji University, Kolhapur, Shivaji University, Kolhapur, , (v)

Page 7 :

M. Com. Part-I, SIM IN ADVANCED ACCOUNTANCY (AUDITING), , INDEX, Unit No., , Topic, , Page No., , Semester-I, 1., , Basic Concepts of Audit, , 1, , 2., , Dividend and Divisible Profit, , 20, , 3., , Types of Audit and Audit of various Entities, , 47, , 4., , Auditing and Assurance Standards, , (vii), , 131

Page 8 :

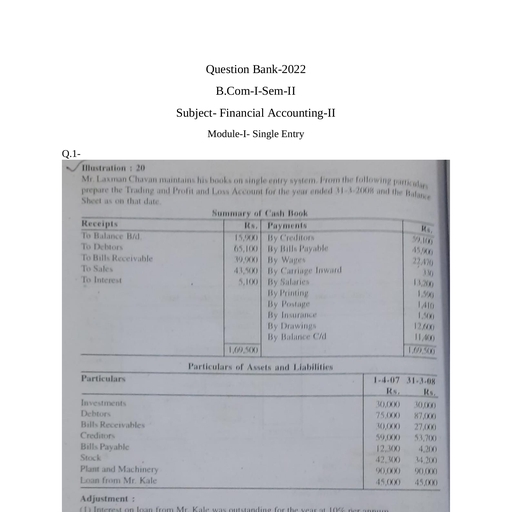

Each Unit begins with the section objectives Objectives are directive and indicative of :, 1. what has been presented in the unit and, 2. what is expected from you, 3. what you are expected to know pertaining to the specific unit,, once you have completed working on the unit., The self check exercises with possible answers will help you, understand the unit in the right perspective. Go through the possible, answers only after you write your answers. These exercises are not to, be submitted to us for evaluation. They have been provided to you as, study tools to keep you in the right track as you study the unit., , Dear Students, The SIM is simply a supporting material for the study of this paper., It is also advised to see the new syllabus 2019-20 and study the, reference books & other related material for the detailed study of the, paper., , (viii)

Page 9 :

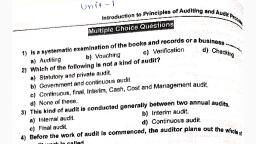

Unit-1, Basic Concepts of Audit, Index :, 1.0 Objectives, 1.1 Introduction, 1.2 Presentation of Subject Matter, 1.2.1 Meaning of Audit, 1.2.2 Scope of Audit, 1.2.3 True and Fair View, 1.2.4 Basic Principles of Governing Audit (AAS-1), 1.2.5 Independence of Auditor, 1.2.6 Difference between Audit and Investigation, 1.3 Summary, 1.4 Terms to Remember, 1.5 Answers to Check your progress, 1.6 Exercise, 1.7 Reference for further study, , 1.0 Objectives:, 1., , To understand the basic concept of audit and its scope., , 2., , To describe the true and fair view., , 3., , To understand the basic principles of governing audit (AAS-1)., , 4., , To distinguish between audit and investigation., , 1.1 Introduction:, Audit in the present form came into existence after the Industrial Revolution, during the 18th century when age of large scale production commenced. The, 1

Page 10 :

organization of business was limited to sole proprietor activities, however, after the, Industrial Revolution, due to large scale production, scope of business organization, enhanced and many stakeholders involved especially investors. Such stakeholders are, interested to know what happen with their resources involved in the specific business, organization, hence, audit become important. In new forms of organization like a, company, owners (shareholders) and management (board of directors and managers), are different. Here, the management who is handling capital and accounts of a, company. It is not possible to every shareholder to check the accounts of the, company. So they appoint a person, on their behalf, who will check the accounts,, here is a need of auditor and auditing by him. Luca Pacialo who first published his, treatise on double entry system of book-keeping for first time in 1494, he described, the duties and responsibilities of an auditor., , 1.1.1 Principles of Auditing:, Auditing is of recent origin as compared to accounting. Auditing principles are, not comparable to the accounting principles. The elementary principles of auditing, are independence, objectivity, full disclosure and materiality which are given below, in brief:, 1), , Principle of Independence: The work of auditing should be separate and, independent from work of accounting. Accounts should be examined in an, independent and unbiased manner, in the audit., , 2), , Principle of Objectivity: The work of auditing should be based on the related, evidences and should be done in an unbiased manner., , 3), , Principle of full disclosure: Auditor should examine material transactions as, well as probable frauds and errors in much greater depth., , 4), , Principle of Materiality: Client should provide the auditor with all available, records, evidences and explanations. The auditor should also declare the result, of his examination in clear and unambiguous manner., , There are some other principles of auditing such as Integrity, Confidentiality,, Skill and Competence, reliance on work performed by others and documentation., , 1.1.2 Objectives of Auditing:, As per SA 200 "Overall Objectives of the Independent Auditor", in conducting, an audit of financial statements, the overall objectives of the auditor are:, 2

Page 11 :

(a) To obtain reasonable assurance about whether the financial statements as a, whole are free from material misstatement; and, (b) To report on the financial statements, and communicate as required by the SAs,, in accordance with the auditor's findings., , 1.2.1 Meaning of Audit:, At the beginning, let us see the meaning of audit. The word "audit" is derived, from the Latin word "audire" which means "to hear". As the changes took place in, duties and responsibilities of auditor, the change in the meaning of audit came and, hence, various definitions of audit are given by distinct authors, thinkers and, organizations which we are going to see in this section., According to Spicer and Pegler, an audit is 'such an examination of the books,, accounts and vouchers of a business, as will enable the auditor to satisfy himself that, the Balance Sheet is properly drawn up, so as give a true and fair view of the state of, affairs of the business, and whether the Profit and Loss Account gives a true and fair, view of the profit earned or loss suffered for the financial period, according to the, best of his information and the explanations given to him and as shown by books,, and if not, in what respects he is not satisfied.", L. R. Dicksee has defined an audit in the words "An audit is an examination of, accounting records undertaken with a view to establish whether they correctly and, completely reflect the transactions to which they puport to relate. In some instance it, may be necessary to ascertain whether the transactions are supported by proper, authority.", As per the opinion of F. R. M. de Paula, the term "Audit denotes something, much wider, namely, the examination of a balance sheet and profit and loss account, prepared by others. As a result of his examination of the books, accounts, vouchers, etc. and of his inquiries, the auditor must satisfy himself that such balance sheet and, profit and loss account are properly drawn up so as to exhibit true and fair view of, the state of affairs and of the earnings of a particular concern.", The Institute of Chartered Accountants of India has said about auditing that "It is, a systematic and independent examination of data, statements, records, operations, and performances (financial or otherwise) of an enterprise for a stated purpose. In, any auditing situation, the auditor perceives and recognizes the propositions before, 3

Page 12 :

him for examination, collects evidence, evaluates the same and on this basis, formulates his judgment which is communicated through his audit report.", According to Montegomery, "Auditing is a systematic examination of books and, records of a business or other organization, in order to ascertain or verify, and to, report upon, the facts regarding its financial operations and results thereof.", J. R. Batliboi has defined auditing as "an intelligent and a critical scrutiny of the, books of account of a business with the documents and vouchers from which they are, written up, for the purpose of ascertaining whether the working results for a, particular period, as shown by the Profit and Loss Account, as also the exact, financial condition of that business, as reflected in the balance sheet are truely, determined and presented by those responsible for their compilation.", On the basis of analysis of all the definitions of auditing we can come to the, conclusion that the auditing has the following characteristics:, 1., , It is a systematic and independent examination of financial data, , 2., , It ensures the correctness of Trading, Profit and Loss Account and Balance, Sheet which makes a verification of true and fair view presented in financial, statements., , 3., , An examination of books of accounts with motive is to detect errors and frauds, in the books of accounts and financial statement., , 4., , An intelligent and a critical scrutiny of the books of account., , 5., , Through process of audit, an auditor collect the evidences, vouchers for, transactions., , 6., , Auditor express an opinion on the quality of financial statements after ensuring, the compliance of financial statements with the accounting standards., , 7., , Auditing concludes with audit report., , We can conclude on the basis of above definitions and characteristics of auditing, that the audit means a critical and intelligent examination of facts-financial or, otherwise, to give in the form of certificate or report an attestation, an expert opinion, or an expert advice., , 4

Page 13 :

1.2.2 Scope of Audit:, The scope of audit is determined by the auditor having regard to following: (a), Terms of the Audit Engagement, (b) Requirement of Relevant Statute and (c), Pronouncements of the ICAI. However, the terms of engagement cannot supersede, the requirements of statute or pronouncements of ICAI., According to ICAI, the following points are merit considerations as far as scope, of audit is concerned:, 1., , Audit should cover the examination of all aspects of an entity relevant to, financial statements being audited., , 2., , To form an opinion on the financial statements, the auditor should be reasonably, satisfied as to whether the information contained in the underlying accounting, records and other source data is reliable and sufficient as the basis for the, preparation of the financial statements., , 3., , In forming his opinion, the auditor should also decide whether the relevant, information is properly disclosed in the financial statements subject to statutory, requirements, where applicable., , 4., , The auditor assesses the reliability and sufficiency of the information contained, in the underlying accounting records and other source data by:, (a) making a study and evaluation of accounting systems and internal controls, and, (b) carrying out such other tests, enquires and other verification procedures of, accounting transactions and account balances as he considers appropriate in, the particular circumstances., , 5., , The auditor determines whether the relevant information is properly disclosed in, the financial statements by:, (a) comparing the financial statements with the underlying accounting records, and other source data to see whether they properly summarize the, transactions and events recorded therein; and, (b) considering the judgments that management has made in preparing the, financial statements accordingly, the auditor assess the selection and, , 5

Page 14 :

consistent application of accounting policies, the manner in which the, information has been classified, and the adequacy of disclosure., 6., , The auditor is not expected to perform duties which fall outside the scope of his, competence. For example, the professional skill required of an auditor does not, include that of a technical expert for determining physical condition of certain, assets., , 7., , Constraints on the scope of the audit of financial statements that impair the, auditor's ability to express an unqualified opinion on such financial statement, should be set out in his report, and a qualified opinion or disclaimer of opinion, should be expressed as appropriate., , Check Your Progress-1, (A) Choose the appropriate alternative from given alternatives below the statement:, 1), , Principle of Independence is the elementary principle of auditing which, refers to the following ..........., (a) The work of auditing should be based on the related evidences and, should be done in an unbiased manner., (b) Auditor should examine material transactions as well as probable, frauds and errors in much greater depth., (c) The work of auditing should be separate and independent from work of, accounting. Accounts should be examined in an independent and, unbiased manner, in the audit., (d) Client should provide the auditor with all available records, evidences, and explanations. The auditor should also declare the result of his, examination in clear and unambiguous manner., , 2), , The scope of audit is determined by the auditor having no regard to which, following point?:, (a) Relation with client, (b) Terms of the Audit Engagement,, (c) Requirement of Relevant Statute and, (d) Pronouncements of the ICAI., 6

Page 15 :

(B) State whether the following statement is true or false:, 1), , Audit is not an intelligent and a critical scrutiny of the books of account, it, is simple verification of transactions., , 2), , Audit should cover the examination of all aspects of an entity relevant to, financial statements being audited., , 3), , The auditor should determine whether relevant information is disclosed in, financial statements., , 1.2.3 True and Fair View:, The financial performance can be understood by financial statements and, financial statements are outcome of maintaining accounts throughout the accounting, year. The accounts are maintained by the owner or management of business., However, users want to know whether these financial statements are prepared with, true and fair view. They want to confirm that financial results and financial position, shown by accounts are true and fair. It is expected that the auditor should confirm, this matter., We can say "Accounts are true and fair” when:, 1., , Financial Statements :, The financial performance shown by financial statements is true and fair. In, other words, we can say when (a) profit and loss shown in Profit and Loss, Account and (b) the value of assets and liabilities shown in balance sheet are, true and fair., The concept or scope of 'true and fair' is not defined by any law. Following, may be considerations in respect of true and fair view:, (a) Conform to accounting principles: The books of accounts must be kept, according to the Generally Accepted Accounting Principles such as the, entity concept, matching concept, periodicity concept, accrual concept or, dual aspect concept etc., (b) No window dressing or secret reserves: There should not be overstatement, or understatement either in financial position or in profit or loss. There, should not be window dressing or secrete reserves. Window dressing is an, act of showing accounts a much better than the actual condition. It is, 7

Page 16 :

expected to show the accounts with actual financial results and actual, financial condition. Such accounts are to show true and fair view., To reflect a true and fair view in accounts, the auditor should ensure that:, �, , The financial statements match with the books of accounts., , �, , The charging depreciation is properly done or appropriate provision is made, for depreciation., , �, , The physical verification of the closing stock is made and its valuation is, properly done., , �, , Intangible assets are properly written off. Such intangible assets include, goodwill, patents, preliminary expenses or other deferred revenue expenses., , �, , Proper provision is made for bad and doubtful debts., , �, , Capital expenses is not treated as revenue expenses and vice versa., , �, , Capital receipts are not treated as revenue receipts., , �, , Effect of changes in rate of foreign exchange on value of assets and, liabilities is recorded properly in the books of accounts., , �, , Contingent liabilities are not treated as actual liabilities and vice versa., , �, , Provision is made for all known losses and liabilities, , �, , A reserve is not shown as a provision and vice versa, , �, , Cut off transactions are recorded properly, so that all sales invoices are, matched with goods delivered and all purchase invoices are matched with, goods received., , �, , Accrual basis accounting has been adopted to record the transactions. Such, transactions may be outstanding expenses, prepaid expenses, income, accrued and advance income etc. They are recorded properly., , �, , Expected or anticipated gains are not credited to the profit and loss account., , �, , Effect of events after the balance sheet date on the value of an asset and, liability is disclosed properly in the books of accounts., , �, , The exceptional or non-recurring transactions are disclosed separately in, the accounts., 8

Page 17 :

2., , Disclose all material facts: All the material facts regarding revenue, expenses,, assets and liabilities must be disclosed in the books of accounts. Material means, significant. The disclosure of significant information in the accounts assists the, users in taking business decisions. There should be neither suppression of vital, facts nor mis-statements., , 3., , Legal requirements: In case of limited company the account must disclose the, matters required to be disclosed under the Companies Act. The final accounts, must be in the format prescribed under Schedule III of the Companies Act,, 2013. Special companies such as banks, insurance, electricity supply companies, prepare accounts as prescribed under special acts or regulations. A co-operative, society, a trust etc. must also prepare the accounts as per their individual, statutory requirement., , 4., , Requirements of Institute of Chartered Accountants of India: The accounts, must also be maintained in accordance with the various guidelines issued by the, ICAI., , 1.2.4 Basic Principles of Governing Audit (AAS-1):, This Auditing and Assurance Standard was the first standard on auditing issued, by the Institute. This Standard describes the basic principles which govern the, auditor’s professional responsibilities and which should be complied with whenever, an audit is carried out. An audit is the independent examination of financial, information of any entity, whether profit oriented or not, and irrespective of its size, or legal form, when such an examination is conducted with a view to expressing an, opinion thereon. Other Auditing and Assurance Standards to be issued by the, Institute (taken in other unit) will elaborate on the principles set out herein to give, guidance on auditing procedures and reporting practices. Compliance with the basic, principles requires the application of auditing procedures and reporting practices, appropriate to the particular circumstances., These principles are, namely, integrity, objectivity and independence,, confidentiality, skills and competence, work performed by others, documentation,, planning, audit evidence, accounting system and internal control, and, finally, audit, conclusions and reporting., 9

Page 18 :

1., , Integrity, Objectivity and Independence:, , The auditor should be straightforward, honest and sincere in his approach to his, professional work. He must be fair and must not allow prejudice or bias to override, his objectivity. He should maintain an impartial attitude and both be and appear to be, free of any interest which might be regarded, whatever its actual effect, as being, incompatible with integrity and objectivity., 2., , Confidentiality:, , The auditor should respect the confidentiality of information acquired in the, course of his work and should not disclose any such information to a third party, without specific authority or unless there is a legal or professional duty to disclose., 3., , Skills and Competence:, , The audit should be performed and the report should be prepared with due, professional care by persons who have adequate training, experience and competence, in auditing. The auditor requires specialized skills and competence which are, acquired through a combination of general education, technical knowledge obtained, through study and formal courses concluded by a qualifying examination recognized, for this purpose and practical experience under proper supervision. In addition, the, auditor requires a continuing awareness of developments including pronouncements, of ICAI on accounting and auditing matters, and relevant regulations and statutory, requirements., 4., , Work Performed by Others:, , When the auditor delegates work to assistants or uses work performed by other, auditors and experts, he will continue to be responsible for forming and expressing, his opinion on the financial information. However, he will be entitled to rely on work, performed by others, provided he exercises adequate skill and care and is not aware, of any reason to believe that he should not have so relied. In the case of any, independent statutory appointment to perform the work on which the auditor has to, rely in forming his opinion, such as in the case of the work of branch auditors, appointed under the Companies Act, 1956, the auditor’s report should expressly state, the fact of such reliance. The auditor should carefully direct, supervise and review, work delegated to assistants. The auditor should obtain reasonable assurance that, work performed by other auditors or experts is adequate for his purpose., 10

Page 19 :

5., , Documentation:, , The auditor should document matters which are important in providing evidence, that the audit was carried out in accordance with the basic principles., 6., , Planning:, , The auditor should plan his work to enable him to conduct an effective audit in, an efficient and timely manner. Plans should be based on a knowledge of the client’s, business. Plans should be made to cover, among other things:, (a) acquiring knowledge of the client’s accounting system, policies and internal, control procedures;, (b) establishing the expected degree of reliance to be placed on internal control;, (c) determining and programming the nature, timing, and extent of the audit, procedures to be performed; and, (d) coordinating the work to be performed., Plans should be further developed and revised as necessary during the course of the, audit., 7., , Audit Evidence:, , The auditor should obtain sufficient appropriate audit evidence through the, performance of compliance and substantive procedures to enable him to draw, reasonable conclusions there from on which to base his opinion on the financial, information. Compliance procedures are tests designed to obtain reasonable, assurance that those internal controls on which audit reliance is to be placed are in, effect. Substantive procedures are designed to obtain evidence as to the, completeness, accuracy and validity of the data produced by the accounting system., They are of two types:, a), , tests of details of transactions and balances;, , b), , analysis of significant ratios and trends including the resulting enquiry of, unusual fluctuations and items., , 11

Page 20 :

8., , Accounting System and Internal Control:, , Management is responsible for maintaining an adequate accounting system, incorporating various internal controls to the extent appropriate to the size and nature, of the business. The auditor should reasonably assure himself that the accounting, system is adequate and that all the accounting information which should be recorded, has in fact been recorded. Internal controls normally contribute to such assurance., The auditor should gain an understanding of the accounting system and related, internal controls and should study and evaluate the operation of those internal, controls upon which he wishes to rely in determining the nature, timing and extent of, other audit procedures. Where the auditor concludes that he can rely on certain, internal controls, his substantive procedures would normally be less extensive than, would otherwise be required and may also differ as to their nature and timing., 9., , Audit Conclusions and Reporting, , The auditor should review and assess the conclusions drawn from the audit, evidence obtained and from his knowledge of business of the entity as the basis for, the expression of his opinion on the financial information. This review and, assessment involves forming an overall conclusion as to whether:, (a) the financial information has been prepared using acceptable accounting, policies, which have been consistently applied;, (b) the financial information complies with relevant regulations and statutory, requirements;, (c) there is adequate disclosure of all material matters relevant to the proper, presentation of the financial information, subject to statutory requirements,, where applicable., The audit report should contain a clear written expression of opinion on the, financial information and if the form or content of the report is laid down in or, prescribed under any agreement or statute or regulation, the audit report should, comply with such requirements. An unqualified opinion indicates the auditor’s, satisfaction in all material respects with the matters dealt with in paragraph 21 or as, may be laid down or prescribed under the relevant agreement or statute or regulation,, as the case may be., , 12

Page 21 :

When a qualified opinion, adverse opinion or a disclaimer of opinion is to be, given or reservation of opinion on any matter is to be made, the audit report should, state the reasons therefor., (Effective Date: This Auditing and Assurance Standard becomes operative for all, audits relating to accounting periods beginning on or after April 1, 1985)., Check your progress-2:, (A) Fill in the blanks:, 1), , ................. is an act of showing accounts a much better than the actual, condition., , 2), , The books of accounts must be kept according to the ............. Accounting, Principles., , 3), , Auditor must be fair and must not allow prejudice or bias to override his, .........., , 4), , The auditor should obtain sufficient appropriate ................. through the, performance of compliance and substantive procedures to enable him to, draw reasonable conclusions there from on which to base his opinion on the, financial information., , (B) State whether the following statement is true or false:, 1), , We can say the accounts are true and fair when the financial performance, shown by financial statements is true and fair., , 2), , If window dressing is found in the financial statements and accounts, it, means they are presented with true and fair view., , 3), , For reflecting a true and fair view in accounts, it is not necessary to match, value of stock in the books and its value according to physical verification., , 4), , All the material facts regarding revenue, expenses, assets and liabilities, must be disclosed in the books of accounts., , 1.2.5 Independence of Auditor:, Only competent and independent person carries out the audit. The auditor, should be straightforward, honest and sincere in his approach to his professional, work. He must be fair and must not allow prejudice or bias to override his, 13

Page 22 :

objectivity. He should maintain an impartial attitude and both be and appear to be, free of any interest., Independence implies acting without any fear or favour. In order to protect the, independence of the auditors, enactments contain various provisions. For example, Section 141 (3) of Companies Act 2013 lays down that the following persons cannot, be appointed as auditor of a company even they are otherwise qualified:, (a) a body corporate other than a limited liability partnership registered under the, Limited Liability Partnership Act, 2008 (6 of 2009);, (b) an officer or employee of the company;, (c) a person who is a partner, or who is in the employment, of an officer or, employee of the company;, (d) a person who, or his relative or partner and so on., The independence of auditor is maintained and protection is given to the auditor, in that respect. If the auditor gives adverse opinion, it has been laid down in the Act, that an auditor cannot be removed without prior approval of central government. An, auditor who is sought to be removed, has the right to present his stand point before, shareholders. Unless and until the independence of auditor is maintained properly,, auditor cannot perform his duties rightly., , 1.2.6 Difference between Audit and Investigation:, Sometime students have impression that auditing and investigation are one and, the same. There is lot of difference between them. Now we will try to understand, what is the difference between audit an investigation., Sr. Audit, No., 1, , Investigation, , Audit is a systematic and independent, examination of data, statements,, records, operations and performances, (financial or otherwise) of an, enterprise for a stated purpose., , 14, , Investigation is a process of searching, enquiry into the profit-earning capacity, or the financial position of a concern or, to find out the extent of the fraud if, there is any suspicion about it and so, on.

Page 23 :

2, , Audit is conducted on behalf of Investigation is carried out on behalf of, owners i.e. shareholders or proprietor outsiders. Such outsiders may be, potential buyer of the business or, etc., banker or money lenders to know the, earning capacity or the financial, position of the firm. Sometime on, behalf of owner also it can be carried, out when they suspect any fraud., Sometime it is carried out by the, Government in the interest of, shareholders or at the instance of the, court., , 3, , According to Companies law, audit is Investigation is not compulsory., compulsory., , 4., , It once audit is done, accounts are not Investigation may be conducted even, again audited. The exception is only though accounts are already audited., of special audit., , 5., , The audit of accounts is done for a Investigation may cover a period of, year or six months., over three to seven years., , 6., , The accounts are audited with a view, to ascertaining whether or not the, Profit and Loss Account and Balance, sheet are drawn up as per law and, they exhibit a true and fair view of the, state of affairs of a business., , Investigation is conducted with a, particular object in view for e.g.- to, know the financial position of the, concern or its earning capacity etc., , 7., , Audit is a kind of test checking., , Investigation is a thorough examination, of the books of accounts for a particular, year or a number of years., , 8., , Audit includes an examination of the Investigation is not only an examination, of accounts but it is also an inquiry into, books of accounts of a business., other factors affecting the business such, as the extent of fraud, who committed it, 15

Page 24 :

or the causes of the fall in the profits., 9., , The report of auditor is sent to the The report of the investigator is sent to, managing director/chairman of the the party which has appointed him., company who put it before the, shareholders., , 10., , The report of the auditor is, stereotyped except when he mentions, the points on which he is not satisfied, with regard to the accounts of the, client., , 11., , The auditor is concerned with The investigator is not concerned with, accounting policies adopted by the accounting policies followed by the, concern and he states the fact about it. firm., , The report of the investigator is in, detail and refers to (a) the instructions, given to him, (b) the method of, approach, (c) the work carried out, (d), the documents relied upon, and (e) his, findings and often his recommendations, to the client., , Check your progress-3:, (A) Fill in the blanks:, 1), , ................ implies acting without any fear or favour., , 2), , .................... is a process of searching enquiry into the profit-earning, capacity or the financial position of a concern or to find out the extent of, the fraud if there is any suspicion about it and so on., , 3), , Investigation may cover a period of over ....... to ............. years., , (B) State whether the following statement is true or false:, 1), , For the purpose of independence of auditor, protection to auditor in respect, of audit is must., , 2), , Employee of a company who is chartered accountant and eligible for, making audit of any company, can carry out audit of the company where he, is employee., , 3), , Investigation is compulsory according to Companies Act., 16

Page 25 :

1.3 Summary:, Audit is a systematic and independent examination of data, statements, records,, operations and performances of an enterprise for a stated purpose. The auditor, perceives and recognizes the propositions before him for examination, collects, evidence, evaluates the same and on this basis formulates his judgment which is, communicated through his audit report. The elementary principles of auditing are: (a), Principle of Independence, (b) Principle of Objectivity, (c) Principle of full, disclosure and (d) Principle of Materiality. There are some other principles of, auditing such as Integrity, Confidentiality, Skill and Competence, reliance on work, performed by others and documentation., The objectives of auditing are (1) to obtain reasonable assurance about whether, the financial statements as a whole are free from material misstatement and (2) to, report on the financial statements, and communicate as required by the SAs, in, accordance with the auditor's findings. Independence implies acting without any fear, or favour. Unless and until the independence of auditor is maintained properly,, auditor cannot perform his duties rightly., The scope of audit has been described in this unit. One of the important concepts, used in accounting and auditing is 'true and fair view'. This unit has highlighted this, concept in lucid manner. Auditing and Assurance Standard-1 is entitled as "Basic, Principles of Governing Audit" which describes the basic principles which govern, the auditor’s professional responsibilities and which should be complied with, whenever an audit is carried out., As far as the difference between audit and investigation is concerned, a lot of, difference is there which we have observed in the last part of this unit. If simply we, see meaning of these two concepts, we can refer the difference between them. Audit, is a systematic and independent examination of data, statements, records, operations, and performances (financial or otherwise) of an enterprise for a stated purpose., Investigation is a process of searching enquiry into the profit-earning capacity or the, financial position of a concern or to find out the extent of the fraud if there is any, suspicion about it and so on., , 17

Page 26 :

1.4 Terms to Remember:, 1., , Audit: Audit is a systematic and independent examination of data, statements,, records, operations and performances of an enterprise for a stated purpose. The, auditor perceives and recognizes the propositions before him for examination,, collects evidence, evaluates the same and on this basis formulates his judgment, which is communicated through his audit report., , 2., , True and Fair View: Accounts are true and fair when the financial performance, shown by financial statements is true and fair. It is auditor's prime duty to verify, whether financial statements represent true and fair view., , 3., , Window dressing: It is an act of showing accounts a much better than the, actual condition., , 4., , Independence of Auditor: Independence implies acting without any fear or, favour. Unless and until the independence of auditor is maintained properly,, auditor cannot perform his duties rightly., , 5., , Investigation: It is a process of searching enquiry into the profit-earning, capacity or the financial position of a concern or to find out the extent of the, fraud if there is any suspicion about it and so on, , 1.5 Answers to Check your progress:, Check Your Progress-1, (A) 1) - (c),, , 2) - (a), , (B) 1) False,, , 2) True,, , 3) True, , Check Your Progress-2, (A) 1) Window dressing, 2) Generally Accepted,, 3) objectivity, 4) audit evidence, (B) Answer: 1) True, 2) False, 3) False, 4) True, Check Your Progress-3, (A) 1) Independence, (B) 1) True,, , 2) Investigation, 3) three, seven;, 2) False,, , 3) False, , 18

Page 27 :

1.6 Exercise:, 1), , What is audit? Describe the scope of audit., , 2), , Explain the basic principles governing an audit according to Auditing and, Assurance Standard-1., , 3), , Distinguish between audit and investigation., , 4), , Write short notes on:, (a) True and Fair View., (b) Independence of auditor., (c) Investigation., , 1.7 Reference for further study:, 1., , Tandon, B. N., Handbook of Practical Auditing, S. Chand and Compay Ltd.,, New Delhi., , 2., , Aruna Jha, Student’s Guide to Auditing & Assurance, Taxmann Publications, Pvt. Ltd., New Rohtak Road, New Delhi., , 3., , S. D. Sharma, Auditing Principles & Practice, Taxmann Publications Pvt. Ltd.,, New Rohtak Road, New Delhi., , 4., , Anand G. Srinivasan, Auditing, Taxmann Publications Pvt. Ltd., New Rohtak, Road, New Delhi., , 5., , S. K. Basu, Fundamentals of Auditing, Pearson India, 2009., , 6., , O. Ray Whittington and Kurt Pany, Principles of Auditing., , 7., , Contemporary Auditing: Kamal Gupta, Tata McGraw Hill Education., , 8., , ICSI, Fundamentals of Accounting and Auditing, The Institute of Company, Secretaries of India, New Delhi., , 9., , Companies Act 2013, , 10. The Institute of Chartered Accountants of India, http://www.icai.org, 11. Government of India,, http://www.mca.gov.in/, , Website, , of, , Ministry, , of, , Corporate, , Affairs,, ���, , 19

Page 28 :

Unit-2, Dividend and Divisible Profit, Index, 2.0 Objectives, 2.1 Introduction, 2.2 Presentation of Subject Matter, 2.2.1 Concept of Dividend and Divisible Profit, 2.2.2 Methods of Payment of Dividend, 2.2.3 Types of Dividends, 2.2.4 Financial, Legal and Policy Considerations in Dividend Decision, Declaration of Dividend (Section 123), 2.2.5 Unpaid Dividend Account (Section 124), 2.2.6 Punishment for Failure to Distribute Dividends (Section 127), 2.2.7 Dividend Policy of Companies, 2.3 Summary, 2.4 Terms to Remember, 2.5 Answer to check your progress, 2.6 Exercises, 2.7 References for further study, , 20

Page 29 :

2.0 Objectives:, After studying this unit students will be able:, �, , �, , �, , To understand the rules and regulations for declaring and paying dividend at the, end of the financial year and in between the financial year., To describe types of dividend and to calculate profit, which can be distributed to, the shareholders as dividend i.e. divisible profit., To understand financial, legal and policy considerations in dividend decision., , 2.1 Introduction:, Auditor is responsible to check whether the financial statements are being, prepared to show true and fair view along with the compliance of all the statutory, provisions of various applicable acts, such as companies Act 2013, Accounting, standards etc., In this chapter, we will see the rules and regulations of payment of divided and, calculation of divisible profit for the payment of dividend, which auditor has to, follow while auditing the financial statements of the company., , 2.2 Presentation of Subject Matter, 2.2.1 Concept of Dividend and Divisible Profit:, a), , Dividend:, , A dividend is a payment made by a company to its shareholders, usually as a, distribution of profits i.e. a portion of profits earned and allocated as payable to the, shareholders yearly or whenever declared. A dividend is allocated as an amount, (generally in % of face value) per share, with shareholders receiving a dividend in, proportion to their shareholding. Section 2(35) of the Companies Act, 2013, simply, states that “dividend” includes any interim dividend. The general understanding of, interim dividend is the dividend paid during the year and the dividend which is paid, after the end of financial year is called as final dividend., e.g. If dividend is paid on 20th December 2019 for the financial year 2019-2020, then, this is called as Interim dividend (Because it is paid during the financial year) and If, , 21

Page 30 :

dividend is paid after 31st March 2020 for the financial year 2019-2020, then it is, called as final dividend ( Because it is paid after the end of financial year)., b) Divisible profit:, The portion of the profit which can legally distributed to the shareholders of the, company by way of dividend is called divisible profit., That means out of profit so earned by the company whatever portion is being, distributed to the shareholders in proportion of their holdings in the company is, considered to be the divisible profit that means distributable profits which, shareholders are liable to take up in the form of dividend is known as divisible, profits., Check your progress-1, State whether the following statement is true or false :, 1), , Interim dividend is paid only if company earns profit., , 2), , Final dividend is paid as a percentage of market value of share, , 3), , As per section 2(35) of Company Act 2013, Dividend includes Interim dividend., , 4), , Dividend is paid to banks for giving loans, , 5), , Payment of Dividend is compulsory., , 2.2.2 Methods of payment of dividend:, A dividend is allocated as a fixed amount per share. Therefore, a shareholder, receives a dividend in proportion to their shareholding., a), , Cash:, , Cash dividends are those paid out in currency, usually via electronic funds, transfer or printed paper cheques. Such dividends are a form of investment income, and are not taxable to the recipient (As per Income Tax Act – table is given below for, the reference). This is the most common method of sharing corporate profits with the, shareholders of the company. For each share owned, a declared amount of money is, distributed. Dividends paid are not classified as an expense, but rather, a deduction of retained earnings., , 22

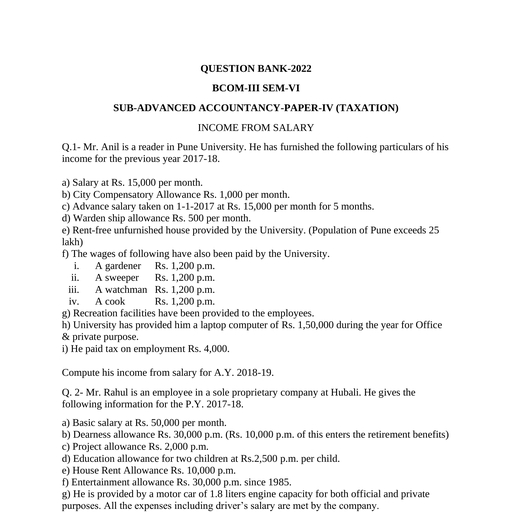

Page 31 :

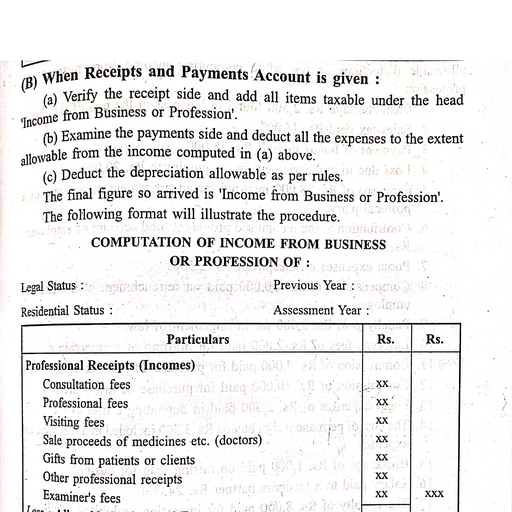

Table No. 2.1 Cash Dividend, Source of Dividend, Income, , Tax Rate for Individuals/HUFs, , Income Tax, Section, , -if aggregate dividend, income received during, the year is less than Rs., 10 lakh, , Nil, , Section 10(34), , -if aggregate dividend, income received during, the year is more than Rs., 10 lakh, , 10%, , Section, 115BBDA, , Foreign Company, , As per the marginal tax rate, applicable to the tax payer, , Section, 115BBD, , Domestic Company, , b) Stock:, Stock or scrip dividends are those paid out in the form of additional stock shares, of the Company in the form of bonus shares. They are usually issued in proportion to, shares owned. For example, for every 100 shares owned, a 5% stock, dividend will yield 5 extra shares., c), , Property:, , Property dividends or dividends in "in kind" are those paid out in the form of, assets from the issuing company, but they are relatively rare., d) Interim Dividends:, Interim dividends are dividend payments made before a company's annual, general meeting and final financial statements. This declared dividend usually, accompanies the company's interim financial statements., e), , Other:, , Other dividends can be used in structured financial assets with a known market, value, can be distributed as dividends; warrants are sometimes distributed in this, 23

Page 32 :

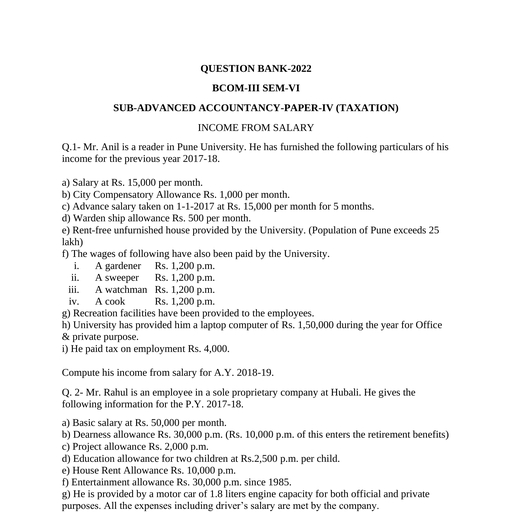

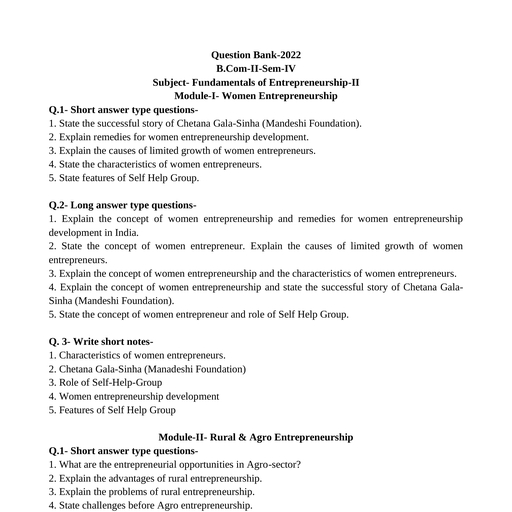

way. For large companies with subsidiaries, dividends can take the form of shares in, a subsidiary company. A common technique for "spinning off" a company from its, parent is to distribute shares in the new company to the old company's shareholders., The new shares can then be traded independently., Check your progress-2, State whether the following statement is true or false :, 1), , Dividend is paid only in cash., , 2), , Bonus shares are given to debt holders., , 3), , Dividend income is fully taxable in the hands of investor., , 4), , Dividend paid by foreign company is fully taxable, , 5), , Payment of Dividend by Saraswat co-op bank is taxable., , 2.2.3 Types of Dividends:, The classification or types of dividend can be taken into consideration as (a), dividend payable on the basis of time and (b) dividend payable on the basis of nature, of shares., a), , Dividend payable on the basis of Time (When declared), , Interim Dividend: When the Board of Directors declare dividend between two, annual general meetings of the company, such dividend is known as Interim, dividend., Final Dividend: When the dividend is declared at the annual general meeting of the, company, it is known as Final dividend., All the provisions applicable on dividend are also applicable on interim dividend., , Dividend, , Interim, , Final, , Figure 2.1 Dividend based on time, 24

Page 33 :

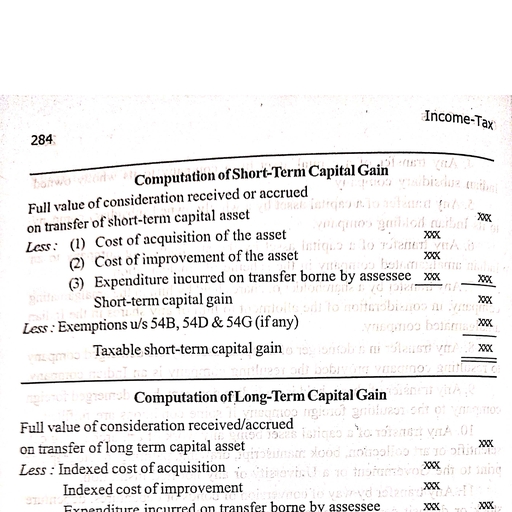

b) Dividend payable on the basis of Nature of shares, Shares can be classified into two categories- Preference shares and equity, shares. The manner of payment of dividend is dependent upon the nature of, shares., (i), , Preference Shares: According to section 43 of the Companies Act, 2013, persons holding preference shares, called preference shareholders, are assured, of a preferential dividend at a fixed rate during the life of the company., Dividend is generally cumulative in nature and need not be paid every year in, case of deficiency of profits., Types of Preference Shares on the basis of payment of dividend, , Preference shares’ classification on the basis of payment of dividend, (a) Cumulative Preference Shares: A cumulative preference share is one that, , carries the right to a fixed amount of dividend or dividend at a fixed rate. Such, a dividend is payable even out of future profit if current year’s profits are, insufficient for the purpose. This means that dividend on these shares, accumulates unless it is paid in full and, therefore; the shares are called, Cumulative Preference Shares., , Preference, Shares, , Shares, , Equity, Shares, , Cumulative, Preference, Shares, , Dividend accumulates, unless it is paid in full, , Noncumulative, Preference, Shares, , No arrears of dividend, in future, , Dividend dependent on dividend policy and, the availability of profits after satisfying the, rights of prererence shareholders., , Figure 2.2 Dividend based on nature of shares, (b) Non-cumulative Preference Shares: A non-cumulative preference share, , carries with it the right to a fixed amount of dividend. In case no dividend is, 25

Page 34 :

declared in a year due to any reason, the right to receive such dividend for that, year expires. It implies that holder of such a share is not entitled to arrears of, dividend in future., (ii) Equity Shares: Equity shares are those shares, which are not preference, , shares. It means that they do not enjoy any preferential rights in the matter of, payment of dividend or repayment of capital. The rate of dividend on equity, shares is recommended by the Board of Directors and may vary from year to, year. Rate of dividend depends upon the dividend policy and the availability of, profits after satisfying the rights of preference shareholders., , 2.2.4 Financial, Legal and Policy Considerations in Dividend Decision, Declaration of Dividend [Section 123], 2.2.4.1 Dividend shall be declared or paid by a company for any financial, year only—, (a) out of the profits of the company for that year arrived at after providing, , for depreciation in accordance with the provisions of section 123(2), or, (b) out of the profits of the company for any previous financial year or years, , arrived at after providing for depreciation in accordance with the, provisions of that sub-section and remaining undistributed, or, [Note: Such depreciation shall be provided in accordance with the, provisions of Schedule II.], (c) out of both (a) and (b); or, (d) out of money provided by the Central Government or a State Government, , for the payment of dividend by the company in pursuance of a guarantee, given by that Government., 2.2.4.2 Transfer to reserves:, A company may, before the declaration of any dividend in any financial year,, transfer such percentage of its profits for that financial year as it may consider, appropriate to the reserves of the company. Therefore, the company may transfer, such percentage of profit to reserves before declaration of dividend as it may, consider necessary. Such transfer is not mandatory and the percentage to be, transferred to reserves is to be decided at the discretion of the company., 26

Page 35 :

Illustration 1:, Radha limited proposes to transfer more than 10% of the profits of the, company to the reserves for the current year, before the declaration of dividend @, 12%. Is Radha Limited allowed to do so?, Solution:, The amount to be transferred to reserves out of profits for a financial year has, been left at the discretion of the company acting through its Board of Directors., Therefore, the company is free to transfer any part of its profits to reserves as it, deems fit., Illustration 2:, Siya Limited has earned a profit of Rs. 1,000 crores for the financial year, 2018-19. It has proposed a dividend @ 9 %. However, it does not intend to transfer, any amount to the reserves of the company out of the profits earned. Can Siya, Limited do so?, Solution:, The amount to be transferred to reserves out of profits for a financial year has, been left at the discretion of the company acting through its Board of Directors., The company is free to transfer any part of its profits to reserves as it deems fit., There is no restriction to transfer any specific amount (i.e. even no amount can be, transferred) to the reserves before declaration of dividend., 2.2.4.3 Declaration of dividend out of accumulated profits:, Where a company, owing to inadequacy or absence of profits in any financial, year, proposes to declare dividend out of the accumulated profits earned by it in, previous years and transferred by the company to the reserves, such declaration of, dividend shall be made only in accordance with prescribed rules. [Second Proviso, to section 123(1)], Exemption: The above proviso shall not apply to a Government Company in, which the entire paid up share capital is held by the Central Government, or by any, State Government or Governments or by the Central Government and one or more, State Governments., , 27

Page 36 :

2.2.4.4 Declaration of dividend from free reserves:, Dividend shall be declared or paid by a company only from its free reserves., No other reserve can be utilized for the purposes of declaration of such dividend., 2.2.4.5 Declaration of dividend by set off of previous losses and depreciation, against the profit of the company for the current year:, No company shall declare dividend unless carried over previous losses and, depreciation not provided in previous year or years are set off against profit of the, company for the current year., For declaration of dividend out of accumulated profits, the Ministry of, Corporate Affairs has provided Rule 3 of the Companies (Declaration and, Payment of Dividend) Rules, 2014. Thereby, when there is inadequacy or absence, of profits in any year, a company may declare dividend out of free reserves., However, the following conditions shall be fulfilled before declaring dividend out, of reserves:, (e) The rate of dividend declared shall not exceed the average of the rates at which, , Rate of Dividend ≤ (RD1 +RD2 + RD3)/3, Where, RD1, RD2, RD3 are rates at which dividend was declared by it in the 3, years immediately preceding that year., dividend was declared by it in the 3 years immediately preceding that year:, However, this rule will not apply if a company has not declared any dividend, in each of the 3 preceding financial years., (f), , The total amount to be drawn from such accumulated profits shall not exceed, one- tenth of the sum of its paid-up share capital and free reserves as appearing, in the latest audited financial statement., , Therefore,, Total amount that can be drawn, 1/10 of (Paid up share capital +, ≤, from accumulated profits, Free reserves), (g) The amount so drawn shall first be utilised to set off the losses incurred in the, , financial year in which dividend is declared before any dividend in respect of, equity shares is declared., 28

Page 37 :

(h) The balance of reserves after such withdrawal shall not fall below 15% of its, , paid up share capital as appearing in the latest audited financial statement., Illustration 3:, A Public Company has been declaring dividend at the rate of 25% on equity, shares during the last 3 years. The Company has not made adequate profits during, the year ended 31st March, 2019, but it has got adequate reserves which can be, utilized for maintaining the rate of dividend at 25%. Advise the Company as to, how it should go about if it wants to declare dividend at the rate of 25% for the, year 2018-19, as per the provisions of the Companies Act, 2013., Solution:, In the given case, the company has made adequate profits for the current year., However, it can declare dividend out of accumulated profits. Hence, the company, can declare a dividend of 25% provided it has the required residual reserve (after, such payment) of 15% of its paid up capital and free reserves as appearing it its, latest audited financial statement. The company should have the dividend, recommended by the Board and put up for the approval of the members at the, Annual General Meeting as the authority to declare dividend lies with the members, of the company., Illustration 4:, Due to inadequacy of profits during the year ended 31st March, 2019, Anisha, Ltd. proposes to declare 10% dividend out of general reserves. From the following, particulars, ascertain the amount that can be utilized from general reserves, according, to the Companies (Declaration of dividend out of Reserves) Rules, 2014:, 17,500 9% Preference shares of ` 100 each, fully paid up, , 17,50,000, , 8,00,000 Equity shares of ` 10 each, fully paid up, , 80,00,000, , General Reserves as on 1.4.2018, , 25,00,000, , Capital Reserves as on 1.4.2018, , 3,00,000, , Revaluation Reserves as on 1.4.2018, , 3,50,000, , Net profit for the year ended 31st March, 2019, , 3,00,000, , 29

Page 38 :

Average rate of dividend during the last five year has been 12%., Solution:, Amount that can be drawn from reserves for 10% dividend, 10% dividend on ` 80,00,000, , 8,00,000, , Profits available, Current year profit, , 3,00,000, , Less: Preference dividend, , (1,57,500), , Amount which can be utilized from reserves, , (1,42,500), 6,57,500, , Conditions as per Companies (Declaration of dividend out of Reserves) Rules,, 2014:, Condition I, Since 10% is lower than the average rate of dividend (12%), 10% dividend can, be declared., Condition II, Maximum amount that can be drawn from the accumulated profits and reserves, should not exceed 10% of paid up capital plus free reserves i.e. ` 12, 25,000 [10% of, (80, 00,000+17, 50,000+25, 00,000)], Condition III, The balance of reserves after drawl `18,42,500 (` 25,00,000 - ` 6,57,500), should not fall below 15 % of its paid up capital i.e. ` 14,62,500 (15% of, ` 97,50,000], Since all the three conditions are satisfied, the company can withdraw, ` 6,57,500 from accumulated reserves. (As per Declaration and Payment of Dividend, Rules, 2014.), 2.2.4.6 Depositing of amount of dividend:, In terms of section 123(4), the amount of the dividend, including interim, dividend, shall be deposited in a scheduled bank in a separate account within 5, days from the date of declaration of such dividend., 30

Page 39 :

This sub-section shall not apply to a Government Company in which the entire, paid up share capital is held by the Central Government, or by any State, Government or Governments or by the Central Government and one or more State, Governments or by one or more Government Company., 2.2.4.7 Interim Dividend:, According to section 123(3), the Board of Directors of a company may declare, interim dividend during any financial year out of the surplus in the profit and loss, account and out of profits of the financial year in which such interim dividend is, sought to be declared., However, in case the company has incurred loss during the current financial, year up to the end of the quarter immediately preceding the date of declaration of, interim dividend, such interim dividend shall not be declared at a rate higher than, the average dividends declared by the company during the immediately preceding, three financial years., If loss is there, Rate of Interim Dividend ≤ (RD1 +RD2 + RD3)/ 3, Where, RD1, RD2, RD3 are rates at which dividend was declared by it in, the 3 years immediately financial years preceding that year., The Board of directors may declare interim dividend and the amount of, dividend including interim dividend shall be deposited in a scheduled bank in a, separate bank account within 5 days from the date of declaration of such dividend., Illustration 5:, Spruha Limited is facing loss in business during the current financial year, 2018-19. In the immediate preceding three financial years, the company had, declared dividend at the rate of 12%, 13% and 14% respectively. To maintain the, goodwill of the company, the Board of Directors has decided to declare 14%, interim dividend for the current financial year. Is the act of Board of Directors, valid?, , 31

Page 40 :

Solution:, Interim dividend shall not be declared at a rate higher than the average, dividends declared by the company during the immediately preceding three, financial years [i.e. (12+13+14)/3 =39/3=13%]. Therefore, decision of Board of, Directors to declare 14% of the interim dividend for the current financial year is, not valid.. They can declare a maximum 13% interim dividend., 2.2.4.8 Payment of dividend: According to section 123(5):, (i), , Dividends are payable in cash. Dividends that are payable to the, shareholder in, cash may be paid by cheque or warrant or in any, electronic mode., , (j), , Dividend shall be payable only to the registered shareholder of the share, or to his order or to his banker., , (k) This sub-section shall apply to the Nidhi company, subject to that any, , dividend payable in cash may be paid by crediting the same to the account, of the member, if the dividend is not claimed within 30 days from the date, of declaration of the dividend., (l), , Nothing in sub-section 5 of section 123, shall prohibit the capitalization of, profits or reserves of a company for the purpose of issuing fully paid-up, bonus shares or paying up any amount for the time being unpaid on any, shares held by the members of the company., , Illustration 6:, The Director of Hrihaan Limited proposed dividend at 12% on equity shares, for the financial year 2018-19. The same was approved in the annual general, meeting of the company held on 20th September, 2019. The Directors declared the, approved dividends., Mr. Kaustubh was the holder of 1,000 equity shares on 31st March, 2019, but, he has transferred the shares to Mr. Arvind, whose name has been registered on, 20th May, 2019. Who will be entitled to the above dividend., Solution:, According to section 123(5), dividend shall be payable only to the registered, shareholder of the share or to his order or to his banker. Facts in the given case state, 32

Page 41 :

that Mr. Kaustubh, the holder of equity shares transferred the shares to Mr. Arvind, whose name has been registered on 20th May 2019. Since, he became the registered, shareholder before the declaration of the dividend in the Annual general meeting of, the company held on 20th September 2019, so, Mr. Arvind will be entitled to the, dividend., 2.2.4.9 Prohibition on declaration of dividend: The Act by virtue of Section 123, (6) specifically provides that a company which fails to comply with the provisions, of section 73 (Prohibition on acceptance of deposits from public) and section 74, (Repayment of deposits, etc., accepted before the commencement of this Act) shall, not, so long as such failure continues, declare any dividend on its equity shares., 2.2.4.10 Prohibition on section 8 companies: According to section 8(1), the, companies having licence under Section 8 (Formation of companies with, Charitable Objects, etc.] of the Act are prohibited from paying any dividend to its, members. Their profits are intended to be applied only in promoting the objects, of the company., 2.2.5 Unpaid Dividend Account [Section 124], The provisions related to Unpaid Dividend Account are given under section, 124 of the Companies Act, 2013, which are as follows:, 2.2.5.1 Declared dividend not paid or claimed to be transferred to the special, account:, Where a dividend has been declared by a company but has not been paid or, claimed within 30 days from the date of the declaration to any shareholder entitled, to the payment of the dividend, - the company shall, within 7 days from the date, of expiry of the said period of 30 days, transfer the total amount of dividend which, remains unpaid or unclaimed to a special account to be opened by the company in, that behalf in any scheduled bank to be called the Unpaid Dividend Account., 2.2.5.2 Preparing of statement of particulars of the unpaid dividend:, The company shall, within a period of 90 days of making any transfer of an, amount under sub-section (1) of section 124 to the Unpaid Dividend Account,, prepare a statement containing the names, their last known addresses and the, unpaid dividend to be paid to each person and place it on the web-site of the, company, if any, and also on any other web-site approved by the Central, 33

Page 42 :

Government for this purpose, in such form, manner and other particulars as may, be prescribed., 2.2.5.3 Default in transferring of amount:, If any default is made in transferring the total amount referred to in section, 124(1) or any part thereof to the Unpaid Dividend Account of the company,- it shall, pay, from the date of such default, interest on so much of the amount as has not, been transferred to the said account, at the rate of 12 per cent per annum and the, interest accruing on such amount shall ensure to the benefit of the members of the, company in proportion to the amount remaining unpaid to them., 2.2.5.4 Apply for payment of claimed amount:, Any person claiming to be entitled to any money transferred under section, 124(1) to the Unpaid Dividend Account of the company may apply to the company, for payment of the money claimed., 2.2.5.5 Transfer of unclaimed amount to Investor Education and Protection, Fund (IEPF):, Any money transferred to the Unpaid Dividend Account of a company in, pursuance of this section which remains unpaid or unclaimed for a period of 7 years, from the date of such transfer shall be transferred by the company along with, interest accrued, if any, thereon to the Fund established under section 125(1) and, the company shall send a statement in the prescribed form of the details of such, transfer to the authority which administers the said Fund and that authority shall, issue a receipt to the company as evidence of such transfer., 2.2.5.6 Transfer of shares to IEPF:, All shares in respect of which dividend has not been paid or claimed for 7, consecutive years or more shall be transferred by the company in the name of, Investor Education and Protection Fund along with a statement containing such, details as may be prescribed:, Provided that any claimant of shares transferred above shall be entitled to claim the, transfer of shares from Investor Education and Protection Fund in accordance with, such procedure and on submission of such documents as may be prescribed., , 34

Page 43 :

Explanation—For the removal of doubts, it is hereby clarified that in case any, dividend is paid or claimed for any year during the said period of 7consecutive, years, the share shall not be transferred to Investor Education and Protection Fund., 2.2.5.7 In case of contravention:, If a company fails to comply with any of the requirements of this section, the, company shall be punishable with fine which shall not be less than five lakh rupees, but which may extend to twenty-five lakh rupees and every officer of the company, who is in default shall be punishable with fine which shall not be less than one lakh, rupees but which may extend to 5 lakh rupees., , 2.2.6 Punishment for Failure to Distribute Dividends [Section 127], Section 127 of the Companies Act, 2013 deals punishment for failure to, distribute dividend on time. According to this section:, (i), , Where a dividend has been declared by a company but has not been paid or the, warrant in respect thereof has not been posted within 30 days from the date of, declaration to any shareholder entitled to the payment of the dividend, every, director of the company shall, if he is knowingly a party to the default, be, punishable with imprisonment which may extend to two years., , (ii) He shall also be liable for a fine which shall not be less than 1,000 rupees for, , every day during which such default continues., (iii) The company shall also be liable to pay simple interest at the rate of 18% p.a., , during the period for which such default continues., (iv) However, the following are the exceptions under which no offence shall be, , deemed to have been committed:, (a), , where the dividend could not be paid by reason of the operation of any law;, , (b), , where a shareholder has given directions to the company regarding the, payment of the dividend and those directions cannot be complied with and the, same has been communicated to him;, , (c), , where there is a dispute regarding the right to receive the dividend;, , (d), , where the dividend has been lawfully adjusted by the company against any, sum due to it from the shareholder; or, 35

Page 44 :

(e), , where, for any other reason, the failure to pay the dividend or to post the, warrant within the period under this section was not due to any default on the, part of the company., , Exemption: This section shall apply to the Nidhis company, subject to that where, the dividend payable to a member is 100 rupees or less, it shall be sufficient, compliance of the provisions of the section, if the declaration of the dividend is, announced in the local language in one local newspaper of wide circulation and, announcement of the said declaration is also displayed on the notice board of the, nidhis for at least 3 months., Illustration 7:, Mr. Suchit, holding equity shares of face value of ` 10 lakhs has not paid an, amount of ` 1 lakh towards call money on shares. Can the same be adjusted against, the dividend amount payable to him?, Answer: Yes, as per law, where the dividend is declared by a company and, there remains a call in arrears and any other sum due from a member, in such case, the dividend can be lawfully adjusted by the company against any sum due to it, from the shareholder., Thus, company can adjust sum of ` 1 lakh due towards call money on shares, against the dividend amount. Payable to Mr.Suchit., Check your progress-3, A) Choose the most appropriate alternative :, 1), , In case of insufficient profits, interim dividend to be paid can not be more than, an average of last _______years, a) 4, , 2), , c) 5, , d) 2, , Final dividend is paid as a percentage of __________ Value, a) Market Value, , 3), , b) 3, , b) Cost, , c) Par value, , d) Application money, , Unpaid dividend account is to be opened in ______________ ., a) SEBI, , b) Co-operative bank, , c) NBFC, , d) Scheduled bank, , 36

Page 45 :

4), , After declaration of dividend, it has to be deposited in bank account within, ________ day, a) 5, , 5), , b) 10, , c) 15, , d) 12, , The balance of reserves after withdrawal shall not fall below ______% of its, paid up share capital as appearing in the latest audited financial statement., a) 5, , b) 10, , c) 15, , d) 12, , B) State whether the following statements are true or false:, , 1) Company can pay dividend using reserves, 2) It is mandatory to transfer dividend amount in bank account within 10 days from, the declaration of dividend, , 3) It is mandatory for Government Company to deposit the amount in bank account, within 5 days from the date of declaration of dividend., , 4) Company can not pay interim dividend if its in losses, 5) Company formed for charitable purpose can not declare dividend, C) Fill in the Blanks, 1), , If Dividend is not claimed by shareholder within __________ days then it has to, be deposited in special account opened with ____________ bank within, _______ days., , 2), , If company fails to transfer amount in unpaid dividend account, then it is liable, to pay interest @ _________ % p.a., , 3), , If dividend is not claimed by shareholder within _________ years , then the, amount has to be transferred to IEPF, , 4), , The rate of dividend declared shall not exceed the average of the rates at which, dividend was declared by it in the _____ years immediately preceding that, year, , 5), , The total amount to be drawn from accumulated profits shall not exceed, ____________ of the sum of its paid-up share capital and free reserves as, appearing in the latest audited financial statement., , 37

Page 46 :

2.2.7 Dividend Policy of Companies, Every company has its own dividend policy. In this section, we can understand, the dividend policy adopted by IDFC Ltd. and RIL., 2.2.7.1 Dividend policy of IDFC Limited:, 1., , Background:, , This policy sets out principles to determine the amount that can be distributed to, equity shareholders as dividend. IDFC Limited proposes to have a dividend, distribution policy that balances the dual objectives of appropriately rewarding, shareholders through dividends and retaining capital in order to maintain a healthy, capital adequacy to support its future capital requirements., 2., , Need and Objective of Dividend Distribution Policy:, , SEBI has made it mandatory for the top 500 listed entities to formulate a, Dividend Distribution Policy (“the Policy”) and disclose the Policy in their annual, reports and on their website. The dividend distribution policy is based on the, following parameters: a) the circumstances under which the shareholders may or may, not expect dividend; b) the financial parameters, internal and external factors, considered while declaring dividend; c) policy as to how the retained earnings will be, utilized; and d) parameters that will be adopted with regards to various classes of, shares., 3., , Utilisation of retained earnings:, , In any given financial year the retained earnings of the company are expected to, be used for the following: Additional capital requirements, Inorganic growth,, General corporate purposes, including contingencies, 4., , Eligibility criteria for declaration of dividend as per RBI:, a), , Every applicable NBFC shall maintain a minimum capital ratio consisting, of Tier I and Tier II capitalϖ which shall not be less than 15 percent of the, aggregate of its on-balance sheet risk weighted assets and the risk adjusted, value of its off-balance sheet items., , b), , The Tier I capital in respect of applicable NBFCs (other than NBFC-MFI, and IDF-NBFC), at any pointϖ of time, shall not be less than 10% by, March 31, 2017., 38

Page 47 :

5., , c), , IDFC is subjected to statutory transfers under section 45(IC) of RBI Act, (20% of profit after tax)ϖ before declaring dividend., , d), , The proposed dividend should be paid only out of current year’s profit, , e), , If the Company does not meet all of the above criteria, it cannot declare any, dividend for thatϖ particular year., , Circumstances under which shareholders may not receive dividends or may, receive reduced dividends:, , The Board may choose not to recommend any dividend or may recommend a, lower payout for a given financial year, if:, , 6., , a), , The company has reported a net loss for the year, , b), , Cash flow from operations is negative, , c), , The capital adequacy metrics of the company are weak, , d), , The company has been prohibited from declaring dividends by any, regulatory authority, , e), , The company has implemented, or intends to implement, a share repurchase, (buy-back) scheme or, , f), , any other alternative profit distribution measures Any other extraordinary, circumstancesϖ, , Factors affecting the Company’s approach to dividend payout:, , The Board will consider the following factors before making any, recommendation for the dividend, a), , Profits earned during the financial year, , b), , Future capital requirements, , c), , Cash flow position, , d), , Amount available for distribution after setting aside regulatory transfersϖ, Past dividend trends, , e), , Reinvestment opportunities, , 39

Page 48 :

7., , Parameters that will be adopted with regards to various classes of shares:, , The company has only one class of equity shareholders. Therefore, the dividend, declared will be distributed equally among all shareholders, based on their, shareholding on the record date., 8., , 9., , Procedure:, a), , The Chief Financial Officer, in consultation with the MD & CEO of the, Company, shall recommend any amount to be declared/ recommended as, dividend to the Board of Directors of the Company., , b), , The Agenda for the Board of Directors of the Company where dividend, declaration or recommendation is proposed shall contain the rationale for, the proposal., , c), , Pursuant to the provisions of the applicable laws and this Policy, the Board, may declare interimϖ dividend(s) as and when they consider it fit, and, recommend final dividend to the shareholders for their approval in the, general meeting of the Company and any final dividend recommended by, Board of Directors, will be subject to the shareholders’ approval, at the, ensuing Annual General Meeting of the Company., , d), , The Company shall ensure compliance of provisions of all applicable laws, in relation to dividendϖ declared by the Company., , Recommendations:, , The company being an Investment NBFC, its dividend payout will largely, depend upon the dividends it receives from its subsidiaries., The Company shall maintain a consistent dividend policy that balances the dual, objective of appropriately rewarding shareholders through dividends and retaining, capital in order to maintain a healthy capital adequacy ratio to support the future, growth., It is recommended that the Company will pay out as dividends between 70% to, 100% of its distributable profits after transferring to statutory and other reserves and, after setting aside cash for its business requirements (inclusive of taxes). Special, dividends, if any, will be declared in addition to the regular dividend payout., , 40

Page 49 :