Page 2 :

UNIT - 1 (PART -1)

Page 3 :

Introduction of Accounting

Page 5 :

Introduction of Financial Accounting, , ●, , ●, , ●, , Financial accounting is a branch of accounting which record, each financial transactions and analyse it to determine the, financial position of the company., It is a process of recording classifying summarising, analyzing and presentation of all financial transactions in a, form of financial statements., Financial accounting has two objectives:- 1. To ascertain the, profitability of business. 2. You know the financial position, of the company.

Page 6 :

Introduction of Financial Accounting, ●, , ●, , ●, , Financial accounting includes the the preparations of, financial statements like income statement cash flow, statement balance sheet etc by using accounting policies., Financial accounting aims at delivering the true and fair, view of financial affairs of business to all its stakeholders,, which is done in accordance with GAAP and IFRS., Financial accounting has an important role in increasing, profitability and efficiency as it helps in managing all, financial resources of the business.

Page 7 :

Nature of Financial Accounting

Page 8 :

Objectives of Financial Accounting

Page 9 :

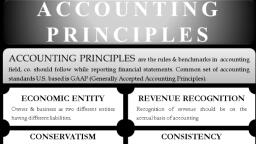

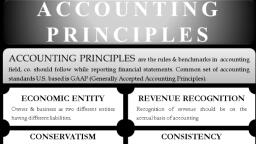

Accounting principles

Page 10 :

Accounting Concepts and Conventions

Page 11 :

Accounting concepts and conventions

Page 12 :

Accounting concepts

Page 13 :

Accounting conventions

Page 14 :

Accounting conventions, , ●, , ●, ●, , Accounting conventions are guidelines used to help, companies determine how to record business transactions, not yet fully covered by accounting standards., They are generally accepted by accounting bodies but are, not legally binding., Accounting conventions were established with a motive to, bring uniformity in the books of accounts at the time of, preparing them.

Page 15 :

Accounting Conventions, , ●, ●, ●, , There are four widely recognized accounting conventions:, conservatism, consistency, full disclosure and materility., Conventions are like customs/traditions that help the, accountant to communicate clear accounting picture., In other words, accounting convention sets the guideline, for the accountant that in turn helps him/her to prepare, accounting statements and reports.

Page 16 :

Full disclosure convention, , This convention is also known as Convention of Prudence., This convention requires that accounting statements should be, honestly prepared and all significant information should be, disclosed therein. That is, while making accountancy records,, care should be taken to disclose all material information., This convention assumes greater importance in respect of, corporate organisations where the management is divorced, from ownership.

Page 17 :

Full Disclosure Convention, , ●, , ●, , Full disclosure convention helps the user in the proper, interpretation of the financial statements of the company., As per this convention at the time of preparing records,, full disclosure of financial information shall be made by the, accountant., Full disclosure can be made in two ways:- (a) Either in the, body of the financial statements, or (b) In notes, accompanying such financial statements.

Page 18 :

Conservatism Conventions, ●, , ●, , As per the Conservatism convention at the time of, recording any financial transaction, you should recognize no, profit but provide for all possible losses. This is the most, important convention as it depends upon the theory that, the future is uncertain., Conservatism impacts current assets and liabilities,as, Nowadays the conservatism convention is being criticized, as it conflicts with full disclosure convention. As through, this convention, there are possibilities that an accountant, may create secret reserves such as depreciation provisions., And due to this, the financial statements do not show a, true and fair view of a business.

Page 19 :

Conservatism Convention, , ●, , ●, , ●, , According to the convention of consistency once the company, has decided to follow a method of accounting then it shall, consistently follow the same method throughout., Along with this, changing the accounting method often would, make the comparison of its own financial statements of, different period difficult for the company., However, if a change is necessary for the accounting method, then there shall be a sound reason for such change.

Page 20 :

Consistency Convention, , ●, , ●, ●, , The convention of consistency helps the management to, analyze the financial statement of different periods and, ensure that corrective decisions are taken, if needed., Consistency convention helps in:- (a) Promoting accuracy (b), Enhancing comparability (c) Decision making., It also state that, if there is any change, then such change, shall be disclosed in the financial statements because, recurring changes in the accounting methods render, financial statements as unreliable.

Page 21 :

Consistency Convention, , ●, , ●, , The accounting convention of consistency states that once, adopted, a business must continue to follow the same, accounting principles and methods in the future accounting, periods., This is because consistency in accounting methods enables, management to draw comparison between the financial, statements of different accounting periods. Such a, comparison helps the management in formulating policies, and take decisions.

Page 22 :

Materiality Conventions, ●, ●, , ●, , Materiality convention implies that the economic significance of, an item will to some extent affect its accounting treatment., Association defines the term materiality as “An item should be, regarded as material if there is reason to believe that, knowledge of it would influence the decision of informed, investor.”, For instance, acquisition of items like fountain pen, stapler, pin, cushion, punching machine etc., can be treated as part of assets,, when considering their durability and span of life. But, it is not, necessary to maintain separate ledgers. Such low cost items can, be treated as expense for the period.

Page 23 :

Materiality Convention, ●, , ●, , The materiality convention of accounting states that the, business should include only the important or relevant facts, in the financial statements. Material facts refer to any, information, which if excluded or misreported in the, financial statements could influence the decision of the, users of such financial statements., This convention unnecessarily burden the accountants in, case they are not able to distinguish between material and, immaterial events. The most important to note is that an, item for a party can be immaterial however for another a, material item.

Page 24 :

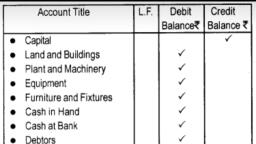

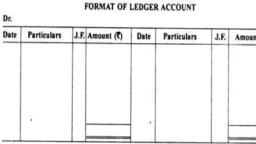

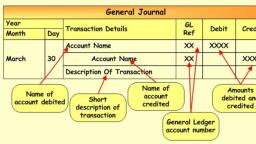

Double Entry System, ●, , ●, ●, , ●, , The double-entry system of accounting or bookkeeping means that for every, business transaction, amounts must be recorded in a minimum of two, accounts., The double-entry system also requires that for all transactions, the amounts, entered as debits must be equal to the amounts entered as credits., The man behind this popular method of booking was the Italian, mathematician Luca Pacioli who first published his comprehensive thesis on, the principles of Double Entry System in 1494., Double entry system of booking is an accounting system which recognizes the, fact that every transaction has two aspects and both aspects of the, transaction are recorded in the books of accounts. In other words, it, recognizes that in order to receive some value, an equal value needs to be, given.

Page 25 :

Double Entry System, ●, , ●, , ●, , To illustrate double entry, let's assume that a company borrows $10,000, from its bank. The company's Cash account must be increased by $10,000, and a liability account must be increased by $10,000., To increase an asset, a debit entry is required. To increase a liability, a, credit entry is required. Hence, the account Cash will be debited for, $10,000 and the liability Loans Payable will be credited for $10,000., Double entry also means that the accounting equation (assets = liabilities +, owner's equity) will always be in balance. In our example, the accounting, equation remained in balance because both assets and liabilities were each, increased by $10,000.