Page 1 :

LISRARY, PHALTA, A) FARM ACCOUNTING, B) HIRE PURCHASE SYSTEM-, EXCLUDING HIRE PURCHASE TRADING, ACCOUNT, Such, UNIT, st the, () THEORY, A) Farm Accounting, As we know, the accounting is language of business. It conveys details of business, activities irrespective of the type of business- trading, manufacturing, service or any other., Same is the case of agricultural activities. In order to know input and output of any business,, we need to maintain proper books of accounts. Therefore, it is necessary to study the account-, ing system used to record farm activities. Accordingly, this unit deals with accounting of farm, activities. This will give working knowledge of farming and the accounting for the same., Farm -The term farm refers to agricultural land, livestock, crops and farm buildings., Farming - The term farming refers to cultivation of land, harvesting crops, horticul-, ture, sericulture, nursery, raising fruits and flowers, growing and selling seeds and plants,, dairy, poultry, fishery, raring sheep, goats, pigs and chicks, etc., Farm Accounting-There is no standardized set of accounting for farm activities. Ma-, jority farmers, therefore, do not maintain the accounts. Recently some tea and coffee compa-, nies in India, are compelled to maintain their accounts under double entry book-keeping sys-, tem. Some medium and big farmers, in western countries maintain record which is necessary, for income tax purpose. They record agriculture activities in order to know cost of cultivation, of different kinds of crops., Ove:, * dare, red t, as on, 000, 000, 000, 100, 800, 00, 600, 000, 000, 00, 500, 500, 000, D00, 00, Features of Farm Transactions -, In order to maintain farm accounts, it is necessary to understand features of transac-, tions involved in farming. They are -, 500, 500, 1. Dominance of Barter Transactions- Many transactions in farming are performed, on barter system. They are measured in terms of money. Eg. Farmers exchange labours among, themselves, a kind of sharing (man, animal and machine) labours in exchange of one another., Sometimes, agriculture produce is given as labour cost or wages. Thus, the transections which, te hot measured in terms of money are not to be recorded in accounts., 2. Difficulty in Applying Cost Concept- It is difficult to ascertain and measure the, COst of assets like livestock-Bullocks, Cows, buffalos, poultry birds, pigs, fish, etc. The value, ese assets is taken at market price. However, the cost concept says the assets are to be, recorded at cost., Advanced Accountancy-I (Unit-II) (67), 1, --

Page 2 :

I herelon, 6. Measy, this requires det, 7. Valus, valued at market price., man and animal, tions become di, 8. Farr, of outputs as well., household cons, on the basis of opportunity cost., and household, Necessity of Farm Accounting :-, and measure t, Application, Ther, Farm accounting is necessary to record farming transactions and measure fore, resources.These reasons are the following-, 1) It enables to mcasure cost of a particular farm activity. This enables to determine profut, margin of the activity., 2) It enables to know the income from each farm activity independently and its profitability., transactions., One party giv, one account, This further enables farmers to improve or discontinue activities which result in loss., 3) It enables to measure profit or loss in farm activities., transaction, debit there, 4), It enables farmers to plan their farm activities., 5) Farm accounts is the essential tool for farm management., Ac, 6) It brings punctuality in farm activities., 7) It helps in getting loans., Difficulties in Farm Accounting, household, Outstandi, 1. Illiterate Farmers- Majority farmers in India are illiterate. Even, literate farmers, don't have knowledge of accounting. Therefore, it is quite difficult to maintain the accounts of, ments, D, ucts, Sto, their activities., 2. Small Holding- Majority farmers are holding very small land that they don't afford, to maintain the accounts., comes a, 3. Fear of Taxation- The farmers are under the fear of application of tax on farm, Purcha, income., Applic, 4. Reluctance- There found reluctance on the part of farmers to maintain the accounts., 5. Measurement of Input-output- In case of farming, output of one activity is taken, as input of another. Eg. Grass generated from crops is used as fodder to animals, poultry,, sheep, goats ,pigs, etc. Valuation of such transactions is uneasy., (68) Advanced Accountancy-I (Unit-II), 2

Page 3 :

this requires detailed data on these labour activities, which is not available at all., man and animal labours in their farming, assignment of cost to those labour is uneasy task as, houschold consumption. Valuation of which is uneasy task. Therefore, recording such transac-, A Measurement of Household Labours- Majority farmers use their own household, y. taring, 7. Valuation of Household Consumption- Large portion of farm output is used for, the con, hons become difficult., d charge, recorded, 8. Farm vs Household Transactions- Farmers do not make difference between farm, hausehold transactions. This becomes quite difficult to ascertain accurate cost of inputs, ani measure the correct value of output., Application of Double Entry Principles, There is no any difference in application of accounting principles in case of farm, ransactions. According to double entry system, every transaction has two-fold effects, i.e.,, one party giving the benefit and the another receiving the benefit- debit and credit. In short,, one account is to be debited and other is to be credited for every transaction. Therefore, every, transaction affects two accounts in opposite direction. The basic principle is that for every, debit there must be a corresponding credit of equal amount., re fam, ie profit, tability., OSs., According to this principle, accounts are classified into three heads:, a) Personal Account : It deals with accounts relating to persons and firms, e.g. Farm, household, Capital Account, Bank Loan, Private Loan, Outstanding Wages, Sundry Creditors,, Outstanding expenses, etc., b) Real Account : It stands for properties and assets, e.g. Land, Agricultural Imple-, ments, Drought Bullock, Incomplete Agro-operations, Crop-in-process, Stock of Agro-prod-, ucts, Stock of Raw Materials, Seeds, Fertilizers, etc. and other Assets;, c) Nominal Account : It incorporates items relating to Expenses and Losses and In-, comes and Gains, e.g. Expenses for using Human Labour and Animal labour, Irrigation charges,, Purchase of Agro-inputs, Sale of Agro-outputs, etc., armers, ints of, Application of Golden Rules, afford, Personal Account : Debit, = the receiver, Credit = the giver, I farm, Real Account:, Debit = what comes in, Credit = what goes out, ounts., Nominal Account:, Debit = Expenses/Losses, taken, ultry,, Credit = Incomes/Gains, Advanced Accountancy-I (Unit-II) (69), 3

Page 4 :

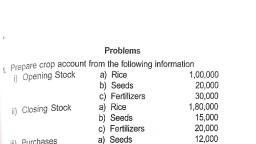

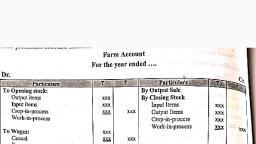

Journal : The agricultural transactions are recorded in the Books of Primary Account, Cash Book : We all know that book which keeps record of all cash transactions, i.e, under Double Entry System and, thereafter, they are posted into respective Ledger. In Busi-, ness, transactions are recorded at first in Journal and from Journal they are posted into Ledger., Books of Accounts, Bullock, Bullock-, Tools, To Depreci, Machine, The same principle and practice is applied here also., Impleme, Farm Bu, Cash receipts and Cash payments, is known as Cash Book. The principle of preparing a, Book of a farm is same as it is in the case of a trading concern. Following are the specimen, some prominant accounts maintained in farm accounting., Cash, Irigation, To Hire Cha, To Interest o, To Notional, To Notional, To Wages (F, To Net Profi, Farm Account, For the year ended ...., Dr., Cr., Particulars, Particulars, (Taken to Ba, To Opening stock:, Output items, Input items, Crop-in-process, Work-in-process, By Output Sale, By Closing Stock, Input Items, Output Items, Сrор-in-process, Work-in-process, XXX, Note : In ca, Crop Accor, Croj, XXX, XXX, XXX, XXX, XXX, XXX, To Wages:, or all item re, XXX, XXX, XXX, Casual, Permanent, XXX, XXX, To Purchases, Fertilizers, Seeds, Pesticides, XXX, XXX, Tо Орening, Wheat, XXX, XXX, XXX, To Expenses and Hire Charges On-, Implements, Tools, Rice (Padc, Vegetable:, Cotton, XXX, XXX, Machinery, Owned bullocks, Tubewell, Fruits, Fertilizers, Seeds, XXX, XXX, XXX, Irrigation charges, Farm Building, Irrigation Shed, Field Shed etc., XXX, XXX, To Purchases, XXX, XXX, Fertilizers, Seeds, Manures, XXX, To Land Revenue, XXX, To Deferred Revenue, XXX, XXX, To Expenses, Expenditure on:, Land development, Multi-cropping, Manual implements, XXX, Слор ехреn, Dep. On ma, Exp. On ma, Wages, Allocated es, To Inter transas, XXX, XXX, XXX, XXX, (70) Advanced Accountancy-I (Unit-II), To Gross Prof, 4

Page 5 :

Bo, To Depreciation on:, Bullocks, Bullock-driven Implements, Tools, Machinery, Implements, Farm Building, Imgation Structure, XXX, XXX, XXX, XXX, men s, XXX, XXX, XXX, XXX, To Hire Charges on Leased in land, To Interest on loan, To Notional Rent on Leased in land, To Notional interest on Own capital, To Wages (Family workers), To Net Profit, (Taken to Balance Sheet), XXX, XXX, XXX, XXX, XXX, XXXXX, Note : In case of Farm Loss, it will appear on credit side., Crop Account, Crop account represent all crops like wheat, rice, maize, jute, cotton, vegetable etc., or all item related to crop section. The following specimen is used for crop account., XXX, Crop Account, for the year ended, Particulars, Particulars, To Opening stock, Wheat, By Sales, Wheat, XXX, XXX, Rice (Paddy), Vegetables, Cotton, Paddy (Rice), Vegetable, Cotton, Fruits, Seeds, Manures, XXX, XXX, XXX, XXX, XXX, XXX, Fruits, XXX, XXX, Fertilizers, XXX, XXX, Seeds, XXX, XXX, XXX, XXX, By Wages (in kinds), By Drawing, (Personal Consumption), To Purchases, XXX, Fertilizers, XXX, XXX, Seeds, XXX, XXx By Contra, By Closing stock, Wheat, Manures, XXX, XXX, XXX, To Expenses, Crop expenses, Dep. On machinery, Exp. On machinery, Wages, Allocated expenses, To Inter transaction (Contra), Rice, XXX, XXX, Vegetable, Cotton, XXX, XXX, XXX, XXX, Fruits, Fertilizers, Seeds, Growing crop, XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX, To Gross Profit, XXX By Gross Loss, XXX, Advanced Accountancy-I (Unit-II) (71), 5