Page 1 :

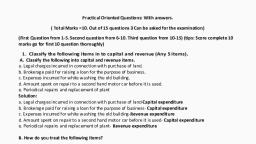

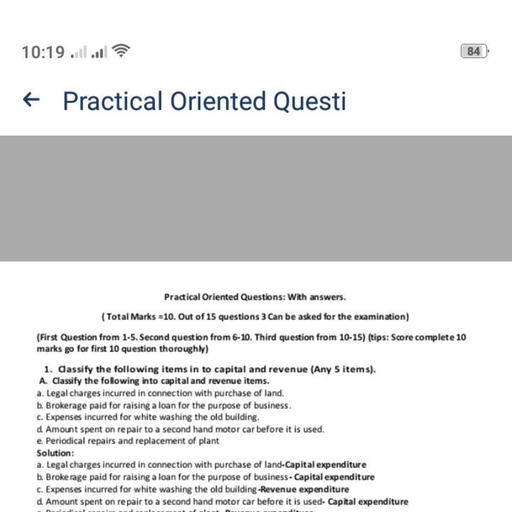

Practical Oriented Questions: With answers., ( Total Marks =10. Out of 15 questions 3 Can be asked for the examination), (First Question from 1-5. Second question from 6-10. Third question from 10-15) (tips: Score complete 10, marks go for first 10 question thoroughly), 1. Classify the following items in to capital and revenue (Any 5 items)., A. Classify the following into capital and revenue items., a. Legal charges incurred in connection with purchase of land., b. Brokerage paid for raising a loan for the purpose of business., c. Expenses incurred for white washing the old building., d. Amount spent on repair to a second hand motor car before it is used., e. Periodical repairs and replacement of plant, Solution:, a. Legal charges incurred in connection with purchase of land-Capital expenditure, b. Brokerage paid for raising a loan for the purpose of business- Capital expenditure, c. Expenses incurred for white washing the old building-Revenue expenditure, d. Amount spent on repair to a second hand motor car before it is used- Capital expenditure, e. Periodical repairs and replacement of plant- Revenue expenditure, B. How do you treat the following items?, a. Life membership fees, b. Sales proceeds of old tennis balls., c. Prize amount received from a lottery, d. Honorarium paid to the secretary., e. Legacies received., Solution:, a. Life membership fees-Capital receipts, b. Sales proceeds of old tennis balls-Revenue receipts, c. Prize amount received from a lottery- Capital receipts, d. Honorarium paid to the secretary- Revenue expenditure, e. Legacies received- Capital receipts, C.Classify the following into capital and revenue items., a. Cost of installing lights and fans., b. Special subscription received for special purpose., c. Laboratory expenses incurred by the science department of a college., d. Prizes awarded to students on the college day., e. Match expenses met out of match fund., Solution:, a. Cost of installing lights and fans-Capital expenditure, b. Special subscription received for special purpose-Capital receipts, c. Laboratory expenses incurred by the science department of a college-Revenue expenditure, d. Prizes awarded to students on the college day- Revenue expenditure, e. Match expenses met out of match fund-Capital expenditure, D.Classify the following into capital and revenue items., a. Honorarium paid to the surgeon by a hospital., b. Installation charges of a new machinery.

Page 2 :

c. Subscription to newspaper and periodicals., d. Cost of construction of pavilion by a sports club., e. Donation received for constructing a swimming pool., Solution:, a. Honorarium paid to the surgeon by a hospital-Revenue expenditure, b. Installation charges of a new machinery-Capital expenditure, c. Subscription to newspaper and periodicals-Revenue expenditure, d. Cost of construction of pavilion by a sports club-Capital expenditure, e. Donation received for constructing a swimming pool-Capital receipts., E.Classify the following into capital and revenue items., a. Carriage paid on goods purchased., b. Salary paid to ground men for upkeep of ground, c. Sale of old sports materials., d. Locker rent paid ., e. Heavy advertisement expenses incurred for a new product., Solution:, a. Carriage paid on goods purchased-Revenue expenditure, b. Salary paid to ground men for upkeep of ground-Revenue expenditure, c. Sale of old sports materials- Revenue expenditure, d. Locker rent paid- Revenue expenditure, e. Heavy advertisement expenses incurred for a new product-Deferred revenue expenditure.(till Q.P), Additional Questions:, F. Classify the following into capital and revenue items., (2018 annual exam March), a. Honorarium paid., b. Installation charges of new machinery., c. Subscription to news papers, d. Cost of purchase of new machinery, e. donation received for building., Solution:, a. Honorarium paid-Revenue expenditure, b. Installation charges of new machinery-Capital expenditure, c. Subscription to news papers-Revenue expenditure, d. Cost of purchase of new machinery- Capital expenditure, e. donation received for building-Capital receipts, G. Classify the following into capital and revenue items., (2016 annual exam March), a. Computer purchased by a college., b. Life membership fees., c. Sale of machinery, d. Subscription received from members., e. Amount spent for upkeep of ground., Solution:, a. Computer purchased by a college-Capital expenditure, b. Life membership fees-Capital receipt, c. Sale of machinery-Capital receipt

Page 3 :

d. Subscription received from members-Revenue receipt, e. Amount spent for upkeep of ground-Revenue Expenditure., H. Classify the following into capital and revenue items., (M.Q.P 2019 by P.U board), a. X-Ray plant purchased by a hospital., b. Interest received., c. Sale of old sports materials., d. Carriage paid on goods purchased, e. Donation received for constructing a swimming pool., Solution:, a. X-Ray plant purchased by a hospital-Capital expenditure, b. Interest received-Revenue receipts, c. Sale of old sports materials-Revenue receipts, d. Carriage paid on goods purchased-Revenue expenditure, e. Donation received for constructing a swimming pool- Capital receipts, 2. Prepare Receipts and Payments Account of a Not-For - Profit Organization with 5, imaginary figures., Dr. Receipts and payments account for the year ending 31.03.2019, Receipts, To Balance b/d, , Rs., 10,000, , Payments, , Cr., Rs., , By salary paid, , 2,000, , By printing charges, , 3,000, , (cash in hand), To entrance fees, To life membership fees, , 5,000, 10,000, , By balance c/d, , 20,000, , (closing cash), 25,000, , 25,000, , 3. How do you treat the followings in the absence of Par tner ship Deed?, a) Profit Sharing Ratio or distribution of profit and loss, b) Interest on Capital, c) Interest on Drawing, d) Interest on advances from partners OR Interest on Partner’s loan., e) Remuneration to partners for firm’s work OR salary or commission to partners., Ans:, a) Profit Sharing Ratio or distribution of profit and loss Equally, b) Interest on Capital not to be allow ed., c) Interest on Drawings not to be charged., d) Interest on advances from partners OR Interest on Partner’s loan, allow ed at 6%, per annum., e) Remuneration to partners for firm’s work OR salary or commission to partners not to, be allowed.

Page 4 :

4. Write two Partners’ Current Accounts under Fixed Capital System with 5 imaginary, figures., Dr., , Particulars, , To drawings a/c, To interest on drawings, a/c, To Balance c/d, , Partners Current a/c, A, B, Particulars, Rs., Rs., 4,000 3,000, 250, 150, By interest on capital a/c, , 2,500, , 2,000, , 4,750, , By A’s salary a/c, By profit and loss, appropriation a/c, , 1,500, , -, , 5,000, 9,000, , 5,000, 7,000, , By balance b/d, , 4,750, , 3,850, , 9,000, , 3,850, 7,000, , Cr., B, Rs., , A, Rs., , 5. Write two Partners’ Capital Accounts under Fluctuating Capital System with 5, imaginary figures., Partners Capital A/c (Under Fluctuating Capital System), Particulars, A, B, Particulars, Rs., Rs., To drawings a/c, 4,000 3,000 By balance b/d, To interest on drawings 250, 150, By interest on capital a/c, a/c, To Balance c/d, 29,750 23,850 By A’s salary a/c, By profit and loss a/c, 34,000 27,000, Dr., , By balance b/d, , Cr., A, B, Rs., Rs., 25,000 20,000, 2,500 2,000, 1,500 5,000 5,000, 34,000 27,000, 29,750 23,850, , 6. Write Profit and Loss Appropriation Account of a firm with 5 imaginary figures., Profit and loss Appropriation account for the year ending 31st March 2019, Cr., Particulars, Rs., Particulars, Rs., To interest on capital a/c, By profit and loss a/c, 50,000, A-(30,000X10%), 3,000, (net profit), B-(20,000X10%), 2,000 5,000, By interest on drawings a/c, To A’s Salary A/c, 5,000, A-Rs.1000, To B’s commission a/c, 3,000, B-Rs.1,500 2,500, To partners capital a/c, (profit transferred), A-19,750, B-19,750 39,500, 52,500, 52,500, Dr.

Page 5 :

7.Prepare Executor’s loan account with imaginary figures showing the repayment in two annual equal, instalments along with interest., (Solution: Assume Gopal is died,31.03.2018 total amount is paid to his executors is Rs. 30,000. 5,000 is paid, immediately and the balance is paid with 10% interest with 2 equal instalments.), Balance = (30,000-5,000)=25,000. 2 Equal instalments = (25,000÷2)= 12,500, Dr., , Date, 31.03.2018, 31.03.2018, 31.03.2019, 31.03.2019, 31.03.2020, , Gopals Executor’s Loan A/c., Particulars, Rs., Date, To cash a/c, 5,000 31.03.2018, (paid immediately), To balance c/d, 25,000, 30,000, To Cash a/c, 15,000 1.04.2018, (12,500+2,500), 31.03.2019, To balance c/d, 12,500, 27,500, To Cash a/c, 13,750 1.04.2019, (12,500+1,250), 31.03.2020, 13,750, , Cr., Rs, 30,000, , Particulars, By Gopals capital a/c, , 30,000, 25,000, 2,500, , By balance b/d, By interest on loan a/c, (25,000x10%), , 27,500, 12,500, 1,250, , By balance b/d, By interest on loan a/c, (12,500x10%), , 13,750, , 8. Give the di sclosure requirements per taining to Share Capi tal in Notes to Accounts, of Balance Sheet of a Company with imaginary figures., Notes to Accounts, Share Capital, Authorised or registered or Nominal Capital:, 50,000 Shares of Rs.10 each, Issued Capital, 20,000 Shares of Rs.10 each, Subscribed Capital, Subscribed but not fully paid up, 20,000 Shares of Rs. 10 each, Rs. 8 called up, Less: Calls in Arrears (20,000 x 2), , (Rs.), 5,00,000, 2,00,000, , 1,60,000, 40,000, , 1,20,000

Page 6 :

9., , Write the pro-forma of a Balance Sheet of a Company wi th main heads only., Balance sheet for the for the year ending________, , I. Equity and liabilities, 1.Shareholders fund, 2. Non-Current Liabilities, 3.Current Liabilities, , Particulars, , II. Assets, 1.Non-currents assets, 2. Current assets, , Note No., , Rs., , Total, , xx, xx, xx, xxx, , Total, , xx, xx, xxx, , 10. Prepare a Statement of Profit and Loss of a Company in vertical form with imaginary, figures of 5 main heads only., Statement of Profit and Loss Account, For the year ended March 31,2019, Particulars, Note, A. Revenue from Operations, B. Other Income, C. Total Revenues (A+B), D. Expenses: Depreciation, E. Profit before Tax (C-D), , Rs., 10,000, 5,000, 15,000, 5,000, 10,000, , 11. Name the major heads under which the following items will be presented in the, Balance Sheet of a Company (Any 5 items only)., Solution: (Also refer Page 163 ), Ans., 1. Calls - in - advance, , Share holders funds - share capital, , 4. Forfei ted shares, , Shareholder funds - share capital, , 7. Reserve fund / Preliminary expenses, , Share holder funds - reserves and surplus, , 2. Calls - in - arrears, , Share holders funds - share capital, , 5. General Reserves, , Share holder funds - reserves and surplus, , 8. Debentures / Public deposits, , Non - current liabilities, , 3. Equi ty share capital / Preference share capital, , Share holders funds - share capital, , 6. Debenture Redemption Reserves, , Share holders funds - reserves and surplus, , 9. Long term loans, , Non - current liabilities, , 10. Long term borrowings, , Non - current liabilities, , 13. Bills Payables, , Current liabilities, , 16. Provisions for taxation, , Current liabilities, , 11. Secured or uns ecure loans, , Non - current liabilities, , 14. Trade payables (Credi tors and Bills Payables), , Current liabilities, , 17. Outstanding expenses, , Current liabilities, , 12. Account payables or creditors, , Current liabilities, , 15. Short term provisions, , Current liabilities

Page 7 :

18. Advance Incomes, , Current liabilities, , 19. Land and Buildings, , Non - current assets - fixed assets, , 22. Freehold / leasehold property, , Non - current assets - fixed assets, , 25. Copy rights, , Non - current assets - fixed assets, , 28. Bills receivables, , Current assets, , 31. Cash i n hand / Bank, , Current assets, , 34. Cash equivalents, , Current assets, , 20. Furniture, , Non - current assets - fixed assets, , 23. Goodwill, , Non - current assets - fixed assets, , 26. Discount / Loss on issue of shares/ debentures, , Non - current assets - other non-current assets, , 29. Trade receivable (Debtors and Bills receivable), , Current assets, , 32. Fixed deposit, , Non - current assets - fixed assets, , 35. Outstanding incomes, , Current assets, , 21. Plant and machinery, , Non - current assets - fixed assets, , 24. Patents, , Non - current assets - fixed assets, , 27. Account receivabl e / Debtors, , Current assets, , 30. Short term loans and advances, , Current assets, , 33. Demand deposit, , Current assets, , 36. Prepaid expens es, , Current assets, , 12. Prepare Comparative Statement of Profit and Loss wi th 5 imaginary figures., Comparative statement of profi t and loss, for the year ended March 31 2018 and 2019, Particulars, 2017-2018 2018-2019 Absolute, (a), (b), Increase, or, Rs., Rs., decrease, c=(a-b), R s., A. Revenue from operations, 60,000, 75,000, 15,000, B. Other Incomes, 15,000, 12,000, -3,000, C. Total Revenues (A+B), 75,000, 87,000, 12,000, D. Expenses: Depreciation, 15,000, 20,000, 5,000, E. Profit before tax( C-D), 60,000, 67,000, 7,000, , % Increase, or, Decrease, d=cx100÷a, 25.00, -20.00, 16.00, 33.33, 11.67

Page 8 :

13. Prepare Common Size Statement of Profit and Loss with 5 imaginary, figures., Common size statement of profit and loss, for the year ended March 31 2018 and 2019, Particulars, , Absolute, Amounts, Absolute, Amounts, , 2017-2018, Rs., A. Revenue from operations, B. Other Incomes, C. Total Revenues (A+B), D. Expenses: Depreciation, E. Profit before tax (C-D), , 60,000, 15,000, 75,000, 15,000, 60,000, , 2018-2019, Rs., 75,000, 12,000, 87,000, 20,000, 67,000, , Percentage of Net, Revenue from operations, , 2017-2018, (%), , 2018-2019, (%), , 100, 25, 125, 25, 100, , 100, 16, 116, 26.67, 89.33, , Note: For Revenue from operations, for both year 100% is assumed, Calculations = first year x 100 ÷ 𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟 𝑓𝑓𝑓𝑓𝑓𝑓𝑓𝑓 𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜, =Second year x 100 ÷ 𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟 𝑓𝑓𝑓𝑓𝑓𝑓𝑓𝑓 𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜𝑜, Example for First year, : 15,000 x 100 /60,000=25%, Example for Second Year : 12,000 X 100 /75,000=16%, 14. Write the pro-forma of Cash Flows from Operating Activities’ under, Direct Method, Cash flow from Operating Activities (Direct Method), Particulars, Rs., Cash flows from operating activities:, Cash receipts from customers, xxx, Less: Cash paid to suppliers and employees, xxx, Cash generated from operations, xxx, Less: Income tax paid, xxx, Cash flow before extraordinary items, xxx, Add/Less: Extraordinary items, xxx, Net cash from operating activities, xxx

Page 9 :

15. Classify the following cash flow activiti es into operating, investing and, financing as per AS - 3 (At least two items each from any two activity and, one item from remaining activity. Total 5 items only)., , Solution:, , SL.No, Operating Activities, 1, -Cash revenue from operations., 2, 3, , -Cash receipt from trade, receivables., -Trading commission received, , 4, , -Cash purchases, , 5, , -Cash paid to supplier, , 6, , -Employee benefits expenses paid., , 7, , -Office and administrative, expenses paid., -Manufacturing overheads paid., , 8, 9, 10, 11, , -Selling and distribution expenses, paid., -Income tax paid., -Rent paid., , Investing Activities, -Purchase of machinery, -Proceeds from sale of old, machinery, -Purchase of non-current, investment., -Purchase of goodwill, -Proceeds from sale of, patents., -Interest received on, debentures held as, investments., -Dividend received on, shares held as investment., -Rent received on property, held as investment., , Financing Activities, -Proceeds from issuance of equity, shares, -Proceeds from long-term, borrowings., -Redemption of preference shares., -Interim dividend paid on equity, shares., -Interest paid on long-term, borrowings., -Dividend paid on preference, shares, -Under-writing commission paid, -Brokerage paid on purchase of, non current investment., -Bank overdraft.