Page 1 :

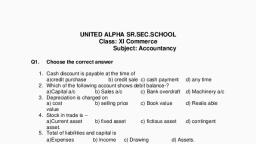

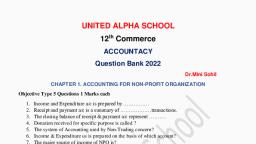

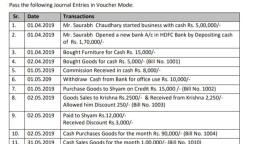

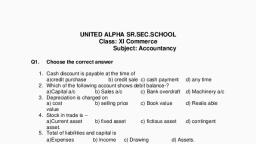

United Alpha Sr.Sec School, Class: XI Com, Subject: Account, Accountancy Question Bank 2022, , Lesson 1, 1. Give the definition of Accounting, 2. What is double entry system of accouting, 3. Define voucher., 4. Write down any two limitations of accountancy., 5. State two features of vouchers., 6. Differentiate between trade and cash discount., 3. What are the advantages of Accounting?, 4. Explain the following a) transactions b) Bad debts c) Drawings d) Capital expenditure, 5. ‘Capital account is a personal account of businessman’ Explain, Lesson 2, 1. Explain two principles of double entry system, 2. What is Dual Aspect Concept?, 3. What are Accounting Standard?, 4. What is meant by principle of full disclosure?, 5. What is historical cost concept?, 6. What is the need of Accounting Standard., 7. Write two merits of double entry system., 8. Write two demerits of double entry system., Lesson 3, 1. What is accounting equation?, 2. Explain the concept of Debit and Credit., 3. Write the rules of Dr. and Cr., 5. Prepare Accounting equation from the following, a) Started business with cash., Rs.80,000, b) Bought goods from Pawan on credit., Rs.20,000, c) Paid to Pawan in full settlement, Rs.19,600, 6. Prepare Accounting equation, a) Commenced business with cash Rs 20000, b) Purchased goods on credit for Rs 5000, c) Salaries paid in cash Rs 1000, d) Paid to creditors Rs 1000, e) Goods sold for cash (cost Rs 10000) for Rs 15000., Lesson 4., 1) What are the rules of Journalising?, 2) What do you mean by compound Journal Entries? Write its conditions, 3) Give Classification of Account, 4) Journalize the following transactions in the book of Vijay., 2018, Jan 1 Commenced business with cash Rs. 50,000 and goods worth Rs. 30,000., Jan 8 Sold goods worth Rs. 15,000 to Dharmendra at 10% trade discount., Jan 10 Sold goods to Sajan worth Rs. 5,000 on 20% trade discount and 10% cash discount. He paid half, the amount in cash., Jan 28 Purchased furniture from Chirag Rs. 8000, Jan 30 Opened a current a/c in bank Rs 2000, Jan 31 Received @ 75 paise in a rupee from a debtor of Rs 500, 5) 2020, Jan 1 Cash Balance Rs. 1,630; Bank overdraft Rs. 375, Jan 2 Deposited into Bank Rs. 1,500, Jan 3 Received from Chetan Rs. 880.Discount allowed Rs. 20, Jan 6 Purchased goods for cash Rs. 600, Jan 7 Paid Suman by cheque Rs. 670. Discount received Rs. 30

Page 2 :

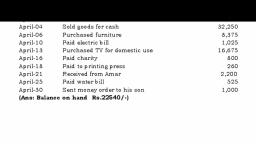

Jan 9, Jan 11, Jan 12, Jan 13, , Received cheque from Ramesh Rs. 750 and some was deposited into Bank., Cheque received from Atmaram Rs. 630 and discount allowed Rs. 20, Cash sales Rs. 130, Deposited Rs. 800 into Bank (which include Atmaram’s cheque), , 6) 2020 April 1The proprietor started business with cash Rs 30000 and also borrowed, from Amit Rs 10000., April 6 Paid salary by cheque Rs 3000, April 8 Withdrew for personal use Goods Rs 200 from bank Rs 500., April 10 Sold goods for Rs 5000 @ 10 % trade discount and 5 % cash discount., April 15 Purchased furniture from Karan Rs 2000, 7) Pass Journal Entries from these transactions in the books of M/s Ronald Bros., 1) Business started with cash Rs 20,000 and machinery Rs 10,000, 2) Goods worth Rs 4000 sold to Hans at 20% Trade Discount and 10% Cash Discount, He paid half the amount in cash., 3) Cashier misappropriates cash Rs 500., SPECIAL TRANSACTION, Jan 1. Goods sold ₹20,000 out of which goods of ₹12,000 was sold on credit on Shyamlal., Jan 2. Salary paid to ram ₹6,000 & due salary of clerks ₹4,000., Jan 3. Shyamlal is declared insolvent received from his official receiver a first and final dividend of 60, Paise in a Rupees on his debt., Jan 4. Received ₹10,000 from sale of old chairs, tables etc., Jan 5. Received cash for a bad debt written off last year ₹700., Jan 6. Received an order for goods for ₹1,20,000 from M/S Gouri Shankar $Sons., Jan 7. Received order for goods from M/S Ranbir $ Co. Of ₹5,00,000 alongwith a cheque for, ₹1,80,000 as advance., Jan 8. Placed order for goods with M/S Kohli $Sons of ₹2,50,000; paid them ₹1,00,000 by cheque in, advance., Jan 9. Kohli $ Sons. supplied goods of ₹2,50,000, Jan 10. Paid a cheque for 60% of the balance amount due to Kohli $Sons on account., Jan 11. Goods costing ₹50,000 were damage in transit; a claim was made on railway authorities for, the same., Jan 12. Received from salesman ₹60,000 for goods sold by him after deducting his travelling, expenses ₹4,000., Jan 13. Sold goods to Vishesh costing ₹40,000 at a profit of 25% and allowed him 10% T.D and, paid for cartage ₹1,000 to be charged from him., Jan 14. Receive a cheque of ₹40,000 from the railway authorities in full settelment of claim for damage, in transit., Lesson 5, 1) What is petty cash book?, 2) Explain the advantages of petty cash Book., 3) What do you mean by Imprest System in Petty cash book?, 4) Write the advantages of Cash Book, 5) What are contra entries? When are these done?, 6) “The balance of cash book cannot have a credit balance.” Explain., 7) What are the types of Subsidiary books., 8) Write the advantages of Subsidiary books, 9) Record the following transactions in the Purchases Book of Mr. Ramlal., 2007 April 1 Bought from Shyam & Co., 10 dozen pencil @ Rs. 40 per dozen., April 4 Bought from Ram Book Co., books worth Rs. 500., April 6 Bought 20 boxes of Ribbons from Arya @ Rs. 40 per box., April 8 Bought 3 dozen pad @ Rs. 10 per pad from Govind., April 10Bought 50 dozen Rubber from Suresh @ Rs. 4 per dozen., 10) Prepare Sunil’s sales book for June, 2006 from the following particulars., June 1 Sold to Subhash at 5% trade discount- 20 metre long cloth @ Rs. 5 per metre, 10 metre, shirting @ Rs. 20 per metre.

Page 3 :

June 15 Sold to Prabha at 10% trade discount- 12 metre long cloth @ Rs. 5 per metre, 40 metre, shirting @ Rs. 10 per metre., June 28 Sold to Sharad at 20% trade discount- 10 Pillow cover @ Rs. 4 per cover, Lesson 6, 1) What is ledger folio ?, 2) What is the need of ledger?, 3) Name the accounts that have Credit balance, 4) Name the accounts that have debit balance., 5) Prepare three column cash book from the following transactions:, 2016, Jan 1 Cash Balance Rs. 1,630; Bank overdraft Rs. 375, Jan 2 Deposited into Bank Rs. 1,500, Jan 3 Received from Chetan Rs. 880., Discount allowed Rs. 20, Jan 6 Purchased goods for cash Rs. 600, Jan 7 Received cheque from Ramesh Rs. 750 and some was deposited into Bank., Jan 10 Paid Jitendra by cheque Rs. 400, Jan 11 Cheque received from Atmaram Rs. 630 and discount allowed Rs. 20, Jan 12 Cash sales Rs. 130, Jan 13 Deposited Rs. 800 into Bank (which include Atmaram’s cheque), 6) From the following transactions, prepare cash book with bank column:, 2018, Rs, Jan 1 Ramratan started business with capital, 10,000, Jan 2 Deposited in bank by opening a current a/c, 9,000, Jan 5 Purchased goods and paid by cheque, 5,000, Jan 6 Received a cheque from sitaram, 500, Jan 8 Deposited in bank, 500, Jan 9 Paid to Mohanlal, 480, Jan 11 Paid cheque for electrical fittings, 300, Jan 13 Withdrew cash from bank for office use, 1,000, Jan 15 Sold goods for cash, 865, Jan 18 Deposited in bank, 1,500, Jan 20 Purchased goods from Mohanlal and paid by cheque, 4,000, Jan 22 Cheque received from Shyamlal and deposited, in the bank on same day, 800, Jan 25 Cheque received from Ashok Kumar, 960, 7) 2017, Apr 1, Cash Balance Rs 3,500 Bank overdraft Rs 5,000, Apr 12 Amount of Rs 500 paid by cheque to Anand and discount received, Rs 50, Apr 15 Received cheque Rs 980 and sent to the bank allowed discount Rs 20, Apr 18 Cheque received from Roy Rs 800, Apr 21 Received cheque from Jimmy Rs 630 and discount allowed Rs 20, Apr 22 All the above cheques deposited in bank., Apr 25 Roy’s cheque was dishonored., 8) 2017, July 1, Cash Balance Rs 8,000 Bank overdraft Rs 1,000, July 6, Cash Sales Rs 1000, July 8, Deposited into Bank Rs 6000., July 14 Received cheque from Ramesh and sent to the bank Rs 3,600, July 15 Cheque received from Roy and endorsed to Raj Rs 6000, July 25 Ramesh’s cheque was dishonoured., Lesson 8, 1) What is trial balance?, 2) Write two features of trial balance., 3) What are the objectives of Trial Balance?, 4) Is Trial balance a conclusive proof of accountancy

Page 4 :

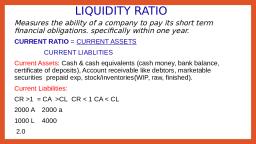

5) Explain the errors located by trial balance, 6) Explain the errors that cant be located by trail balance., Lesson 10, 1) What is a Bill of exchange., 2) Explain Promissory note, 3) What do you mean by dishonor of a bill? Write the conditions., 4) What is Days of grace?, 5) What do you mean by Endorsement of a bill., 6) What is noting charges?, Lesson 11, 1) Define Depreciation.Write its characteristics., 2) Discuss the factors affecting the amount of depreciation., 3) Distinguish between fixed instalment & diminishing balance method., 4) Explain the reasons for origin of depreciation., 5) A company purchased machine on 1st April 2018 for Rs 28,000 and spent Rs 2,000 on its erection, .On 1st October 2018 company purchased another machine for Rs 19,000 and spent Rs 1000 on its, erection.On 1st July 2019 company purchased another machine for Rs 10,000. On 1st Jan 2017 one third, of the machine erected on 1st April 2018 became obsolete and was sold for Rs 3,000., The rate of depreciation is 10% p.a by fixed instalment method., Prepare Machinery account for 3 years., 6) A company purchased machine on 1st Jan 2014 for Rs 37,000 and spent Rs 2,000 on its repair and, Rs 1,000 on its erection.On 1st July 2015 company purchased another machine for Rs 20,000., On 1st July 2016 company sold the Machine for Rs 24,000 which was purchased on 1st Jan 2014., On the same date a new machine was purchased for Rs 30,000.The rate of depreciation is 10% p.a, on diminishing balance method.Prepare Machinery account for 3 years, 7) A) The purchase price of a machine is Rs 28,000 and its establishment exp are, Rs 2000 and residual value is Rs 6000.Its working life is 6 years. Prepare machine, Account for two years, b) Write journal entries for a) purchasing an asset b) charging depreciation on asset, 8) a) Why is fixed instalment method of depreciation called straight line method?, b) What method can be applied for depreciation of a) Motor b) furniture, 9) A firm purchased an old machinery for Rs 10,000 on 1st June 2015 and spent, Rs 5000 on its overhauling. On 1st January 2016 further machine was purchased for, Rs 10,000.On 31st March,2017 the machinery purchased on 1st June 2015 having, become obsolete, was auctioned for Rs 6,000 and new machinery was purchased, for Rs 15,000.Write up the Machinery Account for first 3 years. If depreciation is, provided for 10 % on reducing balance method when the accounts are closed on 31st Dec., Lesson 13., 1) What is outstanding expenses?, 2) What is prepaid expenses?, 3) What does Bad Debts Reserve mean?, 4) Write the advantages of balance sheet., 5) Write a short note on valuation of closing stock., 6) Give the classification of liabilities., 7) Name few Current Assets., 8) Name a few Current Liabilities, 9) What do you mean by fixed assets?, 10) What is bad debt?, 11) What is contingent liability?, 12) What is direct expense?, 13) What is indirect expense?, 14) What is Trading a/c, 15) What do you mean by Gross Profit?, 16) What do you mean by Net Sales?

Page 5 :

Lesson 14, 1), From the following trial balance on 31st December 2016 .Prepare Trading & Profit& Loss a/c, and Balance Sheet., Particular, Amount, Particular, Amount, Stock, 10,000, Sales, 40,000, Purchases, 24,000, Returns outward, 1,000, Salaries, 600, Commission, 200, Cash, 2,000, Rent, 600, Investment, 3,000, Capital, 30,000, Advertisement, 400, Creditors, 6,000, Insurance, 600, Bad Debt Reserve, 400, Wages, 200, Bills Payable, 1,800, Bad debts, 200, Building, 30,000, Debtors, 8,000, Drawings, 1,000, 80,000, 80,000, Adjustment:, a) Closing stock is valued at 10,000, b) Salaries Rs 200 and wages Rs 100 are outstanding., c) Accrued interest on investments Rs 300, d) Create provision for doubtful debt on debtor at 20%, e) Provide depreciation on building @ 10%, f) Goods of Rs 1000 were returned by a customer but no entry was made in books., 2), Prepare Trading and Profit and Loss a/c and Balnce Sheet of M/S Evergreen for the year ending 31st Dec, 2020, Particular, Amount, Particular, Amount, Stock, 16,200, Sales, 65,360, Purchases, 47,000, Commision, 1,320, Power and coal, 2,240, Creditors, 2,500, Wages, 7,200, Bank O/d, 3,300, Cash, 80, Loans, 7,880, Drawings, 2,000, Capital, 24,500, Tax & Insu, 1,315, Bills Payable, 3,850, Gen Exp, 3955, Bad Debt Reserve, 900, Motor lorry, 3,000, Building, 11,000, Plant & Machine, 9,340, Debtors, 6,280, 109,610, 109,610, Adjustment:, a) Closing stock is valued at 23,500, b) Write off Rs 160 as bad debts and create a reserve for bad debts, On debtors @ 5%, c) The owner withdrew goods worth Rs 300 for personal use, goods Rs 500 was distributed free as, samples and goods Rs 200 was given away as gift, d) Accrued commision Rs 180, e) Prepaid insurance Rs 15, 3), Prepare Trading and Profit and Loss a/c and Balnce Sheet of Y ltd for the year ending 31st dec 2019, Particulars, Amount, Particulars, Amount, Stock, 10,000, Capital, 75,000, Purchases, 20,000, Creditors, 5,000, Carrigae I/W, 500, Commission, 1,800, Wages, 2000, Purchase return, 200, Gen.Exp, 1500, Sales, 33,000, Ins pre, 800

Page 6 :

Salary, Sales Ret, Cash in hand, Machine, Building, a), b), c), d), e), , 4,200, 1,000, 9,000, 26,000, 40,000, 115000, Depreciation machine by 10%, Outstanding wages Rs 100 and salary Rs 300, Prepaid insurance Rs 200, Accrued commission Rs 400, unaccrued commission Rs 200, Closing stock Rs 30,000, , 115000